Insurance Financial Planning, & Cytonn Weekly #07/2022

By Research Team, Feb 20, 2022

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 111.5%, up from the 83.5% recorded the previous week, partly attributable to the ample liquidity in the money markets, with the interbank rates remaining unchanged at 4.5% as recorded the previous week. The 364-day paper recorded the highest subscription rate, receiving bids worth Kshs 15.1 bn against the offered Kshs 10.0 bn, translating to a subscription rate of 151.3%, an increase from the 107.6% recorded the previous week. The continued oversubscription of the 364-day paper is attributable to investors’ preference for the longer-dated paper which offers a higher yield of 9.7% compared to the 7.3% and 8.1% yields offered by the 91-day and 182-day papers, respectively. The subscription rate for the 182-day paper increased to 101.5% from 64.0% while that of the 91-day paper declined to 37.2% from 72.3%, recorded the previous week. The yields on the government papers recorded mixed performance, with the yields on the 364-day papers increasing by 5.6 bps to 9.7%, while those of the 182-day and 91-day papers declined by 3.3 bps and 3.5 bps to 8.1% and 7.3%, respectively. The government accepted bids worth Kshs 26.1 bn, out of the Kshs 26.8 bn worth of bids received, translating to an acceptance rate of 97.3%. In the Primary Bond Market, the government released the auction results for the recently issued nineteen-year treasury bond, IFB1/2022/019, which recorded an oversubscription of 176.3%;

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail prices in Kenya effective 15th February 2022 to 14th March 2022 highlighting that fuel prices remained unchanged at Kshs 129.7 per litre for Super Petrol, Kshs 110.6 per litre for Diesel and Kshs 103.5 per litre for Kerosene. Additionally, the National Treasury gazetted the revenue and net expenditures for the first seven months of FY’2021/2022, ending 31st January 2022. Total revenue collected as at the end of January 2022 amounted to Kshs 1.1 tn, equivalent to 60.6% of the original estimates of Kshs 1.8 tn and is 103.8% of the prorated estimates of Kshs 1.0 tn;

Equities

During the week, the equities market recorded mixed performance, with NSE 20 gaining by 1.0%, while NASI and NSE 25 declined by 0.6% and 0.1% respectively, taking their YTD performance to losses of 0.1% for NASI and gains of 0.1% for NSE 20, while NSE 25 recorded a flat performance. The equities market performance was driven by gains recorded by stocks such as BAT, ABSA Kenya and KCB of 10.3%, 3.0% and 1.5%, respectively. The gains were however weighed down by losses recorded by other large cap stocks such as Standard Chartered Bank Kenya (SCBK) and Bamburi of 2.4% and 1.9%, respectively, while Safaricom and Equity Group both recorded losses of 1.4%;

Also, during the week, Standard Africa Holdings Limited, (SAHL), the majority shareholder in Stanbic Holdings announced that it had received regulatory approval from the Capital Markets Authority, for further extension of the exemption from making a full take-over under the Capital Markets (Take over and Mergers) Regulations, 2002. Under the exemption, SAHL aims to acquire a maximum of 10.6 mn ordinary shares in Stanbic to bring its total shareholding to up to 75.0% from 72.3% of Stanbic Holdings’ ordinary shares;

Real Estate

During the week, Centum Real Estate completed and handed over Riverbank apartments to clients. Also, Shelter Afrique, a Pan African housing company announced plans to issue a bond in East Africa, in the Kenyan Capital Market through the NSE aiming to raise USD 500.0 mn (Kshs 56.9 bn) that will be used to finance upcoming affordable housing projects by the firm. In the retail sector, Naivas supermarket, a local retail chain, opened a new outlet at Nairobi’s Greenspan Mall in Donholm, taking its total outlets 80. For Listed Real Estate, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.2 per share while the Acorn D-REIT and IREIT closed the week trading at Kshs 20.2 and Kshs 20.6 per unit, respectively;

Focus of the Week

Over time, financial plans have focused on three key goals – freedom from debt, rainy day savings and wealth generation through investments – leaving insurance plans as an additional separate aspect. However, given the direct impact on one’s finances, insurance planning forms an importance aspect of one’s capability to achieve their other financial goals. This week we focus on insurance planning, highlighting different types of insurance policies, and factors to consider when choosing the most suitable insurance cover;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.49%. To invest, dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.95% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809#;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for conversion, click here for the latest conversion term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 111.5%, up from the 83.5% recorded the previous week, partly attributable to the ample liquidity in the money markets, with the interbank rates remaining unchanged at 4.5% as recorded the previous week. The 364-day paper recorded the highest subscription rate, receiving bids worth Kshs 15.1 bn against the offered Kshs 10.0 bn, translating to a subscription rate of 151.3%, an increase from the 107.6% recorded the previous week. The continued oversubscription of the 364-day paper is attributable to investors’ preference for the longer-dated paper which offers a higher yield of 9.7% compared to the 7.3% and 8.1% yields offered by the 91-day and 182-day papers, respectively. The subscription rate for the 182-day paper increased to 101.5% from 64.0% while that of the 91-day paper declined to 37.2% from 72.3%, recorded the previous week. The yields on the government papers recorded mixed performance, with the yields on the 364-day papers increasing by 5.6 bps to 9.7%, while those of the 182-day and 91-day papers declined by 3.3 bps and 3.5 bps to 8.1% and 7.3%, respectively. The government accepted bids worth Kshs 26.1 bn, out of the Kshs 26.8 bn worth of bids received, translating to an acceptance rate of 97.3%.

In the Primary Bond Market, the government released the auction results for the recently issued 19-year treasury bond namely; IFB1/2022/019. The bond recorded an oversubscription of 176.3%, attributable to the tax-free nature of the bond coupled with the high yields of 13.0% offered by the bond. The government sought to raise Kshs 75.0 bn for funding infrastructural projects, received bids worth Kshs 132.3 bn and accepted bids worth Kshs 98.6 bn, translating to a 74.6% acceptance rate. The coupon rate and the weighted average yield of accepted bids for the bond were both 13.0%.

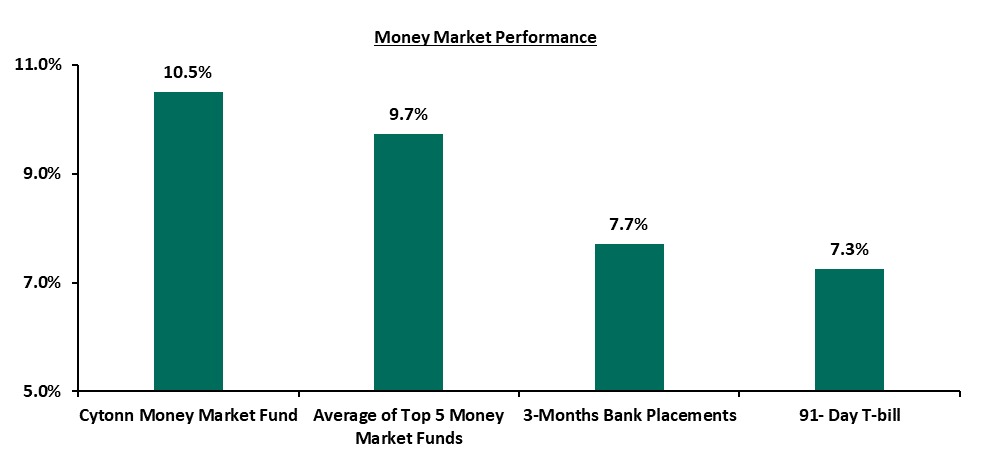

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill declined by 3.5 bps to 7.3%. The average yield of the Top 5 Money Market Funds declined to 9.7%, from 9.8%, while the yield of the Cytonn Money Market Fund remained relatively unchanged at 10.5%, as was recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 18th February 2022:

