Cytonn H1’2024 Markets Review

By Research Team, Jun 30, 2024

Executive Summary

Global Markets Review

According to the World Bank’s June 2024 Global Economic Prospects, the global economy is projected to grow at a rate of 2.6% in 2024, similar to the estimated growth of 2.6% recorded in 2023. The latest projection is 0.6% points lower than the IMF’s projection of 3.2% growth, with the downward revision being on the back of the continued tightening of monetary policies by the Central Banks around the world aimed at curbing the elevated inflationary pressures. Notably, advanced economies are expected to record a 1.5% growth in 2024, remaining unchanged from the 1.5% expansion recorded in 2023. However, emerging markets and developing economies are projected to expand by 4.0% in 2024, marginally downwards from an estimated growth of 4.2% in 2023;

Sub-Saharan Africa Regional Review

According to the World Bank, the Sub-Saharan economy is projected to grow at a moderate rate of 3.4% in 2024, which is 0.8% higher than the 2.6% growth estimate recorded in 2023. The expected recovery is primarily driven by private consumption growth as declining inflation boosts the purchasing power of household incomes. Nevertheless, the risk of debt distress remains high with more than half of countries facing unsustainable debt burdens as the region’s public debt to GDP ratio is expected to remain high at 57.0% in 2024, albeit a decline from 60.0% in 2023. The public debt is expected to remain high due to increased debt servicing costs as a result of continued currency depreciation and increased interest rates in developed economies. Additionally, many countries are providing subsidies in order to mitigate inflationary pressures, which could worsen public finance, increase public debt, and weigh down on debt sustainability;

Kenya Macroeconomic Review

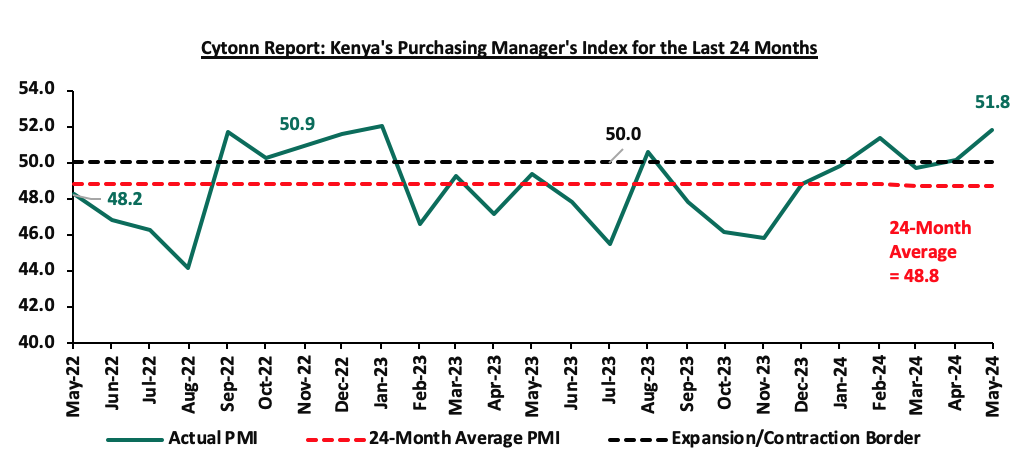

According to the Kenya National Bureau of Statistics (KNBS) 2024 Economic Survey, the Kenyan economy recorded a 5.6% expansion in FY’2023, faster than the 4.9% growth recorded in FY’2022. The main contributor to Kenyan GDP remains to be the Agriculture, Fishing and Forestry sector which grew by 6.5% in FY’2023 compared to a contraction of 1.5% in FY’2022. All sectors in FY’2023, except Mining and Quarrying, recorded positive growths, with varying magnitudes across activities. Most sectors recorded improved growth compared to FY’2022, with Agriculture, Forestry and Fishing, Accommodation and Food Services, and Real Estate Sectors recording the highest growth improvements of 7.9% points, 6.8% points, and 2.8% points, respectively. The average inflation rate for the first half of 2024 came in at 5.6%, lower than the 8.5% recorded in H1’2023, mainly as a result of reduced food and fuel prices. As a result, the business environment improved in H1’2024, with the average Purchasing Managers Index (PMI) coming in at 50.5 in the first five months of 2024, up from the 48.9 recorded in the same period in 2023, as consumers increased their spending;

