Cytonn Monthly – July 2018

By Cytonn Research Team, Aug 5, 2018

Executive Summary

Fixed Income

During the month of July, T-bill auctions recorded an oversubscription, with the average subscription rate coming in at 157.4%, a decline from the 217.7% recorded in June. The yields on the 91-day, 182-day and 364-day papers declined by 11.7 bps, 55.5 bps and 44.9 bps to 7.6%, 9.1% and 10.1%, respectively. The MPC met on 30th July and reduced the Central Bank Rate (CBR) to 9.0% from 9.5%, citing that economic output was still below its potential despite improving economic growth prospects;

Equities

During the month of July, the equities market recorded mixed performance, with NASI and NSE 25 declining by 2.2% and 0.6%, respectively, while NSE 20 gained by 0.3%, taking their YTD performance as at the end of July to (0.4%), (11.2%) and 3.4% for NASI, NSE 20 and NSE 25, respectively. KCB Group emerged as the only bidder for Imperial Bank Limited (IBL), after Diamond Trust Bank (DTB) pulled out of the deal;

Private Equity

During the month of July there was private equity activity in Fundraising, as well as in the Financial Services and Fintech sectors. In fundraising, Musoni issued a Kshs 2.0 bn debt note that will be used to grow its loan book, while Branch International, a mobile based Microfinance Institution (MFI) raised funding through an issuance of a commercial paper. In the financial services sector, Mauritius based SBM holdings, through SBM Kenya Limited, acquired certain assets and liabilities of Chase Bank Kenya while Badoer Investments Limited, a Dubai based investment firm bought a 15.6% stake in Sumac Microfinance Bank for Kshs 100.0 mn (USD 10 mn);

Real Estate

During the month, the real estate sector experienced increased activity across all themes as follows: (i) in the residential sector, H.E President Uhuru Kenyatta signed into law amendments to the Income Tax Act that will allow buyers get a 15.0% tax relief up to a maximum of Kshs 108,000 p.a., or Kshs 9,000 p.m., under the newly introduced Affordable Housing Relief Section. He also signed into law the Stamp Duty Act, which will exempt first time home buyers from paying Stamp Duty Tax, (ii) in the retail sector, Naivas and Shoprite Supermarkets announced plans to open new branches in the Mwembe Tayari Mall and City Mall in Mombasa, respectively, and (iii) in the hospitality sector, PrideInn Hotels announced plans to open a 3-star business hotel in Mombasa comprising of 40-rooms and conference facilities that can accommodate up to 500 people. The increased activities are mainly driven by i) increased government support, especially towards affordable housing development, ii) an improving operating environment, and iii) continued demand for investment-grade property from the expanding middle class and multinationals.

- Cytonn’s real estate developments, The Alma in Ruaka and Amara Ridge in Karen, were featured by CNN International in a report highlighting the growing property market in Kenya. See the feature on CNN here

- Cytonn Investments, on 2nd August 2018, held their quarterly awards ceremony that recognized their top producers for the last quarter. See Event Note

- Moses Njuguna, Distribution Unit Manager, was on Njata T.V. to discuss Investments Process and Decision Making. See Moses here

- The Q2’2018 issue of our quarterly Sharp Cents Magazine, themed Sustainable Finance is out. Read the issue here or email clientservices@cytonn.com to get a copy

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. The Wealth Management Training is run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- We continue to beef up the team with ongoing hires for IT Network Engineer and Unit Managers- Mt. Kenya Region. Visit the Careers section on our website to apply.

- Cytonn Real Estate is looking for a 0.75-acre land parcel for a joint venture in any of the following areas, Lavington, Loresho (near Loresho Shopping Centre and its environs), Spring Valley Shopping Centre and its environs, Redhill Road (should be between Limuru Road Junction and Westlands Link Road), Lower Kabete Road (between Ngecha Road Junction and UON Campus), and Karen. The parcel should be in a good location with frontage to a tarmac road. For more information or leads, email us at rdo@cytonn.com

T-Bills & T-Bonds Primary Auction:

During the month of July, T-bill auctions recorded an oversubscription, with the average subscription rate coming in at 157.4%, a decline from 217.7%, recorded in June. The average subscription rates for the 91, 182 and 364-day papers came in at 70.2%, 90.9% and 258.6%, from 131.6%, 170.9% and 298.9%, the previous month, respectively, with investors’ participation remaining skewed towards longer dated paper. The yields on the 91-day, 182-day and 364-day papers declined by 11.7 bps, 55.5 bps and 44.9 bps to 7.6%, 9.1% and 10.1%, respectively. The T-bills acceptance rate came in at 75.4% during the month, compared to 53.1% in June with the Kenyan government accepting a total of Kshs 140.4 bn of the Kshs 188.8 bn worth of bids received, indicating that bids were largely within ranges the Central Bank of Kenya (CBK) deemed acceptable.

This week, T-bills were undersubscribed, with the subscription rate coming in at 60.4% down from 88.2% the previous week, as a result of tight liquidity in the market attributed to slow government spending that usually characterises the beginning of the fiscal year. The subscription rates for the 91-day, 182-day and 364-day papers came in at 14.2%, 51.5%, and 87.9% compared to 50.6%, 58.6% and 133.0%, the previous week, respectively. Yields on the 91- day paper increased marginally by 0.3 bps to 7.6% while yields on the 182-day and 364-day papers declined by 2.8 bps and 8.0 bps to 9.1% and 10.0%, respectively. The acceptance rate for T-bills declined to 96.8% from 99.3%, the previous week, with the government accepting a total of Kshs 14.0 bn of the Kshs 14.5 bn worth of bids received, against the Kshs 24.0 bn on offer.

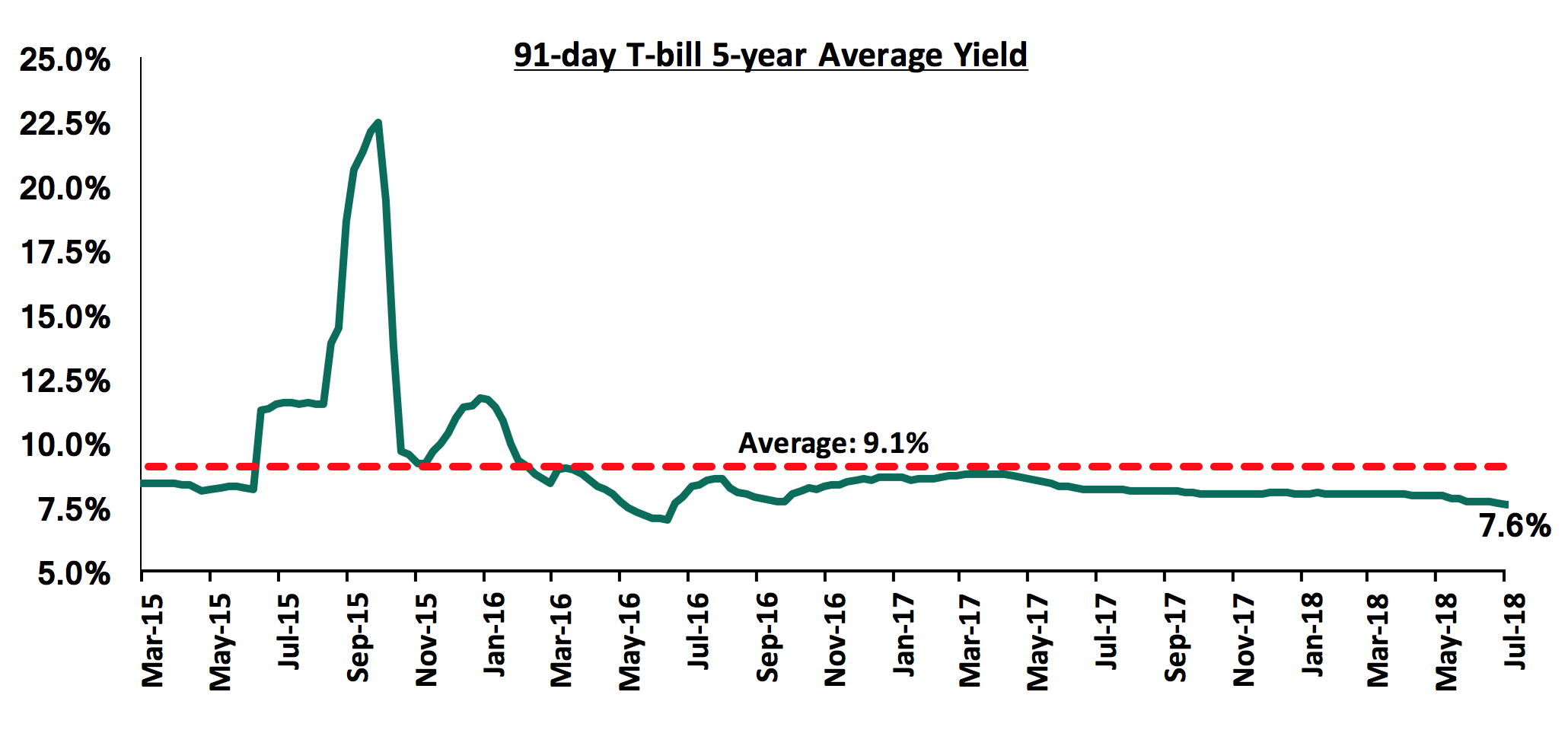

The 91-day T-bill is currently trading at 7.6%, which is below its 5-year average of 9.1%. The lower yield on the 91-day paper is mainly attributable to the low interest rate environment experienced since the passing of the law capping interest rates. We expect this to continue in the short-term, given:

- The discipline of the CBK in stabilizing interest rates in the auction market by rejecting aggressive bids that are priced above market, for both T-bills and T-bonds, and,

- The lowering of the Central Bank Rate by the Monetary Policy Committee in their July meeting to 9.0% from 9.5%, which will effectively reduce lending rates to 13.0% from 13.5%.