|

Money Market Fund Yield for Fund Managers as published on 18th February 2022 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.5% |

|

2 |

Zimele Money Market Fund |

9.9% |

|

3 |

Nabo Africa Money Market Fund |

9.7% |

|

4 |

Sanlam Money Market Fund |

9.4% |

|

5 |

Orient Kasha Money Market Fund |

9.1% |

|

6 |

GenCapHela Imara Money Market Fund |

9.0% |

|

7 |

Apollo Money Market Fund |

9.0% |

|

8 |

Madison Money Market Fund |

8.8% |

|

9 |

CIC Money Market Fund |

8.8% |

|

10 |

Dry Associates Money Market Fund |

8.8% |

|

11 |

Co-op Money Market Fund |

8.5% |

|

12 |

British-American Money Market Fund |

8.5% |

|

13 |

NCBA Money Market Fund |

8.4% |

|

14 |

ICEA Lion Money Market Fund |

8.3% |

|

15 |

AA Kenya Shillings Fund |

7.6% |

|

16 |

Old Mutual Money Market Fund |

7.1% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets remained relatively stable, with the average interbank rate remaining unchanged at 4.5% as recorded the previous week, partly attributable to government payments which offset tax remittances during the week. The average interbank volumes traded increased by 8.3% to Kshs 11.8 bn, from Kshs 10.9 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds were on an upward trajectory, with the yields on the 10-year bond issued in 2014 increasing by 0.1% points to 4.3%, while the yields on the 10-year and 30-year bonds issued in 2018 increased by 0.2% and 0.1% points to 7.2% and 8.9%, respectively. The 7-year and 12-year bonds issued in 2019 and 2021 both increased by 0.2% points to 6.9% and 7.6%, respectively. The 12-year bond issued in 2019 increased by 0.3% points to 7.9%. Below is a summary of the performance:

|

Kenya Eurobond Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

3-Jan-22 |

4.4% |

5.8% |

8.1% |

5.6% |

6.7% |

6.6% |

|

01-Feb-22 |

4.2% |

6.6% |

8.6% |

6.3% |

7.1% |

7.1% |

|

11-Feb-22 |

4.2% |

7.0% |

8.8% |

6.7% |

7.6% |

7.4% |

|

14-Feb-22 |

4.3% |

7.0% |

8.8% |

6.8% |

7.7% |

7.5% |

|

15-Feb-22 |

4.3% |

7.1% |

8.9% |

6.9% |

7.7% |

7.6% |

|

16-Feb-22 |

4.3% |

7.1% |

8.9% |

6.9% |

7.8% |

7.6% |

|

17-Feb-22 |

4.3% |

7.2% |

8.9% |

6.9% |

7.9% |

7.6% |

|

Weekly Change |

0.1% |

0.2% |

0.1% |

0.2% |

0.3% |

0.2% |

|

MTD Change |

0.1% |

0.6% |

0.3% |

0.7% |

0.8% |

0.5% |

|

YTD Change |

(0.1%) |

1.4% |

0.8% |

1.3% |

1.2% |

1.0% |

Source: Central Bank of Kenya

Kenya Shilling:

During the week, the Kenyan shilling remained relatively stable, depreciating marginally by 0.04% against the US dollar to close the week at Kshs 113.7, from Kshs 113.6 recorded the previous week, partly attributable to increased dollar demand from the oil and energy sectors. Key to note, this is the lowest the Kenyan shilling has ever depreciated against the dollar. On a YTD basis, the shilling has depreciated by 0.5% against the dollar, in comparison to the 3.6% depreciation recorded in 2021. We expect the shilling to remain under pressure in 2022 as a result of:

- Increased demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally,

- An ever present current account deficit due to an imbalance between imports and exports, with Kenya’s current account deficit estimated to come in at 5.4% of GDP in 2021, having expanded by 27.4% in Q3’2021 to Kshs 184.6 bn, from Kshs 145.0 bn recorded in Q3’2020, attributable to a robust increase in merchandise imports by 39.6% to Kshs 321.8 bn in Q3’2021, from Kshs 230.5 bn in Q3’2020,

- The aggressively growing government debt, with Kenya’s public debt having increased at a 10-year CAGR of 18.4% to Kshs 8.0 tn in December 2021, from Kshs 1.5 tn in December 2011 thus putting pressure on forex reserves to service some of the public debt, and,

- Rising global crude oil prices on the back of supply constraints at a time when demand is picking up with the easing of COVID-19 restrictions and as economies reopen. Key to note, risks abound this global recovery following the emergence of the new COVID-19 variants.

The shilling is however expected to be supported by:

- High Forex reserves, currently at USD 8.1 bn (equivalent to 5.0-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. In addition, the reserves were boosted by the USD 1.0 bn proceeds from the Eurobond issued in July 2021 coupled with the USD 972.6 mn IMF disbursement and the USD 130.0 mn World Bank loan financing received in June 2021, and,

- Improving diaspora remittances evidenced by a 21.7% y/y increase to USD 338.7 mn in January 2022, from USD 278.3 mn recorded over the same period in 2021, which has continued to cushion the shilling against further depreciation.

Weekly Highlight:

I. Fuel Prices

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail prices in Kenya effective 15th February 2022 to 14th March 2022. Notably, fuel prices remained unchanged at Kshs 129.7 per litre for Super Petrol, Kshs 110.6 per litre for Diesel and Kshs 103.5 per litre for Kerosene. Below are the key take-outs from the statement:

The performance in fuel prices was attributable to:

- The fuel subsidy program under the Petroleum Development Fund which resulted in subsidies of Kshs 14.5 on Super Petrol, Kshs 23.3 on Diesel and Kshs 15.9 on Kerosene during the month,

- Removal of suppliers margins of Kshs 6.3 on Super Petrol, Kshs 5.5 on Diesel and Kshs 7.7 on Kerosene since October 2021,

- The decline in the Free on Board (FOB) price of Murban crude oil in January 2022 by 0.9% to USD 82.0 per barrel, from USD 82.7 per barrel in December 2021,

- A decrease in the average landed costs of Super Petrol by 0.9% to USD 596.8 per cubic meter in January 2022, from USD 602.0 per cubic meter in December 2021,

- A decrease in the average landed costs of Kerosene by 7.0% to USD 534.4 per cubic meter in January 2022, from USD 574.9 per cubic meter in December 2021,

- However, the average landed costs of diesel increased by 7.1% to USD 606.2 per cubic meter in January 2022, from USD 565.9 per cubic meter in December 2021. Additionally, the Kenyan shilling depreciated during the period by 0.4% to Kshs 113.6 in January 2022, from Kshs 113.1 in December 2021.

Since the beginning of the year, global fuel prices have increased by 22.2% to USD 95.3, from USD 78.0 recorded on 1st January 2022, largely attributable to increased global demand coupled with supply constraints amidst economic uncertainty on the back of emerging COVID-19 variants. Notably this is the highest it has been since September 2014 when the price stood at USD 95.8 and as such, we expect the cost of production for net importers to rise in tandem. In the short term, we expect muted pressure on the inflation basket as fuel prices, which are among the major contributors to Kenya’s headline inflation remain constant following the Fuel Subsidy program. Despite the reduction in landed costs of fuel coupled with the additional Kshs 24.9 bn for stabilization of oil market prices, and the rationalization of Capital expenditure, we believe the stabilization under the fuel subsidy program by the National Treasury is unsustainable. This is on the back of the continued rise in global fuel prices which will have the National Treasury continue to compensate the Oil Marketing companies and suppliers whose margins were cut to zero from Kshs 6.3 per litre for super petrol, Kshs 5.5 per litre for diesel and Kshs 1.7 per litre for kerosene since October 2021. Key to note the monthly average subsidy for the past five months starting October 2021 is Kshs 13.6 per litre for super petrol, Kshs 17.7 per litre for diesel and Kshs 15.2 per litre for kerosene.

