Cytonn Monthly - October 2023

By Cytonn Research, Nov 5, 2023

Executive Summary

Fixed Income

During the month of October 2023, T-bills were oversubscribed, with the overall average subscription rate coming in at 129.3%, up from the undersubscription rate of 98.3% recorded in September 2023. The overall average subscription rates for the government papers increased with the 364-day, 182-day and 91-day papers increasing to 25.6%, 34.1% and 626.7%, from 22.4%, 10.6% and 507.5% respectively, which was recorded in September 2023. The average yields on the 364-day paper increased by 0.6% points to 15.3%, while the average yield on the 182-day and 91-day papers increased by 0.5% points each to 15.1% and 15.0% respectively. For the month of October, the government accepted a total of Kshs 111.3 bn of the Kshs 124.1 bn worth of bids received, translating to an acceptance rate of 89.6%;

Additionally, October 2023 bonds were undersubscribed, with the overall subscription rate coming in at 31.5%, albeit lower than the undersubscription rate of 97.2% recorded in September 2023. The tapsales for the bonds FXD1/2023/02 and FXD1/2016/10 received bids worth Kshs 3.4 bn against the offered Kshs 15.0 bn, translating to an undersubscription rate of 23.0%, with the government accepting bids worth Kshs 3.4 bn, translating to an acceptance rate of 97.9%. The subsequent reopened bonds FXD1/2023/02 and FXD1/2023/05 received bids worth Kshs 12.3 bn against the offered Kshs 35.0 bn, translating to an undersubscription rate of 35.1%, with the government accepting bids worth Kshs 6.3 bn translating to an acceptance rate of 51.3%;

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 102.8%, higher than the undersubscription rate of 75.6% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 22.5 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 562.0%, higher than the oversubscription rate of 266.0% recorded the previous week. The subscription rates for the 182-day and 364-day papers decreased to 12.8% and 9.1%, from 56.7% and 18.4% respectively, recorded the previous week. The government accepted a total of Kshs 23.7 bn worth of bids out of Kshs 24.7 bn of bids received, translating to an acceptance rate of 96.1%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day and 91-day papers increasing by 5.2 bps, 14.2 bps and 7.5 bps to 15.4%, 15.3% and 15.2%, respectively;

In the primary bond market, the government is seeking to raise additional Kshs 50.0 bn for infrastructure projects support in the FY’2023/24 by issuing the new 6.5-year bond IFB1/2023/6.5 with a tenor to maturity of 6.5 years. The bidding process opened on 20th October 2023 and will close on 8th November 2023, with the coupon rate to be determined by the market. The bonds value date will be 13th November 2023, with a maturity date of 6th May 2030 and will be tax free as is the case for infrastructure bonds as provided for under the Income Tax Act. We anticipate the bond to be oversubscribed, given that it is tax free in nature, however, investors are expected to attach higher yields as they seek to cushion themselves against future losses on the back of the government’s debt sustainability concerns. Notably, the last infrastructure bond to be issued was the 7-year IFB1/2023/07 in June 2023 which sought to raise Kshs 60.0 bn. The bond registered an oversubscription rate of 367.5%, at a yield of 15.8%. Based on trading of bonds of similar tenor and nature, we expect the IFB1/2023/6.5 to price at 16.3%-16.7%;

During the week, the Kenya National Bureau of Statistics (KNBS) released the year-on-year inflation highlighting that the inflation rate in the month of September 2023 increased to 6.9%, from the 6.8% inflation rate recorded in the month of September 2023, marking the fourth consecutive month that the inflation has remained within the CBK target range of 2.5%-7.5%. The ease in inflation was in line with our projections of an increase to within a range of 6.8% to 7.0%;

Also, during the week, Stanbic Bank released its Monthly Purchasing Manager's Index (PMI), highlighting that the index for the month of October 2023 deteriorated further, coming in at 46.2, down from 47.8 in September 2023, signaling a stronger downturn of the business environment during the first month of Q4’2023. This was on the back of persistent inflationary pressure mainly resulting from the aggressive depreciation of the Kenya Shilling, as well as increased fuel and food prices;

Equities

During the month of October 2023, the equities market was on a downward trajectory, with NASI declining the most by 7.0% while NSE 20, NSE 25 and NSE 10 declined by 3.2%, 4.2% and 4.3% respectively. The equities market performance was driven by losses recorded by large-cap stocks such as KCB, Safaricom, Bamburi, Stanbic Bank and Diamond Trust Bank-Kenya of 16.1%, 14.7%, 6.5%, 6.1% and 6.0% respectively. The losses were, however, mitigated by gains recorded by large cap stocks such as Equity Group and NCBA of 5.6% and 1.8% respectively;

During the week, the equities market was on a downward trajectory, with NSE 10 declining the most by 4.5%, while NASI, NSE 20 and NSE 25 declined by 4.1%, 1.3% and 3.9%, respectively, taking the YTD performance to losses of 32.7%, 13.8%, and 26.5% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as KCB Group, Safaricom and NCBA of 13.3%, 6.8% and 4.7%, respectively;

Real Estate

During the week, President William Ruto launched the first phase of the Kshs 6.0 bn Buxton Point affordable housing project located in Buxton, Mombasa County. Additionally, the President broke ground for the construction of 2,000 units Mzizima housing estate which neighbors Buxton Point;

In the hospitality sector, Lawford Hotel, a luxury beach resort located in Malindi, Kenya, won three prestigious awards at the 17th World Luxury Hotel Awards 2023 held in Athens, Greece;

In the infrastructure sector, President William Ruto launched the construction of the 33.0 Km Bamburi-Mwakirunge-Rabai-Kaloleni road, traversing Mombasa and Kilifi counties during his five-day state tour of the Coastal region. Additionally, Kenya National Highways Authority (KeNHA) announced that phase two of the Dongo Kundu bypass project in Kwale County stretching 17.1 Km, is scheduled for opening in one month and will be fully operational by 2024;

In the industrial sector, British International Investment (BII), the UK's development fund committed Kshs 4.0 bn for the construction of 20 state of the art warehouses in three African countries namely Kenya, Nigeria and Uganda, as well as for the expansion of warehouse technology and advanced software to improve post-harvest pricing transparency;

In regulated Real Estate Funds sector, under the Real Estate Investment Trusts (REITs) segment, Fahari I-REIT closed the week trading at an average price of Kshs 6.1 per share in the Nairobi Securities Exchange, representing a 5.3% decline from the Kshs 6.4 recorded the previous week;

On the Unquoted Securities Platform as at 27th October 2023, Acorn D-REIT and I-REIT closed the week trading at Kshs 25.3 and Kshs 21.7 per unit, a 26.6% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. In addition, Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 16.4%, 0.1% points higher than the 16.3% yield recorded the previous week;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 14.50% p.a. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 16.26% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday, from 9:00 am to 11:00 am. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

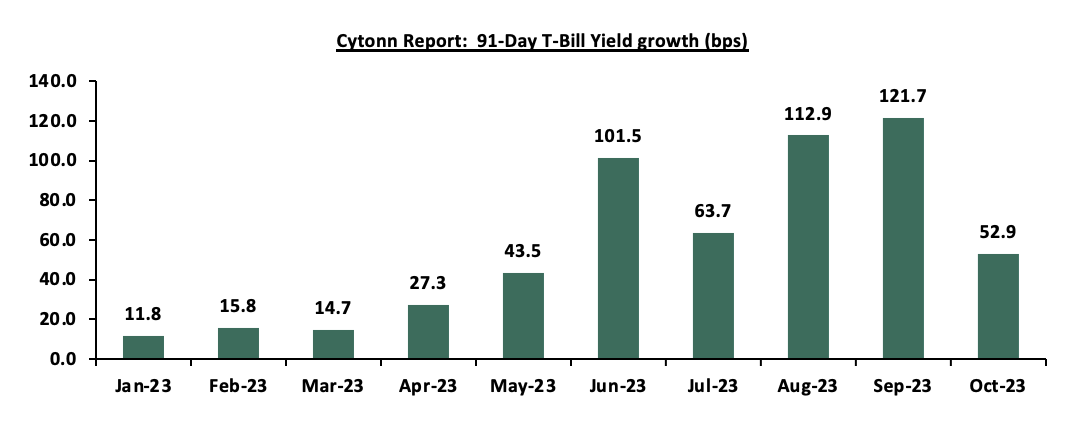

During the month of October 2023, T-bills were oversubscribed, with the overall average subscription rate coming in at 129.3%, up from the undersubscription rate of 98.3% recorded in September 2023. The overall average subscription rates for the government papers increased with the 364-day, 182-day and 91-day papers increasing to 25.6%, 34.1% and 626.7%, from 22.4%, 10.6% and 507.5% respectively, which was recorded in September 2023. The average yields on the 364-day paper increased by 0.6% points to 15.3%, while the average yield on the 182-day and 91-day papers increased by 0.5% points each to 15.1% and 15.0% respectively. For the month of October, the government accepted a total of Kshs 111.3 bn of the Kshs 124.1 bn worth of bids received, translating to an acceptance rate of 89.6%. Notably, the growth in the government papers yields slowed down in October compared to September, with the yields on the 91-day paper growing by 52.9 bps, compared to 121.7 bps growth that was recorded in September, as the government tries to minimize debt cost through avoiding highly priced bids. The chart below shows the yields growth rate for the 91-day paper during the year:

