Kenya Listed Banks H1’2020 Report, & Cytonn Weekly

By Cytonn Research, Sep 13, 2020

Executive Summary

Fixed Income

During the week, T-bills subscription rates was on the rise but remained undersubscribed, with the subscription rate coming in at 84.1%, up from 49.6% the previous week, mainly supported by the improved high liquidity in the money markets. The highest subscription rate was in the 91-day paper, which came in at 180.7%, up from 68.5% recorded the previous week. The yields on the 91-day and 364-day papers remained unchanged at 6.3% and 7.6%, respectively, while that of the 182-day paper increased marginally to 6.7%, from 6.6% the previous week. The Parliamentary Budgetary Office highlighted in their Budget watch 2020/21 and the Medium Term, that the current budget would most likely not steer the country out of the current crisis. Notably, the pandemic has exposed the weak points in the country’s economic growth and it is expected that the government will experience cash challenges given the uncertain economic outlook and revenue performance;

Equities

During the week, the equities market was on an upward trajectory, with NSE 25, NASI and NSE 20 all recording gains of 1.1%, taking their YTD performance to losses of 15.3%, 20.5%, and 29.3%, for NASI, NSE 25 and NSE 20, respectively. The performance was driven by gains by large-cap stocks, with the highest gains being recorded in Equity Group, KCB Group, Standard Chartered Bank and Safaricom, which gained by 3.8%, 3.1%, 2.2% and 1.5%, respectively. During the week, the Capital Markets Authority (CMA) granted African Diaspora Asset Managers (ADAM) Ltd a fund Manager’s License, bringing the total number of licensed fund managers to 25;

Real Estate

During the week, South African retailer, Shoprite, announced plans to exit the Kenyan market by closing down its two remaining outlets, citing poor performance. Tuskys reopened its Malindi and Kilifi branches indicating the retailer’s determination to retain and grow its market share amid financial constraints reported in the past few months. Deacons East Africa Limited, a fashion and clothing retailer, is set to cease its operations in East Africa, announcing the sale of its business and assets, after operating for 60 years. In infrastructure, the Ruiru municipality officials announced the launch of a 12-kilometer new sewer line expected to benefit at least 50,000 homes in Githurai and Kahawa Wendani, Ruiru Sub County;

Focus of the Week

Following the release of H1’2020 results by Kenyan listed banks, this week we analyze the performance of the 10 listed local banks (previously 11, before the acquisition of National Bank by KCB Group Plc), identify the key factors that influenced their performance, and give our outlook for the banking sector;

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.57%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 12.65% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#

- David Gitau, an Investment Analyst at Cytonn Investments, was on Metropol TV talking about Kenya’s Public Debt. Watch David here;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different industry players talk about matters affecting Pension Schemes and the pensions industry at large. Join us every Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 84.1%, up from 49.6% the previous week, mainly supported by the relatively high liquidity in the money markets. The highest subscription rate was in the 91-day paper, which came in at 180.7%, up from 68.5% recorded the previous week. The subscription for the 182-day paper also rose to 76.0%, from 31.6% recorded the previous week, while that of the 364-day paper declined to 53.5% from 60.0% recorded the previous week. The yields on the 91-day and 364-day papers remained unchanged at 6.3% and 7.6%, respectively, while that of the 182-day paper increased marginally to 6.7%, from 6.6% the previous week. The acceptance rate increased to 92.6%, from 91.8% recorded the previous week, with the government accepting Kshs 18.7 bn, out of the Kshs 20.2 bn worth of bids received.

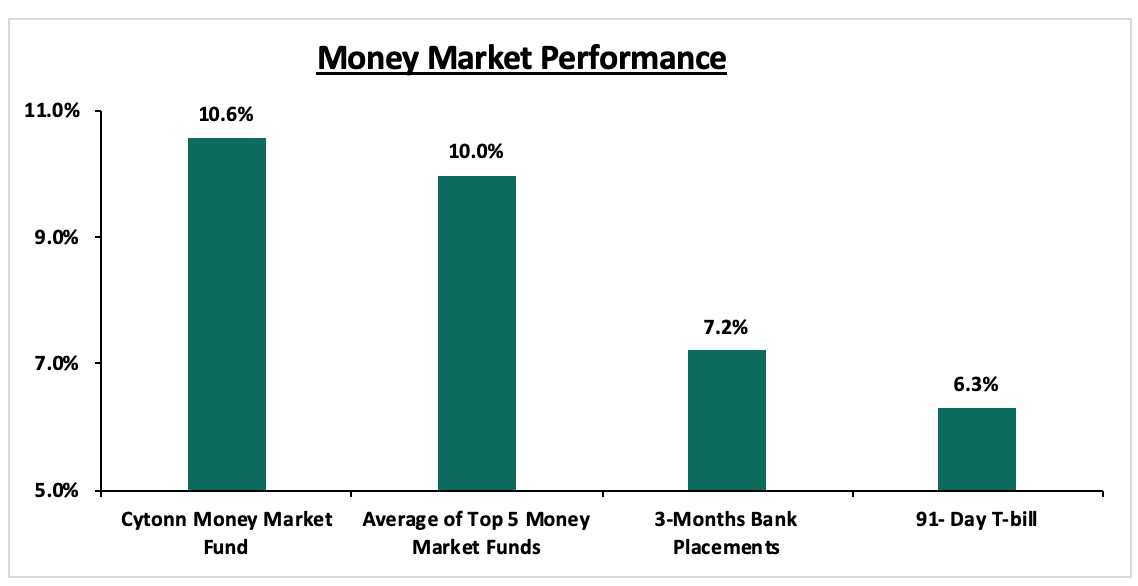

In the money markets, 3-month bank placements ended the week at 7.2% (based on what we have been offered by various banks), while the yield on the 91-day T-bill remained unchanged at 6.3%. The average yield of Top 5 Money Market Funds declined marginally to 10.0%, from 10.1% previously. The yield on the Cytonn Money Market remained unchanged at 10.6%, similar to what was recorded the previous week.

Liquidity:

The money markets remained liquid during the week, with the average interbank rate declining to 2.6%, from 3.1% recorded the previous week, mainly supported by government payments. The average interbank volumes increased by 14.3% to Kshs 12.8 bn, from Kshs 11.2 bn recorded the previous week.

Kenya Eurobonds:

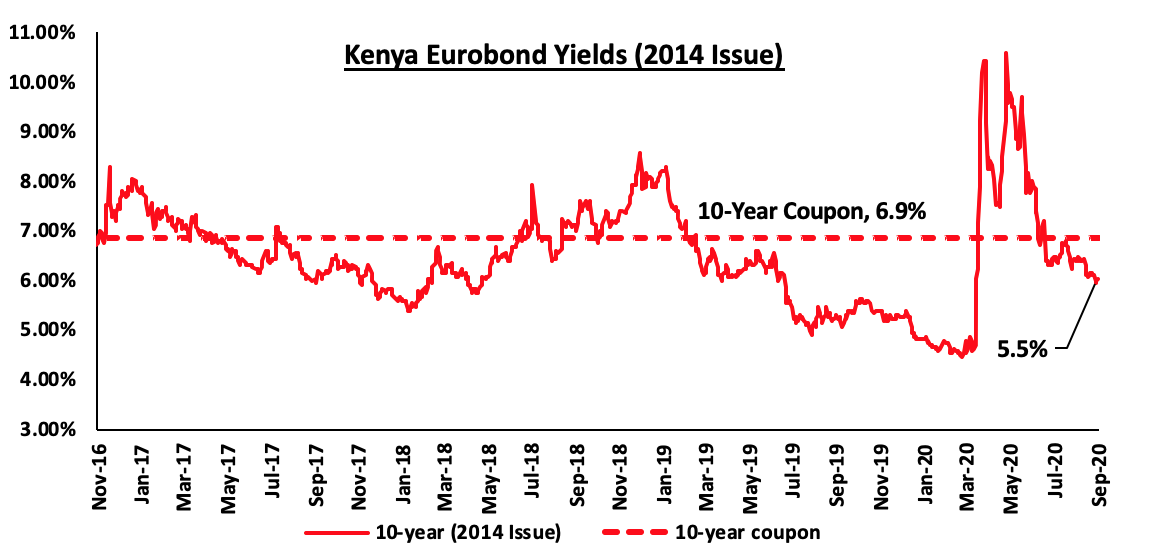

During the week, the yields on Kenyan Eurobonds increased across the board, pointing towards an increased perception of risk for the country. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 increased marginally by 0.1% points to 5.5%, from 5.4% the previous week.