II. Revenue and Net Exchequer for FY’2021/2022

The National Treasury gazetted the revenue and net expenditures for the first seven months of FY’2021/2022, ending 31st January 2022. Below is a summary of the performance:

|

FY'2021/2022 Budget Outturn - As at 31st January 2022 |

|||||

|

Amounts in Kshs billions unless stated otherwise |

|||||

|

Item |

12-months Original Estimates |

Actual Receipts/Release |

Percentage Achieved |

Prorated Estimates |

% achieved of prorated |

|

Opening Balance |

21.3 |

||||

|

Tax Revenue |

1,707.4 |

1,011.7 |

59.3% |

996.0 |

101.6% |

|

Non-Tax Revenue |

68.2 |

42.3 |

62.0% |

39.8 |

106.3% |

|

Total Revenue |

1,775.6 |

1,075.2 |

60.6% |

1,035.8 |

103.8% |

|

External Loans & Grants |

379.7 |

47.3 |

12.5% |

221.5 |

21.4% |

|

Domestic Borrowings |

1,008.4 |

532.9 |

52.8% |

588.3 |

90.6% |

|

Other Domestic Financing |

29.3 |

5.3 |

18.1% |

17.1 |

31.0% |

|

Total Financing |

1,417.4 |

585.6 |

41.3% |

826.8 |

70.8% |

|

Recurrent Exchequer issues |

1,106.6 |

617.8 |

55.8% |

645.5 |

95.7% |

|

CFS Exchequer Issues |

1,327.2 |

650.1 |

49.0% |

774.2 |

84.0% |

|

Development Expenditure & Net Lending |

389.2 |

163.3 |

42.0% |

227.1 |

71.9% |

|

County Governments + Contingencies |

370.0 |

171.8 |

46.4% |

215.8 |

79.6% |

|

Total Expenditure |

3,193.0 |

1,603.0 |

50.2% |

1,862.6 |

86.1% |

|

Fiscal Deficit excluding Grants |

(1,417.4) |

(527.8) |

37.2% |

(826.8) |

63.8% |

|

Fiscal Deficit as a % of GDP |

*11.4% |

5.9% |

|||

|

Total Borrowing |

1,388.1 |

580.3 |

41.8% |

809.7 |

71.7% |

|

*Projected Fiscal Deficit as a % of GDP |

|||||

The key take-outs from the report include:

- Total revenue collected as at the end of January 2022 amounted to Kshs 1,075.2 tn, equivalent to 60.6% of the original estimates of Kshs 1,775.6 tn and is 103.8% of the prorated estimates of Kshs 1,035.8 tn. Notably, the performance is a decline from the 104.3% outperformance recorded in the first six months to December 2021. The decline is partly attributable to the significant deterioration of the business environment seen during the month of January as evidenced by the decline in the purchasing managers index (PMI) to 47.6, from the 14-month high of 53.7 that was recorded in December 2021. Cumulatively, Tax revenues amounted to Kshs 1,011.7 bn, equivalent to 59.3% of the target of Kshs 1,707.4 bn and are 101.6% of the prorated estimates of Kshs 996.0 bn,

- Total financing amounted to Kshs 585.6 bn, equivalent to 41.3% of the original estimates of Kshs 1,417.4 bn and is equivalent to 70.8% of the prorated estimates of Kshs 826.8 bn. Additionally, domestic borrowing amounted to Kshs 532.9 bn, equivalent to 52.8% of the original estimates of Kshs 1.0 tn and is 90.6% of the prorated estimates of Kshs 588.3 bn,

- The total expenditure amounted to Kshs 1.6 tn, equivalent to 50.2% of the original estimates of Kshs 3.2 tn, and is 86.1% of the prorated expenditure estimates of Kshs 1.9 tn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 617.8 bn, equivalent to 55.8% of the original estimates and 95.7% of the prorated estimates of Kshs 645.5 bn, and development expenditure amounted to Kshs 163.3 bn, equivalent to 42.0% of the original estimates of Kshs 389.2 bn and is 71.9% of the prorated estimates of Kshs 227.1 bn,

- Consolidated Fund Services (CFS) Exchequer issues lagged behind their target of Kshs 1,327.2 bn after amounting to Kshs 650.1 bn, equivalent to 49.0% of the target, and are 84.0% of the prorated amount of Kshs 774.2 bn. The cumulative public debt servicing cost amounted to Kshs 570.2 bn which is 48.8% of the original estimates of Kshs 1,169.2 bn, and is 83.6% of the prorated estimates of Kshs 682.0 bn, and,

- Total Borrowings as at the end of January 2022 amounted to Kshs 580.3 bn, equivalent to 41.8% of the Kshs 1,388.1 bn target and are 71.7% of the prorated estimates of Kshs 809.7 bn. The cumulative domestic borrowing target of Kshs 1.0 tn comprises of adjusted Net domestic borrowings of Kshs 661.6 bn and Internal Debt Redemptions (Roll-overs) of Kshs 346.8 bn.

The revenue performance in the first seven months of the current fiscal year point towards continued economic recovery following the ease of COVID-19 containment measures and the effectiveness of the KRA in revenue collection. Additionally, we believe that the current measures such as the implementation of the Finance Act 2021 which led to the upward readjustment of the Excise Duty Tax, Income Tax as well as the Value Added Tax will continue playing a big role in expanding the tax base and consequently enhance revenue collection. However, the approval of the 2021/22 supplementary budget will increase the fiscal deficit to an estimate of 12.9% of GDP, from the earlier estimated deficit of 11.4% of GDP for FY’2021/22. We expect the government to ramp up its revenue collection initiatives in the remaining 5 months of the current year as well as look increasingly to the domestic market to plug in the deficit. Additionally, the emergence of new COVID-19 variants continue to pose risks to the economic recovery. On the upside, we have not seen any major domestic disruptions and as such, we do not expect adverse effects from the variants.

Rates in the Fixed Income market have remained relatively stable due to high liquidity in the money market. The government is 22.3% ahead of its prorated borrowing target of Kshs 430.6 bn having borrowed Kshs 526.5 bn of the Kshs 658.5 bn borrowing target for the FY’2021/2022. We expect a gradual economic recovery as evidenced by the revenue collections of Kshs 1.1 tn during the first seven months of the current fiscal year, which is equivalent to 103.8% of the prorated revenue collection target. However, despite the projected high budget deficit of 11.4% and the lower credit rating from S&P Global to 'B' from 'B+', we believe that the support from the IMF and World Bank will mean that the interest rate environment will remain stable since the government is not desperate for cash. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Markets Performance

During the week, the equities market recorded mixed performance, with NSE 20 gaining by 1.0% while NASI and NSE 25 declined by 0.6% and 0.1% respectively. This week’s performance took their YTD performance to losses of 0.1% for NASI and gains of 0.1% for NSE 20, while NSE 25 recorded a flat performance. The equities market performance was driven by gains recorded by large cap stocks such as BAT, ABSA Kenya and KCB of 10.3%, 3.0% and 1.5%, respectively. The gains were however weighed down by losses recorded by other large cap stocks such as Standard Chartered Bank Kenya (SCBK) and Bamburi of 2.4% and 1.9%, respectively, while Safaricom and Equity Group both recorded losses of 1.4%.

