Cytonn H1’2018 Markets Review

By Cytonn Research Team, Jul 1, 2018

Executive Summary

A. Global Markets Review

Global growth for Q1’2018 was estimated at 3.1%, similar to the projected growth, according to the World Bank. The various regions recorded continued growth in Q1’2018 with China, US and the Eurozone recording GDP growth figures of 6.8%, 2.0% and 0.4% compared to 6.8%, 1.4% and 0.5%, respectively, in Q1’2017. There was divergence in monetary policy, with the US Federal Open Market Committee (FOMC) raising the Federal Funds Rate by 25 bps to a bound of 1.75% - 2.0% in June, marking the second rate hike this year, while the European Central Bank (ECB) maintained the base lending rate at 0.00% in April;

B. Sub-Saharan Africa Regional Review

GDP growth in SSA is projected to come in at 3.4% in 2018, up from 2.8% in 2017, supported by higher commodity prices, and improved capital markets access. Majority of the SSA stock markets recorded negative returns during H1’2018, largely attributable to capital outflows from the markets as profit taking investors exited the markets so as to realize the gains made in various sectors such as oil and gas, that was boosted by a global rally in crude prices, and the financial services sector;

C. Kenya Macro Economic Review

The macroeconomic environment in Kenya has remained relatively stable in the first half of 2018, supported by (i) the Government’s continued investment in infrastructure, (ii) a stable interest rate environment, (iii) a relatively stable currency, having gained by 2.1% against the dollar in H1’2018, and (iv) improved business confidence and strong private consumption. The average inflation rate for H1’2018 decreased to 4.2% from 9.8% in H1’2017, with June 2018 inflation having risen to 4.3% from 4.0% in May;

D. Fixed Income

During the first half of 2018, T-bills auctions recorded an oversubscription, with the average subscription rate coming in at 142.6%, compared to 263.2% in H1’2017. Overall average subscription rates for the 91, 182, and 364-day papers in H1’2018 came in at 105.6%, 122.3% and 177.7%, respectively, from 154.0%, 184.5% and 131.2%, in H1’2017. Yields on T-bills declined by 40 bps, 90 bps and 70 bps in H1’2018, closing at 7.7%, 9.7%, and 10.5%, from 8.1%, 10.6%, and 11.2% for the 91, 182, and 364-day papers, respectively, at the end of 2017;

E. Equities

During H1’2018, the Kenyan equities market recorded mixed performance, with NASI and NSE 25 gaining 1.8% and 2.4% respectively, while NSE 20 declined by 11.5%. Kenyan listed banks released their FY’2017 and Q1’2018 results, recording a 1.0% decline and a 14.4% increase in core EPS, respectively, compared to a growth of 4.4% in FY’2016 and an 8.6% decline in Q1’2017;

F. Private Equity

During H1’2018, we witnessed increased private equity activity across all sectors within our coverage: Financial Services, Education, Hospitality, and Real Estate. The Financial Services sector was dominant with notable transactions in Fintech lending, Insurance, and Banking;

G. Real Estate

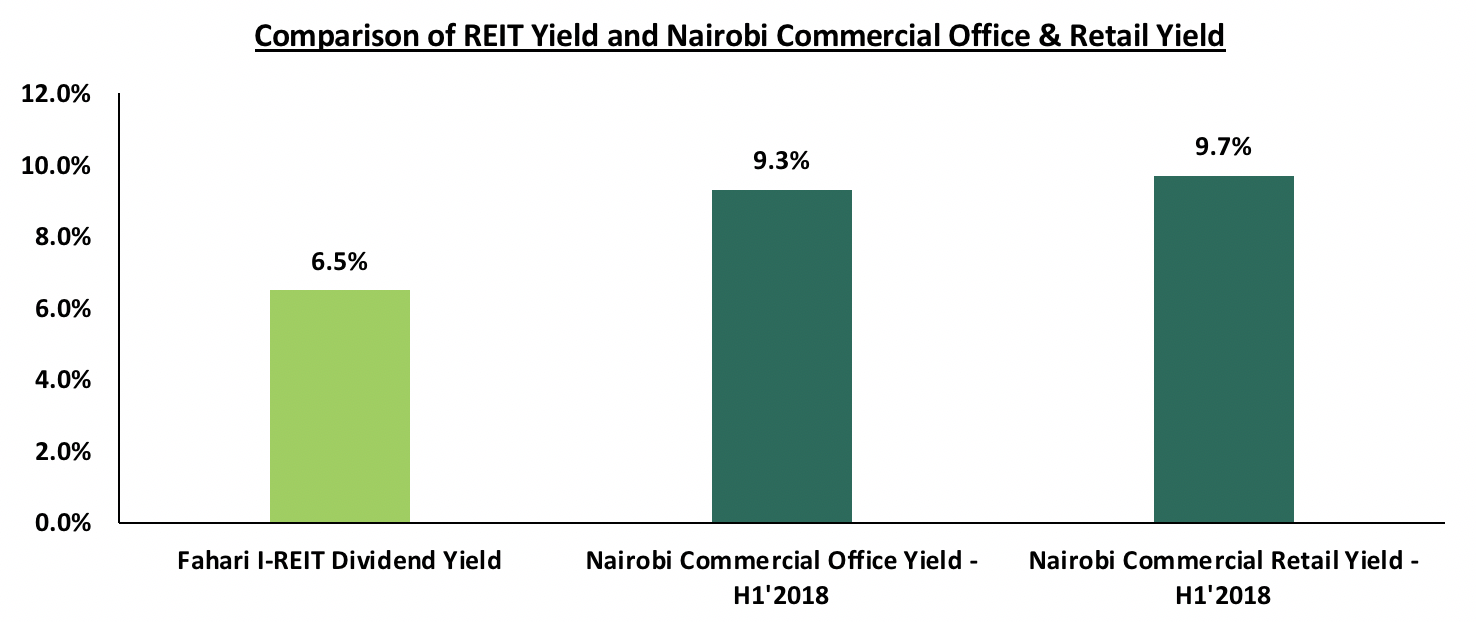

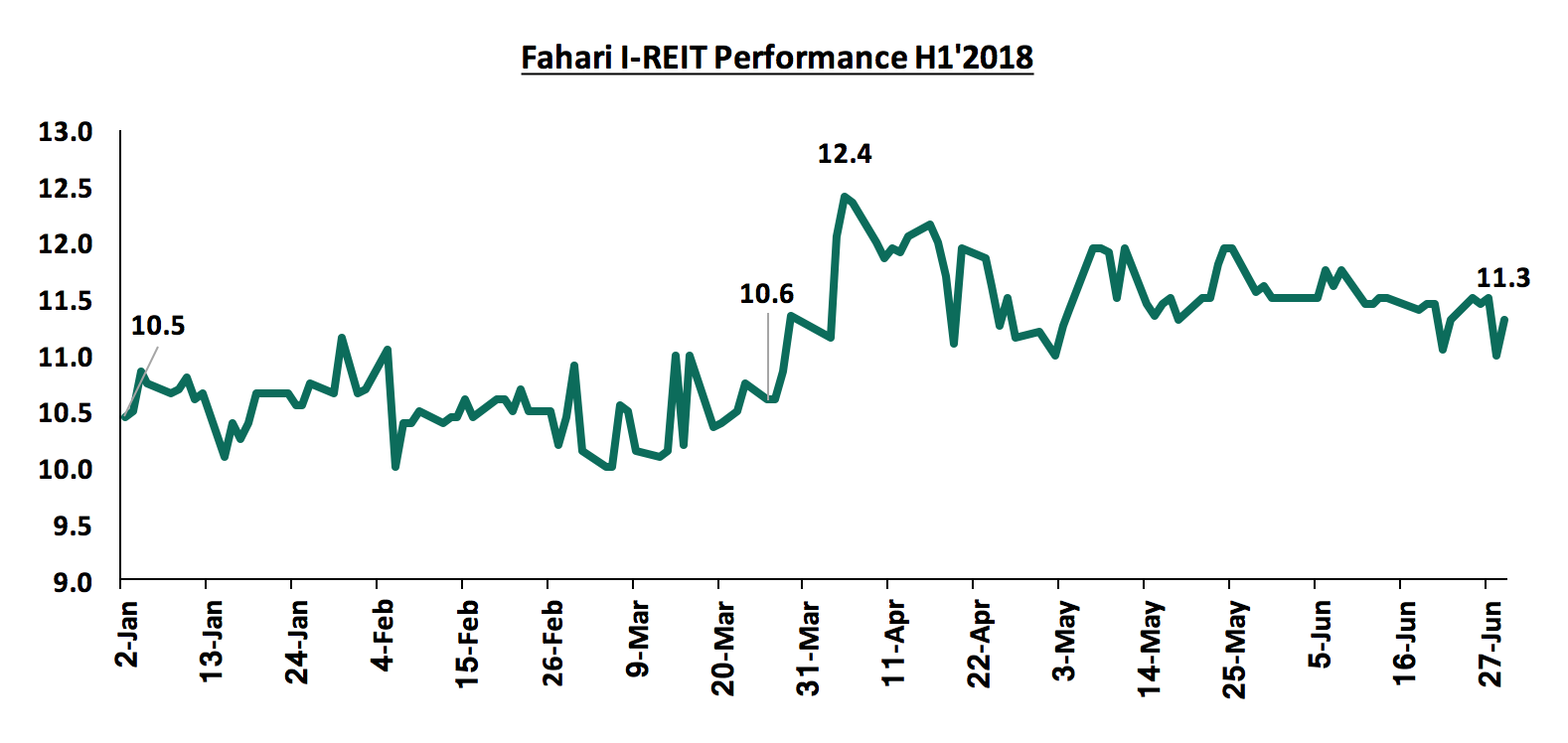

H1’2018 performance of the real estate sector in Kenya improved slightly, with sectors such as office, retail and industrial registering a marginal increase in yields of between 0.1% points and 0.7% points to 9.3%, 9.7% and 6.1% from 9.2%, 9.6% and 5.4%, respectively. The performance has been bolstered by (i) continued demand for investment property from multinational individuals and the growing middle class, (ii) Government efforts towards enabling the environment for developers through key statutory reforms such as National Land Use Policy, and initiatives such as the National Housing Development Fund, (iii) the expanding middle class, and (iv) continued infrastructural improvements in the country.

- During the week, Cytonn Investments Management Plc secured an additional Kshs 2.1 bn in funding from our institutional partners, Taaleri of Finland. This is the fourth time the Finnish firm is investing in Cytonn, having already committed over KES 3.0 bn towards projects by Cytonn – The Alma, Amara Ridge and Situ Village. See Press Release here

- On Wednesday, 27th June 2018, Cytonn Foundation, an initiative of Cytonn Investments that focuses on giving back to the society through skill development, held a Private Wealth Management (WMT) and Cytonn Young Leaders Program (CYLP) training at the Mount Kenya University (MKU) located in Thika, as part of the Foundation’s financial literacy pillar. The University staff were taken through a real estate management training session with a focus on opportunities available in the real estate sector. See Event Note

- Edwin H. Dande, CEO of Cytonn Investments, gave the key-note address at this year’s Founders of the Year Awards (FOYA), held on 29th July 2018. See Event Note here

- On Saturday 30th June, 2018, Cytonn Investments Management Plc held a Staff Team Building Event themed “Crazy Olympics” at the Parklands Sports Club. See Event Note here

- Edwin H. Dande, CEO of Cytonn Investments, was a panelist at the Chartered Accountants Day for the Institute of Chartered Accountants of India - Nairobi Chapter, themed “Corporate Governance”

- Caleb Mugendi, Senior Investments Analyst, discussed the 2018 Appropriation Bill. Watch him on CNBC here

- Maurice Oduor, Senior Investments Manager, discussed the impact of the interest cap law. Watch him on Citizen TV here

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the trainings for their teams. The Wealth Management Trainings are run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- We continue to beef up the team with ongoing hires for: Full Stack Software Engineer, Unit Manager-Nairobi. Visit the Careers section on our website to apply

Introduction:

Most global economies registered continued economic growth in the first quarter of 2018, with China, USA and the Eurozone registering growths of 6.8%, 2.0% and 0.4% y/y, compared to 6.7%, 1.1% and 0.5%, respectively, in Q1’2017. The regions begun the year with good performance but ongoing trade concerns and abrasive geopolitical stances have threatened to derail this.