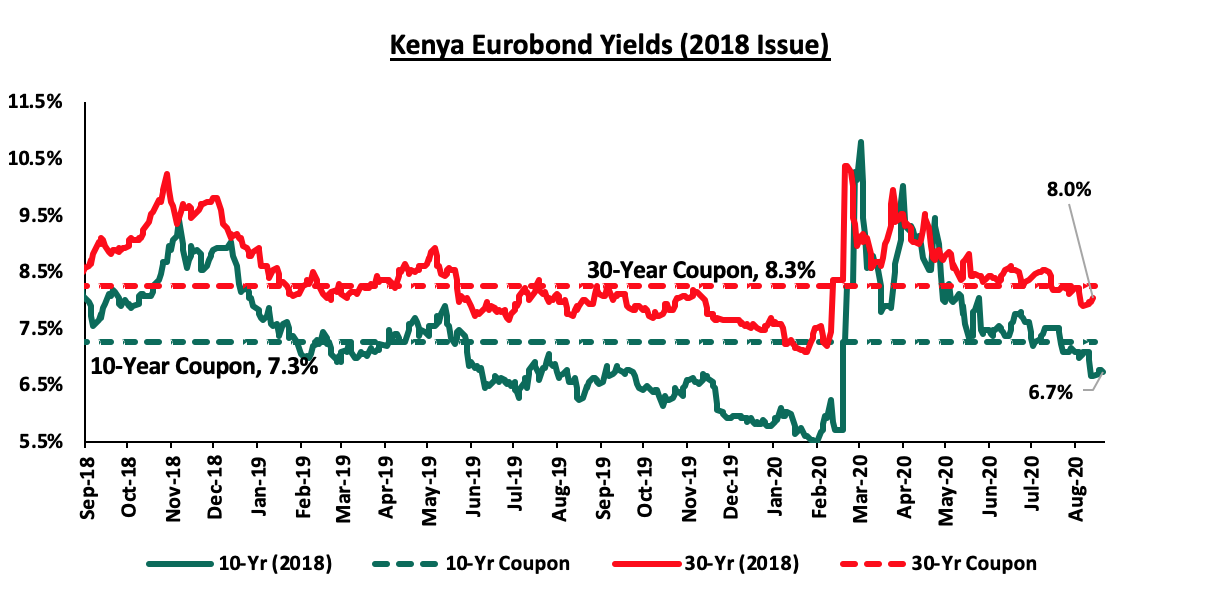

During the week, the yields on the 10-year and 30-year Eurobonds both increased marginally by 0.1% points to close at 6.7% and 8.0%, respectively from 6.6% and 7.9%, recorded the previous week.

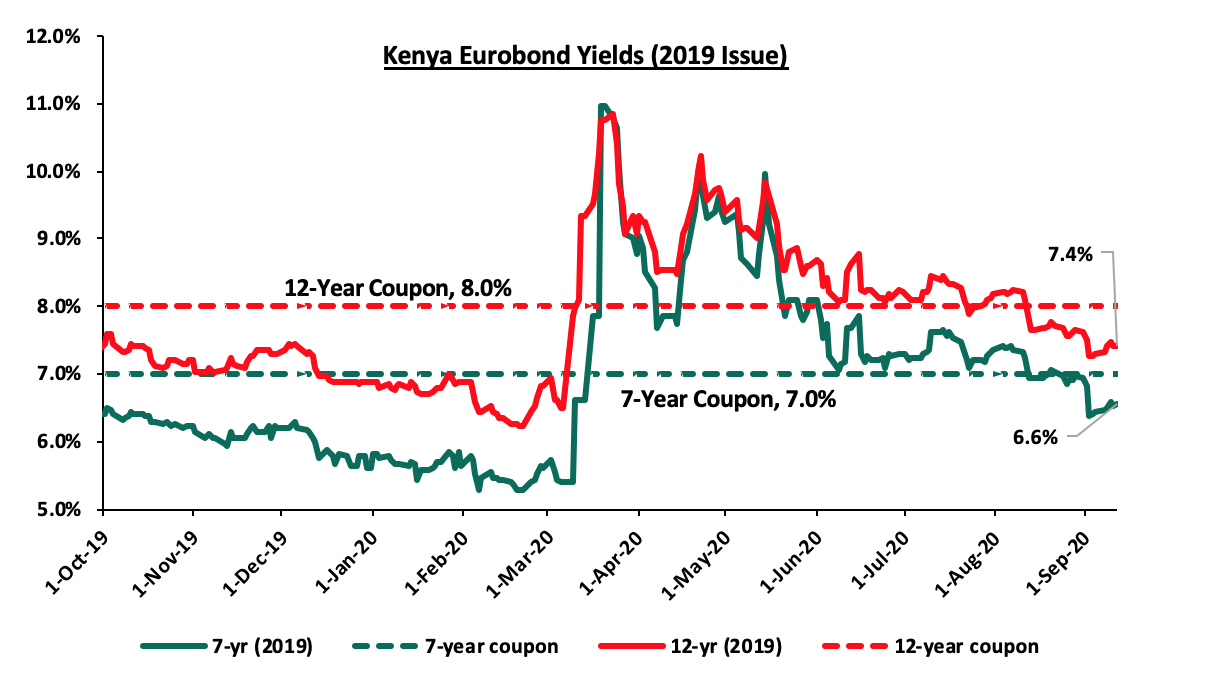

During the week, the yields on the 2019 dual-tranche Eurobond issue with 7-years increased by 0.2% points to 6.6%, from 6.4% the previous week. The 12-year Eurobond also increased by 0.1% points to 7.4%, from 7.3% recorded the previous week.

Kenya Shilling:

During the week, the Kenyan shilling remained under pressure against the US dollar, depreciating marginally by 0.1%, to close at Kshs 108.4, from Kshs 108.3 the previous week, mainly attributable to increased dollar demand from importers, coupled with the lack of adequate sellers in the market. On an YTD basis, the shilling has depreciated by 7.0% against the dollar, in comparison to the 0.5% appreciation in 2019.

In the short term, the shilling is expected to be supported by:

- The high levels of forex reserves, currently at USD 8.9 mn (equivalent to 5.4-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover;

- Relatively strong Diaspora remittances that increased by 23.4% to USD 277.0 million in July compared to USD 225 million in July 2019, despite being 4.0% lower than the USD 288.5 million in June 2020, leading to the narrowing of the country’s current account deficit to 4.7% of GDP in the 12 months to July 2020, compared to 5.0% of GDP in the 12 months to June.

Weekly Highlight:

During the week, the Parliamentary Budgetary Office highlighted in their Budget watch 2020/21 and the Medium Term, that the current budget would most likely not steer the country out of the current crisis. Notably, the pandemic has exposed the weak points in the country’s economic growth and it is expected that the government will experience cash challenges given the uncertain economic outlook and revenue performance. According to the release, the current fluctuation in fuel prices poses a risk to the country’s inflation coupled with the expectations of below-average rainfall for the months of October, November, and December which could adversely affect food security.

The key take-outs from the report include:

- Revenue Prospects during the pandemic: The ordinary revenue collected as of June 2020 was Kshs 1.6 tn, Kshs 300.0 bn (16.0% below the set target of Kshs 1.9 tn according to the Budget estimates). The National Treasury projects ordinary revenue to decline from Kshs 1,643.4 bn in 2019/20 (revised estimates II) to Kshs 1,621.4 bn in 2020/21. A decline in income tax collection is expected to be among the major drivers of the expected decline in revenue due to income loss by workers across most sectors. The fiscal deficit is expected to come in at (7.6%), worse than the (7.3%) recorded in FY’2017/18. The government plans to be cushioned by the earlier introduced measures such as:

-

- The Minimum Taxation of 1.0% of gross turnover for SMEs which will take effect from 1st January 2021,

- The 1.5% Digital Service Tax on gross transaction value,

- Expansion of the Excise duty tax base by reducing the threshold of alcohol strength for spirits from 10.0% to 6.0%

For more information on this see our focus on COVID-19 Economic Containment Policies

- Debt Management FY’2020/21: The country’s debt servicing will be a significant source of liquidity pressures in FY’2020/21. Public debt service expenses are projected to increase by Kshs 157.7bn (about 20.0%) to Kshs 925.9 bn in FY’2020/21. Below is a table with the estimates for the coming financial years;

|

Public Debt Servicing Expenses (amounts in Kshs. Millions) |

|||||

|

Financial Year |

2019/20 |

2020/21 |

2021/22 |

2022/23 |

2023/24 |

|

Interest Payments |

|||||

|

Internal Debt |

301,812.00 |

321,911.00 |

370,430.00 |

382,588.00 |

385,662.00 |

|

External Debt |

131,868.00 |

162,434.00 |

166,821.00 |

173,950.00 |

183,692.00 |

|

Total - Interest |

433,680.00 |

484,345.00 |

537,251.00 |

556,538.00 |

569,354.00 |

|

Redemption |

|||||

|

Internal Debt |

213,691.00 |

261,955.00 |

246,810.00 |

336,623.00 |

357,165.00 |

|

External Debt |

121,477.00 |

179,640.00 |

239,393.00 |

257,612.00 |

258,457.00 |

|

Total – Redemption |

335,168.00 |

441,595.00 |

486,203.00 |

594,235.00 |

615,622.00 |

|

Public Debt Service Expenses |

768,848.00 |

925,940.00 |

1,023,454.00 |

1,150,773.00 |

1,184,976.00 |

Source: Approved Budget Estimates

As at June 2020, Kenya’s debt stock stood at Kshs 6.6 tn and is projected to reach Kshs 7.5 tn by June 2021. Notably, the expected widening of the fiscal deficit will be driven by reduced economic activity which has led to a slowdown in revenue generation. As such, any fiscal consolidation efforts will be adversely affected. Despite the outlook indicating lower interest rates as a result of the accommodative monetary policy stance, there still exists high refinancing and interest rate risk. Among the concerns regarding the country’s debt, is the profitability and cashflow generations debt-financed projects where efficiencies need to be created to ensure they start contributing to the debt repayment, and,

