Cytonn Q1’2025 Markets Review

By Research Team, Apr 6, 2025

Executive Summary

Global Markets Review

According to the World Bank the global economy is projected to grow at 2.7% in 2025, matching the 2.7% growth recorded in 2024. This forecast marks a slight upward revision from earlier projections, reflecting economic recovery, particularly for emerging markets. The World Bank’s growth projection is 0.6% points lower than the IMF’s 2025 forecast of 3.3%. The upward revision is despite the global inflationary pressures and continued tightening by central banks for much of 2024. However, recent developments indicate that some central banks, such as those in the United States and England, have begun to cut interest rates in response to easing inflation, which could stimulate economic activity going forward. Notably, advanced economies are expected to record a 1.9% growth in 2025, up from the 1.7% expansion recorded in 2024. However, emerging markets and developing economies are projected to expand by 4.2% in 2025, remaining unchanged from an estimated growth of 4.2% in 2024;

Sub-Saharan Africa Regional Review

According to the World Bank, the Sub-Saharan economy is projected to grow at a moderate rate of 4.1% in 2025, which is 0.9% higher than the 3.2% growth estimate recorded in 2024. The expected recovery is primarily driven by private consumption growth as declining inflation boosts the purchasing power of household incomes. Nevertheless, the risk of debt distress remains high with more than half of countries facing unsustainable debt burdens. The public debt is expected to remain high due to increased debt servicing costs as a result of continued currency depreciation and high interest rates in developed economies. Additionally, many countries are providing subsidies in order to mitigate inflationary pressures, which could worsen public finance, increase public debt, and weigh down on debt sustainability;

In Q1’2025, most of the select Sub-Saharan currencies depreciated against the US Dollar, primarily due to elevated inflationary pressures in the region, high debt servicing costs that continued to deplete foreign exchange reserves, and monetary policy tightening by advanced economies. High interest rates in developed countries resulted in significant capital outflows as investors, both institutional and individual, sought higher returns offered in these economies. Additionally, the rising inflation across most Sub-Saharan economies exerted pressure on local currencies due to the increasing cost of imports;

Kenya Macroeconomic Review

According to the Kenya National Bureau of Statistics (KNBS) Q3’2024 Quarterly Gross Domestic Product Report, the Kenyan economy recorded a 4.0% growth in Q3’2024, slower than the 6.0% growth recorded in Q3’2023. The main contributor to Kenyan GDP remains to be the Agriculture, Fishing and Forestry sector which grew by 4.2% in Q3’2024, lower than the 5.1% expansion recorded in Q3’2023. In Q3’2024 all sectors, except Mining and Quarrying and Construction recorded positive growths, with varying magnitudes across activities. Most sectors recorded declining growth rates compared to Q3’2023 with Accommodation and Food Services, Mining and Quarrying and Financial & Insurance Sectors recording the highest declines of 20.8%, 11.9%, and 10.8% points, respectively. Other sectors that recorded a contraction in growth rate, from what was recorded in Q3’2023 were Construction, Electricity and Water Supply and Real Estate sector which grew by 6.0%, 2.4%, and 2.2% points respectively. The slowed growth in the economy is majorly attributed to the high cost of borrowing that stagnated the private sector credit growth in the country, the high fuel prices which made production more expensive;

Fixed Income

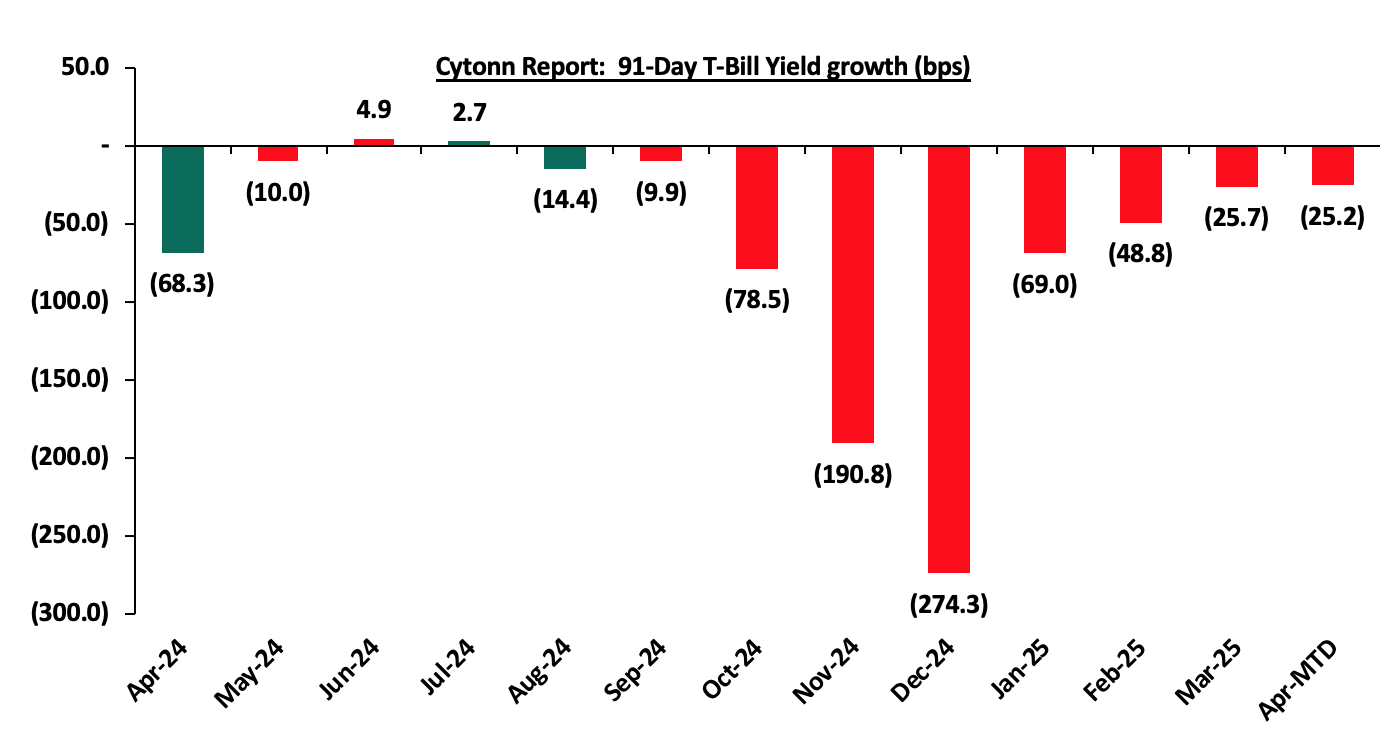

During the quarter, T-bills were oversubscribed, with the overall subscription rate coming in at 136.1%, up from 132.6% in Q1’2024. Investors’ preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 424.6 bn against the offered Kshs 52.0 bn, translating to an oversubscription rate of 221.1%, albeit lower than the subscription rate of 494.4% recorded in the previous year same period. Overall subscriptions for the 364-day and 182-day papers increased significantly to 140.4% and 97.8%, from 64.3% and 56.3% in Q1’2024, respectively. The yields on all the papers were on a downward trajectory with the average yields on the 91-day, 182-day, and 364-day papers decreasing by 7.3%, 7.0%, and 5.9% points to 9.2%, 9.5%, and 10.8%, from 16.4%, 16.6%, and 16.7%, respectively, recorded in Q1’2024. The downward trajectory in yields is mainly due to high liquidity in the money market which allowed the government to front load most of its borrowing. The acceptance rate during the period came in at 86.4%, albeit lower than the 88.8% recorded in Q1’2024, with the government accepting a total of Kshs 366.8 bn out of the Kshs 424.6 bn worth of bids received;

During the week, T-bills were oversubscribed for the first time in two weeks, with the overall subscription rate coming in at 169.5%, a reversal from the undersubscription rate of 61.4% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 11.2 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 279.5%, higher than the undersubscription rate of 69.8%, recorded the previous week. The subscription rates for the 182-day paper increased to 44.9% from the 17.1% recorded the previous week while the 364-day paper increased to 250.1% from the 102.5% recorded the previous week. The government accepted a total of Kshs 40.5 bn worth of bids out of Kshs 40.7 bn bids received, translating to an acceptance rate of 99.7%. The yields on the government papers were on a downward trajectory with the yields on the 91-day paper decreasing the most by 16.1 bps to 8.6% from 8.8% recorded the previous week. The yields on the 364-day paper decreased by 2.5 bps to remain relatively unchanged from the 10.4% recorded the previous week while the 182-day paper decreased by 2.3 bps to 9.0% from the 9.1% recorded the previous week;

During the quarter, the government re-opened five bonds, seeking to raise Kshs 125.0 bn during the quarter. The bonds were generally oversubscribed, receiving bids worth Kshs 299.9 bn against the offered Kshs 125.0 bn, translating to a subscription rate of 239.9%. The government accepted Kshs 214.5 bn of the Kshs 299.9 bn worth of bids received, translating to an acceptance rate of 71.5%;

Also, during the quarter, the government announced its first-ever domestic treasury bond buyback aiming to buyback Kshs 50.0 bn of Kshs 185.1 bn outstanding ofs the FXD1/2020/005, FXD1/2022/003 and IFB1/2016/009 with tenors to maturity of 0.4 years, 0.3 years and 0.4 years respectively, and fixed coupon rates of 11.7%, 11.8% and 12.5% respectively. The total outstanding amounts for the FXD1/2020/005, FXD1/2022/003 and IFB1/2016/009 were Kshs 104.5 bn, Kshs 60.6 bn and Kshs 19.9 bn each respectively. The offer was oversubscribed, with the overall subscription rate coming in at 112.2%, receiving bids worth Kshs 56.1 bn against the offered Kshs 50.0 bn. The government accepted bids worth Kshs 50.1 bn, translating to an acceptance rate of 89.3%, and equivalent to 27.1% of the total outstanding amount of Kshs 185.1 bn for the three bonds. The weighted average yield for the accepted bids for the FXD1/2022/003, FXD1/2020/005 and IFB1/2016/009 came in at 9.1%, 8.9% and 9.1% respectively;

During the week, the Central Bank of Kenya released the auction results for the re-opened treasury bonds FXD1/2020/015, FXD1/2022/015 and FXD1/2022/025 with tenors to maturity of 9.9 years, 12.1 years and 22.6 years respectively and fixed coupon rates of 12.8% 13.9% and 14.2% respectively. The bonds were oversubscribed, with the overall subscription rate coming in at 102.5%, receiving bids worth Kshs 71.7 bn against the offered Kshs 70.0 bn. The government accepted bids worth Kshs 71.4 bn, translating to an acceptance rate of 99.5%. The weighted average yield for the accepted bids for the FXD1/2020/015, FXD1/2022/015 and FXD1/2022/025 came in at 13.7%, 13.8% and 14.2%. Notably, the 13.7% on the FXD1/2020/015 was relatively unchanged from the last tap sale in March 2022 while the 13.8% on the FXD1/2022/015 was lower than the 14.2% recorded on the last time it was reopened in January 2023 and the 14.2% on the FXD1/2022/025 was lower than the 15.7% recorded the last time it was reopened in January 2025. With the Inflation rate at 3.6% as of March 2025, the real returns of the FXD1/2018/025, FXD1/2022/015 and FXD1/2022/025 are 10.1%, 10.2% and 10.6%. Given the withholding tax of 10.0%% for the three bonds, a shorter-term bond subject to 15.0% withholding tax would need to offer an equivalent yield of 14.5%, 14.6% and 15.0% for the FXD1/2020/015, FXD1/2022/015 and FXD1/2022/025 respectively;

During the week, Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of March 2025 increased slightly, coming in at 51.7, up from 50.6 in February 2025, signaling another improvement in business conditions. This marked the sixth consecutive month that index fell above the 50.0 neutral mark. Increased output, new orders and increased sales supported the improvement;

The Monetary Policy Committee (MPC) is set to meet on Tuesday, 8th April 2025, to review the outcome of its previous policy decisions and recent economic developments, and to decide on the direction of the Central Bank Rate (CBR). In their previous meeting held on 5th February 2025, the committee noted that they would closely monitor the impact of the policy measures taken so far, as well as developments in the global and domestic economy, and stood ready to reconvene earlier if necessary. Additionally, the MPC decided to cut the CBR by 50.0 bps citing that its previous interventions successfully curbed inflation to below the midpoint of the CBK’s target range, which came in at 3.6% in March 2025, supported by the exchange rate stability, and lower fuel inflation;

Equities

During the quarter, the equities market was on an upward trajectory with NSE 20, NASI, NSE 25 and NSE 10 gaining by 10.8%,6.0%, 3.8% and 3.1% respectively. The equities market performance during the quarter was driven by gains recorded by large caps such as Stanbic Bank, DTB-Kenya, and NCBA Bank of 17.9%, 9.8%, and 8.9%, respectively. The gains were however weighed down by losses recorded by Co-operative Bank, Equity Bank and BAT of 2.7%, 2.5% and 1.3 respectively;

During the week, the equities market recorded a mixed performance, with NASI, NSE 25, and NSE 10 gaining by 0.5%, 0.1%, and 0.1%, respectively, while NSE 20 declined by 0.1%, taking the YTD performance to gains of 8.1%, 4.9%, 2.3% and 1.3% for NSE 20, NASI, NSE 25, and NSE 10 respectively. The equities market performance during the week was mainly driven by gains recorded by East African Breweries Limited (EABL), NCBA Group, and Stanbic Bank of 3.2%, 2.9%, and 2.3% respectively. The gains were however weighed down by losses recorded by large-cap stocks such as KCB Group, ABSA and DTB-K of 5.7%, 4.7% and 1.0% respectively

During the week, Jubilee Holdings Limited released their FY’2024 results. Jubilee’s Profit After Tax (PAT) increased by 82.5% to Kshs 4.7 bn, from Kshs 2.6 bn recorded in FY’2023. The performance was mainly driven by a 13.5% increase in Insurance Services Revenues to Kshs 25.7 bn, from Kshs 22.6 bn in FY’2023, but was however weighed down by the 11.4% increase in Insurance Services Expenses to Kshs 24.2 bn in FY’2024, from Kshs 21.8 bn in FY’2023

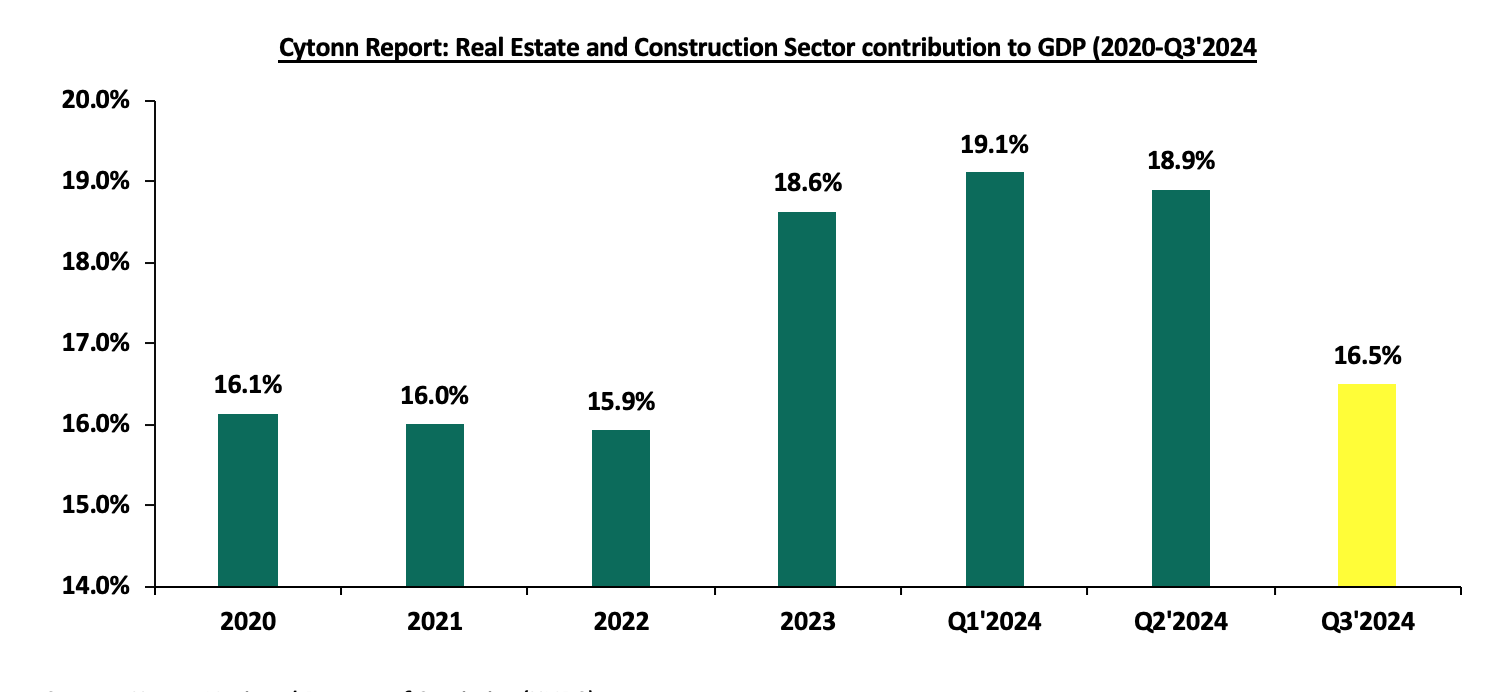

Real Estate

In Q1’2025, the general Real Estate sector continued to witness considerable growth in activity in terms of property transactions and development activities. Consequently, the sector’s activity contribution to Gross Domestic Product (GDP) grew by 5.5 % to Kshs 283.8 bn in Q3’2024, from Kshs 268.9 bn recorded during the same period in 2023. In addition, the sector contributed 10.8% to the country’s GDP, 0.3% points increase from 10.5% recorded in Q3’2023. Cumulatively, the Real Estate and construction sectors contributed 16.5% to GDP, 0.2% points decrease from 16.7% in Q3’2023, attributable to decline in construction contribution to GDP by 0.4% points, to 5.7% in Q3’2024, from 6.1% recorded in Q3’2023;

