Cytonn Q1’2022 Markets Review

By Research Team, Apr 4, 2022

Executive Summary

Global Markets Review

The world economy is projected to register a slower growth in 2022 than earlier envisaged, with the International Monetary Fund (IMF) projecting a 4.4% growth in 2022 down from the initial projection of a 4.9% growth. The downward revision was mainly attributable to continued presence and effects of the Omicron COVID-19 variant coupled with supply chain disruptions that continued to hinder global manufacturing growth. Advanced Economies are projected to expand by 3.9%, while Developing and Emerging Markets are projected to expand by 4.8% in 2022;

Sub-Saharan Africa Regional Review

According to the International Monetary Fund (IMF), Sub Saharan Africa is projected to register a 3.7% GDP growth in 2022, slower than the 4.0% growth recorded in 2021. The slowed economic growth is partly attributable to the emergence on new strains of COVID-19 such as the Omicron variant that necessitated imposition of measures to curb its spread coupled with increasing inflationary pressures due to broadening of price pressures of key imports such as oil.

The select currencies recorded mixed performance against the US Dollar with the South African Rand being the largest gainer YTD, gaining by 8.0% against the dollar, while the Ghanaian Cedi was the largest decliner, depreciating by 21.7% YTD. Yields on African Eurobonds increased in Q1’2022 partly attributable to investors attaching a higher risk premium on the Sub-Saharan region and other emerging markets to compensate for the increasing inflationary pressures and currency depreciation risks;

Kenya Macroeconomic Review

The Kenyan Economy is projected to grow at an average rate of 4.9% in 2022, from an estimate of 5.6% in 2021, mainly on the back of the global recovery and the easing of COVID-19 containment measures following an increase in vaccination rates and reduced infections. However, in Q1’2022, there was a general slowdown in the business environment in the private sector as evidenced by the average Purchasing Managers’ Index (PMI) for the first two months of Q1’2022 which came in at 50.3, lower than the 52.1 recorded during a similar period in 2021. Despite this deterioration, the total revenue collected for the two months amounted to Kshs 266.5 bn, 22.3% of the total revenue collected for FY’2021/2022, pointing towards continued economic recovery following the ease of COVID-19 containment measures and the effectiveness of the KRA in revenue collection;

Fixed Income

During the first quarter of 2022, T-bills were slightly oversubscribed, with the overall subscription rate coming in at 101.5%, up from 69.1% in Q4’2021. The oversubscription was partly attributable to the eased liquidity in the money market during the quarter, which saw the average interbank rate decline to 4.7%, from 5.1% in Q4’2021. Overall subscriptions for the 91-day paper declined to 89.0% from 103.9% in Q4’2021 while that of the 182-day and 364-day papers increased to 80.9% and 127.1% in Q1’2022, from 59.0% and 65.3% in Q4’2021, respectively. The yields on government securities in the secondary market were on an upward trajectory during the quarter, which saw the FTSE bond index decline by 1.1% to close at Kshs 95.0, from Kshs 96.1 recorded in Q4’2021;

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 29.7%, down from the 55.8% recorded last week, partly attributable to the tightened liquidity in the market, with the average interbank rate coming in at 4.6%, from 4.3% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 1.5 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 38.1%, a decline from the 58.0% recorded the previous week. The subscription rate for the 182-day and 364-day papers declined to 31.3% and 24.7%, respectively, from 38.4% and 72.2%, recorded the previous week. The government accepted bids worth Kshs 7.10 bn, out of the Kshs 7.13 bn worth of bids received, translating to an acceptance rate of 99.7%, reflecting the government’s debt appetite;

Equities

During Q1’2022, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 6.4%, 2.9% and 4.8%, respectively. The equities market performance during the quarter was driven by losses recorded by large caps such as Safaricom, EABL, Bamburi and Equity Group of 10.0%, 9.1%, 5.9% and 4.3%, respectively. The losses were however mitigated by gains recorded by stocks such as BAT, Standard Chartered Bank (SCBK), ABSA Bank Kenya and NCBA Group of 12.4%, 12.1%, 5.1% and 2.6%, respectively. During the first quarter of 2022, listed banks in Kenya released their FY’2021 results, recording an increase in their earnings growth, with their average core Earnings per share (EPS) recording a weighted average growth of 83.2%, compared to a weighted average decline of 26.8% in FY’2020. The performance is however largely skewed by the strong EPS growth from ABSA, NCBA Group and Equity Group of 161.2%, 123.7% and 99.4%, respectively;

Real Estate

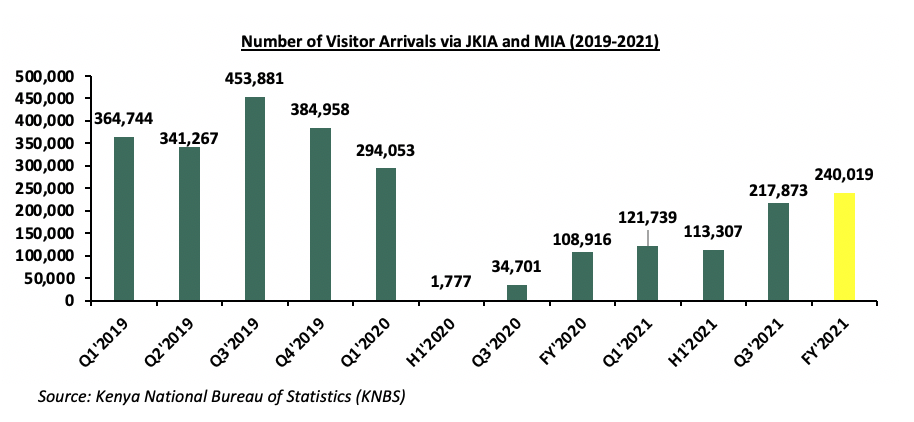

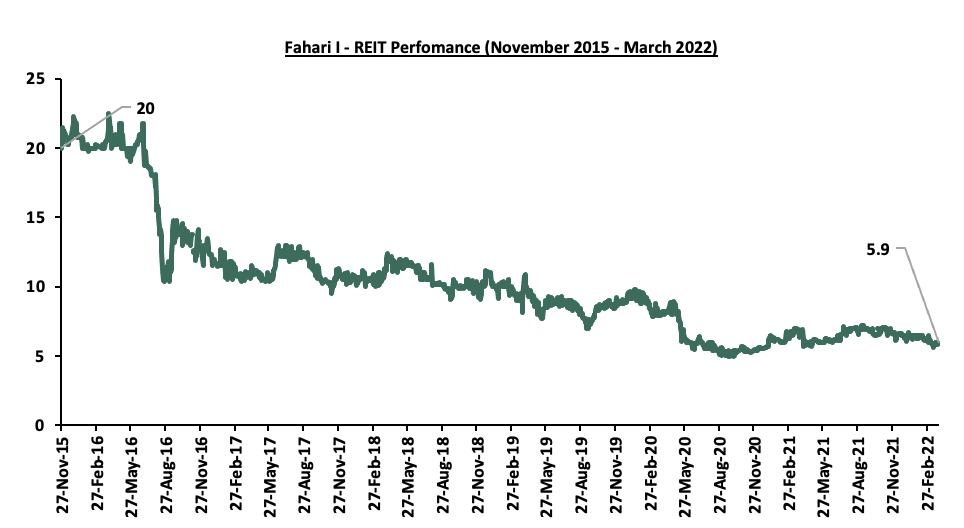

The real estate sector performance generally improved in Q1’2022 attributed to the improved operating environment supporting increased real estate property transactions. In the Nairobi Metropolitan Area (NMA), the residential sector recorded improved performance with a 0.6% points y/y increase in average total returns to 5.7% from the 5.1% recorded in Q1’2021. The commercial office sector recorded average rental yields of 7.3% in Q1’2022, representing a 1.5% points y/y increase from 6.8% recorded in Q1’2021 while the retail market recorded average rental yields of 7.5%, similar to FY’2020. The land sector recorded an average annualized capital appreciation of 2.4% in Q1’2022, with land prices in the satellite towns realizing the highest capital appreciation at 4.1% y/y. Additionally, during the quarter, ILAM Fahari I-REIT released their FY’2021 reporting a decline in Earnings per share by 183.7% to Kshs (0.7) in FY’2021, from Kshs 0.8 in FY’2020. Acorn Holdings also released their FY’2021 I-REIT and D-REIT results reporting Earnings per Unit for the two at Kshs 3.6 and Kshs 2.3, respectively.

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.40%. To invest, dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.90% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809#;

- Justin Mwangi, a Senior Investment Analyst, was on a panel on Twitter Spaces to discuss the Fundraising Options in Kenya for Entrepreneurs. Listen to Justin here,

- We continue to offer Wealth Management Training every Thursday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for assignment, click here for the latest conversion term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Global Economic Growth:

The world economy is projected to register a slower growth in 2022 than earlier envisaged, with the International Monetary Fund (IMF) projecting a 4.4% growth in 2022 down from the initial projection of a 4.9% growth. The downward revision is mainly attributable to:

- Inflationary pressures around the globe and more so in developed economies that has resulted in hiking of interest rates to tame inflation and rolling back of stimulus packages,

- Supply chain constraints that were in existence due to the COVID-19 pandemic have been worsened by the Russia-Ukraine conflict. As a result, prices of key manufacturing inputs for majority of the economies such as energy have increased, exerting higher inflationary pressures and currency depreciation as demand for dollars goes up,

- COVID-19 remains a constraining factor for global economic growth due to emergence of new strains, and resurgence in infections in some economies such as China which have necessitated imposition of lockdowns, and,

- High debt levels in developing economies, with governments having borrowed heavily to revive economies in 2020, and the increase in the poverty levels in some regions such as the Sub-Saharan Africa is also expected to dampen the economic outlook.

Economic growth will however be supported by the increased access to vaccines and high vaccination rates that have curbed the increase in COVID-19 infection rates. Cumulatively, 58.5% of the world’s population has been fully vaccinated, against the World Health Organisation’s global target of 70.0% by H1’2022.

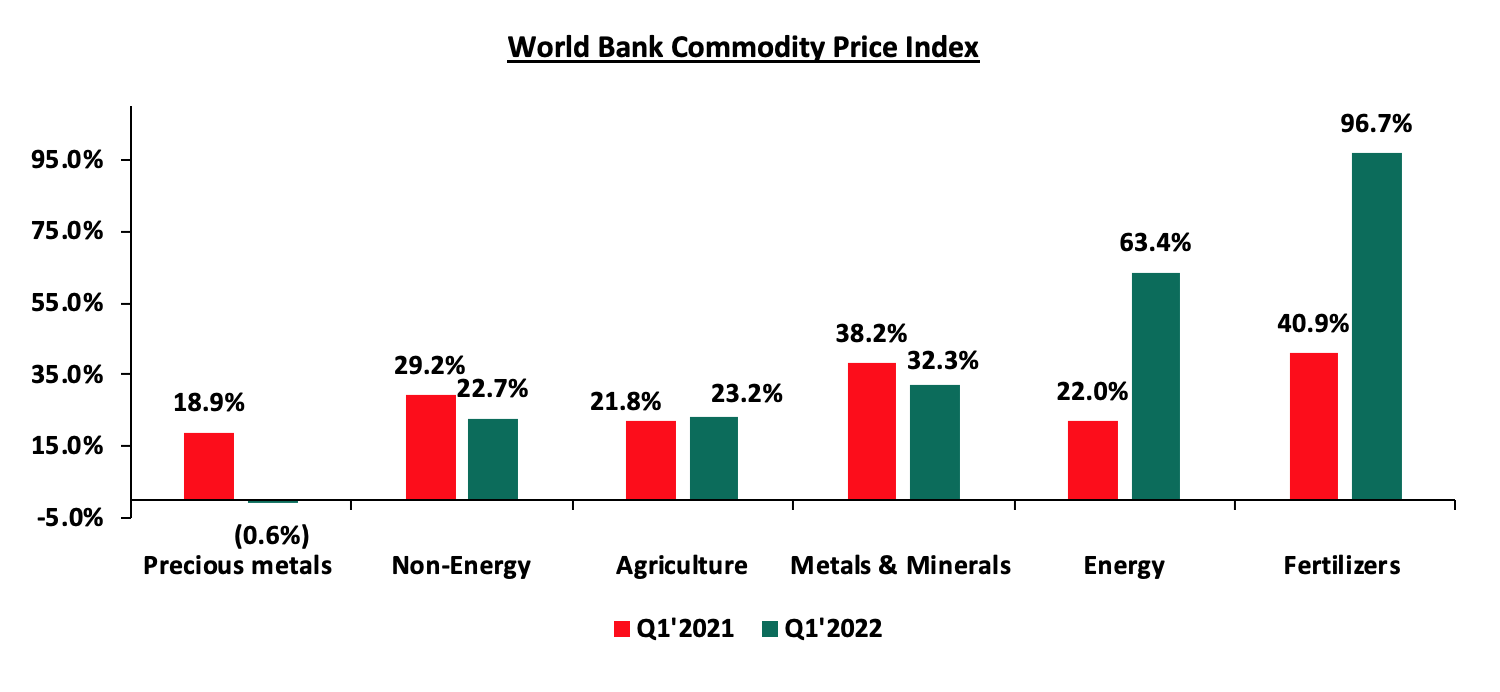

Global Commodities Market Performance:

Global commodity prices registered mixed performance in Q1’2022, with prices of precious metals declining by 0.6% largely driven by reduced demand for safe haven assets in Q1’2022, as compared to a similar period last year. Fertilizer prices recorded the highest increase, gaining by 96.7% in Q1’2022, mainly attributable to mismatch between demand and supply arising from supply chain constraints, as a result of the Russian government’s decision to halt fertilizer exports in a retaliatory move following sanctions for their role in the Russia - Ukraine conflict. Key to note, Russia is the single largest producer of fertilizers. Below is a summary performance of various commodities:

Source: World Bank

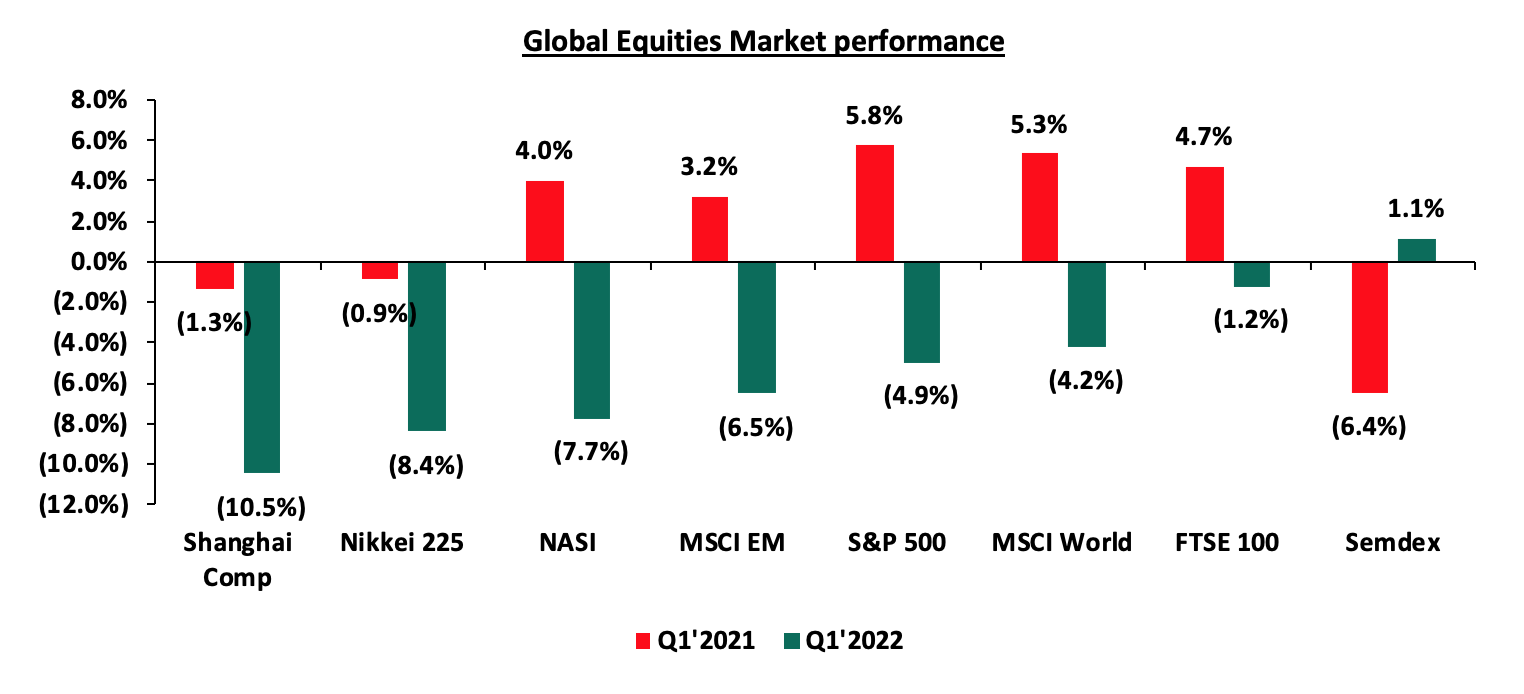

Global Stock Market Performance:

Global stock markets recorded mixed performance in Q1’2022, with most of the markets recording declines, attributable to capital outflow from the equities markets as investors sought less risky markets such as government papers. The Mauritius SEMDEX index was the only gainer, recording a 1.1% year to date gain as at 31st March 2022, while the Shanghai Composite index was the worst-performing index with losses of 10.5% YTD. Below is a summary of the performance of key indices:

Economic Growth:

According to the International Monetary Fund (IMF), Sub Saharan Africa is projected to register a 3.7% GDP growth in 2022, slower than the 4.0% growth estimate recorded in 2021. The slowed economic growth is partly attributable to the emergence on new strains of COVID-19 such as the Omicron variant that necessitated imposition of measures to curb its spread coupled with increasing inflationary pressures due to broadening of price pressures of key imports such as oil. Economic growth has further been weighed down by slow COVID-19 vaccine roll out, with the region having fully vaccinated only 12.0% of its population, as compared to a global average of 58.5%. Additionally, the region is facing debt sustainability concerns, with most of the countries having huge debt levels, with the IMF highlighting in their Regional economic outlook that five African countries were in debt distress, a further thirteen in high risk of debt distress, and 17 in moderate risk of debt distress. This is partly attributable to significant shortfalls in revenue collection and depreciating local currencies which in turn undermined their ability to service maturing debt obligations. However, the region’s growth will be supported by increase in prices for commodity exports such as oil which are expected to support growth in Nigeria and Angola while high coffee and cotton prices will support near-term recovery in Kenya, Tanzania and Ethiopia.

Currency Performance:

The vast majority of the select currencies depreciated against the US Dollar in Q1’2022 continuing the trend witnessed in FY’2021, with only the South African Rand and the Botswana Pula gaining by 8.0% and 2.4%, respectively. The Ghanaian Cedi was the worst performer in Q1’2022 as it depreciated by 24.1% against the dollar. The performance is partly attributable to increasing concerns over public debt sustainability with public debt to GDP ratio reaching 80.1% in December 2021, coupled with affirmation of a negative outlook by Fitch ratings in January 2022. This has seen Ghana’s attractiveness to foreign investors decline and subsequent decline in foreign exchange inflows. On the other hand, the South African Rand appreciation is partly attributable to rallying of commodity prices of the country’s minerals such as gold, platinum, silver and coal. The increase in commodity prices, coupled with an expected hike in interest rates have increased trade and investment activities have increased in the country. The Kenya Shilling depreciated by 1.6% in Q1’2022 to close at Kshs 115.0 against the US Dollar, compared to Kshs 113.1 recorded at the end of 2021.Below is a table showing the performance of select African currencies:

|

Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Mar-21 |

Dec-20 |

Mar-22 |

Last 12 Months change (%) |

Q1’2022 change (%) |

|

South African Rand |

14.8 |

15.9 |

14.6 |

1.2% |

8.0% |

|

Botswanan Pula |

11.0 |

11.7 |

11.4 |

(3.6%) |

2.4% |

|

Malawian Kwacha |

776.3 |

817.3 |

818.9 |

(5.2%) |

(0.2%) |

|

Tanzania Shilling |

2,314.0 |

2,297.8 |

2,318.5 |

(0.2%) |

(0.9%) |

|

Nigerian Naira |

380.6 |

410.9 |

415.7 |

(8.4%) |

(1.2%) |

|

Ugandan Shilling |

3,660.0 |

3,544.3 |

3,595.1 |

1.8% |

(1.4%) |

|

Kenyan Shilling |

109.5 |

113.1 |

115.0 |

(4.7%) |

(1.6%) |

|

Mauritius Rupee |

40.7 |

43.3 |

45.4 |

(10.3%) |

(4.7%) |

|

Zambian Kwacha |

22.1 |

16.7 |

18.2 |

21.8% |

(8.7%) |

|

Ghanaian Cedi |

5.8 |

6.0 |

7.3 |

(20.6%) |

(21.7%) |

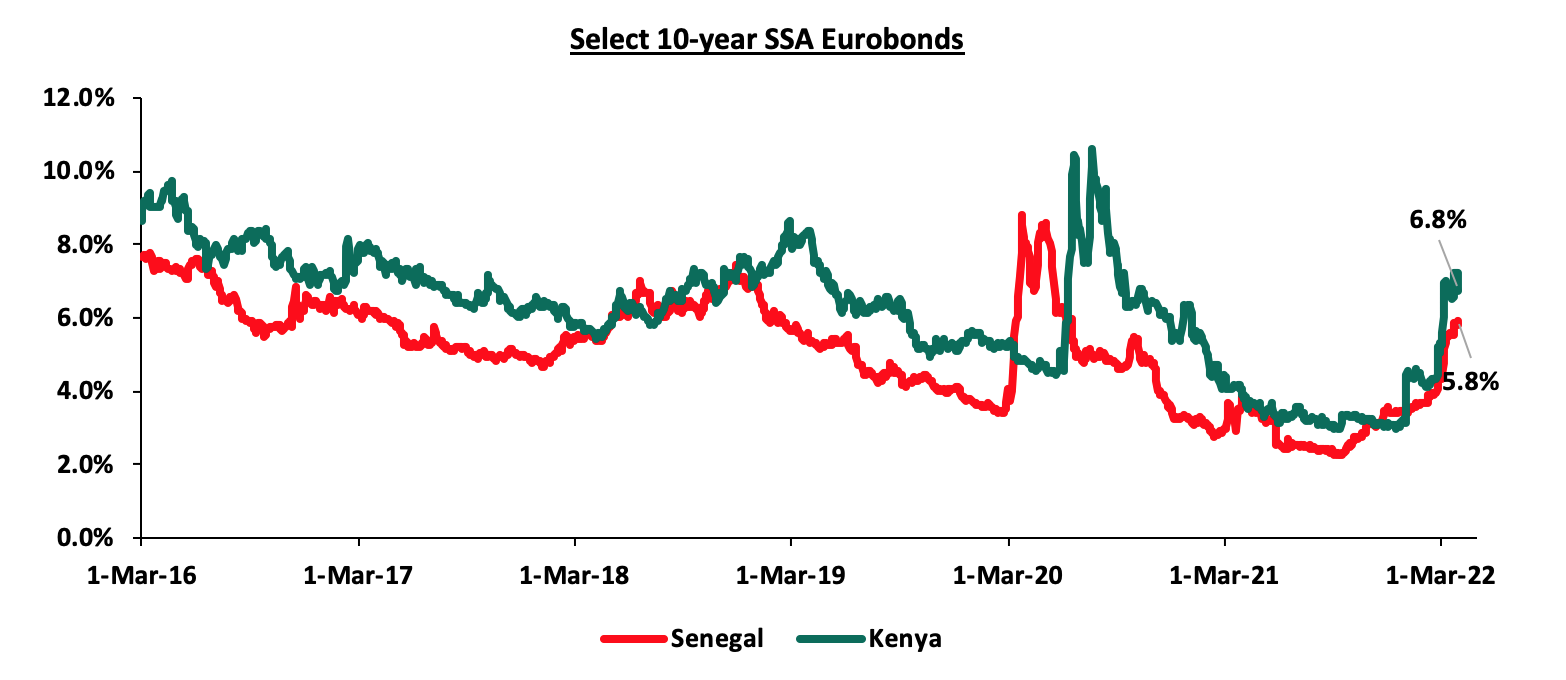

African Eurobonds:

Yields on African Eurobonds generally increased in Q1’2022 partly attributable to investors attaching higher risk premium on the Sub-Saharan region and other emerging markets due to perceived higher risks arising from increasing inflationary pressures and local currency depreciation. The increase in Eurobond yields come on the back of inflationary pressures and local currency depreciation that has worsened the existing supply chain constraints. Yields on both the Kenyan and Senegal Eurobonds increased in Q1’2022 by 2.4% to 6.8% and 5.8%, from 4.4% and 2.4%, respectively, recorded in December 2021.

Below is a graph showing the Eurobond secondary market performance of select 10-year Eurobonds issued by their respective countries;

Equities Market Performance:

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in Q1’2022, with South Africa’s JALSH being the best performing market gaining by 11.2% attributable to the increased foreign investor sentiments following rallying of commodity prices coupled with the appreciating local currency. Ghana’s GGSECI was the worst-performing market with a loss of 19.1%, partly attributable to the re-imposition of capital gains tax on securities listed on the Ghanaian Stock Exchange, which has seen investors prefer fixed income securities with relatively higher yields. The GGSECI has also seen capital flight from foreign investors due to uncertainties caused by inflationary and currency depreciation pressures.

Below is a summary of the performance of key exchanges:

|

Equities Markets Performance (Dollarized*) |

||||||

|

Country |

Index |

Mar-21 |

Dec-21 |

Mar-22 |

Last 12 Months change (%) |

YTD change (%) |

|

South Africa |

JALSH |

4,502.4 |

4,638.8 |

5,160.0 |

14.6% |

11.2% |

|

Nigeria |

NGSEASI |

102.6 |

103.9 |

113.0 |

10.1% |

8.7% |

|

Zambia |

LASILZ |

182.3 |

363.4 |

377.2 |

106.9% |

3.8% |

|

Rwanda |

RSEASI |

0.2 |

0.1 |

0.1 |

(28.7%) |

(0.9%) |

|

Tanzania |

DARSDEI |

1.5 |

1.6 |

1.5 |

2.5% |

(3.9%) |

|

Uganda |

USEASI |

0.4 |

0.4 |

0.4 |

(8.5%) |

(8.5%) |

|

Kenya |

NASI |

1.5 |

1.5 |

1.4 |

(9.7%) |

(9.7%) |

|

Ghana |

GGSECI |

384.9 |

464.4 |

375.6 |

(2.4%) |

(19.1%) |

|

*The index values are dollarized for ease of comparison |

||||||

GDP growth in Sub-Saharan Africa region is expected to slow in 2022 in line with the rest of the global economy. The region still faces key challenges among them emergence of new COVID-19 variants coupled with inflationary pressures worsened by global geopolitical tensions. Additionally, the region continues to suffer from high debt levels that will make them less attractive to foreign capital and high costs of debt service following expiry of Debt Service Suspension Initiative and weakening of local currencies.

The Kenyan Economy is projected to grow at an average rate of 4.9% in 2022, from an estimate of 5.6% in 2021, mainly on the back of the global recovery and the easing of COVID-19 containment measures following an increase in vaccination rates and reduced infections. The move is expected to support growth in sectors like tourism, hospitality, manufacturing and trade, which are yet to fully recover from the pandemic. The table below shows the GDP projections according to various organizations;