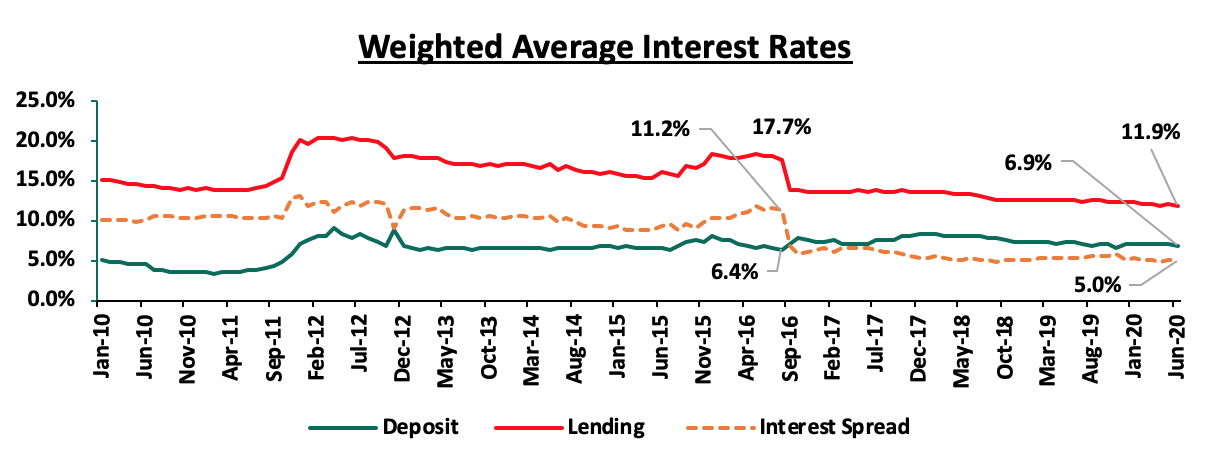

- Monetary Policy: To support the economy, the Central Bank initiated various measures to ensure there is ample liquidity in the economy. These include; the lowering of the Central Bank Rate so as to make loans more affordable, lowering the cash reserve ratio by 100 bps to 4.25%, and increasing the maximum tenor of repurchase agreements from 28 days to 91 days. As a result of the accommodative stance, lending rates have declined to 11.9% as at June 2020, from 12.3% seen in December 2019. The same can be seen in the below illustration,

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. The government is 59.0% ahead of its prorated borrowing target of Kshs 112.2 bn having borrowed Kshs 178.5 bn. In our view, the government will not be able to meet their revenue collection targets of Kshs 1.9 tn for FY’2020/2021 because of the current subdued economic performance in the country brought about by the spread of COVID-19, and therefore leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug in the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term to medium-term fixed income securities to reduce duration risk.

Market Performance

During the week, the equities market was on an upward trajectory, with NSE 25, NASI and NSE 20 all recording gains of 1.1% y, taking their YTD performance to losses of 15.3%, 20.5%, and 29.3%, for NASI, NSE 25 and NSE 20, respectively. The performance was driven by gains recorded by large-cap stocks, with the highest gains being recorded in Equity Group, KCB Group, Standard Chartered Bank and Safaricom, which gained by 3.8%, 3.1%, 2.2% and 1.5%, respectively.

Equities turnover declined by 18.3% during the week to USD 22.3 mn, from USD 27.4 mn recorded the previous week, taking the YTD turnover to USD 1.1 bn. Foreign investors remained net buyers during the week, with a net buying position of USD 2.0 mn, from a net buying position of USD 5.9 mn recorded the previous week, taking the YTD net selling position to USD 258.4 mn.

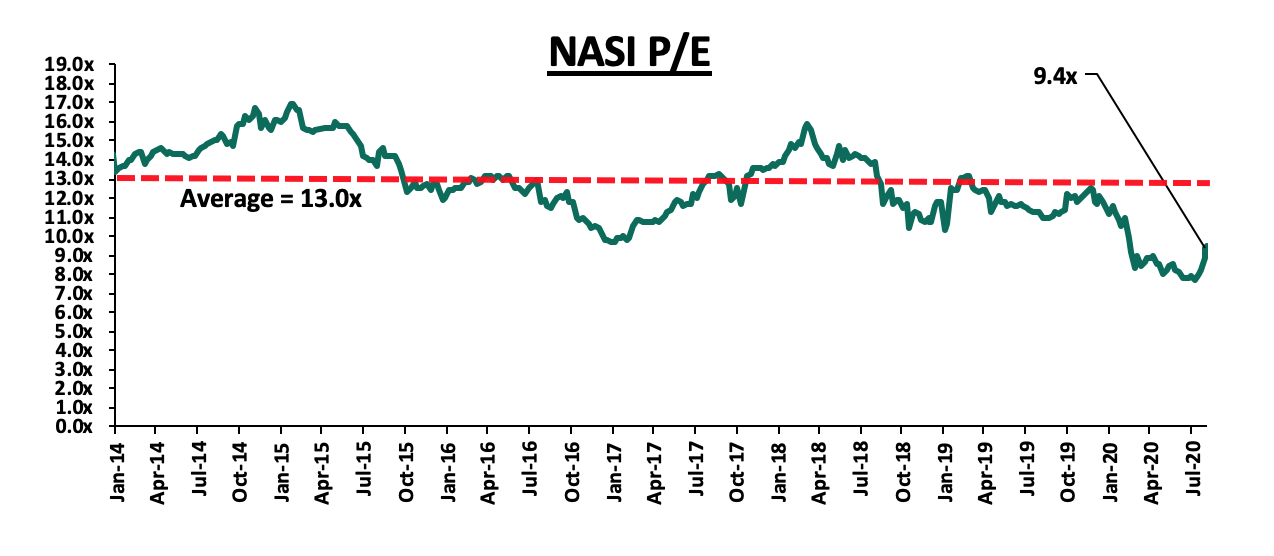

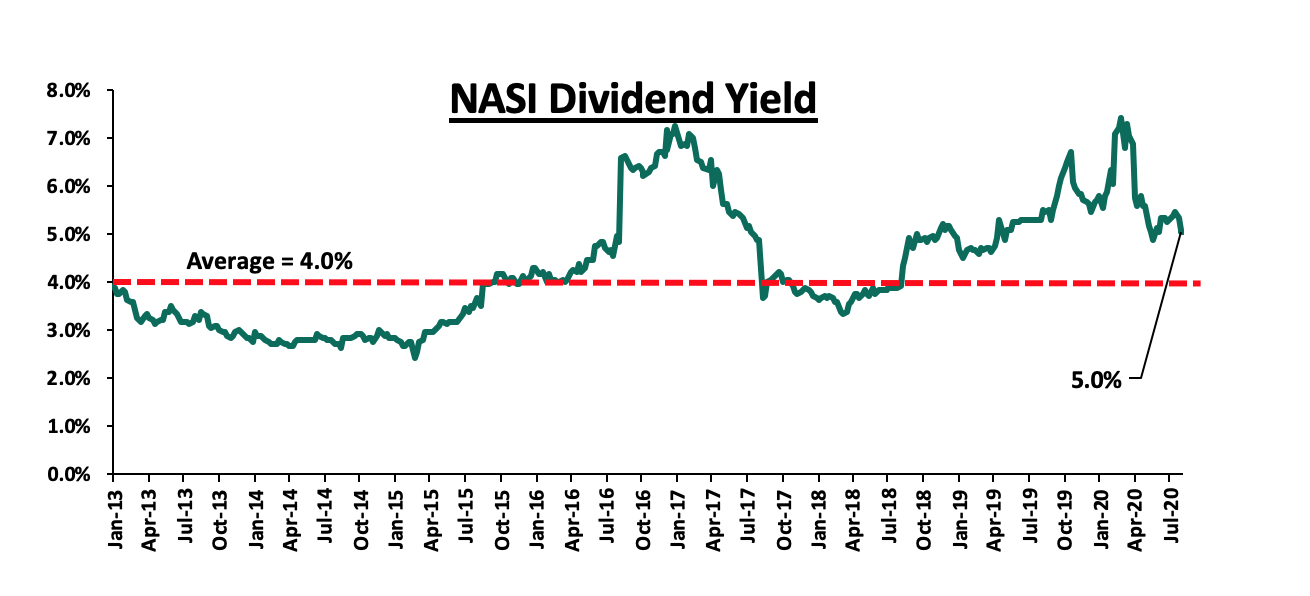

The market is currently trading at a price to earnings ratio (P/E) of 9.4, 27.8% below the 11-year historical average of 13.0x. The average dividend yield is currently at 5.0%, down from 5.1% recorded the previous week and 1.0% points above the historical average of 4.0%. The decline in dividend yield is attributable to price gains recorded by most stocks.

With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 9.4x is 21.9% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, the Capital Markets Authority (CMA) granted African Diaspora Asset Managers (ADAM) Ltd a fund Manager’s License. In the statement by CMA, the fund manager will offer financial products and services such as asset management, wealth management, unit trusts, discretionary portfolio management, etc. and will target clients in the Kenyan markets as well as Africans in the diaspora. ADAM will offer Collective Investment Schemes (CIS) such as;

- ADAM Money Market Fund,

- ADAM Fixed Income Fund,

- ADAM Equity Fund ,

- ADAM Business growth Fund, and,

- ADAM Property Fund.