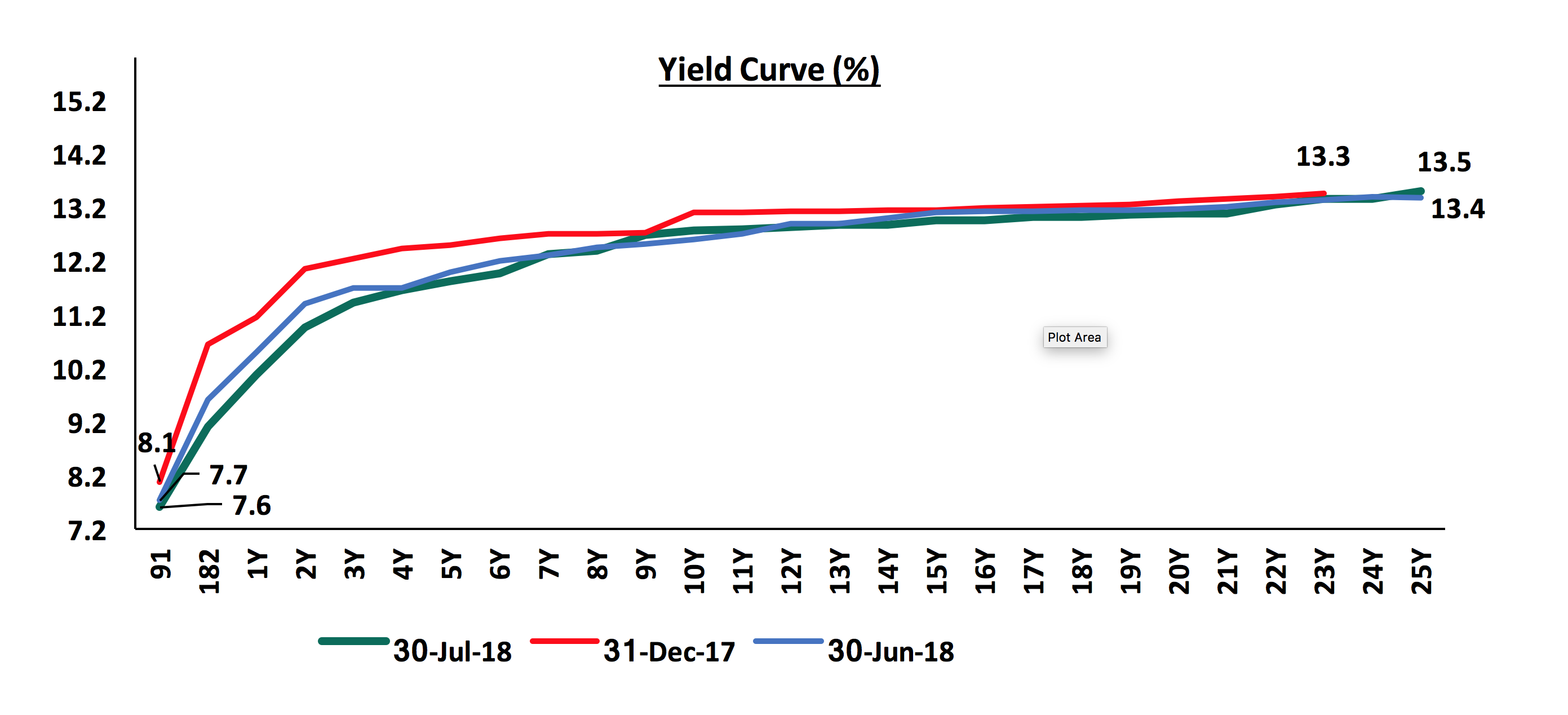

During the month, the Kenyan Government issued a new 20-year Treasury bond (FXD 2/2018/20) with the coupon rate set at 13.2% in a bid to raise Kshs 40.0 bn for budgetary support. The issue had a lacklustre performance, with the overall subscription rate coming in at 34.7% while the weighted average rate of accepted bids came in at 13.4%, in line with our expectations of 13.3% - 13.5%. The government accepted Kshs 10.5 bn out of the Kshs 13.9 bn worth of bids received, translating to an acceptance rate of 75.8%. Despite the government’s effort to increase the local debt maturity profile by issuing longer dated bonds, there has been low appetite for the issues. We attribute this to the uncertainty in the interest rate environment following the tabling of the Finance Bill 2018 that proposes the repeal of interest rate cap, which if passed, might result into upward pressure on interest rates.

Secondary Bond Market:

The yields on government securities in the secondary market continued to decline in July as the Central Bank of Kenya continued to reject expensive bids in the primary market. According to the FTSE NSE Bond Index, Treasury bonds listed at the Nairobi Securities Exchange (NSE) gained 1.0% during the month, bringing the YTD performance to 9.1%.

Liquidity:

The average interbank rate increased to 6.4% at the end of July from 4.1% at the end of June, pointing to declined liquidity during the month, the increase was attributed to banks seeking funds for quarterly tax remittances.

During the week, the average interbank rate increased to 7.2% from 4.1% the previous week, while the average volumes traded in the interbank market declined by 26.8% to Kshs 12.4 bn from Kshs 16.9 bn the previous week. The increase in the average interbank rate points to declined liquidity, which the CBK attributed to low Government payments in the early weeks of the fiscal year 2018/2019.

Kenya Eurobonds:

According to Bloomberg, the yield on the 5-year and 10-Year Eurobonds issued in June 2014 declined by 1.2% points and 1.5% points to 4.1% and 6.4%, respectively from 5.3% and 7.9% in June. During the week, the yields on the 5-year and 10-year Eurobonds issued in 2014 both rose by 20 bps to 4.1% and 6.6% from 3.9% and 6.4%, respectively. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 4.7% points and 3.1% points for the 5-year and 10-year Eurobonds, respectively, due to the relatively stable macroeconomic conditions in the country.

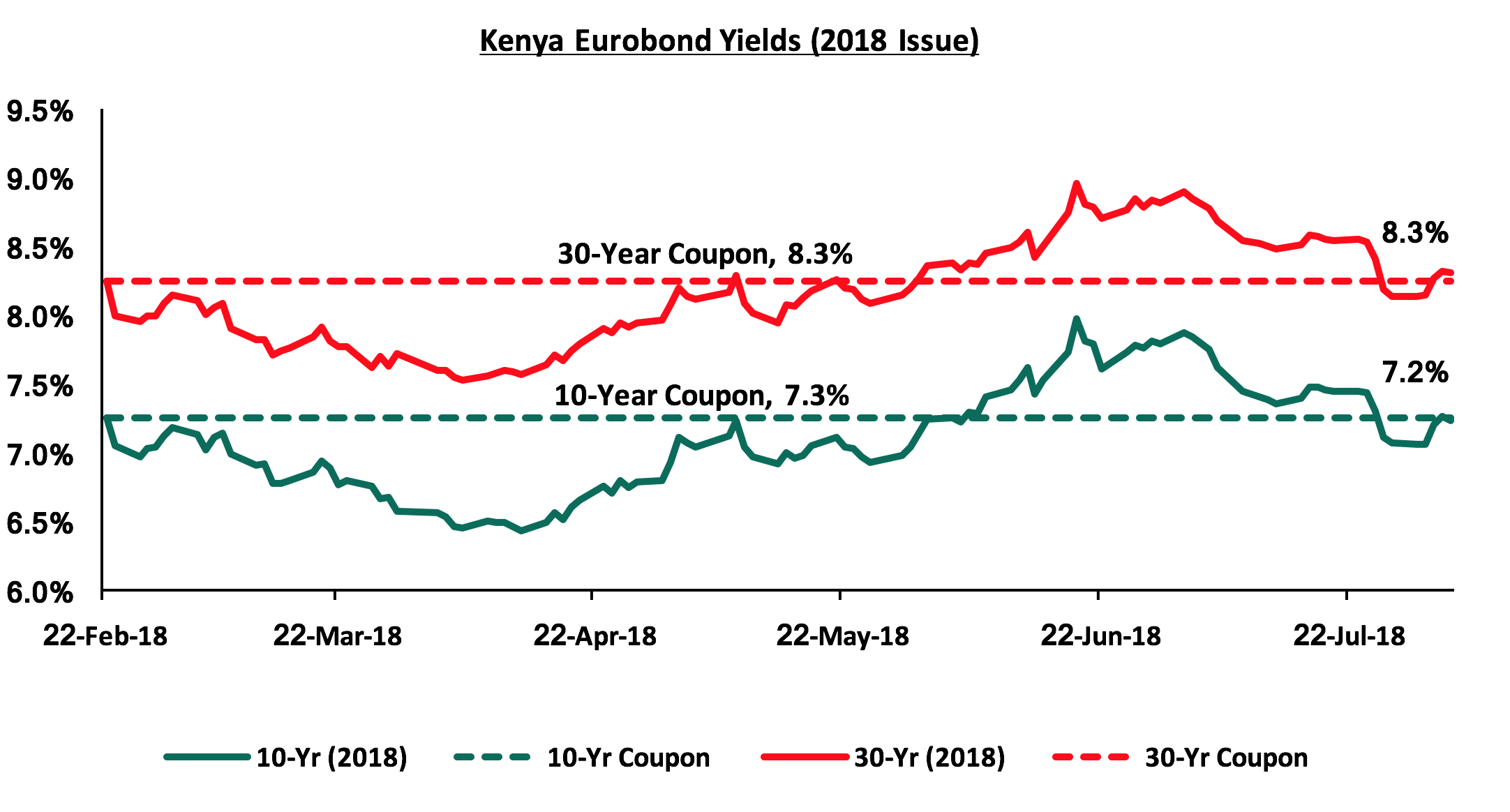

During the month, the yields on the 10-year and 30-year Eurobond issued in February 2018 declined by 70 bps to 7.1% and 8.1% from 7.8% and 8.8% in June, respectively as a result of improved liquidity in the global markets and lower risk perception as a result of improved investor sentiments based on the stable macroeconomic conditions. During the week, the yields on the 10-year and 30-year Eurobonds both increased by 10 bps and 20 bps respectively, to 7.2% and 8.3% from 7.1% and 8.1% last week, respectively. Since the issue date, the yield on the 10-year Eurobond has declined by 1 bps points while the 30-year Eurobond has increased by 10 bps.

