Apr 19, 2020

Following the release of the FY’2019 results by Kenyan listed banks, the Cytonn Financial Services Research Team undertook an analysis on the financial performance of the listed banks and identified the key factors that shaped the performance of the sector, and our expectations of the banking sector for the rest of the year.

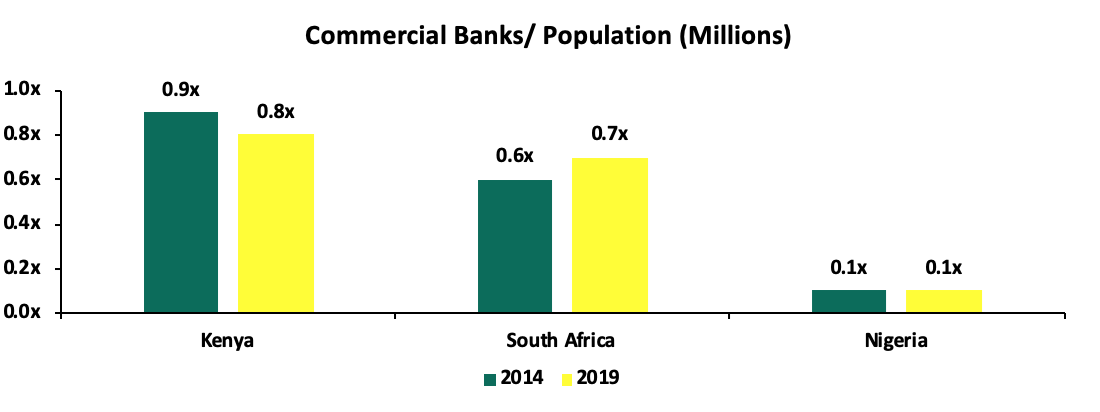

The Banking sector witnessed a number of consolidation activities in FY’2019 as players in the sector were either acquired or merged. We still maintain our view that Kenya remains overbanked as the number of banks remains relatively high compared to the population. Increased consolidation will reduce the number of banks in the country which currently stand at 38, thus reducing the commercial banks to population ratio from the current 0.8x. We expect an increase in consolidation activities going forward which will lead to the formation of relatively larger, well-capitalized and possibly more stable entities.

As such our report is themed “Increased Consolidation in the Banking Sector” as we assess the key factors that influenced the performance of the banking sector in 2019, the key trends, the challenges banks faced, and areas that will be crucial for growth and stability of the banking sector going forward. As such, we shall address the following:

- Key Themes That Shaped the Banking Sector Performance in FY’2019,

- Summary of The Performance of the Listed Banking Sector in FY’2019,

- The Focus Areas of the Banking Sector Players Going Forward, and,

- Brief Summary and Ranking of the Listed Banks based on the Outcome of Our Analysis.

Section I: Key Themes That Shaped the Banking Sector Performance in FY’2019

Below, we highlight the key themes that shaped the banking sector in FY’2019, which include regulation, consolidation, asset quality, revenue diversification, SME Focused Services, and rebranding:

- Regulation - The impactful regulations of the banking sector included the Repeal of the Interest Rate Cap (Banking (Amendment) Act, 2019), IFRS 9, Demonetization and the implementation of the Banking Sector Charter:

-

- Repeal of the Interest Rate Cap (Banking (Amendment) Act, 2019): During the year, President Uhuru Kenyatta signed the Finance Bill, 2019 into law in effect repealing Section 33B, which pertained to the interest rate cap, citing that while the purpose of the capping, introduced in September 2016 through the enactment of the Banking (Amendment) Act 2015, was to address the widespread concerns about affordability and availability of credit to Kenyans, it had instead caused unintended consequences that were significant and damaging to the economy and Micro, Small and Medium Enterprises (MSMEs). The National Assembly failed to raise a two-thirds majority to overturn President Uhuru’s memorandum to repeal the interest rate cap. Read our most recent report focusing on the interest rate cap here.