Below is the summary of the key occurrences in H1’2018 per region:

United States:

The US Federal Open Market Committee (FOMC) hiked the Federal Funds Rate twice during the year, settling on a range of 1.75% - 2.00% in June. The decision by the FOMC to hike rates was on the back of a decline in the unemployment rate to an 18-year low of 3.8% in June from 3.9% in March 2018, below the unemployment rate target of 4.5%. The committee highlighted that economic growth has been rising at a solid rate to record a 2.0% GDP growth in Q1’2018, bolstered by tax cuts and a strong labor market. The Committee expects to raise the federal funds rate 2 more times in 2018, due to (i) a sustained GDP growth of 2.0% in Q1’2018, expected to record hit 2.7% for FY’2018, (ii) strong labor market conditions as indicated by the low unemployment rate, and (iii) inflation that is at 2.8%, which is expected to edge closer to the Committee's preferred level of 2.0% over the medium term.

The US stock market recorded a positive performance, with S&P 500 having gained by 0.8% in H1’2018, attributed to gains in the technology and financial services sectors, on optimism of pro-growth and protectionism policies from the current Trump administration, such as the corporate tax cut from 30.0% to 21.0%, which has tended to boost corporate earnings and thereby lead to rising stock prices.

We expect the US market to remain supported by a strong labor market that will spur domestic consumption and economic growth. However, the ongoing trade wars between the US and China, the Eurozone, Mexico and Canada is likely to dampen the country’s growth prospects, which could disrupt product supply chains and undercut business investment.

Eurozone:

In the Eurozone, the momentum in growth waned, as the GDP growth was recorded at 0.4% in Q1’2018, which was lower than the 0.7% growth recorded in both Q1’2017 and Q4’2017. The decline in the GDP growth could largely be attributed to a weak performance in the external sector, as exports declined by 0.4%, for the first time since Q4’2012. The decline in exports was largely due to a lower aggregate demand of products that could be attributed to a strong Euro currency. Moreover, there was overall reduced government spending coupled with reduced fixed investment growth. The Eurozone PMI declined by 5.9% to 55.5 from 58.8 recorded in January 2018. The decline in the PMI points to slowing economic growth in the region, as inflows from new business grew at a reduced pace.

The European Central Bank (ECB) recently met in June, maintaining the base lending rate at 0.00%, and the rates on the marginal lending facility and deposit facility at 0.25% and (0.40%), respectively. The current negative deposit rates are expected to persist in 2018 and impact growth positively by spurring domestic regional consumption. The Bank also announced an upcoming end to its Quantitative Easing (QE) program at its June meeting. The ECB will finalize its asset purchase program at the end of December 2018 and halve the pace of purchases from the current EUR 30.0 bn per month to EUR 15.0 bn per month in the final quarter of the year. This points to the beginning of the end for monetary stimulus in the Eurozone. The bank also signaled that the path of interest rates going forward, is likely to remain at the current levels through to the summer of 2019, granted inflation moves as expected.

The stock markets in Europe registered declines in the first half of 2018, with the FTSE 100 declining by 0.1%, primarily due to the healthcare and telecommunication sectors. The region’s stock markets began the year with a positive performance, but were weighed down by uncertainty on the path of US interest rates and the outlook of global trade. The sectors tend to serve as “bond proxies” that offer stable returns and are much sought after when bond yields are low. However, amid rising US rates, and therefore rising bond yields, these sectors declined on account of increased capital outflows.

On the political front, growing global trade tensions are threatening the Eurozone’s outlook. On 22nd June, US President Donald Trump threatened to escalate a trade dispute with the EU by slapping a 20.0% tariff on automobiles. This came after the EU enacted retaliatory tariffs on US goods, following the US’s imposition of tariffs on steel and aluminum imports from the EU. While the US’ initial tariffs on steel and aluminum are expected to have a relatively small economic effect, the automobile industry is a much larger sector and the US is the biggest market for EU car exports, meaning that the economic effect would be much more pronounced for countries such as Germany and the UK, if the tariffs are imposed. On the domestic political front, Italy and Spain have experienced political uncertainty. New, relatively unstable governments have been installed in both countries, as detailed below:

In Italy:

- A Coalition Government formed by the populist Five Star Movement (M5S) and right-wing League party was installed in June, ending months of political deadlock, and,

- The Coalition spelt out plans for fiscally expansionary policies, which may cause the government to clash with European bodies if they flout the expenditure guidelines.

In Spain:

- Pedro Sánchez was sworn in as the new Prime Minister at the start of June, after the incumbent Mariano Rajoy lost a confidence motion in parliament after a fallout from a massive corruption scandal that he had been implicated in, and,

- The newly installed government has weak political mettle, as it commands only 84 seats out of 350 in parliament, which will constrain policymaking and possibly limit its tenure.

In Germany:

- Political uncertainty has increased due to an internal dispute within the ruling coalition over migration policy. The dispute is seen as undermining Chancellor Angela Merkel’s leadership, which is receiving opposition from the Interior Minister Horst Seehofer, who threatened to prevent immigrants registered in other European countries from gaining entry into Germany, a move that Merkel has been vocal against.

Declining GDP growth recorded in the first quarter of 2018, coupled with rising inflation and mounting political risks, led to a downgrade of the region’s GDP growth estimates. According to World Bank, GDP is now projected to grow by 2.1% in FY’2018, down from last month’s forecast of 2.3%. Rising inflation is likely to reduce household consumption this year. The ongoing trade tensions between the Eurozone and the US is expected to impact negatively on the external trade sector, as commodities such as automobiles, are set to be disadvantaged in the US, which is a major market for them. This, coupled with the various political problems in major member countries, is expected to hamper the regions GDP growth for the year 2018.

China:

China’s y/y GDP in Q1’2018 increased by 6.8% to Yuan 19.9 tn (USD 3.2 tn), the same rate as Q3’2017 and Q4’2017. The steady economic growth was driven by (i) a steady growth in industrial production, (ii) an increase in private consumption, and (iii) increased investment in infrastructure by the government. New businesses and industries continued to record steady growth, as corporate profit and resident incomes steadily increased which boosted private consumption. The services sector, which accounted for 56.6% of the economy, played a key role in driving China’s economic growth, with a growth rate of 7.5% y/y.

On the stock market, the Shanghai Composite Index declined by 15.0% in H1’2018. The heightened uncertainty occasioned by a prolonged trade spat between China and the US has dampened investor sentiment in the country, resulting in a generally stronger Yuan against major currencies. Corporate results for December 2017 had showed positive trends. However, stock performance within sectors was attributed to investor sentiment that was influenced by political events both domestically and globally.

The Chinese economy faces several challenges that could derail the steady growth pace recorded in the previous quarters. These include (i) increased protectionism policies (policies aimed at protecting own domestic interests) in countries such as the US, (ii) monetary policy adjustments by major economies, and (iii) financial market turbulence mainly in the Eurozone. This could lead to increased uncertainty in the international markets, which could affect the country’s export business seeing as the economy is a net exporter of their domestically produced commodities. The US administration has imposed tariffs of about USD 50.0 bn on Chinese goods and, recently announced activation of denial of export privileges against leading Chinese telecom equipment maker ZTE Corp. However, the government is insistent on the capability of the economy to handle trade tensions with the United States, citing the country's increasingly domestic-led growth from local consumption, growing innovation edge, and ample room for development and policy control.

We expect the global economy to recover and post a better growth than that recorded in FY’2017, on account of improving commodity prices, increased income levels and by extension consumption levels. However, ongoing geopolitics are likely to dampen any growth prospects.

Regional Economic Growth:

During H1’2018, the IMF released their Regional Economic Outlook report for Sub-Saharan Africa (SSA) dated April 2018, with a focus on domestic revenue mobilization and private investment. The key take-outs from the report were:

- GDP growth in SSA is projected to come in at 3.4% in 2018, up from 2.8% in 2017, supported by higher commodity prices, and improved capital markets access,

- The average current account deficit in SSA is estimated to have narrowed to 2.6% of GDP in 2017, from 4.1% in 2016. The improvement was due to an increase in international receipts in about half of the region’s economies. For large oil exporters, external balances improved due to higher oil production, improvement in oil prices, and reduced imports with the current account deficit in the Central African Economic and Monetary Community (CEMAC) declining to 4.3% of GDP in 2017, from 13.8% of GDP in 2016. In non-resource intensive countries, the current account deficits remained high in 2017, due to a combination of low exports, high capital goods imports, high food and fuel imports, and increased imports related to public infrastructure projects, and,

- Regional annual inflation in SSA fell to just over 10.0% in 2017, from 12.5% in 2016, and is expected to fall further in 2018, driven by declining food prices due to improved weather conditions.

The report points to an improved operating environment in SSA with (i) a projected higher GDP growth in 2018 of 3.4%, compared to 2.8% in 2017, (ii) the average current account deficit narrowing to 2.6% of GDP in 2017, from 4.1% in 2016, and (iii) average annual inflation declining to 10.0% in 2017 from 12.5% in 2016, expected to fall further in 2018. The key concern, however, remains the rising debt burden, as public debt continued to rise in 2017, with about 40.0% of low-income developing countries in the region being in debt distress or at a high risk of debt distress, and the median level of public debt in SSA exceeding 50.0% of GDP. With the rise in debt, interest payments have also been on the rise, with the median interest payments-to-revenue ratio close to 10.0%, up from the 5-year average of 5.0%.

Regional Currencies:

Regional currencies generally declined during H1’2018 due to the strengthening of the US dollar as evidenced by the dollar index gaining 2.5% on a year to date basis. The table below shows the performance of the various currencies:

|

Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Jun-17 |

Dec-17 |

Jun-18 |

Last 12 months |

YTD change % |

|

Kenyan Shilling |

103.7 |

103.2 |

101.1 |

2.5% |

2.1% |

|

Malawian Kwacha |

725.4 |

725.5 |

726.3 |

(0.1%) |

(0.1%) |

|

Zambian Kwacha |

9.2 |

10.0 |

10.0 |

(8.6%) |

(0.1%) |

|

Nigerian Naira |

324.5 |

360.0 |

361.2 |

(11.3%) |

(0.3%) |

|

Tanzanian Shilling |

2237.0 |

2234.6 |

2270.0 |

(1.5%) |

(1.6%) |

|

Mauritius Rupee |

34.7 |

33.6 |

34.6 |

0.3% |

(2.9%) |

|

Botswana Pula |

10.2 |

9.8 |

10.4 |

(1.5%) |

(5.7%) |

|

Ghanaian Cedi |

4.4 |

4.5 |

4.8 |

(8.4%) |

(6.0%) |

|

Ugandan Shilling |

3578.0 |

3643.3 |

3884.2 |

(8.6%) |

(6.6%) |

|

South African Rand |

13.1 |

12.4 |

13.7 |

(5.0%) |

(10.8%) |

SSA Eurobonds:

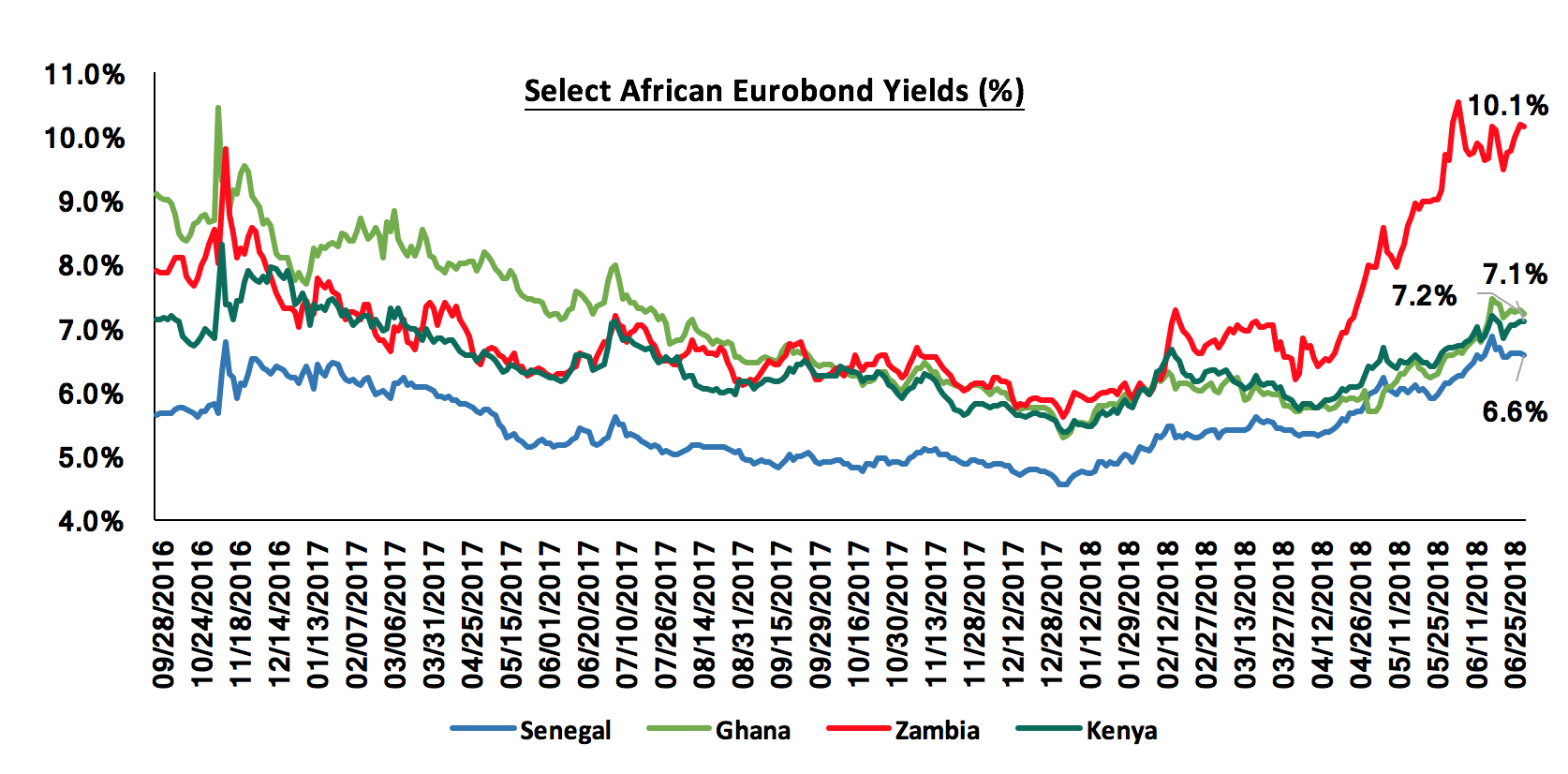

The first half of 2018 was characterized by Eurobond issuance by 5 Sub Saharan African countries (Kenya - USD 2.0 bn, Nigeria - USD 2.5 bn, Senegal - USD 2.2 bn, Ghana - USD 2.0 bn, and South Africa - USD 2.0 bn) jointly raising USD 10.7 bn; see our Focus Note on the Eurobonds in Sub-Saharan Africa here.

The table below shows the performance of select Eurobonds with a tenor of 10-years in the Sub-Saharan Africa region, with all yields having increased during the H1’2018 period:

|

Select Sub Saharan Africa 10-Year Tenor Eurobonds Performance |

|||||

|

Country |

Jun-17 |

Dec-17 |

Jun-18 |

Last 12 Months (% Points) |

YTD Change (% Points) |

|

Ghana |

7.4% |

5.7% |

7.2% |

(0.2%) |

1.5% |

|

Kenya |

6.4% |

5.6% |

7.1% |

0.7% |

1.5% |

|

Senegal |

5.2% |

4.7% |

6.6% |

1.3% |

1.9% |

|

Zambia |

6.8% |

5.9% |

10.1% |

3.4% |

4.3% |

Yields on African Eurobonds have risen attributed to corrections in global markets in line with the rising US Treasury yields, which act as a crucial benchmark for financial markets. This has also seen flight of capital as investors move to the relatively less risky USA securities. These corrections were driven by the end of the US Federal Reserve’s expansionary policy measures with 2 Fed rate hikes in the first half of 2018, which has seen a rise in the US Treasury yields against a backdrop of tighter monetary policy, rising interest rates, and inflation expected to rise in the coming months having edged up to 2.8% in May from 2.5% in April.

Regional Stock Markets:

Majority of the SSA stock markets recorded negative returns during H1’2018, largely attributable to capital outflows from the markets as profit taking investors exited the markets to realize the gains made in various sectors such as oil and gas, that was boosted by a global rally in crude prices, and the financial services sector. Various markets had experienced bullish runs from the previous year to Q1’2018 as indicated in our Q1’2018 Markets Review, however, price correction due to the capital outflows resulted in the declining performance in the second quarter of 2018. Below is a summary of the performance of key bourses in SSA:

|

Equities Market Performance (Dollarized) |

|||||

|

Country |

Jun-17 |

Dec-17 |

Jun-18 |

Last 12 Months |

YTD Change(%) |

|

Malawi |

21.8 |

29.8 |

42.4 |

94.6% |

42.3% |

|

Ghana |

446.5 |

569.7 |

600.9 |

34.6% |

5.5% |

|

Kenya |

1.5 |

1.7 |

1.7 |

17.1% |

4.0% |

|

Zambia |

519.4 |

532.1 |

547.4 |

5.4% |

2.9% |

|

Nigeria |

105.2 |

106.2 |

105.9 |

0.6% |

(0.3%) |

|

Uganda |

0.5 |

0.6 |

0.5 |

15.4% |

(2.5%) |

|

Rwanda |

0.1 |

0.2 |

0.1 |

0.8% |

(4.3%) |

|

Tanzania |

1.0 |

1.1 |

1.0 |

1.6% |

(6.4%) |

|

BRVM |

0.5 |

0.4 |

0.4 |

(13.2%) |

(11.6%) |

|

South Africa |

3953.1 |

4802.6 |

4188.0 |

5.9% |

(12.8%) |

NB: Please note these indices are dollarized and may differ from the equities section, which is in Kshs

We are of the view that increased government spending on infrastructure development, improving commodity prices in the global markets, better weather conditions and relative political stability will be the key drivers for SSA growth in 2018.

Economic Growth:

During the first half of 2018, we tracked Kenya GDP growth projections for FY’2018 released by 15 organizations, that comprised of research houses, global agencies, and government organizations. The average GDP growth, including our projection of 5.5% as at Q2’2018, came in at 5.5%, unchanged from average projections released in Q1’2018. The common view is that GDP growth will improve in 2018, from 4.9% in 2017, generally due to (i) recovery in the agriculture sector on the back of improved weather conditions, and (ii) recovery in the business environment following easing of political risk caused by the prolonged political impasse over the 2017 presidential elections.

|

Kenya 2018 Annual GDP Growth Outlook |

|||

|

No. |

Organization |

Q1'2018 |

Q2'2018 |

|

1 |

Central Bank of Kenya |

6.2% |

6.2% |

|

2 |

Kenya National Treasury |

5.8% |

5.8% |

|

3 |

Oxford Economics |

5.7% |

5.7% |

|

4 |

African Development Bank (AfDB) |

5.6% |

5.6% |

|

5 |

Stanbic Bank |

5.6% |

5.6% |

|

6 |

Citibank |

5.6% |

5.6% |

|

7 |

International Monetary Fund (IMF) |

5.5% |

5.5% |

|

8 |

World Bank |

5.5% |

5.5% |

|

9 |

Fitch Ratings |

5.5% |

5.5% |

|

10 |

Barclays Africa Group Limited |

5.5% |

5.5% |

|

11 |

Cytonn Investments Management Plc |

5.4% |

5.5% |

|

12 |

Focus Economics |

5.3% |

5.3% |

|

13 |

BMI Research |

5.3% |

5.2% |

|

14 |

The Institute of Chartered Accountants in England and Wales |

5.6% |

5.6% |

|

15 |

Standard Chartered |

4.6% |

4.6% |

|

Average |

5.5% |

5.5% |

|

The macroeconomic environment in Kenya has remained relatively stable in the first half of 2018, supported by (i) continued investment in infrastructure, (ii) a stable interest rate environment, (iii) a relatively stable currency, having gained by 2.1% in H1’2018, and (iv) improved business confidence and strong private consumption as evidenced by an average Stanbic PMI of 55.0 in the first 5 months of 2018 up from 50.2 in the first 5-months of 2017. The outlook on economic growth for 2018, is positive following improved weather conditions set to boost agricultural productivity, water supply and electricity that will in turn favor the manufacturing sector. Low private sector credit growth, which stood at 2.8% as at April as compared to the 5-year average of 14.0%, remains one of the key concerns for economic growth.

The Kenya Shilling:

The Kenya Shilling appreciated against the US Dollar by 2.1% in H1’2018 to close at Kshs 101.1 from Kshs 103.2 at the end of 2017. This week, the Kenyan Shilling declined by 0.2% against the dollar to close at Kshs 101.1 from Kshs 100.8 the previous week due to end month dollar demand from oil importers and manufacturers. In our view, the shilling should remain relatively stable in the short term, supported by,

- The narrowing of the current account deficit which stood at 6.1% of GDP as at March 2018 from 6.4% in December 2017,

- Stronger inflows from principal exports which include coffee, tea and horticulture which increased by 9.3% during the month of April to Kshs 21.9 bn from Kshs 20.0 bn in a similar period the previous year, with the exports from coffee, and horticulture increasing by 6.7%, and 25.0% y/y, respectively, despite tea exports declining marginally by 1.6% y/y,

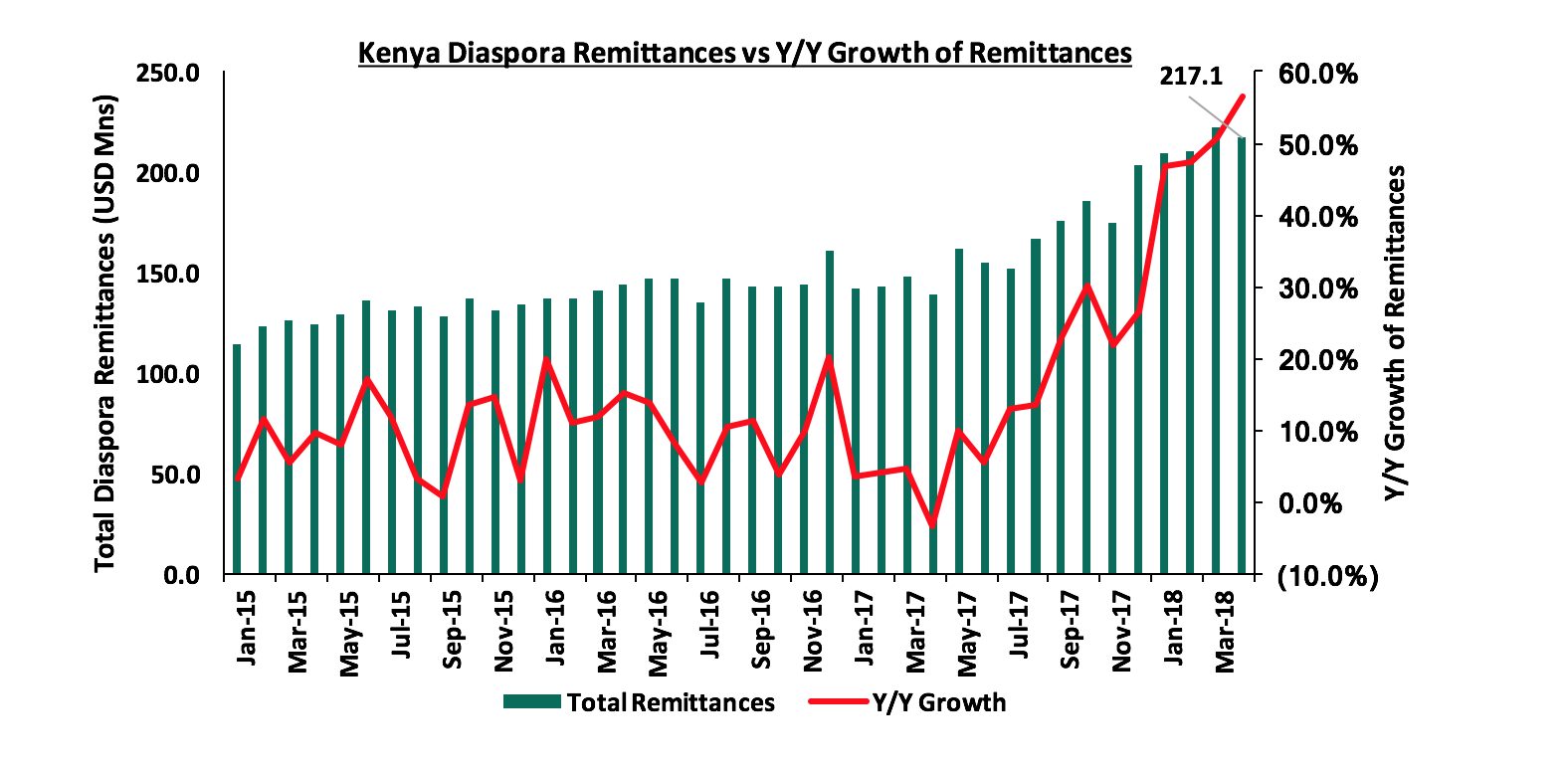

- Improving diaspora remittances, which increased by 56.6% to USD 217.1 mn in April 2018 from USD 138.6 mn in April 2017 with the bulk contribution coming from North America at USD 114.0 attributed to (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient, and,