The Kenya Shilling:

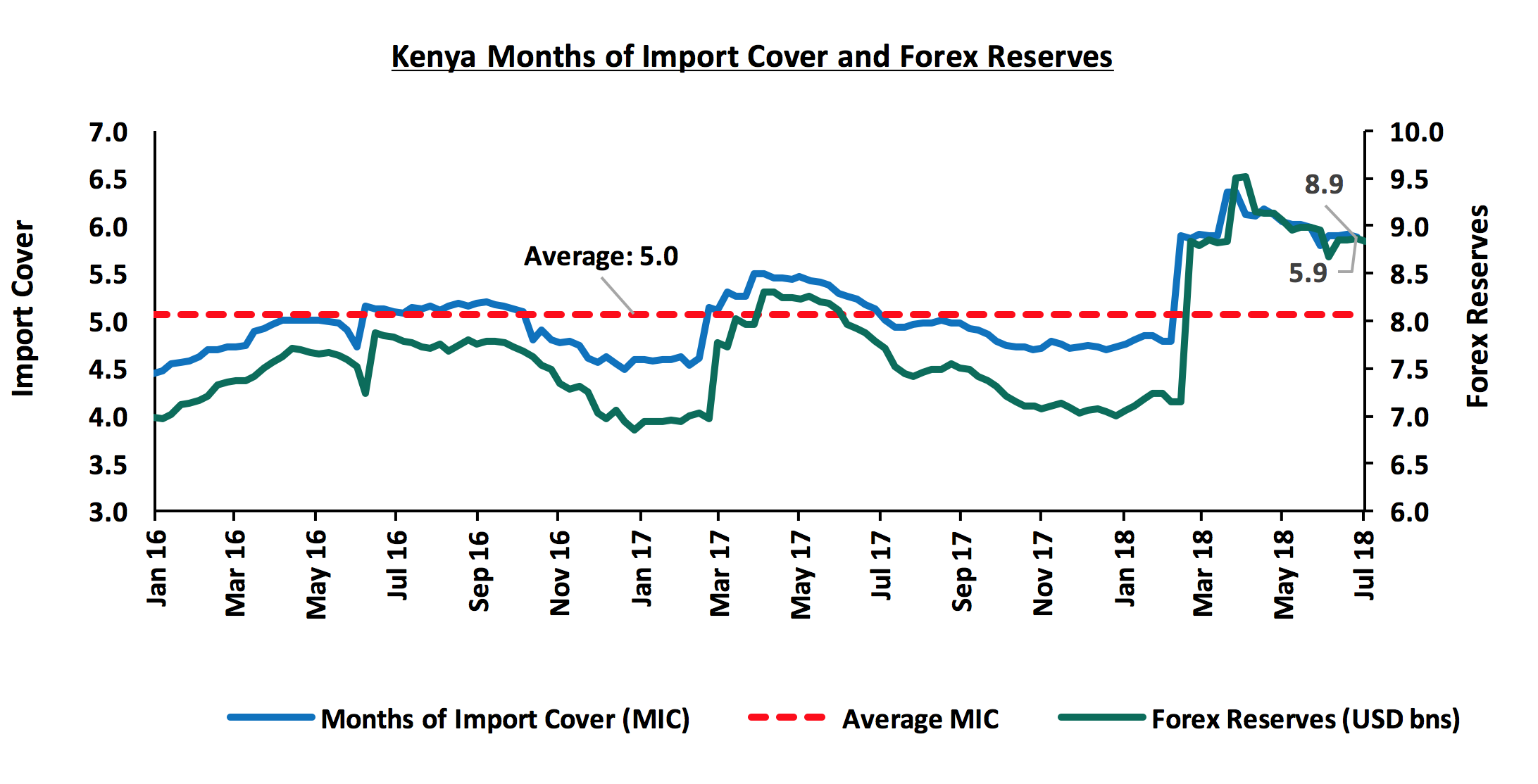

The Kenya Shilling appreciated by 0.6% against the US Dollar during the month of July to Kshs 100.4, from Kshs 101.1 at the end of June, supported by inflows from diaspora remittances. During the week, the Kenya Shilling appreciated by 0.1% against the US Dollar to close at Kshs 100.3 from Kshs 100.5, the previous week, supported by inflows from diaspora remittances. On a YTD basis, the shilling has gained 2.7% against the USD. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit to 5.8% in June from 6.3% in March, and is expected to narrow to 5.4% of GDP in 2018 driven by growth of agricultural exports, continued of diaspora remittances as well as tourism receipts,

- Stronger inflows from principal exports, which include coffee, tea and horticulture, which increased by 9.3% during the month of April to Kshs 21.9 bn from Kshs 20.0 bn in a similar period the previous year, with the exports from coffee, and horticulture increasing by 6.7%, and 25.0% y/y, respectively, while tea exports have declined marginally by 1.6% y/y,

- Improving diaspora remittances, which increased by 16.9% to USD 253.7 mn in May 2018, from USD 217.1 mn in April 2018, with the bulk contribution coming from North America at USD 122.8 mn attributed to (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient, and,

- Sufficient forex reserves, currently at USD 8.8 bn (equivalent to 5.8 months of import cover) and the USD 1.5 bn stand-by credit and precautionary facility by the IMF, still available until September 2018.

Inflation:

The inflation rate for the month of July recorded a marginal rise to 4.4% from 4.3% in June. The inflation rate declined by 0.9% m/m due to a 2.4% decline in the Food and Non-Alcoholic Drinks’ Index, which was driven by a decrease in prices of some food basket items such as tomatoes, maize and beans outweighing increases in other constituents of the food basket. Housing, Water, Electricity, Gas and Other Fuels’ Index increased by 0.1% in July 2018 compared to 0.5% recorded in June 2018. This was mainly attributed to an increase in prices of kerosene, electricity and cooking gas. The Transport Index also increased by 0.6% mainly on account of increase in the price of petrol which outweighed decrease in price of diesel. Below is a summary of key changes in the Consumer Price Index (CPI) in July:

|

Major Inflation Changes in the Month of July 2018 |

|||

|

Broad Commodity Group |

Price change m/m (July-18/June-18) |

Price change y/y (July-18/July-17) |

Reason |

|

Food & Non-Alcoholic Beverages |

(2.4%) |

0.5% |

This was driven by a decrease in prices of some food basket items such as tomatoes, maize and beans outweighing increases in others |

|

Transport Cost |

0.6% |

8.5% |

This was on account of increase in the pump price of petrol which outweighed decrease in price of diesel |

|

Housing, Water, Electricity, Gas and other Fuels |

0.1% |

14.4% |

This was mainly attributed to an increase in prices of kerosene, electricity and cooking gas |

|

Overall Inflation |

(0.9%) |

4.4% |

The m/m decline was due to a 2.4% decline in food prices which has a CPI weight of 36.0% |

We expect inflation in H2’2018 to experience upward pressure, partly due to the base effect, and the expected rise in fuel and transport prices with the introduction of 16.0% VAT on petroleum products as from September 2018 and other tax reforms proposed under the Finance Bill 2018. We however still expect inflation to remain within the government’s set target of 2.5%-7.5% during the year.

Monetary Policy:

The Monetary Policy Committee (MPC) met on Monday 30th July, 2018 to review the prevailing macroeconomic conditions and give direction on the Central Bank Rate (CBR). The MPC reduced the CBR at 9.0% from 9.5%, which was not in line with our expectations as detailed in our MPC Note, citing that economic output was still below its potential despite improving economic growth prospects, as evidenced by:

- Inflation expectations were well anchored within the target range despite rising to 4.3% in June from 4.0% in May. The MPC noted that the overall inflation is expected to remain within the government target range despite upward pressure from rising fuel prices due to a rise in global oil prices and the impact of excise tax on some of the CPI items. Expectations of declining food prices due to favorable weather conditions is expected to mitigate the upward inflationary pressure,

- Private sector credit growth, which grew by 4.3% in June up from 2.8% in April, with the highest growth in lending being recorded in the building and construction, manufacturing, and trade sectors at 13.5%, 12.3% and 8.6%, respectively, and

- Increased private sector optimism as per the MPC Private Sector Market Perception Survey conducted in May 2018, which showed that the private sector was optimistic about local economic prospects in 2018. This was mainly attributed to a relatively stable macroeconomic environment, renewed business confidence, a rebound in agriculture due to improved weather conditions, continued infrastructure investment by the government, with the government’s focus on the Big Four Agenda.

The MPC however noted the risk of perverse outcomes from the lowering of the CBR stating that they will be closely monitoring its impact as well as other developments in the domestic and global economy ready to take any additional measures as necessary. See the CBK Release.

Monthly Highlights:

According to the Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI), the business environment in the country continued to expand in July 2018 though at a moderate pace. The seasonally adjusted PMI declined to 53.6 in July from 55.0 in June. A PMI reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. Firms reported growth in value of outputs due to the continued rise in new export orders, which rose at the fastest pace since March. This was despite high input costs attributed to an increase in fuel prices, leading to upward pressure on production costs, and consequently a rise in average selling prices with the cost burden being transferred to customers. In response to increased output requirements, firms also raised their staffing levels though at a slow and marginal pace. The private sector has remained resilient as the PMI is still above 50, we however expect the sector to experience increased input costs going forwards with the introduction of 16.0% VAT on petroleum products as from September 2018 and other tax reforms proposed under the Finance Bill 2018.

According to the quarterly Balance of payments report, released in July, Kenya’s current account deficit improved during Q1’2018, coming in at Kshs 107.9 bn from Kshs 129.7 bn in Q1’2017, a decline of 16.8%, equivalent to 8.9% of GDP in Q1’2018, from 11.3% recorded in Q1’2017. The decline was attributed to export growth, which outpaced the growth in imports, growing at 7.1% to Kshs 162.9 bn from Kshs 152.1 bn in Q1’2017, compared to the 6.5% increase in imports to Kshs 432.1 bn from Kshs 406.4 bn in Q1’2017. In addition, there was a 28.0% increase in the services trade balance, coupled with the 26.9% increase in the secondary income (transfers) balance, whose increase could be attributed to the 46.1% increase in diaspora remittances. The current account deficit is expected to narrow further to 5.4% of GDP in 2018 from 6.2% in 2017, supported by

- Continued growth of the primary agricultural exports particularly tea and horticulture,

- Continued improvement in diaspora remittances, and,

- Improved tourism receipts

Despite the expectations of an increase in the value of petroleum products due to higher global oil prices, lower imports of food as a result of improved weather conditions and the reduced importation of SGR-related equipment is expected to mitigate the impact on the current account.

According to the Kenya National Bureau of Statistics (KNBS) Q1’2018 Gross domestic product report also released in July, Kenya’s economy expanded by 5.7% in Q1’2018, higher than 4.8% in Q1’2017. This improved growth was attributed to:

- Recovery in agriculture, which recorded a growth of 5.2% due to improved weather conditions,

- Improved business and consumer confidence, and

- Increased output in the real estate, manufacturing, and wholesale & retail trade sectors, which grew by 6.8%, 2.3% and 6.3%, respectively.