During the week, Kenya secured Kshs 559.6 mn from the World Bank Group to initiate a credit guarantee scheme aimed at providing affordable mortgages to non-salaried workers, commonly referred to as "hustlers." This initiative, managed by the Kenya Mortgage Guarantee Trust (KMGT), seeks to mitigate lender risk by covering up to 40% of potential mortgage defaults, encouraging financial institutions to extend home loans to informal sector workers who typically lack consistent income streams;

Additionally, during the week, Kenya introduced a State-backed initiative to provide affordable mortgages of up to Kshs 6.0 mn to non-salaried workers, aiming to enhance homeownership among the informal sector, which comprises approximately 83.0% of the nation's 18.0 mn labor force. The Kenya Mortgage Guarantee Trust (KMGT) will cover up to 40.0% of defaulted mortgages, encouraging banks and savings and credit cooperative societies (Saccos) to extend credit to individuals with irregular incomes;

Also during the week, the state postponed the launch of 4,888 housing units, initially scheduled for March 2025, to May 2025 due to delays in the installation of essential fittings, notably lifts. Housing Principal Secretary Charles Hinga acknowledged the setback, stating that while final touches are being applied and the allocation process is ongoing, the realistic timeline for completion is now May;

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 21st March 2025. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs s 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 21st March 2025, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 138,600 shares for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015.

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 14.90% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Tuesday, from 7:00 pm to 8:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Global Economic Growth:

According to the World Bank the global economy is projected to grow at 2.7% in 2025, matching the 2.7% recorded in 2024. This forecast marks a slight upward revision from earlier projections, reflecting economic recovery, particularly for emerging markets. The World Bank’s growth projection is 0.6% points lower than the IMF’s 2025 forecast of 3.3%. However, recent developments indicate that some central banks, such as those in the United States and England, have begun to cut interest rates in response to easing inflation, which could stimulate economic activity going forward. Notably, advanced economies are expected to record a 1.9% growth in 2025, up from the 1.7% expansion recorded in 2024. However, emerging markets and developing economies are projected to expand by 4.2% in 2025, remaining unchanged from an estimated growth of 4.2% in 2024.

The stabilization in global economic growth in 2024 as compared to 2023 is majorly attributable to;

- The recovery in global trade supported by a pickup in goods trade. Services-trade growth is expected to provide less tailwinds this year, given that tourism has nearly recovered to pre-pandemic levels. However, the trade outlook remains lackluster compared to recent decades, partly reflecting a proliferation of trade-restrictive measures and elevated trade policy uncertainty, and,

- A decrease in inflation rates making progress toward central bank targets in advanced economies and Emerging Markets and Developing Economies (EMDEs), but at a slower pace than previously expected. Core inflation has remained stubbornly high in many economies, supported by rapid growth of services prices. As such, by the end of 2026, global inflation is expected to settle at an average rate of 3.5%, broadly consistent with central bank’s targets.

The global economy is showing signs of improvement, with inflationary pressures easing and several central banks moving from rate hikes to rate cuts. This shift is expected to support economic recovery, although growth remains uneven across regions.

Global Commodities Market Performance:

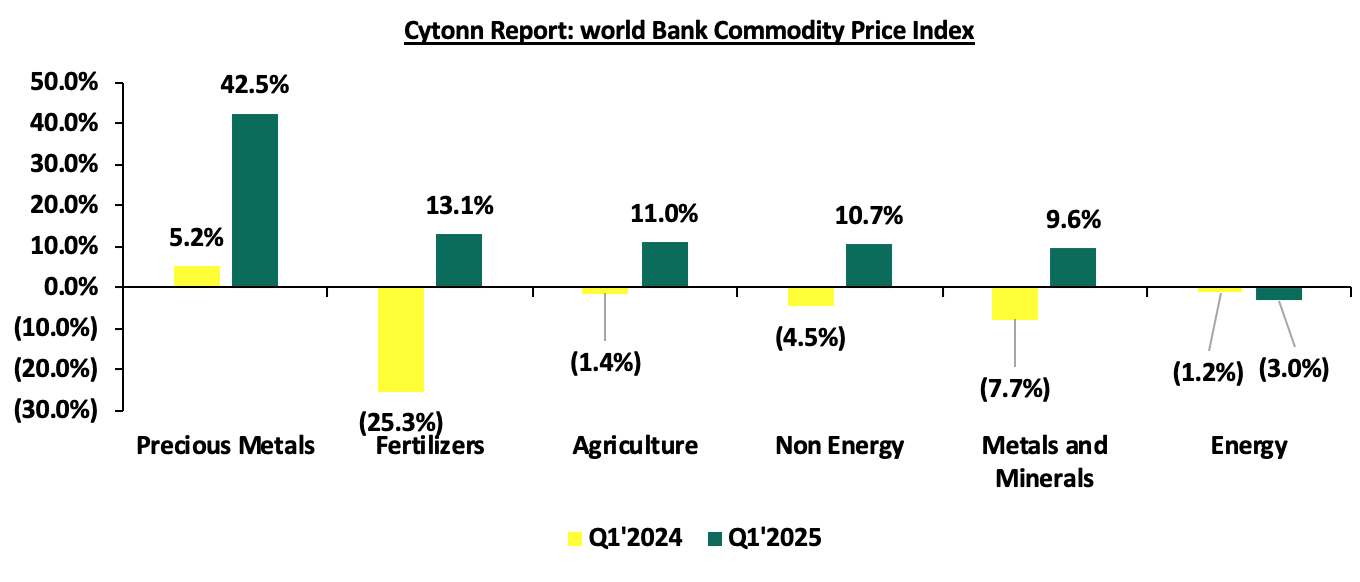

Global commodity prices registered mixed performance in Q1’2025, with prices of energy declining by 3.0%, higher than the 1.2% decrease recorded in Q1’2024, mainly as a result of the declining energy production and exports among oil-importing economies coupled with reduced geopolitical tensions on the Middle east that caused disruption on the supply leading. On the other hand, prices of Precious Metals, Fertilizers, Agriculture, and Non-Energy increased by 42.5%, 13.1%, 11.0%, and 9.6% respectively, on the back of increased global demand coupled with easing supply chain constraints. Below is a summary performance of various commodities;

Source: World Bank

Q1’2025 data as of February 2025

Global Equities Market Performance:

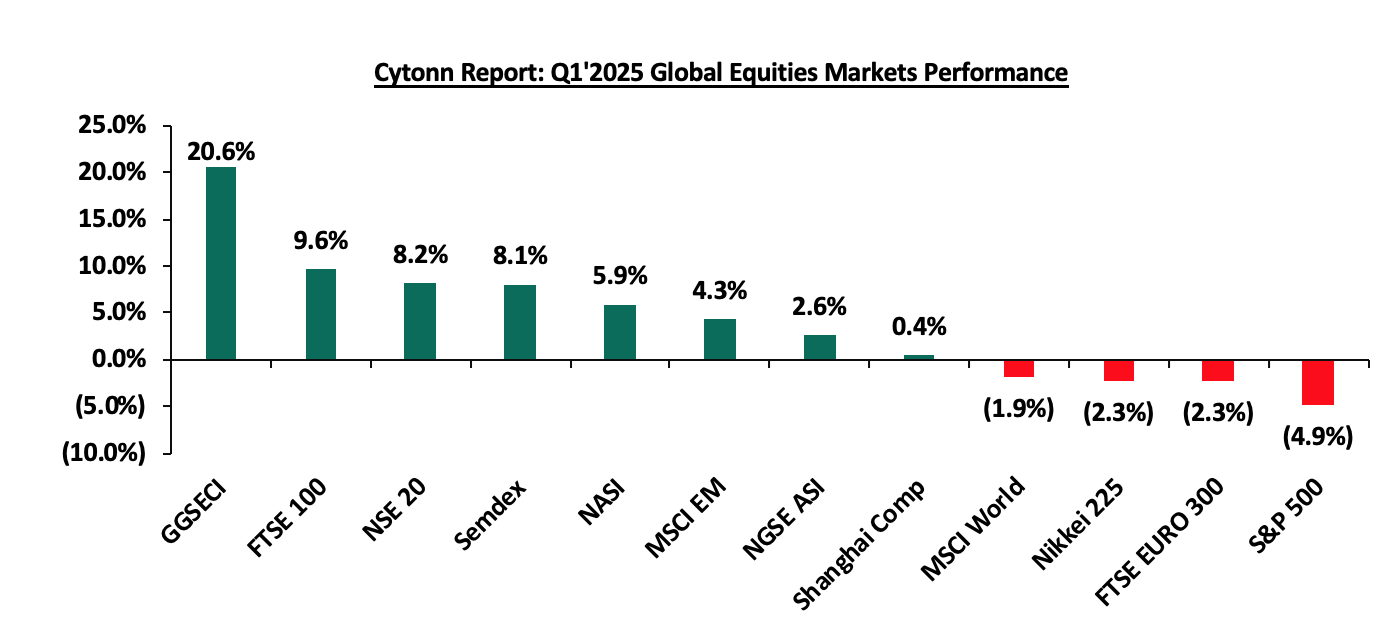

The global stock market recorded mixed performance in Q1’2025, with most indices in the developed countries recording gains during the period, largely attributable to increased investor sentiments as a result of continued economic recovery following the full reopening of the economies coupled with investor preference for the stock markets in the developed countries. Notably, GGSECI was the best performer during the period, recording a gain at 53.5% in Q1’2025 largely driven by gains in the large-cap stocks such as Access Bank, MTN Ghana and Standard Chartered Bank gaining by 74.4%,27.6% and 13.0%, following improved earnings during the period, additionally supported by easing inflation. S&P 500 was the largest decliner, recording losses of 4.9% with the performance being skewed by tariffs imposed by US President Donald Trump which hit the top global corporations coupled with the increase in bond yields even though the interest rates were cut. Below is a summary of the performance of key indices as at the end of Q1’2025:

*Dollarized performance

Sub-Saharan Africa Region Review

According to the World Bank, the Sub-Saharan economy is projected to grow at a moderate rate of 4.1% in 2025, which is 0.9% higher than the 3.2% growth estimate recorded in 2024. The expected recovery is primarily driven by private consumption growth as declining inflation boosts the purchasing power of household incomes. Nevertheless, the risk of debt distress remains high with more than half of countries facing unsustainable debt burdens. The public debt is expected to remain high due to increased debt servicing costs as a result of continued currency depreciation and high interest rates in developed economies. Additionally, many countries are providing subsidies in order to mitigate inflationary pressures, which could worsen public finance, increase public debt, and weigh down on debt sustainability.

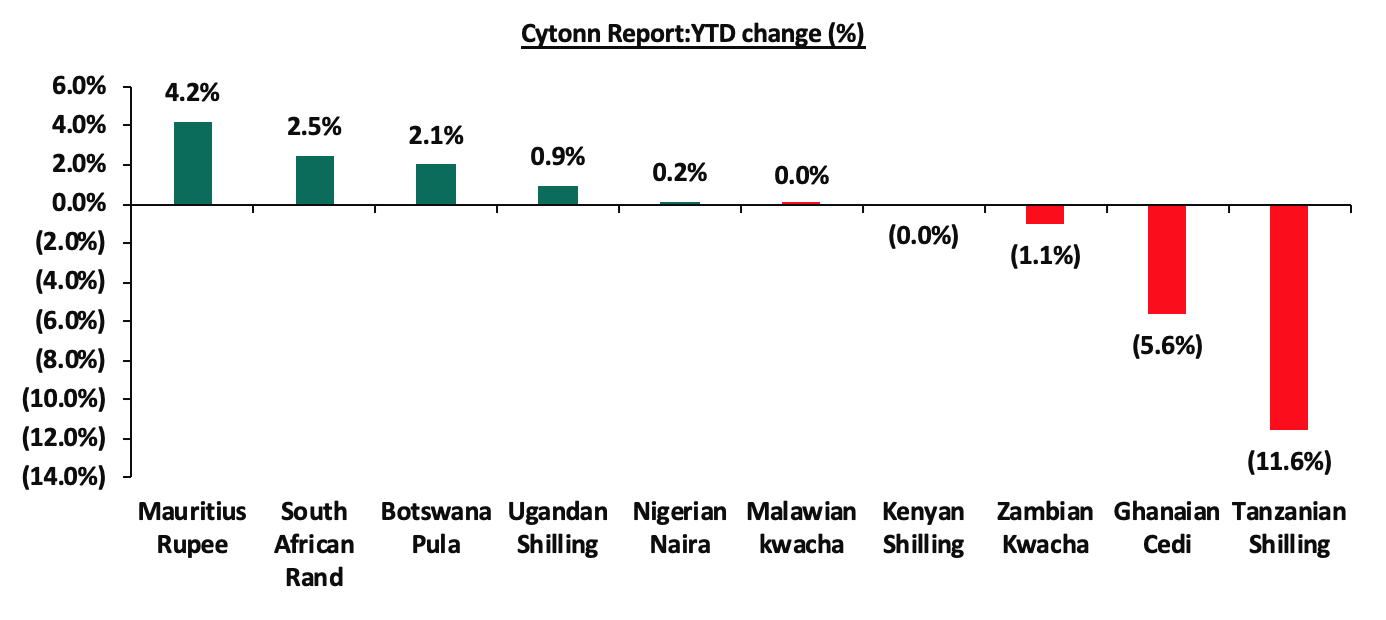

Currency Performance:

In Q1’2025, most of the select Sub-Saharan currencies depreciated against the US Dollar, primarily due to elevated inflationary pressures in the region, high debt servicing costs that continued to deplete foreign exchange reserves, and monetary policy tightening by advanced economies. High interest rates in developed countries resulted in significant capital outflows as investors, both institutional and individual, sought higher returns offered in these economies. Additionally, the rising inflation across most Sub-Saharan economies exerted pressure on local currencies due to the increasing cost of imports. However, the Mauritius Rupee emerged as the best performer among the selected currencies, appreciating by 4.2% against the USD on a year-to-date basis, closing Q1'2025 at MUR 45.7, from MUR 47.7 at the beginning of the year. Below is a table showing the performance of select African currencies against the US Dollar:

|

Cytonn Report: Select Sub-Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Mar-24 |

Jan-25 |

Mar-25 |

Last 12 months |

YTD change (%) |

|

Mauritius Rupee |

46.3 |

47.7 |

45.7 |

1.3% |

4.2% |

|

South African Rand |

19.0 |

18.8 |

18.3 |

3.7% |

2.5% |

|

Botswana Pula |

13.7 |

14.0 |

13.7 |

0.1% |

2.1% |

|

Ugandan Shilling |

3,885.9 |

3,697.6 |

3,662.6 |

5.7% |

0.9% |

|

Nigerian Naira |

1,418.6 |

1,540.7 |

1,538.3 |

(8.4%) |

0.2% |

|

Malawian kwacha |

1,742.0 |

1,750.3 |

1,750.2 |

(0.5%) |

0.0% |

|

Kenyan Shilling |

131.8 |

129.3 |

129.3 |

1.9% |

(0.0%) |

|

Zambian Kwacha |

24.8 |

27.9 |

28.2 |

(13.8%) |

(1.1%) |

|

Ghanaian Cedi |

13.2 |

14.7 |

15.5 |

(17.7%) |

(5.6%) |

|

Tanzanian Shilling |

2,557.5 |

2,374.7 |

2,650.0 |

(3.6%) |

(11.6%) |

Source: Yahoo Finance

The chart below shows the year-to-date performance of different sub-Saharan African countries in Q1’2025;

Source: Yahoo Finance

Key take outs from the above table and chart include:

- The Mauritius Rupee was the largest gainer against the USD Dollar, gaining by 4.2% year to date to close at MUR 45.7 as at the end of March from the MUR 47.7 recorded at the beginning of the year. The Rupee's strength has been supported by several factors, including the county’s effort to contain excess volatility of the rupee by market selling USD 120.0 mn in order to intervene the domestic foreign exchange, coupled with the US Federal Reserve's decision to cut its benchmark interest rate by 25 basis points to a range of 4.25%-4.50% has also contributed to a favorable environment for the South African Rand, and,

- The Tanzanian Shilling was the worst performing currency in Q1’2025, depreciating by 11.6%, mainly as a result of rising imports and increased public debt linked to major infrastructure projects.