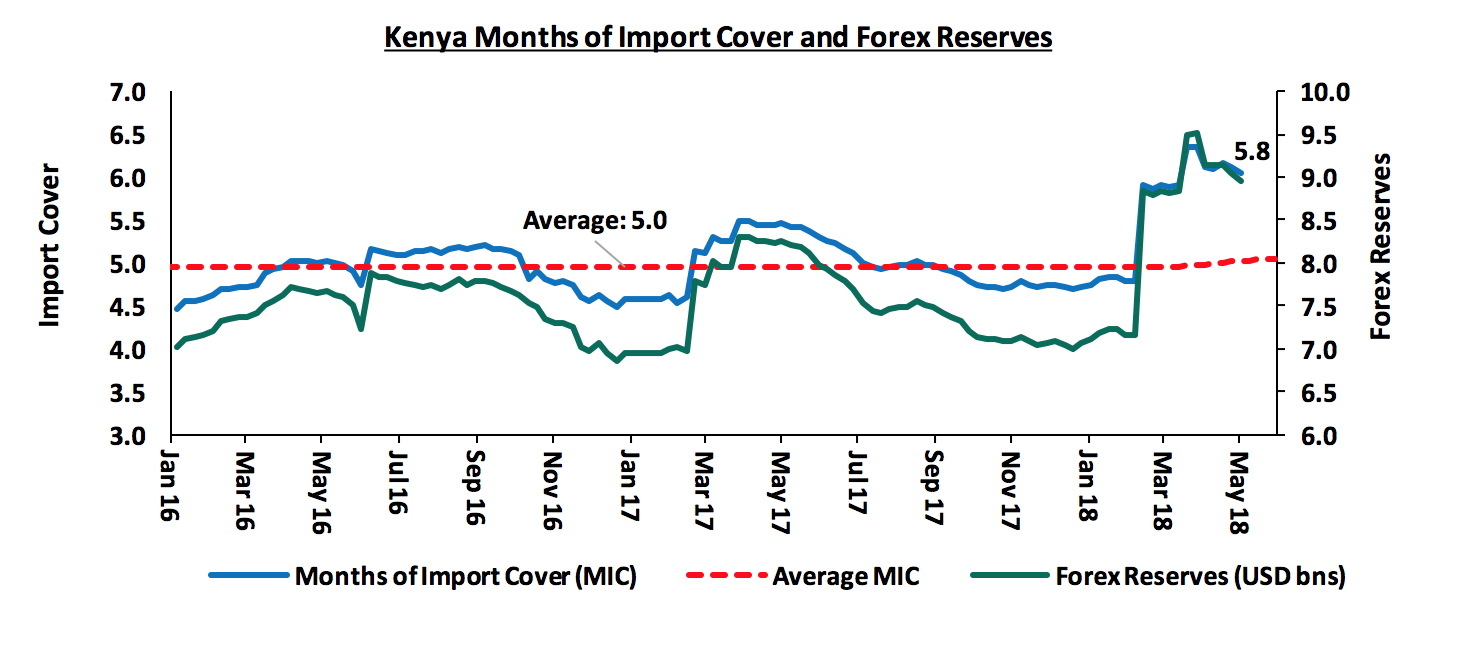

- High forex reserves, currently at USD 8.7 bn (equivalent to 5.8 months of import cover) and the USD 1.5 bn stand-by credit and precautionary facility by the IMF, still available until September 2018.

Inflation:

The average inflation rate for H1’2018 decreased to 4.2% from 9.8% in H1’2017, with June’s inflation having risen to 4.3% from 4.0% in May. Y/Y inflation in June 2018 declined mainly due to the base effect, however, m/m inflation declined by 0.9% due to a 2.2% decline in the Food and Non-Alcoholic Drinks’ Index driven by a decrease in prices of some food basket items such as onions, potatoes, maize and cabbages outweighing increases in others. Key to note is that inflation in June was not in line with our expectations of between 6.1% and 6.4%, which we expected to be driven by a base effect given declining inflation in June 2017, and increases in the transport index, the housing, water, electricity, gas & fuel index, and food inflation, as highlighted in our Cytonn Weekly #25/2018.

|

Major Inflation Changes in the Month of June 2018 |

|||

|

Broad Commodity Group |

Price change m/m (June-18/May-18) |

Price change y/y (June-18/June-17) |

Reason |

|

Food & Non-Alcoholic Beverages |

(2.2%) |

0.9% |

This was due to a decrease in prices of |

|

Transport Cost |

0.4% |

7.5% |

This was on account of an increase in the pump price of petrol and diesel |

|

Housing, Water, Electricity, Gas and other Fuels |

0.5% |

14.2% |

This was |

|

Overall Inflation |

(0.9%) |

4.3% |

The m/m decline was due to a 2.2% decline in food prices which has a CPI weight of 36.0% |

We expect relatively higher inflation during the second half of the year, mainly due to the base effect, as June was the inflexion point last year where inflation started declining. Going forward, we expect inflation to average 7.0% in 2018, which is within the government target range of 2.5% - 7.5%.

Monetary Policy:

The Monetary Policy Committee (MPC) met thrice in H1’2018, In the January 22nd meeting, they decided to retain the CBR at 10.0%, noting an increased optimism for growth prospects in the economy and inflation expectations anchored within the Government target range of 2.5% - 7.5%. In the March 19th meeting, the MPC decided to lower the CBR to 9.5% for the first time since July 2016, noting that there was room for monetary policy easing to further support economic activity as evidenced by (i) inflation, which had eased to 4.5% in February 2018 from 4.8% in January, and (ii) increased private sector optimism as per the MPC private sector market perception survey. They later retained the CBR at 9.5% in the May 28th meeting, citing that the impact of the 50-bps reduction in March had not yet been fully transmitted to the economy, despite there being room for monetary policy easing to further support economic activity.

Half-Year Highlights:

The Kenyan National Treasury released the fiscal year 2018/19 national budget in June 2018. Below are some of the key highlights

Amounts in Kshs trillions unless stated otherwise

|

Comparison of 2017/18 and 2018/19 Fiscal Year Budgets |

||||||||

|

|

2018/19 |

% change 2017/18 to 2018/19 |

2017/18 |

% change 2016/17 to 2017/18 |

2016/17 |

|||

|

Revenue |

1.9 |

14.5% |

1.7 |

9.6% |

1.5 |

|||

|

Recurrent expenditure |

1.5 |

7.7% |

1.4 |

13.3% |

1.2 |

|||

|

Development expenditure |

0.6 |

7.8% |

0.6 |

(27.3%) |

0.8 |

|||

|

County governments |

0.4 |

7.3% |

0.4 |

16.4% |

0.3 |

|||

|

Total expenditure |

2.5 |

7.7% |

2.3 |

(0.2%) |

2.3 |

|||

|

Deficit as % of GDP |

(5.7%) |

1.5% |

(7.2%) |

1.9% |

(9.1%) |

|||

|

Net foreign borrowing |

0.3 |

(11.2%) |

0.3 |

(30.3%) |

0.5 |

|||

|

Net domestic borrowing |

0.3 |

(8.6%) |

0.3 |

(14.7%) |

0.3 |

|||

|

Total borrowing |

0.6 |

(10.0%) |

0.6 |

(23.6%) |

0.8 |

|||

Key take-outs from the table:

- Total expenditure in the fiscal year 2018/2019 is set to increase by 7.3%, to Kshs 2.5 tn from Kshs 2.3 tn in the fiscal year 2017/18,

- Development expenditure is set to increase at a slightly faster rate than recurrent expenditure; with recurrent increasing by 7.7% to Kshs 1.5 tn from Kshs 1.4 tn, while development will increase by 7.8% to Kshs 625.0 bn from Kshs 579.6 bn in FY 2017/18,

- The budget deficit is projected to decline to 5.7% of GDP from an estimated 7.2% of GDP in the FY 2017/18; this in line with the International Monetary Fund’s (IMF’s) recommendation, in a bid to reduce Kenya’s public debt requirements,

- The total borrowing requirement to plug in the deficit is expected to decline to Kshs 558.9 bn from Kshs 620.8 bn, in a bid to reduce Kenya’s public debt burden which is estimated at 55.6% of GDP as at 2017 by the IMF, 5.6% above the East African Community (EAC) Monetary Union Protocol, the World Bank Country Policy and Institutional Assessment Index, and the IMF threshold of 50.0%, but well below the 74.0% mark considered a signal for debt unsustainability, and,

- Debt financing of the 2018/19 budget is split 51:49 between foreign and domestic borrowing, with the foreign and domestic debt being estimated at Kshs 287.0 billion (equivalent to 3.0% of GDP) and Kshs 271.9 billion (equivalent to 2.8% of GDP), respectively.

Key to note is that the Treasury proposed a repeal of the interest rate cap, subject to passing by the National Assembly, stating that the rate cap had not achieved its intended purpose; this is after failing to mention it in the Draft Financial Markets Conduct Bill, 2018 – see our Focus Note on the Conduct Bill here. The Kenyan budget has always been expansionary given that Kenya is a developing country, and this has led to a budget deficit usually bridged through debt, resulting in a rising debt-to-GDP ratio, estimated to have hit 55.6% by the end of 2017, 5.6% above the East African Community (EAC) Monetary Union Protocol threshold of 50.0%. To reduce this deficit, a few changes have been proposed to beef up revenue collection as follows: (i) an expected implementation of the 16.0% VAT on petroleum products from September 2018, (ii) the raising of excise duty fee on cellular money transfer services to 12.0% from 10.0%, previously, and (iii) introduction of a robin hood tax of 0.05% on any amount exceeding Kshs 500,000 transferred through financial institutions. As we continue to see significant changes to taxes, we are of the view that this should be accompanied by equally significant reduction efforts in recurrent expenditure, as only this joint effort will lead to a substantial decline in the budget deficit and in turn the public debt burden.