The year 2018 is set to be a better year in terms of the macroeconomic environment and economic growth, which resulted into stronger economic growth in the first quarter of the year, and we expect a similar trend going forward. During the week, the Central Bank of Kenya Governor maintained CBK’s 2018 GDP growth projection at 6.2%. With the country’s economy having grown by 5.7% in Q1’2018, and with the current freeze on new government projects and the low private sector credit growth remaining low at 4.3% in June, we maintain our 2018 GDP growth projection of between 5.4% and 5.6%. The strong economic growth will be supported by recovery in the agriculture and manufacturing sectors following improved weather conditions set to boost agricultural productivity, water supply and electricity that will in turn favour the manufacturing sector, and continued growth in tourism, real estate and construction sectors. Below is a table of Kenya’s 2018 GDP growth projections that we track released by 15 organizations, that comprises of research houses, global agencies, and government organizations. The average GDP growth expectations for 2018 is at 5.5%.

|

Kenya 2018 Annual GDP Growth Outlook |

||||

|

No. |

Organization |

Q1'2018 |

Q2'2018 |

Q3'2018 |

|

1 |

Central Bank of Kenya |

6.2% |

6.2% |

6.2% |

|

2 |

Kenya National Treasury |

5.8% |

5.8% |

5.8% |

|

3 |

Oxford Economics |

5.7% |

5.7% |

5.7% |

|

4 |

African Development Bank (AfDB) |

5.6% |

5.6% |

5.6% |

|

5 |

Stanbic Bank |

5.6% |

5.6% |

5.6% |

|

6 |

Citibank |

5.6% |

5.6% |

5.6% |

|

7 |

International Monetary Fund (IMF) |

5.5% |

5.5% |

5.5% |

|

8 |

World Bank |

5.5% |

5.5% |

5.5% |

|

9 |

Fitch Ratings |

5.5% |

5.5% |

5.5% |

|

10 |

Barclays Africa Group Limited |

5.5% |

5.5% |

5.5% |

|

11 |

Cytonn Investments Management Plc |

5.4% |

5.5% |

5.5% |

|

12 |

Focus Economics |

5.3% |

5.3% |

5.3% |

|

13 |

BMI Research |

5.3% |

5.2% |

5.2% |

|

14 |

The Institute of Chartered Accountants in England and Wales |

5.6% |

5.6% |

|

|

15 |

Standard Chartered |

4.6% |

4.6% |

4.6% |

|

|

Average |

5.5% |

5.5% |

5.5% |

Rates in the fixed income market have been on a declining trend, as the government continues to reject expensive bids, as it is currently 118.2% ahead of its pro-rated borrowing target for the current financial year. The 2018/19 budget gives a domestic borrowing target of Kshs 271.9 bn, 8.6% lower than the 2017/2018 fiscal year’s budget of Kshs 297.6 bn, which the government surpassed. The lower borrowing target may result in reduced pressure on domestic borrowing. However, the National Treasury has proposed to repeal the interest rate cap, which if repealed could result in upward pressure on interest rates, as banks would resume pricing of loans to the private sector based on their risk profiles. With the cap still in place, we maintain our expectation of stability in the interest rate environment. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium-term fixed-income instruments.

Market Performance:

During the month of July, the equities market recorded mixed performance, with NASI and NSE 25 declining by 2.2% and 0.6%, respectively; while NSE 20 gained by 0.3%, taking their YTD performance as at the end of July to (0.4%), (11.2%) and 3.4% for NASI, NSE 20 and NSE 25, respectively. The equities market performance during the month was shaped by gains in large caps such as Equity Group, BAT, Standard Chartered and EABL of 3.8%, 3.3%, 2.5% and 2.3%, respectively, which were offset by declines in other large caps such as NIC Group, Safaricom, Bamburi and Co-operative bank of 2.8%, 4.3%, 2.2% and 3.1%, respectively.

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 declining by 0.8%, 0.3% and 0.8%, respectively, due to declines in large cap stocks such as Safaricom, Standard Chartered Bank and Equity Group, which declined by 3.4%, 2.0% and 1.5%, respectively.

Equities turnover declined by 29.8% during the month to USD 96.7 mn from USD 137.7 mn in June, taking the YTD turnover to USD 1.2 bn. Foreign investors remained net sellers during the month. Most investors exited the market at the relatively healthy valuation, with possible re-entry at cheaper valuations in the future. We expect the market to remain supported by improved investor sentiment as the economy recovers from shocks experienced last year.

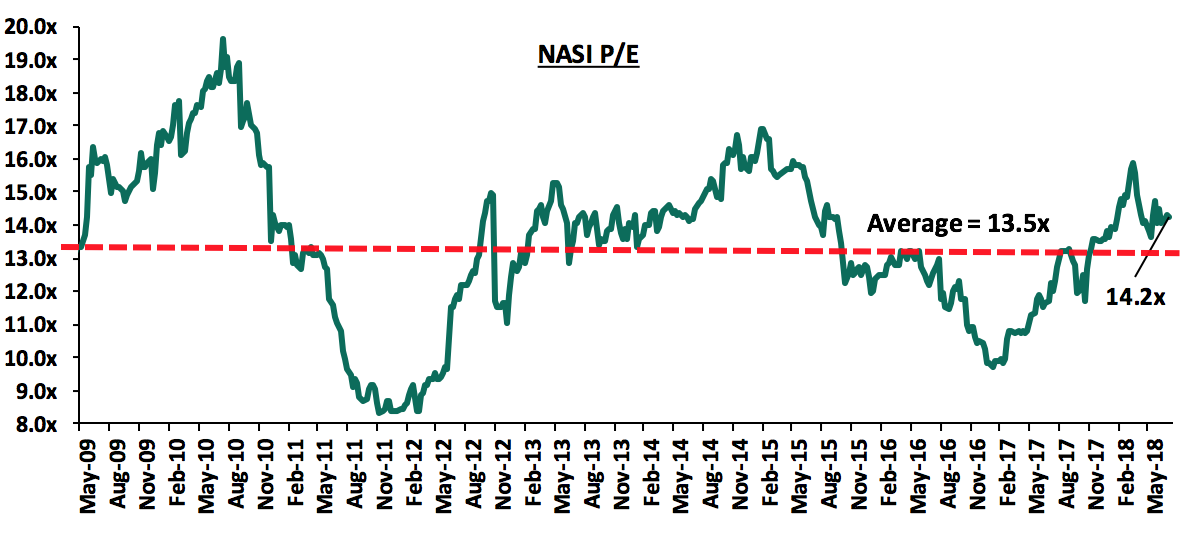

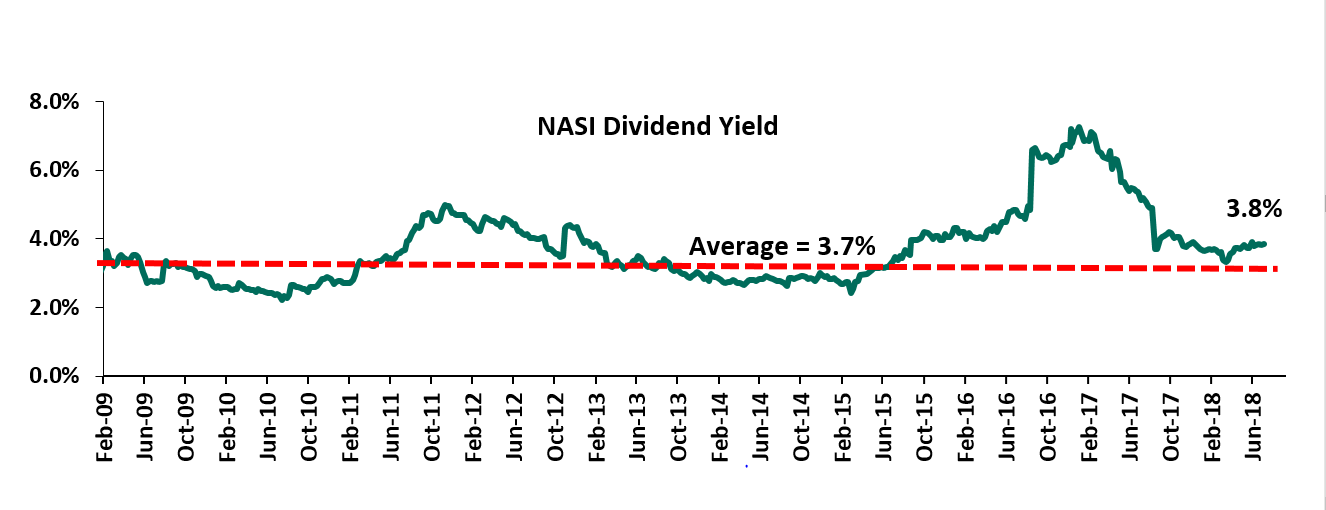

The market is currently trading at a price to earnings ratio (P/E) of 14.2x, 5.2% above the historical average of 13.5x, and a dividend yield of 3.8%, slightly above the historical average of 3.7%. Despite the valuations nearing the historical average, we believe there still exist pockets of value in the market. The current P/E valuation of 14.2x is 46.4% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 71.1% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Monthly Highlights:

During the month, KCB Group emerged as the only bidder for a stake in Imperial Bank Limited (IBL), which is under receivership, after Diamond Trust Bank (DTB), having also expressed interest, pulled out of the deal. IBL was put under receivership in August 2015, with a loan book of Kshs 41.0 bn and deposits of Kshs 58.0 bn. The Central Bank of Kenya (CBK) and KDIC is to engage KCB in discussions with the aim of maximizing the value for depositors. In April, the bidders were tasked to disclose the oversight frameworks they planned to implement, the type of transaction they intended to proceed with, and the financial resources that could be deployed to compete the transaction. The impending resolution of the matter, which could possibly result in the bank’s coming out of receivership, will be welcomed by customers, whose deposits have been locked in the bank since August 2015. We note that the process needs to be expedited, as the transaction falls way behind the expected timelines shared by the CBK, who, in September 2017, had scheduled to have a winning bidder by February 2018. If successful, this would mark the second instance a bank is brought out of receivership, after the recently concluded deal that saw SBM Kenya complete the acquisition of certain assets and Liabilities of Chase Bank Limited (under Receivership). For more information, see our Cytonn Weekly #29/2018