Key to note, ADAM Business Growth Fund will be a private Equity Fund which will provide debt and equity capital to the Small and Medium Enterprises both in Kenya and Africa. This is a very important development to see capital markets focused on financing businesses given the current absence in capital market funding for businesses. According to the World Bank, capital markets make up 60.0% of funding for businesses, with the balance of 40.0% coming from bank funding. In Kenya, bank funding makes up 95.0% of business funding, with only 5.0% coming from the capital market, due to the dominance by banks and the stifled capital markets. It is our view that we need to take actions to open up our capital markets through the following steps:

- Remove conflicts of interest in the governance of capital markets and create a governance structure that is more responsive to market participants and market growth,

- Expand the pool of licensed Trustees beyond banks: given that capital markets and banking markets are in competition, limiting Unit Trust Fund trustees to only banks is an institutionalization of an inherent conflict, which is not good for market growth,

- Reduce the high minimum investment amounts required to invest in High Yield Funds and Real Estate Investment Trusts (REITs); at Kshs 1.0 mn and Kshs 5.0 mn, respectively, the minimum amounts are too high in an economy where the median income is Kshs 50,000. Having a product with a minimum investment amount of Kshs 1.0 mn, 20 times the median income, locks out the vast majority of potential investors from the capital markets,

- Improve disclosures for investors by requiring that each Unit Trust Fund publishes a periodic report of exactly where their funds are invested. As seen recently, investors in the Amana Money Market fund have had to face a two year freeze in accessing any of their funds and are now faced with significant losses, of up-to 60.0% of their fund value, yet they were not aware that their funds had been invested in Nakumatt Commercial Paper, and,

- Allow schemes to receive funds from investors from as many banks as is convenient to the investors; limiting receiving banks to just one bank is stifling to investors. For example, an investor in Bank A who wants to invest Kshs 1,000 in a Money Market Fund that uses Bank B as a receiving bank, may incur transfer charges of Kshs 100 to transfer from their Bank A to Bank B. The Kshs. 100 transfer fee is already 10.0% of their investment, and with money market funds returning 9.0% to 10.0% p.a, it would take a whole year for the investor just to recover their transaction costs. This is obviously discouraging to small investors and it is not good for market growth. We believe the best solution would be to allow Unit Trust Funds to open as many accounts as is convenient to their investors.

Following the licensing of ADAM, the total number of licensed fund managers will be 25. As at Q1’2020, there were 24 approved Collective Investment Schemes made up of 92 funds in Kenya. Out of the 24 however, only 19 were active while 5 were inactive. Given that the fund manager also seeks to target foreign investors, we believe that this will be a value addition to the clients most especially those seeking to invest in the Kenyan market. Additionally, this may also lead to an improvement in Kenya’s Foreign Direct Investment which stood at 115.1 bn in 2019.

Universe of Coverage:

|

Company |

Price at 04/09/2020 |

Price at 11/09/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

64.8 |

65.0 |

0.4% |

(40.4%) |

109.0 |

119.4 |

3.9% |

87.6% |

0.3x |

Buy |

|

Kenya Reinsurance |

2.1 |

2.3 |

7.6% |

(25.4%) |

3.0 |

4.0 |

4.6% |

81.6% |

0.2x |

Buy |

|

Sanlam |

12.8 |

12.5 |

(2.4%) |

(27.6%) |

17.2 |

18.4 |

0.0% |

47.8% |

1.2x |

Buy |

|

Jubilee Holdings |

220.5 |

220.0 |

(0.2%) |

(37.3%) |

351.0 |

313.8 |

3.6% |

46.2% |

0.5x |

Buy |

|

NCBA*** |

23.2 |

22.6 |

(2.8%) |

(38.8%) |

36.9 |

30.7 |

1.0% |

37.1% |

0.6x |

Buy |

|

KCB Group*** |

36.8 |

37.9 |

3.1% |

(29.8%) |

54.0 |

46.4 |

9.9% |

32.4% |

0.8x |

Buy |

|

Co-op Bank*** |

11.6 |

11.5 |

(0.9%) |

(29.7%) |

16.4 |

14.2 |

8.4% |

31.9% |

0.8x |

Buy |

|

I&M Holdings*** |

44.0 |

46.0 |

4.5% |

(14.8%) |

54.0 |

57.8 |

5.1% |

30.8% |

0.7x |

Buy |

|

Standard Chartered*** |

162.3 |

165.8 |

2.2% |

(18.1%) |

202.5 |

197.2 |

7.8% |

26.8% |

1.2x |

Buy |

|

Equity Group*** |

35.7 |

37.0 |

3.8% |

(30.8%) |

53.5 |

44.5 |

5.9% |

26.2% |

0.9x |

Buy |

|

ABSA Bank*** |

9.7 |

9.7 |

0.4% |

(27.0%) |

13.4 |

10.8 |

12.0% |

22.9% |

1.2x |

Buy |

|

Liberty Holdings |

8.0 |

8.0 |

0.0% |

(22.7%) |

10.4 |

9.8 |

0.0% |

22.5% |

0.6x |

Buy |

|

Stanbic Holdings |

85.5 |

81.0 |

(5.3%) |

(25.9%) |

109.3 |

84.9 |

9.0% |

13.8% |

0.6x |

Accumulate |

|

Britam |

7.6 |

8.0 |

5.3% |

(11.3%) |

9.0 |

8.6 |

3.3% |

11.1% |

0.8x |

Accumulate |

|

HF Group |

3.8 |

4.1 |

6.3% |

(37.3%) |

6.5 |

4.1 |

0.0% |

1.2% |

0.2x |

Lighten |

|

CIC Group |

2.1 |

2.1 |

1.9% |

(20.1%) |

2.7 |

2.1 |

0.0% |

(1.9%) |

0.7x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are banks in which Cytonn and/ or its affiliates are invested in |

||||||||||

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

I. Retail

During the week, South African Retailer, Shoprite, announced plans to exit the Kenya retail market barely two years since its entry, citing underperformance of its branches. The retailer currently has two operational stores located at Westgate Mall and Garden City. This comes after the closure of its other branches such as the Karen Branch in Nairobi and the City Mall branch in Nyali. The poor performance of the retailer is attributed to decline in revenues due to reduced footfall and constrained consumer spending amid a tough financial environment. In addition, the retailer has continued to witness increased competition from players such as Naivas, QuickMart and Carrefour. Shoprite, which has 2,300 stores across Africa, in its trading statement, reported that its South African division grew by 8.7% while sales at its supermarkets outside South Africa fell by 1.4%. The company posted a Kshs 1.8 bn loss for its business outside South Africa, partly attributed to the losses registered in the Kenya stores.

Tuskys, a local retail chain reopened its Malindi and Kilifi branches indicating the retailer’s determination to retain and grow its market share amid financial constraints reported in the past few months leading to the closure of 8 of its branches, due to rent arrears among them being the Kisumu and Eldoret branch. The move to reopen the 2 branches brings the number of the retailer’s operational branches to 57. The reopening is attributed to financial support following the signing of terms of agreement with an undisclosed Mauritius-based private equity fund for the provision of a financing facility amounting to approximately Kshs 2.0 bn in August 2020. We expect the move by Tuskys to secure debt financing and the reopening of its branches to cushion the retailer against financial shocks amid reduced revenues and boost investor confidence especially in the Kenya’s retail sector.

Deacons East Africa Limited, a fashion and clothing retailer, is set to shut down its operations in East Africa, announcing the sale of its business and assets after 60 years in the fashion and clothing industry as a result of failure to raise Kshs 450.0 mn aimed at helping the business remain afloat. Deacons currently owns 4U2, FNF, Adidas, and Bossini clothing and shoe stores at Sarit Center, Two Rivers Mall, Yaya Center, Village Market and Garden City within Kenya. The company was placed under administration in November 2018, two years after selling its shares at the Nairobi Securities Exchange (NSE) due to debts amounting to Kshs 1.1 bn after it lost its biggest franchise, the South African retailer Mr. Price Limited. The case of Deacons is almost similar to that of Nakumatt, Botswana’s Choppies, and Uchumi who exited the Kenyan retail market as a result of huge debts affecting their operations which resulted to insolvency hence the inability to meet financial obligations to landlords, suppliers and employees.

The exit of retailers, such as Shoprite has affected the retail market performance with growing vacancy rates coupled by the existing oversupply of space. According to the Cytonn H1’2020 Market Review the occupancy rates dropped by 1.9% points to 74.0% in H1’2020, from 75.9% in FY’2019 and we expect this to be exacerbated by the exit of retailers such as Deacons and the growing focus on e-commerce. However, we expect the sector’s performance to be cushioned by the reopening of outlets by retailers, such as Tuskys and the continued expansion of both local and international retailers, such as Massmart.