Fixed Income

During H1’2024, T-bills were oversubscribed, with the overall subscription rate coming in at 132.6%, up from 121.7% in H1’2023. Investors’ preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 420.6 bn against the offered Kshs 104.0 bn, translating to an oversubscription rate of 404.4%, albeit lower than the oversubscription rate of 481.8% recorded in H1’2023. Overall subscription rates for the 364-day and 182-day papers came in at 80.7% and 75.7%, higher than the 37.9% and 61.3%, respectively, recorded in H1’2023. The average yields on the 364-day, 182-day, and 91-day papers increased by 5.7% points, 6.1% points, and 6.1% points to 16.7%, 16.6%, and 16.2% in H1’2024, respectively, from 11.0%, 10.5%, and 10.2%, respectively, in H1’2023. The upward trajectory in yields is mainly on the back of investors attaching higher risks amid increased credit risk in the country, hence the need to demand higher returns to cushion against the possible loss, and, the government’s desperate need to keep borrowing in the domestic market. The acceptance rate during the period came in at 92.3%, higher than the 91.6% recorded in H1’2023, with the government accepting a total of Kshs 763.5 bn out of the Kshs 827.3 bn worth of bids received;

During the week, T-bills remained undersubscribed for the third consecutive week, with the overall undersubscription rate coming in at 32.0%, lower than the undersubscription rate of 60.0% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 4.4 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 109.0%, albeit lower than the oversubscription rate of 148.0% recorded the previous week. The subscription rates for the 182-day and 364-day papers decreased to 14.9% and 18.3% respectively from the 39.3% and 45.5% respectively recorded the previous week. The government accepted a total of Kshs 6.1 bn worth of bids out of Kshs 7.7 bn bids received, translating to an acceptance rate of 78.7%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day, and 91-day papers increasing by 3.7 bps, 2.6 bps, and 0.6 bps to 16.79%, 16.76%, and 15.98% respectively from 16.75%, 16.74% and 15.97% respectively recorded the previous week;

In the primary bond market, the government is seeking to raise a total of Kshs 50.0 bn for budgetary support in the month of July by re-opening two bonds and issuing a tap sale. The two fixed coupon treasury bonds issued concurrently include the re-opened FXD1/2024/10 and FXD1/2008/20, with a tenor to maturity of 9.7 years and 3.9 years, respectively, and have their coupon rates set at 16.0% and 13.8% respectively. The bonds’ value dates will be 22nd July 2024, with maturity dates of 13th March 2034 and 5th June 2028 for FXD1/2024/10 and FXD1/2008/20 respectively; Given the bonds are trading at 15.0% and 17.7% for the FXD1/2024/10 and FXD1/2008/20 respectively in the secondary bond market, we expect the bidding range to come in at 15.25% - 16.55% and 17.55% - 17.75% respectively. Further, the government is seeking to raise Kshs 20.0 bn through the tap sale of the FXD1/2023/002 bond, with a tenor to maturity of 1.2 years, a coupon rate of 17.0% and a period of sale of Wednesday 26th June 2024 to Thursday 4th July 2024. The bids shall be priced at the average rate of accepted yield for the initial values which stood at 17.1%;