Commercial banks began implementing Treasury’s new Robin Hood tax of 0.05% on bank transfers of above Kshs 0.5 mn that was proposed in the 2018/19 Budget presented to Parliament. Lenders communicated to customers notifying them of the new fee adjustment that took effect from 1st July 2018. However, the implementation of the tax was suspended by the High Court following a move by the Kenya Bankers Association (KBA) seeking to suspend its implementation. It was noted that the petition raised fundamental constitutional concerns, among them being the principle of public participation, given KBA’s claims that there was no stakeholder engagement prior to the operationalization of the law as required by the Constitution. The Attorney-General, Mr. Kihara Kariuki, had termed the quest to suspend the Robin Hood tax premature as Parliament has not passed the relevant Bill into law, arguing that Parliament had already invited public participation on the Finance Bill 2018, according banks an opportunity to present their views on the Bill. For more information, see our Cytonn Weekly #28/2018

Barclays Africa Group Limited changed its name to Absa Group following the London-based Barclays Plc’s exit from the African market to concentrate on European and United States markets. Barclays Plc had acquired a majority stake of 56.4% in Absa Group in 2005, gradually increased its stake to 62.0% but reduced to 14.9% after selling to the large institutional investor Public Investment Corporation of South Africa (PIC). Its Kenyan subsidiary, however, is looking to complete the rebranding process in 2020 and will continue operating as Barclays Bank Kenya till then. The move to separate with the London based parent company presents an opportunity for the local lender to explore new business areas and products that were initially hampered by the restrictions imposed by the parent group, hence enabling the bank to quickly implement new products based on mobile and internet banking that resonate with local markets. We are of the view that with the exit of the London-based parent company, Barclays will be able to compete more favourably with its peers, as it plans to increase its market share in the region by 5 million customers by 2020. Thus, with more localized decision-making, the lender is well positioned to quickly exploit any opportunities that arise as well as build on their innovative profile that has seen the bank offer efficient services to its customers. For more information, see our Cytonn Weekly #27/2018

During the month, capital markets stakeholders agreed to collaborate on a joint strategy that aims to ensure proper packaging of investment products that meet issuers and investors’ expectations, in a bid to enhance both listing and uptake of products. The strategy incorporates agencies such as the Treasury, the Nairobi Securities Exchange, the Central Depository and Settlement Corporation (CDSC), as well as the Fund Managers Association (FMA), alongside the Kenya Association of Stockbrokers and Investment Banks (KASIB), licensed market intermediaries, and the East African Venture Capital Association (EAVCA). The initiative was informed by a recent study conducted by Capital Markets Authority (CMA) that raised concern over the low number of listings and low uptake of capital markets products such as the Barclays Gold ETF and the Fahari I-REIT. We are of the view that this initiative will not only help investors better evaluate and understand capital market products, thereby increasing uptake of investment products; but will also assist issuers take advantage of capital-raising opportunities by tailoring investment products to meet investors’ expectations. For more information, see our Cytonn Weekly #26/2018

Bank M Tanzania Plc has been placed under administration by the Bank of Tanzania (BoT) after the bank ran into critical liquidity problems that have rendered it unable to meet its maturing obligations. This means the lender will not resume normal business for up to 90 days effective 2nd August 2018, until the regulator determines an appropriate course of action. The move is expected to affect the operations of the Kenyan lender M-Oriental, formerly Oriental Commercial Bank, where Bank M acquired a 51.0% stake in 2016 through transfer of 42.3 mn shares valued at Kshs 30.0 per share, with the total transaction being valued at Kshs 1.3 bn translating to a P/B of 1.4x. Bank of Tanzania has appointed a statutory manager to manage the bank’s operations after suspending its board of directors and management team. Bank M of Tanzania entered the Kenyan market in 2016, with a deposit base of Kshs 31.8 bn and a loan book of Kshs 33.5 bn.

The Bank of Ghana (BoG) has issued a universal banking licence to government-owned Consolidated Bank Ghana Limited, after revoking the licences of five banks namely UniBank Ghana Limited, The Royal Bank Limited, Beige Bank Limited, Sovereign Bank Limited, and Construction Bank Limited. The BoG appointed Mr. Nii Amanor Dodoo of KPMG as the Receiver for the five banks. All deposit liabilities of the five banks have been transferred to the Consolidated Bank. Operations will run as usual at the respective banks, which will now become branches of the Consolidated Bank, and the staff of these banks will also be absorbed by Consolidated Bank. Boards of Directors and shareholders of these banks will no longer have any roles. An asset quality review conducted by the BoG in 2016 revealed vulnerabilities in the five mentioned banks, namely:

- UniBank and Royal Bank were both found to be significantly undercapitalized,

- Royal Bank was found to have a high non-performing loans ratio of 78.9% owing to poor credit and liquidity risk management frameworks,

- Sovereign Bank has been unable to publish its financial statements for December 2017, and it emerged that the bank’s licence was obtained by false pretences through the use of suspicious and non-existent capital, and,

- Beige Bank and Construction Bank were each granted provisional licences in 2016 and launched in 2017. Subsequent investigations revealed that, similar to Sovereign Bank, both banks obtained their banking licences under false pretences through the use of suspicious and non-existent capital, which resulted in a situation where their reported capital is inaccessible to them for their operations.

The Bank of Ghana also approved a Purchase and Assumption Agreement between Consolidated Bank and the Receiver for the five banks, under which Consolidated Bank has acquired all deposits and other specified liabilities, and good assets of the five banks. The Government has issued a bond of up to GH¢ 5.8 bn to finance the shortfall between the liabilities and good assets assumed by Consolidated Bank. The Bank of Ghana aims to promote a strong and resilient banking sector to drive economic growth, and needs a strong and stable banking sector to drive the process of economic transformation. To this effect, the BoG recently raised the minimum capital threshold for lenders by more than threefold to GHS 400.0 mn (USD 84.0 mn) from GHS 120.0 mn (USD 25.0) mn, in a move aimed at strengthening the banking sector and encourage lending. At least 15 lenders in the country, including Ghana Commercial Bank, have met or are close to meeting the new capital requirements ahead of the December 2018 deadline.

Corporate Governance Changes:

East African Breweries Limited announced the retirement of Dr. Alan Shonubi from the Board after completing 9 years (3 terms) as an independent non-executive director, effective 26th July 2018. The company also gave notice of the appointment of Mr. Jimmy D. Mugerwa as an independent non-executive director, effective 27th July 2018. Following the changes:

- The board size remains unchanged with 11 members, an odd number, hence the score remains the same at 1.0 since 11 is the optimal number of board members;

- Gender diversity also remains unchanged at 18.2% female composition, hence the metric score also remains the same at 0.5 since it’s less than 30.0%,

- Ethnic diversity also remains unchanged since the incoming director, a Ugandan, replaces the outgoing who is also Ugandan; hence the score remains the same at 1.0 since less than 30.0% are from one ethnicity,

- The proportion of non-executive members also remains unchanged at 72.7% since the incoming director is also non-executive, hence the score remains unchanged at 1.0 as it is still greater than 50.0%;

Overall, the comprehensive score has therefore remained unchanged at 77.1%, and the rank remained unchanged at position 8 in Cytonn Corporate Governance Index.

WPP Scangroup Plc also announced changes in its Board of Directors. The company gave notice of the appointment of Mr. Richard Omwela as the Chairman of the Board, in addition to appointments of Mr. Pratul Shah and Mr. Dominic Grainger, both as directors of the company, effective 26th July 2018. Following the changes:

- The board size has increased to 11, an odd number, from 10 hence an improvement of the metric score to 1.0 from 0.5,

- Gender diversity remains unchanged at 10.0%, hence the metric score remains unchanged at 0.5 as it is less than 33.0%,

- Ethnic diversity also remains unchanged at 55.6%, hence the score remains the same at 0.0 since more than 30.0% are from one ethnicity,

- The proportion of non-executive members has remained unchanged at 90.0%, hence the score remains unchanged at 1.0 as it is still greater than 50.0%;

Overall, the comprehensive score has therefore remained unchanged at 66.7%, and the rank also remained unchanged at position 25 in the Cytonn Corporate Governance Index.

Equities Universe of Coverage:

Below is our equities universe of coverage:

|

Banks |

Price as at 29/06/2018 |

Price as at 31/07/2018 |

m/m change |

YTD Change |

LTM Change |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

|

Ghana Commercial Bank*** |

5.15 |

5.08 |

(1.4%) |

0.6% |

(1.4%) |

7.6% |

61.7% |

1.2x |

|

NIC Bank*** |

35.50 |

34.50 |

(2.8%) |

2.2% |

12.5% |

2.9% |

58.6% |

0.8x |

|

Zenith Bank*** |

25.00 |

23.00 |

(8.0%) |

(10.3%) |

(6.5%) |

11.7% |

56.6% |

1.0x |

|

I&M Holdings*** |

115.00 |

110.00 |

(4.3%) |

5.8% |

(3.5%) |

3.1% |

51.8% |

1.1x |

|

Diamond Trust Bank*** |

199.00 |

200.00 |

0.5% |

4.2% |

8.7% |

1.3% |

44.2% |

1.1x |

|

Union Bank Plc |

6.10 |

5.90 |

(3.3%) |

(24.4%) |

29.7% |

0.0% |

40.5% |

0.6x |

|

KCB Group*** |

46.25 |

47.00 |

1.6% |

9.9% |

15.3% |

6.2% |

32.4% |

1.5x |

|

Ecobank |

8.45 |

8.23 |

(2.6%) |

8.3% |

29.3% |

0.0% |

31.3% |

2.3x |

|

Barclays |

11.75 |

11.55 |

(1.7%) |

20.3% |

17.3% |

8.7% |

30.4% |

1.4x |

|

CRDB |

160.00 |

160.00 |

0.0% |

0.0% |

(23.8%) |

0.0% |

29.8% |

0.5x |

|

UBA Bank |

10.50 |

9.55 |

(9.0%) |

(7.3%) |

(1.5%) |

15.7% |

27.7% |

0.6x |

|

HF Group*** |

8.50 |

8.00 |

(5.9%) |

(23.1%) |

(15.8%) |

3.8% |

23.8% |

0.3x |

|

Co-operative Bank |

17.50 |

16.95 |

(3.1%) |

5.9% |

8.3% |

4.8% |

22.0% |

1.5x |

|

Equity Group |

46.25 |

48.00 |

3.8% |

20.8% |

17.8% |

4.0% |

16.2% |

2.5x |

|

Stanbic Bank Uganda |

32.00 |

33.00 |

3.1% |

21.1% |

22.2% |

3.5% |

13.5% |

2.1x |

|

CAL Bank |

1.28 |

1.27 |

(0.8%) |

17.6% |

61.3% |

0.0% |

8.5% |

1.1x |

|

Bank of Kigali |

286.00 |

290.00 |

1.4% |

(3.3%) |

16.0% |

4.8% |

8.2% |

1.6x |

|

Guaranty Trust Bank |

40.50 |

40.05 |

(1.1%) |

(1.7%) |

2.6% |

6.3% |

4.3% |

2.1x |

|

Stanbic Holdings |

91.50 |

93.50 |

2.2% |

15.4% |

16.9% |

5.7% |

(0.9%) |

1.1x |

|

Access Bank |

10.35 |

10.00 |

(3.4%) |

(4.3%) |

(0.5%) |

4.0% |

(2.0%) |

0.7x |

|

Standard Chartered |

198.00 |

203.00 |

2.5% |

(2.4%) |

(8.1%) |

6.1% |

(3.5%) |

1.6x |

|

Bank of Baroda |

150.00 |

140.00 |

(6.7%) |

23.9% |

29.6% |

1.8% |

(4.9%) |

1.2x |

|

SBM Holdings |

7.28 |

7.40 |

1.6% |

(1.3%) |

(3.4%) |

4.1% |

(6.5%) |

1.0x |

|

Stanbic IBTC Holdings |

52.00 |

49.75 |

(4.3%) |

19.9% |

38.6% |

1.2% |

(23.0%) |

2.5x |

|

FBN Holdings |

10.60 |

10.10 |

(4.7%) |

14.8% |

68.3% |

2.8% |

(24.0%) |

0.5x |

|

Standard Chartered |

23.14 |

26.00 |

12.3% |

3.0% |

15.7% |

0.0% |

(25.2%) |

3.3x |

|

National Bank |

6.25 |

5.80 |

(7.2%) |

(38.0%) |

(39.3%) |

0.0% |

(49.5%) |

0.4x |

|

Ecobank Transnational |

20.00 |

20.60 |

3.0% |

21.2% |

24.8% |

0.0% |

(55.1%) |

0.7x |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5th largest shareholder **** Stock prices are in respective country currency |

||||||||

We are “NEUTRAL” on equities for investors with a short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for long-term investors, and with expectations of higher corporate earnings this year, we are “POSITIVE” for investors with a long-term investment horizon.

During the month of July, there was increased private equity activity from firms carrying out Fundraising, as well as in the Fintech and Financial Services sectors.

Fundraising

- Musoni, a Microfinance Institution (MFI), which targets small-scale farmers and the informal sector, is set to issue Kshs 2.0 bn in debt notes through a private placement. The main targets are asset managers, trust management funds and high net-worth individuals. The move is aimed at shifting from foreign based funding to funding from local institutions in Kenya. The Kshs 2.0 bn debt notes will be used to grow the loan book, which stood at Kshs 18.0 bn. We are of the view that the debt will be priced at 16.0% p.a. for the 2-year debt note, and 17.0% p.a. for the 3-year debt note. It also seeks the local funding to offset exchange risk it will incur on paying back debt to foreign investors in their respective currencies. For more information, see our Cytonn Weekly #26/2018

- Branch International, a mobile-based MFI operating in Kenya, Tanzania, Nigeria and California, raised Kshs 350.0 mn (USD 3.5 mn) in capital investment through an issuance of a second commercial paper that was arranged by Barium Capital, a capital-raising advisory firm owned by Centum Investments. The capital investment is expected to grow Branch’s loan book as it expects to disburse Kshs 25.2 bn (USD 250 mn) in 2018 and plans to expand into new markets such as India. For more information, see our Cytonn Weekly #27/2018

- Prime Bank, a mid-sized lender in Kenya, is in talks with private equity funds to sell an undisclosed stake. The bank which concluded a private placement of debt worth Kshs 1.0 bn in 2016, also got an extension of its credit facility valued at Kshs 1.4 bn, by The French Development Financial Institution, PROPARCO, the same year. The capital injection from the sale of the stake will be used to increase the banks capacity to support long-term loans to its clientele; the bank’s loan book stood at Kshs 37.1 bn in March 2018.

According to the EMPEA (Emerging Markets Private Equity Association) Sub Saharan Africa Q1’2018 Insight, the private capital landscape is showing signs of improvement after a period of slow growth and currency volatility in some of the regions’ leading economies. Fundraising in the region increased by 10% year on year, totalling to USD 493 mn. The current financing gap for SMEs in Sub Saharan Africa is an upwards of USD 70 bn as per the Enclude, ANDE and Shell Capital Foundation, and banks are aiming to close this gap by offering convenient access to debt. The growth of alternative channels of funding is important to the economy, since in Kenya, 95% of funding comes from the banking sector and only 5% from non-bank institutions funding.

Fintech

- GreenTech Partners, a German investment firm, invested an undisclosed amount for an undisclosed stake in Bismart Insurance, a Kenyan insurance aggregator start-up. Insurance aggregators are digital platforms that collect information on various insurance products, their coverage, features and prices in order to avail them to consumers through their website and mobile applications. It enables the consumers to select the best insurance products that meet their needs. For more information, see our Cytonn Weekly #28/2018

Financial Services Sector

- Mauritius based SBM Holdings, a banking institution with headquarters in Port Louis, Mauritius, through its subsidiary SBM Kenya Limited, acquired certain assets and liabilities of Chase Bank after getting the approval of the Cabinet Secretary for the National Treasury. After the acquisition, SBM Kenya will assume 75% of the value of the deposits as well as take up majority of the branches and employees. The acquisition will also see SBM take control of 62 Chase Bank branches, significantly increasing the banks’ foothold in the country. SBM has injected Kshs 2.6 bn in Chase Bank and is planning to inject a further Kshs 6.0 bn to revive the collapsed bank. For more information, see our Cytonn Weekly #26/2018

- Badoer Investment Limited, a Dubai-Based investment firm, has bought a 15.6% stake in Sumac Microfinance Bank for Kshs 100.0 mn (USD 1.0 mn). Sumac Microfinance Bank is a Kenyan SME lender with a client base of 10,000 members and currently operates in Nairobi, Kiambu and Nakuru. The deal values Sumac Microfinance at Kshs 641.0 mn (USD 6.4 mn). The Microfinance Institution (MFI) currently has a loan book worth Kshs 1.0 bn (USD 10.0 mn). The capital injected will be used to grow its loan book and facilitate expansion in the region, with plans to open offices in Eldoret, Kisumu and Meru. For more information, see our Cytonn Weekly #29/2018

Private equity investments in Africa remains robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

During the month of July, the real estate sector recorded an increase in activities from both local and multinational investors, driven by:

- The huge housing deficit of 2 mn units according to the National Housing Corporation,

- High returns, with the sector recording total returns of on average 24.3% p.a. over the last 5-years,

- An attractive macro-economic environment with GDP growth averaging at 5.5% over the last 5-years,

- Government incentives such as a 15% corporate tax relief to developers who construct more than 100 low cost units per annum,

- Continued infrastructural improvements, and,

- The intensified government focus on the affordable housing initiative, through the Big 4 Agenda.

Industry Reports:

During the month, a number of reports were released, highlighting the real estate sector performance. The various reports are as explained in the table below;

|

Theme |

Report |

Key Take Outs |

|

Residential |

|

|

|

||

|

||

|

||

|

Hospitality |

|

|

|

||

|

||

|

||

|

||

|

Land |

|

|

|

Market Updates |

|

|

|

The Kenya National Bureau of Statistics (KNBS) -Gross Domestic Product Report Q1'2018 |

|

|

|

||

|

||

|

||

During the month, activities in various real estate themes were as outlined below:

- Residential Sector

The residential real estate sector continued to experience increased activities especially with regard to provision of affordable housing in Kenya. These included:

- H.E President Uhuru Kenyatta signed into law amendments to the Income Tax Act that will allow buyers get a 15.0% tax relief up to a maximum of Kshs 108,000 p.a., or Kshs 9,000 p.m., under the newly introduced Affordable Housing Relief section. He also signed into law the Stamp Duty Act, which will exempt first time home buyers from paying the Stamp Duty Tax, which normally is 2.0% - 4.0% of the property value. Buyers of affordable homes will therefore receive significant financial relief related to tax burdens, hence facilitating home ownership and offtake of the affordable homes that are to be delivered over the next 5-years. For more information, please see CytonnWeekly#28/2018

- The National Housing Co-operatives Union (NACHU) board announced that it would be embarking on the establishment of a regulated mortgage Sacco in a model that is set to see the board access mortgage guarantees from the Kenya Mortgage Refinancing Company. The NACHU board also plans to raise funds for its mass housing initiative via the launch of a REIT. In our view, if implemented, this will enable the board, which mainly focuses on provision of decent and affordable housing and infrastructure for low-income communities, to participate in the Kenyan Government’s Big 4 Agenda, by giving it financial muscle. For more information, please see CytonnWeekly#28/2018

- Housing Finance (HF) Group Limited, a mortgage provider in Kenya, announced plans to sell its existing home loans to the Kenya Mortgage Refinancing Company (KMRC), then use the proceedings to provide new housing loans as low as Kshs 2.5 mn for about 200 new housing units over the next year. For more information, please see CytonnWeekly#29/2018

- Signing of a Memorandum of Understanding that will see United States of America (USA) companies and Kenyan companies collaborate with the aim of implementing the Big 4 Agenda, which include (i) ensuring food security, (ii) provision of affordable housing, (iii) manufacturing, and (iv) provision of affordable healthcare. The MoU will provide a framework for the 2 countries to engage in various business opportunities with regard to the Big 4 Agenda. For more information, please see CytonnWeekly#26/2018

- In its efforts to drive the affordable housing initiative, the government has contracted consultancy firm, KPMG, to prepare a public participation masterplan for the planned affordable houses to be put up in all counties. The masterplan will inform the housing models to be designed as well as prices to be set for individual units in each county depending on off-takers purchasing power. In our view, this is a positive move, as it will ensure the government and private sectors understand and effectively address the target citizens’ need for affordable housing, and

- Mombasa County Land, Housing and Physical Planning Executive Hon. Edward Dzila Nyale announced plans to break ground on a Kshs 200 bn low cost housing project in August 2018. The project is set to deliver 32,000 units in the next 2-years in Mzizima, Miritini, Greenfields, Changamwe, Likoni and Nyerere estate, all in Mombasa County, through Public Private Partnership (PPP). PPP’S have various advantages such as, better public services through improved operational efficiency, timely projects delivery and within budgets, however PPP structured projects in Kenya such as construction of hostels by Kenyatta University (K.U) and Moi University are yet to kick off. The key constraints have been;

- Regulatory hindrances such as lack of a mechanism to transfer public land to a Special Purpose Vehicle (SPV) to facilitate access to private capital through the use of the land as security,

- Lack of clarity on returns and revenue-sharing,

- The extended time-frame of PPPs while private developers prefer to exit projects within 3-5 years, and,

- Bureaucracy and slow approval processes.