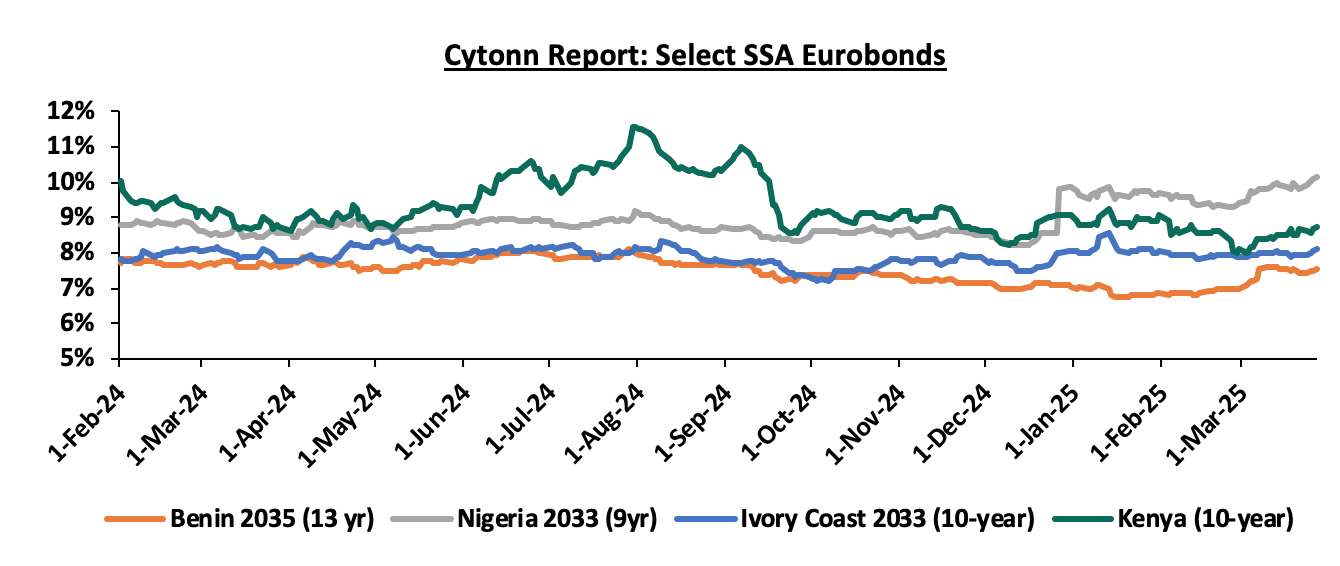

African Eurobonds:

Africa’s appetite for foreign-denominated debt has increased in recent times with the latest issuers during the three months to end of Q1’2025 being Ivory Coast and Benin raising a total of USD 0.7 bn and USD 0.5 bn respectively. Additionally, 2024 issuers were Ivory Coast, Benin, Kenya, Senegal and Cameroon raising a total of USD 2.6 bn, USD 0.8 bn, USD 1.5 bn, USD 0.8 bn and USD 0.6 bn respectively. Notably, all the bonds were oversubscribed with the high support being driven by the yield hungry investors and also the outlook of positive recovery in the regional economies. It is good to note that there was a general decline in the yields of the various bonds from different countries due to general improvement in investor sentiment as the economy recovers and the easing inflationary pressures in the region. The yields of the Ivory Coasts’ 10-year Eurobond maturing in 2033 increased marginally by 0.3% points to 8.4% as at the end of March 2025 from 7.8% recorded in March 2024. Similarly, the Yields of the Kenya’s 10-year Eurobond maturing in 2028 decreased by 0.1% points to 8.7% as at the end of March 2025 from 8.8% in March 2024, partly attributable to improved investor confidence following the successful buy-back of the 2027 Eurobond maturity, increased IMF Credit funding and the stabilizing of the Kenyan shilling against the dollar. Below is a graph showing the Eurobond secondary market performance of select Eurobonds issued by the respective countries:

Source: Bloomberg, CBK

Equities Market Performance:

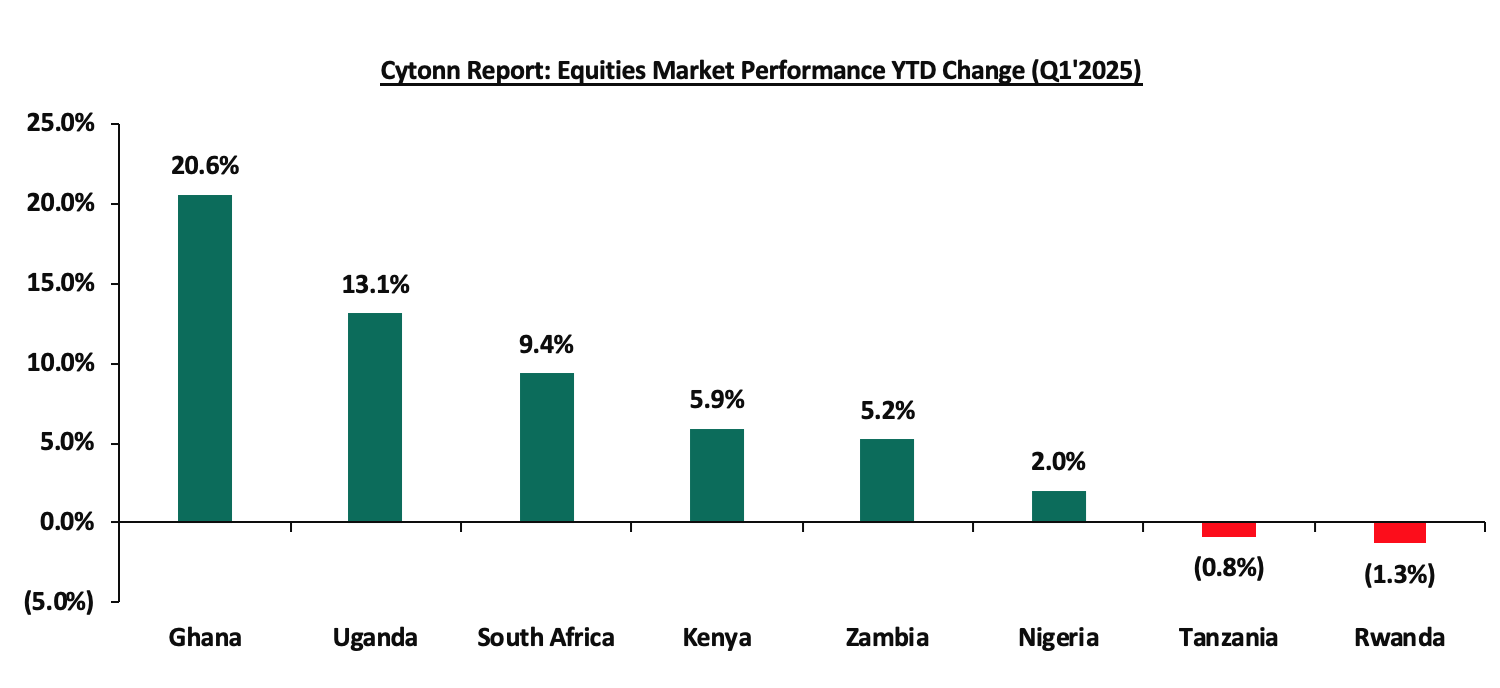

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in Q1’2025, with Ghana’s stock market (GSECI) being the best performing market gaining by 20.6% YTD attributable to gains in the large-cap stocks such as Access Bank, MTN Ghana and Standard Chartered Bank gaining by 74.4%,27.6% and 13.0%, following improved earnings during the period, additionally supported by easing inflation. Rwanda’s RAEASI was the worst performing stock market, declining by 1.3% YTD, mainly attributable to losses recorded by large-cap stocks such as KCB Rwanda and MTN Rwanda of 1.6% and 15.4% respectively. Below is a summary of the performance of key indices:

|

Cytonn Report: Equities Market Performance Q1'2025(Dollarized*) |

||||||

|

Country |

Index |

Mar-24 |

Jan-25 |

Mar-25 |

Last 12 months |

YTD Change |

|

Ghana |

GSECI |

261.8 |

333.8 |

402.5 |

53.7% |

20.6% |

|

Uganda |

USEASI |

0.3 |

0.3 |

0.4 |

29.1% |

13.1% |

|

South Africa |

JALSH |

3,891.5 |

4,502.1 |

4,924.7 |

26.6% |

9.4% |

|

Kenya |

NASI |

0.9 |

1.0 |

1.0 |

17.9% |

5.9% |

|

Zambia |

LASILZ |

524.8 |

578.8 |

608.9 |

16.0% |

5.2% |

|

Nigeria |

NGEASI |

73.9 |

67.5 |

68.8 |

(6.8%) |

2.0% |

|

Tanzania |

DARSDEI |

0.7 |

0.9 |

0.9 |

23.4% |

(0.8%) |

|

Rwanda |

RSEASI |

0.1 |

0.1 |

0.1 |

(4.7%) |

(1.3%) |

|

*The index values are dollarized for ease of comparison |

||||||

Source: Cytonn Research, Kwayisi, Yahoo Finance

The chart below shows the YTD Performance of the sub-Saharan Equities Market;

Dollarized performance

GDP growth in the Sub-Saharan Africa region is expected to slow down, in line with the rest of the global economy. Additionally, public debt continues to be a major headwind, with high debt levels experienced in the region on the back of continued weakening of local currencies, which will make debt servicing costlier, making the region less attractive to foreign capital.

According to the Kenya National Bureau of Statistics (KNBS) Q3’2024 Quarterly Gross Domestic Product Report, the Kenyan economy recorded a 4.0% growth in Q3’2024, lower than the 6.0% growth recorded in Q3’2023. The main contributor to Kenyan GDP remains to be Agriculture, Fishing and Forestry sector which grew by 4.2% in Q3’2024, lower than the 5.1% expansion recorded in Q3’2023. In Q3’2024 all sectors, except Mining and Quarrying and Construction recorded positive growths, with varying magnitudes across activities. Most sectors recorded declining growth rates compared to Q3’2023 with Accommodation and Food Services, Mining and Quarrying and Financial & Insurance Sectors recording the highest declines of 20.8%, 11.9%, and 10.8% points, respectively. Other sectors that recorded a contraction in growth rate, from what was recorded in Q3’2023 were Construction, Electricity and Water Supply and Real Estate sectors, of 6.0%, 2.4%, and 2.2% points respectively. The slowed growth in the economy is majorly attributed to the high cost of borrowing , the low private sector credit growth and the high fuel prices. The Kenyan Economy is projected to grow at an average of 4.8% in 2024, revised from an average of 5.3% after a weaker-than-expected growth in Q2’2024 and Q3’2024, according to various organizations as shown below:

|

Cytonn Report: Kenya 2024 Growth Projections |

|||

|

No. |

Organization |

2024 GDP Projections |

2024 Revised GDP Projections |

|

1 |

International Monetary Fund |

5.3% |

5.0% |

|

2 |

National Treasury |

5.5% |

4.7% |

|

3 |

World Bank |

5.2% |

4.7% |

|

4 |

Fitch Solutions |

5.2% |

4.5% |

|

5 |

Cytonn Investments Management PLC |

5.4% |

4.9% |

|

Average |

5.3% |

4.8% |

|

Source: Cytonn Research

In 2025, the Kenyan economy is expected to rebound, returning to its growth path, with the average projected growth estimated at 5.2% by various organizations as outlined below:

|

Cytonn Report: Kenya 2025 Growth Projections |

||

|

No. |

Organization |

2025 GDP Projections |

|

1 |

International Monetary Fund |

5.0% |

|

2 |

National Treasury |

5.3% |

|

3 |

World Bank |

5.3% |

|

4 |

Fitch Solutions |

5.1% |

|

5 |

Cytonn Investments Management PLC |

5.4% |

|

Average |

5.2% |

|

Source: Cytonn Research

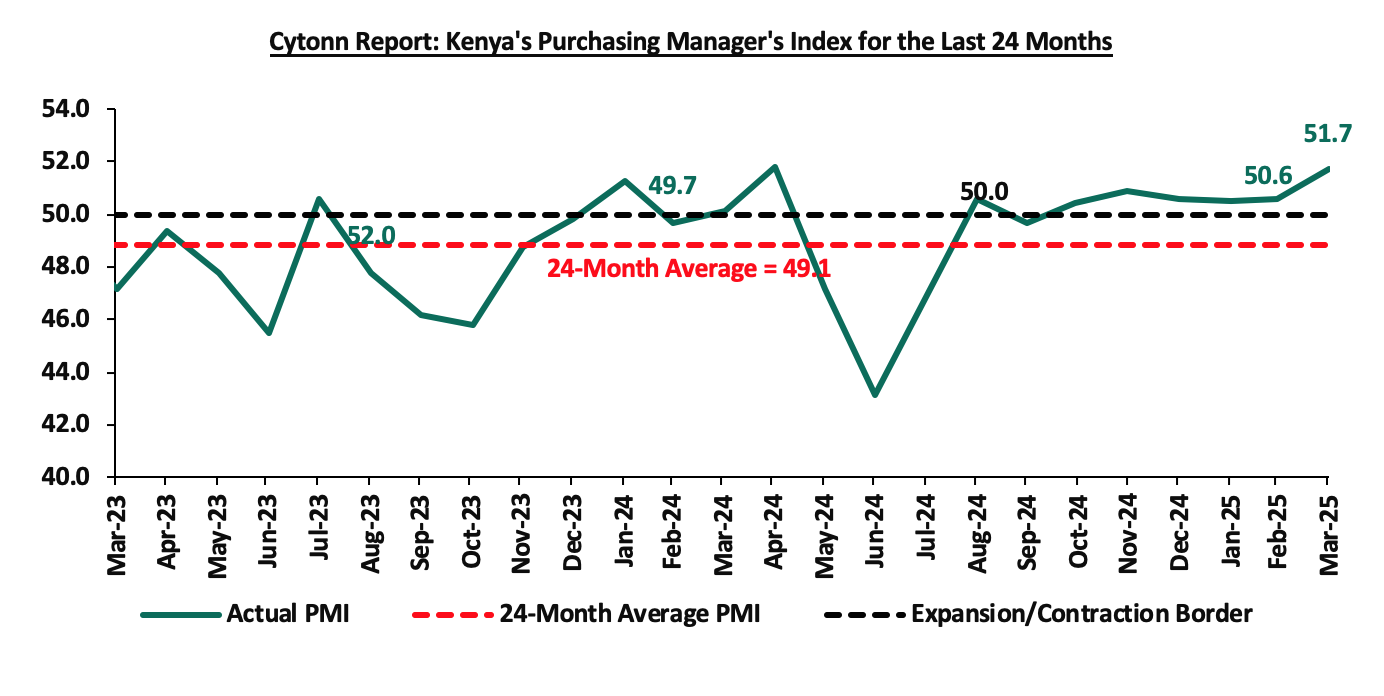

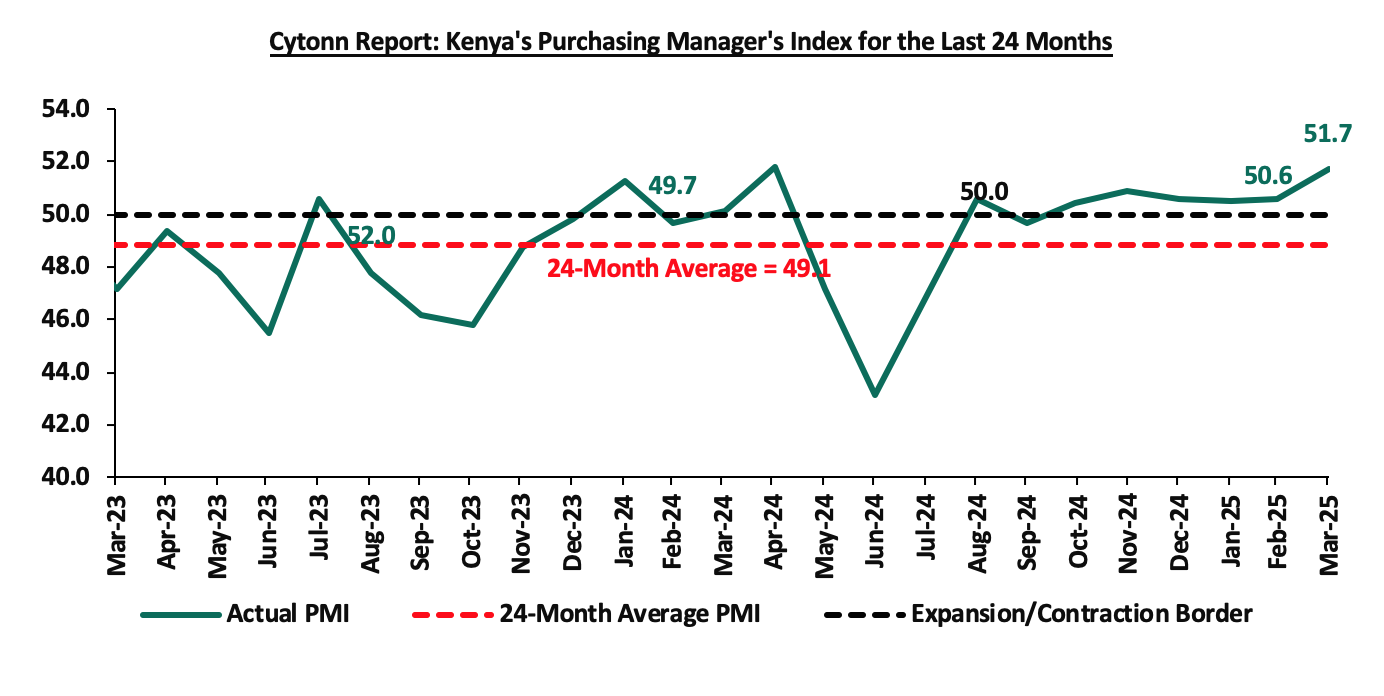

Key to note, Kenya’s general business environment slightly improved in Q1’2025, with the average Purchasing Manager’s Index coming in at 50.9, compared to 50.3 recorded in a similar period in 2024. The improvement was mainly on the back of easing monetary policy stance, reducing the cost of borrowing and increasing spending therefore supporting business activity. The chart below summarizes the evolution of PMI over the last 24 months. (A reading above 50.0 signals an improvement in business conditions, while readings below 50.0 indicate a deterioration):

Inflation:

Inflation:

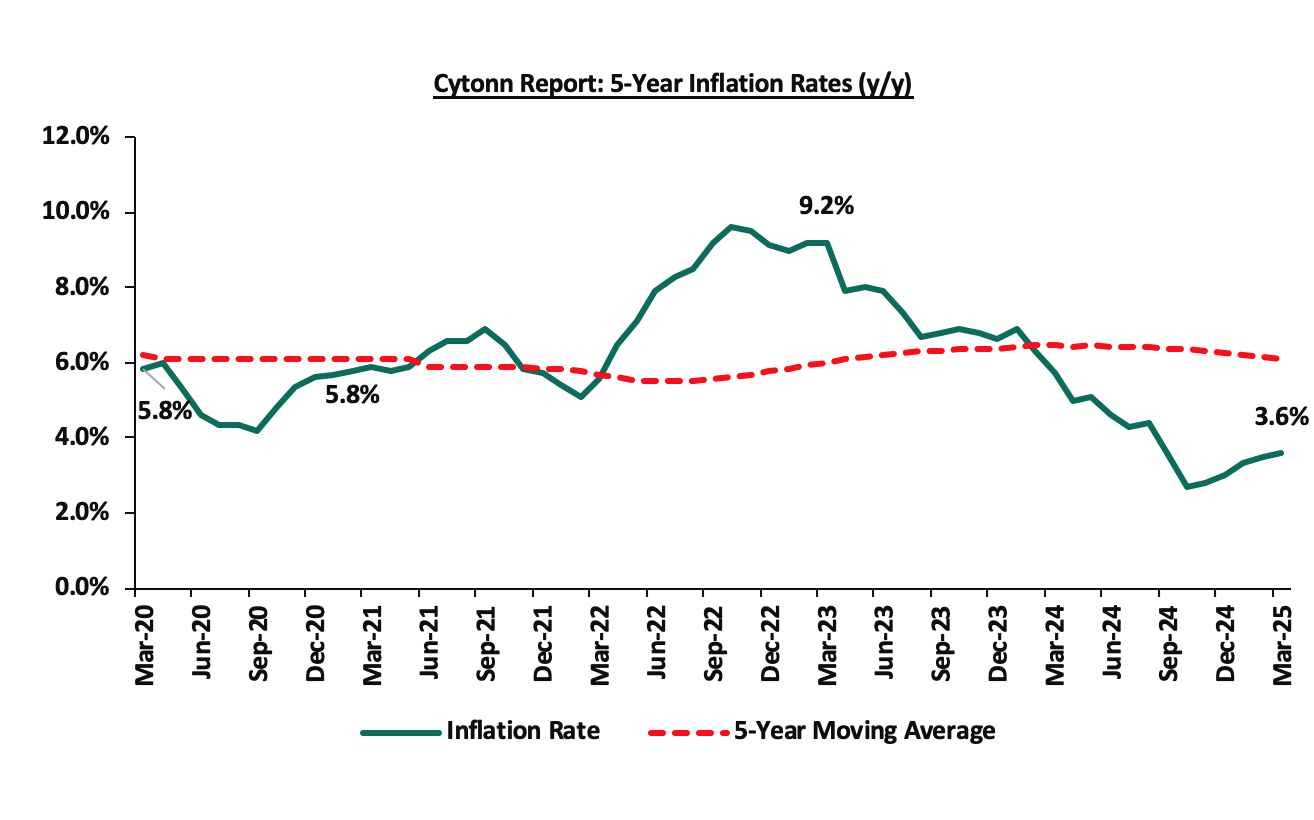

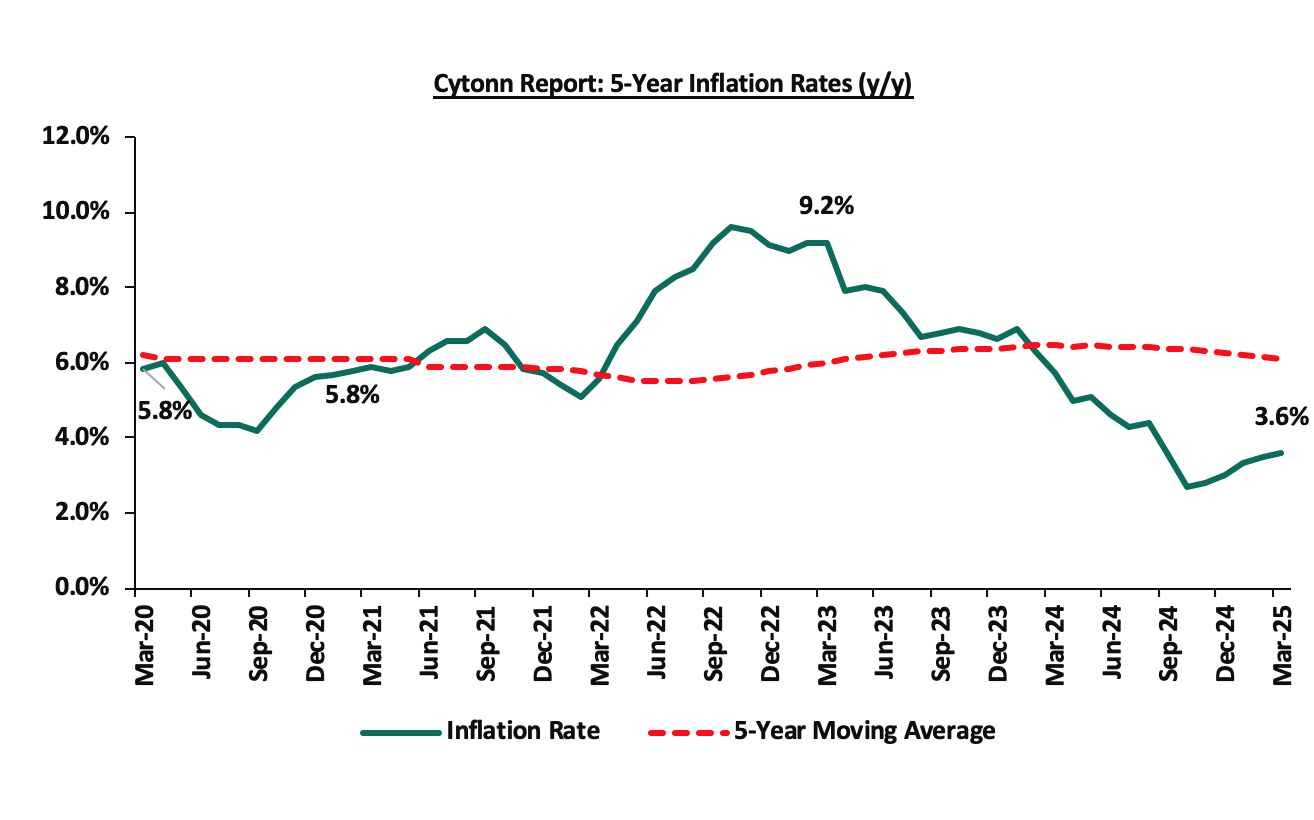

The average inflation rate decreased to 3.5% in Q1’2025, compared to 6.3% in Q1’2024, attributable to a stronger Shilling, and stabilized fuel prices. Notably, the maximum allowed price for Super Petrol and Diesel in March remained unchanged at Kshs 176.6 and Kshs 167.1 respectively from the prices announced for the month of February. Inflation for the month of March 2025 increased to 3.6%, from 3.5% recorded in February 2025, mainly driven by a 0.7% increase in the Food & Non-Alcoholic Beverages category. Below is a chart showing the inflation trend for the last five years:

Over the last 21 months, Kenya’s inflation has persistently remained within the Central Bank of Kenya (CBK) target range of 2.5% - 7.5%, owing to a stronger Shilling and reduced fuel prices. However, risks still persist, particularly due to the high fuel prices and an increasingly accommodative monetary policy, with the MPC on 5th February 2025, cutting the CBR rate by 50 bps to 10.75% from 11.25%. In their meeting this month, we expect further cuts that would increase the money supply and, therefore, may drive inflation upwards.

Going forward, we expect the inflationary pressures to remain within the CBK’s preferred target, mainly on the back of a stable Shilling, and stable fuel prices. However, the loosening monetary policy, the still elevated, though stabilized fuel prices, and the increasing electricity prices remain a risk for the inflation rate.

March 2025 Inflation

The y/y inflation in March 2025 increased slightly by 0.1% points to 3.6%, from the 3.5% recorded in February 2025. This was in line with our projected range of 3.6% to 3.8%, where our decision was mainly driven by the easing in the Central Bank Rate (CBR) to 10.75% in February 2025, slight depreciation of the Kenya Shilling against the US Dollar and increased electricity prices in March 2025. The headline inflation in March 2025 was majorly driven by increases in prices of commodities in the following categories; Food & Non-Alcoholic Beverages, and Transport sector which grew by by 6.6% and 1.5% respectively. However, the commodity prices in Housing, Water, Electricity, Gas & other fuels declined by 0.8%.

|

Cytonn Report: Major Inflation Changes – March 2025 |

|||

|

Broad Commodity Group |

Price change m/m (March-2025/ February -2025) |

Price change y/y (March-2025/March-2024) |

Reason |

|

Food and non-alcoholic beverages |

0.7% |

6.6% |

The m/m increase was mainly driven by the increase in prices of commodities such as kales, Irish potatoes and maize grain (loose) by 6.2%, 4.5% and 3.3% respectively. However, the increase was weighed down by decreases in prices of sugar and beans by 0.7% and 0.2% respectively |

|

Transport |

0.2% |

1.5% |

The transport index recorded a slight m/m increase mainly due to a 3.9% increase in local flights prices. Prices of Super Petrol and Diesel remained unchanged at Kshs 176.6 and Kshs 167.1 respectively |

|

Housing, water, electricity, gas and other fuels |

0.2% |

(0.8%) |

The m/m increase was mainly driven by an increase in prices of gas/LPG by 0.2% coupled with an increase in prices of 50kWh electricity and 200kWh electricity by 1.0% and 0.9% respectively. |

|

Overall Inflation |

0.4% |

3.6% |

The m/m increase was mainly attributable to the 0.7% increase in food and non-alcoholic beverages. |

Notably, March’s overall headline inflation increased slightly for the fifth consecutive month, remaining within the CBK’s preferred range of 2.5%-7.5% for the twenty first consecutive month. The increase in headline inflation in March 2025 comes amid the maximum allowed price for Super Petrol and Diesel remaining unchanged at Kshs 176.6 and Kshs 167.1 respectively. Despite fuel prices remaining unchanged, prices are still high, resulting in high production costs and high costs of goods and services. Additionally, the reduction in the CBR to 10.75% from 11.25% is likely to increase the money supply through lower borrowing costs, which may cause a slight rise in inflation rates as the effects of the CBR gradually take hold in the broader economy. The Kenya Shilling also recorded a 4.7 bps year-to-date appreciation to Kshs 129.2, from the Kshs 129.3 recorded at the beginning of the year. This stabilization in the exchange rate and fuel prices is however expected to continue anchoring inflationary pressures in the country remaining within the CBK’s preferred range of 2.5%-7.5%. The chart below shows the inflation rates for the past 5 years:

Going forward, we expect inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a stable currency and stable fuel prices. Additionally, favourable weather conditions will also contribute to stabilizing food prices, further supporting stable inflation rates. The risk, however, lies in the fuel prices which despite their stability, still remain elevated compared to historical levels. Additionally, the Monetary Policy Committee cut the Central Bank Rate by 50.0 bps to 10.75% from 11.25% in its February 2025 meeting, with the aim of easing the monetary policy, while maintaining exchange rate stability, and will meet again in April 8th 2025. This cut in the Central Bank Rate is likely to elevate inflationary pressures gradually as consumer spending rises leading to demand- pull inflation. The committee is expected to lower rates further, though gradually, to provide further support for the economy.