During the week, equities turnover declined by 26.4% to USD 17.0 mn, from USD 23.1 mn recorded the previous week, taking the YTD turnover to USD 135.3 mn. Foreign investors turned net sellers, with a net selling position of USD 0.5 mn, from a net buying position of USD 2.5 mn recorded the previous week, taking the YTD net buying position to USD 1.3 mn.

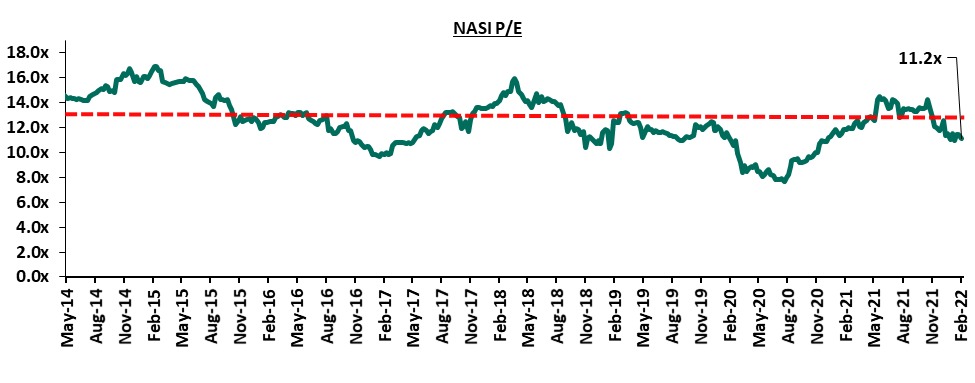

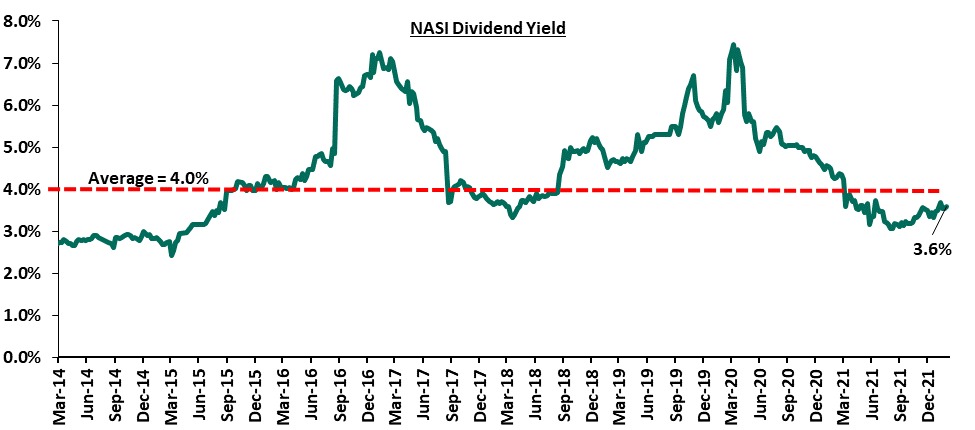

The market is currently trading at a price to earnings ratio (P/E) of 11.2x, 13.6% below the historical average of 12.9x, and a dividend yield of 3.6%, 0.4% points below the historical average of 4.0%. Key to note, NASI’s PEG ratio currently stands at 1.4x, an indication that the market is trading at a premium to its future earnings growth. Basically, a PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The current P/E valuation of 11.2x is 44.8% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

Standard Africa Holdings Limited acquires regulatory approval to acquire more stake in Stanbic Holdings

During the week, Standard Africa Holdings Limited, (SAHL), the majority shareholder in Stanbic Holdings announced that it had received regulatory approval from the Capital Markets Authority, for further extension of the exemption from making a full take-over under the Capital Markets (Take over and Mergers) Regulations, 2002. Under the exemption, SAHL aims to acquire a maximum of 10.6 mn ordinary shares in Stanbic to bring its total shareholding to up to 75.0% of Stanbic Holdings’ ordinary shares.

SAHL first announced the intention to purchase shares from willing shareholders in March 2018, with an intention to acquire 59.0 mn ordinary shares at a price of Kshs 95.0 per share. For more information, please see our Cytonn Weekly 11/2018. As of 31st December 2021, SAHL had acquired 48.4 mn shares, translating to a success rate of 82.0% hence the application for an extension. Key to note, this is the second time SAHL is requesting for an extension for purchasing Stanbic’s shares. SAHL’s shareholding has since increased to 72.3% as of December 2021, from 60.0% in December 2017, with a target of up to 75.0%. The table below highlights the performance of the share purchase as at 31st December 2021.

|

Period |

Shares acquired |

% acquired |

% held |

|

December 2017 |

60.0% |

||

|

March 2018 – July 2018 |

31,656,612 |

8.0% |

68.0% |

|

July 2018 - November 2019 |

4,309,756 |

1.1% |

69.1% |

|

November 2019 - December 2020 |

8,146,241 |

2.1% |

71.2% |

|

January 2021 - December 2021 |

4,289,769 |

1.1% |

72.3% |

Source: Stanbic Holdings Annual Reports

The move by Standard Bank Group, a listed entity in the Johannesburg Stock Exchange (JSE) through its investment vehicle SAHL to increase its shareholding in Stanbic Holdings affirms the importance of Stanbic Holdings to the larger group and confidence in its future growth. This is also expected to boost investor confidence in the Kenyan Banking Sector which has continued to rally from a harsh business environment following the COVID-19 pandemic. Stanbic Bank, a subsidiary of Stanbic Holdings, has continued to post a positive performance, posting an increase in PAT by 43.2% to Kshs 5.1 bn in Q3’2021 from Kshs 3.2 bn in Q3’2020. Return on average equity increased to 15.8% in Q3’2021 from 12.0% in Q3’2022. In our view, we expect further activity share repurchase and buyback activity in the bourse from companies whose prices and valuations are currently low. The move by the CMA to allow for exemptions from making full take overs is also commendable as it allows for investors to increase their shareholding by carrying out on-market trading to acquire a higher stake, as compared to having to acquire the entire entities.

Universe of coverage:

|

Company |

Price as at 11/02/2022 |

Price as at 18/02/2022 |

w/w change |

YTD Change |

Year Open 2022 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

2.3 |

2.3 |

0.4% |

(1.3%) |

2.3 |

3.2 |

8.8% |

49.5% |

0.2x |

Buy |

|

Jubilee Holdings |

299.0 |

292.8 |

(2.1%) |

(7.6%) |

316.8 |

381.7 |

3.1% |

33.5% |

0.5x |

Buy |

|

I&M Group*** |

21.5 |

21.5 |

0.2% |

0.5% |

21.4 |

24.4 |

10.5% |

23.9% |

0.6x |

Buy |

|

KCB Group*** |

45.3 |

46.0 |

1.5% |

1.0% |

45.6 |

51.4 |

2.2% |

13.8% |

0.9x |

Accumulate |

|

Liberty Holdings |

7.0 |

6.8 |

(2.9%) |

(3.7%) |

7.1 |

7.7 |

0.0% |

12.6% |

0.5x |

Accumulate |

|

Britam |

7.2 |

7.0 |

(2.2%) |

(6.9%) |

7.6 |

7.9 |

0.0% |

11.9% |

1.2x |

Accumulate |

|

NCBA*** |

25.3 |

25.1 |

(0.8%) |

(1.6%) |

25.5 |

26.4 |

6.0% |

11.3% |

0.6x |

Accumulate |

|

Standard Chartered*** |

137.5 |

134.3 |

(2.4%) |

3.3% |

130.0 |

137.7 |

7.8% |

10.4% |

1.1x |

Accumulate |

|

Equity Group*** |

53.3 |

52.5 |

(1.4%) |

(0.5%) |

52.8 |

56.6 |

0.0% |

7.8% |

1.4x |

Hold |

|

Co-op Bank*** |

13.0 |

13.2 |

1.5% |

1.2% |

13.0 |

13.1 |

7.6% |

6.9% |

1.0x |

Hold |

|

Diamond Trust Bank*** |

58.3 |

59.0 |

1.3% |

(0.8%) |

59.5 |

61.8 |

0.0% |

4.7% |

0.3x |

Lighten |

|

Stanbic Holdings |

94.0 |

96.3 |

2.4% |

10.6% |

87.0 |

94.7 |

3.9% |

2.4% |

0.9x |

Lighten |

|

ABSA Bank*** |

11.7 |

12.0 |

3.0% |

2.1% |

11.8 |

11.9 |

0.0% |

(0.7%) |

1.2x |

Sell |

|

CIC Group |

2.2 |

2.2 |

(1.8%) |

(0.9%) |

2.2 |

1.9 |

0.0% |

(12.4%) |

0.7x |

Sell |

|

HF Group |

3.7 |

3.5 |

(3.8%) |

(7.6%) |

3.8 |

3.0 |

0.0% |

(15.9%) |

0.2x |

Sell |

|

Sanlam |

11.0 |

15.0 |

36.4% |

29.9% |

11.6 |

12.1 |

0.0% |

(19.6%) |

1.6x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.4x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the discovery of new COVID-19 variants, the upcoming Kenyan general elections and the slow vaccine rollout to continue weighing down the economic outlook. On the upside, we believe that the relaxation of lockdown measures in the country will lead to improved investor sentiments in the economy.

I. Residential

- Centum Handover of Riverbank Apartments

During the week, Centum Real Estate completed and handed over Riverbank apartments to clients. The project broke ground in August 2019 and has taken approximately 36 months to complete. This marks the handover of 160 units in a project that has a deal pipeline of more than 1,500 residential units planned within the 102-Acre master-planned Two Rivers Development. Some of the key residential developments at Two-Rivers include Cascadia, The Loft, and, Mizizi Court. The 102 acres’ master planned community also entails the 65,000 SQM Two Rivers mall, a City hotel known as City Lodge, and, an office tower. A detailed summary of the developments is highlighted below;

All Values in Kshs Unless Stated Otherwise

|

Riverbank Apartments |

|||

|

Typology |

Plinth Area |

Price 2022 (Kshs mn) |

Price Per SQM |

|

1-Bed |

87 |

16.0 |

183,908 |

|

2-Bed |

130 |

21.5 |

165,385 |

|

3-Bed |

185 |

28.0 |

151,351 |

|

Average |

166,881 |

||

Source: Centum Real Estate

The investment focus on Limuru road where the project is located is supported by;

- Relatively good infrastructure, enhancing accessibility to commercial nodes such as Gigiri, Westlands and the CBD, thus boosting demand from Nairobi’s working class,

- Demand from expatriates such as the United Nations serving in international organizations located along Limuru Road,

- Presence of amenities such as Two Rivers Mall, Village Market, Rosslyn Riviera, Ridgeways Mall,

- Close proximity to learning institutions such as Potterhouse Runda, Sabis International, and Braeburn Ridgeways, and,

- Relatively high levels of security due to proximity to the UN Blue Zone.

Additionally, investment in mixed-use developments such as Two Rivers which also has Riverbank as one of its residential developments, continues to create operational synergies across various Real Estate themes hence enabling investors to maximize returns, either through rental income or capital appreciation. MUDs are also more convenient and preferred given that the development mix creates an upscale living environment with easy access to work places, retail stores, and/or, residential areas. In terms of performance, according to the Cytonn Mixed-Use Development Report-2021, MUDs recorded an average rental yield of 7.2% in 2021, 0.7% points higher than the respective single use themes which recorded average rental yield of 6.5% in the similar period, signalling better returns as opposed to the singe use themes.

The table below shows the performance of single-use and mixed-use development themes between 2020 and 2021;

|

Thematic Performance of MUDs in Key Nodes 2020-2021 |

||||||

|

MUD Themes Average |

Market Performance Average |

|||||

|

Rental Yield 2020 |

Rental Yield 2021 |

∆ in y/y MUD Rental yield |

Rental Yield 2020 |

Rental Yield 2021 |

∆ in y/y Market Average Rental Yield |

|

|

Retail |

7.1% |

8.4% |

1.3% |

7.7% |

7.8% |

0.1% |

|

Offices |

6.9% |

7.1% |

0.2% |

6.8% |

6.6% |

(0.2%) |

|

Residential |

6.3% |

6.0% |

(0.3%) |

5.8% |

5.2% |

(0.6%) |

|

Average |

6.9% |

7.2% |

0.3% |

6.8% |

6.5% |

(0.3%) |

|

* Market performance is calculated from nodes where sampled MUDs exist |

|

|||||

Source: Cytonn Research 2021

- East African Bond by Shelter Afrique

Also during the week, Shelter Afrique, a Pan African housing company announced plans to issue a bond in East Africa, in the Kenyan Capital Market through the NSE and aims to raise USD 500.0 mn (Kshs 56.9 bn). The funds raised from the bond will be used to finance upcoming affordable housing projects within East Africa with a keen eye on the Kenyan market (details about the tenor and the interest rates of the bond are yet to be disclosed). The firm’s decision to float the bond comes after the Kenya Mortgage Refinance Company got the greenlight from the Capital Markets Authority (CMA) to float its first-ever bond aimed at raising Kshs 10.5 bn through Medium Term Notes (MTN). Once issued, Shelter Afrique’s bond will be the third affordable housing bond to be floated in less than a year after the Capital Markets Authority (CMA) approving the issuance of a Kshs 3.9 bn Medium Term Note (MTN) programme for Urban Housing Renewal Development Limited (UHRD) in November 2021. The UHRD bond which has a Kshs 600.0 mn green-shoe option with an 18-month tenor and an interest rate of 11.0% is expected to finance the construction of the ongoing Pangani Affordable Housing Project.

The floating of the bond by Shelter Afrique to raise capital for investment in affordable housing homes is expected to;

- Provide access to low cost homes for residents targeting affordable developments,

- Improve living standards of residents through promoting ease of accessibility to decent homes, and,

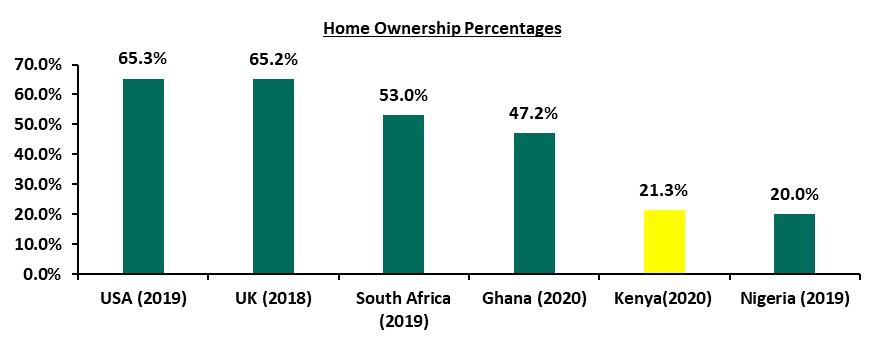

- Improve the home ownership rates in Kenya, which is currently at 21.3% in urban areas as at 2020, compared to other African countries such as South Africa and Ghana at 53.0% and 47.2%, respectively. The graph below shows the home ownership percentages in various countries;