We therefore remain sceptical on the success of the initiative, based on the above challenges unless the National and County Governments of Kenya address them.

- Commercial Sector:

In the commercial theme, the Anti-Corruption Agency is set to acquire the Integrity Centre Building, which hosts Ethics and Anti-Corruption Commission's (EACC) headquarters along Valley Road in Milimani, Nairobi. The National Land Commission (NLC) approved the acquisition of the building built on 1.2 acres from Tegus Limited at Kshs 1.5 bn. Tegus Limited is thus exiting the development at a return of 30.3% p.a. over 5-years, where they bought the development at Kshs. 400 mn in 2013 and exiting at Kshs 1.5 bn in 2018. The increase in value is driven by land capital appreciation in the area currently at Kshs 387.0 mn per acre compared to Kshs 263.0 mn in 2013 and growing at a 6-year CAGR of 22.5%. Based on market performance, the development is expected to record a rental yield of 9.6%, in line with Kilimani office performance, against a Nairobi market average of 9.3%.

In retail sector, French retailer Carrefour’s franchise in Kenya, released its H1’2018 financial report, recording a 143.0% increase in revenue from Kshs 8.2 bn recorded in FY’2017 to approximately Kshs 19.9 bn in H1’2018. This is attributable to the retailer’s accelerated expansion in Nairobi currently operating at the Two Rivers Mall in Runda, the Thika Road Mall at Roy Sambu, the Junction Mall along Ngong’ Road, the Sarit Centre in Westlands, and The Hub and Galleria Malls in Karen.

During the month, the retail sector witnessed an increase in activities in Nairobi with a number of retailers, both local and international expanding, as shown below:

|

International Retailers (Household Products) in Kenya |

|||||

|

Retailer |

Country of Origin |

Nature of Store |

No of Stores Opened |

Branches Opened |

Branches Planned to be Opened |

|

Carrefour |

France |

Supermarket |

5 |

Two Rivers Mall, Thika Road Mall, The Hub Karen, Sarit Centre and The Junction Mall |

Village Market, Galleria Mall |

|

Shoprite |

South Africa |

Supermarket |

0 |

|

Westgate Mall, Garden City, Mombasa City Mall and 4 undisclosed |

|

Choppies |

Botswana |

Supermarket |

11 |

Kiambu Mall, Nairobi CBD, Nakuru, South Field Mall, Kisii etc |

Signature Mall |

|

Game |

South Africa |

Supermarket |

2 |

Garden City Mall, The Waterfront Karen |

|

|

Miniso |

Japan |

Household and consumer goods |

3 |

Village Market, Thika Road Mall, The Junction |

The Hub Karen, South Field Mall |

|

|||||

Source: Cytonn Research 2018

- Industrial Sector

Centum Investments Plc broke ground on its Kshs 100.0 bn industrial park in Kilifi County named Vipingo Investment Park, out of which 1,150-acres of the serviced plots will be set aside for manufacturing, warehouses, logistics and commercial developments. The firm is expecting to leverage on industrial park’s proximity to the port of Mombasa, Moi International Airport and the Mombasa SGR Terminal, which are located 35 km from the industrial park and the LAPPSET Corridor and Lamu Port. The industrial parks in Nairobi recorded a 0.7% points increase in rental yields from 5.4% as at H1’2017 to 6.1% in H1’2018, according to our Cytonn H1'2018 Market Review, attributed to an 11.8% increase in occupancy levels. The performance is majorly driven by (i) the renewal of investor confidence following the conclusion of the prolonged electioneering period, and (ii) increased focus by the government on manufacturing, with the sector being included among the governments Big Four Agenda of focus for the next 4-years.

- The Hospitality Sector

During the month of July, the hospitality sector continued to attract investment from both local and global players as follows;

- Airlines continue to increase their flights frequency driven by increased tourist arrivals into the country. The following airlines announced an increase in flight frequency during the month;

- Fly Tristar Airline announced plans to increase its flights from Nairobi to Mombasa, from four times a week to everyday, and also start flights from Nairobi to Malindi, and Nairobi to Ukunda, and,

- Air France announced plans to increase its flight's frequency from Paris to Nairobi to five times a week as from March 2019, from the current three flights.

- PrideInn Hotels announced plans to open a 3-star business hotel in Mombasa comprising of 40 rooms and conference facilities that can accommodate up to 500 people. For more information, please see our CytonnWeekly#26/2018, and,

- Kenya Airways, KQ, signed a memorandum with Fairmont Hotels & Resorts, where travellers will be accommodated in the Fairmont facilities; The Norfolk in Nairobi County, Fairmont Mount Kenya Safari Club in Laikipia County, and Fairmont Mara Safari Club in Narok County, a move aimed at benefitting both institutions in terms of attracting high end clientele and also more tourist activity for the country. For more information, please see our CytonnWeekly#28/2018.

We retain a positive outlook for the hospitality sector in Kenya driven by (i) increased demand for accommodation and other hospitality services by both local and international guests, with the number of international arrivals growing by 16.7% from 1.2 mn in 2015 to 1.4 mn in 2017, (ii) improved security following the end of the electioneering period, (iii) the revision of negative travel advisories, warning international citizens, e.g. from the United States against visiting Kenya, (iv) positive reviews from travel advisories such as Trip Advisor who ranked Nairobi as the 3rd best place to visit in 2018, (v) continued marketing efforts by the Kenya Tourism Board, (vi) Jomo Kenyatta International Airport (JKIA) ranking as the best airport in Africa and 38th globally according to Worldwide rankings by Airhelp, and (vii) improved flight operations and systems, which will make it easier and more convenient for travellers.

- Land

During the month, the land sector recorded various controversial cases regarding ownership. However, we note that mitigations have been put in place therefore not disrupting development activities. The key activities are;

- The families displaced by the Kshs 5.6 bn Eldoret Southern Bypass from Cheplaskei to Maili Tisa are set to be compensated by the National Land Commission after land acquisition is finalised, and,

- The Nairobi County Government issued a 14-day notice on 30th July 2018 to private developers who have encroached on public land and road reserves to evict. This is to pave way for county projects that had stalled due to land-grabbing.

- Infrastructure

Infrastructural development has continued to boost growth in, not only real estate, but also other sectors in Kenya and has a significant impact on the country’s macro-economic growth. This has thus led to both the National and County Governments actively undertake expansionary infrastructural initiatives.

During the month of July, we saw the launch and completion of various infrastructural projects across the country, including:

|

Infrastructural Project in Kenya as at July 2018 |

||||||

|

|

Name of Project |

Type |

Length (Kms) |

County |

Project Value |

Progress |

|

1. |

Lamu – Isiolo Road |

Road |

530 km |

Lamu/Isiolo |

Kshs 62.0 bn |

To commence in August 2018 |

|

2. |

Gilgil to Njoro Road |

Road |

23 km |

Nakuru |

Kshs 1.4 bn |

Commenced in July 2018 |

|

3. |

Sewerage systems in Murang’a County |

Sewer system |

|

Muranga |

Kshs 4.0 bn |

Capital sourced from Arab Development Bank |

|

4. |

Konza City Infrastructure |

Road, fiber cable connectivity and electricity reticulation |

40 km |

Machakos |

Kshs 40.0 bn |

The Kenyan Government has committed capital |

|

5. |

Konza City Infractructure |

Data center |

|

Machakos |

Kshs 17.0 bn |

The Kenya Government has committed capital |

|

6. |

Industrial area’s Enterprise Road to the City Centre flyover |

Flyover |

2.0km |

Nairobi |

Plans underway |

Plans underway |

Source: Cytonn Research 2018

Other key highlights in infrastructure in July 2018 were:

- The Capital Markets Authority announced that Kiambu, Meru, and Machakos Counties may spearhead the country into an initiative that will see counties raise funds from the public for the financing of their infrastructural projects through the sale of bonds, and,

- Plans are underway for the establishment of nine major cities along the ongoing Kshs 2.5 trillion LAPSSET Corridor. The towns, which will include Lamu, Isiolo, Lodwar, and Mandera, are set to be game-changers in terms of economic and social development and will include transport rails and highways as well as international airports in Lamu and Lodwar, in addition to the Isiolo International Airport.

The increased investment in infrastructure is an indication that the government is committed to its developmental agenda and guarantees overall growth of the Kenyan economy and a positive impact on real estate as more areas are opened up for development.