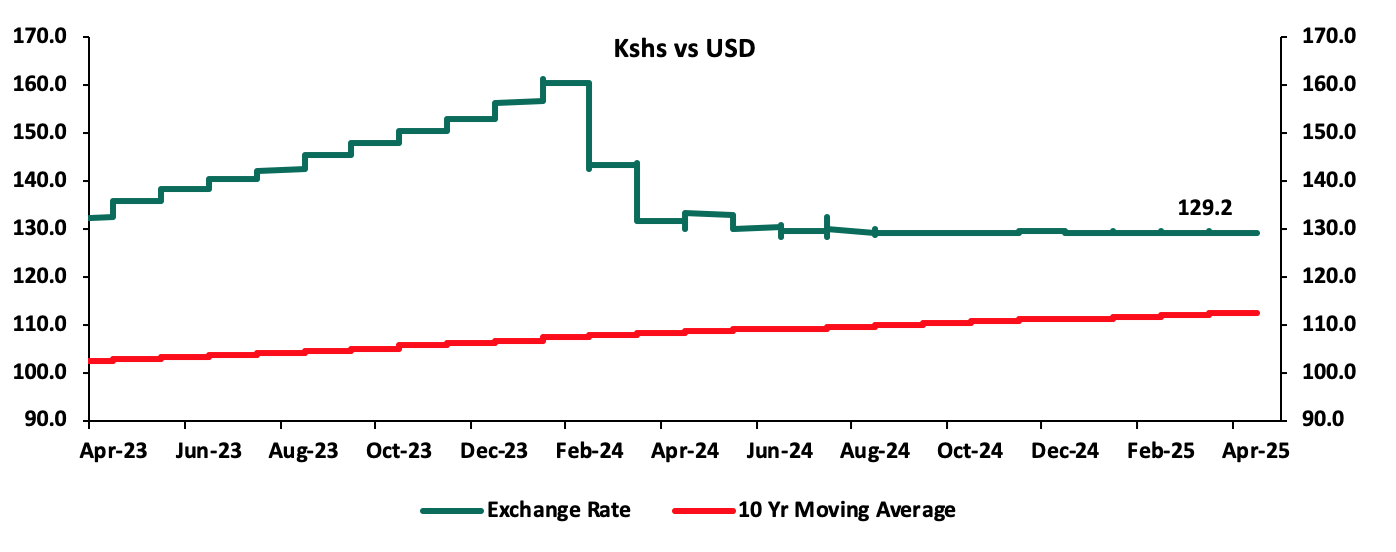

The Kenyan Shilling:

The Kenyan Shilling remained stable during the quarter, depreciating slightly against the US Dollar by 1.8 bps in Q1’2025, to close at Kshs 129.3, relatively unchanged from end of FY’2024, possibly attributable to reduced foreign inflows during the quarter as a result of the lower interest rates following the Monetary Policy Committee decision to cut the Central Bank Rate (CBR) to 10.75%, and higher liquidity increasing money supply of the local currency relative to the dollar. During the week, the Kenya Shilling appreciated against the US Dollar by 5.5 bps to Kshs 129.2 from the Kshs 129.3 recorded the previous week.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,956.5 mn in the twelve months to February 2025, 14.5% higher than the USD 4,329.7 mn recorded over the same period in 2024. These has continued to cushion the shilling against further depreciation. In the February 2025 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 53.0% in the period,

- The tourism inflow receipts which came in at Kshs 452.2 bn in 2024, a 19.8% increase from Kshs 377.5 bn inflow receipts recorded in 2023, and owing to tourist arrivals that improved by 14.6% to 2,394,376 in 2024 from 2,089,259 in 2023, and,

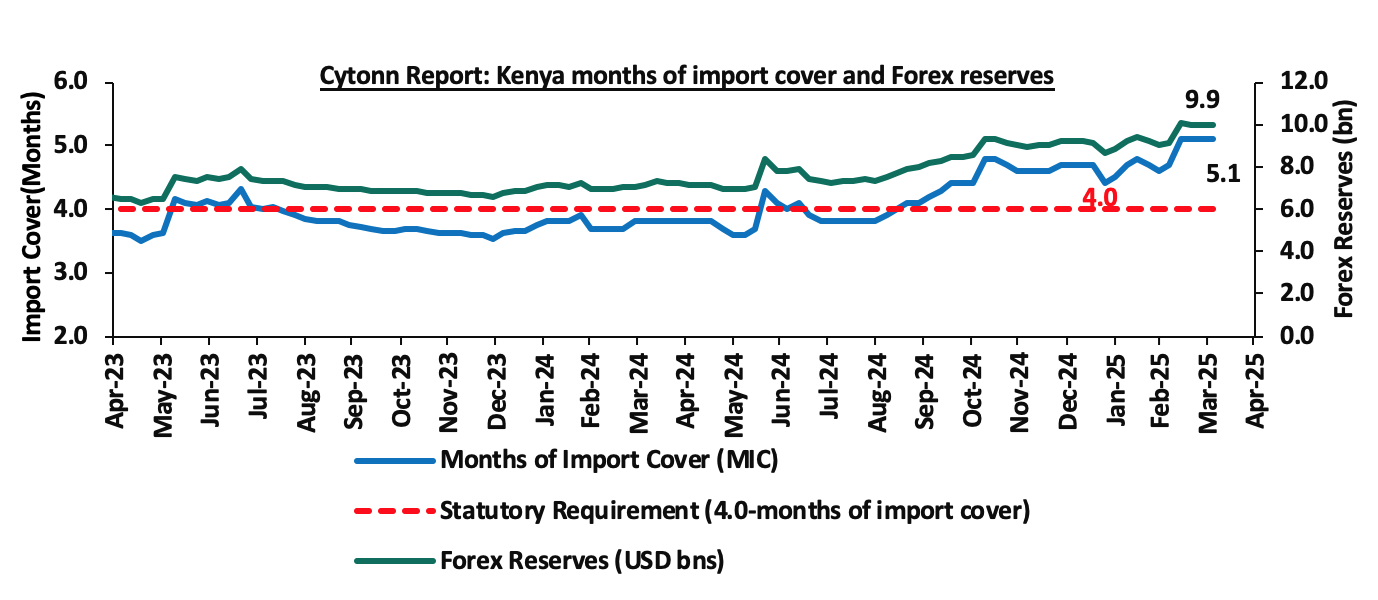

- Improved forex reserves currently at USD 9.9 bn (equivalent to 5.1-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2025 as a result of:

- An ever-present current account deficit which came at 4.0% of GDP in Q3’2024, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 62.1% of Kenya’s external debt is US Dollar-denominated as of September 2024.

Key to note, during the quarter, Kenya’s forex reserves increased by 8.2% to close at USD 10.0 bn from the USD 9.2 recorded at the start of the quarter. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Monetary Policy:

The Monetary Policy Committee (MPC) met once in Q1’2025, where the Central Bank Rate was cut by 50 bps to 10.75% from the 11.25% , noting that its previous interventions had successfully stabilized exchange rate pressures, and anchored inflation with inflation coming at 3.3%, 3.5 and 3.6% in January, February and March 2025 respectively, remaining within and below the mid-point of the CBK target range of 2.5%-7.5%. Below are some of the key highlights from the February 2025 meeting:

- The overall inflation increased marginally by 0.3% points to 3.3% in January 2025, from 3.0% in December 2024, positioning it below the mid-point of the preferred CBK range of 2.5%-7.5%. Core inflation decreased to 2.0% in January 2025, from 2.2% in December 2024, reflecting subdued demand pressures in the economy. This decline was largely attributed to lower prices of processed food items, particularly sugar, maize, and wheat products. Conversely, non-core inflation increased to 7.1% in January 2025, from 5.2% in December 2024, driven by higher prices of food crops, especially vegetables, due to seasonal factors. Lower energy and utilities costs, including reduced electricity and fuel prices, continued to help moderate non-core inflation. Overall inflation is expected to stay below the mid-point of the target range in the near term, supported by low and stable core inflation, an anticipated reduction in energy prices, and a stable exchange rate.

- In January 2025, the Kenya National Bureau of Statistics (KNBS) and the Central Bank of Kenya (CBK) jointly introduced core and non-core inflation figures in Kenya. Core inflation excludes items with highly volatile or transient prices from the overall Consumer Price Index (CPI), offering a clearer view of underlying inflation trends. Alongside overall inflation, CBK will now monitor core and non-core inflation numbers, aligning with global best practices of inflation-targeting central banks. This initiative also adheres to the East African Community (EAC) guidelines for harmonized CPI computation. The core CPI basket includes 275 items, representing 81.1% of the overall CPI weight, making it a more accurate tool for tracking inflation trends, closely aligned with overall inflation.

- The recently released Quarterly Gross Domestic Product Report, for Q3’2024 showed a slowdown in the performance of the Kenyan economy, with real GDP growing by 4.0%, slower than the 6.0% recorded a similar period in 2023. This was attributable to deceleration in growth in most sectors of the economy, particularly agriculture and forestry, real estate, financial and insurance, information and communication, and transport and storage. The economy is expected to continue to strengthen in 2025 with real GDP growth projected to come in at 5.4%, from the 4.6% growth projected for 2024. The growth is supported by resilient services sector, expected recovery in growth of credit to the private sector, sustained performance in agriculture, and enhanced exports. However, this positive outlook is tempered by potential risks, including geopolitical tensions.

- Goods exports increased by 15.4% in the 12 months to December 2024, compared to 2023, reflecting a rise in exports of agricultural commodities and re-exports. Goods imports rose by 9.9% reflecting increases in intermediate and capital goods imports. The current account deficit as at December 2024 is estimated at 3.7% of GDP, down from 4.0% in 2023, driven by stronger goods exports, robust diaspora remittance inflows, and reduced oil imports. In 2024, diaspora remittances rose by 18.0% totalling to USD 4,945.0 from USD 4,190.0 in 2023 and tourist arrivals in 2024 increased by 14.6%. The current account deficit was fully financed by capital and financial inflows, leading to an overall balance of payments surplus of USD 1,466.0 mn. This surplus, combined with IMF disbursements, resulted in a USD 2,749.0 mn build-up in gross reserves. For 2025, the current account deficit is projected at 3.8% of GDP and is expected to be fully financed by capital and financial inflows, yielding a balance of payments surplus of USD 591.0 mn and an increase in gross reserves of USD 1,451.0 mn.

- The CBK foreign exchange reserves, which currently stand at USD 9, 219.0 and representing 4.7 months of import cover, continue to provide adequate cover and a buffer against any short-term shocks in the foreign exchange market,

- The banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans decreased to 16.4% in December 2024 compared to 16.5% in October 2024. Decreases in NPLs were noted in the manufacturing, trade, building and construction, real estate and energy and water sectors. Banks have continued to make adequate provisions for the NPLs,

- The CEOs Survey and Market Perceptions Survey conducted ahead of the MPC meeting revealed an improved optimism about business activity and economic growth prospects for the next 12 months. The optimism was attributed to the stable macroeconomic environment reflected in the low inflation rate and stability in the exchange rate, expectations of a decline in interest rates, favorable weather conditions supporting agriculture, resilience of the services sector, and improved global growth prospects. Nevertheless, respondents expressed concerns about high cost of doing business and subdued consumer demand,

- The Survey of the Agriculture Sector for January 2025 revealed an expectation for moderate upward pressure on overall headline inflation in the next three months, on account of higher vegetables and cereals prices attributed to seasonal factors. Nevertheless, respondents expressed that stability in pump prices and exchange rate are expected to moderate inflation,

- Global growth is expected to continue to recover and is projected at 3.3% in 2025 from an estimate of 3.2% in 2024, attributable to strong growth in the United States, strong growth in some large emerging market economies such as India, and improved growth prospects in the United Kingdom. The main risk to the global growth outlook relates to an elevated uncertainty on trade policy amid rising tariffs on imports and further escalation of geopolitical tensions particularly the conflict in the Middle East and the Russia-Ukraine war

- Global headline inflation has eased; however, the rate of decline has slowed in major economies due to persistent core inflation. Central banks in these economies have continued to reduce interest rates, though at varying speeds based on their inflation and growth projections. While international oil prices have moderated, the risk of volatility remains high, fuelled by rising import tariffs and ongoing geopolitical tensions. Meanwhile, food inflation has risen, primarily due to higher edible oil prices.

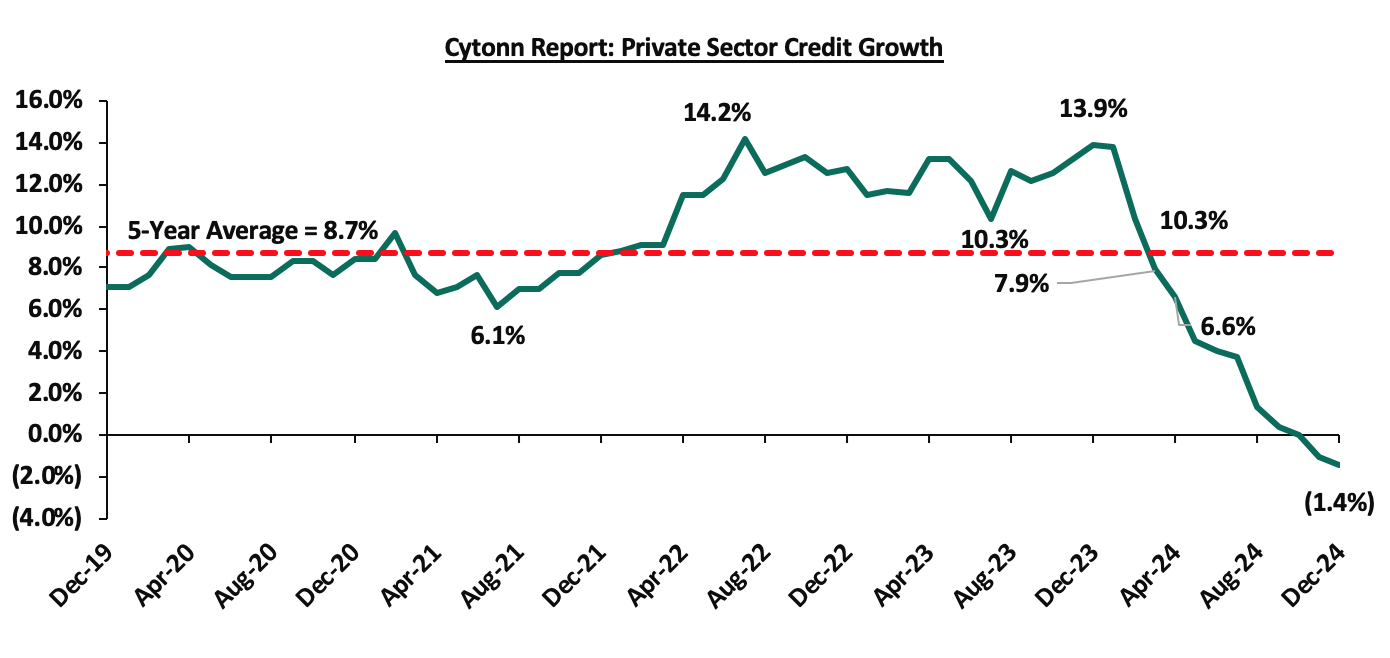

- Growth in private sector credit contracted by 1.4% in December 2024 compared to the previous year, mainly attributed to exchange rate valuation effects on foreign currency-denominated loans due to the appreciation of the Shilling and reduced demand attributable to high lending interest rates. In December, local currency loans stood at 2.1%, while foreign currency loans, which make up around 26.0% of total loans, decreased by 11.4%. The chart below shows the movement of the private sector credit growth over the last five years:

- The Committee acknowledged the ongoing implementation of the FY’2024/25 Supplementary Budget I. These measures are anticipated to further support fiscal consolidation, reducing the fiscal deficit to 4.3% of GDP in FY’2024/25, from 5.3% of GDP in FY’2023/24. The fiscal consolidation in the medium-term should reduce debt vulnerabilities while moving the present-value-of-debt to GDP ratio towards the target anchor of 55.0%.

The MPC noted that overall inflation is expected to stay below the midpoint of the target range of 2.5%–7.5% in the near term. This outlook is supported by stable core inflation, low energy prices, and a stable exchange rate which is largely attributed to its earlier tight monetary policy stance. As a result, the MPC has shifted to a more accommodative monetary policy, reducing the Central Bank Rate (CBR) by a cumulative 225 bps to 10.75% by February 2025 from 13.0% in June 2024. Additionally, central banks in major economies have continued to lower interest rates at varying paces. The Committee also noted that economic growth slowed in 2024, creating room for further easing of monetary policy to support economic activity while maintaining exchange rate stability. The MPC stated that the CRR reduction would release additional liquidity to banks, which is expected to reduce the cost of funds, lower lending rates, and boost private sector credit growth. The Committee observed that despite significant reductions in the CBR since the August 2024 meeting, lending rates have only marginally declined. It emphasized that banks must take further action to reduce lending rates to stimulate private sector credit growth and support economic activity. To ensure compliance with the Risk-Based Credit Pricing Model (RBCPM), the CBK decided to initiate on-site inspections of banks to verify their alignment with the RBCPM in reducing interest rates. Recent amendments to the Banking Act empower the CBK to penalize any bank that fails to pass on the reduced cost of funds to borrowers. The MPC noted that it will continue to monitor the effects of these policy measures, as well as global and domestic economic developments, and will remain ready to take additional action if necessary. The next MPC meeting is scheduled for April 2025.