|

GDP Growth Rate |

|||

|

No. |

Organization |

2021 Estimates |

2022 Projections |

|

1. |

International Monetary Fund |

5.6% |

6.0% |

|

2. |

Cytonn Investments Management PLC |

5.7% |

4.5% |

|

3. |

S&P Global |

6.0% |

4.5% |

|

4. |

World Bank |

5.0% |

4.7% |

|

Average |

5.6% |

4.9% |

|

|

Forecasted in Q4’2021 |

|||

Source: Cytonn Research

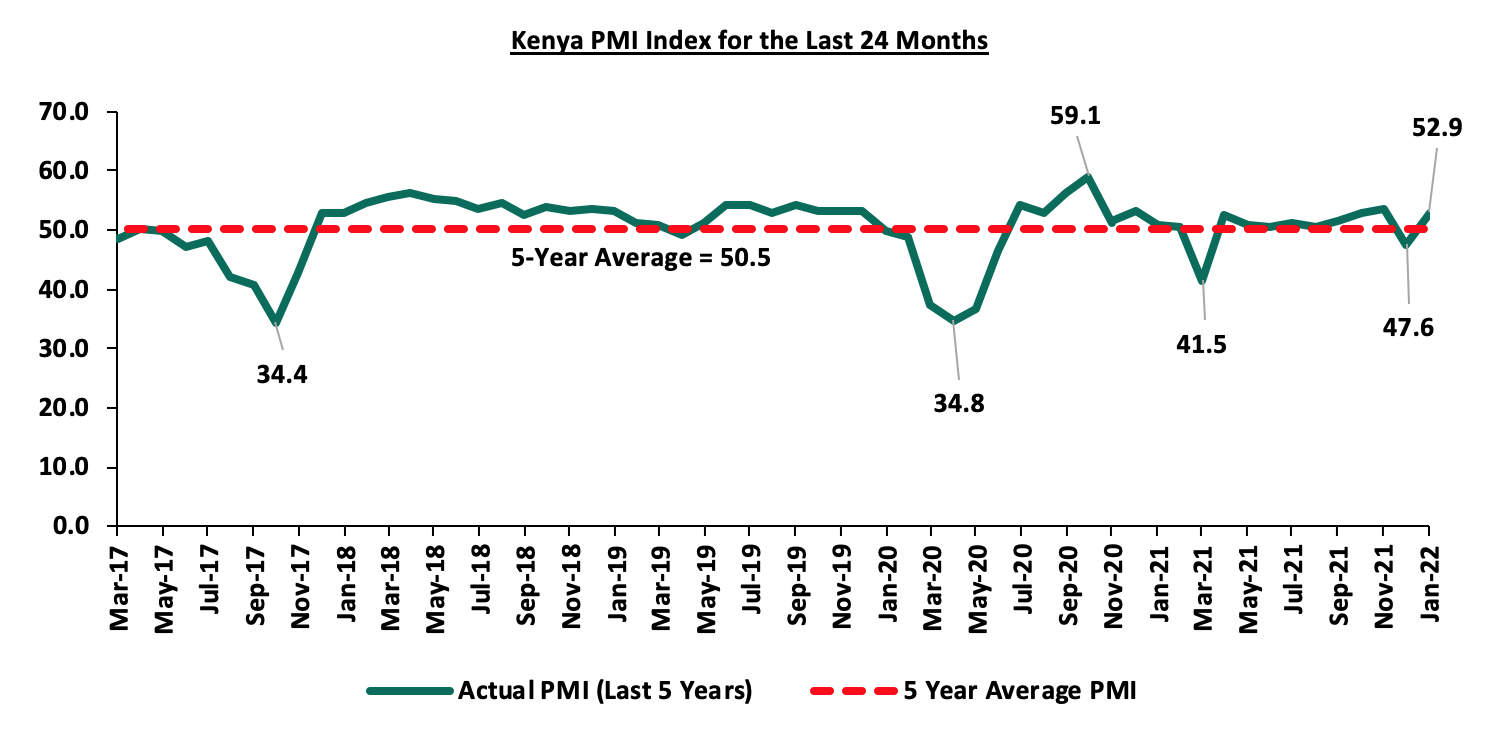

The average PMI for the first two months of Q1’2022 came in at 50.3, lower than the 52.1 recorded during a similar period in 2021 pointing towards a slowdown in the business environment in the private sector. The performance was weighed down by January’s Purchasing Managers’ Index (PMI) which came in at 47.6, marking an 8-month low largely due to lower domestic spending and travel following an uptick in price pressures and persistent COVID-19 cases from the Omicron Variant at the beginning of the year. Below is the PMI chart for the last five years:

Despite this deterioration, the total revenue collected for the two months amounted to Kshs 266.5 bn, 22.3% of the total revenue collected for FY’2021/2022 pointing towards continued economic recovery following the ease of COVID-19 containment measures and the effectiveness of the KRA in revenue collection. Additionally, Fitch Ratings affirmed Kenya’s Long-Term Foreign- Currency Issuer Default Rating (IDR) at ‘B+’ with a Negative Outlook, unchanged from the previous review in March 2021. The B+ rating was on the back of the strong economic growth, with Kenya’s economy having recorded a 9.9% growth in Q3’2021, up from a 2.1% contraction recorded in a similar period in 2020, coupled with the continued macroeconomic stability.

However, risks lie on the downside on the back of;

- Rising fuel prices driven by persistent supply chain constraints coupled with the geopolitical pressures occasioned by the Russian invasion which is expected to put pressure on the inflation basket,

- Resurgence of new and more transmissible variants of the COVID-19 virus in the country’s trading partners is expected to weigh on investment performance, funding and aggravate the country’s debt vulnerabilities,

- The uncertainties surrounding the upcoming 2022 August elections, which are likely to have a negative effect on the business environment,

- Erratic weather conditions which are already causing severe hardship and subdued growth in the agricultural sector. Should the drought intensify, this would weigh on the near-term economic outlook, and,

- External risk such as weaker global growth with the IMF revising down the projected global growth for 2022 to 4.4%, 0.5% points lower than the earlier projection of a 4.9% growth rate, higher than anticipated energy prices and tighter external financing conditions.

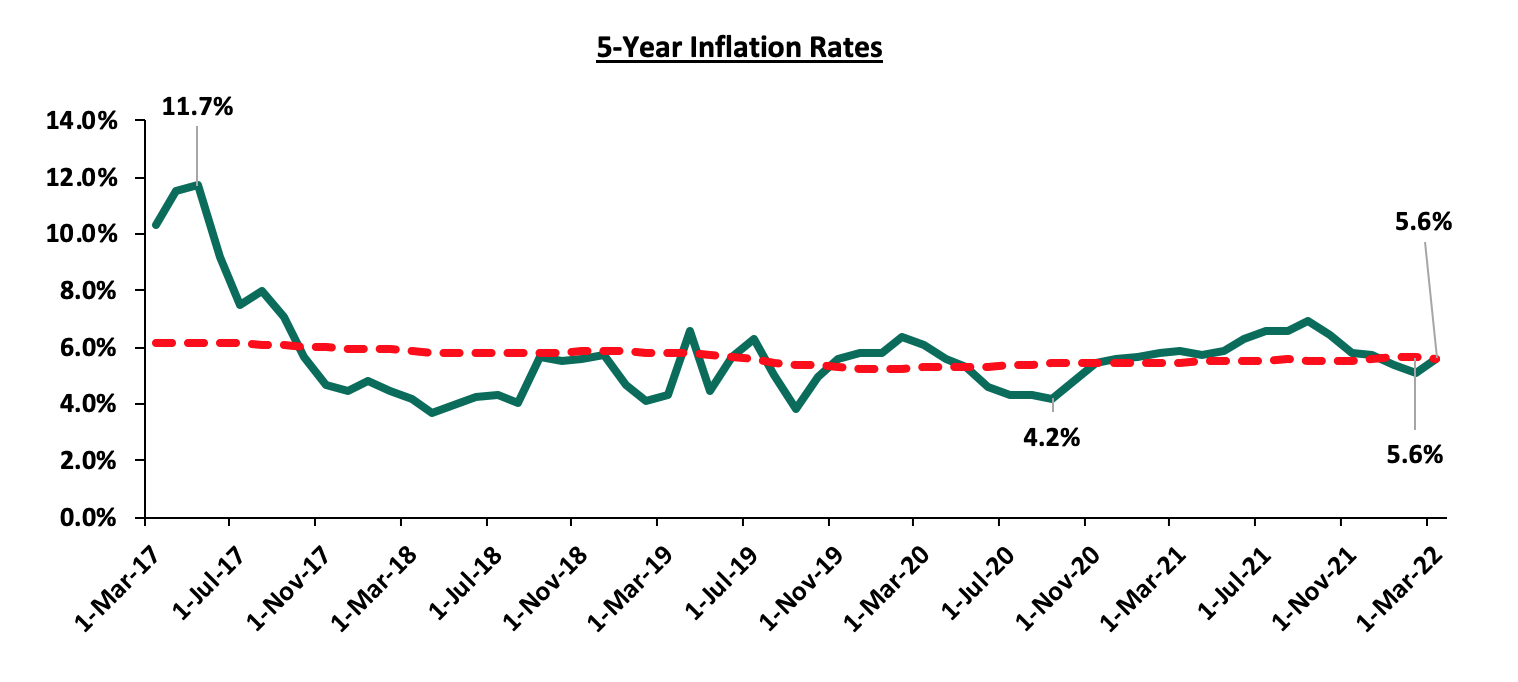

Inflation:

The average inflation rate declined to 5.3% in Q1’2022 compared to 5.8% in a similar period in 2021 mainly attributable to the unchanged fuel prices, during the period of review following a fuel subsidy programme under the Petroleum Development Fund. Below is the inflation chart for the last five years:

March Inflation

The y/y inflation for the month of March increased to 5.6%, from the 5.1% recorded in February 2022, in line with our expectations. The increase was mainly attributable to the increase in the y/y Food and non-alcoholic beverages, Housing, water, electricity, gas and other fuels as well as transport cost, which increased by 9.9%, 4.9% and 3.7%, respectively. Food and non-alcoholic beverages index has had the greatest increase both year on year and month on month mainly due the supply constraints of production materials and the erratic weather conditions.

The table below shows a summary of both the year on year and month on month commodity groups’ performance;

|

Major Inflation Changes – March 2022 |

|||

|

Broad Commodity Group |

Price change m/m (March-22/February-22) |

Price change y/y (March-22/March-21) |

Reason |

|

Food & Non-Alcoholic Beverages |

1.5% |

9.9% |

The m/m increase was mainly contributed by increase in prices of cooking oil, wheat flour and tomatoes among other food items. The increase was however mitigated by a decline in prices of green grams, carrots and oranges |

|

Housing, Water, Electricity, Gas and other Fuel |

0.7% |

4.9% |

The m/m increase was as a result of increase in the price cooking gas by 7.8% m/m and 38.2% since March 2021

|

|

Transport Cost |

0.6% |

3.7% |

The m/m increase was as a result of the increase in prices of super petrol and diesel in the month of March following the rise in global oil prices. This was the first rise in fuel prices since September 2021 |

|

Overall Inflation |

0.9% |

5.6% |

The m/m increase was due to a 1.5% increase in the food and non-alcoholic beverages index as compared to the 0.8% increase in the month of February |

Source: KNBS

Going forward, we expect the inflation pressures to remain elevated but within the government’s set range of 2.5% - 7.5%. However, concerns remain high on the rising food and fuel prices which are expected to put pressure on inflation, given that these are a major contributor to the inflation basket. Additionally, we believe that the fuel subsidy program by the National Treasury stands at risk of being depleted and is unsustainable, as evidenced by the increased compensation amounts which further increase the possibility of depletion. As such, fuel prices are likely to keep rising should the landed cost continue increasing and thus exert upward pressure on the inflation basket.

The Kenya Shilling:

The Kenya Shilling depreciated against the US Dollar by 1.6% in Q1’2022, to close at Kshs 115.0, from Kshs 113.1 in December 2021, marking an all-time low. The depreciation is partly attributable to increased dollar demand from the oil and energy sectors. During the week, the Kenya Shilling depreciated marginally against the US Dollar by 0.2% to close at Kshs 115.0, from Kshs 114.7 the previous week. We expect the shilling to remain under pressure as a result of:

- Rising global crude oil prices on the back of supply constraints and geopolitical pressures at a time when demand is picking up with the easing of COVID-19 restrictions and as economies reopen. Key to note, risks abound the recovery following the emergence of the new COVID-19 variants,

- Increased demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally,

- An ever present current account deficit due to an imbalance between imports and exports, with Kenya’s current account deficit estimated to come in at 5.6% of GDP in the 12 months to February 2022 compared to the 4.3% for a similar period in 2021. The wider deficit reflects a higher import bill, particularly for oil, which more than offset increased receipts from agricultural and services exports, and remittances, and,

- The aggressively growing government debt, with Kenya’s public debt having increased at a 10-year CAGR of 18.4% to Kshs 8.0 tn in December 2021, from Kshs 1.5 tn in December 2011 thus putting pressure on forex reserves to service some of the public debt.

The shilling is however expected to be supported by:

- High Forex reserves currently at USD 7.8 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. In addition, the reserves were boosted by the USD 1.0 bn proceeds from the Eurobond issued in July 2021, USD 972.6 mn IMF disbursement, USD 130.0 mn World Bank loan financing received in June 2021 and the recently approved USD 750.0 mn World Bank loan facility, and,

- Improving diaspora remittances evidenced by a 23.5% y/y increase to USD 321.5 mn as of February 2022, from USD 260.3 mn recorded over the same period in 2021, which has continued to cushion the shilling against further depreciation.

Monetary Policy:

During the quarter, the Monetary Policy Committee (MPC) met twice and in both sittings, maintained the Central Bank Rate (CBR) at 7.0% for the thirteenth consecutive time after concluding that the accommodative stance implemented in March 2020 was having the intended effects on the economy.

However, during the 29th March 2022 sitting, the committee raised concerns on the elevated global risks on the back of heightened geopolitical tensions, volatile commodity prices as well as the COVID-19 pandemic and their potential impact on the domestic economy. Below are some of the key highlights from the meeting:

- Overall inflation declined to 5.1% in February 2022 compared to 5.4% in January, 2022 mainly attributable to lower food and fuel prices which declined by 8.7% and 6.5%, respectively. Inflation is expected to remain within the Government’s target range of 2.5%-7.5% but pressure abounds in the short term following the rise in fuel and food prices,

- Private sector credit growth has been recovering, having grown by 9.1% in the twelve months to February 2022, an increase from the 8.6% recorded in December 2021. The key sectors supporting this growth include Transport and Communication (24.1%), Consumer durables (14.0%) and Manufacturing (7.6%), and,

- The current account deficit to GDP is estimated at 5.6% in the 12-months to February 2022, a 1.3% points increase, from 4.3% recorded over a similar period in 2021. Exports of goods remained strong, growing by 12.1% in the twelve months to February 2022, compared to a similar period in 2021. Receipts from exports of horticulture and manufactured goods increased by 7.9% and 31.3%, respectively, in the twelve months to February 2022 compared to a similar period in 2021. However, receipts from tea exports declined by 0.3 %, partly attributable to the impact of accelerated purchases in 2020.

The MPC concluded that the current accommodative monetary policy stance remains appropriate and therefore decided to retain the Central Bank Rate (CBR) at 7.00%, in line with our expectations. The Committee will meet again in May 2021, but remains ready to re-convene earlier if necessary.