Source: Centre for Affordable Housing Africa, Federal Reserve Bank

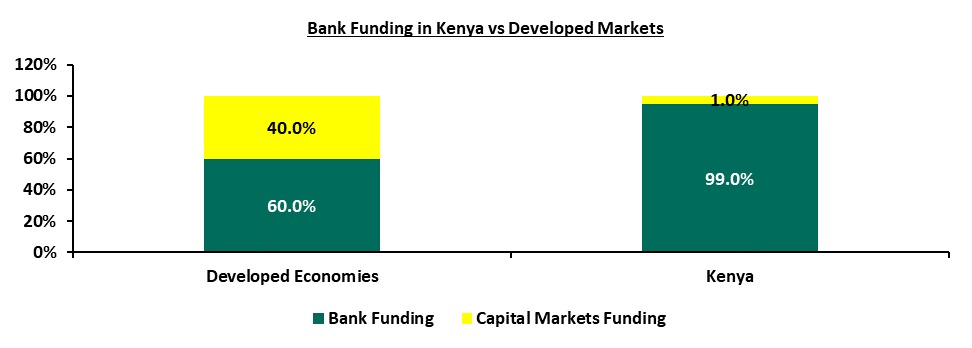

The planned issuance of the East African bond by Shelter Afrique is an indication that developers have continued to explore diversified sources of financing for their Real Estate projects. Bonds are a source of debt capital for businesses that are well established and need funds for long-term growth of the business. The company can raise funds by selling bonds to different investors and sharing profits from the projects for which bonds are issued. Currently, approximately 99.0% of business funding in Kenya is sourced from banks compared to approximately 1.0% from the capital markets, according to World Bank mainly due to underdevelopment of the latter.

Source: World Bank

Moreover, the market has continued to witness emerging structured financing options such as; (i) Real Estate structured notes which may include project notes, Real Estate-backed Medium Term Notes and other high yield loan notes, and, (ii) Real Estate Investment Trusts (REITS). For a detailed analysis on the Alternative methods of Financing Real Estate Projects, please see our topical.

Once issued, we anticipate an oversubscription of the bond given the increased investor appetite and confidence, and, the high liquidity in the market. We also expect to see more affordable housing projects taking shape thereby complementing the governments big 4 agenda on affordable housing.

We expect to continue to witnessing increased development activities across the sector with developers making efforts to actualize their developments and the continued efforts to raise funds to support the affordable housing agenda.

III. Retail

Naivas supermarket, a local retail chain, opened a new outlet at Nairobi’s Greenspan Mall in Donholm taking up the space left by Tuskys. This will take its total countrywide outlets to 80. This also marks the first outlet to be opened by the retailer in 2022 with an anticipated plan to open another outlet by the end of February 2022 at Imara Shopping Mall in Imara Daima. The move to open a new store at Greenspan Mall is also supported by;

- The presence of a good transport network enhancing client and supplier accessibility, the area is served by the Outering Road which was recently expanded,

- Positive demographics with Embakasi constituency where Donholm is located being the most populated constituency in Nairobi recording a population of 988,808, representing 22.5% of the total population in Nairobi County at 4,397,073 as at 2019 according to the Kenya National Bureau Census Report, and,

- Affordability with Eastlands where Donholm is classified, recording an average rent per SQFT of Kshs 133, which is 21.8% lower than the market average of Kshs 170 per SQFT according to the Cytonn Annual Markets Review-2021.

The table below shows the submarket performance of nodes in the Nairobi Metropolitan Area (NMA);

|

Nairobi Metropolitan Area Retail Market Performance FY’2021 |

|||

|

Area |

Rent Kshs /SQFT FY’2021 |

Occupancy % FY’2021 |

Rental Yield FY’2021 |

|

Westlands |

213 |

78.8% |

10.0% |

|

Karen |

202 |

84.0% |

9.8% |

|

Kilimani |

183 |

86.0% |

9.8% |

|

Ngong Road |

171 |

79.0% |

7.7% |

|

Kiambu Road |

180 |

74.2% |

7.7% |

|

Mombasa Road |

148 |

75.0% |

6.8% |

|

Thika Road |

161 |

74.0% |

6.7% |

|

Satellite Towns |

142 |

69.0% |

6.2% |

|

Eastlands |

133 |

71.6% |

5.6% |

|

Average |

170 |

76.8% |

7.8% |

The table below shows the summary of the number of stores of the Key local and international retailer supermarket chains in Kenya;Source: Cytonn Research

|

Main Local and International Retail Supermarket Chains |

||||||||||

|

Name of Retailer |

Category |

Highest number of branches that have ever existed as at FY’2018 |

Highest number of branches that have ever existed as at FY’2019 |

Highest number of branches that have ever existed as at FY’2020 |

Highest number of branches that have ever existed as at FY’2021 |

Number of branches opened in 2022 |

Closed branches |

Current number of Branches |

Number of branches expected to be opened in 2022 |

Projected number of branches FY’2022 |

|

Naivas |

Local |

46 |

61 |

69 |

79 |

1 |

0 |

80 |

1 |

81 |

|

QuickMart |

Local |

10 |

29 |

37 |

47 |

1 |

0 |

49 |

0 |

49 |

|

Chandarana |

Local |

14 |

19 |

20 |

23 |

1 |

1 |

24 |

4 |

28 |

|

Carrefour |

International |

6 |

7 |

9 |

16 |

0 |

0 |

16 |

0 |

16 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

0 |

0 |

12 |

0 |

12 |

|

Tuskys |

Local |

53 |

64 |

64 |

3 |

0 |

61 |

3 |

0 |

3 |

|

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

3 |

0 |

3 |

|

Uchumi |

Local |

37 |

37 |

37 |

2 |

0 |

35 |

2 |

0 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

13 |

0 |

0 |

0 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

4 |

0 |

0 |

0 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

65 |

0 |

0 |

0 |

|

Total |

|

257 |

313 |

334 |

185 |

3 |

179 |

189 |

5 |

194 |

Source: Online Research

The retail sector performance is expected to be supported by factors such as i) expansion by local and international retailers taking up spaces left by troubled retailers such as Tuskys and Nakumatt, ii) positive demographics, iii) infrastructure developments opening up areas for Real Estate investments promoting accessibility, and, iv) the improved business environment promoting transactions and activities. However, the current oversupply of physical retail space oversupply of 1.7 mn SQFT in the Kenyan retail market and 3.0 mn SQFT in the Nairobi Metropolitan Area and the rise of e-commerce is expected to weigh down performance of the Retail Sector.