Fiscal Policy:

The execution of the FY’2024/25 budget has been largely smooth, despite facing challenges in July and August 2024 due to demonstrations that disrupted economic activities. These disruptions led to a decline in revenue collection, increased debt servicing costs, and the need to address outstanding expenditure carryovers from FY’2023/24, as well as pending bills. Additionally, there have been rising expenditure pressures driven by increased demand for additional resources and as a result, the National Treasury presented the Supplementary Estimates II for the Fiscal Year 2024/25 to the National Assembly.

The table below summarizes the overall change in the FY’2024/25 budget estimates.

|

Cytonn Report: FY’2024/25 Supplementary Budget Estimates II (Kshs bn) |

|||||

|

Item |

Original Approved Estimates FY’2024/25 (a) |

Supplementary Estimates I FY’2024/25 (b) |

Supplementary Estimates II FY’2024/25 (c) |

% Change (c/a) |

% Change (c/b) |

|

Recurrent Expenditure |

1,632.1 |

1,591.6 |

1,728.6 |

5.9% |

8.6% |

|

Development Expenditure |

746.3 |

641.2 |

590.1 |

(20.9%) |

(8.0%) |

|

Ministerial National Government Expenditure |

2,378.4 |

2,232.8 |

2,318.6 |

(2.5%) |

3.8% |

|

Consolidated Fund Services |

1,213.5 |

1,237.2 |

1,242.7 |

2.4% |

0.4% |

|

County Equitable Allocation |

400.1 |

411.0 |

418.3 |

4.5% |

1.8% |

|

Total Expenditure |

3,992.0 |

3,880.9 |

3,979.6 |

(0.3%) |

2.5% |

Source: The National Treasury

Key take outs from the table include;

- The recurrent expenditure (Costs incurred to cover regular government expenses such as salaries, operational costs and maintenance costs) increased by 8.6% to Kshs 1,728.6 bn in the Supplementary Estimates II from Kshs 1,591.6 bn in the Supplementary Estimates I, and by 8.6% from Kshs 1,632.1 bn in the original estimates, an indication of the government's initiative to increase expenditure allocation to boost public services, responding to economic growth and ensuring the well-being of its citizens,

- Development expenditure (Costs incurred in order to create assets that will provide long term public infrastructure such as roads, hospitals, and schools) declined by 8.0% to Kshs 590.1 bn in the Supplementary Estimates II from Kshs 641.2 bn in the Supplementary Estimates I, and by 20.8%% from Kshs 746.3 bn in the original estimates a detriment to the sectors such as infrastructure, energy, water and health that require heavy development financing,

- The Ministerial National Government expenditure estimates for the FY’2024/25 Supplementary Budget II is set to increase by 3.8% to Kshs 2,318.6 bn from Kshs 2,232.8 bn Supplementary Budget I translating to an increase of Kshs 85.9 bn in expenses for the government. This increase is mainly due to the increasing expenditure in various sectors and public services,

- Consolidated Fund Services (CFS) (refers to the Consolidated Fund established in the Kenya’s constitution into which development partners deposit funds before disbursing to the Exchequer accounts for projects such as servicing of public debt, and subscription to International Organizations) has increased by 0.4% to Kshs 1,242.7 bn from Kshs 1,237.2 bn in the Supplementary Budget I and further by 4.5% from Kshs 1,213.5 in the original estimates, and,

- The County Equitable Share (allocation on national government revenue to county governments) increased by 1.8% to Kshs 418.3bn from Kshs 411.0 bn in the Supplementary Estimates I.

Notably, for the FY’2024/2025, from the figures released by the National Treasury for revenue and net expenditures collected as at the end of February 2025, total revenue collected amounted to Kshs 1,403.7 bn, equivalent to 56.7% of the revised estimates of Kshs 2,475.1 bn for FY’2024/2025 and is 85.1% of the prorated estimates of Kshs 1,650.0 bn. The total expenditure amounted to Kshs 2,316.1 bn, equivalent to 55.0% of the revised estimates of Kshs 4,207.9 bn, and is 82.6% of the prorated target expenditure estimates of Kshs 2,805.3 bn.

Going forward, we believe that the coming months’ revenue collection performance will largely depend on how quickly the country’s business climate stabilizes. We therefore expect the government to cut on its expenditure, mostly the development expenditure in order to finance the growing debt maturities and the ballooning recurrent expenditure.

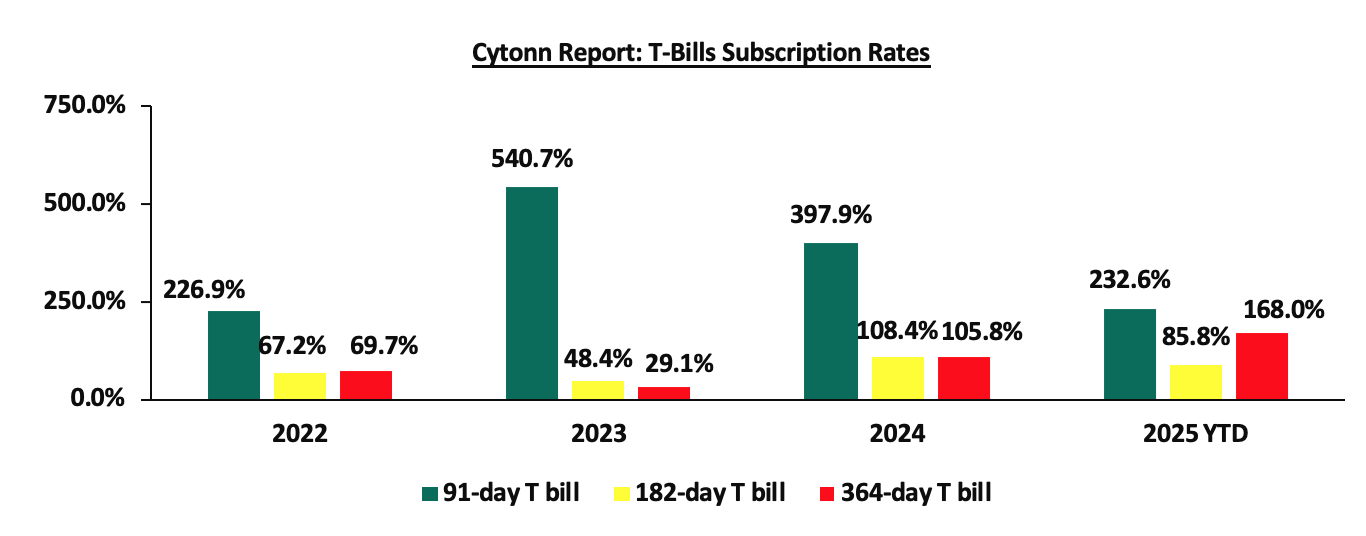

During the quarter, T-bills were oversubscribed, with the overall subscription rate coming in at 136.1%, up from 132.6% in Q1’2024. Investors’ preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 424.6 bn against the offered Kshs 52.0 bn, translating to an oversubscription rate of 221.1%, albeit lower than the subscription rate of 494.4% recorded in the previous year same period. Overall subscriptions for the 364-day and 182-day papers increased significantly to 140.4% and 97.8%, from 64.3% and 56.3% in Q1’2024, respectively. The yields on all the papers were on a downward trajectory with the average yields on the 91-day, 182-day, and 364-day papers decreasing by 7.3%, 7.0%, and 5.9% points to 9.2%, 9.5%, and 10.8%, from 16.4%, 16.6%, and 16.7%, respectively, recorded in Q1’2024. The downward trajectory in yields is mainly due to high liquidity in the money market which allowed the government to front load most of its borrowing. The acceptance rate during the period came in at 86.4%, albeit lower than the 88.8% recorded in Q1’2024, with the government accepting a total of Kshs 366.8 bn out of the Kshs 424.6 bn worth of bids received. The chart below shows the yield growth rate for the 91-day paper in 2024 and during the year:

During the week, T-bills were oversubscribed for the first time in two weeks, with the overall subscription rate coming in at 169.5%, a reversal from the undersubscription rate of 61.4% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 11.2 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 279.5%, higher than the undersubscription rate of 69.8%, recorded the previous week. The subscription rates for the 182-day paper increased to 44.9% from the 17.1% recorded the previous week while the 364-day paper increased to 250.1% from the 102.5% recorded the previous week. The government accepted a total of Kshs 40.5 bn worth of bids out of Kshs 40.7 bn bids received, translating to an acceptance rate of 99.7%. The yields on the government papers were on a downward trajectory with the yields on the 91-day paper decreasing the most by 16.1 bps to 8.6% from 8.8% recorded the previous week. The yields on the 364-day paper decreased by 2.5 bps to remain relatively unchanged from the 10.4% recorded the previous week while the 182-day paper decreased by 2.3 bps to 9.0% from the 9.1% recorded the previous week

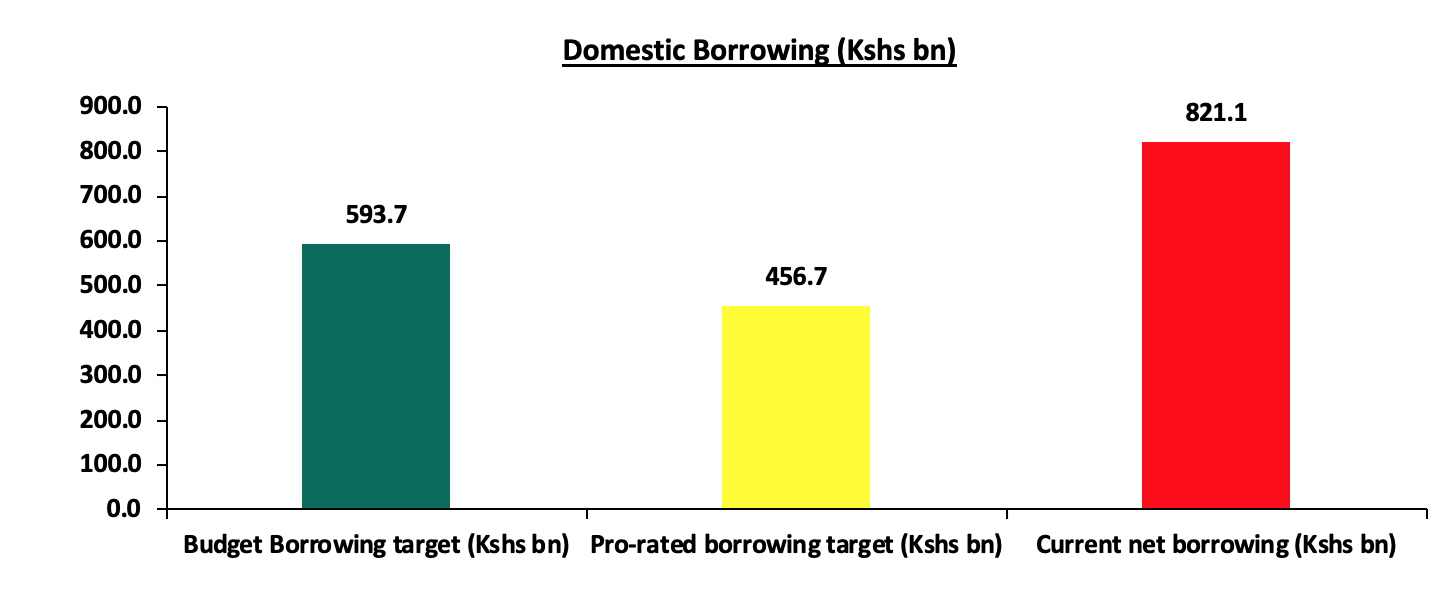

So far in the current FY’2024/25, government securities totalling Kshs 1,459.0 bn have been advertised. The government has accepted bids worth Kshs 1,786.8 bn, of which Kshs 1,151.2 bn and Kshs 635.6 bn were treasury bills and bonds, respectively. Total redemptions so far in FY’2024/25 equal to Kshs 965.7 bn, with treasury bills accounting for Kshs 916.7 bn, and 49.0 bn for treasury bonds. As a result, currently, the government has a domestic borrowing surplus of Kshs 227.4 bn, which is 38.3% of the total net domestic borrowing target of Kshs 593.7 bn for FY’2024/25. The chart below shows government’s current borrowing position:

The chart below compares the overall average T-bills subscription rates obtained in 2022, 2023, 2024, and 2025 Year to Date (YTD):

Primary T-bond Auctions in Q1’2025:

During the quarter, the government re-opened five bonds, seeking to raise Kshs 125.0 bn during the quarter. The bonds were generally oversubscribed, receiving bids worth Kshs 299.9 bn against the offered Kshs 125.0 bn, translating to a subscription rate of 239.9%. The government accepted Kshs 214.5 bn of the Kshs 299.9 bn worth of bids received, translating to an acceptance rate of 71.5%. The table below provides more details on the bonds issued during the quarter:

|

Cytonn Report: Bond Issuances in Q1’2025 |

||||||||||

|

Issue Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount offered (Kshs bn) |

Actual Amount Raised (Kshs bn) |

Total bids received |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

|

10/03/2025 |

FXD1/2018/025 - Reopened |

18.3 |

13.4% |

25.0 |

35.2 |

47.0 |

13.8% |

188.0% |

75.0% |

|

|

17/02/2025 |

IFB1/2022/014 - Reopened |

11.8 |

13.9% |

70.0 |

65.3 |

93.1 |

14.0% |

411.3% |

45.4% |

|

|

IFB1/2023/017 - Reopened |

15.1 |

14.4% |

65.6 |

100.8 |

14.3% |

|

||||

|

20/01/2025 |

FXD1/2022/025 -Reopened |

22.8 |

14.2% |

30.0 |

24.7 |

28.4 |

15.7% |

196.7% |

87.0% |

|

|

FXD1/2018/015-Reopened |

8.3 |

12.7% |

23.8 |

30.6 |

14.2% |

77.7% |

||||

|

Q1’2025 Total |

|

|

125.0 |

214.5 |

299.9 |

|

|

|

||

|

Q1’2024 Total |

|

|

200.0 |

334.6 |

440.5 |

|

|

|

||

|

Q1’2025 Average |

15.3 |

13.7% |

|

|

|

14.4% |

239.9% |

71.5% |

||

|

Q1’2024 Average |

5.1 |

17.5% |

|

|

|

18.3% |

220.2% |

76.0% |

||

Source: CBK

During the quarter, the government re-opened five treasury bonds, including FXD1/2018/025, IFB1/2022/014, IFB1/2023/017, FXD1/2018/015, and FXD1/2022/025, with weighted average yields of 13.8%, 14.0%, 14.3%, 14.2% and 15.7% respectively, and fixed coupon rates of 13.4%, 13.9%, 14.4%, 12.7% and 14.2% respectively.

Also, during the quarter, the government announced its first-ever domestic treasury bond buyback aiming to buyback Kshs 50.0 bn of Kshs 185.1 bn for the FXD1/2020/005, FXD1/2022/003 and IFB1/2016/009 with tenors to maturity of 0.4 years, 0.3 years and 0.4 years respectively, and fixed coupon rates of 11.7%, 11.8% and 12.5% respectively. The total outstanding amounts for the FXD1/2020/005, FXD1/2022/003 and IFB1/2016/009 were Kshs 104.5 bn, Kshs 60.6 bn and Kshs 19.9 bn each respectively. The offer was oversubscribed, with the overall subscription rate coming in at 112.2%, receiving bids worth Kshs 56.1 bn against the offered Kshs 50.0 bn. The government accepted bids worth Kshs 50.1 bn, translating to an acceptance rate of 89.3%, and equivalent to 27.1% of the total outstanding amount of Kshs 185.1 bn for the three bonds. The weighted average yield for the accepted bids for the FXD1/2022/003, FXD1/2020/005 and IFB1/2016/009 came in at 9.1%, 8.9% and 9.1% respectively.