Q1’2022 Highlights;

- The Kenya National Bureau of Statistics (KNBS) released the Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 9.9% growth in Q3’2021, up from the 2.1% contraction recorded in a similar period in 2020 pointing towards continued economic recovery. For more information, see our Cytonn Weekly #1/2022,

- The Kenya National Bureau of Statistics released the Quarterly Balance of Payments report for Q3’2021 report highlighting that Kenya’s balance of payments improved in Q3’2021, coming in at a deficit of Kshs 34.4 bn, from a deficit of Kshs 103.9 bn in Q3’2020. The decline was mainly attributable to an 11.9% increase in the stock of gross official reserve to Kshs 1,064.2 bn from Kshs 951.0 bn in Q3’2020. For more information, see our Cytonn Weekly #1/2022,

- The World Bank released the Global Economic Prospects and the Sub–Saharan Africa outlook highlighting that the Kenyan economy is expected to grow by 5.0% in 2021 and 4.7% in 2022, supported by improving exports and the positive vaccine rollout. However, the erratic weather conditions in the country is expected to weigh down the economic growth as Agriculture is the largest contributor to Kenya’s GDP growth at 20.5% in Q3’2021. For more information, see our Cytonn Weekly #2/2022,

- The National Treasury presented the Supplementary Budget for the fiscal year 2021/22 to the National Assembly. The treasury is seeking to increase the gross total budget by 3.3% to Kshs 3,377.8 bn, from the previous estimates of Kshs 3,269.2 bn. The increase in the supplementary budget is mainly on account of a 12.3% increase in funds allocated towards the Ministry of Health to Kshs 136.0 bn from the original estimates of Kshs 121.1 bn as the government amps up its fight against COVID-19, coupled with a 3.7% increase in the infrastructure budget to Kshs 202.5 bn from the earlier approved Kshs 195.2 bn. For more information, see our Cytonn Monthly - January

- Stanbic Bank released its monthly Purchasing Manager’s Index (PMI) highlighting that the index for the month of February 2022 increased to 52.9 following a nine months low of 47.6 recorded in January 2022. The index points towards strengthened business environment in the country on the back of continued economic recovery as COVID-19 cases continue to decline. For more information, see our Cytonn Monthly – February,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum fuel prices in Kenya effective 15th March 2022 to 14th April 2022 highlighting that super petrol and diesel prices increased by 3.9% and 4.5% to Kshs 134.7 per litre and Kshs 115.6 per litre, respectively, from Kshs 129.7 per litre and Kshs 110.6 per litre recorded last month. The price of Kerosene remained unchanged at Kshs 103.5 per litre, same as recorded in the previous month. For more information, see our Cytonn Weekly #11/2022,

- The World Bank approved a USD 750 mn (Kshs 80.9 bn) loan facility aimed at accelerating Kenya’s ongoing inclusive and resilient recovery from the COVID-19 pandemic, and, strengthening fiscal sustainability reforms that contribute to greater transparency and the fight against corruption. For more information, see our Cytonn Weekly #11/2022,

- The National Treasury gazetted the revenue and net expenditures for the first eight months of FY’2021/2022, ending 28th February 2022 highlighting that Total revenue collected as at the end of February 2022 amounted to Kshs 1,192.8 bn, equivalent to 67.2% of the original estimates of Kshs 1,775.6 bn and is 100.8% of the prorated estimates of Kshs 1,183.8 bn. Notably, the performance is a decline from the 103.8% outperformance recorded in the first seven months to January 2021, mainly attributable to a 26.9% decline in the monthly revenue collection to Kshs 117.6 bn in February 2022, as compared to a monthly average of Kshs 160.9 bn in the first seven months to January 2021. Cumulatively, tax revenues amounted to Kshs 1,126.4 bn, equivalent to 66.0% of the original estimates of Kshs 1,707.4 bn and 99.0% of the prorated estimates of Kshs 1,138.3 bn. For more information, see our Cytonn Weekly #11/2022, and,

- Fitch Ratings affirmed Kenya’s Long-Term Foreign- Currency Issuer Default Rating (IDR) at ‘B+’ with a Negative Outlook, unchanged from the previous review in March 2021. The B+ rating was on the back of the strong economic growth, with Kenya’s economy having recorded a 9.9% growth in Q3’2021, up from a 2.1% contraction recorded in a similar period in 2020, coupled with the continued macroeconomic stability. Fitch Ratings estimates Kenya’s real GDP growth to come in at 6.5% in 2021 and to slow down to 6.0% in 2022, due to downsides posed by the upcoming August general elections. Below is a summary of the credit ratings on Kenya released in the last two years:

|

Rating Agency |

Previous Rating |

Current Rating |

Current Outlook |

Date Released |

|

Fitch Ratings |

B+ |

B+ |

Negative |

22nd March 2022 |

|

S&P Global |

B+ |

B |

Stable |

5th March 2021 |

|

Moody’s |

B1 |

B2 |

Negative |

19th June 2020 |

For more information, see our Cytonn Weekly #12/2022.

Going forward, we expect Kenya’s economy to record a gradual recovery in 2022, growing at a rate of 4.9%, from the 5.6% estimated growth recorded in 2021. However, we foresee the emergence of new COVID-19 variants, rising global fuel prices, erratic weather conditions coupled with the high debt appetite to slow down the recovery.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the first quarter of 2022, T-bills were slightly oversubscribed, with the overall subscription rate coming in at 101.5%, up from 69.1% in Q4’2021. The oversubscription was partly attributable to the improvement in liquidity in the money market during the quarter, which saw the average interbank rate decline to 4.7%, from 5.1% in Q4’2021. Overall subscriptions for the 91-day paper declined to 89.0% from 103.9% in Q4’2021 while that of the 182-day and 364-day papers increased to 80.9% and 127.1% in Q1’2022, from 59.0% and 65.3% in Q4’2021, respectively. Investors’ interest remained skewed towards the longer 364-day paper mainly due to its higher yield averaging 9.6% in comparison to the 8.1% and 7.3% average yield offered by the 182-day and 91-day papers, respectively. Yields on all the papers were on an upward trajectory with the average yields on the 364-day, 182-day and the 91-day papers increasing to 9.6%, 8.1% and 7.3%, from 8.7%, 7.7% and 7.1%, respectively recorded in Q4’2021. The acceptance rate for the quarter increased to 93.5% from 91.0% in Q4’2021, with the government accepting a total of Kshs 272.8 bn of the Kshs 292.2 bn worth of bids received during the quarter.

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 29.7%, down from the 55.8% recorded last week, partly attributable to the tightened liquidity in the market, with the average interbank rate coming in at 4.6%, from 4.3% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 1.5 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 38.1%, a decline from the 58.0% recorded the previous week. The subscription rate for the 182-day and 364-day papers declined to 31.3% and 24.7%, respectively, from 38.4% and 72.2%, recorded the previous week. The yields on the government papers recorded mixed performance with yields on the 182-day and 91-day papers increasing by 3.0 bps and 1.9 bps, to 8.2% and 7.3%, respectively while the yield on the 364-day paper declined by 1.5 bps to 9.8%. The government accepted bids worth Kshs 7.10 bn, out of the Kshs 7.13 bn worth of bids received, translating to an acceptance rate of 99.7%, reflecting the government’s debt appetite.

Primary T-bond auctions in Q1’2022:

In Q1’2022, the government issued seven Treasury bonds and re-opened three of them on tap sale, seeking to raise Kshs 216.5 bn. The bonds were generally oversubscribed, receiving bids worth Kshs 264.9 bn against the offered Kshs 216.5 bn, translating to a subscription rate of 122.4%. The government was keen on maintaining low rates and thus accepted only Kshs 203.3 bn of the Kshs 264.9 bn worth of bids received, translating to an acceptance rate of 76.7%. The table below provides more details on the bonds issued during the quarter:

|

No. |

Issue Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount offered (Kshs bn) |

Actual Amount Raised (Kshs bn) |

Total bids received |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

1 |

1/10/2022 |

FXD1/2020/005 |

3.4 |

11.7% |

30.0 |

27.4 |

28.4 |

13.0% |

94.6% |

96.6% |

|

2 |

1/24/2022 |

FXD2/2018/10 |

7.0 |

12.5% |

30.0 |

34.9 |

38.4 |

12.7% |

128.0% |

90.9% |

|

3 |

FXD1/2021/20 |

19.7 |

13.4% |

13.8% |

||||||

|

4 |

2/21/2022 |

IFB1/2022/019 |

19.0 |

13.0% |

75.0 |

98.6 |

132.3 |

13.0% |

176.3% |

74.6% |

|

5 |

3/14/2022 |

FXD1/2021/05 |

4.7 |

11.3% |

50.0 |

18.5 |

40.9 |

12.0% |

81.9% |

45.1% |

|

6 |

FXD1/2020/15 |

12.9 |

12.8% |

13.7% |

||||||

|

7 |

FXD1/2021/25 |

24.2 |

13.9% |

14.0% |

||||||

|

8 |

3/18/2022 |

FXD1/2021/05 (Tap-sale) |

4.7 |

11.3% |

31.5 |

23.9 |

24.9 |

12.0% |

79.0% |

95.9% |

|

9 |

FXD1/2020/15 (Tap-sale) |

12.9 |

12.8% |

13.7% |

||||||

|

10 |

FXD1/2021/25 (Tap-sale) |

24.2 |

13.9% |

14.0% |

||||||

|

Q1'2022 Total |

|

|

216.5 |

203.3 |

264.9 |

|

122.4% |

76.7% |

||

|

Q1'2022 Average |

|

12.6% |

43.3 |

40.7 |

53.0 |

13.2% |

112.0% |

80.6% |

||

|

Q4'2021 Average |

|

12.5% |

50.00 |

22.7 |

25.8 |

12.8% |

121.2% |

89.1% |

||

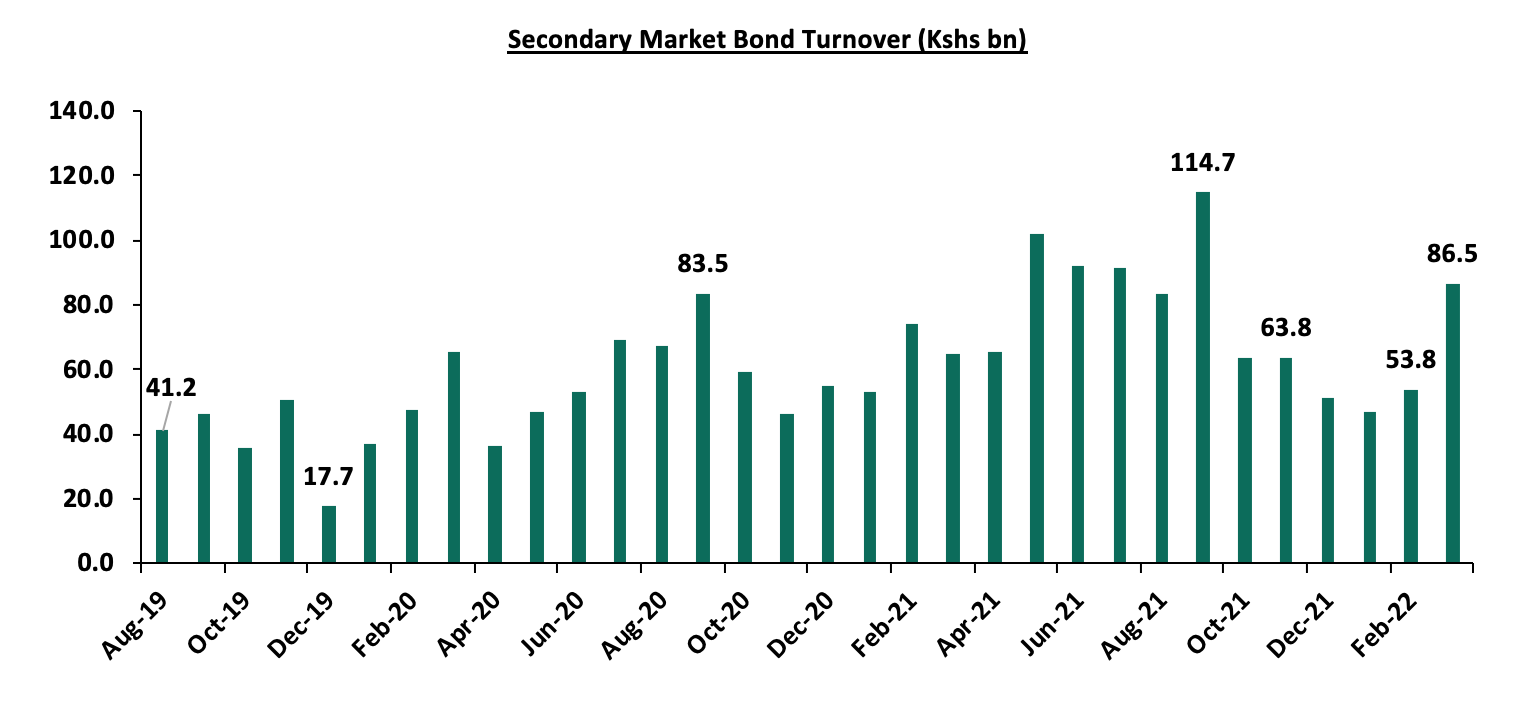

Secondary Bond Market Activity:

- Bond Turnover

In the secondary bond market there was increased activity, with the turnover increasing by 4.6% to Kshs 187.1 bn, from Kshs 178.9 bn in Q4’2021, partially attributable to the high liquidity and increased allocation to treasury bonds by local institutional investors as they sought for higher and relatively lower risk yields in the market.

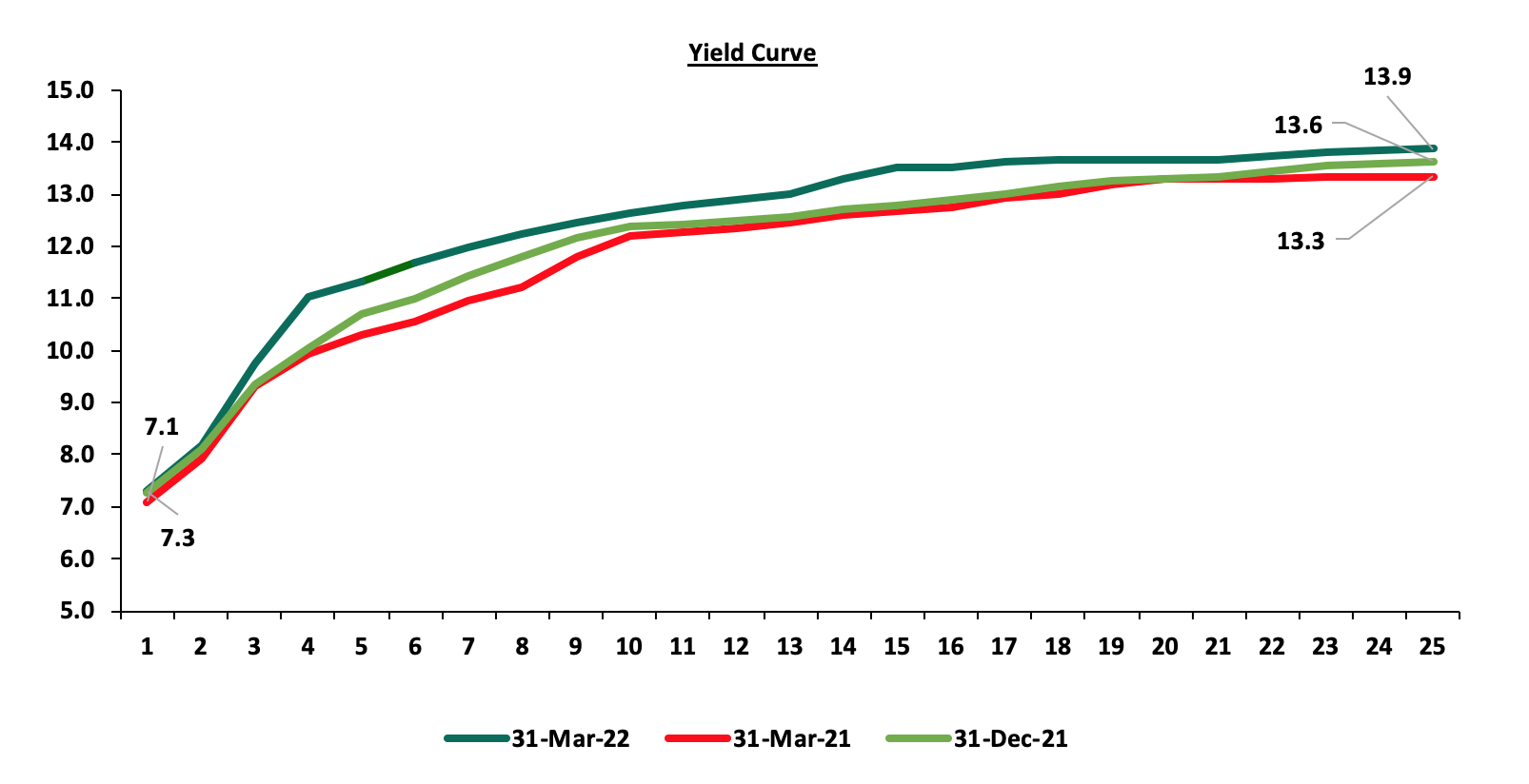

- Yield Curve

The yields on government securities in the secondary market were on an upward trajectory during the quarter, which saw the FTSE bond index decline by 1.1% to close at Kshs 95.0, from Kshs 96.1 recorded in Q4’2021. We expect the rise in the yield curve to be sustained in the coming quarter, mainly driven by increased borrowing appetite by the government as the fiscal year approaches the end coupled with investors’ hunt for higher yields. The chart below shows the yield curve movement in Q1’2022:

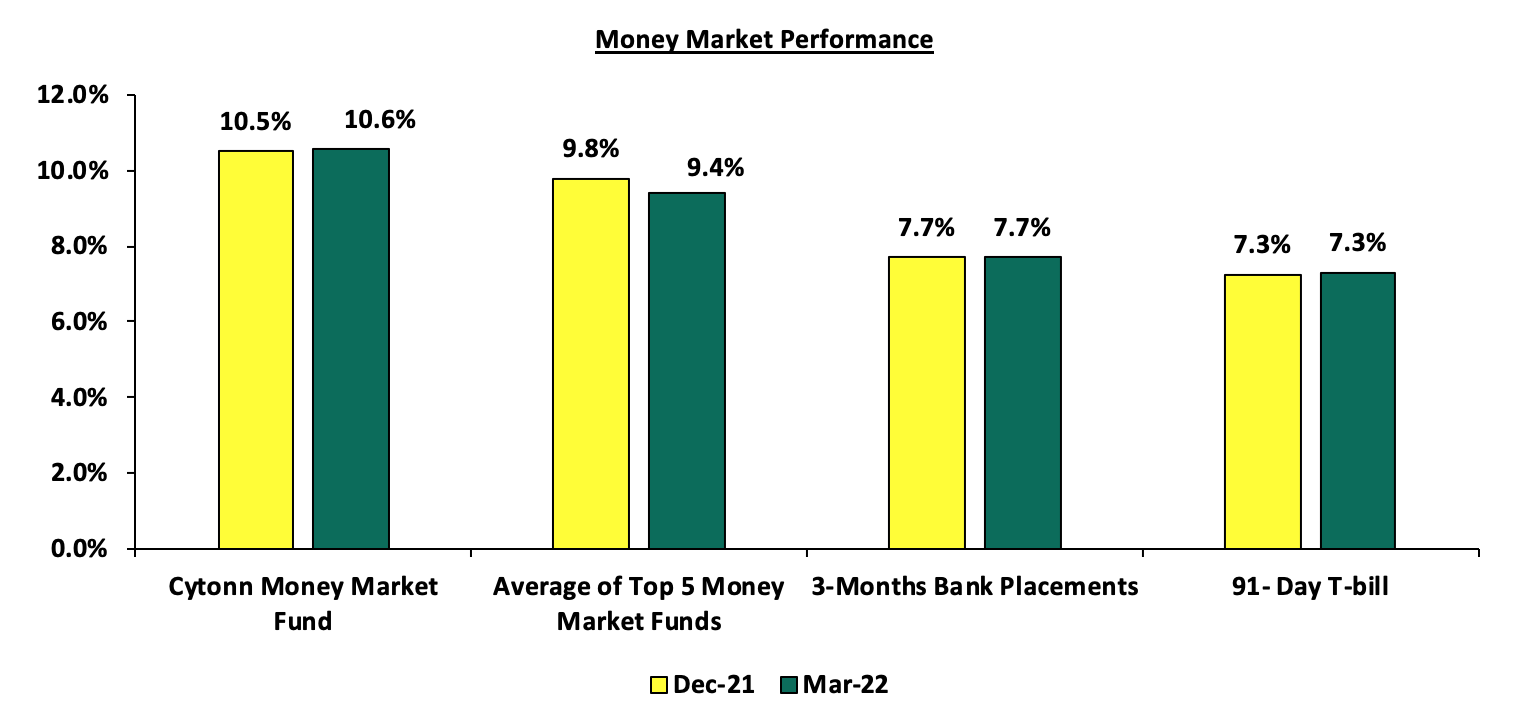

Money Market Performance

In the money markets, 3-month bank placements during the quarter, at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased marginally by 1.9 bps to close the quarter at 7.3%. The average yield of the Top 5 Money Market Funds declined by 0.4% points to close at 9.4%, from 9.8%, recorded the previous week while the yield on the Cytonn Money Market Fund increased by 0.1% points to 10.6%, from 10.5% recorded in December 2021. The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 1st April 2022:

|

Money Market Fund Yield for Fund Managers as published on 1st April 2022 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.5% |

|

2 |

Zimele Money Market Fund |

9.9% |

|

3 |

Sanlam Money Market Fund |

9.8% |

|

4 |

Nabo Africa Money Market Fund |

9.7% |

|

5 |

Madison Money Market Fund |

9.6% |

|

6 |

Apollo Money Market Fund |

9.3% |

|

7 |

Dry Associates Money Market Fund |

9.2% |

|

8 |

CIC Money Market Fund |

9.0% |

|

9 |

GenCap Hela Imara Money Market Fund |

8.7% |

|

10 |

Co-op Money Market Fund |

8.5% |

|

11 |

Orient Kasha Money Market Fund |

8.4% |

|

12 |

NCBA Money Market Fund |

8.4% |

|

13 |

ICEA Lion Money Market Fund |

8.4% |

|

14 |

British-American Money Market Fund |

8.0% |

|

15 |

Old Mutual Money Market Fund |

7.4% |

|

16 |

AA Kenya Shillings Fund |

6.3% |

Liquidity:

In Q1’2022, liquidity in the money market eased, as evidenced by the decline in the interbank rate to 4.7%, from 5.1% the previous quarter, partly attributable to government payments which offset tax remittances. Additionally, the average volumes traded in the interbank market increased by 19.6% to Kshs 12.6 bn, from Kshs 10.6 bn recorded in Q4’2021.

During the week, liquidity tightened with the average interbank rate increasing to 4.6%, from 4.3% recorded the previous week attributable to tax remittances which offset government payments as it met its end of month tax obligations. Additionally, there was a 22.4% increase in the average volumes traded in the interbank market to Kshs 13.3 bn, from Kshs 10.9 bn the previous week.

Kenya Eurobonds:

In Q1’2022, Eurobonds were on an upward trajectory attributable to reduced investor sentiment partly due to the rising geopolitical tension between Russia and Ukraine, with investors preferring safer havens and partly attributable to the affirmation of a negative outlook for Kenya’s economy by Fitch Ratings. Additionally, the United States Federal Reserve’s interest rate hike in March, saw capital outflows from emerging markets as investors shifted to the United States Bonds market.

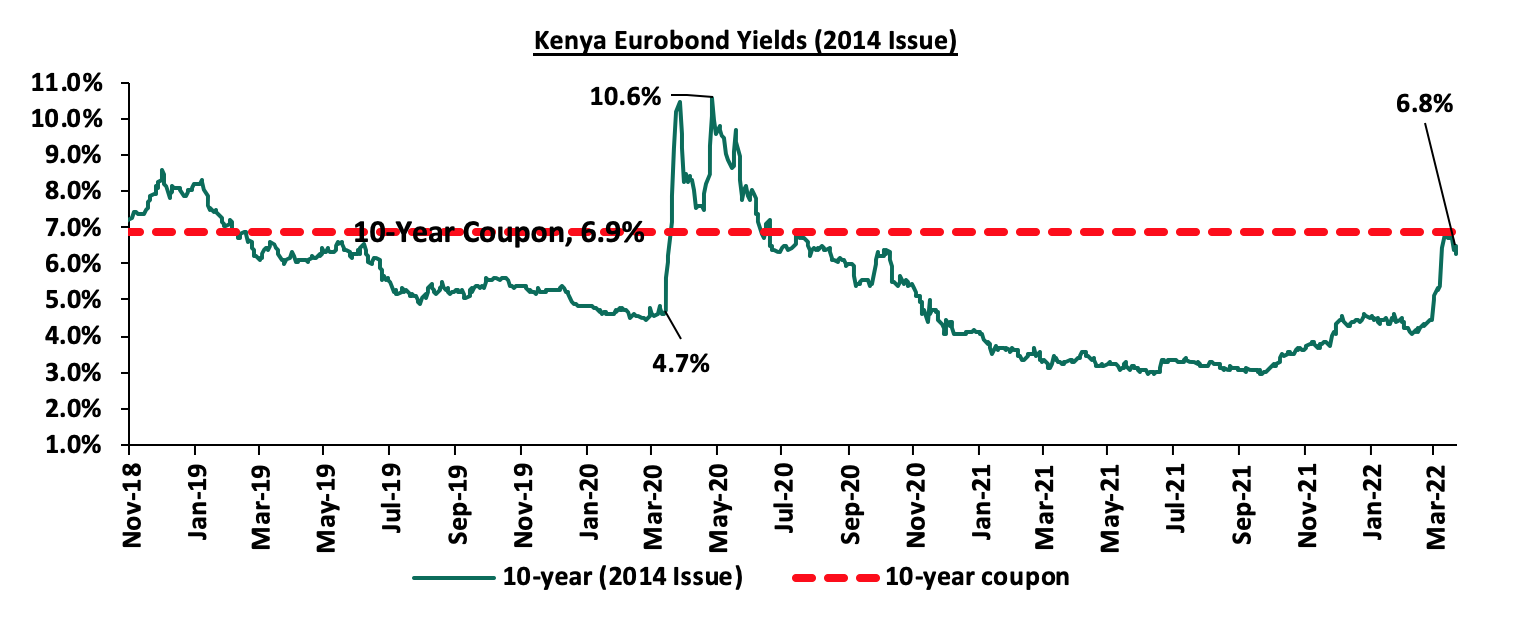

During the quarter, the yield on the 10-year Eurobond issued in 2014, increased by 2.3% points to close at 6.8%, from 4.5% recorded in Q4’2021. During the week, the yield on the 10-year Eurobond issued in 2014 decreased by 0.4% points to 6.8%, from 7.2% recorded last week.

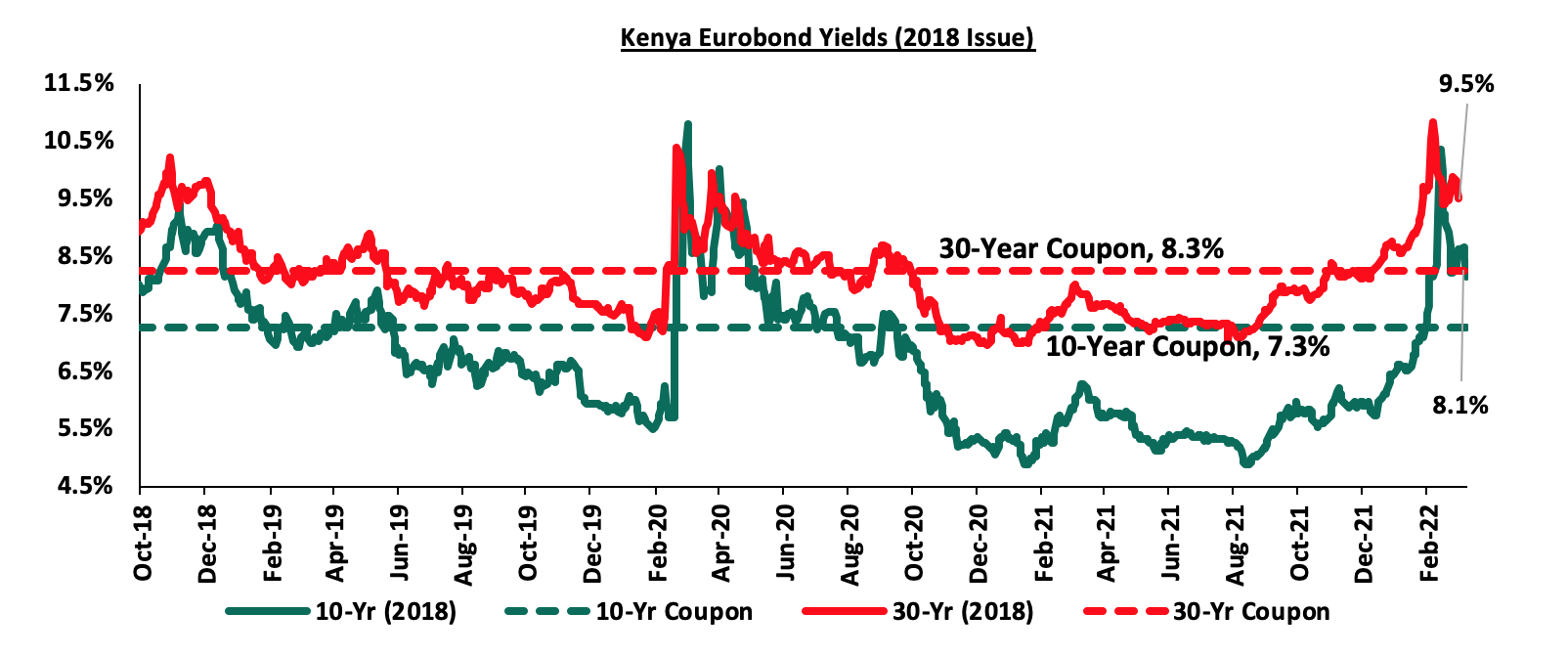

During the Quarter, the yield on the 10-year and 30-year Eurobonds issued in 2018 increased by 2.3% points and 1.4% points to close at 8.1% and 9.5%, from 5.8% and 8.1%. During the week, the yield on the 10-year and 30-year Eurobonds issued in 2018 declined by 0.5% points and 0.4% points to 8.1% and 9.5%, from 8.6% and 9.9%, respectively, recorded last week.