Macroeconomic Indicators Table:

The table below summarizes the various macroeconomic indicators, the expectation at the beginning of 2018, the actual H1’2018 experience, the impact of the same, and our expectations going forward:

|

Macro-Economic & Business Environment Outlook |

|||||

|

Macro-Economic Indicators |

2018 Expectations at Beginning of Year |

YTD 2018 Experience |

Going Forward |

Outlook - Beginning of Year |

Current Outlook |

|

Government Borrowing |

Government to come under pressure to borrow as it is well behind both domestic and foreign borrowing targets for FY 2017/18, and KRA is unlikely to meet its collection target due to expected suppressed corporate earnings in 2017 |

i. The government surpassed its domestic borrowing target for the 2017/18 fiscal year, having borrowed Kshs 390.2 bn against a target of 297.6 bn |

With the interest rate cap still in place, we don’t expect upward pressure on interest rates. Should the cap be repealed, we expect this to result in upward pressure on interest rates in the next borrowing cycle, as the government will no longer have an easy time collecting funds from the domestic market. However, with National Assembly against a complete repeal and The Draft Financial Markets Conduct Bill, 2018 having not addressed the issue of the interest rate cap, we still remain positive on government borrowing. |

Negative |

Positive |

|

Exchange Rate |

Currency projected to range between Kshs 102.0 and Kshs 107.0 against the USD in 2018. With the possible widening of the current account deficit being a possible point of concern, we expect the CBK to continue to support the Shilling in the short term through its sufficient reserves of USD 7.1 bn (equivalent to 4.7 months of import cover) |

The Shilling has appreciated by 2.1% against the USD YTD to 101.1. |

The government projects the current account deficit to narrow to 5.4% of GDP in 2018 due to lower food and SGR imports. |

Neutral |

Neutral |

|

Interest Rates |

Upward pressure expected on interest rates, especially in the first half of the year, as the government falls behind its borrowing targets for the fiscal year. However, with the Banking (Amendment) Act, 2015, the MPC might be unable to do much with the CBR which has remained at 10.0% throughout 2017 |

The MPC met on 28th May 2018 and maintained the CBR at 9.5 citing that the impact of the 50-bps reduction in March had not yet been fully transmitted to the economy, despite there being room for monetary policy easing to further support economic activity |

The interest rate environment is expected to remain relatively stable with the CBK not accepting |

Neutral |

Neutral |

|

Inflation |

Inflation expected to average 7.5% compared to 8.0% last year |

Inflation has averaged 4.2% in the first half of 2018. The year on year inflation rate for the month of June rose to 4.3% from 4.0% in May, driven by a 0.5% rise in Housing, Water, Electricity, Gas and Other Fuels’ Index attributed to an increase in prices of kerosene and charcoal which outweighed decreases in electricity charges |

Inflation in H2’2018 is expected to experience upward pressure, partly due to the base effect, and the expected rise in fuel and transport prices with the introduction of 16.0% VAT on petroleum products as from September 2018. |

Positive |

Positive |

|

GDP |

GDP growth projected to come in at between 5.3% - 5.5% |

Kenya’s economy grew by 4.9% in 2017, compared to 5.9% in 2016 in line with our expectation of between 4.7% - 5.2%. The consensus GDP growth projection for Kenya in 2018 is at 5.5% (an average taken from 15 research firms, global agencies and government organizations projections), which is an improvement from the GDP growth experienced in 2017 |

GDP growth is projected to come in between 5.4% - 5.6% in 2018 driven by recovery of growth in the agriculture sector, continued growth in the tourism, real estate and construction sectors, and growth in the manufacturing sector |

Positive |

Positive |

|

Investor Sentiment |

Investor sentiment expected to improve in 2018 given the now settling operating environment after conclusion of the 2017 elections |

The Kenya Eurobond was 7.0x oversubscribed partly showing the appetite for Kenyan securities by the foreign community, and investor confidence in Kenya’s stable and relatively diversified economy |

Given (i) the now settled operating environment following the elections in 2017, (ii) the expectation that long term investors will enter the market seeking to take advantage of the valuations which are still historically low, and (iii) expectations of a relatively stable shilling, we still expect investor sentiment to improve in 2018 |

Positive |

Positive |

|

Security |

Security expected to be maintained in 2018, especially given that the elections were concluded and the USA lifted its travel warning for Kenya, placing it in the 2nd highest tier of its new 4-level advisory program, indicating positive sentiments on security from the international community |

The political climate in the country has eased, compared to Q3’2017 with security maintained and business picking up. Kenya now has direct flights to and from the USA, a possible signal of improving security in the country |

We expect security to be maintained in 2018, especially given that the elections are now concluded, the government has settled into office, and the country's two principals are working together towards growing the economy after the recent hand shake |

Positive |

Positive |

Of the 7 indicators we track, 5 are positive and 2 are neutral, with government borrowing being the only indicator whose outlook has changed, to positive from negative. This is a positive change from the last half of 2017 where we had 4 positives, 1 negative and 3 neutrals. From this, we maintain our positive outlook on the 2018 macroeconomic environment.

T-Bills & T-Bonds Primary Auction:

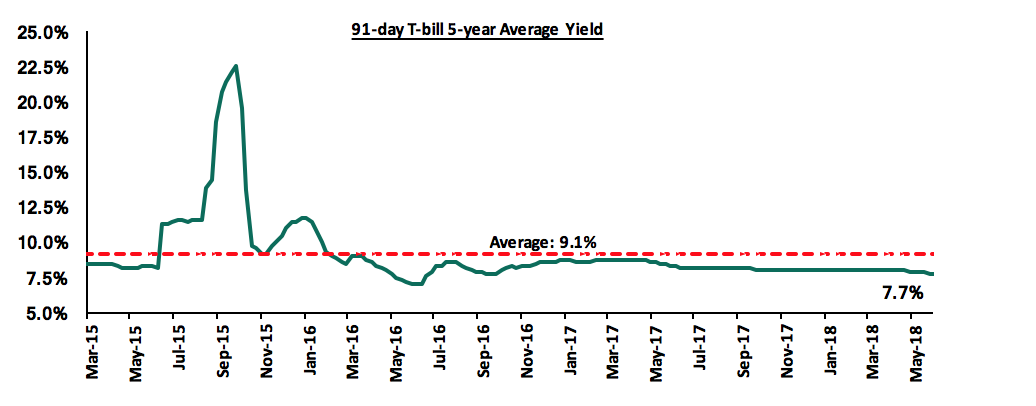

During the first half of 2018, T-bills auctions recorded an oversubscription, with the average subscription rate coming in at 142.6% compared to 263.2% in H1’2017. Overall average subscription rates for the 91, 182, and 364-day papers in H1’2018 came in at 105.6%, 122.3% and 177.7%, respectively, from 154.0%, 184.5% and 131.2%, in a similar period in 2017. Yields on T-bills declined by 40 bps, 90 bps and 70 bps in H1’2017, closing at 7.7%, 9.7%, and 10.5%, from 8.1%, 10.6%, and 11.2% for the 91, 182, and 364-day papers, respectively, at the end of 2017, mainly due to the Central Bank of Kenya’s (CBK’s) efforts to keep rates low by rejecting expensive bids in the auction market.

During the week, T-bills were oversubscribed at a subscription rate of 126.0%, down from 214.7% recorded the previous week. Yields on the 91- day and 364- day papers remained unchanged at 7.7% and 10.5%, respectively while yields on the 182-day paper declined to 9.6% from 9.7%, the previous week, as T-bill yields continue to decline. The acceptance rate declined to 88.5% from 98.8%, the previous week, with the government accepting Kshs 26.8 bn of the Kshs 30.2 bn worth of bids received.

The yield on the 91-day T-bill is currently at 7.7%, below its 5-year average of 9.1%. The lower yield on the 91-day paper is mainly attributed to the low interest rate environment we have been experiencing, and we expect this to continue in the short-term because (i) the rate cap is still in place which will make it easier for the government to borrow from the domestic market, as institutions will continue channeling funds more actively towards government securities deemed less risky, since the pricing of loans to the private sector is based on the Central Bank Rate as opposed to their risk profiles, and (ii) the government domestic borrowing requirement for the 2018/19 financial year has been reduced by 8.6%, with revenues expected to increase by 14.5% from the previous fiscal year.

Should the rate cap be repealed as per the recommendation by the National Treasury as well as the International monetary fund (IMF), it would result in upward pressure on interest rates, as banks would resume pricing of loans to the private sector based on their risk profiles thus banks would revert to channeling funds to loans as opposed to government securities.

During H1’2018, the Kenyan Government issued 6 Treasury Bonds on a monthly basis, with details in the table below:

|

No. |

Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount to be Raised (Kshs bn) |

Actual Amount Raised (Kshs bn) |

Average Accepted Yield |

Average Subscription Rate |

Average Acceptance Rate |

|

1 |

16/01/18 |

IFB 1/2018/15 |

15.0 |

12.5% |

40.0 |

5.0 |

12.5% |

139.4% |

9.0% |

|

30/01/18 |

IFB 1/2018/15 (tap sale) |

35.0 |

36.2 |

12.5% |

103.5% |

99.9% |

|||

|

2 |

12/02/18 |

FXD/1/2010/15(re-open) |

7.1 |

10.3% |

40.0 |

4.4 |

12.7% |

60.4% |

54.7% |

|

FXD2/2013/15(re-open) |

10.2 |

12.0% |

8.8 |

12.9% |

|||||

|

27/02/18 |

FXD1/2010/15 (tap sale) |

7.1 |

10.3% |

27.0 |

0.3 |

12.7% |

14.1% |

100.0% |

|

|

FXD2/2013/15(tap sale) |

10.2 |

12.0% |

3.5 |

12.9% |

|||||

|

3 |

9/03/18 |

FXD 1/2018/5 |

5.0 |

12.3% |

40.0 |

23.1 |

12.3% |

128.5% |

61.4% |

|

FXD 1/2018/20 |

20.0 |

13.2% |

8.5 |

13.3% |

|||||

|

|

27/03/18 |

FXD 1/2018/5(tap sale) |

5.0 |

12.3% |

8.5 |

15.5 |

12.3% |

182.5% |

100.0% |

|

FXD 1/2018/20(tap sale) |

20.0 |

13.0% |

13.3% |

||||||

|

4 |

30/04/18 |

FXD1/2008/15 (Re-open) |

15.0 |

12.5% |

40.0 |

20.15 |

12.3% |

81.9% |

82.0% |

|

FXD1/2018/20 (Re-open) |

20.0 |

13.2% |

8.5 |

13.3% |

|||||

|

5 |

25/06/18 |

FXD1/2018/15 |

15.0 |

12.7% |

40.0 |

12.9 |

13.1% |

50.5% |

63.6% |

|

6 |

25/06/18 |

FXD1/2018/25 |

25.0 |

13.4% |

5.2 |

13.5% |

25.3% |

51.1% |

Performance in the Primary T-bond auctions in H1’2018 was varied between the various issues, with the subscription rate averaging 87.3% (an undersubscription). The average acceptance rate for the first half of the year came in at 65.2%, as the CBK continued to reject bids deemed expensive in order to maintain the rates at low levels, with tap sales still being used as a tool to plug in any deficits from primary auction bids.

Liquidity:

Liquidity levels remained stable and well distributed in the market as indicated by the 25.7% decline in the average volumes traded in the interbank market to Kshs 15.5 bn from Kshs 20.8 bn, recorded in H2’2017, and the subsequent decline in the interbank rate to 5.2% from 7.2% at the end of 2017. During the week, liquidity tightened with the average interbank rate rising to 6.2% from 4.1% recorded the previous week attributed to remittances of Value Added Tax (VAT) and quarterly corporate taxes through commercial banks. There was an increase in the average volumes traded in the interbank market by 41.1% to Kshs 19.9 bn, from Kshs 14.1 bn the previous week.

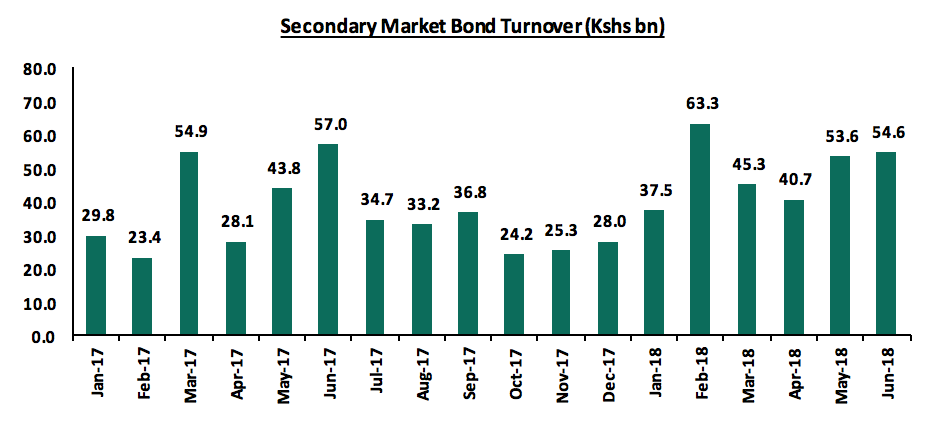

Secondary Bond Market Activity:

The NSE FTSE Bond Index gained 4.7% during H1’18 while the secondary bonds market recorded reduced activity, with turnover decreasing by 8.9% to Kshs 215.8 bn from 236.9 bn recorded in H1’2017.