During the week, the Central Bank of Kenya released the auction results for the re-opened treasury bonds FXD1/2020/015, FXD1/2022/015 and FXD1/2022/025 with tenors to maturity of 9.9 years, 12.1 years and 22.6 years respectively and fixed coupon rates of 12.8% 13.9% and 14.2% respectively. The bonds were oversubscribed, with the overall subscription rate coming in at 102.5%, receiving bids worth Kshs 71.7 bn against the offered Kshs 70.0 bn. The government accepted bids worth Kshs 71.4 bn, translating to an acceptance rate of 99.5%. The weighted average yield for the accepted bids for the FXD1/2020/015, FXD1/2022/015 and FXD1/2022/025 came in at 13.7%, 13.8% and 14.2%. Notably, the 13.7% on the FXD1/2020/015 was relatively unchanged from the last tap sale in March 2022 while the 13.8% on the FXD1/2022/015 was lower than the 14.2% recorded on the last time it was reopened in January 2023 and the 14.2% on the FXD1/2022/025 was lower than the 15.7% recorded the last time it was reopened in January 2025. With the Inflation rate at 3.6% as of March 2025, the real returns of the FXD1/2018/025, FXD1/2022/015 and FXD1/2022/025 are 10.1%, 10.2% and 10.6%. Given the withholding tax of 10.0%% for the three bonds, a shorter-term bond subject to 15.0% withholding tax would need to offer an equivalent yield of 14.5%, 14.6% and 15.0% for the FXD1/2020/015, FXD1/2022/015 and FXD1/2022/025 respectively.

Secondary Bond Market Activity:

- Bond Turnover

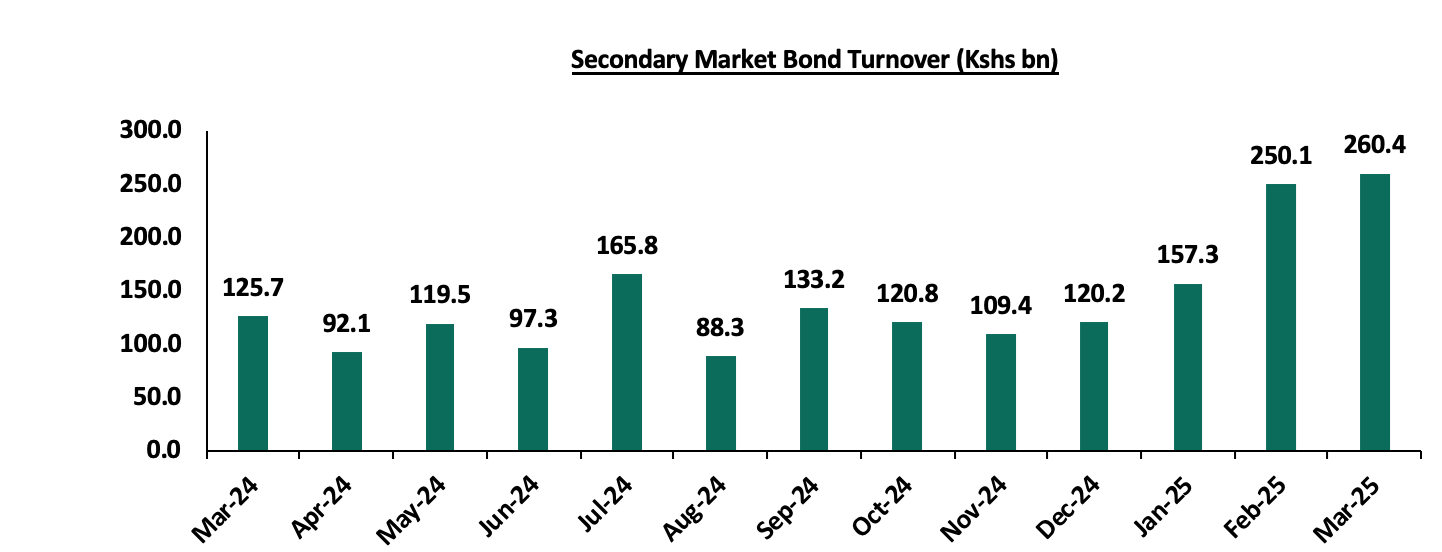

In the secondary bond market, activity increased, with the turnover increasing by 45.4% to Kshs 667.8 bn, from Kshs 459.3 bn in Q1’2024, pointing towards increased activities by commercial banks in the secondary bond market. Similarly, on a year-on-year basis, the bond turnover increased by 107.2% to Kshs 260.4 in March 2025, from Kshs 125.7 bn worth of treasury bonds transacted over a similar period last year. The chart below shows the bond turnover over the past 12 months;

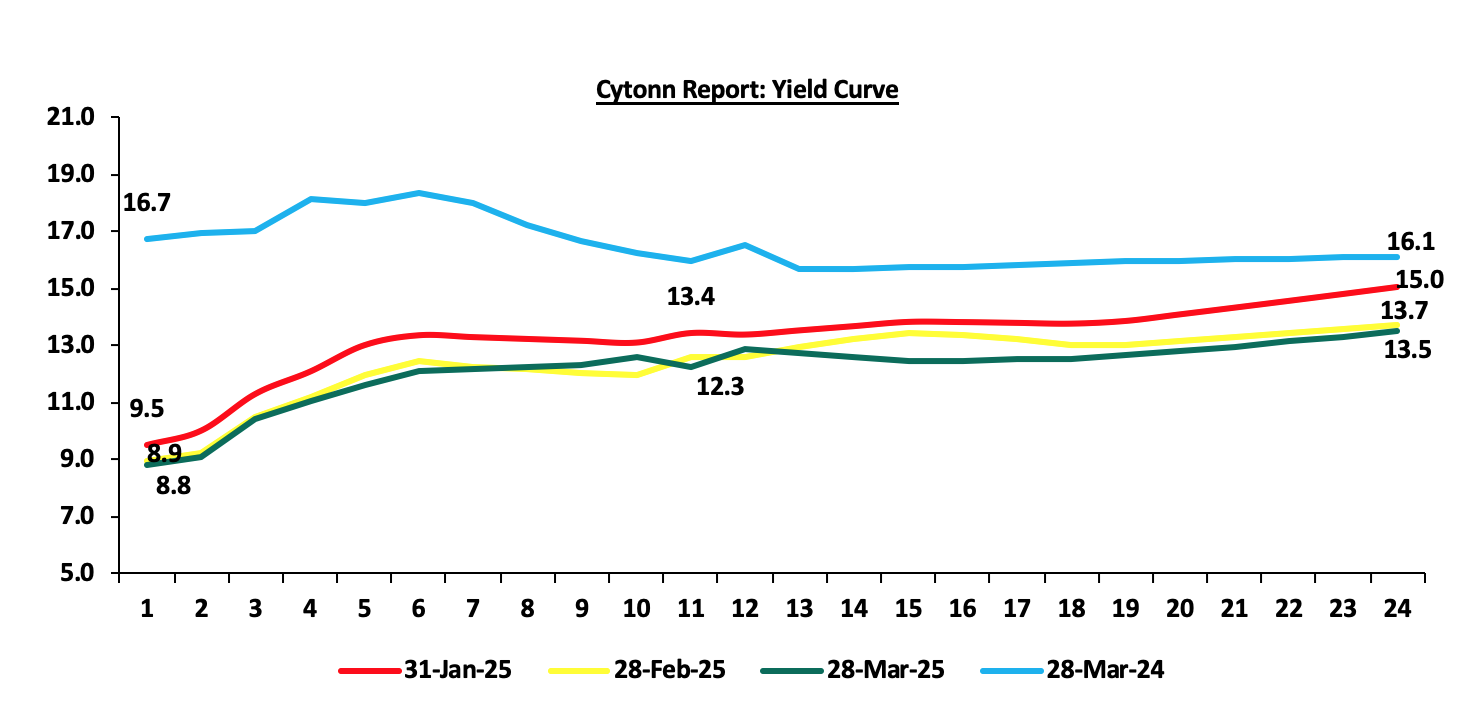

- Yield Curve

During Q1’2025, yields on the government securities were on a downward trajectory compared to the same period in 2024. This was primarily driven by continued effort by the government to reject highly priced bids, local currency stabilization, and eased inflation. These factors reduced the need for investors to demand higher yields as compensation for inflation and currency depreciation risks, resulting in an overall decline across the yield curve. Notably, the yield curve has adjusted from a humped yield curve observed in 2023 and most part of 2024, towards a normal upward sloping curve, with long-term bonds registering highest yields. The shift in sentiment indicates increased confidence in the economic landscape. The chart below shows the yield curve movement during the period:

Money Market Performance:

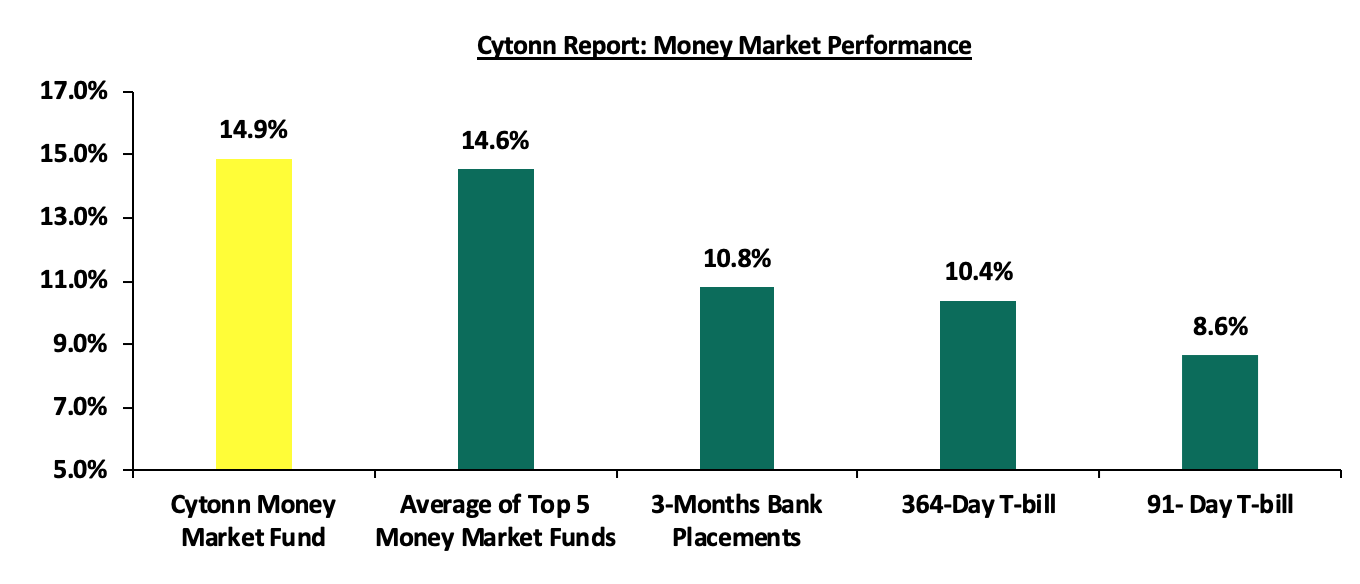

In the money markets, 3-month bank placements ended the week at 10.8% (based on what we have been offered by various banks), the yields on the government papers were on a downward trajectory with the yields on the 364-day paper decreasing by 2.5 bps to remain relatively unchanged from the 10.4% recorded the previous week, while yields on the 91-day paper decreased by 16.1 bps to 8.6% from the 8.8% recorded the previous week. The yield on the Cytonn Money Market Fund decreased by 19.0 bps to 14.9% from the 15.1% recorded the previous week, while the average yields on the Top 5 Money Market Funds decreased by 25.2bps to close the week at 14.6%, from the 14.8% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 4th April 2025:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 4th April 2025 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Gulfcap Money Market Fund |

16.3% |

|

2 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn app) |

14.9% |

|

3 |

Etica Money Market Fund |

14.1% |

|

4 |

Kuza Money Market fund |

13.8% |

|

5 |

Lofty-Corban Money Market Fund |

13.7% |

|

6 |

Orient Kasha Money Market Fund |

13.3% |

|

7 |

Ndovu Money Market Fund |

13.1% |

|

8 |

Enwealth Money Market Fund |

12.7% |

|

9 |

British-American Money Market Fund |

12.5% |

|

10 |

Old Mutual Money Market Fund |

12.5% |

|

11 |

Arvocap Money Market Fund |

12.5% |

|

12 |

Apollo Money Market Fund |

12.3% |

|

13 |

Madison Money Market Fund |

12.3% |

|

14 |

Nabo Africa Money Market Fund |

12.2% |

|

15 |

Dry Associates Money Market Fund |

12.1% |

|

16 |

Jubilee Money Market Fund |

11.9% |

|

17 |

Sanlam Money Market Fund |

11.8% |

|

18 |

Faulu Money Market Fund |

11.7% |

|

19 |

Co-op Money Market Fund |

11.5% |

|

20 |

GenAfrica Money Market Fund |

11.5% |

|

21 |

Absa Shilling Money Market Fund |

11.2% |

|

22 |

CIC Money Market Fund |

11.2% |

|

23 |

ICEA Lion Money Market Fund |

10.9% |

|

24 |

KCB Money Market Fund |

10.8% |

|

25 |

Mali Money Market Fund |

10.6% |

|

26 |

AA Kenya Shillings Fund |

10.5% |

|

27 |

Genghis Money Market Fund |

10.0% |

|

28 |

Mayfair Money Market Fund |

9.7% |

|

29 |

Stanbic Money Market Fund |

7.5% |

|

30 |

Ziidi Money Market Fund |

7.3% |

|

31 |

Equity Money Market Fund |

5.7% |

Source: Business Daily

Liquidity:

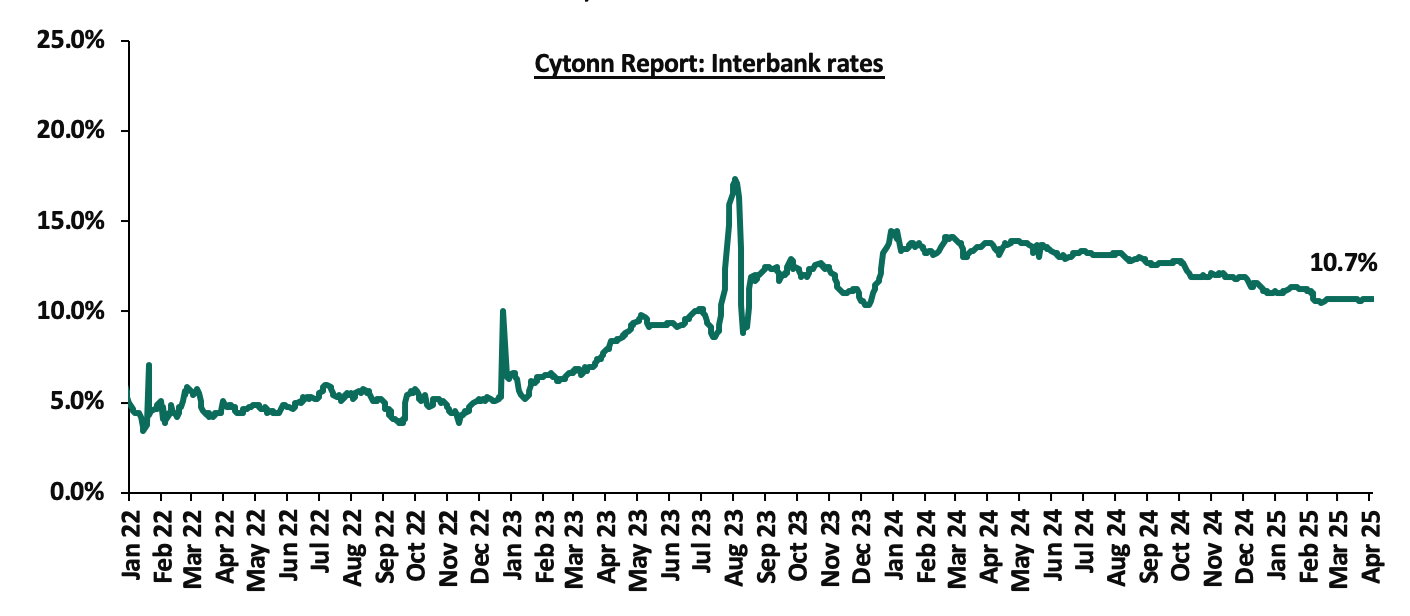

During the quarter, liquidity in the money market eased, with the average interbank rate decreasing by 2.7% points to 10.9% from 13.6% in Q1’2024, partly attributable to government payments that offset tax remittances. The average volumes traded in the interbank market decreased by 19.5% to Kshs 19.2 bn, from Kshs 23.9 bn recorded in Q1’2024.