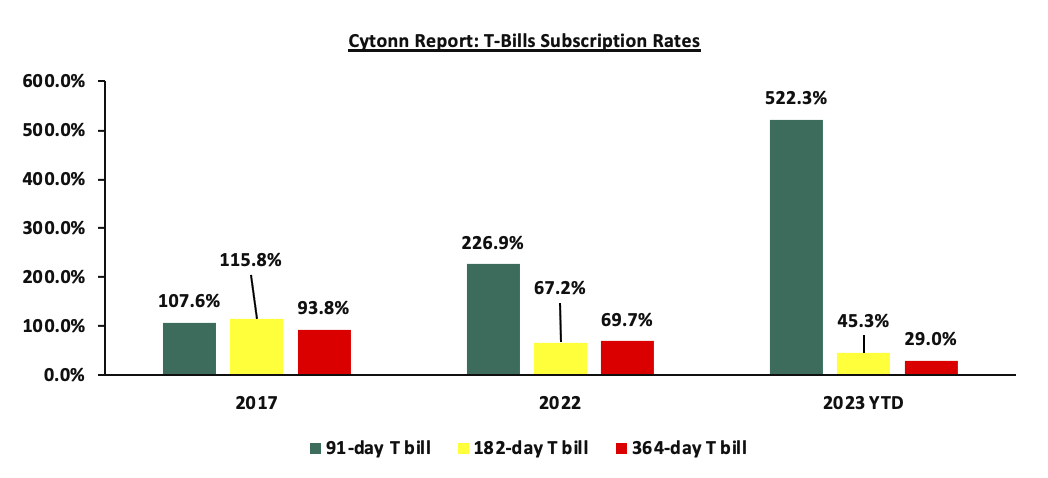

This week, T-bills were oversubscribed, with the overall subscription rate coming in at 102.8%, higher than the undersubscription rate of 75.6% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 22.5 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 562.0%, higher than the oversubscription rate of 266.0% recorded the previous week. The subscription rates for the 182-day and 364-day papers decreased to 12.8% and 9.1%, from 56.7% and 18.4% respectively, recorded the previous week. The government accepted a total of Kshs 23.7 bn worth of bids out of Kshs 24.7 bn of bids received, translating to an acceptance rate of 96.1%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day and 91-day papers increasing by 5.2 bps, 14.2 bps and 7.5 bps to 15.4%, 15.3% and 15.2%, respectively; The chart below compares the overall average T- bills subscription rates obtained in 2017, 2022 and 2023 Year to Date (YTD):

Additionally, October 2023 bonds were undersubscribed, with the overall subscription rate coming in at 31.5%, albeit lower than the undersubscription rate of 97.2% recorded in September 2023. The tapsales for the bonds FXD1/2023/02 and FXD1/2016/10 received bids worth Kshs 3.4 bn against the offered Kshs 15.0 bn, translating to an undersubscription rate of 23.0%, with the government accepting bids worth Kshs 3.4 bn, translating to an acceptance rate of 97.9%. The subsequent reopened bonds FXD1/2023/02 and FXD1/2023/05 received bids worth Kshs 12.3 bn against the offered Kshs 35.0 bn, translating to an undersubscription rate of 35.1%, with the government accepting bids worth Kshs 6.3 bn translating to an acceptance rate of 51.3%. The table below provides more details on the bonds issued during the month of October 2023:

|

Cytonn Report: Treasury Bonds Issued in October 2023 |

|||||||||

|

Issue Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount offered (Kshs bn) |

Actual Amount Raised/Accepted (Kshs bn) |

Total bids received (Subscription) |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

10/2/2023 |

FXD1/2023/02- Tapsale |

1.9 |

17.0% |

15.0 |

2.6 |

2.6 |

17.5% |

23.0% |

99.2% |

|

FXD1/2016/10- Tapsale |

2.9 |

15.0% |

0.8 |

0.8 |

17.9% |

93.7% |

|||

|

10/16/2023 |

FXD1/2023/02-Reopened |

1.9 |

17.0% |

35.0 |

4.8 |

6.5 |

17.7% |

35.1% |

74.2% |

|

FXD1/2023/05-Reopened |

4.8 |

16.8% |

1.5 |

5.8 |

18.0% |

25.6% |

|||

|

Oct 2023 Average |

|

2.9 |

16.5% |

50.0 |

9.7 |

15.7 |

17.8% |

31.5% |

61.5% |

|

Sep 2023 Average |

|

2.4 |

16.0% |

35.0 |

21.6 |

34.0 |

17.7% |

97.2% |

63.6% |

Source: Central Bank of Kenya (CBK)

In the primary bond market, the government is seeking to raise additional Kshs 50.0 bn for infrastructure projects support in the FY’2023/24 by issuing the new 6.5-year bond IFB1/2023/6.5 with a tenor to maturity of 6.5 years. The bidding process opened on 20th October 2023 and will close on 8th November 2023, with the coupon rate to be determined by the market. The bonds value date will be 13th November 2023, with a maturity date of 6th May 2030 and will be tax free as is the case for infrastructure bonds as provided for under the Income Tax Act. We anticipate the bond to be oversubscribed, given that it is tax free in nature, however, investors are expected to attach higher yields as they seek to cushion themselves against future losses on the back of the government’s debt sustainability concerns. Notably, the last infrastructure bond to be issued was the 7-year IFB1/2023/07 in June 2023 which sought to raise Kshs 60.0 bn. The bond registered an oversubscription rate of 367.5%, at a yield of 15.8%. Based on trading of bonds of similar tenor and nature, we expect the IFB1/2023/6.5 to price at 16.3%-16.7%.

Secondary Bond Market:

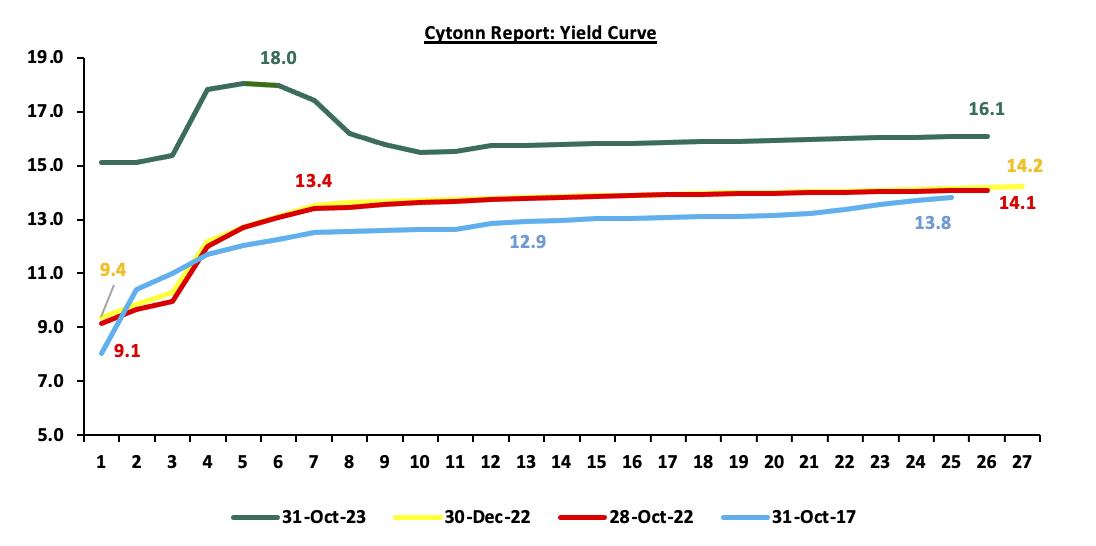

The yields on the government securities were on an upward trajectory during the month compared to the same period in 2022. Notably, the yields on short to medium-term government bonds continue to rise faster than the yield on the long-term bonds as investors avoid long-term duration risk, and attaching higher yields as they seek to cushion themselves against future losses on the back of the government’s debt sustainability concerns, ahead of the upcoming USD 2.0 bn Eurobond maturity in June,2024. The chart below shows the yield curve movement during the period:

The secondary bond turnover decreased by 33.3% to Kshs 64.2 bn, from Kshs 96.2 bn recorded in September 2023, pointing towards decreased activities by commercial banks in the secondary bonds market. On a year on year basis, the bonds turnover increased by 11.5% from Kshs 57.6 bn worth of treasury bonds transacted over a similar period last year.

Money Market Performance:

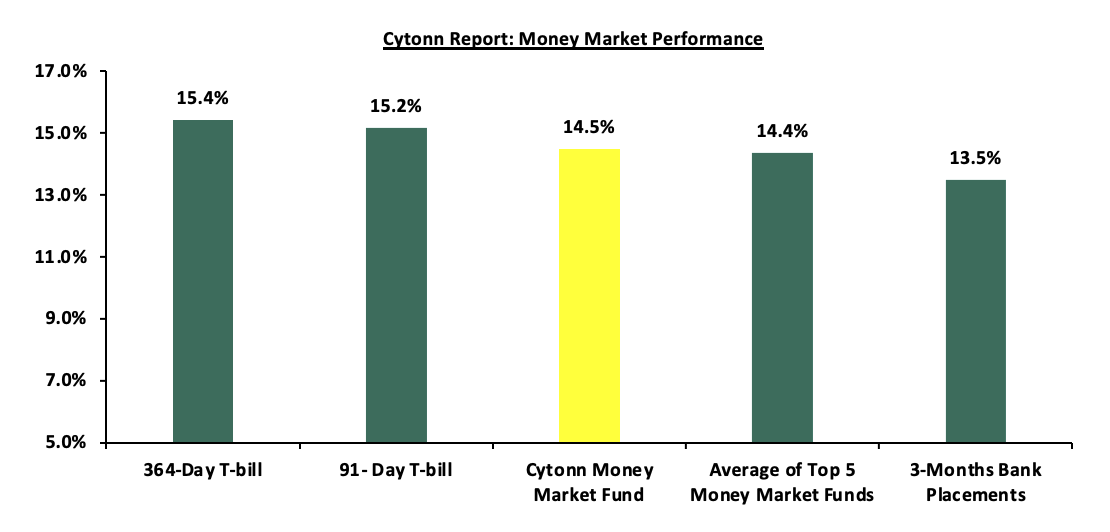

In the money markets, 3-month bank placements ended the week at 13.5% (based on what we have been offered by various banks), The yield on the 364-day paper increased by 5.2 bps to 15.4%, while that of 91-day paper increased by 7.5 bps to 15.2%. The yield of Cytonn Money Market Fund decreased by 1.0 bps to stay relatively unchanged at 14.5% and the average yields on the Top 5 Money Market Funds increased by 22.8 bps to 14.4% from 14.1% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 3rd November 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 3rd November 2023 |