The table below shows the performance of the retail sector;

All values in Kshs unless stated otherwise

|

Summary of Nairobi Metropolitan Area (NMA) Retail Sector Performance |

|||||||

|

Item |

Q1' 2019 |

H1' 2019 |

Q3' 2019 |

FY' 2019 |

H1' 2020 |

∆ Y/Y |

∆ H1’2020 |

|

Average Asking Rents (Kshs/SQFT) |

174.3 |

170.0 |

167.0 |

175.6 |

170.3 |

(0.2%) |

(3.1%) |

|

Average Occupancy (%) |

76.8% |

75.6% |

74.5% |

75.9% |

74.0% |

(1.6%) points |

(1.9%) points |

|

Average Rental Yields |

8.5% |

8.2% |

8.0% |

7.8% |

7.4% |

(0.8%) points |

(0.4%) points |

Source: Cytonn research

The table below shows local and international retailers that have exited or closed down outlets in Kenya;

|

Local and international retailers that have exited or closed down outlets in Kenya |

||

|

Name of Retailer |

Initial no. of branches |

Current no. of branches |

|

Nakumatt Holdings |

65 |

0 |

|

Botswana’s Choppies |

15 |

2 |

|

South Africa’s Shoprite |

4 |

2 |

|

Uchumi |

37 |

4 |

|

Tuskys |

63 |

57 |

|

Total |

184 |

65 |

Source: Online Research

Even though the retail sector in Kenya has experienced some major exits leaving spaces unoccupied, there are still several key players entering into the market taking up spaces formerly occupied by outgoing local and international retailers as shown in the table below:

|

Main Local and International Retail Supermarket Chains opened in 2020 |

|

|

Name of retailer |

Number of branches |

|

QuickMart Supermarket |

3 |

|

French retailer, Carrefour |

1 |

|

South Africa’s Game Stores |

1 |

|

Naivas Supermarket |

4 |

|

Chandarana Foodplus Supermarket |

1 |

|

Total |

10 |

Source: Online Research

II. Infrastructure

During the week, Ruiru municipality officials announced the launch of a 12 kilometer new sewer line that is expected to benefit at least 50,000 homes in Githurai and Kahawa Wendani, Ruiru Sub County upon completion by June 2021. The Kshs 120.0 mn project will be funded by the World Bank through the Kenya Urban Support Programme (KUSP). Other World Bank funded projects in the area that have successfully been commissioned include; construction of a storm water drainage in Chuma Mbili, rehabilitation of the 2.0 km Kahawa-Wendani road, tarmacking of 1.5 km Mumbi stage road to Mwiki Bridge in Kiuu ward and installation of street lights in Mwihoko.

According to the 2019 Kenya Population and Housing Census, Ruiru is the 6th largest urban center in Kenya with a population of 490,120, a 105.6% increase from 238,858 in 2009. The growing numbers have been driven by ease of accessibility through the Thika-super highway and the Eastern by-pass, availability of amenities such as Shopping malls e.g. Thika Road Mall (TRM) and Unicity Mall, and the growing working and student population. The area has continued to record increased development activities as developers seek to leverage on the positive demographics which have led to a growing demand for housing since Ruiru acts as a dormitory to Nairobi’s working population. In addition, Ruiru was named as one of the towns in Kiambu County (in addition to Kikuyu, Juja, Thika, and Limuru) to spearhead the county’s affordable housing rent-to-own scheme where 19,500 units are set to be put up by 2022. We therefore expect that the construction of the Ruiru Sewerage Network, will support the development activities in areas such as Kahawa Wendani, Githurai, Kahawa Sukari, and Kiuu through allowing for densification, improving the value of properties as the area will be more habitable, and a relatively low development cost burden for developers, thus boosting the real estate sector.

We have a neutral outlook for the real estate sector supported by improving infrastructure. On the retail front, we expect the prime spaces exited by struggling retailers to be taken up by growing retail brands such as Carrefour.

Following the release of the H1’2020 results by Kenyan listed banks, the Cytonn Financial Services Research Team undertook an analysis on the financial performance of the listed banks and identified the key factors that shaped the performance of the sector, and our expectations of the banking sector for the rest of the year.

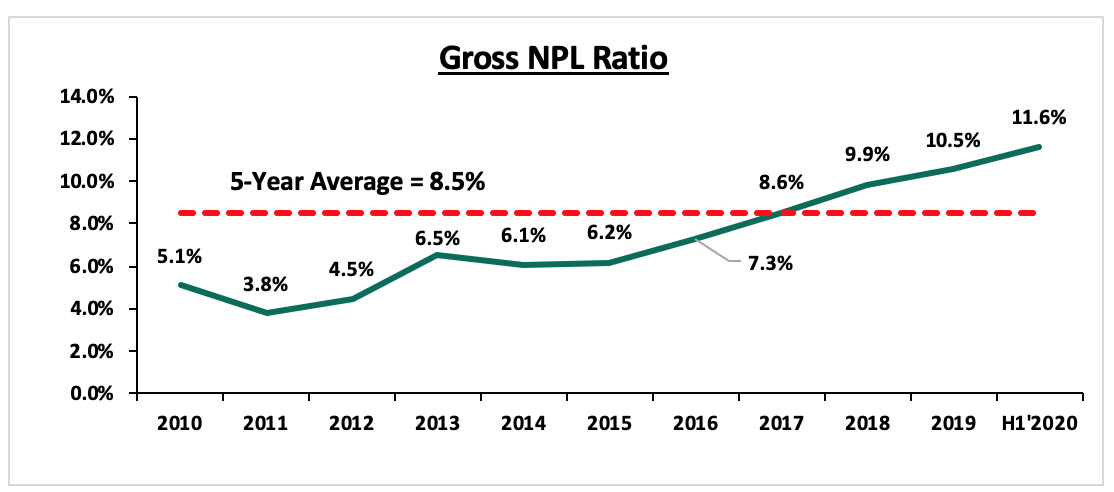

Core Earnings per Share recorded a weighted decline of 33.6% in H1’2020, compared to a weighted growth of 9.0% recorded in H1’2019. As reported by most of the banks, the decline in the earnings was mainly attributable to the increased provisioning on the back of the subdued business environment. Asset quality for listed banks deteriorated in H1’2020 with the gross NPL ratio rising by 1.6% points to 11.6% from 10.0% in H1’2019. This was high compared to the 5-year average of 8.5%. The banking sector was also keen on restructuring loans in order to offer relief for its customers against the effects of COVID-19. The loan restructuring involved placing moratoriums on both interest and principal payments for three months to one year. As at the end of June 2020, the total amount of loan restructured stood at Kshs 844.0 bn representing 29.1% of the banking sector loan book.

The report is themed “Depressed earnings and deteriorating asset quality amid the COVID-19 Operating Environment” as we assess the key factors that influenced the performance of the banking sector in H1’2020, the key trends, the challenges banks faced, and areas that will be crucial for growth and stability of the banking sector going forward. As such, we shall address the following:

- Key Themes That Shaped the Banking Sector Performance in H1’2020,

- Summary of The Performance of the Listed Banking Sector in H1’2020,

- The Focus Areas of the Banking Sector Players Going Forward, and,

- Brief Summary and Ranking of the Listed Banks based on the Outcome of Our Analysis.

Section I: Key Themes That Shaped the Banking Sector Performance in H1’2020

Below, we highlight the key themes that shaped the banking sector in H1’20120 which include regulation, monetary policy, consolidation, asset quality, and capital conservation:

- Regulation :

- Guidance on Loan Restructuring: The Central Bank of Kenya on March 27th, 2020 provided commercial banks and mortgage finance companies with guidelines on loan reclassification, and provisioning of extended and restructured loans as per the Banking Circular No 3 of 2020. The key take-outs from the circular included:

-

- Central Bank stipulated that banks would be allowed to extend loan repayments for their customers for a period not more than one year,

- The cost of restructuring and extension of loans would be met by the banks and the banks would have to report any restructuring in relation to the COVID-19 pandemic to the Central Bank monthly,

- Banks would be required to keep a record of all restructured and extended loans with the details of how the pandemic has affected specific customers whose loans are restructured and monitoring measures adopted by the bank, and,

- Personal loans that have been extended or restructured by banks would not be subjected to the classification of renegotiated loans stipulated in CBK’s prudential guidelines meaning that banks would not have to classify the loans as non-performing loans.