- IFRS 9 - The effects of IFRS 9 to banks continued to be seen as more banks used the 18-months to 24-months window to comply with the requirements of the new standards. With the implementation of IFRS 9, which took effect from 1st January 2018, banks were expected to provide both for the incurred and expected credit losses. The CBK had given commercial banks a one-year earnings protection window for the implementation of the IFRS 9 to charge the higher provisions against the retained earnings in the balance sheet and not on the profit and loss account. The banking industry experienced the effects in 2019, recording an increase in NPL Coverage to 58.5% in FY’19, from 54.6% in FY’18, as a result of increased provisioning,

- Demonetization: During the year, the Central Bank of Kenya concluded the withdrawal of the older Kshs. 1,000 banknotes and introduce new notes in an effort to track and curb illicit financial flows. After the demonetization exercise, which had little impact on inflation or the exchange rate, Kshs. 7.4 billion, or 3.0% of the total value in the circulation of Kshs. 1,000 notes, was rendered worthless. In some cases, this exercise tightened liquidity in the money market thus prompting people to seek alternatives on digital platforms, thus, increasing NFI from fees and commissions. The Central Bank of Kenya (CBK), under Sections 9 and 51 of the CBK Act and following approval by the CBK Board, recently announced that it had transferred Kshs 7.4 bn from its General Reserve Fund to the Government Consolidated Fund in support of the fight against Coronavirus. The transfer was executed by crediting the Ministry of Finance’s Deposit Account at CBK. As such, by issuing the Kshs 7.4 bn to the Treasury, the CBK effectively put the same amount it had withdrawn back into circulation.

- Banking Sector Charter Act: The Central Bank of Kenya (CBK) proposed to introduce a Banking Sector Charter that will guide service provision in the sector. The Charter aims to instill discipline in the banking sector in order to make it responsive to the needs of the banked population. The Central Bank of Kenya set a clear vision for the banking sector guided by the four pillars, namely, risk-based credit pricing, transparency, customer centricity, and ethical culture. By May 2019, all banks had submitted their time-bound plans to implement the Banking Sector Charter Act and CBK is now monitoring implementation.

- Consolidation: Consolidation activity remained one of the key highlights witnessed in FY’2019 as players in the sector were either acquired or merged, leading to the formation of relatively larger, well-capitalized and possibly more stable entities. The following were the major M&A’s activities witnessed during the year:

-

- On 6th September 2019, KCB Group finalized the take-over of 100.0% of all the ordinary shares of National Bank of Kenya (NBK) through a share swap of 1 ordinary share of KCB for every 10 NBK shares, after the Capital Markets Authority approved the acquisition. For more information on the transaction, see Cytonn Weekly #36/2019,

- On 27th September 2019, the Central Bank of Kenya announced the merger of Commercial Bank of Africa Limited and NIC Group PLC, effective 30th September 2019, following attainment of all regulatory approvals. For more information on the transaction, see Cytonn Weekly #39/2019,

Other mergers and acquisitions activities announced recently include;

- Equity Group Holdings, in its expansion strategy, has various on-going acquisitions in the region having entered into a binding term sheet with Atlas Mara Limited to acquire certain banking assets in 4 countries in exchange for shares in Equity Group which are inclusive of:

- 62.0% of the share capital of Banque Populaire du Rwanda (BPR);

- 100.0% of the share capital of Africa Banking Corporation Zambia (ABCZam) Ltd;

- 100.0% of the share capital of Africa Banking Corporation Tanzania (ABCTz), and;

- 100.0% of the share capital of Africa Banking Corporation Mozambique Ltd (ABCMoz).