||

|

Rank |

Fund Manager |

Effective Annual |

|

1 |

GenAfrica Money Market Fund |

14.9% |

|

2 |

Cytonn Money Market Fund |

14.5% |

|

3 |

Enwealth Money Market Fund |

14.4% |

|

4 |

Etica Money Market Fund |

14.0% |

|

5 |

Apollo Money Market Fund |

14.0% |

|

6 |

Lofty-Corban Money Market Fund |

14.0% |

|

7 |

Madison Money Market Fund |

13.8% |

|

8 |

Jubilee Money Market Fund |

13.2% |

|

9 |

Nabo Africa Money Market Fund |

13.2% |

|

10 |

Sanlam Money Market Fund |

13.2% |

|

11 |

Co-op Money Market Fund |

13.1% |

|

12 |

Kuza Money Market fund |

12.8% |

|

13 |

GenCap Hela Imara Money Market Fund |

12.8% |

|

14 |

AA Kenya Shillings Fund |

12.6% |

|

15 |

Old Mutual Money Market Fund |

12.5% |

|

16 |

Absa Shilling Money Market Fund |

12.1% |

|

17 |

KCB Money Market Fund |

12.0% |

|

18 |

ICEA Lion Money Market Fund |

11.5% |

|

19 |

Equity Money Market Fund |

11.5% |

|

20 |

Dry Associates Money Market Fund |

11.5% |

|

21 |

CIC Money Market Fund |

11.2% |

|

22 |

Orient Kasha Money Market Fund |

11.0% |

|

23 |

Mali Money Market Fund |

10.3% |

|

24 |

British-American Money Market Fund |

9.4% |

Source: Business Daily

Liquidity:

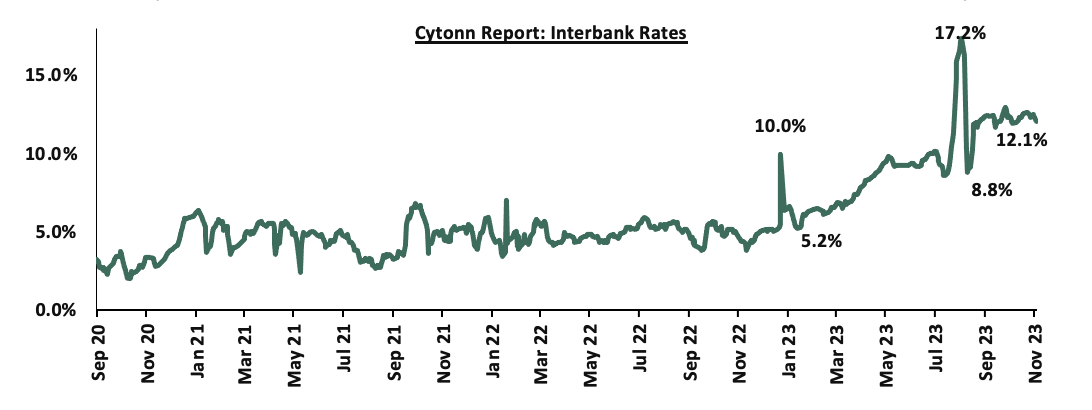

Liquidity in the money markets marginally eased in the month of October 2023, with the average interbank rate remaining relatively unchanged at 12.3%. During the month of October, the average interbank volumes traded decreased by 22.2% to Kshs 21.0 bn, from Kshs 27.0 bn recorded in September. Also, during the week, liquidity in the money markets eased, with the average interbank rate decreasing to 12.3%, from 12.5% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded increased by 2.0% to Kshs 14.3 bn, from Kshs 14.1 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the month, the yields on the Eurobonds were on a downward trajectory with the yield on the 10-year Eurobond issued in 2014 declining the most by 3.7% points to 14.6% from 18.3% recorded in end of September 2023. Also, during the week, the yields on Eurobonds were on a downward trajectory with the yield on the 10-year Eurobond issued in 2014 recording the largest decline of 1.1% points to 14.1%, from 15.2%, recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 2nd November 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Tenor |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD) |

2.0 bn |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

|

Years to Maturity |

0.6 |

4.3 |

24.3 |

3.6 |

8.6 |

10.6 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

2-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

29-Sep-23 |

18.3% |

13.3% |

12.5% |

14.3% |

12.7% |

12.3% |

|

26-Oct-23 |

15.2% |

13.6% |

12.4% |

14.1% |

12.9% |

12.4% |

|

27-Oct-23 |

14.5% |

13.4% |

12.3% |

13.8% |

12.7% |

12.2% |

|

30-Oct-23 |

14.6% |

13.3% |

12.2% |

13.6% |

12.7% |

12.1% |

|

31-Oct-23 |

14.6% |

13.1% |

12.1% |

13.6% |

12.6% |

12.0% |

|

1-Nov-23 |

14.6% |

13.1% |

12.0% |

13.5% |

12.5% |

11.8% |

|

2-Nov-23 |

14.1% |

12.8% |

11.7% |

13.1% |

12.1% |

11.5% |

|

Weekly Change |

(1.1%) |

(0.8%) |

(0.7%) |

(1.0%) |

(0.8%) |

(1.0%) |

|

MoM Change |

(3.7%) |

(0.1%) |

(0.4%) |

(0.7%) |

(0.1%) |

(0.3%) |

|

YTD Change |

1.2% |

2.3% |

0.9% |

2.2% |

1.3% |

1.6% |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the month, the Kenya Shilling depreciated by 1.7% against the US Dollar, to close the month at Kshs 150.6, from Kshs 148.1 recorded at the end of September 2023, partly attributable to the increased dollar demand from importers, especially oil and energy sectors.

Also, during the week, the Kenya Shilling depreciated by 0.5% against the US dollar to close at Kshs 151.1, from Kshs 150.4 recorded the previous week. On a year to date basis, the shilling has depreciated by 22.4% against the dollar, adding to the 9.0% depreciation recorded in 2022. We expect the shilling to remain under pressure in 2023 as a result of:

- An ever-present current account deficit, which came at 3.7% of GDP in Q2’2023 from 6.0% recorded in a similar period last year,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.1% of Kenya’s external debt is US Dollar denominated as of June 2023, and,

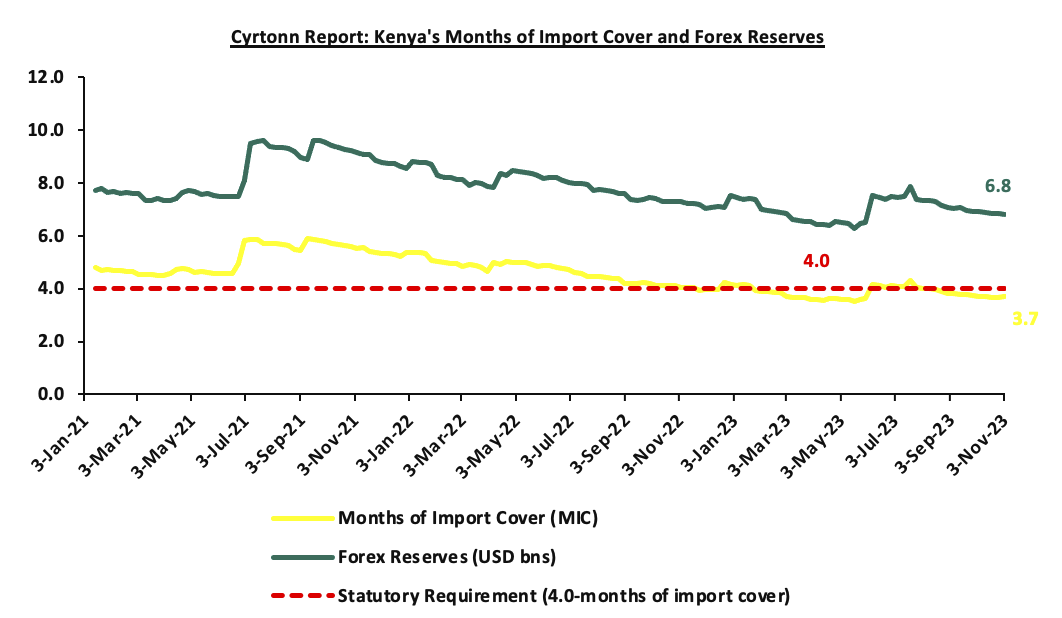

- Dwindling forex reserves currently at USD 6.8 bn (equivalent to 3.7-months of import cover), which is below the statutory requirement of maintaining at least 4.0-months of import cover.

The shilling is however expected to be supported by:

- Diaspora remittances standing at a cumulative USD 3106.7 mn in 2023 as of September 2023, 3.8% higher than the USD 2,992.5 mn recorded over the same period in 2022, which has continued to cushion the shilling against further depreciation. In the September 2023 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 57.0% in the period, and,

- The tourism inflow receipts which came in at USD 268.1 bn in 2022, a significant 82.9% increase from USD 146.5 bn inflow receipts recorded in 2021.

The chart below summarizes the evolution of Kenya’s months of import cover (MIC) over the years:

Notably, the MIC has been on a downward trajectory, to close October at 3.7 months, from the 3.8 months recorded at end of September. Likewise, Forex Reserves declined to USD 6.8 bn in October, from USD 6.9 bn recorded in September.