Kenya Eurobonds:

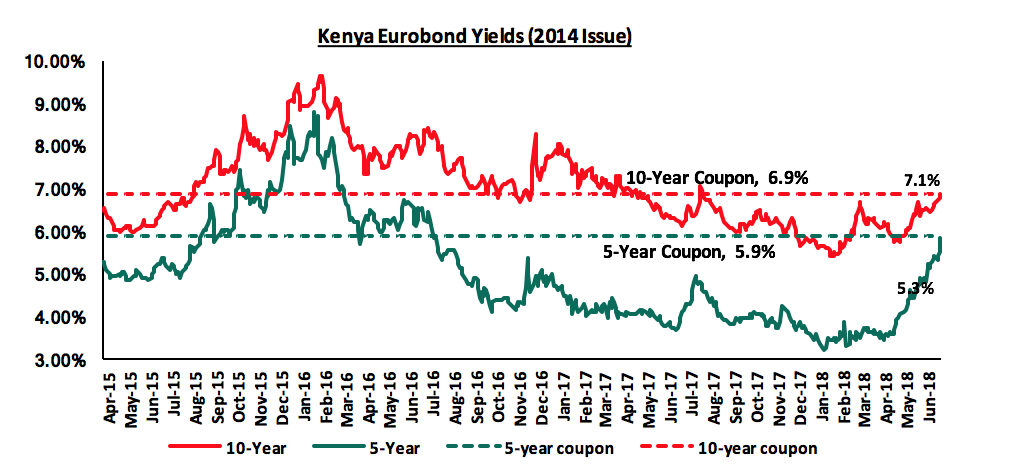

According to Bloomberg, the yields on the 5-year and 10-Year Eurobonds issued in 2014 have increased by 1.9% points and 1.5% points respectively in H1’2018. During the week the yields on the 5-year Eurobond remained unchanged at 5.3%, while the 10-year Eurobond increased by 20 bps to 7.1% from 6.9%, the previous week. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 3.5% points and 2.6% points for the 5-year and 10-year Eurobonds, respectively, an indication of relatively stable macroeconomic conditions in the country.

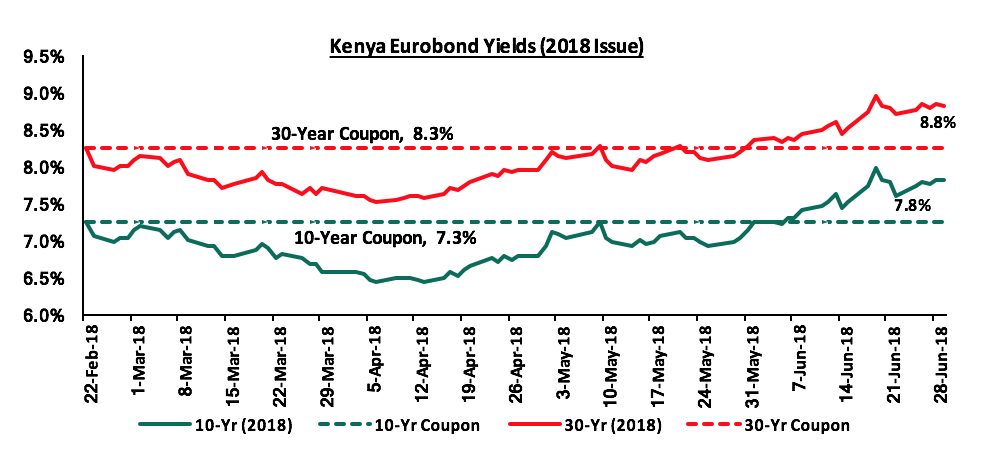

For the February 2018 Eurobond issue, since the issue date, yields on the 10-year and 30-year Eurobonds have both increased by 0.5% points. During the week, the yields on the 10-year Eurobond increased by 20 bps to 7.8% from 7.6% the previous week while the 30-year Eurobonds increased by 10 bps to 8.8% from 8.7% the previous week.

Rates in the fixed income market have remained stable, and had been on a declining trend towards the tail end of the fiscal year 2017/18, as the government rejected expensive bids given it had been under no pressure to borrow. The government is however likely to remain behind its borrowing target for the better part of the first half of the 2018/19 financial year as per historical data. The newly released 2018/19 budget gives a domestic borrowing target of Kshs 271.9 bn, 8.6% lower than the current fiscal year’s target, which may result in reduced pressure on domestic borrowing. However, the National Treasury has proposed to repeal the interest rate cap, which if repealed can result in upward pressure on interest rates, as banks would resume pricing of loans to the private sector based on their risk profiles. With the cap still in place, we maintain our expectation of stability in the interest rate environment. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium to long-term fixed income instruments.

Market Performance:

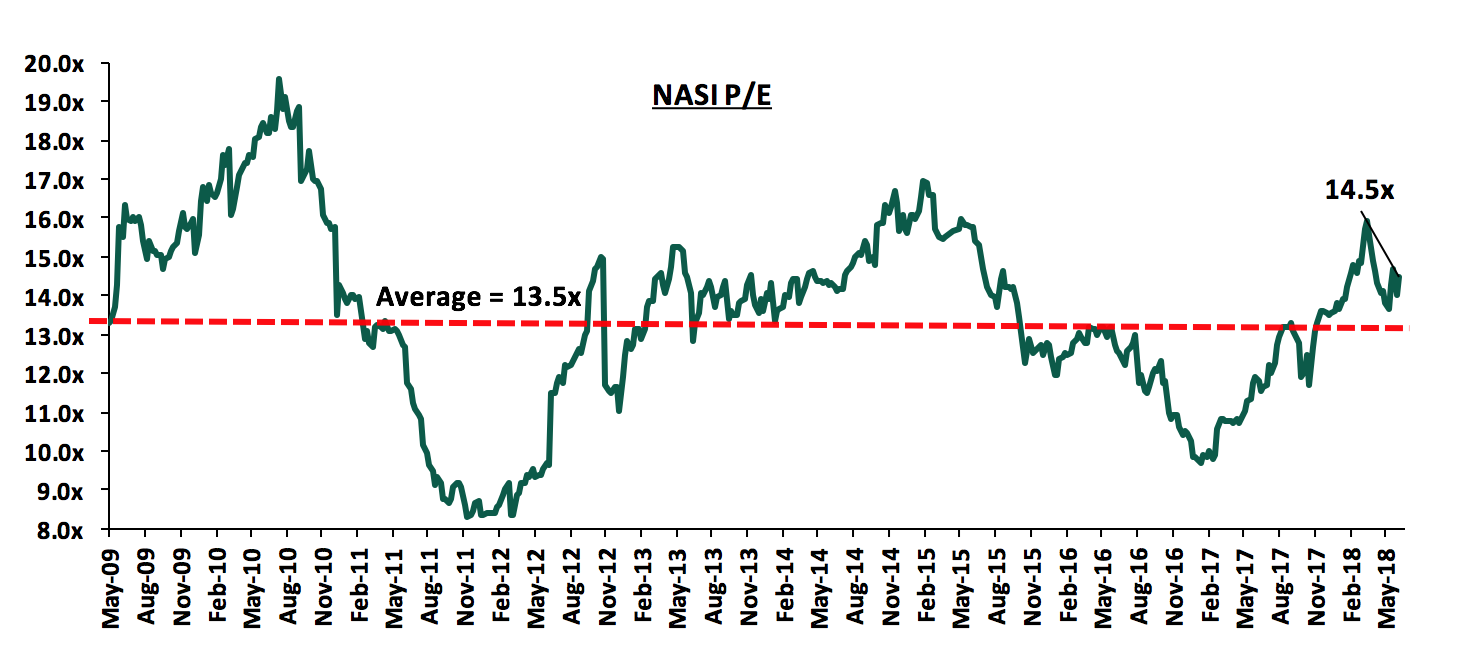

After the bullish run experienced in the first quarter of 2018, where the Kenyan equities market gained 10.6%, the second quarter recorded a decline of 8.8%, bringing the first half gains for NASI, NSE 20 and NSE 25 to 1.8%, (11.5%) and 2.4%, respectively. The decline in market performance during Q2’2018 was as a result of declines in prices of large cap bank stocks such as Equity Group Holdings, KCB Group, Coop and Diamond Trust Bank, which declined by 14.4%, 11.9%, 10.7% and 9.1%, respectively. The declines were mainly in the banking sector stocks, mainly due to various banks closing their books, for dividends and counters beginning to trade ex-dividend. The result was that a majority of foreign investors held net-selling positions, exiting the market at expensive valuations, as the rally had brought the market above its historical P/E average. During the week, the market recorded mixed performance, as NASI and NSE 25 gained by 0.9% and 0.7% while the NSE 20 declined by 0.4%. The marginal gains recorded could be attributed to gains in counters such as Bamburi Cement, EABL and Safaricom that gained by 4.5%, 2.8% and 1.7% respectively. Profit taking investors exited the market, with possible re-entry at cheaper valuations in the future.

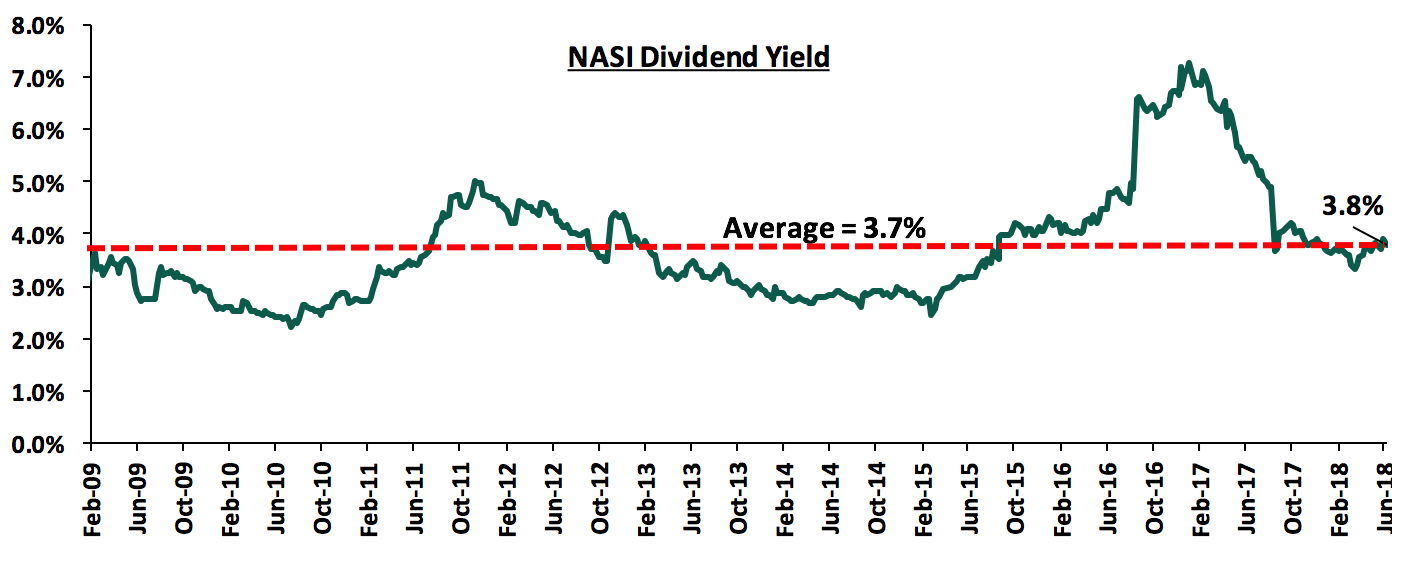

Equity turnover during H1’2018 rose by 34.4% to USD 1.1 bn from USD 795.7 mn in H1’2017. This can be attributed to improved investor sentiment, as a result of improved political stability after the election period, coupled with a bullish experienced in the banking sector, fueled by speculation of a repeal of the interest rate cap and investors taking positions on counters that declared profits for dividend income. The market is currently trading at a price to earnings ratio of 14.5x compared to 11.8x at the end of H1’2017. The current valuation is at 7.4% above the historical average of 13.5x. The current dividend yield of 3.8% is less than 5.5% recorded at the end of H1’2017, and is slightly above the historical average of 3.7%. The current P/E valuation of 14.5x is 49.5% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 74.7% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market:

During the first half of 2018, banks released their FY’2017 and Q1’2018 results, recording declining performance in FY’2017 as core EPS declined by 1.0% but recovering in Q1’2018 to record a 14.4% growth in core EPS. The growth in core EPS could largely be attributed to an 8.1% growth in Net Interest Income in Q1’2018 compared to a 3.8% decline in FY’2017, as banks adapted to operating under the interest rate cap regime, with increased focus in Non-Funded Income (NFI) as shown by the increase in NFI to total income proportion to 37.1% from 33.6% in FY’2017.