These acquisitions will allow Equity Group Holdings an easy penetration into these four African countries. Further, the lender is set to acquire a 66.5% controlling stake worth Kshs 10.9 bn in the Congo-based lender, effectively valuing BCDC at Kshs 16.4 bn. Successful completion of the above transactions will likely see Equity expand its regional footprint, aiding the bank’s performance. Read more information on the same here,

- Commercial International Bank (an Egyptian private-sector bank) sent an application to the Competition Authority of Kenya propositioning to acquire a controlling interest in Mayfair Bank, a Tier III Kenyan bank. Mayfair is the fourth-smallest lender in Kenya and it recorded a loss of Kshs. 0.4 bn in FY’2019,

- In January 2020, the Central Bank of Kenya gave a go-ahead to Nigerian lender, Access Bank PLC to acquire a 100% stake in Transnational Bank PLC for an undisclosed amount. Read more information on the same here,

- Co-operative Bank of Kenya announced it has opened talks to acquire a 100.0% stake in Jamii Bora Bank Limited. The announcement came months after Commercial Bank of Africa (CBA), dropped its cash buy-out offer and instead, merged with NIC Bank to form NCBA Group. Read more information on the same here,

Below is a summary of the deals in the last 5-years that have either happened, been announced or expected to be concluded:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs. Bns) |

Transaction Stake |

Transaction Value |

P/Bv Multiple |

Date |

|

Co-operative Bank |

Jamii Bora Bank |

3.4 |

100.0% |

Undisclosed |

N/A |

Mar-20* |

|

Access Bank PLC (Nigeria) |

Transnational Bank PLC. |

1.9 |

100.0% |

Undisclosed |

N/A |

Jan-20* |

|

Commercial International Bank |

Mayfair Bank |

1.1 |

Undisclosed |

Undisclosed |

N/A |

Dec-19* |

|

Oiko Credit |

Credit Bank |

3.0 |

22.8% |

1.0 |

1.5x |

Aug-19 |

|

KCB Group |

National Bank of Kenya |

7.0 |

100.0% |

6.6 |

0.9x |

Sep-19 |

|

CBA Group |

NIC Group |

33.5 |

53%:47% |

23.0 |

0.7x |

Sep-19 |

|

CBA Group** |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan-19 |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan-19 |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank Ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3.0 |

100.0% |

5.0 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

75.7% |

1.4x |

||||

|

* Announcement date **Deals that were dropped |

||||||

The number of commercial banks in Kenya has now reduced to 38, compared to 43 banks from 5-years ago. The ratio of the number of banks and Kenya’s 47.6 million people now stands at 0.8x, compared with a ratio of 0.9x, 5-years ago. The ratio is improving, however, Kenya still remains overbanked as the number of banks remains relatively high compared to the population. For more on this see our topical