During the week, liquidity in the money markets marginally eased, with the average interbank rate decreasing by 2.9 bps, to remain unchanged from the 10.7% recorded the previous week, partly attributable to tax remittances that were offset by government payments. The average interbank volumes traded decreased by 48.4% to Kshs 6.3 bn from Kshs 12.1 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the quarter, the yields on Eurobonds recorded a mixed performance, with the 7-year Eurobond issued in 2019 decreasing the most by 1.0% points to 7.5% from 8.5% recorded at the start of the quarter while the 30-year Eurobond issued in 2018 increased the most by 0.4% points to 10.7% from 10.3% recorded at the start of the quarter. Also, during the week, the yields on Kenya’s Eurobonds recorded a mixed performance, with the yield on the 7-year issued in 2024 increasing the most by 82.8 bps to 11.0% from the 10.2% recorded the previous week, while the 10-year Eurobond issued in 2018 decreased the most by 16.5 bps to 8.6% from the 8.7% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 3rd April 2025;

|

Cytonn Report: Kenya Eurobonds Performance |

|

||||||

|

|

2018 |

2019 |

2021 |

2024 |

2025 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

11-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.3 bn |

1.2 bn |

1.0 bn |

1.5 bn |

1.5 bn |

|

Years to Maturity |

3.0 |

23.0 |

2.2 |

7.2 |

9.3 |

5.9 |

11.0 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

9.9% |

|

02-Jan-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.1% |

|

|

27-Mar-25 |

8.7% |

10.6% |

7.5% |

10.2% |

10.3% |

10.2% |

|

|

28-Mar-25 |

8.8% |

10.7% |

7.5% |

10.3% |

10.3% |

10.3% |

|

|

31-Mar-25 |

8.8% |

10.8% |

7.6% |

10.4% |

10.4% |

10.4% |

|

|

01-Apr-25 |

8.8% |

10.8% |

7.5% |

10.4% |

10.4% |

10.4% |

|

|

02-Apr-25 |

9.0% |

10.9% |

7.5% |

10.5% |

10.5% |

10.5% |

|

|

03-Apr-25 |

8.6% |

11.2% |

8.0% |

10.9% |

10.9% |

11.0% |

|

|

Weekly Change |

(0.2%) |

0.6% |

0.5% |

0.6% |

0.6% |

0.8% |

- |

|

Q/Q Change |

(0.3%) |

0.4% |

(1.0%) |

0.2% |

0.2% |

0.2% |

- |

|

YTD Change |

(0.5%) |

0.9% |

(0.5%) |

0.8% |

0.8% |

0.9% |

- |

Source: Central Bank of Kenya (CBK) and National Treasury

Weekly Highlights:

- Stanbic Bank’s February 2025 Purchasing Manager’s Index (PMI)

In March 2025, the Stanbic Bank Kenya PMI showed an improvement in business conditions, coming in at 51.7, up from 50.6 in February 2025, signaling another improvement in business conditions. This marked the sixth month that index fell above the 50.0 neutral mark. Increased output, new orders and increased sales supported the improvement. On a year-to-year basis, the index recorded 4.0% points increase from the 49.7 recorded in March 2024. The modest improvement of the general business environment is mainly attributable to inflation remaining relatively low in March coming in at 3.6%, remaining within the Central Bank of Kenya (CBK) target range of 2.5% to 7.5% for the twenty first consecutive month. However, this was a slight increase of 0.1% points from 3.5% in February 2025 attributable to increase in prices of commodities in Food & Non-Alcoholic Beverages and Transport sector by 6.6% and 1.5% respectively. The lower Central Bank Rate (CBR) at 10.75% led to reduced borrowing costs, further promoting improved business activity.

Input purchases increased due to the increased sales resulting in a slight build-up of raw material inventory. The average input charges marginally increased, attributable to a marginal increase in purchase prices and the slight tightening of inflationary pressures. As a result, purchase price increases were relatively modest. Meanwhile, output prices rose, just marginally. The sector data showed an increase in output, for the sixth consecutive month attributable to increased sales. However, some firms faced challenges in sales growth due to inflation and customers’ cash flow constraints prompting them to lower their fees in an effort to boost sales. New orders increased for the sixth consecutive month attributable to increased customers and increased demand. Moreover, the private sector saw an increase in new customers due to increased marketing efforts and favourable weather conditions. Additionally, employment numbers rose for the second consecutive month, with most firms marginally increasing their staffing levels attributable to minimal capacity pressures. Notably, there was a marginal increase in staffing costs. On the sectoral performance, most sectors experienced growth in output and sales. However, the manufacturing sector saw difficulties in production and new orders.

Private sector prices increased marginally in March for the fifth consecutive month. The marginal increase in purchasing costs and taxes led to price increases. However, the increase in prices was weighed down by the easing of input price inflation. Notably, overall sentiment towards future activity of the Kenyan business environment was negative. The outlook reflected concerns about the general economy despite investment in expansion through new outlets and product diversification. Key to note, a PMI reading of above 50.0 indicates an improvement in the business conditions, while readings below 50.0 indicate a deterioration. The chart below summarizes the evolution of PMI over the last 24 months

Going forward, we anticipate that the business environment will improve in the short to medium term as a result of the improving economic environment driven by lower interest rates following the easing monetary policy with the CBR decreasing by 50.0 bps to 10.75% from 11.25% in February 2025, the stability of the Kenyan Shilling against the USD and the low inflation rates currently at 3.6% and stable fuel prices. However, we expect businesses to be weighed down by the high cost of living coupled with the high taxation, which are set to increase input costs. Overall the private sector is expected to continue with the recovery albeit with potential headwinds in the coming months.

- MPC Note on the 8th April 2025 Monetary Policy Committee (MPC) Meeting

We expect the MPC to cut the Central Bank Rate (CBR) by 25.0 bps – 75.0 bps to within a range of 10.00% - 10.50% with their decision mainly being supported by:

- The need to support the economy by adopting a more accommodative policy that will ease financing activities and support private sector financing. Private sector credit growth marginally increasing to 1.4% in December 2024, a further decline from 1.3% in October 2024. A rate cut would help unlock the private sector's potential, enabling it to act as a key driver of economic recovery and sustained growth. Additionally, the business environment remains subdued, hence a cut in the CBR will help spur economic growth, increase money supply and improve business activities in the country

- Rate cuts by global giant economies: The European Central Bank announced a rate cut by 25 bps to 2.50% on 6th March 2025, from 2.75% earlier in 30th January 2025. Meanwhile, the US Federal Reserve decided to maintain their benchmark interest rate in their recent sitting on 19th March 2025 at 4.25%-4.50% for the second time since January sitting, following the rate cut by 25.0 bps to a range of 4.25%-4.50% in their December 2024 meeting from a range of 4.50%-4.75% in their November 2024 meeting. As such, we expect the MPC to follow through with this set precedence of loosening the monetary policy and cut the rate further, and,

- The continued stability of the Shilling against major currencies: Despite the February rate cut in the CBR the shilling has remained stable , this still gives room for a moderate cut without reversing the Shilling’s stability. Since the last meeting, the Kenyan Shilling has depreciated marginally by 4.0 bps against the US Dollar to 129.2 as at 4th April 2025, from Kshs 129.2 recorded on 5th February 2025, but remains stable. The stability of the Shilling is expected to be supported by the stable foreign reserves which are currently at 5.1 months of import cover, above the statutory requirement of 4.0 months cover

For more details, please see our April 2025 MPC Note

Rates in the Fixed Income market have been on a downward trend due to high liquidity in the money market which allowed the government to front load most of its borrowing. The government is 79.8% ahead of its prorated net domestic borrowing target of Kshs 456.7 bn, and 38.3% ahead of the total FY’2024/25 net domestic borrowing target of Kshs 593.7 bn, having a net borrowing position of Kshs 821.1 bn (inclusive of T-bills). However, we expect a continued downward readjustment of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to stabilize in the short to medium-term and hence investors are expected to shift towards the long-term papers to lock in the high returns.

Market Performance:

During the quarter, the equities market was on an upward trajectory with NSE 20, NASI, NSE 25 and NSE 10 gaining by 10.8%,6.0%, 3.8% and 3.1% respectively. The equities market performance during the quarter was driven by gains recorded by large caps such as Stanbic Bank, DTB-Kenya, and NCBA Bank of 17.9%, 9.8%, and 8.9%, respectively. The gains were however weighed down by losses recorded by Co-operative Bank, Equity Bank and BAT of 2.7%, 2.5% and 1.3 respectively

Equities turnover declined by 34.5% in Q1’2025 to USD 202.7 mn, from USD 309.5 mn in Q4’2024. Foreign investors remained net sellers in Q1’2025 with a net selling position of USD 25.2 mn, from a net selling position of USD 19.5 mn recorded in Q4’2024.

During the week, the equities market recorded a mixed performance, with NASI, NSE 25, and NSE 10 gaining by 0.5%, 0.1%, and 0.1%, respectively, while NSE 20 declined by 0.1%, taking the YTD performance to gains of 8.1%, 4.9%, 2.3% and 1.3% for NSE 20, NASI, NSE 25, and NSE 10 respectively. The equities market performance was mainly driven by gains recorded by East African Breweries Limited (EABL), NCBA Group, and Stanbic Bank of 3.2%, 2.9%, and 2.3% respectively. The gains were however weighed down by losses recorded by large-cap stocks such as KCB Group, ABSA and DTB-K of 5.7%, 4.7% and 1.0% respectively

During the week, equities turnover increased by 11.7% to USD 11.5 mn from USD 10.3 mn recorded the previous week, taking the YTD turnover to USD 214.2 mn. Foreign investors became net buyers, with a net buying position of USD 1.0 mn, from a net selling position of USD 0.7 mn recorded the previous week, taking the YTD net selling position to USD 24.1 mn.

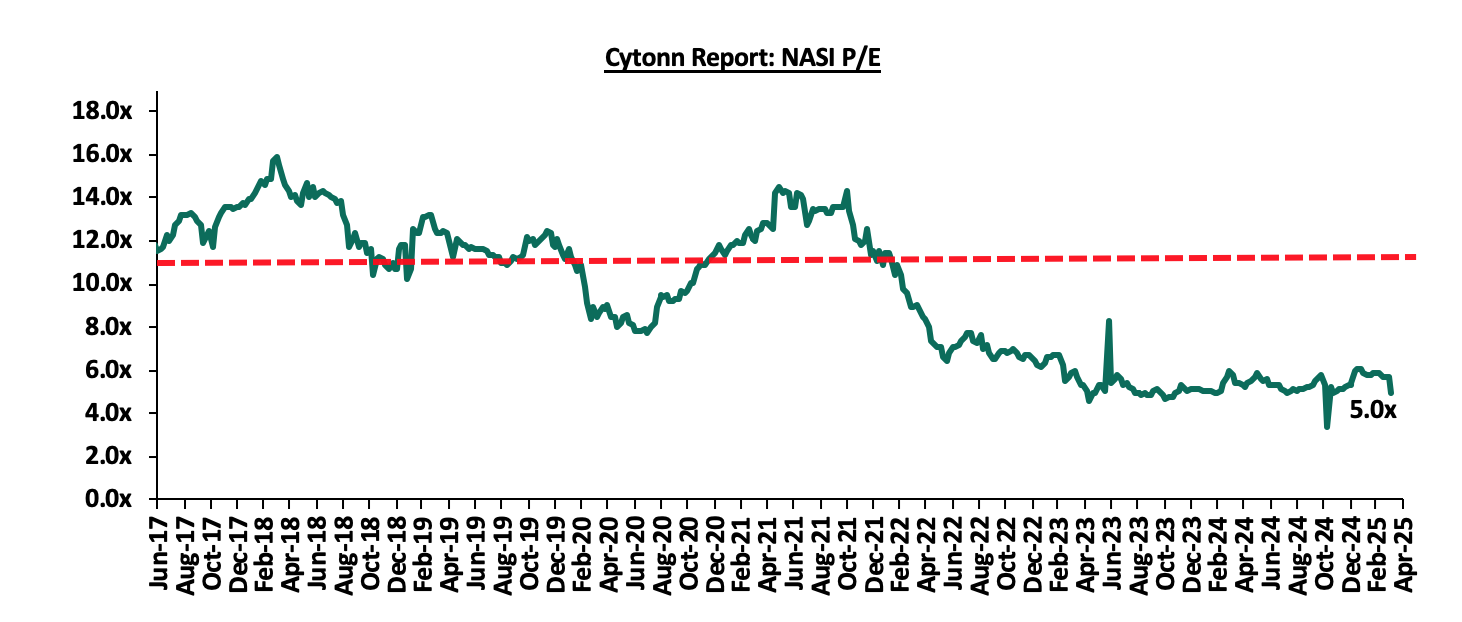

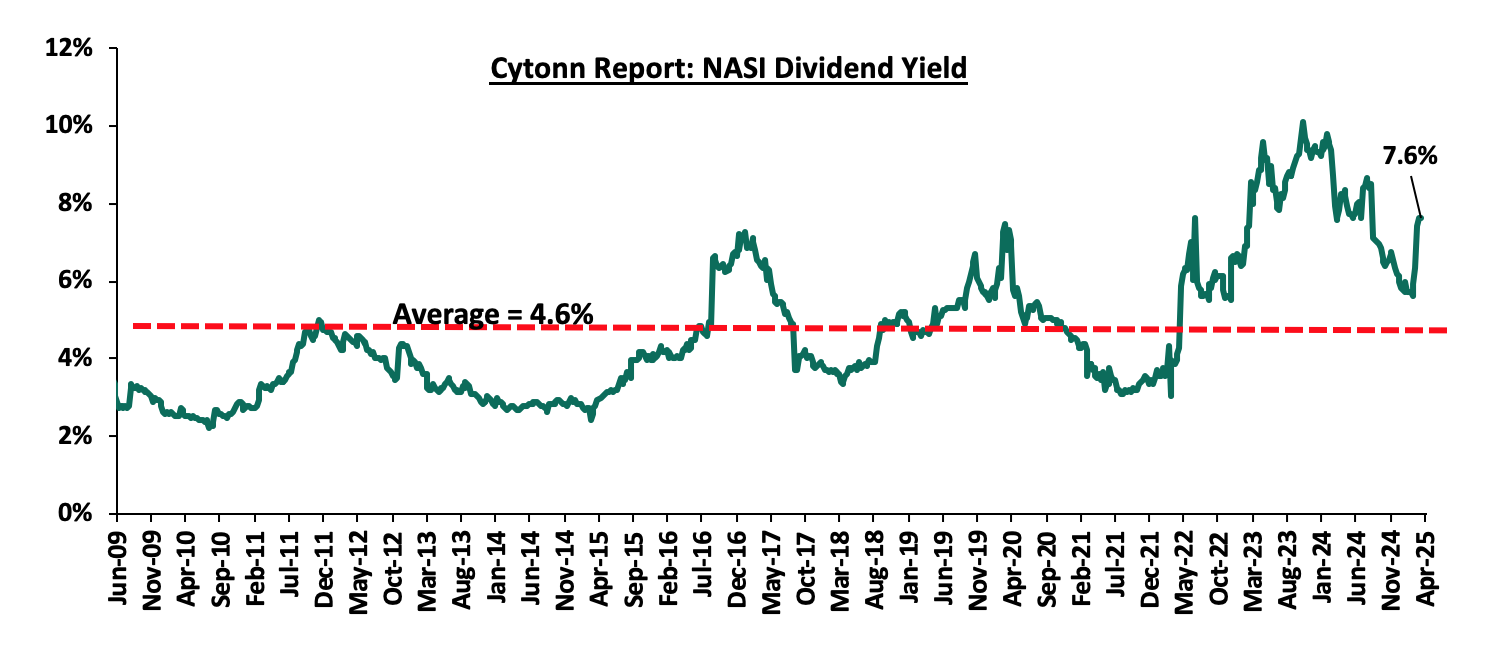

The market is currently trading at a price-to-earnings ratio (P/E) of 5.0x, 57.0% below the historical average of 11.6x. The dividend yield stands at 7.6%, 3.0% points above the historical average of 4.6%. Key to note, NASI’s PEG ratio currently stands at 0.6x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Listed Banks’ FY’2024 Performance

During the first quarter of 2025, the listed banking sector released their FY’2024 results, recording a weighted average y/y earnings growth of 26.2% in their core EPS in FY’2024. The performance in FY’2024 was supported by a 12.0% growth in weighted average net interest income coupled with a 13.9% growth in weighted average non-funded income. The table below shows the performance of listed banks that have released their FY’2024 results using several metrics:

|

Cytonn Report: Listed Banks Performance in FY’2024 |

||||||||||||||

|

Bank |

Core EPS Growth |

Interest Income Growth |