- Listed Real Estate

- The Fahari I- REIT, Kenya

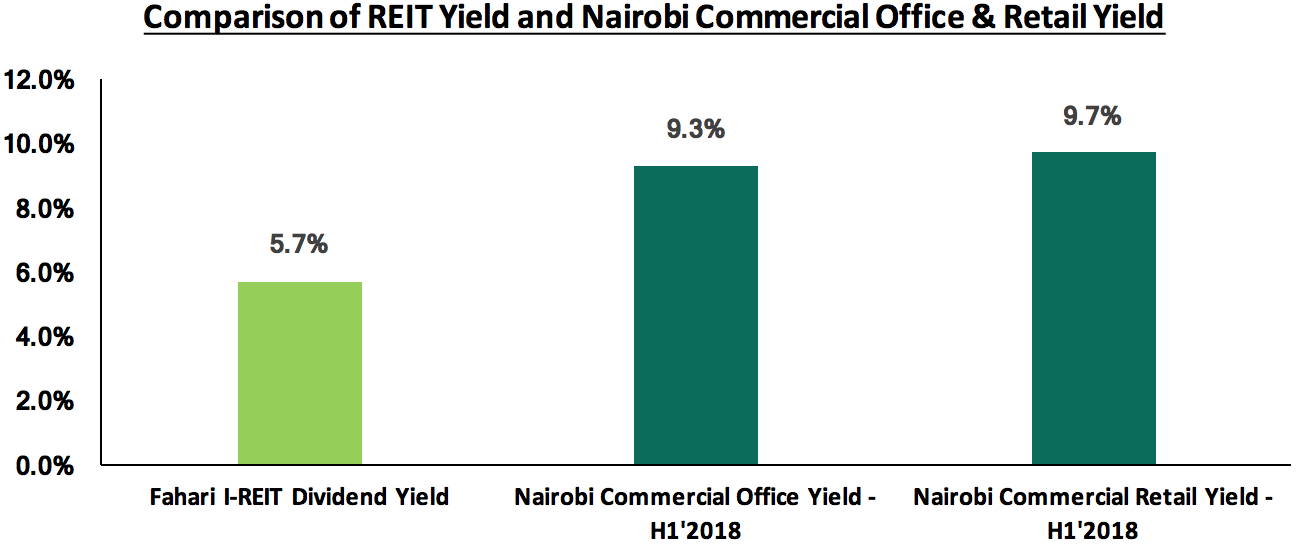

Stanlib Fahari I-REIT released their H1’2018 earnings, registering a 16.3% y/y decline in earnings to Kshs 0.36 per unit from Kshs 0.43 per unit in H1’2017, attributable to 7.7% decline in operating income outpacing the 0.9% decline in operating expenses. The operating income decline is attributable to an 18.1% decline in interest income to Kshs 41.9 mn from Kshs 51.1 mn in H1’2017, coupled with a 2.1% decline in rental income to Kshs 135.1 mn from Kshs 138.0 mn in H1’2017. The company, however, noted that the decline in rental income is attributable to a temporary increase in vacancies, coupled with some tenants bargaining for reduced rentals upon the renewal of leases, despite the additional 1-month rental income contribution by their newly acquired property 67 Gitanga Place, which was acquired in May 2018. For example, one of the properties owned by the REIT, the Greenspan Mall had an occupancy of 74.0% in 2018 from 90.0% in 2017, which is 5.5% points lower than the Nairobi retail market average at 79.5%. Property expenses also declined by 9.5% to Kshs 38.1 mn from Kshs 42.1 mn in H1’2017. The faster decline in property expenses compared to rental income led to a decline in the property operating expense ratio to 28.2% from 30.5% in H1’2017. The I-REIT recorded a dividend yield of 5.7%, based on Kshs 10.5 market price per share as at 1st August 2018, assuming the dividend pay-out ratio remains at 91.0%, similar to the FY’2017 pay-out. The yield is relatively low compared to brick and mortar assets with commercial retail and office achieving rates of 9.7% and 9.3% in H1’2018, respectively, as shown below;

Source: Cytonn Research 2018

For a more comprehensive analysis on the REIT H1’2018 performance, see our Stanlib Fahari I-REIT Earnings Note.

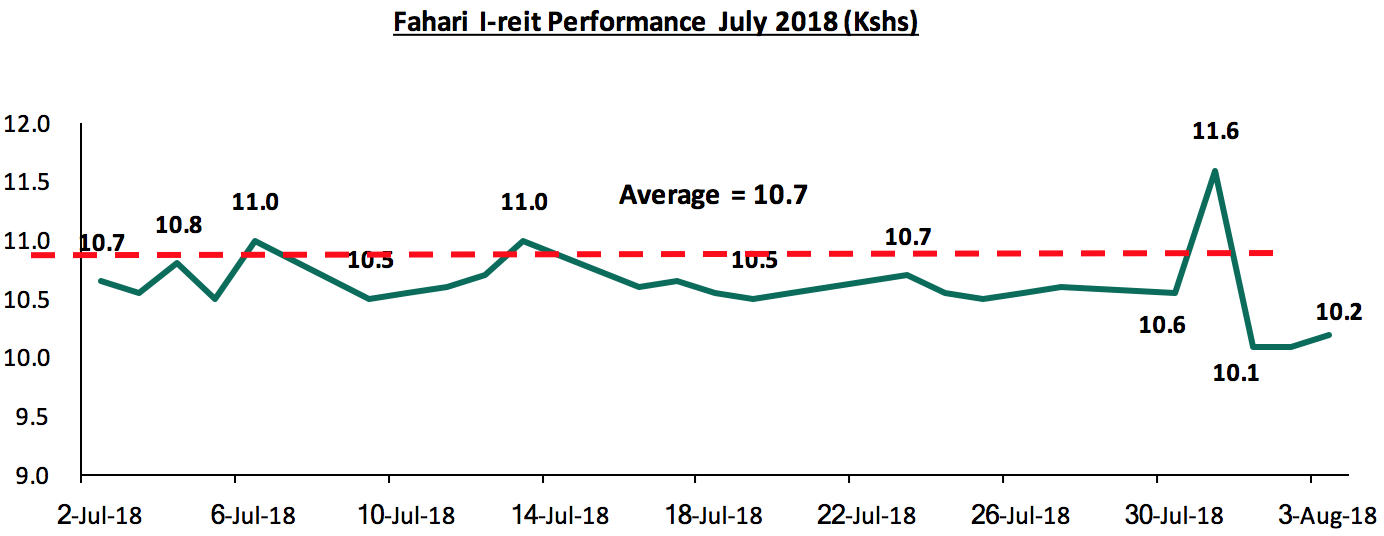

On the bourse, during the month, Stanlib’s Fahari I-REIT price rose by 2.7%, closing at Kshs 11.6 per share from Kshs 11.3 per share at the end of June 2018, but still trading at a 42.0% discount from its listing price of Kshs 20.0 in November 2015. During the past week, the Fahari I-REIT price declined by 3.8% closing at Kshs 10.2 per share attributable to the 16.3% Y/Y decline in earnings in H1’2018 hence negative investor sentiments. In addition, at Kshs 10.2 per share as at 3rd August 2018, the REIT is trading at a discount of 48.7% to its Net Asset Value per share, which currently stands at Kshs 19.9 as per H1’2018 reporting. The prices for the instrument have remained low averaging at Kshs 10.7 in July 2018 largely due to: i) opacity of the exact returns from the underlying assets, ii) the negative sentiments currently engulfing the sector given the poor performance of Fahari and Fusion REIT (FRED), iii) inadequate investor knowledge, iv) the poor performance of Fahari I-REIT recording a dividend yield of 5.7% compared to office and retail at 9.3% and 9.7%, respectively, and v) lack of institutional support for REITs. We expect the REIT to continue trading at low prices and in low volumes.

The graph below shows the REIT’s performance in July 2018;

Source: Bloomberg

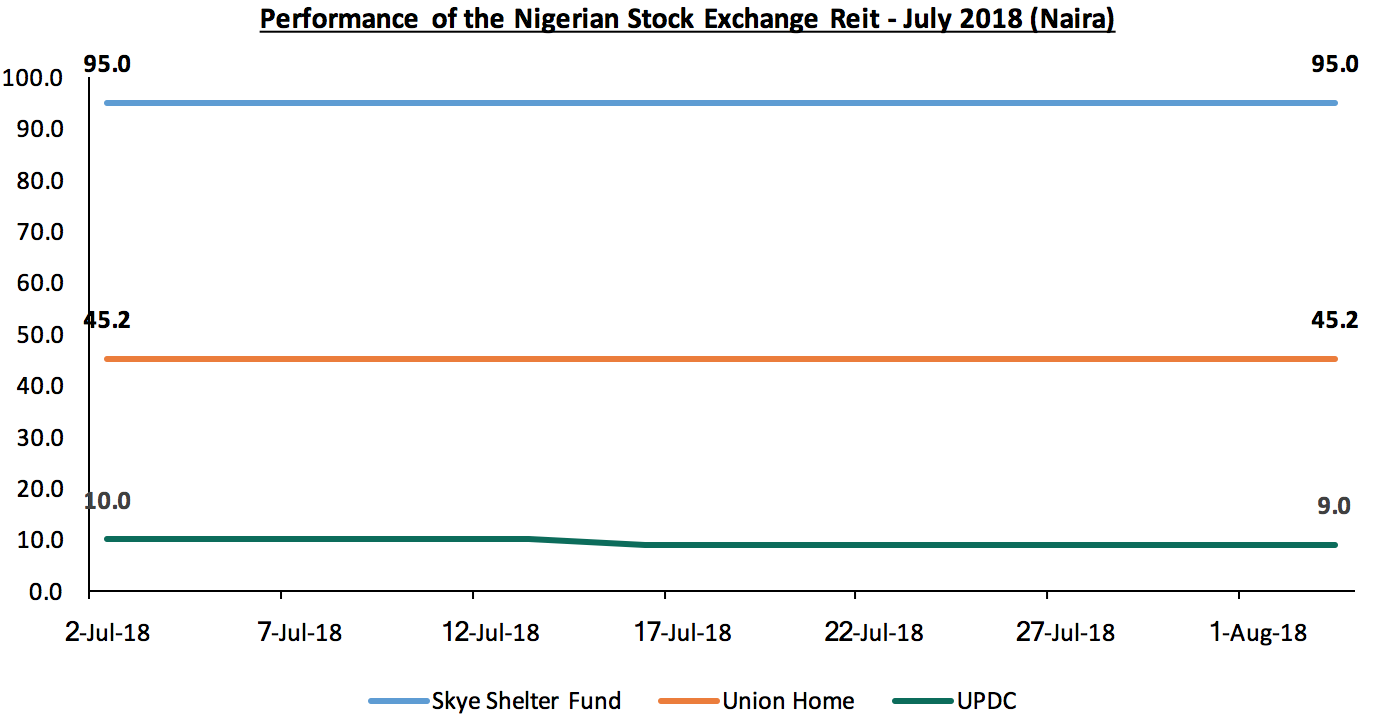

- REITS on the Nigeria Stock Exchange

In Nigeria, the REITs market continued to remain flat. Of the three REITs we cover, two, that is, Union Home and Skye Shelter’s prices, remained unchanged, while the UPDC REIT declined by 10.0% to NGN 9 from NGN 10 at the beginning of the month. Nigeria’s REITs market has plateaued indicating a stalled demand for the past couple of years which is attributable to shallow investor knowledge, poor market regulation amidst a high-interest rate environment; and therefore, we expect the performance to continue on this trend for the long term.

Source: Bloomberg

We retain a positive outlook for the real estate sector in Kenya driven by: (i) positive demographic trends such as rapid urbanization that currently stands at 4.4% against a global average of 2.1%, and rapid population growth rates of 2.6% against a global average of 1.2%, (ii) stable macro-economic environment, (iii) sustained infrastructural development, and (iv) government initiatives to tackle the huge housing deficit of 2 mn units, growing by approximately 200,000 units per annum according to National Housing Corporation (NHC).

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.