Weekly Highlights:

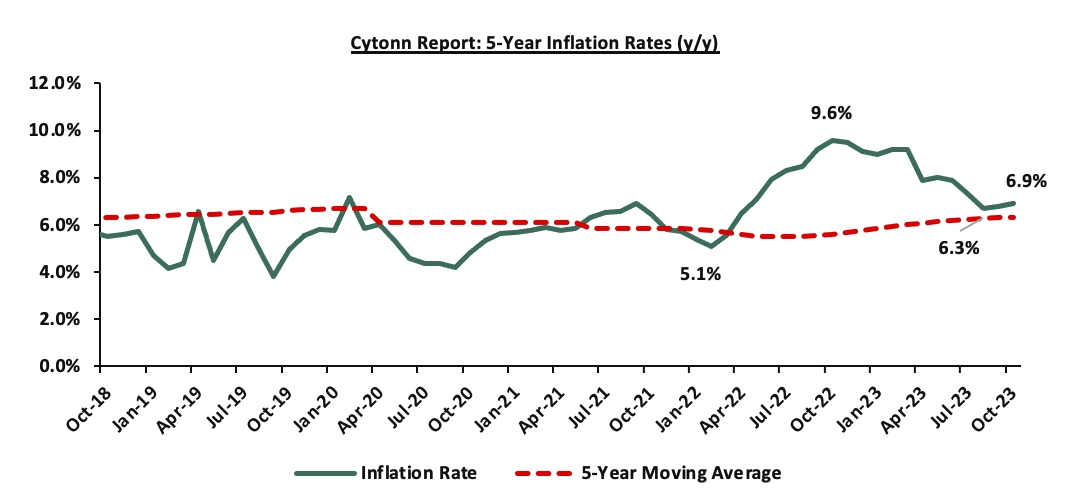

- October 2023 Inflation

The y/y inflation in October 2023 increased marginally by 0.1% points to 6.9%, from the 6.8% recorded in September 2023. This was in line with our projections of an increase to within a range of 6.8% to 7.0%. The headline inflation in October 2023 was majorly driven by increase in prices of commodities in the following categories; transport, food and non-alcoholic beverages and housing, water, electricity, gas and other fuels by 13.6%, 7.8% and 7.8% respectively. The table below shows a summary of both the year on year and month on month commodity indices performance:

|

Cytonn Report: Major Inflation Changes – 2023 |

|||

|

Broad Commodity Group |

Price change m/m (October-2023/September-2023) |

Price change y/y (October-2022/October-2023) |

Reason |

|

Food and Non-Alcoholic Beverages |

1.3% |

7.8% |

The m/m increase was mainly driven by the increase in prices of commodities such as potatoes, tomatoes and Oranges of 9.6%, 5.4% and 2.8%, respectively. However, the increase was weighed down by decrease in prices of Maize flour-sifted, maize flour-fortified, and wheat flour-white by 4.1%, 3.2%, and 0.8%, respectively. |

|

Housing, Water, Electricity, Gas and Other Fuel |

1.9% |

7.8% |

The m/m performance was mainly driven by the increase in prices of 13.0kg gas/LPG by 7.3%. However, there was a decrease in prices of Electricity of 200KWH and 50KWH by 5.0% and 3.3% respectively. |

|

Transport cost |

1.5% |

13.6% |

The m/m increase in transport Index was mainly due to increase in prices of country bus fares on the back of the rise in the prices of petrol and diesel by 2.7% and 2.2%, respectively. |

|

Overall Inflation |

1.0% |

6.9% |

The m/m increase was mainly driven by 1.9% increase in Housing, Water, Electricity, Gas and Other Fuel. |

Notably, the overall headline inflation remained within the Central Bank of Kenya (CBK) target range of 2.5% to 7.5% for the fourth consecutive month. The increase in headline inflation in October 2023 comes amid the recent rise in fuel prices which increased by 2.7%, 2.2% and 1.2% to Kshs 217.4, Kshs 205.5 and Kshs 205.1 per litre of Super Petrol, Diesel and Kerosene, respectively, for the period between 15th October 2023 to 14th November 2023. The chart below shows the inflation rates for the past 5 year;

Source: KNBS

Going forward, we expect inflationary pressures to persist in the short to medium term partly on the back increased government spending following the provisions in proposed supplementary budget which saw the government revise its expenditure upwards by 5.0% to Kshs 3.9 tn, from Kshs 3.7 tn at the beginning of the FY’2023/2024. Key to note, the high commodity prices in the country is also attributed to the sustained depreciation of the Kenya Shilling which has inflated the import bills. As a result, manufacturers pass on the cost to consumers through hike in consumer prices. However, we expect the measures taken by the government to subsidize major inputs of agricultural production such as fertilizers to lower the cost of farm inputs and support the easing of inflation in the long term.

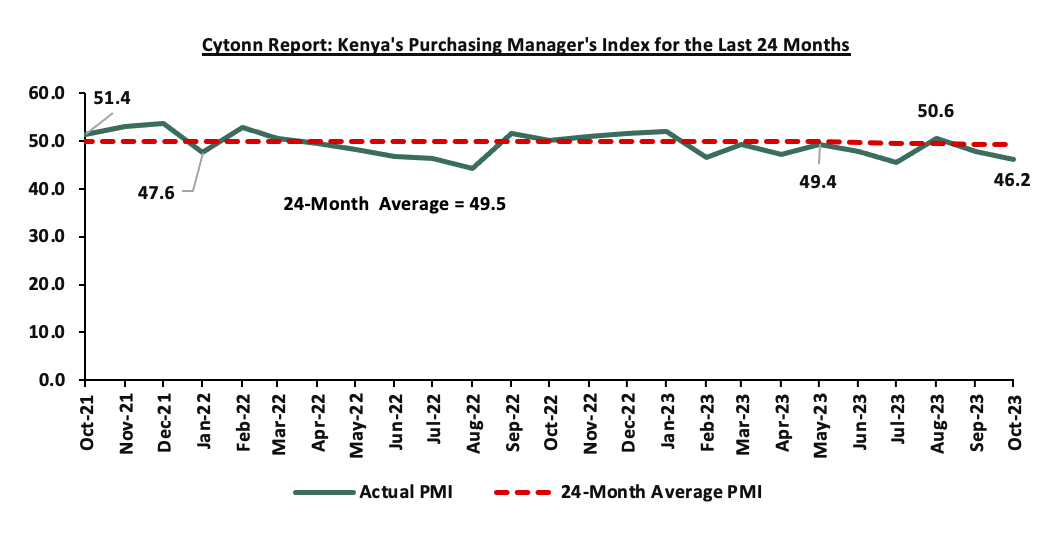

- October 2023 Purchasing Managers Index (PMI)

During the week, Stanbic Bank released its Monthly Purchasing Manager's Index (PMI), highlighting that the index for the month of October 2023 deteriorated further, coming in at 46.2, down from 47.8 in September 2023, signaling a stronger downturn of the business environment for the first month of Q4’2023. On a year to year basis, the index recorded an 8.0% deterioration from the 50.2 recorded in October 2022. The strong downturn of the general business environment is mainly attributable to the elevated inflationary pressure experienced in the country, albeit within the Central Bank of Kenya (CBK) target range of 2.5%–7.5% with the inflation rate in October 2023 slightly tightening to 6.9%, from 6.8% recorded in September 2023. This was on the back of further increase in fuel prices by an average of Kshs 4.3 per litre, as well as the aggressive depreciation of the Kenyan shilling, having depreciated against the dollar by 1.7% in the month of October. As such, input costs rose at the quickest pace in history, resulting from the deterioration of the Shilling against the dollar, which led to price pressures. Consequently, demand worsened as heightened prices resulted to erosion of spending power, leading to a decline in new businesses.

Additionally, the manufacturing output declined at a faster rate compared to September, as firms adjusted to reduced demand by cutting their workforce, resulting to the highest rate of workforce cut since June 2022. Construction, wholesale and retail sectors recorded the highest decline in new business activities.

Notably, exports remained high during the month, attributable to the weak shilling, which made Kenyan exports more affordable in the global market. Key to note, a PMI reading of above 50.0 indicates an improvement in the business conditions, while readings below 50.0 indicate a deterioration. The chart below summarizes the evolution of PMI over the last 24 months:

Going forward, we project that the business environment will continue to be restrained in the short to medium term on the back of the persistent depreciation of the Kenyan Shilling, consequently raising the importation and production costs, thus raising inflation. Additionally, fuel prices remain high and on an upward trajectory as well as food prices, which continue to put inflationary pressures in the private sector. Further, the increased taxation, with likelihood of more upward tax revisions is set to continue restraining the business environment in the country. As a result, the volume of new businesses is expected to remain stifled as consumers cut back on spending owing to a lack of purchasing power. Notably, the general improvement in business conditions is largely dependent on the stability of the Kenya shilling, given that the country's high cost of production is mostly attributable to the high import cost of goods owing to the poor performance of the shilling.

Monthly Highlights:

- The National Treasury gazetted the revenue and net expenditures for the first quarter of FY’2022/2023, indicating that the total revenue collected as at the end of September 2023 amounted to Kshs 540.0 bn, equivalent to 21.0% of the original estimates of Kshs 2,571.2 bn for FY’2023/2024 and is 84.0% of the prorated estimates of Kshs 642.8 bn. Please see our Cytonn weekly #41/2023,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective 15th October 2023 to 14th November 2023. Notably, fuel prices for super petrol, Diesel and Kerosene increased by 2.7%, 2.2% and 1.2% to Kshs 217.4, Kshs 205.5 and Kshs 205.1, respectively, from Kshs 211.6, Kshs 200.9 and Kshs 202.6 per litre for super petrol, Diesel and Kerosene respectively. Please see our Cytonn Weekly #41/2023,

- The Kenya National Bureau of Statistics (KNBS) released the Q2'2023 Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 5.4% growth in Q2’2023, marginally faster than the 5.2% growth recorded in Q2’2022. Please see our Cytonn Q3'2023 Markets Review,

- The monetary policy committee met on October 3, 2023 to review the outcome of its previous policy decisions amidst a backdrop of continued global uncertainties, high inflationary pressures, a weak global growth outlook as well as measures taken by other economies around the world in response to these developments. The MPC retained the CBR Rate at 10.50%, which was in line with our expectations of the MPC to maintain the CBR rate at the current rate. Please see our Cytonn Q3'2023 Markets Review, and,

- Stanbic Bank released its monthly Purchasing Manager's Index (PMI), highlighting that the index for the month of September 2023 slid back into the negatives, coming in at 47.8, down from 50.6 in August 2023, signaling a stronger downturn of the business environment at the end of Q3’2023. Please see our Cytonn Q3'2023 Markets Review.