Listed Banks Q1’2018 results:

Kenyan listed banks released their Q1'2018 results, recording a 14.4% increase in core EPS compared to a decline of 8.6% in Q1’2017. The performance for Kenyan listed banks in Q1’2018 are as summarized below:

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Cost of Funds |

Net Interest Income Growth |

NIM |

NFI Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Loan Growth |

Growth in Govt. Securities |

IFRS 9 Capital Ratios Effect |

|

National Bank |

348.0% |

(14.2%) |

(11.7%) |

3.3% |

(15.8%) |

7.1% |

(12.3%) |

31.0% |

91.3% |

(6.3%) |

(12.0%) |

(9.8%) |

(0.6%) |

|

Stanbic |

79.0% |

17.7% |

17.4% |

3.3% |

17.9% |

7.0% |

55.4% |

49.0% |

73.7% |

13.2% |

11.4% |

83.5% |

(0.6%) |

|

Equity Group |

21.7% |

10.5% |

10.5% |

2.7% |

10.5% |

8.4% |

6.3% |

49.0% |

7.2% |

10.0% |

3.5% |

45.5% |

(0.5%) |

|

KCB Group |

14.0% |

10.9% |

13.0% |

3.1% |

10.0% |

8.2% |

(1.1%) |

32.8% |

(2.3%) |

8.7% |

5.8% |

(10.7%) |

(0.8%) |

|

Barclays Bank |

7.7% |

8.1% |

6.8% |

2.9% |

8.5% |

9.6% |

5.0% |

29.2% |

(6.7%) |

8.4% |

(1.9%) |

35.3% |

1.00% |

|

Co-op Bank |

6.8% |

9.1% |

5.0% |

4.0% |

10.8% |

8.6% |

3.8% |

32.0% |

9.6% |

5.7% |

2.8% |

21.3% |

(0.9%) |

|

DTB |

3.0% |

4.9% |

4.2% |

5.1% |

5.4% |

6.4% |

4.4% |

22.0% |

8.3% |

11.6% |

3.0% |

16.0% |

(1.6%) |

|

NIC Group |

2.2% |

8.2% |

35.9% |

5.2% |

(8.3%) |

6.3% |

5.5% |

29.6% |

1.8% |

22.1% |

(0.4%) |

81.2% |

(0.8%) |

|

I&M holdings |

1.8% |

2.5% |

10.9% |

4.8% |

(2.7%) |

7.4% |

43.9% |

37.0% |

45.9% |

3.5% |

7.6% |

(1.7%) |

(0.2%) |

|

StanChart |

(12.5%) |

7.7% |

16.4% |

3.6% |

4.5% |

7.8% |

6.5% |

32.0% |

27.0% |

13.2% |

(2.6%) |

12.4% |

(0.5%) |

|

HF Group |

(58.4%) |

(12.8%) |

(13.0%) |

7.2% |

(12.6%) |

5.1% |

64.2% |

28.9% |

(62.7%) |

(6.1%) |

(12.5%) |

(41.4%) |

0.0% |

|

Weighted Average Q1'2018 |

14.4% |

9.3% |

11.4% |

3.4% |

8.1% |

8.1% |

9.5% |

37.1% |

12.2% |

9.4% |

3.2% |

25.0% |

(0.3%) |

|

Weighted Average Q1'2017 |

(8.6%) |

(11.6%) |

(10.3%) |

3.0% |

(10.1%) |

9.2% |

18.6% |

37.8% |

8.7% |

11.7% |

7.1% |

43.1% |

- |

Key takeaways from the table above include:

- The listed banks recorded a 14.4% increase in core EPS, compared to a decline of 8.6% decline in Q1’2017. Only Standard Chartered Bank and Housing Finance Group recorded declines in core EPS, registering declines of 12.5% and 58.4%, respectively. HF Group recorded the biggest decline at 58.4%, on the back of a 12.6% decline in Net Interest Income (NII);

- Average deposit growth came in at 9.4%. Thus, the interest expense paid on deposits recorded a higher growth of 11.4% on average, indicating that banks are growing deposits by opening more interest earning accounts. This is also reflected by the increase in the cost of funds to 3.4% from 3.0% in Q1’2017;

- Average loan growth was recorded at 3.2%, with interest income increasing by 9.3%, as banks adapted to the interest rate Cap regime, with increased allocations in government securities;

- Investment in government securities has grown by 25.0%, outpacing loan growth of 3.2%, showing increased lending to the government by banks as they avoid the risky borrowers;

- The average Net Interest Margin in the banking sector currently stands at 8.1%, a decline from the 9.2% recorded in Q1’2017;

- Non-funded income has grown by 9.5%, which included a Fee and Commissions growth of 12.2%. This shows that banks are charging more fee income to improve their income on loans above the rate cap maximum; and;

- The sector saw a decline in total capital relative to risky assets by 0.3% due to implementation of IFRS 9, indicating the implementation of the standard affected the sector’s capital position though not as much as expected. We expect this reduction to increase in the future.

Half-Year Highlights:

Consolidation in the banking sector picked up at the start of 2017, but slowed as the year progressed. In 2018, only one acquisition deal took place; SBM Bank Kenya Ltd completed the acquisition of certain assets and liabilities of Chase Bank Limited, which was under receivership. Following the agreement between the Central Bank of Kenya (CBK), Kenya Deposit Insurance Corporation (KDIC) and SBM Bank Kenya, 75.0% of the value of all moratorium deposits at Chase Bank will be transferred to SBM Bank Kenya. The remaining 25.0% will remain with Chase Bank Limited. This is a major milestone as this is the first successful instance, in the history of Kenya, of a bank being successfully brought out of receivership. Chase Bank was taken under receivership of the CBK in 2016, with customer deposits in excess of Kshs 100.0 bn. The acquisition will see SBM take control of the 62 Chase Bank branches, significantly increasing the bank’s foothold in the country. SBM Bank has injected Kshs 2.6 bn in Chase Bank, and is planning to inject a further Kshs 6.0 bn after the acquisition to revive the collapsed bank. However, the transaction value is yet to be disclosed. In addition to this, the bank is expected to absorb all the 1,300 former employees of Chase Bank Limited. We shall update with the transaction multiples once the deal is fully finalized and transaction values disclosed. We are however surprised that some of the smaller banks have managed to stay independent this long, as we would have expected weaker banks (that don’t serve a niche, don’t have a clear deposit gathering strategy and have low capital positions), being forced to merge or be acquired as they succumb to sustained effects of the interest rate cap and the implementation of IFRS 9, which affects their profitability and capital levels. Going forward we still expect more consolidations in the industry.

Below is the summary of the transaction metrics of some of the acquisitions that have taken place in the banking sector within the last 5 years:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bns) |

Transaction Stake |

Transaction Value (Kshs bns) |

P/Bv Multiple |

Date |

|

Diamond Trust Bank Kenya |

Habib Bank Limited Kenya |

2.38 |

100.0% |

1.82 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.75 |

100.0% |

2.75 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.80 |

51.0% |

1.30 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

2.95 |

100.0% |

5.00 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.15 |

75.0% |

2.60 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.08 |

66.0% |

2.50 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.86 |

70.0% |

8.60 |

3.2x |

Nov-13 |

|

Average |

|

|

80.3% |

|

1.8x |

|

The National Treasury released the Draft Financial Markets Conduct Bill, 2018, which is supposed to mitigate the reduced lending that could be attributed to the Banking (Amendment) Act 2015. The Bill, will seek to assess the whole credit management in the economy. The bill seeks to:

- Ensure better conduct by banks and other lendersin terms of extending credit to retail financial customers. By categorically not defining lenders as banks, this, in our view, might be the introduction of licensing for credit companies that are not banks, and,

- Provide consumer protection, mainly for retail customers by ensuring their credit contracts are clear and well understood in terms of interest, fees, charges and costs on credit facilities, thereby removing the opacity that has been existent in loan prices.

However, as noted in our focus note The Draft Financial Markets Conduct Bill, 2018, the Bill only addresses consumer protection and fails to address the problem of access to credit for the private sector, mainly by SMEs. We are of the view that more still needs to be done to address the fact that banks will most likely still prefer to lend to the risk-free government as opposed to lending to a riskier retail customer at the current 13.5%, (4.0% points above the current CBR of 9.5%) as dictated by the Banking (Amendment) Act 2015. The Bill was formulated to pave way for the repeal of the Banking (Amendment) Act 2015, as a clause in the Finance Bill, presented to Parliament by the Cabinet Secretary for National Treasury Henry Rotich.

Equities Universe of Coverage:

Below is our Equities Universe of Coverage:

|

Bank |

Price as at 22/06/2018 **** |

Price as at 29/06/2018 **** |

w/w change |

YTD Change |

LTM Change |

Target Price * |

Dividend Yield |

Upside/Downside ** |

P/TBv Multiple |

||

|

GCB*** |

5.2 |

5.2 |

0.6% |

2.6% |

(0.4%) |

7.7 |

7.4% |

57.3% |

1.2x |

||

|

NIC Bank*** |

36.5 |

35.5 |

(2.7%) |

5.2% |

21.1% |

54.1 |

2.7% |

51.0% |

0.9x |

||

|

I&M Holdings |

116.0 |

115.0 |

(0.9%) |

(9.4%) |

11.7% |

169.5 |

3.0% |

49.1% |

1.2x |

||

|

Diamond Trust Bank |

196.0 |

199.0 |

1.5% |

3.6% |

24.4% |

280.1 |

1.3% |

44.2% |

1.1x |

||

|

Zenith Bank |

25.9 |

25.0 |

(3.5%) |

(2.5%) |

19.6% |

33.3 |

10.4% |

39.1% |

1.1x |

||

|

Union Bank Plc |

5.9 |

6.1 |

3.4% |

(21.8%) |

17.1% |

8.2 |

0.0% |

38.1% |

0.6x |

||

|

KCB Group*** |

47.8 |

46.3 |

(3.1%) |

8.2% |

23.3% |

60.9 |

6.3% |

33.8% |

1.5x |

||

|

CRDB |

160.0 |

160.0 |

0.0% |

0.0% |

(8.6%) |

207.7 |

0.0% |

29.8% |

0.5x |

||

|

Ecobank |

8.5 |

8.5 |

(0.6%) |

11.2% |

32.8% |

10.7 |

0.0% |

26.2% |

2.4x |

||

|

Barclays |

11.9 |

11.8 |

(1.3%) |

22.4% |

18.7% |

14.0 |

8.4% |

26.1% |

1.5x |

||

|

HF Group*** |

8.5 |

8.4 |

(0.6%) |

(19.2%) |

(12.9%) |

10.2 |

3.8% |

24.5% |

0.3x |

||

|

Equity Group |

48.5 |

46.3 |

(4.6%) |

16.4% |

21.7% |

55.5 |

4.1% |

18.6% |

2.5x |

||

|

Co-operative Bank |

17.5 |

17.5 |

0.0% |

9.4% |

26.1% |

19.7 |

4.6% |

17.1% |

1.5x |

||

|

Stanbic Bank Uganda |

32.0 |

32.0 |

0.0% |

17.4% |

18.5% |

36.3 |

3.7% |

17.0% |

2.0x |

||

|

UBA Bank |

10.6 |

10.5 |

(0.9%) |

1.9% |

10.9% |

10.7 |

14.2% |

15.1% |

0.7x |

||

|

CAL Bank |

1.2 |

1.2 |

0.0% |

13.0% |

64.0% |

1.4 |

0.0% |

14.8% |

1.0x |

||

|

Bank of Kigali |

290.0 |

286.0 |

(1.4%) |

(4.7%) |

16.7% |

299.9 |

4.8% |

8.2% |

1.6x |

||

|

Stanbic Holdings |

92.0 |

92.0 |

0.0% |

13.6% |

28.7% |

85.9 |

5.7% |

(0.9%) |

1.1x |

||

|

Standard Chartered |

201.0 |

198.0 |

(1.5%) |

(4.8%) |

(4.3%) |

184.3 |

6.2% |

(2.1%) |

1.6x |

||

|

Guaranty Trust Bank |

40.7 |

40.5 |

(0.5%) |

(0.6%) |

13.4% |

37.2 |

5.9% |

(2.7%) |

2.3x |

||

|

SBM Holdings |

7.2 |

7.3 |

1.4% |

(2.9%) |

0.3% |

6.6 |

4.2% |

(4.5%) |

1.0x |

||

|

Access Bank |

10.4 |

10.4 |

(0.5%) |

(1.0%) |

8.4% |

9.5 |

3.8% |

(4.8%) |

0.7x |

||

|

Bank of Baroda |

155.0 |

150.0 |

(3.2%) |

32.7% |

38.9% |

130.6 |

1.6% |

(14.1%) |

1.3x |

||

|

Stanbic IBTC Holdings |

48.8 |

52.0 |

6.7% |

25.3% |

60.3% |

37.0 |

1.2% |

(22.9%) |

2.5x |

||

|

Standard Chartered |

27.0 |

27.0 |

0.0% |

6.9% |

59.5% |

19.5 |

0.0% |

(27.9%) |

3.4x |

||

|

FBN Holdings |

10.7 |

10.6 |

(0.5%) |

20.5% |

71.0% |

6.6 |

2.3% |

(35.4%) |

0.6x |

||

|

Ecobank Transnational |

20.2 |

20.0 |

(1.0%) |

17.6% |

50.3% |

9.3 |

0.0% |

(54.1%) |

0.7x |

||

|

National Bank |

6.6 |

6.3 |

(5.3%) |

(33.2%) |

(32.1%) |

2.8 |

0.0% |

(57.6%) |

0.4x |

||

|

|

*Target Price as per Cytonn Analyst estimates |

||||||||||

|

|

**Upside / (Downside) is adjusted for Dividend Yield |

||||||||||

|

|

***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5th largest shareholder ****Share prices in respective country local currency |

||||||||||

We are “NEUTRAL” on equities for investors with a short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for long-term investors, and with expectations of higher corporate earnings this year, we are “POSITIVE” for investors with a long-term investment horizon

Financial Services Sector:

The financial services sector remained attractive in H1’2018 for both local and international investors. Some of the key deals include;

- Old Mutual, a UK based international financial services group providing investment and savings, insurance, asset management and retirement solutions, increased its stake in UAP Holdings in a deal to convert a Kshs 2.7 bn loan into equity through its subsidiary Old Mutual Holdings Kenya. The transaction was valued at a P/B multiple of 1.8x, a 15% discount from the average insurance sector transaction P/B multiple of 2.1x over the last seven years, hence a valuation discount. For more information, see our Cytonn Weekly #25/2018

- European financial services company Allianz Group agreed to acquire 8.0% in African reinsurer Africa Re. The total cash consideration payable at closing amounted to Eur. 69.0 mn (Kshs 8.14 bn). An 8.0 % stake at Eur. 69.0 mn equalled to 228,112 shares and implied a market valuation of Eur. 862.5 mn (Kshs 101.7 bn); based on their last published financial statements (December 2016). The book value was Eur. 774.8 mn (Kshs 91.4 bn), implying a P/B valuation of 1.2x. For more information, see our Cytonn Weekly #23/2018

- AfricInvest, a private equity and venture capital firm based in Tunisia with a focus on agribusiness, financial services, healthcare, education and commercial sectors, completed a transaction to buy a 14.3% stake in Britam, a diversified financial services group that is listed on the Nairobi Securities Exchange, for Kshs 5.7 bn. The transaction involved the creation of 360.8 mn new shares, which AfricInvest bought at a price of Kshs 15.9 per share. Britam will use the capital to accelerate property development, inject fresh investments into its subsidiaries, and to revamp its technology to enable it deliver its products via digital channels like mobile phones, with an eye on Micro-insurance. The acquisition was carried out at a P/B multiple of 1.4x which is a discount from the average insurance sector transaction P/B multiple of 2.1x over the last seven years, hence a relatively cheaper transaction valuation. For more information, see our Cytonn Weekly #21/2018. Following the same, Swiss Re, a reinsurance company based in Zurich Switzerland, also acquired a 13.8% stake in Britam for Kshs 4.8 bn. The transaction involved the acquisition of 348.5 mn shares of Plum LLP at a price of Kshs 13.8 per share. The acquisition was carried out at a P/B multiple of 1.3x, again, a 38.0% discount from the average insurance sector transaction P/B multiple of 2.1x over the last seven years, hence a relatively cheaper transaction valuation. For more information, see our Cytonn Weekly #24/2018.

- Centum Investments, an investment company based in Kenya, injected Kshs 1.1 bn into its banking subsidiary Sidian Bank, through a rights issue meant to fund the lender’s growth initiatives and to drive its strategic goal of becoming a Tier 2 bank by 2022. With a 72.9% stake in Sidian Bank, the additional sum meant that Centum had defended its entire stake in the rights issue. The additional capital will support the bank’s growth plans, including further investments in its trade finance business, which saw a growth in portfolio from Kshs 896.0 mn in 2016 to Kshs 6.6 bn by close of 2017. For more information, see our Cytonn Q1' 2018 Markets Review,

- Sanlam Kenya, a financial services company listed on the Nairobi Securities Exchange, which mainly deals in insurance, investments and retirements schemes, invested an additional Kshs 121.7 mn in equity in Sanlam General, formally Gateway Insurance. Sanlam Kenya, then Pan Africa Insurance Holdings Limited (Pan Africa), first acquired 31,948,950 ordinary shares of Gateway Insurance, a 51.0% stake, in March 2015 for Kshs 561.0 mn. It also subscribed to additional shares in Gateway amounting to Kshs 139.7 mn to increase its shareholding to 56.5% in the same year. After the transaction, it renamed Gateway Insurance to Sanlam General. The first and second transaction valued the company at Kshs 1.1 bn and Kshs 1.2 bn, respectively. The acquisitions were carried out at a P/B multiple of 1.1x compared to the market average of 2.1x . The acquisition was a strategic move for the company to re-enter the general insurance market and to enable them to offer their clients with more comprehensive solutions such as personal and institutional insurance products. For more information, see our Cytonn Weekly #19/2018,

- Digital Financial Services (DFS) Lab, a Fintech accelerator supported by The Bill and Melinda Gates Foundation, announced an investment of USD 200,000 (Kshs 20.0 mn) in four African start-ups, two of which are Kenyan: (i) Cherehani Africa, which relies on mobile-based tech to provide credit and distribute personalized financial literacy content to women and adolescent girls who own micro-enterprises, and (ii) another unnamed start-up that focuses on digital lending. DFS Lab identifies promising entrepreneurs and invests in for-profit companies that focus on consumers in Sub-Saharan Africa and Asia. Products from the four companies have been found to simplify processes for accessing financial information and cash via mobile phone. Cherehani Africa provides access to finances to women and adolescent girls with basic level education, aged 17-45 years. For more information, see our Cytonn Weekly #17/2018,

- Fonds Européen de Financement Solidaire (Fefisol), a Luxembourg-based private equity (PE) firm, invested Kshs 100.0 mn in Kenya’s Musoni Microfinance Limited for an undisclosed stake. The investment by Fefisol will be used to grow their loan book, which stood at Kshs 1.2 bn as at January 2018. The funds will support Musoni’s objective of achieving competitive low-cost lending in the country at a time where bank funding continues to be relatively expensive. For more information, see our Cytonn Weekly #7/2018,

- Kuramo Capital, a New-York based private equity firm completed a transaction to acquire a minority stake in Kenyan investment bank Sterling Capital for an undisclosed amount. The acquisition came after the reinstatement of Sterling’s investment banking license in October 2017, after it was downgraded to stockbroker level in 2011, for failing to meet CMA’s revised minimum capital limit that required investment banks to raise their minimum capital to Kshs 250.0 mn from Kshs 30.0 mn, while stockbrokers were required to increase their capital to Kshs 50.0 mn, up from Kshs 5.0 mn. For more information, see our Cytonn Weekly #4/2018,

- Atlas Mara Limited, a financial services holding company, increased its strategic stake in Union Bank Nigeria (UBN) through a Naira 26.3 bn (USD 75.0 mn) investment in UBN’s rights issue. UBN completed a Naira 49.7 bn (USD 138.2 mn) rights offering on the Nigerian Stock Exchange at a price of Naira 4.1 per share and registered a 120.0% subscription rate. Atlas Mara’s investment of USD 75.0 mn translated to around 6.6 bn shares. Atlas Mara previously owned 44.5% of UBN’s issued share capital at the time, translating to 7.6 bn shares. With the acquisition, Atlas obtained a total shareholding of 14.1 bn shares from the 29.1 bn shares issued, translating to a 48.6% ownership in UBN. The transaction was valued at a P/B of 0.3x, an 84.2% discount to the average P/B multiple of 1.9x for select listed Banks in Nigeria. For more information, see our Cytonn Weekly #3/2018,

The insurance sector recorded significant activity during H1’2018, the same being witnessed in recent years. This is indicated in the table below that highlights the transaction multiples in Kenya’s insurance sector over the last seven years;

|

Insurance Sector Transaction Multiples over the Last Seven Years |

|||||||

|

No. |

Acquirer |

Insurance Acquired |

Book Value (bn Kshs) |

Transaction Stake |

Transaction Value (bn Kshs) |

P/B |

Date |

|

1. |

Africa Development Corporation |

Resolution Health East Africa |

N/A |

25.1% |

0.2 |

N/A |

Dec-10 |

|

2. |

Leapfrog Investments |

Apollo Investments |

0.3 |

26.9% |

1.1 |

15.6x |

Dec-11 |

|

3. |

Saham Finances |

Mercantile Insurance |

0.5 |

66.0% |

Undisclosed |

N/A |

Jan-13 |

|

4. |

Swedfund |

AAR |

0.4 |

20.0% |

0.4 |

5.4x |

May-13 |

|

5. |

BAAM |

Continental Re Kenya |

0.7 |

30.0% |

0.3 |

1.4x |

Apr-14 |

|

6. |

Union Insurance of Mauritius |

Phoenix of East Africa |

1.8 |

66.0% |

2.0 |

1.6x |

May-14 |

|

7. |

UK Prudential |

Shield Assurance |

0.1 |

100.0% |

1.5 |

10.2x |

Sep-14 |

|

8. |

Swiss Re |

Apollo Investments |

0.6 |

26.9% |

Undisclosed |

N/A |

Oct-14 |

|

9. |

Britam |

Real Insurance Company |

0.7 |

99.0% |

1.4 |

2.1x |

Nov-14 |

|

10. |

Leapfrog Investments |

Resolution Insurance |

0.2 |

61.2% |

1.6 |

11.7x |

Nov-14 |

|

11. |

Old Mutual Plc |

UAP Holdings |

9.6 |

60.7% |

11.1 |

1.9x* |

Jan-15 |

|

12. |

MMI Holdings |

Cannon Assurance |

1.7 |

75.0% |

2.4 |

1.9x |

Jan-15 |

|

13. |

Pan Africa Insurance Holdings |

Gateway Insurance Company Ltd |

1.0 |

51.0% |

0.6 |

1.1x |

Mar-15 |

|

14. |

Barclays Africa |

First Assurance |

2.0 |

63.3% |

2.9 |

2.2x |

Jun-15 |

|

15. |

IFC |

Britam |

22.5 |

10.4% |

3.6 |

1.5x |

Mar-17 |

|

16. |

AfricInvest III |

Britam |

28.5 |

14.3% |

5.7 |

1.4x |

Sep-17 |

|

17. |

Swiss Re Asset Management |