According to data from the July 2020 Monetary Policy Committee (MPC) Meeting, this has seen a total of Kshs 844.0 bn, representing 29.1% of the total Kshs 2.9 tn banking sector loan book, being restructured as at June 2020. The table below highlights some of the major banks that have disclosed the number of loans they have restructured;

|

No. |

Bank |

Amount Restructured (Kshs bn) |

% of restructured loans to total loans |

H1’2020 y/y Change in Loan loss provision |

|

1 |

Kenya Commercial Bank |

120.2 |

21.7% |

263.8% |

|

2 |

Equity Group Holdings |

92.0 |

23.5% |

773.4% |

|

3 |

Diamond Trust Bank |

64.0 |

31.8% |

249.2% |

|

4 |

NCBA Group |

58.0 |

23.4% |

180.9% |

|

5 |

Absa Bank Kenya |

57.0 |

28.2% |

228.1% |

|

6 |

Co-operative Bank of Kenya |

39.2 |

14.4% |

57.9% |

|

7 |

Standard Chartered Bank of Kenya |

22.0 |

16.4% |

328.8% |

|

|

Total |

452.4 |

22.8% |

297.4% |

- Consolidation: Consolidation activity remained one of the highlights witnessed in H1’2020, in line with our expectations, as players in the sector were either acquired or merged, leading to the formation of relatively larger, well-capitalized, and possibly more stable entities. The following were the major M&A’s activities witnessed during the first half of 2020:

-

- On 27th January 2020, Nigerian lender, Access Bank PLC completed the acquisition of a 100% stake in Transnational Bank PLC for an undisclosed amount, with Access Bank PLC targeting to enhance its corporate and retail banking business in Kenya through the acquisition. Access Bank is Nigeria’s largest lender by assets, with an asset base of USD 16.7 bn (equivalent to Kshs 1.7 tn) as at Q1’2020. The deal will see Nigerian banks deepen their presence in Kenya with the United Bank of Africa (UBA) and Guarantee Trust Bank already in the market. For more information on the transaction, see Cytonn Weekly #03/2020,

- On 7th April 2020, the Central Bank of Kenya (CBK) approved the acquisition of a 51.0% stake in Mayfair Bank Limited by an Egyptian lender, Commercial International Bank (CIB), effective 1st May 2020 for an undisclosed amount. The Central Bank of Kenya (CBK) welcomed the transaction, citing it will diversify and strengthen the resilience of the Kenyan banking sector. Commercial International Bank, Egypt’s leading private sector bank, has an asset base of USD 24.2 bn (Kshs 2.5 tn) as of December 2019. CIB’s business model focusses on individuals, SMEs, institutions, and corporates and will be the first Egyptian bank to establish a presence in Kenya. The deal will see CIB provide Mayfair Bank Limited with the requisite skills, resources, and infrastructure to scale up its business. For more information on the transaction, see Cytonn Weekly #17/2020,

- On 4th May 2020, the Central Bank of Kenya approved the acquisition of Imperial Bank’s assets and assumption of liabilities worth Kshs 3.2 bn each by KCB Group effective 2nd June 2020. The move will see Imperial Bank depositors paid a total of Kshs 3.2 bn over a period of 4 years and will have cumulatively recovered 37.3% of the deposits since 2015 when payments commenced. Imperial Bank was put under receivership (a process that can assist creditors to recover funds in default and can help troubled companies to avoid bankruptcy) in October 2015 due to inappropriate banking practices, with the CBK transferring Imperial Bank’s management and control to the KDIC. For more information on the transaction, see Cytonn Weekly #21/2020, and,

- On 23rd June 2020, Equity Group Holdings announced it had mutually agreed with Atlas Mara to call off plans to acquire banking assets in four countries in exchange for shares in Equity Group. This follows a January announcement by the board of Equity Group announcing the extension of discussions between the Group and Atlas Mara after the expiry of the transaction period before the two parties could sign a detailed transaction agreement. Read more information on the same here.

Other mergers and acquisitions activities announced after H1’2020 include;

- On 11th August 2020, Equity Group Holdings completed the 66.5% stake acquisition of the Banque Commerciale Du Congo (BCDC) at a cost of USD 95.0 mn (Kshs 10.3 bn). The acquisition was first announced by the group on 18th November 2019 and was subject to approvals from the Central Bank of Kenya (CBK), Democratic Republic of Congo’s Central Bank, and the COMESA Competition Commission. Initially, the deal was to cost USD 105.0 mn (Kshs 11.4 bn), however factoring in the adverse effects of the COVID-19 pandemic on the two economies, the two parties agreed to reduce the amount to USD 95.0 mn (Kshs 10.3 bn). For more information on the transaction, see Cytonn Weekly #33/2020,

- On 25th August 2020, Co-operative Bank Kenya completed the 90.0% acquisition of Jamii Bora Bank and rebranded it to Kingdom Bank Limited. The Central Bank of Kenya approved the acquisition of a 90.0% stake of Jamii Bora’s shareholding by the Co-operative Bank, which was to be completed on 21st August 2020 after the deal received all regulatory approval following approval by the National Treasury on 4th August 2020. In March 2020, the Co-operative bank opened talks of a 100.0% acquisition of Jamii Bora Bank (JBB) before varying their offer to a 90.0% stake for Kshs 1.0 bn effectively valuing Jamii Bora Bank at Kshs 1.1 bn. For more information on the transaction, see Cytonn Weekly #35/2020, Cytonn Weekly #32/2020, and Cytonn Weekly #26/2020, and,

- On 20th July 2020, I&M Holdings plc issued a cautionary statement to its shareholders on its intention to acquire 90.0% of the share capital of Orient Bank Limited Uganda (OBL). Once completed, this will be the third bank acquisition in 2020 after the CBK gave a go-ahead to Nigerian lender, Access Bank PLC to acquire a 100.0% stake in Transnational Bank PLC and the 90.0% acquisition of Jamii Bora Bank by Co-operative Bank. The proposed transaction will be subject to approval from the Central Bank of Kenya, Central Bank of Uganda, the Capital Markets Authority, and the company shareholders. Read more on the same here.

Below is a summary of the deals in the last 5-years that have either happened, been announced, or expected to be concluded:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs. Bns) |

Transaction Stake |

Transaction Value |

P/Bv Multiple |

Date |

|

Co-operative Bank |

Jamii Bora Bank |

3.4 |

90.0% |

1.0 |

0.3x |

Aug-20 |

|

Commercial International Bank |

Mayfair Bank Limited |

1.0 |

51.0% |

Undisclosed |

N/D |

May-20* |

|

Access Bank PLC (Nigeria) |

Transnational Bank PLC. |

1.9 |

100.0% |

1.4 |

0.7x |

Feb-20* |

|

Equity Group |

Banque Commerciale Du Congo |

8.9 |

66.5% |

10.3 |

1.2x |

Nov-19* |

|

KCB Group |

National Bank of Kenya |

7.0 |

100.0% |

6.6 |

0.9x |

Sep-19 |

|

CBA Group |

NIC Group |

33.5 |

53%:47% |

23.0 |

0.7x |

Sep-19 |

|

Oiko Credit |

Credit Bank |

3.0 |

22.8% |

1.0 |

1.5x |

Aug-19 |

|

CBA Group** |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan-19 |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan-19 |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank Ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3.0 |

100.0% |

5.0 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

74.5% |

1.3x |

||||

|

* Announcement Date ** Deals that were dropped |

||||||

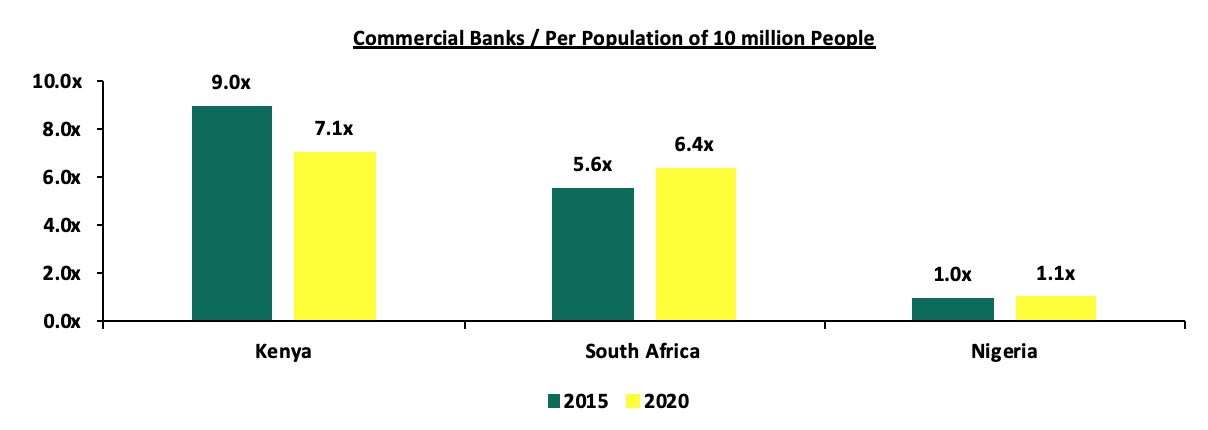

The number of commercial banks in Kenya has now reduced to 38, compared to 43 banks 5-years ago. The ratio of the number of banks per 10 million population in Kenya now stands at 7.1x, which is a reduction from 9.0x 5-years ago, demonstrating continued consolidation of the banking sector. However, despite the ratio improving, Kenya still remains overbanked as the number of banks remains relatively high compared to the population. For more on this see our topical