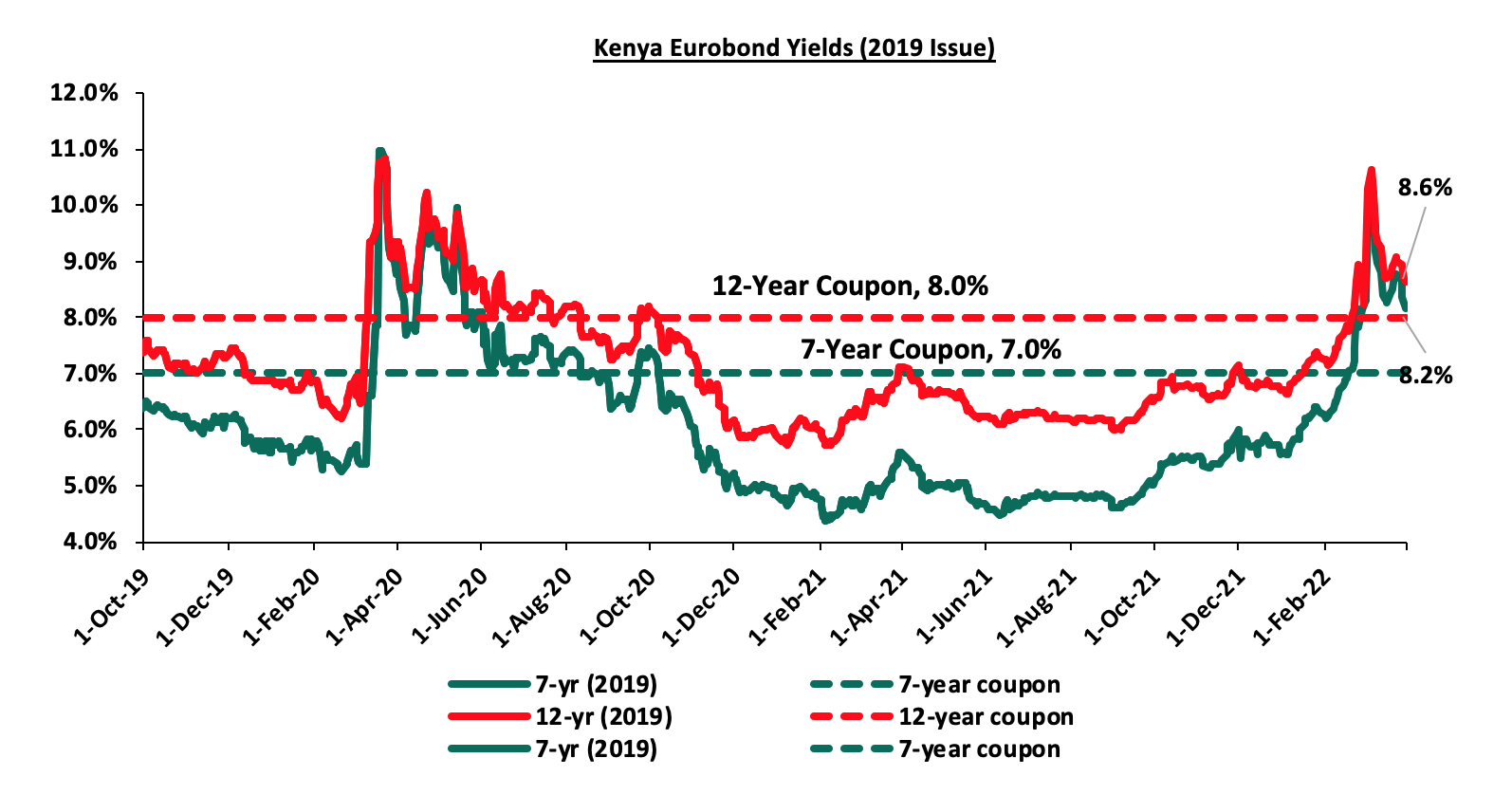

During the Quarter, the yield on the 7-year and 12-year Eurobonds issued in 2019, increased by 2.6% points and 1.9% points to close at 8.2% and 8.6%, from 5.6% and 6.7% at the end of Q4’2021. During the week, the yield on the 7-year and the 12-year Eurobonds issued in 2019 declined by 0.5% points and 0.4% points to 8.2% and 8.6% from 8.7% and 9.0%, respectively, as was recorded the previous week.

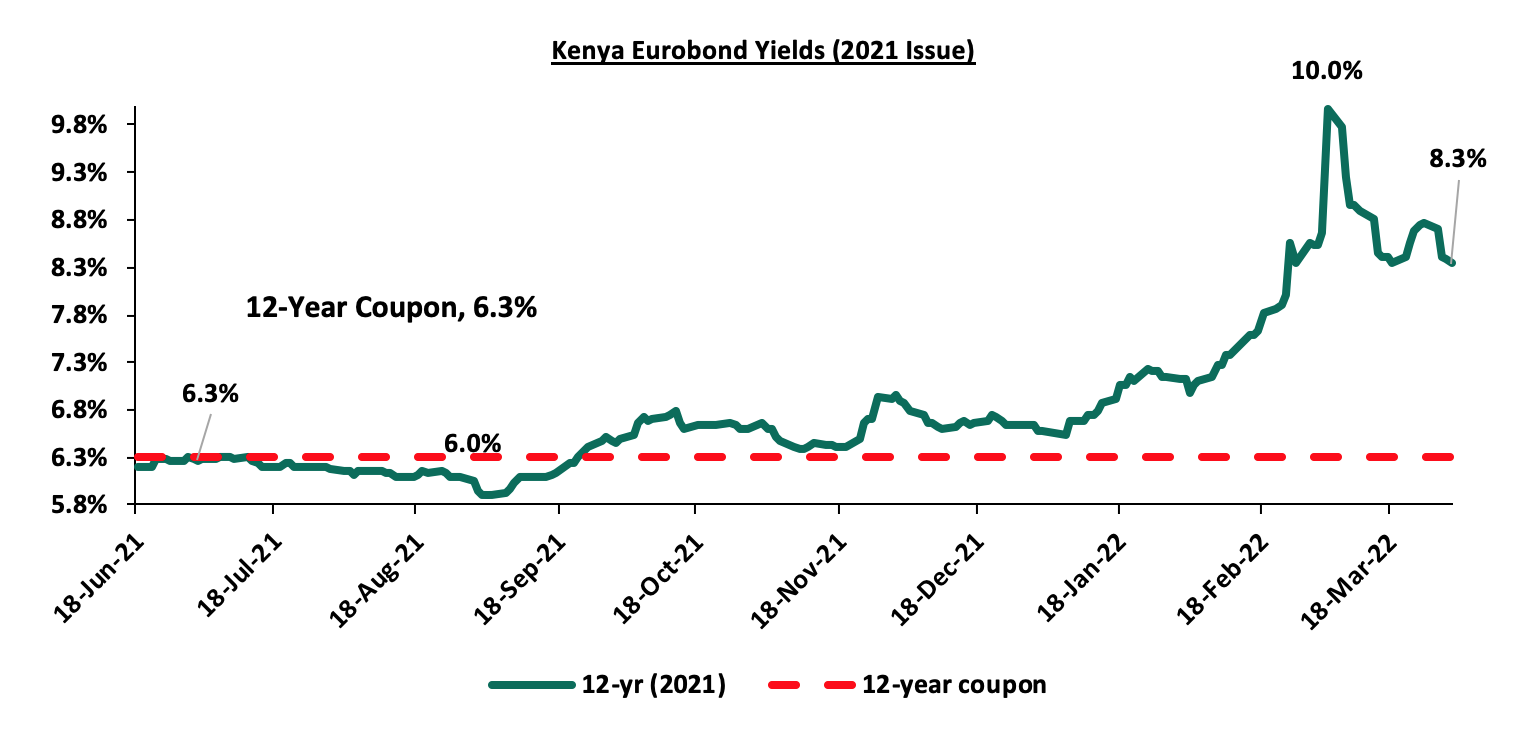

During the Quarter, the yield on the 12-year Eurobond issued in 2021 increased by 1.7% points to close at 8.3%, from 6.6% in Q4’2021. During the week, the yield on the 12-year Eurobond issued in 2021 declined by 0.5% points to 8.3%, from 8.8% recorded last week.

Rates in the Fixed Income market have remained stable due to the relatively ample liquidity in the money market. The government is 4.5% ahead of its prorated borrowing target of Kshs 508.9 bn having borrowed Kshs 531.7 bn of the Kshs 661.6 bn borrowing target for the FY’2021/2022. We expect a gradual economic recovery as evidenced by the revenue collections of Kshs 1.2 tn during the first eight months of the current fiscal year, which was equivalent to 100.8% of the prorated revenue collection target. However, despite the projected high budget deficit of 11.4% and the affirmation of the `B+’ rating with negative outlook by Fitch Ratings, we believe that the support from the IMF and World Bank will mean that the interest rate environment will remain stable since the government is not desperate for cash. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During Q1’2022, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 6.4%, 2.9% and 4.8%, respectively, taking their YTD performance as at the end of March to losses of 6.8%, 3.5% and 5.1% for NASI, NSE 25 and NSE 20 respectively. The equities market performance during the quarter was driven by losses recorded by large caps such as Safaricom, EABL, Bamburi and Equity Group of 10.0%, 9.1%, 5.9% and 4.3%, respectively. The losses were however mitigated by gains recorded by stocks such as BAT, Standard Chartered Bank (SCBK), ABSA and NCBA Group of 12.4%, 12.1%, 5.1% and 2.6%, respectively.

Equities turnover declined by 24.8% during the quarter to USD 244.0 mn, from USD 324.2 mn in Q4’2021. Foreign investors remained net sellers during the quarter, with a net selling position of USD 14.8 mn, from a net selling position of USD 72.9 recorded in Q4’2020.

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 2.7%, 0.9% and 2.3%, respectively, driven by losses recorded by Equity Group, Safaricom, Co-operative Bank and ABSA of 4.6%, 4.0%, 2.3% and 2.0%, respectively. The losses were however mitigated by gains recorded by stocks such as Diamond Trust Bank (DTB-K) and Bamburi of 3.1% and 1.1%, respectively.

During the week, equities turnover declined by 16.3% to USD 17.0 mn from USD 20.2 mn recorded the previous week, taking the YTD turnover to USD 248.2 mn. During the week, foreign investors remained net sellers, with a net selling position of USD 3.0 mn, from a net selling position of USD 0.9 mn recorded the previous week, taking the YTD net selling position to 14.8 mn.

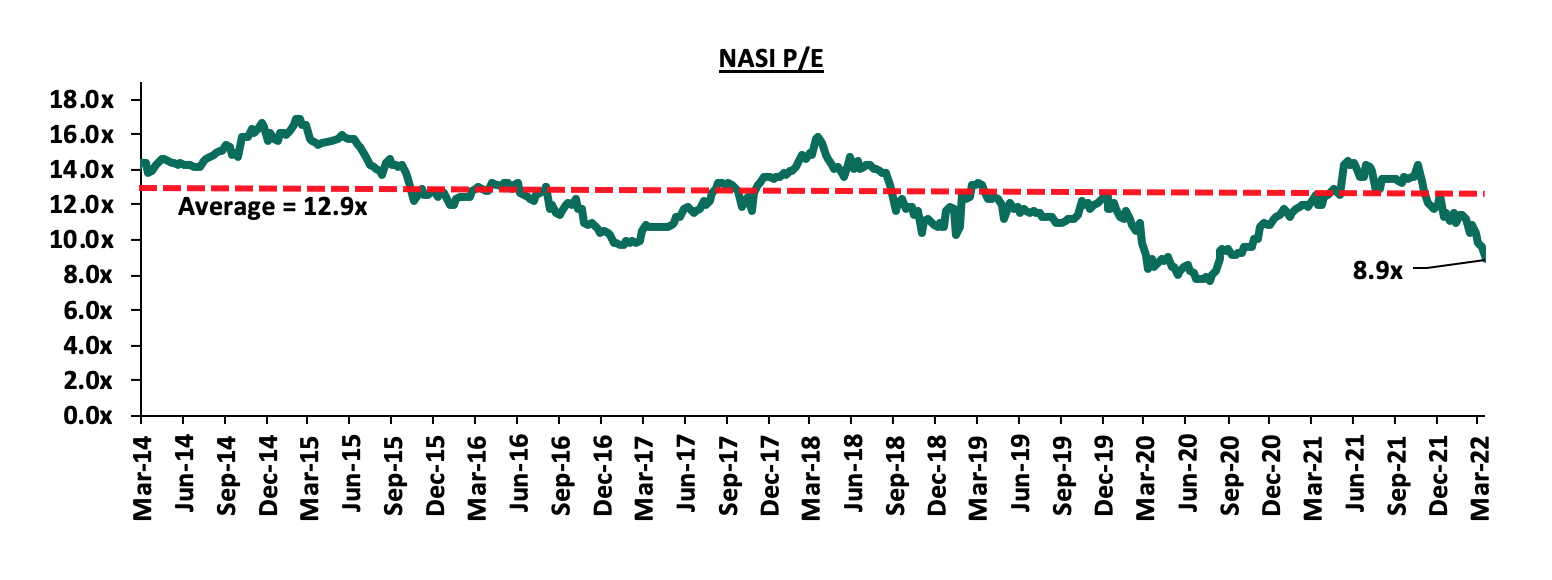

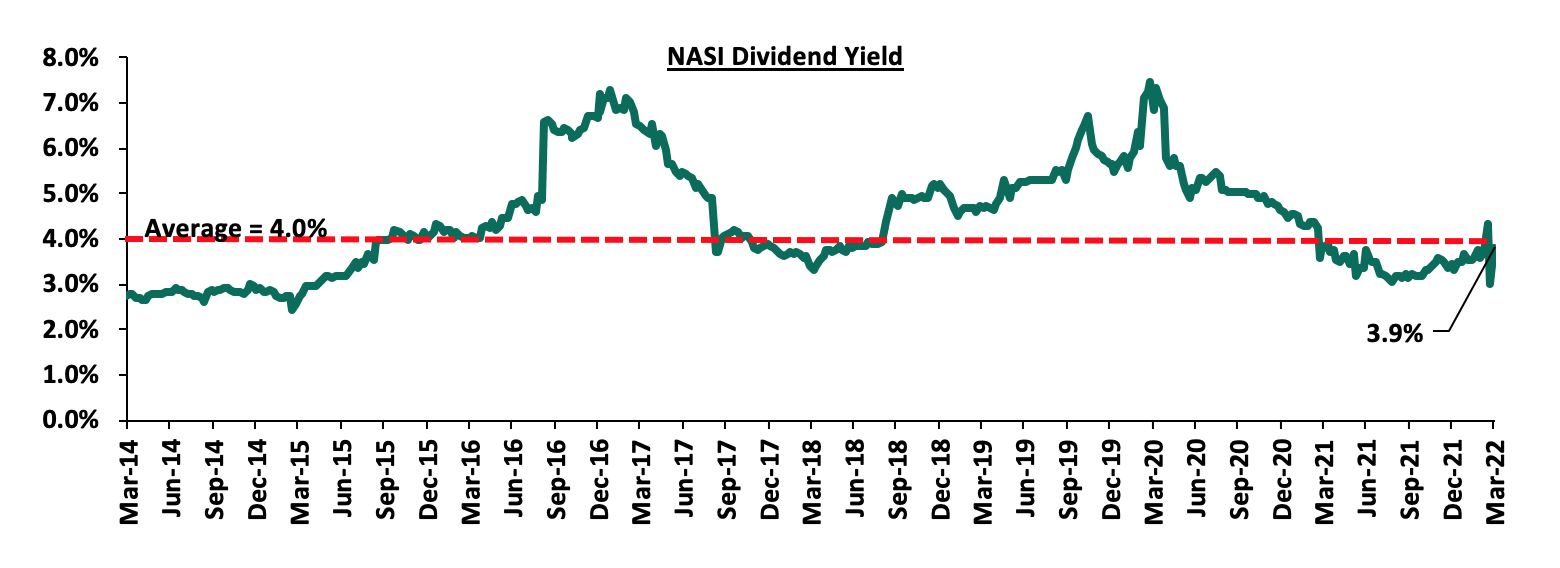

The market is currently trading at a price to earnings ratio (P/E) of 8.9x, 30.9% below the historical average of 12.9x, and a dividend yield of 3.8%, 0.2% points below the historical average of 4.0%. Notably, this week’s P/E is the lowest it has been since August 2020. Key to note, NASI’s PEG ratio currently stands at 1.1x, an indication that the market is trading at a premium to its future earnings growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The current P/E valuation of 8.9x is 15.6% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Earnings Releases:

- Asset Quality

The table below is a summary of the asset quality for the banks that have released

|

|

FY'2020 NPL Ratio** |

FY'2021 NPL Ratio* |

% point change in NPL Ratio |

FY'2020 NPL Coverage** |

FY'2021 NPL Coverage* |

% point change in NPL Coverage |

|

ABSA Bank Kenya |

7.7% |

7.9% |

0.2% |

71.1% |

77.7% |

6.6% |

|

KCB |

14.8% |

16.6% |

1.8% |

59.8% |

52.9% |

(6.9%) |

|

Equity Group |

11.5% |

8.6% |

(2.9%) |

62.4% |

68.7% |

6.3% |

|

NCBA Group |

14.7% |

16.0% |

1.3% |

60.9% |

73.6% |

12.7% |

|

Standard Chartered Bank Kenya |

16.0% |

16.0% |

(0.0%) |

80.6% |

84.4% |

3.8% |

|

Stanbic Bank |

11.8% |

9.3% |

(2.5%) |

60.6% |

51.8% |

(8.8%) |

|

I&M Holdings |

11.6% |

9.5% |

(2.1%) |

66.8% |

71.4% |

4.6% |

|

Diamond Trust Bank |

11.9% |

12.9% |

1.0% |

40.0% |

41.8% |

1.8% |

|

Co-operative Bank of Kenya |

18.7% |

14.6% |

(4.1%) |

50.3% |

60.6% |

10.3% |

|

HF Group |

24.6% |

21.1% |

(3.5%) |

63.4% |

73.6% |

10.2% |

|

Mkt Weighted Average |

13.3% |

12.2% |

(1.1%) |

62.3% |

65.3% |

3.0% |

|

*Market cap weighted as at 01/04/2022 |

||||||

|

**Market cap weighted as at 15/04/2021 |

||||||

Key take-outs from the table include;

- Asset quality for the listed banks that have released their FY’2021 results improved during the period, with the weighted average NPL ratio declining by 1.1% points to a market cap weighted average of 12.2%, from an average of 13.3% for the listed banking sector in FY’2020. The improvement in asset quality is attributable to declining credit risk on the back of increased business activities in 2021 driven by the gradual economic recovery,

- NPL Coverage for the listed banks increased to a market cap weighted average of 65.3% in FY’2021, from 62.3% recorded in FY’2020, as the banks increased their provisioning levels to proactively manage risks brought about by the emergence of new COVID-19 variants coupled with the slow recovery of some sectors such as tourism and hospitality and,

- KCB Group recorded a decline in their NPL coverage despite the NPL ratio rising, which would suggest modest provisioning. Given the slow recovery in some sectors locally and the high NPL ratios in some of the group’s subsidiaries, we expected the group to maintain the high provisioning to cater for the existing credit risk. Key to note, if KCB’s NPL Coverage remained at the 59.8% level recorded in 2020, the bank would have had an additional provisioning of Kshs 8.4 bn, which would have reduced the earnings per share from the reported Kshs 10.6 to Kshs 8.6.

- Summary Performance

The table below highlights the performance of the banks that have released so far, showing the performance using several metrics, and the key take-outs of the performance;

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

ABSA |

161.2% |

1.9% |

15.9% |

8.0% |

7.1% |

4.7% |

31.6% |

11.6% |

5.9% |

5.2% |

87.2% |

12.20% |

21.1% |

|

NCBA |

123.7% |

5.1% |

3.9% |

6.1% |

5.9% |

5.6% |

45.0% |

2.5% |

11.5% |

20.9% |

51.9% |

(1.8%) |

13.6% |

|

Equity |

99.4% |

27.9% |

37.2% |

24.8% |

6.8% |

15.8% |

39.3% |

29.4% |

29.5% |

30.0% |

61.3% |

23.0% |

26.6% |

|

KCB |

74.3% |

15.1% |

17.6% |

14.4% |

8.4% |

8.8% |

28.0% |

9.0% |

9.1% |

29.7% |

80.7% |

13.5% |

21.8% |

|

SCBK |

66.2% |

(6.1%) |

(24.7%) |

(1.6%) |

6.4% |

24.9% |

35.5% |

19.9% |

3.5% |

(4.2%) |

47.5% |

3.7% |

17.4% |

|

HF Group |

65.1% |

(8.0%) |

(12.7%) |

(2.1%) |

4.2% |

3.6% |

22.8% |

21.2% |

(5.6%) |

7.8% |

92.0% |

6.2% |

(7.2%) |

|

COOP |

53.0% |

13.9% |

17.0% |

12.9% |

8.0% |

11.0% |

32.1% |

18.1% |

7.7% |

13.7% |

76.1% |

8.2% |

17.3% |

|

Stanbic |

43.2% |

1.6% |

15.2% |

12.2% |

6.2% |

4.2% |

42.6% |

(8.5%) |

(5.8%) |

(17.4%) |

83.0% |

11.2% |

14.0% |

|

DTB |

25.1% |

9.1% |

6.9% |

10.6% |

5.1% |

3.0% |

24.0% |

10.8% |

11.2% |

11.9% |

66.5% |

5.7% |

6.8% |

|

I&M |

0.7% |

18.8% |

(0.4%) |

33.8% |

6.3% |

1.1% |

29.0% |

16.9% |

13.0% |

23.4% |

71.0% |

12.4% |

12.2% |

|

FY'21 Mkt Weighted Average* |

83.2% |

14.0% |

17.1% |

15.4% |

7.1% |

10.9% |

34.6% |

15.9% |

13.4% |

18.4% |

70.1% |

13.2% |

20.3% |

|

FY'20 Mkt Weighted Average** |

(26.8%) |

16.7% |

12.5% |

18.9% |

7.3% |

6.4% |

35.4% |

(2.1%) |

22.3% |

26.3% |

69.8% |

11.7% |

13.2% |

|

*Market cap weighted as at 01/04/2022 |

|||||||||||||

|

**Market cap weighted as at 15/04/2021 |

|||||||||||||

Key takeaways from the table above include:

- The listed banks that have released recorded an 83.2% weighted average growth in core Earnings per Share (EPS), compared to a weighted average decline of 26.8% in FY’2020 for the listed banking sector. The performance is however largely skewed by the strong performance from ABSA Bank and NCBA whose core EPS grew by 161.2% and 123.7%, respectively,

- The Banks have recorded a weighted average deposit growth of 13.4%, slower than the 22.3% growth recorded in FY’2020,

- Interest expense grew at a faster pace, by 17.4%, compared to the 12.5% growth in FY’2020. On the other hand, cost of funds declined, coming in at a weighted average of 2.8% in FY’2021, from 2.9% in FY’2020, owing to the faster growth in average interest-bearing liabilities, an indication that the listed banks were able to mobilize cheaper deposits,

- Average loan growth came in at 13.2%, 1.5% points lower than the 11.7% growth recorded in FY’2020. Additionally, the loan growth was lower than the 18.4% growth in government securities, an indication that banks shied away from lending due to uncertainties surrounding the emergence of new COVID-19 variants coupled with the slow recovery of some sectors such as tourism and hospitality,

- Interest income grew by 14.0%, compared to a growth of 16.7% recorded in FY’2020 while the weighted average Yield on Interest Earning Assets (YIEA) increased to 9.7%, from the 9.5% recorded in FY’2020 for the listed banking sector, an indication of the increased allocation to higher-yielding assets by the sector during the period. Net Interest Margin (NIM) now stands at 7.1%, 0.2% points lower than the 7.3% recorded in FY’2020 for the whole listed banking sector, and,

- Non-Funded Income grew by 10.9%, compared to the 6.4% growth recorded in FY’2020. This can be attributable to the faster growth in the fees and commission which grew by 11.0% compared to a decline of 2.1% in FY’2020, following the expiry of the waiver on fees on mobile transactions.

For the various earnings notes of the various companies, click these links:

- Stanbic Holdings FY’2021 Earnings Note;

- KCB Group FY’2021 Earnings Note;

- Cooperative Bank FY’2021 Earnings Note;

- ABSA Bank Kenya FY’2021 Earnings Note;

- Standard Chartered Bank Kenya FY’2021 Earnings Note;

- Equity Group FY’2021 Earnings Note;

- NCBA Group FY’2021 Earnings Note;

- HF Group FY’2021 Earnings Note;

- Diamond Trust Bank Kenya (DTB-K) FY’2021 Earnings Note;

- I&M Holdings FY’2021 Earnings Note;

Quarterly Highlights:

During the quarter;

- The International Finance Corporation (IFC) disclosed that it would disburse USD 165.0 mn (Kshs 18.6 bn) to Equity Bank Kenya Limited in form of a 7-year Tier 2 subordinated loan. This amount is expected to be used to shore up the Bank’s Tier 2 capital and for onward lending to climate smart projects and Small and Medium Enterprises (SMEs) in Kenya. For more information, please see our Cytonn Weekly #01/2022,

- Equity Group Holdings (EGH), announced the completion of the incorporation of a subsidiary, Equity Group Insurance Holdings Limited, a non-operating insurance holding company and issuance of a life insurance license to Equity Life Assurance Kenya (ELAK) Limited. ELAK, which is fully owned by Equity Group Insurance Holdings Limited, will conduct and undertake long-term insurance business in Kenya. This came after EGH obtained the prerequisite approvals from its shareholders and the Central Bank of Kenya (CBK), before subsequent registration and licensing from the Insurance Regulatory Authority (IRA) on 10th January 2022. For more information, please see our Cytonn Weekly #02/2022,

- The Central Bank of Kenya (CBK) recently released the Quarterly Economic Review for the period ending 30th September 2021, highlighting that the banking sector’s total assets increased by 10.6% to Kshs 5.8 tn, from Kshs 5.3 tn in September 2020. The sector’s Profit before Tax (PBT) increased by 68.2% to Kshs 49.1 bn, from Kshs 29.2 bn recorded in September 2020. For more information, please see our Cytonn Weekly #04/2022

- Moody’s Rating Agency rated the Kenyan banking sector as stable following the banks’ impressive performance in the eleven months to November 2021, with the profits before tax coming in at Kshs 178.8 bn exceeding the pre-pandemic earnings of Kshs 150.1 bn over the same period in 2019. The gradual economic recovery is expected to support banks in improving their loan quality and profitability, while capital, funding, and liquidity will remain strong, in line with our Q3’2021 Banking Sector report. For more information, please see our Cytonn Weekly #06/2022,

- Standard Africa Holdings Limited (SAHL), the majority shareholder in Stanbic Holdings, announced that it had received regulatory approval from the Capital Markets Authority for further extension to acquire increased stake of up to 75.0% in Stanbic Holdings. This comes after SAHL had received an exemption from making a full take-over under the Capital Markets (Take over and Mergers) Regulations, 2002 in July 2018. Under the exemption, SAHL aims to bring its total shareholding to up to 75.0% of Stanbic Holdings’ ordinary shares, from 72.3% as of 31st December 2021. For more information, please see our Cytonn Weekly #07/2022,

- The Central Bank of Kenya (CBK), released the Commercial Banks’ Credit Survey Report for the quarter ended December 2021. The quarterly Credit Officer Survey is undertaken by the CBK to identify the potential drivers of credit risk in the banking sector. During the quarter, 38 operating commercial banks and 1 mortgage finance company participated in the Commercial Banks Credit Officer Survey. The report highlights that the banking sector’s loan book recorded an 8.3% y/y growth, with gross loans increasing to Kshs 3.3 tn in December 2021, from Kshs 3.0 tn in December 2020. For more information, kindly see our Cytonn Weekly #10/2022,

- The Central Bank of Kenya (CBK) released the Quarterly Economic Review Report October-December 2021, highlighting that the sector’s total assets increased by 10.8% to Kshs 6.0 tn in December 2021, from Kshs 5.4 tn in December 2020 and Profit before Tax (PBT) increased by 0.4% to Kshs 49.3 bn, from Kshs 49.1 bn in Q4’2020. For more information, kindly see our Cytonn Weekly #12/2022, and,

- The Insurance Regulatory Authority of Kenya (IRA) released the Quarterly Insurance Industry Report for the period ended 31st December highlighting that the industry’s gross premiums rose by 18.5% to Kshs 276.1 bn, from Kshs 233.0 bn recorded in Q4’2020, with the general insurance business contributing 55.2% of the industry’s premium income, a 1.0% point decline from the 56.2% contribution witnessed in Q4’2020. For more information, kindly see our Cytonn Weekly #12/2022.