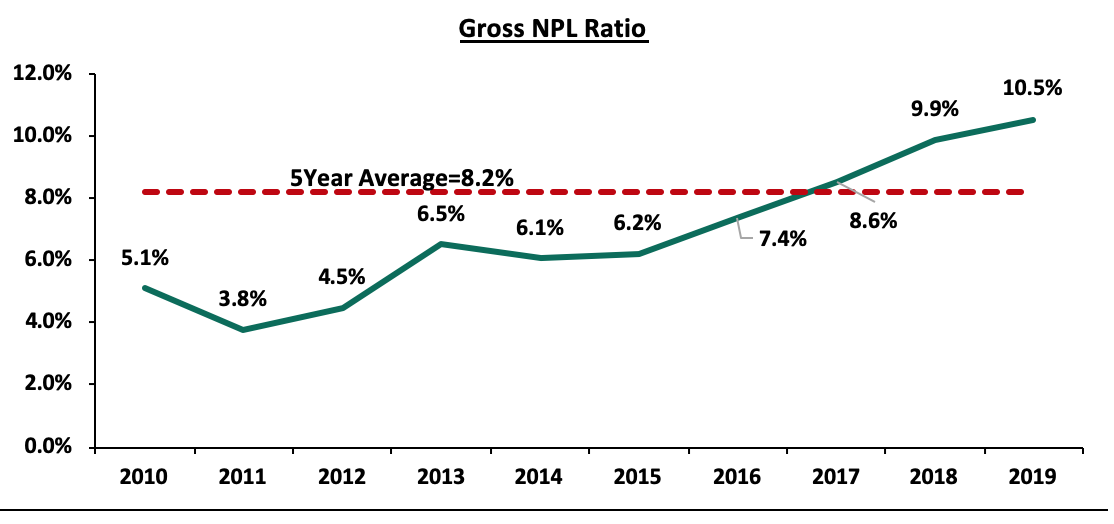

- Asset Quality - Asset quality deteriorated in FY’2019 with the gross NPL ratio increasing by 0.6% points to 10.5% from 9.9% in FY’2018. This was high compared to the 5-year average of 8.2%. The major sectors contributing largely to NPLs include real estate, retail, and manufacturing sectors, which saw lenders such as Stanbic Holdings suffer huge impairment losses from ARM, having lent the manufacturing company Kshs. 3.3 bn. Similarly, KCB Group and Co-operative Bank suffered from Uchumi Supermarket’s loans default, which translated to the lenders having to write off loans valued at Kshs. 656.0 mn with Co-operative Bank waiving 40.0% of its loan. If the asset deterioration trend persists, this will likely impact the bank’s bottom line due to the associated impairment charges, especially after the adoption of the new IFRS 9 standard

The chart below highlights the asset quality trend:

- Revenue Diversification: Listed banks continued their revenue diversification drive by growing the Non-Funded Income (NFI) segment with the average revenue mix of Funded to NFI for listed banks in FY’19 coming in at 63:37 compared to 67:33 recorded in FY’2018. The growth in NFI was supported by various banks launching several initiatives as highlighted below:

- KCB Bank deployed their Digital Customer Service platform as part of their digital transformation efforts. Aside from improved customer experience, their platforms will be able to collect real-time data on customers, then analyze and use it to make educated decisions on how to improve operations on an ongoing basis. This launch made KCB the third company in Africa to launch a WhatsApp banking solution following First Bank of Nigeria and HF Group,

- Co-operative Bank of Kenya launched the Co-op Bank Property Hub under its mortgage division, which will offer property sales and mortgage origination to its clients. For more information, please see our Kenya Mortgage Refinancing Company Update & Cytonn Weekly #17/2019,

- Co-operative Bank also highlighted its plan of growing the business of its leasing-focused subsidiary Co-op Bank Fleet. For more information, please see our report Nanyuki Real Estate Investment Opportunity, 2019, & Cytonn Weekly #23/2019,

- Diamond Trust Bank Kenya (DTBK) announced that it has partnered with SWIFT, a leading provider of secure financial messaging services, to provide real-time cross border payments to its clients. For more information, please see our Kenya Mortgage Refinancing Company Update & Cytonn Weekly #17/2019, and,

- Standard Chartered Bank Kenya (SCBK) launched an innovation hub lab in Nairobi dubbed Xcelerator in a bid to boost its revenue streams and diversify by riding on financial technology. For additional information, please see our Cytonn Weekly #15/2019.

- SME Focused Services: In FY’2019, a majority of banks began shifting their focus to SME lending among other services by providing SME targeting services with various banks focusing on SME lending as highlighted:

- In September 2019, Equity Group joined the global SME financing Forum with the goal of the forum being to promote the financial growth of SMEs. The bank offloaded Kshs. 150.0 bn worth of treasury bills and redirect the funds to SME lending, in a bid to deepen financial inclusion and boost sustainable investments in Kenya,

- Central Bank of Kenya launched a mobile loan app called Stawi in partnership with five Kenyan banks including; NCBA Group Plc, Co-operative Bank of Kenya, Diamond Trust Bank Kenya, KCB Bank, and NIC Bank. This app will give access to MSMEs ranging from Kshs. 30,000 to Kshs. 250,000. Further, it allows for a repayment period of 1-12 months at an interest of 9.0% p.a.,

- The African Guarantee Fund (AGF) set aside USD 170.0 mn (Kshs 17.1 bn) with an aim to back Kenyan Banks to enable them to lend to MSMEs. AGF committed to guarantee half the value of a loan balance to a single MSME borrower or half the value of an outstanding MSME loan portfolio, charging banks a fee ranging between 1.5%-3.0% for the risk guarantee, and,

- Credit Bank acquired a Kshs 824.0 mn loan from Africa Development Bank for onward lending to SMEs. The loan is to be accessed by companies in the construction, agriculture, renewable energy, and manufacturing sector, in a bid to enhance sustainable growth