Rates in the Fixed Income market have been on an upward trend given the continued high demand for cash by the government and the occasional liquidity tightness in the money market. The government is 25.7% behind its prorated net domestic borrowing target of Kshs 91.2 bn, having a net borrowing position of Kshs 67.7 bn of the domestic net borrowing target of Kshs 316.0 bn for the FY’2023/2024. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to bridge the fiscal deficit through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the month of October 2023, the equities market was on a downward trajectory, with NASI declining the most by 7.0% while NSE 20, NSE 25 and NSE 10 declined by 3.2%, 4.2% and 4.3% respectively. The equities market performance was driven by losses recorded by large-cap stocks such as KCB, Safaricom, Bamburi, Stanbic Bank and Diamond Trust Bank-Kenya of 16.1%, 14.7%, 6.5%, 6.1% and 6.0% respectively. The losses were, however, mitigated by gains recorded by large cap stocks such as Equity Group and NCBA of 5.6% and 1.8% respectively.

During the week, the equities market was on a downward trajectory, with NSE 10 declining the most by 4.5%, while NASI, NSE 20 and NSE 25 declined by 4.1%, 1.3% and 3.9%, respectively, taking the YTD performance to losses of 32.7%, 13.8%, and 26.5% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as KCB Group, Safaricom and NCBA of 13.3%, 6.8% and 4.7%, respectively.

Equities turnover increased marginally by 1.6% in the month of October to USD 28.2 mn, from USD 27.8 mn recorded in September 2023. Foreign investors remained net sellers, with a net selling position of USD 2.9 mn, from a net selling position of 8.5 mn recorded in September.

During the week, equities turnover decreased by 63.1% to USD 4.1 mn from USD 11.1 mn recorded the previous week, taking the YTD total turnover to USD 602.6 mn. Foreign investors remained net sellers for the fourth consecutive week with a net selling position of USD 0.3 mn, from a net selling position of USD 2.3 mn recorded the previous week, taking the YTD foreign net selling position to USD 285.4 mn.

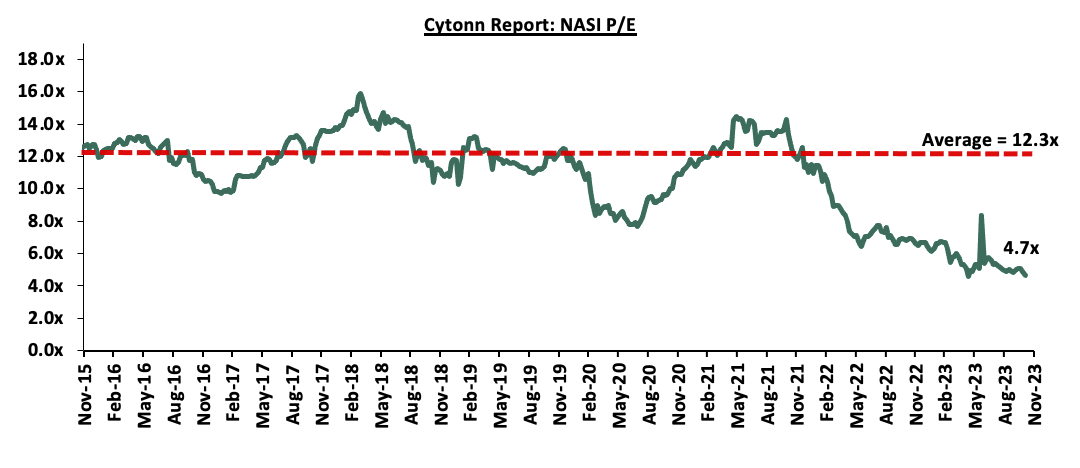

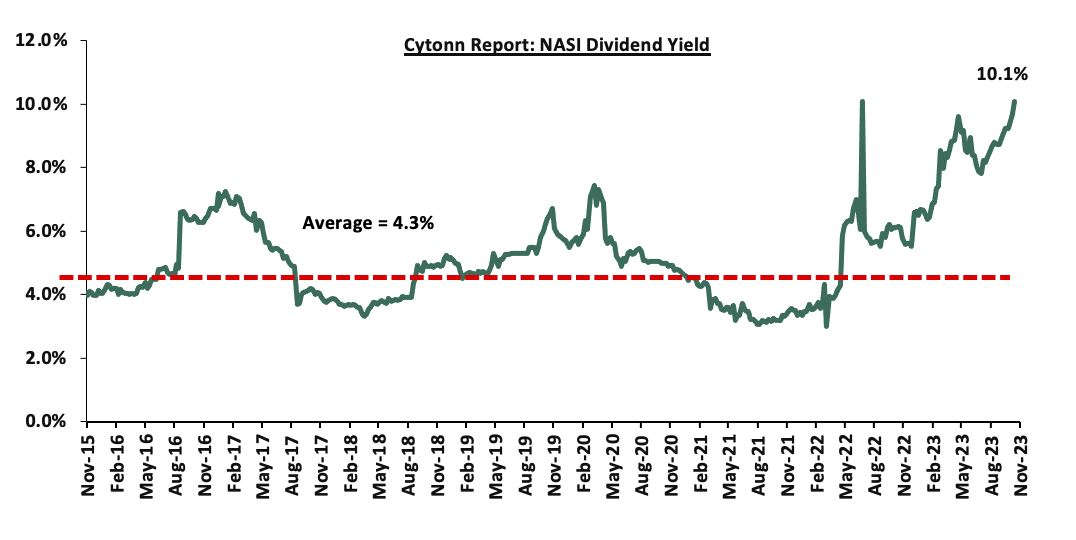

The market is currently trading at a price to earnings ratio (P/E) of 4.7x, 61.7% below the historical average of 12.2x. The dividend yield stands at 10.1%, 5.8% points above the historical average of 4.3%. Key to note, NASI’s PEG ratio currently stands at 0.6x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

https://cytonnreport.com/storage/research/654782c69e8e99.01142319.png

Universe of coverage:

|

Cytonn Report: Equities Universe of Coverage |

|||||||||||

|

Company |

Price as at 27/10/2023 |

Price as at 03/11/2023 |

w/w change |

m/m change |

YTD Change |

Year Open 2023 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

KCB Group*** |

18.9 |

16.4 |

(13.3%) |

(16.1%) |

(57.4%) |

38.4 |

30.7 |

12.2% |

100.0% |

0.3x |

Buy |

|

Liberty Holdings |

4.0 |

3.7 |

(6.5%) |

5.6% |

(26.0%) |

5.0 |

5.9 |

0.0% |

58.7% |

0.3x |

Buy |

|

Kenya Reinsurance |

1.8 |

1.7 |

(1.7%) |

(1.7%) |

(8.0%) |

1.9 |

2.5 |

11.6% |

57.6% |

0.1x |

Buy |

|

Jubilee Holdings |

185.0 |

182.0 |

(1.6%) |

(1.5%) |

(8.4%) |

198.8 |

260.7 |

6.6% |

49.8% |

0.3x |

Buy |

|

Sanlam |

7.4 |

6.9 |

(6.8%) |

6.1% |

(28.0%) |

9.6 |

10.3 |

0.0% |

49.1% |

1.9x |

Buy |

|

ABSA Bank*** |

11.9 |

11.5 |

(3.4%) |

(3.3%) |

(6.1%) |

12.2 |

14.8 |

11.8% |

41.0% |

0.9x |

Buy |

|

Diamond Trust Bank*** |

45.0 |

45.0 |

(0.1%) |

(6.0%) |

(9.8%) |

49.9 |

58.1 |

11.1% |

40.4% |

0.2x |

Buy |

|

I&M Group*** |

17.3 |

17.3 |

0.0% |

0.0% |

1.5% |

17.1 |

21.8 |

13.0% |

39.0% |

0.4x |

Buy |

|

Co-op Bank*** |

11.8 |

11.4 |

(3.8%) |

(0.8%) |

(6.2%) |

12.1 |

13.5 |

13.2% |

32.2% |

0.5x |

Buy |

|

NCBA*** |

39.0 |

37.2 |

(4.7%) |

1.8% |

(4.6%) |

39.0 |

43.2 |

11.4% |

27.7% |

0.7x |

Buy |

|

Equity Group*** |

38.0 |

37.1 |

(2.4%) |

5.6% |

(17.6%) |

45.1 |

42.6 |

10.8% |

25.6% |

0.8x |

Buy |

|

Stanbic Holdings |

109.0 |

105.0 |

(3.7%) |

(6.1%) |

2.9% |

102.0 |

118.2 |

12.0% |

24.6% |

0.8x |

Buy |

|

Standard Chartered*** |

156.0 |

155.8 |

(0.2%) |

(5.3%) |

7.4% |

145.0 |

170.9 |

14.1% |

23.9% |

1.1x |

Buy |

|

Britam |

4.8 |

5.0 |

4.4% |

(1.8%) |

(4.4%) |

5.2 |

6.0 |

0.0% |

20.1% |

0.7x |

Buy |

|

CIC Group |

1.9 |

2.2 |

17.1% |

(6.5%) |

14.7% |

1.9 |

2.5 |

5.9% |

20.1% |

0.7x |

Buy |

|

HF Group |

4.0 |

3.8 |

(4.8%) |

(12.8%) |

21.0% |

3.2 |

3.2 |

0.0% |

(16.0%) |

0.2x |

Sell |

|

Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

|||||||||||

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently being undervalued to its future growth (PEG Ratio at 0.6x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the equities outlook in the short term.