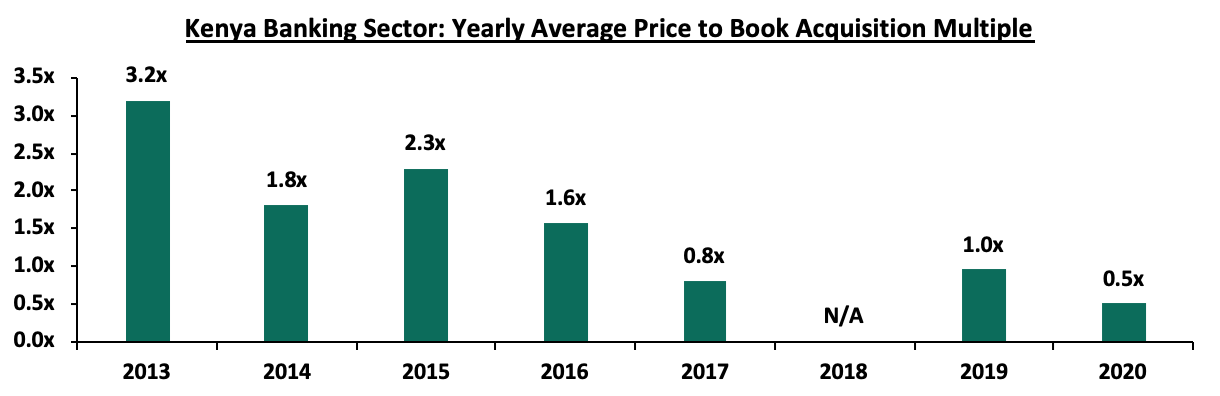

Additionally, the acquisition cost for banks has come down significantly, from an average acquisition cost of 3.2x price to book value in 2013, to 0.5x price to book value in 2020, as highlighted in the chart below;

- Asset Quality - Asset quality for listed banks deteriorated in H1’2020 with the Gross NPL ratio rising by 1.6% points to 11.6% from 10.0% in H1’2019. This was high compared to the 5-year average of 8.5%. Consequently, this saw increased provisioning across the industry to proactively manage risks given the tough economic conditions. The NPL coverage has risen to 57.8% in H1’2020 from 55.9% recorded in H1’2019. In accordance with IFRS 9, banks are expected to provide both for the incurred and expected credit losses. We expect higher provisional requirements to subdue profitability during the year across the banking sector on account of the tough business environment.

The chart below highlights the asset quality trend:

- Capital Preservation: In a bid to preserve capital, the below-listed banks announced they were suspending cash dividends:

- Equity Group’s Board of Directors withdrew their recommendation to pay a first and final dividend of Kshs 2.5 per share for FY’2019. This decision was made after considering the effects of the COVID-19 pandemic and the need to conserve cash to enable the company to respond appropriately to the unfolding crisis in terms of supporting its customers through the crisis and directing cash resources to potential opportunities that may arise, and,

- NCBA Group announced it would withhold the final dividend payment of Kshs 1.5 per share, to shareholders totaling to Kshs 2.2 bn for FY’2019. NCBA’s board instead recommended the payment of a stock dividend (bonus Issue) and not a cash dividend. The bonus share issue will see shareholders receive one share for every ten held, creating 149.8 mn additional shares, given that the entity currently has 1.5 bn shares listed on the securities exchange. The additional shares were valued at Kshs 4.3 bn based on NCBA’s share price of Kshs 28.75 as at 24 April 2020. The stock dividend valued at Kshs 4.3 bn is more than what the lender would have paid in the cash dividend of Kshs 2.2 bn. For more information on this see Cytonn Weekly # 17/2020.

A similar trend has been mirrored globally by both financial and non-financial businesses frantically seeking ways to save money with several regulators encouraging companies to cease the discretionary payments of dividends to shareholders. For instance, in the United Kingdom (UK), the seven largest banks sought to cancel dividend pay-outs despite having solid capital bases, due to fears of an economic recession.

Additionally, the Central Bank of most countries has offered guidelines to the banks on dividend payments with, for instance, the Federal Reserve announcing on 25th June 2020 that it would cap dividend payments and prevent share repurchases up to the end of 2020. Closer home, on 6th April 2020, the South African Reserve Bank’s Prudential Authority advised banks not to pay out dividends this year and that the bonuses for senior executives should also be put on hold during this period as well. The authority highlighted that this directive would ensure banks conserve their capital and as such, enable the banks to fulfill their fundamental roles. Locally, the Central Bank of Kenya on 14th August 2020, directed that Banks will have to get approval before declaring dividends for the current financial year. The Central Bank has given guidance to lenders asking them to revise their ICAAP (Internal Capital Adequacy Assessment Process) based on the pandemic as highlighted in the Banking Circular No 11 of 2020. Subject to the submission of the revised Internal Capital Adequacy Assessment Process, (ICAAP), CBK will determine if it will endorse the board’s decision to pay out dividends.

Following the release of the H1’2020 results, as expected, most banks did not declare any interim dividends for H1’2020 in a bid to preserve their capital amid the subdued environment.

Section II: Summary of the Performance of the Listed Banking Sector in H1’2020:

The table below highlights the performance of the banking sector, showing the performance using several metrics, and the key take-outs of the performance.

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

ABSA |

(84.8%) |

0.9% |

(3.3%) |

2.5% |

7.3% |

4.2% |

32.8% |

4.1% |

8.3% |

17.4% |

81.2% |

8.2% |

15.9% |

|

KCB |

(40.4%) |

23.2% |

25.7% |

22.3% |

7.6% |

6.0% |

31.0% |

4.3% |

34.6% |

54.5% |

73.8% |

17.0% |

16.0% |

|

NCBA |

(38.3%) |

9.6% |

7.7% |

11.2% |

3.4% |

28.0% |

47.3% |

61.3% |

9.1% |

24.0% |

63.6% |

4.0% |

8.9% |

|

DTBK |

(36.5%) |

(3.3%) |

(9.0%) |

1.2% |

5.6% |

5.9% |

25.3% |

24.2% |

(0.1%) |

9.8% |

75.2% |

5.6% |

9.8% |

|

SCBK |

(31.3%) |

(6.3%) |

(12.1%) |

(4.6%) |

6.9% |

6.6% |

31.9% |

(5.2%) |

12.3% |

2.1% |

52.4% |

11.9% |

13.7% |

|

Stanbic |

(31.2%) |

(4.8%) |

(3.1%) |

(0.7%) |

4.5% |

(18.8%) |

44.0% |

(36.7%) |

20.6% |

(13.4%) |

81.9% |

32.8% |

10.9% |

|

I&M |

(29.5%) |

3.4% |

9.4% |

(1.4%) |

5.5% |

(7.1%) |

37.8% |

7.7% |

6.4% |

30.1% |

73.1% |

7.2% |

15.4% |

|

Equity |

(24.4%) |

18.5% |

23.6% |

16.9% |

8.1% |

(13.0%) |

36.9% |

(10.8%) |

18.6% |

24.2% |

72.0% |

22.0% |

17.5% |

|

Co-op |

(3.6%) |

6.8% |

(4.4%) |

11.6% |

8.4% |

(5.1%) |

34.3% |

(42.5%) |

18.9% |

28.8% |

70.8% |

5.7% |

18.6% |

|

HF Group |

N/A |

(12.7%) |

(18.20%) |

(3.9%) |

4.3% |

(68.8%) |

22.4% |

42.1% |

15.8% |

13.5% |

97.4% |

(5.8%) |

(3.0%) |

|

H1'20 Mkt Weighted Average* |

(33.6%) |

10.4% |

10.0% |

10.9% |

7.0% |

(1.1%) |

35.2% |

(3.4%) |

18.5% |

25.9% |

71.5% |

14.5% |

15.4% |

|

H1'19Mkt Weighted Average** |

9.0% |

3.7% |

5.3% |

3.8% |

7.7% |

16.5% |

37.2% |

12.7% |

8.6% |

12.1% |

73.8% |

9.8% |

19.3% |

|

*Market-cap-weighted as at 28/08/2020 |

|||||||||||||

|

**Market-cap-weighted as at 06/09/2019 |

|||||||||||||

Key takeaways from the table above include:

- For the first half of 2020, the core Earnings Per Share (EPS) declined by (33.6%) as compared to a 9.0% growth in H1’2019,

- The sector recorded a deposit growth of 18.5% up from the 8.6% growth recorded in H1’2019. Interest expense, on the other hand, grew faster by 10.0%, compared to 5.3% in H1’2019. Cost of funds, however, declined, coming in at a weighted average of 2.9% in H1’2020, from 3.0% in H1’2019, an indication that the sector was able to mobilize cheaper deposits,

- Average loan growth came in at 14.5%, which was faster than the 9.8% recorded in H1’2019, but slower than the 25.9% growth in government securities, an indication of the bank's preference of investing in Government securities compared to lending to individuals and businesses,

- Interest income rose by 10.4%, compared to a growth of 3.7% recorded in H1’2019. The faster growth in interest income may be attributable to the 16.1% growth in loans and increased allocation to government securities. Despite the rise in interest income, the Yield on Interest Earning Assets (YIEA) declined to 9.7% from the 10.4% recorded in H1’2019, an indication of the increased allocation to lower-yielding government securities by the sector. The decline in the YIEA can also be attributed to the reduced lending rates for customers by the sector, in line with the Central Bank Rate cuts. Consequently, the Net Interest Margin (NIM) now stands at 7.0%, compared to the 7.7% recorded in H1’2019 for the listed banking sector, and,

- Non-Funded Income declined by 1.1% y/y, slower than the 16.5% growth recorded in H1’2019. The performance in NFI was on the back of declined growth in fees and commission of 3.4%, which was slower than the 12.7% growth recorded in H1’2019. The low growth in fees and commission can be attributed to the recent waiver on fees on mobile transactions below Kshs 1,000 and the free bank-mobile money transfer. Banks with a large customer base who rely heavily on mobile money transactions are likely to take the biggest hit.