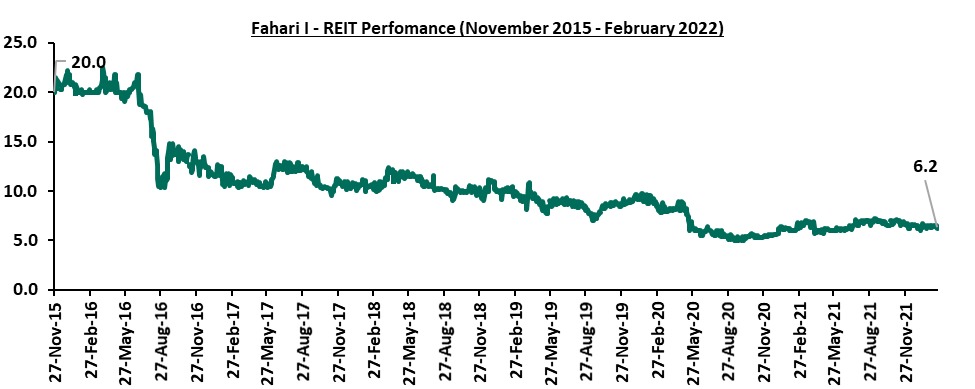

III. Listed Real Estate

In the Nairobi Stock Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.2 per share. This represented a 4.6% and 3.1% Week-to-Date (WTD) and Year-to-Date (YTD) decline, respectively, from Kshs 6.5 per share and Kshs 6.4 per share, respectively. On an Inception-to-Date (ITD) basis, the REIT’s performance continues to be weighed down having realized a 69.0% decline from Kshs 20.0. In the Unquoted Securities Platform, the Acorn D-REIT closed the week trading at Kshs 20.2 while the I-REIT closed at Kshs 20.6 per unit. This performance represented a 1.0% and 3.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 Inception price. The Kenyan REIT market performance continues to be weighed down by factors such as; i) a general lack of knowledge on the financing instrument, ii) general lack of interest of the REIT by investors, iii) high minimum investment amount at Kshs 5.0 mn for the D-REIT, and, iv) lengthy approval processes to get all the necessary requirements thus discouraging those interested in investing in it. The graph below shows Fahari I-REIT’s performance from November 2015 to February 2022;

Other Highlights:

The trustee of the property fund Ilam Fahari I-REIT, Co-operative Bank of Kenya Limited, issued a profit warning for the year ended 31st December 2021.The dismal performance is partly attributable to the loss of revenue from their anchor tenant, Tuskys, at Greenspan Mall, coupled with the revaluation losses recorded by their REIT properties. Net earnings are expected to decline by at least 25.0% to Kshs 111.0 mn, lower than the Kshs 148.0 mn reported in 31st December 2020. We however expect the REIT’s performance to gradually improve in the near term given that Naivas has taken over the space previously occupied by Tuskys supermarket.

The Real Estate sector is expected to record increased activities supported by focus on the affordable housing initiative, the delivery of projects to buyers promoting investor confidence, and the expansion by local and international retailers. However, the low of investor appetite in REITs is expected to weigh down the performance of the sector.

Financial Planning refers to a systematic approach towards managing one’s finances by allocating resources optimally in an effort to maximize the use of these resources in order to achieve one’s financial goals and objectives. Having a comprehensive financial plan is important as it enables one to achieve financial freedom by actively managing their spending habits, work towards wealth generation while taking cognisance of their current and expected income levels. Recent economic challenges such as the COVID-19 pandemic have made it difficult for many Kenyans to stick to their financial plans as many were not prepared for the adverse effects of the pandemic such as income disruption and job layoffs. Such unexpected financial occurrences highlight the importance of a financial plan that is inclusive of ways of how to deal with unexpected financial occurrences including emergency savings and taking up insurance covers.

Insurance covers help give one a financial protective cover against different types of financial risks. Despite the importance of insurance, Kenya’s insurance penetration rate remains at a paltry 2.2%, as per the IRA Annual Report 2020 behind countries like South Africa which had an insurance penetration rate of 13.7%, and the global average of 7.4%, as of 2020. Insurance penetration rate refers to the ratio of gross insurance premiums to a country’s Gross Domestic Product (GDP) and indicates the level of development of the insurance sector in the country. It is in light of these statistics and bearing in mind the importance of insurance planning, that we chose to discuss the topic in order to continue sensitizing the market on the importance of personal financial planning, and in particular insurance planning.

Previously, we have published the following topicals on financial planning:

- Personal Financial Planning in August 2019 and February 2020 - We discussed the importance of financial planning, the various considerations to make based on one’s own characteristics, needs and preferences and some of the investment avenues available,

- Financial Planning Amidst COVID-19 in June 2020 - We covered the effects of Coronavirus on financial planning and financial planning opportunities in the coronavirus environment,

- Financial Planning for Retirement in August 2020 – We focused on how to plan your finances in preparation for retirement given its inevitability, various types of pension schemes and where pension schemes invest, and,

- Financial Planning for Education in March 2021 - We analyzed various education plans, looked at why one should invest, best financial planning tips to consider and the factors at play when selecting a suitable education plan.

This week, we will cover the following sections:

- Introduction to Financial Planning,

- What is Insurance Financial Planning?

- Tips on choosing the Right Insurance Policy, and,

- Conclusion.

Section I: Introduction to Financial Planning

Personal financial planning refers to a systematic approach towards managing one’s finances in an effort to maximize the finances in a manner that will aid in the achievement one’s financial goals and objectives. Financial planning involves a process that consists of the following steps:

- Assessment: In this step, an individual assesses their current financial situation by identifying various factors that could possibly affect their financial plan. At this point, it is important to ask questions such as; what is my current income? What are my financial objectives? What are my spending habits? Etc. The aim of this step is to evaluate the individuals personal income, spending habits, lifestyle and see how each of them affects their financial plan,

- Goal Setting: In this step, the individual outlines the financial goals they want to achieve in the long-run, as well as the next actionable steps to achieving these goals. Ultimately, this provides a clear roadmap towards the achievement of one’s financial objectives,

- Execution of the financial plan: This refers to how best one can action the laid out plans. A well laid out plan should highlight the suitable channels and instruments that will be used to achieve the goals. An inclusion of timelines is also important, but this depends on if it is a short term investment e.g. Money Market Funds or long term investments e.g. Bonds and Real Estate, and,

- Monitoring and reassessing the financial plan: Given that goals and priorities change over time, it is important to monitor and reassess the financial plan created, leaving room for readjustments along the way if necessary. Constant reviewing allows you to analyse your individual investments and determine if they are worth keeping, as well making sure they align with any changes that might have occurred along the way.

To achieve one’s financial goals there are some key habits that one needs to practice;

- Saving: Saving entails consuming less out of a given amount of resources in the present in order to consume more in the future by setting aside part of your income in some form of asset. Efficient saving requires discipline, where we should always treat savings as a necessary expense,

- Investing: Investing involves the purchase of an asset with the hope of generating income or capital appreciation. Saving is often confused with investing, but they are not the same. Saving focuses on capital preservation whereas investing focuses on wealth generation in addition to capital preservation, for the majority of investment products. There are different asset classes that one can invest in and an investor will choose their preferred investment vehicles based on their risk tolerance and appetite, the returns expected and the liquidity requirement. It is important to diversify one’s portfolio through investing in different instruments in a bid to mitigate risk,

- Debt and Debt Management: Is debt good or not? Debt is only good if used towards an investment or for future financial gain such as business, education, or property. However, it is advisable to take up debt for investment only if the economic rate of return, which is simply how an investment’s economic benefits compare to its costs, is able to finance the debt repayment. Anticipating future needs and saving adequately for them can help in minimizing the need to take on debt, and,

- Budgeting: Budgeting is simply creating a plan on how to spend your money. Budgets help guide and control your expenditure. It is important that you have the discipline to create a budget around the resources you have and stick to it. When budgeting, prioritize your needs and necessary expenses and try as much as possible to cut down on unnecessary expenses to save money. Additionally, it is vital to review your budget regularly as the circumstances around you and responsibilities change.

Section II: What is Insurance Financial Planning?