- Industry Reports

During the month, the following industry reports were released and the key take-outs were as follows;

|

Cytonn Report: Notable Industry Reports During the Month of October 2023 |

|||

|

# |

Theme |

Report |

Key Take-outs |

|

1 |

Hospitality and Construction Sectors |

The Leading Economic Indicators (LEI) June and July Reports by Kenya National Bureau of Statistics (KNBS) |

|

We expect to continue witnessing growth in Kenya's Real Estate sector in terms of activity, propelled by: i) recovery of accommodation and food sectors' sustained recovery supported by increased international visitor arrivals into the country, ii) aggressive marketing of Kenya’s tourism sector and its continued recognition through awards such as the World Travel Awards 2023, iii) positive demographics above the global averages, thus driving the demand for Real Estate upward. However, we expect hindrances to the sector's optimal performance, primarily due to; i) high construction costs exacerbated by inflationary pressures as a result of both local and global economic shocks, and, ii) depreciation of the Kenyan shilling against major international currencies such as the United States Dollar (USD) which has in turn led to an increase in prices of key construction commodities including as cement, steel, hardcore. This has in turn slowed down the growth of the construction sector and subsequently led to a decline in cement consumption.

- Residential Sector

During the week, President William Ruto launched the first phase of the Kshs 6.0 bn Buxton Point affordable housing project located in Buxton, Mombasa County. The project which is spearheaded by Gulf Africa Limited is planned to deliver 1,984 affordable housing units in two phases, with 584 units already completed under phase one. The President also broke ground for the construction of an additional 1,400 units to be delivered under the second phase of the Buxton project. The project will comprise residential units of various typologies, and community facilities including a community centre, kindergarten, social hall, sports courts, green areas, swimming pool, food courts and public exercise area. The table below gives a summary of the unit types, sizes and prices for the development;

|

Cytonn Report: Buxton Point Affordable Housing Project |

||||

|

Typology |

Unit Size (SQM) |

Unit Price (in Kshs) |

Price Per SQM |

Monthly Payments (under the TPS for Social Housing Units in Kshs) |

|

One=Bedroom |

38 |

2.9 mn |

76,316 |

11,004 |

|

Two-bedroom |

56 |

4.4 mn |

78,571 |

16,696 |

|

Three-Bedroom |

75 |

5.9 mn |

78,667 |

22,388 |

|

Average |

56 |

4.4 mn |

77,851 |

16,696 |

Source: Buxton Point Sales Team

The President highlighted that Buxton phase two will constitute both social housing, affordable housing and market rate units, however, the specific allocations to the three segments is yet to be disclosed. Under social housing, former tenants will be granted first priority in the Tenant Purchase Scheme (TPS) and will make regular monthly payments for a duration of between 20 to 30 years to become eventual homeowners. Purchasers will pay interest rates of 3.0% for social housing units, 6.0% for affordable housing units and 9.0% for units under the market rate segments. For houses sold under the TPS, assuming a tenor of 30 years and a 10.0% deposit, purchasers of one bedroom, two bedroom and three-bedroom units will be required to pay monthly repayments of Kshs 11,004, Kshs 16,696, and Kshs 22,388 respectively.

Additionally, the President broke ground for the construction of 2,000 units Mzizima housing estate which neighbors Buxton Point. The two projects form part of Kshs 200.0 bn housing projects planned and initiated to redevelop ten estates through a joint venture between County Government of Mombasa and private investors.

As the Affordable Housing Programme (AHP) continues to take shape in the country, we expect to see consistent project initiations and completions of affordable housing projects, in line with the government’s agenda on housing. With Buxton Estate Project as the pioneering affordable housing project in Mombasa County, we expect to witness an increase in projects rolled out under the AHP in the coastal region going forward, in line with the national housing agenda and behind the footsteps of counties such as Nairobi, Machakos, Homa Bay and Nakuru. The table below summarizes various affordable housing projects by the private sector in Kenya;

|

Cytonn Report: Affordable Housing Projects Initiated by Private Sector Players in Kenya |

||

|

Project Name |

Location |

Number of Units |

|

Great Wall Gardens Phase 5 |

Mavoko, Machakos County |

1,128 |

|

Samara Estate |

Ruiru |

1,824 |

|

Moke Gardens |

Athi River |

30,000 |

|

Habitat Heights |

Mavoko |

8,888 |

|

Tsavo Apartments |

Embakasi, Riruta, Thindigua, Roysambu, and, Rongai |

3,200 |

|

Unity West |

Tatu City |

3,000 |

|

RiverView |

Athi River |

561 |

|

Kings Serenity |

Ongata Rongai, Kajiado County |

734 |

|

Joinven Estate |

Syokimau, Machakos County |

440 |

|

Kisima Park |

Lukenya |

17,152 |

|

Oasis Park, Athi River |

Athi River |

20,000 |

|

Muselele Estate |

Mavoko |

3,250 |

|

Joinven Investments Ltd |

Syokimau |

400 |

|

Jewel Heights |

1,550 |

|

|

Benvar Estates |

Juja, Kiambu |

15,034 |

|

Kentek Ventures |

Syokimau, Machakos |

53,716 |

|

Samara Estates |

Migaa, Kiambu |

1,824 |

|

Edeville |

Donholm |

1,300 |

|

Breezewood Gardens |

4,950 |

|

|

Centum Investments, Rea Vipingo |

Vipingo, Kilifi |

5,300 |

|

The Creek Village |

Mshomoroni, Mombasa |

968 |

|

Buxton Point |

Buxton, Mombasa |

1,984 |

|

Total |

177,203 |

|

Source: Boma Yangu, Online Research

Other notable highlights in the sector during the month include;

- The State Department for Housing and Urban Development unveiled details of President William Ruto’s affordable housing plan that will allow salaried workers earning Kshs 150,000 and above per month to acquire homes through the State-funded program. For more information, please see our Cytonn Weekly #42/2023, and,

- The Capital Markets Authority (CMA) granted Linzi Finco Trust the approval to issue an inaugural Shariah compliant bond, ‘Linzi Sukuk’. The bond which is set to raise Kshs 3.0 bn to finance the development of 3,069 institutional grade affordable housing units will offer an internal rate of return of 11.1%. For more information, please see our Cytonn Weekly #39/2023.

We expect to continue seeing prioritized efforts by the current administration to address the annual housing deficit in Kenya, which is estimated to be 80.0% according to the Center for Affordable Housing Finance Africa (CAHF). The government has aimed to address this deficit by partnering with the private sector through offering incentives for developers and implementing public and legal interventions to provide supporting infrastructure, and streamline transactions in the sector for execution of affordable housing options for its citizens. However, the exorbitant cost of financing in housing development and increasing construction expenses pose significant challenges in Kenya's housing sector, particularly in urban areas. This results in elevated development costs for builders, making it difficult for people to afford homes.

- Retail Sector

Notable highlights during the month include;

- Chain store Naivas Supermarket opened its 100th outlet located along King’ara road, Lavington, Nairobi. The opening of this latest store marks a significant achievement in the retailer's ongoing expansion plan dubbed 'Road to 100', which has been in progress for several months. For more information, please see our Cytonn Weekly #41/2023,

- Chain store Naivas Supermarket opened its 99th outlet located along Ronald Ngala Street Tudor, Sabasaba, Mombasa County. The retailer’s decision to open up the store forms part of its expansion strategy dubbed ‘Road to 100’. For more information, please see our Cytonn Q3’2023 Markets Review, and,

- French retailer Carrefour Supermarket, opened a new outlet at Ellis Plaza along Wabera Street in Nairobi CBD, bringing the retailer’s number of operating outlets countrywide to 21. The move is part of the retailer’s strategic plan to expand its footprint in the Kenyan market especially in the capital city with currently 17 outlets operating in Nairobi County, and 2 within the heart of the city. For more information, please see our Cytonn Q3’2023 Markets Review.

We expect to continue witnessing a consistent increase in activities within the Kenyan retail sector driven by several factors, including: i) ongoing expansion efforts by both local and international retailers as they aim to capture a larger market share and stamp their market dominance, ii) increased capital investments from foreign entities in the Kenyan retail market amid growth of e-commerce in the country, iii) growing demand for goods and services fueling demand for retail spaces on the back of favorable demographics, and iv) continued infrastructural developments improving accessibility of various regions, thereby opening up new opportunities for retail investment in areas that were previously inaccessible. However, we expect the sector's optimal performance will be weighed down by challenging economic conditions on the back of rising inflation that is continually eroding the purchasing power of consumers. Moreover, the existing oversupply of retail spaces, estimated at 3.3 mn SQFT in the Nairobi Metropolitan Area (NMA) and 2.1 mn SQFT in the broader Kenyan retail sector (excluding NMA) which we expect will limit the sector's growth by stifling absorption rates.