- Rebranding: FY’2019 saw banks rebranding in a bid to capture a larger market share through improving their public image and brand recognition ;

- Barclays Africa Group – Barclays Bank of Kenya (BBK), now Absa Bank Kenya, completed its rebranding exercise to Absa Group, as the bank continued to invest in Information Technology (IT) equipment and brand modernization. The transition was completed well ahead of the bank’s strategy to transition fully to Absa by June 2020. Barclays Africa Group’s rebranding to ABSA has been ongoing since 2018 with the plan to rename all the subsidiaries in Africa and realigning the banks to their South African roots. The new identity is meant to show the bank's scalability in Africa and reflect its strategy of being forward-looking. This move also reflected a cultural transformation where they promised that their quality and extensity of services would change and improve with the new brand, and,

- NCBA Group- FY’2019 saw NIC Bank and CBA Group merger to form NCBA Group, currently the third-largest bank in Kenya in terms of assets. NCBA Group was able to amend its logo and is in the process of streamlining its services to offer better services than what was previously offered by the individual banks. They are also trying to follow suit of the other big banks by publicizing their strategy to focus on SME services and part of their goal is to close some of the overlapping branches and spread out further than the 41 counties they are currently operating to reach more SMEs especially those in marginalized areas.

Section II: Summary of the Performance of the Listed Banking Sector in FY’2019:

The table below highlights the performance of the banking sector, showing the performance using several metrics, and the key take-outs of the performance.

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

I&M |

26.6% |

4.5% |

12.0% |

(0.5%) |

5.9% |

9.1% |

34.8% |

5.0% |

7.8% |

3.4% |

76.3% |

5.2% |

19.5% |

|

ABSA |

21.2% |

6.8% |

11.0% |

5.4% |

7.7% |

9.1% |

31.4% |

8.8% |

14.6% |

32.3% |

82.0% |

9.9% |

16.7% |

|

Equity |

13.8% |

12.2% |

24.8% |

8.6% |

8.5% |

19.0% |

40.6% |

16.1% |

14.2% |

6.2% |

75.9% |

23.3% |

22.0% |

|

COOP |

12.4% |

1.4% |

0.8% |

1.7% |

8.5% |

33.1% |

35.4% |

34.7% |

8.7% |

46.8% |

80.1% |

8.7% |

19.2% |

|

KCB |

4.9% |

12.2% |

4.4% |

15.0% |

8.2% |

22.6% |

33.4% |

39.0% |

27.7% |

41.0% |

78.0% |

17.4% |

20.7% |

|

SCBK |

1.7% |

(5.9%) |

(22.4%) |

0.4% |

7.4% |

0.3% |

32.2% |

(4.7%) |

1.8% |

0.9% |

56.3% |

8.5% |

17.5% |

|

Stanbic |

1.6% |

8.1% |

7.1% |

10.7% |

5.2% |

14.0% |

46.1% |

11.7% |

2.4% |

(12.7%) |

85.1% |

9.3% |

13.6% |

|

DTBK |

1.6% |

(6.9%) |

(7.3%) |

(6.5%) |

5.6% |

6.2% |

23.6% |

3.1% |

(0.9%) |

12.9% |

71.1% |

3.1% |

12.9% |

|

NCBA |

(12.4%) |

(34.1%) |

(34.0%) |

(34.2%) |

3.3% |

25.9% |

60.4% |

14.4% |

10.9% |

11.8% |

65.9% |

4.1% |

10.6% |

|

HF |

N/A |

(15.4%) |

(16.7%) |

(13.2%) |

4.3% |

6.4% |

41.6% |

91.2% |

7.7% |

43.3% |

103.1% |

(11.3%) |

(1.1%) |

|

FY'19 Mkt Weighted Average* |

8.9% |

3.2% |

3.4% |

3.4% |

7.3% |

17.4% |

37.4% |

18.4% |

12.7% |

19.4% |

75.0% |

12.8% |

18.4% |

|

FY'18 Mkt Weighted Average** |

13.8% |

6.5% |

10.6% |

2.6% |

7.9% |

3.8% |

33.2% |

(1.0%) |

10.3% |

9.1% |

75.5% |

4.3% |

19.0% |

|

*Market cap-weighted as at 09/04/2020 |

|||||||||||||

|

**Market cap-weighted as at 31/12/2018 |

|||||||||||||

Key takeaways from the table above include:

- The above ten listed Kenyan banks recorded an 8.9% average increase in core Earnings per Share (EPS), lower than the 13.8% recorded in FY’2018 for all listed banks. The Return on Average Equity (RoAE) consequently declined to 18.4%, from 19.0% recorded in FY’2018

- The banks recorded stronger deposit growth, which came in at 12.7%, faster than the 10.3% growth recorded in the sector in FY’2018. Despite the stronger deposit growth, Interest expenses increased at a slower pace of 3.4%, compared to 10.6% in FY’2018, indicating the banks have been able to mobilize relatively cheaper deposits, which saw the cost of funds decline to 3.7 from 4.1 in FY’2018

- Average loan growth came in at 12.8%, which was faster than the 4.3% recorded in FY’2018 with the growth in loans being accelerated towards the tail end of FY’2019 following the repeal of interest rate cap in November 2019. Despite the increase in net loans, the loan to deposit ratio declined marginally to 75.0% from 75.5% in FY’2018 indicating that the effects expected from the repeal of the interest rate had not yet taken effect as banks continue recalibrating their models to adjust for new loan pricing. We, however, expect banks to refocus on lending with many banks looking to target select segments such as corporate entities and Small and Medium Enterprises (SMEs). Government securities, on the other hand, recorded a growth of 19.4% y/y, which was faster compared to the loans and the 9.1% growth recorded in FY’2018. This was attributable to banks’ continued preference towards investing in government securities, which offered better risk-adjusted returns during the interest rate cap era,

- Listed Banks recorded a slower 3.2% growth in interest income compared to the 6.5% recorded in FY’2018. This may be attributable to the lower yields on interest-earning assets which declined to 9.9% from 10.7% in FY’2018. The lower yields on interest-earning assets are attributable to a decline in lending rates which were pegged to the Central Bank Rate (CBR). In FY’2019, the CBR was lowered by 50 bps from the 9.0% set in July 2018 to 8.5%. Consequently, the Net Interest Margin (NIM) in the banking sector as at FY’2019, stood at 7.3%, a decline from the 7.9% recorded in FY’2018, mainly due to the faster growth in average interest-earning assets which grew by 5.5% in FY’2019 outpacing the 3.4% growth in Net Interest Income, and,

- Non-Funded Income grew by 17.4% y/y, faster than the 3.8% recorded in the sector in FY’2018. The growth in NFI was boosted by the total fee and commission income which improved by 18.4%, compared to the (1.0%) growth recorded in the sector FY’2018. We believe the growth in total fees was due to a re-correction from the decline in 2018 which was a one-off adjustment as a result of the implementation of the effective interest rate which required banks to amortize fees and commissions on loans over the tenor of the loans.

Section III: Outlook on the Focus Areas of the Banking Sector Players Going Forward:

In summary, the banking sector showed improved performance, which was largely attributable to persistent revenue diversification evidenced by the 17.4% growth in NFI in FY’2019 from 3.8% growth in FY’2018. Growth in NFI was attributable to the growth in fees and commissions which recorded an 18.4% growth in FY’2019. Consequently, the increase in loan growth, especially toward the tail end of FY’2019, after the interest rate cap repeal, reveal that the sector was plagued by stringent regulations. We expect banks to refocus on lending once they recalibrate their models to adjust for new loan pricing, therefore, increasing the Loan to Deposit Ratio. With the loosening of the regulations particularly the repeal of the interest rate cap, the sector can focus on the following items to increase growth and profitability:

- Refocus on Core Operations - With the repeal of the interest rate cap, banks can now price loans based on customers’ risk profiles, banks and will, therefore, be able to increase interest rates with bias to credit risk rating of borrowers, which will, in turn, improve their interest income. Going forward, we expect banks to refocus on lending with many banks looking to target select segments such as corporate entities and Small and Medium Enterprises (SMEs). This strategy can be expected to persist post the interest rate cap era,