Cytonn Coverage:

|

Company |

Price as at 25/03/2022 |

Price as at 1/04/2022 |

w/w change |

q/q change |

YTD Change |

Year Open 2022 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

2.3 |

2.2 |

(1.8%) |

(2.2%) |

(3.5%) |

2.3 |

3.2 |

4.5% |

48.4% |

0.2x |

Buy |

|

Jubilee Holdings |

274.0 |

274.8 |

0.3% |

(14.1%) |

(13.3%) |

316.8 |

381.7 |

5.1% |

44.0% |

0.5x |

Buy |

|

Liberty Holdings |

6.3 |

5.7 |

(8.9%) |

(15.4%) |

(19.3%) |

7.1 |

7.7 |

0.0% |

34.4% |

0.4x |

Buy |

|

I&M Group*** |

21.2 |

20.5 |

(3.3%) |

(0.9%) |

(4.2%) |

21.4 |

24.4 |

7.3% |

26.2% |

0.6x |

Buy |

|

KCB Group*** |

44.0 |

44.0 |

0.0% |

(3.1%) |

(3.4%) |

45.6 |

51.4 |

6.8% |

23.5% |

0.9x |

Buy |

|

Equity Group*** |

51.5 |

49.2 |

(4.6%) |

(4.3%) |

(6.8%) |

52.8 |

56.6 |

6.1% |

21.3% |

1.3x |

Buy |

|

Britam |

6.8 |

6.7 |

(2.3%) |

(11.5%) |

(11.6%) |

7.6 |

7.9 |

0.0% |

17.9% |

1.1x |

Accumulate |

|

NCBA*** |

25.9 |

25.9 |

0.0% |

2.6% |

1.8% |

25.5 |

26.4 |

11.6% |

13.5% |

0.6x |

Accumulate |

|

Co-op Bank*** |

12.9 |

12.6 |

(2.3%) |

(0.8%) |

(3.1%) |

13.0 |

13.1 |

7.9% |

11.6% |

0.9x |

Accumulate |

|

Diamond Trust Bank*** |

57.0 |

58.8 |

3.1% |

(0.8%) |

(1.3%) |

59.5 |

61.8 |

5.1% |

10.3% |

0.3x |

Accumulate |

|

Sanlam |

11.4 |

11.0 |

(3.5%) |

(4.8%) |

(4.8%) |

11.6 |

12.1 |

0.0% |

9.6% |

1.2x |

Hold |

|

Stanbic Holdings |

102.0 |

104.8 |

2.7% |

18.1% |

20.4% |

87.0 |

105.2 |

8.6% |

9.0% |

0.9x |

Hold |

|

ABSA Bank*** |

12.4 |

12.0 |

(2.8%) |

5.1% |

2.1% |

11.8 |

11.9 |

9.2% |

8.4% |

1.2x |

Hold |

|

Standard Chartered*** |

142.0 |

143.8 |

1.2% |

12.1% |

10.6% |

130.0 |

137.7 |

9.7% |

5.5% |

1.1x |

Hold |

|

HF Group |

3.2 |

3.2 |

(2.5%) |

(19.0%) |

(17.1%) |

3.8 |

3.0 |

0.0% |

(6.2%) |

0.2x |

Sell |

|

CIC Group |

2.0 |

2.2 |

10.0% |

(2.3%) |

1.8% |

2.2 |

1.9 |

0.0% |

(14.8%) |

0.8x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

|||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.1x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the discovery of new COVID-19 variants, the upcoming Kenyan general elections and the slow vaccine rollout to continue weighing down the economic outlook. On the upside, we believe that the relaxation of COVID-19 containment measures in the country will lead to improved investor sentiments.

In Q1’2022, the Real Estate sector recorded notable activities compared to a similar period in 2021 attributable to the recovery of the Kenyan economy enabling increased Real Estate property transactions and boosting investor confidence. Some of the key factors that have continued to shape the performance of the Real Estate sector include:

- Continued focus on Affordable Housing by both the government and the private sector, for instance, the State Department of Housing and Urban Development partnered with Seascan Development Limited to construct 4,900 affordable housing units in a project dubbed Mowlem Estate in Nairobi’s Dandora area,

- Efforts by the government to provide affordable mortgages through the Kenya Mortgage Refinance Company aiming to increase home ownership. The firm rolled out a Kshs 10.5 bn Medium-Term Note (MTN) bond programme in January 2022, which recorded an oversubscription of 478.6% in the first tranche that aimed to raise Kshs 1.4 bn,

- Resumption of business operations by firms supported by the improved operating environment driving increase in office occupancies hence a better performance of the Commercial Office Sector,

- Positive demographics evidenced by Kenya’s relatively high urbanization and population growth rates of 4.0% p.a and 2.3% p.a, respectively, against the global average of 1.8% p.a and 1.0% p.a, respectively, as at 2020, driving increased demand for developments,

- Improved infrastructure opening up areas for investment such as the Nairobi Expressway, and Nairobi Western Bypass projects, among many others, and,

- Aggressive entry and expansion by local and international retailers such as Naivas, QuickMart, and Carrefour, taking up spaces previously occupied by troubled retailers such as Tuskys and Nakumatt.

However, a couple of challenges impeding performance of the sector include;

- Reduced lending to the Real Estate sector evidenced by a 3.9% decline in gross loans advanced to the Real Estate sector to Kshs 456.0 bn in FY’2021, from Kshs 439.0 bn realized in FY’2020. This is attributed to an increase in the number of Non-Performing Loans (NPLs) in the Real Estate sector by 21.6% to Kshs 74.7 bn in FY’2021 ,from Kshs 61.4 bn realized in FY’2020 according to the Central Bank of Kenya, with the increased Real Estate loan default rates being driven by the tough economic environment,

- Increase in prices of construction materials such as steel, paint, and cement which is expected to lead to slowdown in the Real Estate sector according to the Architectural Association of Kenya,

- Travel Advisories in the country which is expected to have a downturn on the performance of the Hospitality sector, such as the Travel Advisory by the United Kingdom (UK) citing heightened threat of terrorism in Kenya,

- The existing oversupply of space in some sectors e.g. 1.7 mn SQFT in the Kenyan Retail sector and 6.7mn SQFT in the Commercial Office sector,

- Shift towards e-commerce affecting demand and uptake of physical Retail spaces, and,

- Continued poor performance of the REIT market in Kenya due to lack of Knowledge and interest of the financing instrument by investors.

Despite these limitations, the Real Estate sector has registered increased activities in Q1’2022 and remains an attractive investment class. However, as 2022 is an election year, we expect a slow-down in market prices and sales volumes since investors and prospective buyers are expected to adopt a wait and see approach. The impact is expected to be temporary and the market is likely to stabilise on the back of relatively strong GDP growth at 5.2% as at Q3’2021, and an attractive demographic profile.

Market Performance:

I. Residential Sector

During Q1’2022, the residential sector recorded an improvement in performance on a YoY basis with average y/y total returns to investors coming in at 5.7%, a 0.6% points increase from 5.1% recorded in Q1’2021. However, on a q/q basis this was a 0.4% points decline from the 6.1% average total return in FY’2021. Prices in all segments saw an uptick with an overall average price appreciation of 0.9% in the residential market with the average rental yield recording a 0.2% points y/y increase to 4.8% from 4.6% recorded in Q1’2021, attributed to improvement in rental rates amid an improved economy.

|

Residential Performance Summary-Q1’2022 |

|||||||||

|

Segment |

Average of Rental Yield Q1'2022 |

Average of Price Appreciation Q1'2022 |

Total Returns Q1'2022 |

Average of Rental Yield Q1'2021 |

Average of Price Appreciation Q1'2021 |

Average of Total Returns Q1'2021 |

y/y change in Rental Yield (% Points) |

y/y change in Price Appreciation (% Points) |

y/y change in Total Returns (% Points) |

|

Detached Units |

|||||||||

|

High End |

3.9% |

1.3% |

5.2% |

3.6% |

1.0% |

4.6% |

0.3% |

0.3% |

0.6% |

|

Upper Mid-End |

4.2% |

1.1% |

5.3% |

4.5% |

0.6% |

5.0% |

(0.3%) |

0.5% |

0.3% |

|

Satellite Towns |

4.5% |

1.3% |

5.8% |

4.1% |

0.7% |

4.8% |

0.4% |

0.6% |

1.0% |

|

Detached Units Average |

4.2% |

1.2% |

5.4% |

4.1% |

0.8% |

4.8% |

0.1% |

0.4% |

0.6% |

|

Apartments |

|||||||||

|

Upper Mid-End |

5.6% |

0.5% |

6.1% |

5.2% |

0.0% |

5.2% |

0.4% |

0.5% |

0.9% |

|

Lower Mid-End |

5.2% |

0.6% |

5.8% |

5.0% |

0.2% |

5.3% |

0.2% |

0.4% |

0.5% |

|

Satellite Towns |

5.4% |

0.9% |

6.3% |

5.4% |

0.0% |

5.5% |

0.0% |

0.9% |

0.8% |

|

Apartments Average |

5.4% |

0.6% |

6.0% |

5.2% |

0.1% |

5.3% |

0.2% |

0.5% |

0.7% |

|

Residential Market Average |

4.8% |

0.9% |

5.7% |

4.6% |

0.4% |

5.1% |

0.2% |

0.5% |

0.6% |

Source: Cytonn Research 2022

A. Detached Units Performance

Detached units recorded an improvement in performance in Q1’2022 compared to Q1’2021 with average y/y returns to investors coming in at 5.4%, representing a 0.6% points y/y increase from 4.8% recorded in Q1’2021. This was attributed to investor confidence in the market, that saw transactional volumes pick amid recovery in the Real Estate market. Satellite Towns were the best performing segment with an average y/y total return of 5.8%, with Syokimau and Ngong offering the highest average y/y total returns at 6.7%. The best performing node was Redhill recording the highest average y/y total returns at 7.2%, followed by Syokimau and Ngong, and finally Athi River whose average y/y total return came in at 6.6%. Rongai and Langata recorded the lowest returns at 4.2%.

|

Detached Units Performance – Q1’2022 |

||||||||

|

Row Labels |

Average of Price per SQM Q1'2022 |

Average of Rent per SQM Q1'2022 |

Average of Occupancy Q1'2022 |

Average of Uptake Q1'2022 |

Average of Annual Uptake Q1'2022 |

Average of Rental Yield Q1'2022 |

Average of Price Appreciation Q1'2022 |

Total Returns |

|

High-End |

||||||||

|

Rosslyn |

188,415 |

819 |

85.9% |

94.4% |

13.6% |

4.7% |

1.8% |

6.5% |

|

Kitisuru |

227,272 |

736 |

92.0% |

91.2% |

12.5% |

4.2% |

1.4% |

5.6% |

|

Runda |

211,728 |

789 |

91.0% |

95.4% |

10.0% |

4.1% |

1.1% |

5.2% |

|

Karen |

185,270 |

686 |

85.3% |

88.1% |

12.3% |

3.5% |

0.8% |

4.3% |

|

Lower Kabete |

156,352 |

422 |

81.9% |

80.1% |

12.1% |

3.1% |

1.2% |

4.3% |

|

Average |

193,807 |

691 |

87.2% |

89.8% |

12.1% |

3.9% |

1.3% |

5.2% |

|

Upper Mid-End |

||||||||

|

Redhill & Sigona |

100,476 |

442 |

90.0% |

88.6% |

13.7% |

4.3% |

2.9% |

7.2% |

|

Ridgeways |

167,607 |

761 |

84.0% |

77.9% |

11.8% |

5.3% |

1.1% |

6.4% |

|

Lavington |

163,505 |

576 |

86.0% |

82.7% |

11.6% |

4.0% |

1.4% |

5.4% |

|

Loresho |

168,277 |

719 |

74.3% |

72.9% |

12.7% |

4.7% |

0.3% |

5.0% |

|

South B/C |

104,789 |

338 |

81.7% |

78.5% |

11.4% |

3.2% |

1.4% |

4.6% |

|

Runda Mumwe |

151,208 |

604 |

85.3% |

82.1% |

11.3% |

4.3% |

0.2% |

4.5% |

|

Langata |

137,432 |

282 |

88.6% |

88.9% |

10.1% |

3.5% |

0.7% |

4.2% |

|

Average |

141,899 |

532 |

84.3% |

81.7% |

11.8% |

4.2% |

1.1% |

5.3% |

|

Lower Mid-End |

||||||||

|

Syokimau/Mlolongo |

73,436 |

311 |

79.1% |

85.8% |

17.0% |

3.8% |

2.9% |

6.7% |

|

Ngong |

59,840 |

337 |

85.3% |

89.7% |

11.6% |

5.1% |

1.6% |

6.7% |

|

Athi River |

84,577 |

313 |

86.5% |

91.9% |

12.9% |

3.9% |

2.7% |

6.6% |

|

Ruiru |

65,251 |

302 |

83.8% |

71.3% |

16.0% |

5.0% |

1.5% |

6.5% |

|

Kitengela |

67,478 |

274 |

92.0% |

73.8% |

11.4% |

4.9% |

1.1% |

6.0% |

|

Thika |

63,581 |

302 |

79.8% |

79.0% |

12.3% |

5.0% |

1.0% |

6.0% |

|

Donholm & Komarock |

92,706 |

389 |

93.9% |

98.0% |

13.1% |

4.9% |

(1.0%) |

3.9% |

|

Juja |

71,242 |

266 |

75.1% |

71.4% |

14.3% |

4.5% |

1.2% |

5.6% |

|

Rongai |

80,521 |

251 |

81.1% |

87.5% |

15.5% |

3.3% |

0.9% |

4.2% |

|

Average |

73,119 |

305 |

84.1% |

83.2% |

13.8% |

4.5% |

1.2% |

5.7% |

Source: Cytonn Research 2022

B. Apartments Performance

Apartments registered improvement in Q1’2022 with average total returns recording a 0.7% points y/y increase to 6.0% in Q1’2022 from of 5.3% in Q1’2021, attributed to 0.5% points increase in y/y average price appreciation to 0.6% in Q1’2022 from 0.1% in Q2’2022. Satellite towns continued to be the best performing segment with average y/y total returns coming in at 6.3% attributed to the relatively high rental yield averaging at 5.4% and an average y/y price appreciation of 0.9%. The best performing nodes in terms of returns were Waiyaki Way, Westlands, Imara Daima, and, Ruaka which recorded an average y/y total returns of 8.4%, 8.1%,7.6%, and 7.5%, respectively attributed to relatively high rental yields coupled with resilience of house prices in the areas. Donholm and Kikuyu were the worst performing nodes which recorded average y/y total returns of 4.2% each.

|

Apartments Performance – Q1’2022 |

||||||||

|

Area |

Average of Price per SQM Q1’2022 |

Average of Rent per SQM Q1’2022 |

Average of Occupancy Q1’2022 |

Average of Uptake 2021 |

Average of Annual Uptake Q1’2022 |

Average of Rental Yield Q1’2022 |

Average of Price Appreciation Q1’2022 |

Total Returns |

|

Upper Mid-End |

||||||||

|

Westlands |

148,981 |

872 |

87.4% |

86.6% |

43.8% |

6.5% |

1.6% |

8.1% |

|

Upperhill |

136,249 |

813 |

81.3% |

92.0% |

14.8% |

5.7% |

1.0% |

6.7% |

|

Kileleshwa |

125,270 |

671 |

87.5% |

82.8% |

14.0% |

5.8% |

0.7% |

6.5% |

|

Kilimani |

104,503 |

534 |

87.1% |

93.5% |

18.2% |

6.2% |

(0.6%) |

5.6% |

|

Loresho |

120,762 |

514 |

90.7% |

94.0% |

10.0% |

4.6% |

0.1% |

4.7% |

|

Parklands |

119,893 |

559 |

88.0% |

87.3% |

13.4% |

4.8% |

0.0% |

4.8% |

|

Average |