- Hospitality Sector

During the week, Lawford Hotel, a luxury beach resort located in Malindi, Kenya, won three prestigious awards at the 17th World Luxury Hotel Awards 2023 held in Athens, Greece. The hotel which is the oldest operating hotel in both Malindi and in Kenya, secured awards in the categories of; i) Luxury Villa Resort, ii) Luxury Historical Hotel and, iii) Luxury Coastal Hotel. Lawford Hotel, nestled in a tropical oasis surrounded by lush vegetation and exquisite landscape of the Kenyan coast comprises 70 deluxe suites, 20 family suites and 8 private villas. Other notable winners include Crowne Plaza Nairobi, crowned as the Best Luxury Airport Hotel for the second consecutive time after being awarded the best in the same category in the 16th World Luxury Hotel Awards in 2022. A total of 8 Kenyan hotels received awards under different categories as summarized below;

|

Cytonn Report: 17th World Luxury Hotel Awards 2023 Kenya Hotels Winners |

|||

|

# |

Hotel |

Award |

Category |

|

1 |

Crowne Plaza Nairobi Airport |

Luxury Airport Hotel |

African |

|

Luxury Business Hotel |

Kenya |

||

|

Luxury Sustainable Hotel |

Regional |

||

|

2 |

Muthu Keekorok Lodge, Maasai Mara, Narok |

Luxury Game Lodge |

Kenya |

|

Luxury Safari Lodge |

Kenya |

||

|

3 |

Radisson Blu Hotel & Residence, Nairobi Arboretum |

Luxury Design Boutique Hotel |

Kenya |

|

Luxury Business Hotel |

Regional |

||

|

Luxury City Hotel |

Regional |

||

|

4 |

Sarova Lion Hill Game Lodge |

Luxury Game Lodge |

Regional |

|

Luxury Safari Lodge |

Regional |

||

|

Luxury Family Hotel |

Africa |

||

|

5 |

Sarova Mara Game Camp |

Luxury Tented Safari Camp |

Africa |

|

Luxury Tented Camp |

Global |

||

|

Luxury Safari Retreat |

Region |

||

|

6 |

Sarova Stanley Hotel |

Luxury Heritage Hotel |

Africa |

|

Luxury City Hotel |

Kenya |

||

|

Luxury Conference and Event Hotel |

Kenya |

||

|

7 |

Sarova Whitesands Beach Resort and Spa |

Luxury Family Beach Resort |

Africa |

|

Luxury Beachfront Resort |

Regional |

||

|

8 |

The Lawford Hotel, Malindi |

Luxury Coastal Hotel |

Africa |

|

Luxury Historical hotel |

Africa |

||

|

Luxury Villa Resort |

Regional |

||

Source: World Luxury Hotel Awards

This comes a week after 13 Kenyan hotels and brands clinched numerous high-calibre awards at the 30th World Travel Awards 2023, where Nairobi and Diani emerged as Africa’s top tourists’ destinations. In addition, Kenya was voted as Africa’s leading travel destination. These awards firmly position Kenya as the ultimate tourism destination, underscoring the unmatched allure and desirability of the Kenyan hospitality industry. Moreover, the awards point towards a rapidly growing luxury tourism market in the country, and is exemplified by the recent entry of Miftah Concierge, a leading provider of tailored lifestyle management and luxury travel services based in Dubai.

Other notable highlights during the month include;

- Kenya’s Diamonds Resorts secured two prestigious awards at the 30th World Travel Awards 2023. Diamond Leisure Beach and Golf Resort located in Diani, and Diamond’s Dreams of Africa Resort which is located in Malindi, Kenya were crowned Africa’s Leading Resort and Africa’s Leading All-Inclusive Resort respectively. For more information, please see our Cytonn Weekly #43/2023,

- Miftah Concierge, a leading provider of tailored lifestyle management and luxury travel services based in Dubai expanded its operations into Kenya. The move is part of the firm’s ambitious expansion strategy into Africa, using Kenya as a strategic base to initiate growth and operations across the continent. For more information, please see our, Cytonn Weekly #42/2023, and,

- W Hospitality Group released the Hotel Chain Development Pipelines in Africa 2023 Report, compiling data from 45 regional and international hotel chains highlighting Kenya was ranked fifth highest in the continent by number of planned rooms, with 25 hotels and 3,729 rooms in the pipeline. Additionally, Nairobi was ranked the fifth highest city with anticipated additions to supply, with 17 hotels and 3,161 rooms expected to open in 2023. For more information, please see our Cytonn Q3’2023 Markets Review.

We expect that going forward, the sector’s performance will be supported by factors such as; i) continued recognition of Kenya’s hospitality sector through positive awards and accolades, ii) anticipated increased spending in the sector driven by increased budgetary allocation towards the sector through the Tourism Fund and Tourism Promotion Fund (TPF) in FY’2023/24, iii) increased international tourism arrivals into the country in 2023, compared to a similar period in 2022, iv) aggressive marketing campaigns by the Kenya Tourism Board on the Magical Kenya platforms, v) concerted efforts to promote local and regional, vi) development of niche products such as cruise tourism, adventure tourism, culture and sports tourism, vii) continuous opening and expansions by local and international hotel brands such as JW Marriott of the Bonvoy Global and Pan Pacific Hotels Group in the country, and, viii) counties efforts to boost tourism in efforts aimed at enhancing County revenue collections. However, the sector's optimal performance is expected to be subdued by challenging economic conditions such as rising operational costs attributed to the rising inflation, and, recently issued travel advisories by multiple governments, including those of China and the United States amidst concerns of possible security breaches and threats.

- Industrial Sector

During the week, British International Investment (BII), the UK's development fund committed Kshs 4.0 bn for the construction of 20 state of the art warehouses in three African countries namely Kenya, Nigeria and Uganda, as well as for the expansion of warehouse technology and advanced software to improve post-harvest pricing transparency. The warehouses will offer storage capacity for 230,000 tonnes of agricultural produce, creating opportunities for an additional 200,000 farmers to access cost-effective storage solutions and optimize their crop sales, potentially leading to increased income for these farmers. The funding will be channeled to Afex, Africa's commodities platform, which manages a network of over 200 warehouses in Nigeria, Kenya, and Uganda, benefiting more than 450,000 farmers. Upon completion, the project will; i) support small-scale farmers in grain storage and assist in addressing food insecurity, ii) contribute to the development of technologically advanced warehouses and essential infrastructure across the three countries and in Africa, and, ii) significantly improve market access and enhance income prospects for small-scale farmers.

We expect the performance of the industrial sector in Kenya will continue to be supported by; i) establishment of more government and private Special Economic Zones (SEZs), Export Processing Zones (EPZs), industrial parks strategically located along major agricultural zones and infrastructural and transportation linkages across the country, ii) government’s focus to stimulate industrialization through focused investments under the Kenya Industrial Transformation Programme , iii) government's accelerated focus on exporting agricultural and horticultural products to the international market, iv) recognition of Kenya as a regional hub attracting increased investments by foreign manufacturing entities such as CFAO Motors, Unilever East Africa, Safic-Alcan, Taifa Gas, Globeleq, among others, v) increased demand for data centres by both the government and private-sector firms driven by continued increase in demand for data protection services in line with the Data Protection Act 2019 requiring personal data to be stored in servers or data centres located within Kenya’s borders, vi) increased demand for cold storage facilities for perishable agricultural produces for export and drugs and vaccines whose demand is supported by the Universal Health Coverage program initiated by the government and private and Non-Governmental health organisations, and, vii) increased demand of e-commerce warehouses in the retail sector. However, the prolonged stalling of development of supporting infrastructure such as roads, water and electricity within industrial parks will continue to hamper optimum development and investments in the industrial sector.

- Infrastructure Sector

During the week, President William Ruto launched the construction of the 33.0 Km Bamburi-Mwakirunge-Rabai-Kaloleni road, traversing Mombasa and Kilifi counties during his five-day state tour of the Coastal region. The construction of the road is poised to be a transformative development that promises to significantly enhance accessibility between the two counties, in addition to stimulating and catalyzing trade thus fostering economic growth and prosperity of the two counties. Moreover, the road stands as a beacon of welcomed progress, representing a substantial stride in infrastructure development for the entire region upon completion.

The road among other key infrastructural projects underpins the government’s commitment to the development of infrastructure in the region, aimed at promoting travel and tourism by enabling easier movement of tourists across the three coastal counties of Mombasa, Kilifi and Kwale. Notably, the Kenyan coast has benefited from the commissioning and completion of several key infrastructural projects including the Kshs 4.5 bn Makupa brige project completed in August 2022, Likoni floating bridge, Changamwe interchange linking Jomvu and Kibarani areas in Mombasa County and, the Dongo Kundu bypass in Kwale County, with phase two of the project nearing completion. Additionally, during the week, Kenya National Highways Authority (KeNHA) announced that the second phase of the Dongo Kundu project, which stretches 17.1 Km is scheduled for opening in one month and will be fully operational by 2024. The project will boost tourism in the south coast by connecting Mombasa and Kwale counties from the Port-Reitz – SGR areas via the Mwache-Mkupe bridge, significantly reducing commute time and eliminating the need to use the Likoni ferry channel to reach Kwale County from Mombasa County.

Notable highlights during the month include;

- Kenya National Highways Authority (KeNHA) announced plans to set up 26 virtual weighbridges across the country, aimed at enhancing roads monitoring in concerted efforts to minimize road damage. The weighbridges will be designed to have a system which will include sensors, loops, scanners, Automatic Number Plate Recognition (ANPR), and Closed-Circuit Television (CCTV) cameras. The weighbridges will be installed along the Southern Bypass, two at Sagana, Kirinyaga County, Kamulu, Yatta, Eldoret, Mayoni, Ahero, Kaloleni, Laisamis, Sabaki, Madogo in Garissa, Mwatate, Kibwezi, Malili, Emali, Kajiado, Salgaa, Makutano, Mukumu, Cheptiret, Malaba, Eldama Ravine, Meru and Kamagambo areas. The weighbridges will be controlled remotely, and will allow for vehicles especially on bypasses to remit signals for overloaded vehicles to the control room. This will enable for the flagging of vehicles which are in violation. KeNHA’s push to install additional weighbridges comes at a time when there is growing concern of road damage, occasioned by overloaded trucks. For more information, please see our Cytonn Weekly #41/2023.

We expect to witness a reduction in the number of infrastructure projects, especially roads initiated and completed in the country during the FY’2023/24 period, as the sector grapples to stabilize and deliver results primarily due to significant budget cuts, as highlighted in the Supplementary Budget for FY'2023/24. According to the National Treasury, the allocation to the State Department for roads reduced by 8.3% to Kshs 230.1 bn from Kshs 250.8 bn. This was attributed to redirection of funds to other key sectors such as education, as well as to address mounting costs over debt repayment, on the back of increasing debt obligations exacerbated by the depreciation Kenyan Shilling. However, we expect both the local and national governments will continuously foster strategic partnership with other public transport agencies, and major stakeholders to promote the larger infrastructure sector beyond roads. Furthermore, we retain the stance that the government remains focused on investing in infrastructural development within the country with a particular emphasis on rural and remote communities.