In this section we will focus on different ways in which one can deal with financial emergencies before delving in insurance financial planning:

A. Planning for Financial Emergencies

A financial emergency is an unexpected occurrence that has a risk of destabilizing one’s financial position. It includes some of the following examples: i) Loss of employment, ii) Medical emergencies such as injuries arising from a car accident, iii) Death of an earning family member or spouse, iv) Unexpected car expenses, v) Forced relocation due to job change, and, v) Natural disasters such as earthquakes and mudslides. The main ways of dealing with financial emergencies include:

- Building up an Emergency Fund - An emergency fund is a form of self-insurance whereby an individual puts aside some money in order to reduce and possibly eliminate financial distress arising from unexpected situations. It is key to note that an emergency fund in this context is different from savings plans for other purposes such as housing, education, and retirement. It is recommended to first build your reserve, the emergency fund, up to the intended goal amount before then proceeding to save for other financial goals. The recommended amount to put aside is 3 to 6 months equivalent of your living expenses. For instance, if one earns Kshs 50,000 per month, the recommended emergency fund size should be Kshs 150,000 to Kshs 300,000,

- Exploring other sources of income – An extra source of income will ensure one is able to build your emergency fund and increase your overall savings level. Higher savings levels will help to minimize the impact of unexpected financial losses as there will be sufficient cash in reserve to cover them, and,

- Taking up Insurance Covers - It is advisable to take up insurance covers as not all unforeseen financial obligations can be offset by the emergency fund. Insurance enables you to work and live without fear as you know that should anything happen; the insurance cover will cater for the expenses. It is key to note that the a maximum claims settlement is not guaranteed, due to factors such as depreciation of property, replacement costs and exclusions in the policy, and insurance companies will need to be absolutely satisfied as per the terms and conditions applicable before settling a claim fully. Insurance policies are sometimes misunderstood and you should seek the advice of an insurance agent before choosing the policy that suits you in order to understand key concepts such as the cover period, the various terms and conditions and the premium payable for a particular insurance policy.

B. Importance of Insurance Planning

Insurance is an important part of financial planning because it protects an individual and their loved ones from costs and losses associated with accidents, disability, natural disasters, illnesses and death. Some of the main benefits of insurance include:

- Financial Security – A key benefit of insurance is the replacement of lost or damaged assets. Insurance covers can, for example, help to minimize business disruptions or even income disruption,

- Medium of saving and wealth generation – Some insurance covers help you save towards different financial goals in a regulated and low-risk environment. These types of insurance covers include Unit Linked long term insurance policies whereby part of the premium is used to purchase life protection and the rest is used to purchase units in an investment fund managed by the insurance company. Additionally, education savings plans help guardians to secure their children’s education by providing a flexible platform with the additional benefits of waiver of premiums in the event of death of the guardian,

- Peace of mind – Insurance helps improve the quality of one’s life as it assures them that if anything adverse were to happen to their loved ones or assets, they will have gain financial respite, and,

- Protection of your loved ones – While money cannot replace the presence of a family member, taking covers such as life insurance can help in ensuring that even after one is gone, the family and dependents have some funds to endure any financial hardship.

C. Types of Insurance Covers in Kenya

An insurance policy is a document evidencing the existence of an insurance contract containing the terms and conditions of the contract. There are two main forms of insurance namely life / long term and general / short term insurance. The key difference is that life insurance contracts are usually more than one year while general insurance contracts are for one year or less.

|

Main Types of Insurance Covers in Kenya |

|

|

General / Short Term Business |

Life / Long Term Business |

|

Motor Insurance |

Life Assurance Policies |

|

Liability Insurance |

Education Savings Plans |

|

Fire and Burglary Insurance |

Pension Plans |

|

Marine Insurance |

|

|

Workers Compensation (as under the Work Injury Benefits Act –WIBA) |

|

|

Medical Insurance |

|

Understanding the various types of insurance policies is key as each policy type has different sub-classes and rating factors. For instance, property insurance is divided into domestic insurance, fire and allied perils, burglary insurance, plate glass and all risk insurance. All these types of insurances have different rating factors and hence, our view is that it is vital that an individual or firm seeks professional advice before purchasing insurance policies to ensure that their specific needs are met.

Section III: Choosing the Right Insurance Policy

Choosing the right insurance policy involves analysing both internal factors and external factors. Under the self-assessment step, individuals analyse the various internal factors including their income, spending habits, age, gender, number of dependents and state of one’s health. Other factors that one needs to consider are external such as the financial health of the insurance company, customer service and how the insurance cover works, as explained in detail below:

- Reputation / Financial Health of Your Insurer – The financial health of an insurance company is important as ideally a client would want an insurance company that is well run and will be around when a claim occurs. Additionally, reputation is an important consideration especially in claims payments as clients prefer insurers who have a reputation of fast and efficient claims processing – however, at times an insurance company could earn a bad claims processing reputation unfairly and clients are advised to consult expert advice from qualified intermediaries to ensure they make the right decisions,

- How your Insurance Works – Generally speaking, it is important to understand how your particular insurance cover of interest works, that is the policy document contents, exclusions, contact persons. Here the individual may consider their preferred length of insurance plan and flexibility, and, if the insurance policy they are assessing can cater to their individual needs,

- Affordability of Premiums – It is important for one to choose an insurance plan that one can afford to pay the premiums, especially for long term insurance/life insurance. For short term general insurance, affordability is also key and first time buyers may shop around to find out the cheapest option in the market that also caters to their needs.

Other factors are more specific to the type of cover that a client wants, for example for medical insurance, one may consider the following factors:

- Additional Benefits - There are obvious services that the healthcare plan will clearly tell you about and outline in ‘black and white’. However, there may be other additional benefits that may not be as apparent. An interested client should ask about these peripheral benefits, and find out what is covered, and if there any other additional fees,

- Medical Provider Network – It is important to ensure that one’s preferred healthcare plan is accepted by their current healthcare provider, hospital and pharmacy. Policy holders prefer medical covers that have a wide provider network to ensure that regardless if where they may be, they can still enjoy the cover, and,

- Medicine Coverage - Medical prescriptions are the largest expense for most people’s healthcare plans. Therefore, make sure to consider whether it is included in your plan, and how much is covered.

Below is a table showing the different stages of one’s life and common policies taken in each:

|

Stage in Life/Employment Status |

Common Types of Insurance for the Stage |

|||

|

Young Adult (Single) |

|

|||

|

Married |

|

|

||

|

Married with Children |

|

|

||

|

Business Owner |

|

|

||

|

Employed |

|

|||

|

Retired |

|

|||

Section IV: Conclusion

In conclusion, financial planning is a practice that can be tailor made for any need and with insurance plans being a vital need, we believe that more Kenyans should include insurance plans as part of their comprehensive financial plan. Below are a few tips that are useful when looking for an insurance cover in Kenya:

- Shop around - There are many insurance companies and a wide variety of coverages out there. If you’re looking for clarification, you may want to consider working with an agent (who sells insurance for just one company) or through an insurance broker (who represents multiple insurance companies) instead of buying online directly,

- Ask your insurance provider what the policy does not cover - Every insurance policy lists perils that are not covered, known as “exclusions”. It is important to ask the insurance provider to explain the exclusions in your policy at the outset, which will save you the stress and frustration of discovering them after you incur damage or a loss,

- Consider bundling several policies with one insurance company - If you are looking to insure multiple vehicles or obtain multiple types of business coverage (like liability, property, and cyber risk), then you may want to find a single insurance provider who carries multiple products and enjoy possible discounts (usually through negotiations),

- Review your insurance needs on a yearly basis - As your needs evolve, so will your insurance policy. When you’ve made a change, it’s important to consider whether your policy needs to adapt to new risk exposures

- Do not defer payments - Default of payment is considered a “bad risk”, which can lead to a higher rate. If you decide you do not want to renew your policy, you should immediately notify the insurer in writing, and,

- Take measures to minimize risk and prevent loss - Risk management can go a long way in helping you stay protected e.g. if it is a home insurance, install CCTVs, hire a security guard etc. This also help in minimizing premiums. Good planning and the right protection can help you stay ahead of risk in your day-to-day operations.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.