- Continued Revenue Diversification - The increase in NFI growth outperformed that of interest income, thus, allowing the banks to remain profitable amid a rigid regulatory environment. However, with the regulations having been loosened banks will need to continue diversifying their income in order to reduce their reliance on interest income, thus, decreasing the pressure on interest rates. For example, Co-operative Bank’s “Soaring Eagle Initiative” enables both channel diversification through internet banking, Mco-op cash, and merchant banking among others, as well as consultancy and capacity building,

- Expansion and Further Consolidation - With the Microfinance-Bill 2019 of increasing the minimum on core capital requirements still in its pilot stage more mergers and acquisitions would enable the unprofitable and/or smaller banks to manage the requirement and be able to increase profitability through cost efficiency and deposits growth.

- Increased Adoption of Technology - Banks have been riding on the digital revolution wave to improve their operational efficiency. Increased adoption of alternative channels of transactions such as mobile, internet and agency banking, has led to increased transactions carried out via alternative channels and out of bank branches, which have been reduced to handling high-value transactions and other services such as advisory. Thus banks reduced front-office operations, thereby cutting the number of staff required and by extension, reducing operating expenses and hence, improving operational efficiency,

Section IV: Brief Summary and Ranking of the Listed Banks based on the Outcome of Our Analysis:

As per our analysis on the banking sector from a franchise value and a future growth opportunity perspective, we carried out a comprehensive ranking of the listed banks. For the franchise value ranking, we included the earnings and growth metrics as well as the operating metrics in order to carry out a comprehensive review of the banks.

The overall ranking was based on a weighted average ranking of Franchise value (accounting for 40%) and intrinsic value (accounting for 60%). The Intrinsic Valuation is computed through a combination of valuation techniques, with a weighting of 40.0% on Discounted Cash-flow Methods, 35.0% on Residual Income and 25.0% on Relative Valuation, while the Franchise ranking is based on banks operating metrics, meant to assess efficiency, asset quality, diversification, and profitability, among other metrics. The overall FY’2019 ranking is as shown in the table below:

|

Bank |

Franchise Value Score |

Intrinsic Value Score |

Weighted Score |

FY'2019 Rank |

Q3'2019 Ranking |

|

KCB Group Plc |

52 |

3 |

22.6 |

1 |

1 |

|

I&M Holdings |

50 |

5 |

23.0 |

2 |

2 |

|

Co-operative Bank of Kenya Ltd |

54 |

4 |

24.0 |

3 |

3 |

|

Equity Group Holdings Ltd |

58 |

2 |

24.4 |

4 |

4 |

|

DTBK |

70 |

1 |

28.6 |

5 |

7 |

|

Stanbic Bank/Holdings |

61 |

9 |

29.8 |

6 |

5 |

|

ABSA |

67 |

7 |

31.0 |

7 |

6 |

|

NCBA Group Plc |

81 |

6 |

36.0 |

8 |

8 |

|

SCBK |

80 |

8 |

36.8 |

9 |

9 |

|

HF Group Plc |

87 |

10 |

40.8 |

10 |

10 |

Changes from the Q3’2019 Ranking are:

- Diamond Trust Bank Kenya whose rank improved to Position 5 from Position 7 in Q3’2019 mainly due to an improvement in the Gross NPL ratio to 7.6% in FY’2019 from 8.9% in Q3’2019, in turn, improving its franchise value score,

- Stanbic Holdings whose rank declined to Position 6 from Position 5 in Q3’2019 mainly due to a deterioration in the Return on Average Equity ratio to 13.6% in FY’2019 from 18.5% in Q3’2019 thus, in turn, worsening the franchise value score, and,

- Absa Bank Kenya whose rank declined to Position 7 from Position 6 in Q3’2019 mainly due to a deterioration in Net Interest Margin to 7.7% in FY’2019 from 8.5% in Q3’2019 thus, in turn, worsening the franchise value score.

For more information, see our Cytonn FY’2019 Listed Banking Sector Review

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.