- Regulated Real Estate Funds

- Real Estate Investments Trusts (REITs)

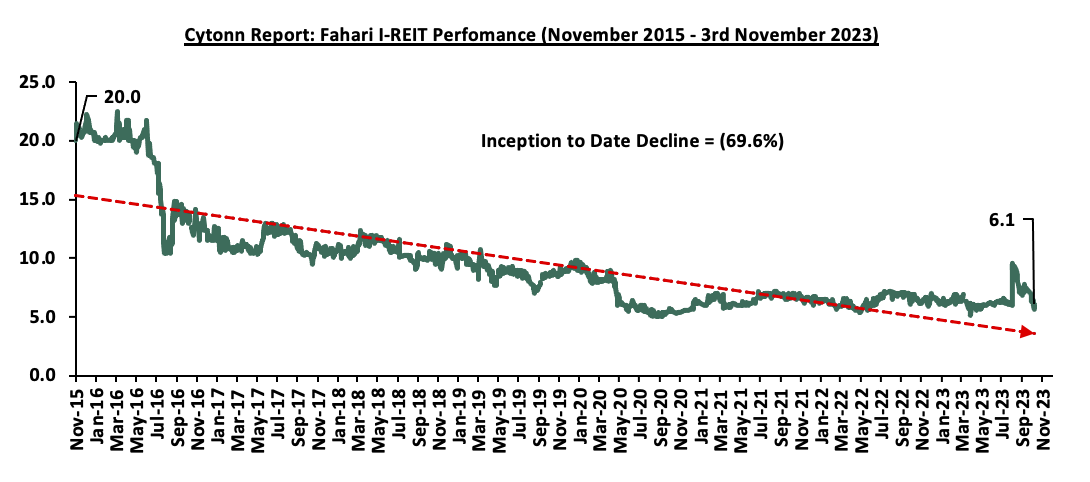

In the Nairobi Securities Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.1 per share. The performance represents a 5.3% decline from Kshs 6.4 per share recorded last week, taking it to a 10.3% Year-to-Date (YTD) loss from Kshs 6.8 per share recorded on 3 January 2023. Additionally, the performance represents a 69.6% Inception-to-Date (ITD) loss from the Kshs 20.0 price. The dividend yield currently stands at 10.7%. The graph below shows Fahari I-REIT’s performance from November 2015 to 3rd November 2023;

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.3 and Kshs 21.7 per unit, respectively, as of 27th October 2023. The performance represented a 26.6% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 30.7 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 633.8 mn, respectively, since inception in February 2021.

Other notable highlights during the month include;

- LAPTrust Imara I-REIT traded for the first time on 25th October 2023 since its listing, with a total of 30.0 mn shares traded in two deals valued at Kshs 600.0 mn, with the share price remaining unchanged from its listing price of Kshs 20.00. The I-REIT which is structured as a close-ended fund consisting of 346.2 mn units worth Kshs 6.9 bn was initially intended to remain non-public, with no securities offered to the general market for the next three years. For more information, please see our Cytonn Weekly #43/2023,

- Trading of ILAM Fahari I-REIT units resumed trading on the Nairobi Securities Exchange after a two-week trading suspension from Friday 6th October 2023. The suspension was to allow for the redemption of 36.6 mn units from Non-Professional investors in order to facilitate the conversion of the I-REIT into a restricted REIT from an un-restricted REIT. For more information, please see our Cytonn Weekly #43/2023,

- ILAM Fahari I-REIT released results for the redemption offer of 36.6 mn units from Non-Professional investors following the conclusion and subsequent lapsing of the conversion offer period by ICEA Lion Asset Managers (ILAM) on Friday 6th October. The redemption offer was oversubscribed by 113.4%, receiving applications for redemption of 41.4 mn units from Non-Professional investors at an offer price of Kshs 11.0. For more information, please see our Cytonn Weekly #42/2023, and,

- The trading of ICEA Lion Asset Management (ILAM) Fahari I-REIT units was suspended, with effect from Friday 6th October upon the conclusion and subsequent lapsing of the conversion offer period by ICEA Lion Asset Managers. For more information, please see our Cytonn Weekly #41/2023.

REITs provide various benefits like tax exemptions, diversified portfolios, and stable long-term profits. However, the continuous deterioration in performance of the Kenyan REITs and restructuring of their business portfolio is on top of other general challenges such as; i) inadequate comprehension of the investment instrument among investors, ii) prolonged approval processes for REITs creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and, iv) minimum investment amounts set at Kshs 5.0 mn, continue to limit the performance of the Kenyan REITs market.

- Cytonn High Yield Fund (CHYF)

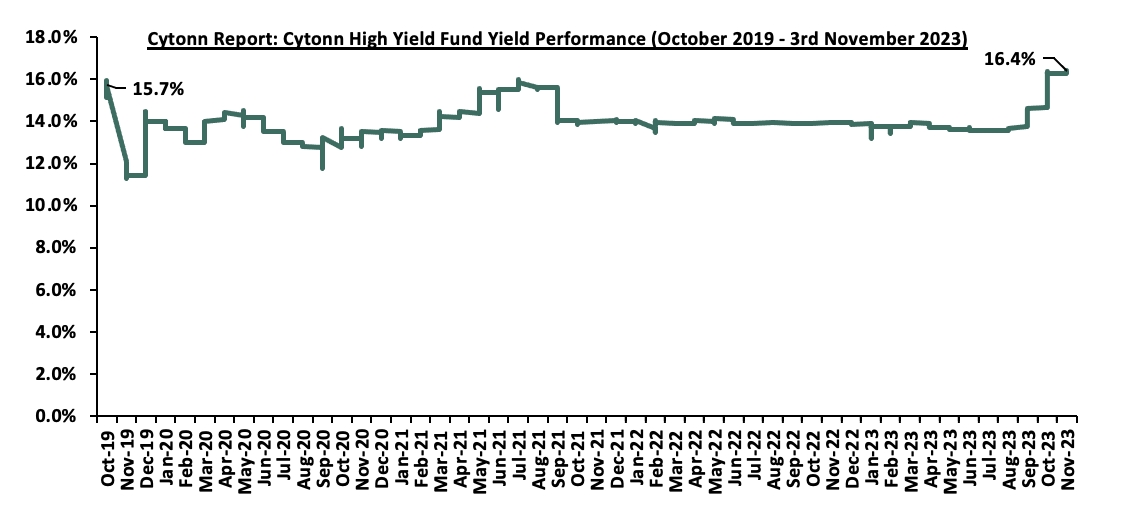

Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 16.4%, a 0.1%-points increase from the 16.3% yield recorded the previous week. The performance represented a 2.5%-points Year-to-Date (YTD) increase from 13.9% yield recorded on 1st January 2023, and 0.7%-points Inception-to-Date (ITD) increase from the 15.7% yield. The graph below shows Cytonn High Yield Fund’s performance from November 2019 to 3rd November 2023;

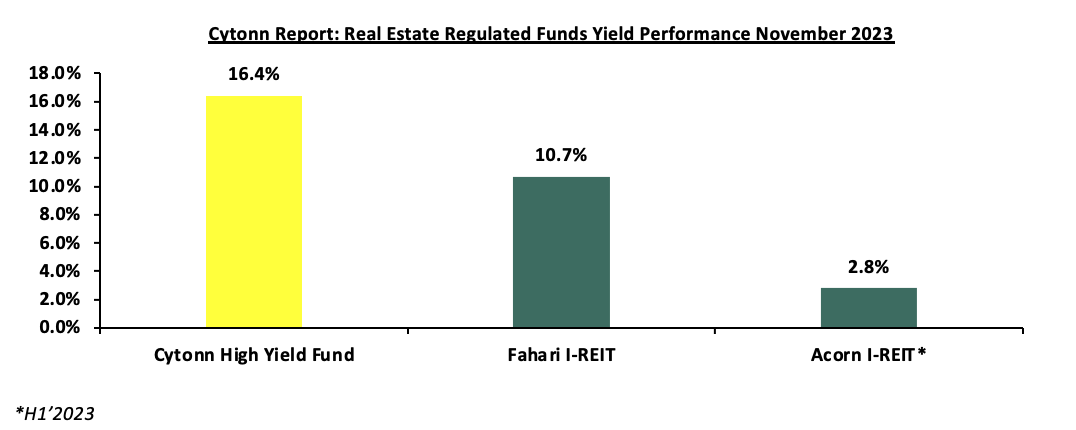

Notably, the CHYF has outperformed other regulated Real Estate funds with an annualized yield of 16.4%, as compared to Fahari I-REIT and Acorn I-REIT with yields of 10.7%, and 2.8% respectively. As such, the higher yields offered by CHYF makes the fund one of the best alternative investment resource in the Real Estate sector. The graph below shows the yield performance of the Regulated Real Estate Funds;

Source: Cytonn Research

We expect performance of the Kenyan Real Estate sector will continue to be driven by; i) increased launch and completions of affordable housing projects in line with the government’s affordable housing agenda, ii) increased demand for Real Estate and properties facilitated by positive demographics above global averages, iii) increased tourist arrivals into the country gearing towards pre-COVID levels, iv) continued recognition of Kenya as a regional business hub attracting foreign investments into the country, v) increased positive awards and accolades in the hospitality industry accorded to both local and international hotel brands positioning the country as a vibrant tourism market, vi) government’s focused investments in the industrial sector, and, vii) local and national governments continuous efforts to foster strategic partnerships with other public transport agencies, and major stakeholders to promote infrastructural development. However, rising costs of construction hindering developments, existing oversupply in select Real Estate sectors weighing down on absorption rates, and reduced budgetary allocations to the infrastructure sector will hamper the optimal performance of the sector.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.