Section III: Outlook of the banking sector:

The banking sector showed subdued performance as evidenced by the decline in the core-earnings per share by 33.6%, as compared to a growth of 9.0% in H1’2020. This was occasioned by the increased provisioning on the expectations on the rise in the non-performing loans. Further, the waiver on mobile transactions below Kshs 1,000 and the free bank-mobile money transfer muted the growth in Non-Funded Income leading to a decline in the growth in fees and commission. However, despite the tough operating environment, the banking sector has historically shown resilient performance amid short-term and long term shocks such as the implementation of the interest rate caps.

Based on the current tough operating environment, we believe 2020 performance in the banking sector will be shaped by the following key factors

- Increased Liquidity due to lower Cash Reserve Ratio (CRR): The Monetary Policy Committee (MPC) during their 29th April 2020 meeting lowered the Cash Reserve Ratio (CRR), which is a fraction of total customer deposits that the commercial banks have to hold with the Central Bank, by 100 bps to 4.25% from 5.25%. The reduction is projected to have injected approximately Kshs. 35.2 bn in additional liquidity, to commercial banks for onward lending to distressed borrowers. The reduction was the first one since July 2009. The MPC during their July 2020 MPC Meeting highlighted that Kshs 34.1 bn, representing 89.1% of the 35.2 bn had been utilized by the banking sector to offer a reprieve to their customers as well as support lending in the sectors that have been hard hit by the pandemic such as Tourism, Manufacturing as well as Real Estate. We expect the low CRR ratio to improve the banking sector's liquidity and as such, banks with have more money to loan to businesses and individuals as well as invest in other businesses. Additionally, given that a low CRR translates to a low amount held in the CBK at no interest, we expect this to lead to a decline in the interest rates charged on loans by the sector,

- Depressed Interest Income: With the large amount of restructuring and reclassification of loans witnessed in H1’2020, we expect the bank’s core source of revenue which is interest income to be negatively affected in the short term. Given the relaxation of the loan interest payments and the borrower's preference to long term tenor extensions on their loan holiday to between 9-12 months, the bank's interest income is set to drop. Banks are also not lending aggressively due to higher credit risk. We foresee a slower growth in loans in the next quarter and thereafter if the pandemic is to persist further with banks turning to less risky investments such as government securities which rose by 25.9% faster than the 14.5% rise in loans in H1’2020,

- Lower Net Interest Margins (NIM): The accommodative stance taken by the Monetary Policy Committee (MPC), a 150 bps cut in the Central Bank Rate (CBR), YTD, has seen the deposit rates, saving rates and lending rates decline by 0.3% points, 0.2% points and 0.4% points, to 6.8%, 4.1% and 11.9% from 7.1%, 4.3%, and 12.3%, respectively, recorded in January 2020. The increased investments by banks to government securities as opposed to lending, coupled with the increased liquidity in the money market has also seen the yield curve readjust downwards. As such, we foresee the sector’s Yield on Interest Earning Assets (YIEA) continue to decline in tandem with the decline in the yields on government securities. Additionally, we foresee a continued decline in the sector’s NIMs in the coming quarter, most especially for banks reducing their lending rates for customers in line with the CBR cuts,

- Increased Provisioning- The risk of loan defaults remains elevated despite an improvement in the operating environment in line with the relaxation of Coronavirus measures. We foresee increased provisioning in the sector as compared to FY’2019, given the lagged recovery process from the pandemic. Additionally, we expect the higher provisioning requirements as per the IFRS guidelines to further subdue the profitability of the banking sector during the year,

- Cost Rationalization: Given the expectation of depressed revenues, banks are expected to continue pursuing their cost rationalization strategies. A majority of banks have been riding on the digital revolution wave to improve their operational efficiency. Increased adoption of alternative channels of transactions such as mobile, internet, and agency banking, has led to increased transactions carried out via alternative channels and out of bank branches, which have been reduced to handling high-value transactions and other services such as advisory. Thus banks reduced front-office operations, thereby cutting the number of staff required and by extension, reducing operating expenses and hence, improving operational efficiency,

- Continued Revenue Diversification - The increase in NFI growth outperformed that of interest income, thus, allowing the banks to remain profitable amid a rigid regulatory environment. However, with the new regulations put in place by the Central bank to cushion citizens against the effects of the COVID-19 pandemic, banks’ non-interest income is likely to be depressed. Some measures such as waiving all charges for balance inquiry through digital platforms will see banks record lower income from the fees they charge,

- Expansion and Further Consolidation - With the Microfinance-Bill 2019 of increasing the minimum on core capital requirements still at its pilot stage more mergers and acquisitions would enable the unprofitable and/or smaller banks to manage the requirement and be able to increase profitability through cost efficiency and deposits growth.

Section IV: Brief Summary and Ranking of the Listed Banks:

As per our analysis on the banking sector from a franchise value and a future growth opportunity perspective, we carried out a comprehensive ranking of the listed banks. For the franchise value ranking, we included the earnings and growth metrics as well as the operating metrics shown in the table below in order to carry out a comprehensive review of the banks:

|

Bank |

Loans to Deposits Ratio |

Cost to Income Ratio |

Return on Average Capital Employed |

Deposit/Branch (Kshs bns) |

Gross NPL Ratio |

NPL Coverage |

Tangible Common Ratio |

Non-Funded Income/Revenue |

|

Coop Bank |

75.6% |

60.1% |

18.6% |

2.4 |

11.8% |

54.6% |

15.1% |

34.3% |

|

KCB Group |

73.8% |

71.5% |

16.0% |

2.1 |

13.8% |

56.9% |

13.2% |

31.0% |

|

DTBK |

71.9% |

64.1% |

9.8% |

2.0 |

8.3% |

51.2% |

15.5% |

25.3% |

|

Equity Bank |

72.0% |

69.3% |

17.5% |

1.8 |

11.0% |

48.5% |

15.5% |

36.9% |

|

I&M Holdings |

73.1% |

54.4% |

16.3% |

3.8 |

11.1% |

63.1% |

15.9% |

37.8% |

|

NCBA Group |

63.6% |

79.8% |

8.9% |

4.8 |

13.1% |

53.2% |

12.5% |

47.3% |

|

Absa Bank |

81.2% |

80.6% |

15.9% |

3.0 |

8.0% |

63.6% |

10.9% |

32.8% |

|

SCBK |

52.4% |

63.0% |

13.7% |

7.1 |

13.9% |

78.2% |

15.0% |

31.9% |

|

Stanbic Bank |

81.9% |

45.7% |

10.9% |

11.0 |

8.5% |

64.8% |

13.0% |

44.0% |

|

HF Group |

97.4% |

123.0% |

(3.0%) |

1.9 |

26.7% |

54.3% |

16.4% |

22.4% |

|

Weighted Average H1'2020 |

72.0% |

67.3% |

15.5% |

3.5 |

11.6% |

57.8% |

14.2% |

35.2% |

The overall ranking was based on a weighted average ranking of Franchise value (accounting for 60%) and intrinsic value (accounting for 40%). The Intrinsic Valuation is computed through a combination of valuation techniques, with a weighting of 40.0% on Discounted Cash-flow Methods, 35.0% on Residual Income, and 25.0% on Relative Valuation, while the Franchise ranking is based on banks operating metrics, meant to assess efficiency, asset quality, diversification, and profitability, among other metrics. The overall H1’2020 ranking is as shown in the table below:

|

Bank |

Franchise Value Score |

Intrinsic Value Score |

Weighted Score |

H1'2020 Rank |

Q1'2020 Ranking |

|

I&M Holdings |

2 |

3 |

2.4 |

1 |

1 |

|

Co-operative Bank of Kenya Ltd |

1 |

6 |

3.0 |

2 |

2 |

|

KCB Group Plc |

6 |

2 |

4.4 |

3 |

3 |

|

Equity Group Holdings Ltd |

4 |

5 |

4.4 |

4 |

4 |

|

DTBK |

7 |

1 |

4.6 |

5 |

5 |

|

Stanbic Bank/Holdings |

3 |

9 |

5.4 |

6 |

6 |

|

ABSA |

5 |

8 |

6.2 |

7 |

7 |

|

NCBA Group Plc |

9 |

4 |

7.0 |

8 |

9 |

|

SCBK |

8 |

7 |

7.6 |

9 |

8 |

|

HF Group Plc |

10 |

10 |

10.0 |

10 |

10 |

Major Changes from the H1’2020 Ranking are:

- KCB Group recorded a decline in the franchise value ranking, coming in 6th mainly on the back of the deterioration of their asset quality as evidenced by the group's high Non- Performing Loans (NPL) ratio of 13.8% against a weighted average of 11.6%,

- NCBA Group whose rank improved to Position 8 from Position 9 in Q1’2020 mainly due to an improvement in NPL Ratio to 13.1% in H1’2020 from 14.5% in Q1’2020, in turn, improving its franchise value score, and,

- SCBK whose rank declined to Position 9 from Position 8 in Q1’2020 mainly due to a deterioration in the cost to income ratio to 63.0% in H1’2020 from 58.1% in Q1’2020 thus, in turn, worsening the franchise value score.

For more information, see our Cytonn H1’2020 Listed Banking Sector Review

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.