Equities

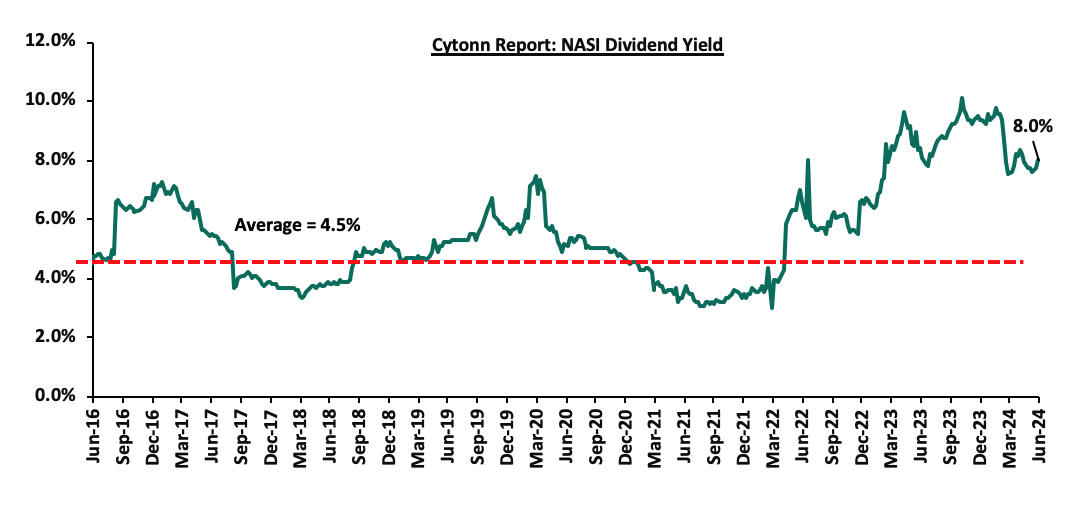

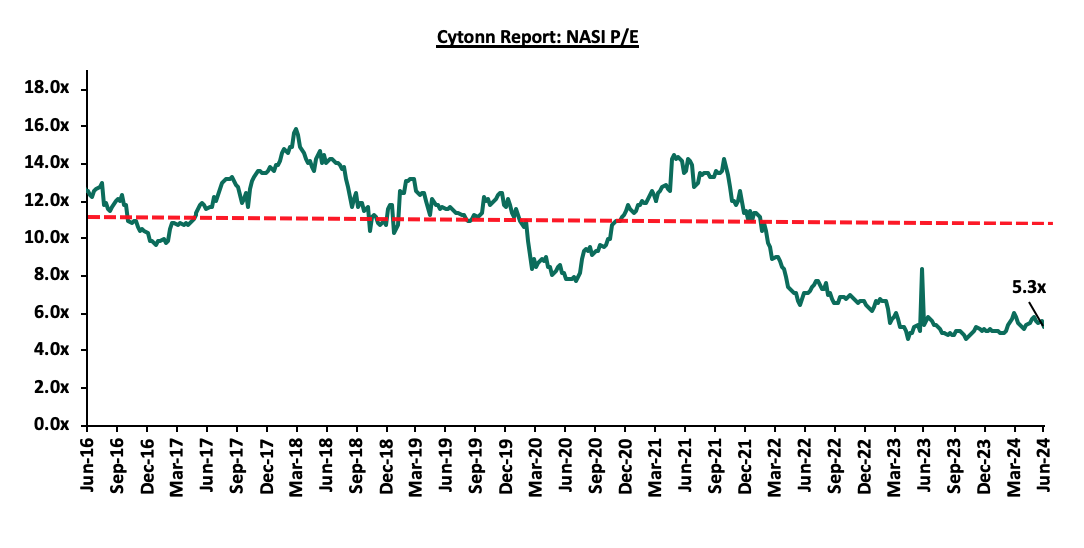

During Q2’2024, the equities market was on a downward trajectory, with NSE 20, NSE 25, NSE 10, and NASI declining by 5.5%, 3.8%, 3.3%, and 3.2%, respectively, taking the H1’2024 performance to gains of 22.6%, 19.8%, 19.0% and 9.8% for NSE 10, NSE 25, NASI, and NSE 20 respectively. The equities market performance during the quarter was driven by losses recorded by large caps such as DTB-K Group, Co-operative Bank, and BAT of 15.5%, 15.3%, and 14.7%, respectively. The losses were however mitigated by gains recorded by East African Breweries Limited (EABL), KCB Group, and ABSA Bank of 12.5%, 4.0%, and 0.4% respectively;

During the week, the equities market was on a downward trajectory, with NSE 20, NASI, NSE 10, and NSE 25 declining by 4.3%, 2.9%, 2.6%, and 2.2%, respectively, taking the YTD performance to gains of 22.6%, 19.8%, 19.0% and 9.8% for NSE 10, NSE 25, NASI, and NSE 20 respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as KCB Group, Safaricom, and Equity Group of 8.5%, 4.7%, and 2.6%, respectively. The losses were however mitigated by gains recorded by East African Breweries Limited (EABL), NCBA Group, and Stanbic Bank of 2.8%, 0.5%, and 0.4% respectively;

Real Estate

In H1’2024, Kenya’s Real Estate sector recorded notable growth in terms of activity compared to a similar period in 2023, attributable to continued investments flowing into the sector. The NMA residential sector recorded a slight downturn in performance, with the average total returns coming in at 5.9%, a 0.2%-point decline from 6.1% recorded in H1’2023. The performance was primarily attributed to a decrease in the residential average y/y price appreciation which came in at 0.6% in H1’2024, 0.4%-points lower than the 1.0% appreciation recorded in H1’2023, mainly driven by reduced property transactions during the period under review. The retail sector recorded average rental yields of 7.9% in H1’2024, representing a 0.2% points y/y decline from 8.2% recorded in H1’2023. The average selling prices for land in the Nairobi Metropolitan Area (NMA) in H1’2024 recorded a capital appreciation of 3.9% to Kshs 132.7 mn, from Kshs 128.6 mn recorded in H1’2023;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 17.54% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Monday, from 10:00 am to 12:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Global Economic Growth:

According to the World Bank’s June 2024 Global Economic Prospects, the global economy is projected to grow at a rate of 2.6% in 2024, similar to the estimated growth of 2.6% recorded in 2023. The latest projection is 0.6% points lower than the IMF’s projection of 3.2% growth, with the downward revision being on the back of the continued tightening of monetary policies by the Central Banks around the world aimed at curbing the elevated inflationary pressures. Notably, advanced economies are expected to record a 1.5% growth in 2024, remaining unchanged from the 1.5% expansion recorded in 2023. However, emerging markets and developing economies are projected to expand by 4.0% in 2024, marginally downwards from an estimated growth of 4.2% in 2023.

The stabilization in global economic growth in 2024 as compared to 2023 is majorly attributable to;

- The recovery in global trade supported by a pickup in goods trade. Services-trade growth is expected to provide less of a tailwind this year, given that tourism has nearly recovered to prepandemic levels. However, the trade outlook remains lackluster compared to recent decades, partly reflecting a proliferation of trade-restrictive measures and elevated trade policy uncertainty, and,

- A decrease in inflation rates making progress toward central bank targets in advanced economies and Emerging Markets and Developing Economies (EMDEs), but at a slower pace than previously expected. Core inflation has remained stubbornly high in many economies, supported by rapid growth of services prices. As such, by the end of 2026, global inflation is expected to settle at an average rate of 2.8%, broadly consistent with central bank targets.

The global economy is expected to remain subdued in the short term, mainly as a result of persistent inflationary pressures as well as tight monetary policies, which are expected to curtail economic growth.

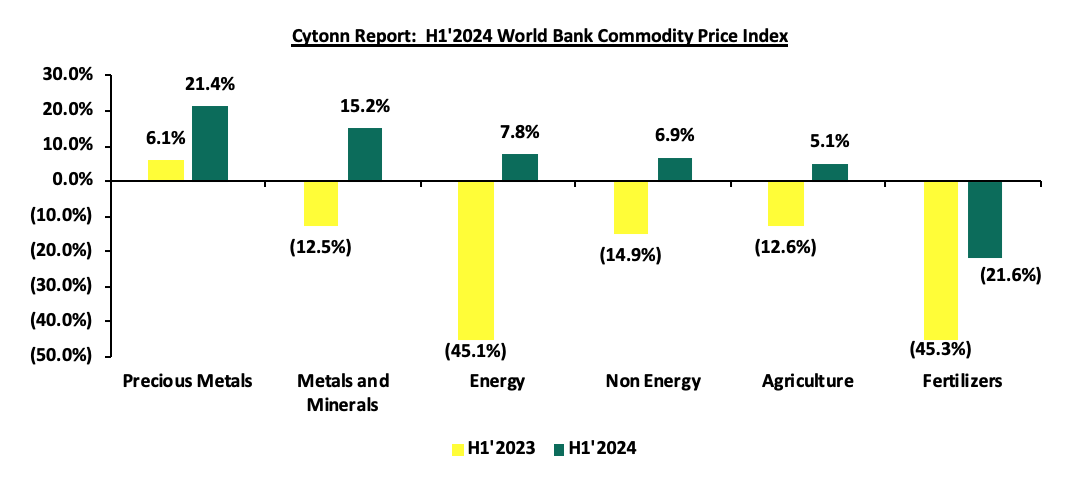

Global Commodities Market Performance:

Global commodity prices registered mixed performance in H1’2024, with prices of fertilizers declining by 21.6%, which is an improvement compared to the 45.3% decrease recorded in H1’2023, mainly as a result of the stabilization in fertilizer trade volumes and improved availability of primary nutrients like nitrogen, phosphorus, and potassium. On the other hand, prices of precious metals, Metals and Minerals, Energy, Non-Energy and Agriculture increased by 21.4%, 15.2%, 7.8%, 6.9% and 5.1%, respectively, on the back of increased global demand coupled with easing supply chain constraints. Below is a summary performance of various commodities;

Source: World Bank

Global Equities Market Performance:

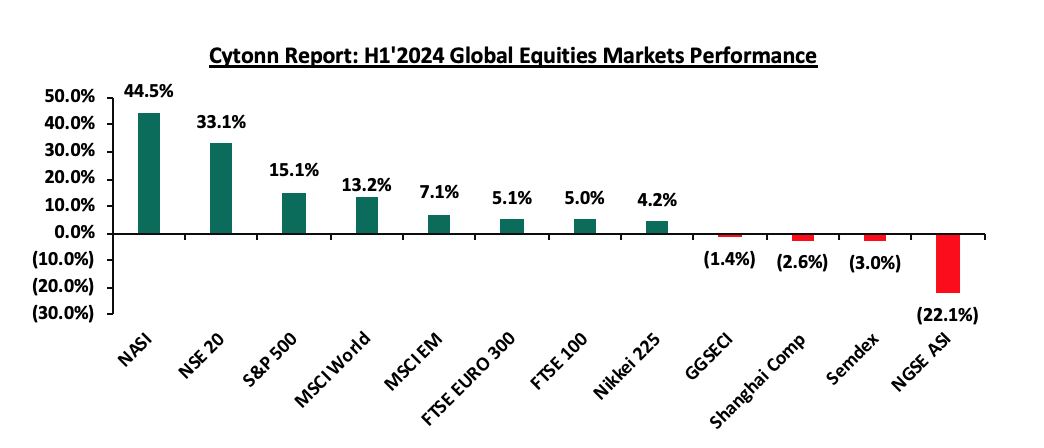

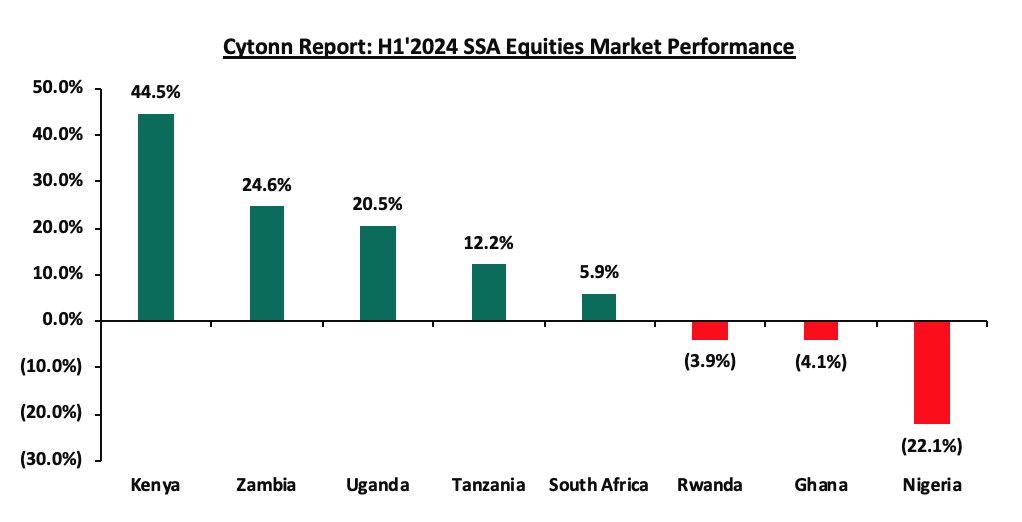

The global stock market recorded mixed performance in H1’2024, with most indices in the developed countries recording gains during the period, largely attributable to increased investor sentiments as a result of continued economic recovery following the full reopening of the economies coupled with investor preference for the stock markets in the developed countries. Notably, NASI recorded the largest gain at 44.5% in H1’2024 largely driven by gains in the large-cap stocks in the financial sector following improved earnings during the period in addition to the improved business environment as evidenced by the average Purchasing Managers Index (PMI) of 50.5 in the first five months of 2024 up from the 48.7 recorded in the same period last year. NGSE ASI was the largest decliner, recording losses of 22.1% with the performance being skewed by the weakened Nigerian Naira following a recent decision by the Central Bank of Nigeria to adopt a floating exchange rate regime. Below is a summary of the performance of key indices:

*Dollarized performance

According to the World Bank, the Sub-Saharan economy is projected to grow at a moderate rate of 3.4% in 2024, which is 0.8% higher than the 2.6% growth estimate recorded in 2023. The expected recovery is primarily driven by private consumption growth as declining inflation boosts the purchasing power of household incomes. Nevertheless, the risk of debt distress remains high with more than half of countries facing unsustainable debt burdens as the region’s public debt to GDP ratio is expected to remain high at 57.0% in 2024, albeit a decline from 60.0% in 2023. The public debt is expected to remain high due to increased debt servicing costs as a result of continued currency depreciation and increased interest rates in developed economies. Additionally, many countries are providing subsidies in order to mitigate inflationary pressures, which could worsen public finance, increase public debt, and weigh down on debt sustainability.

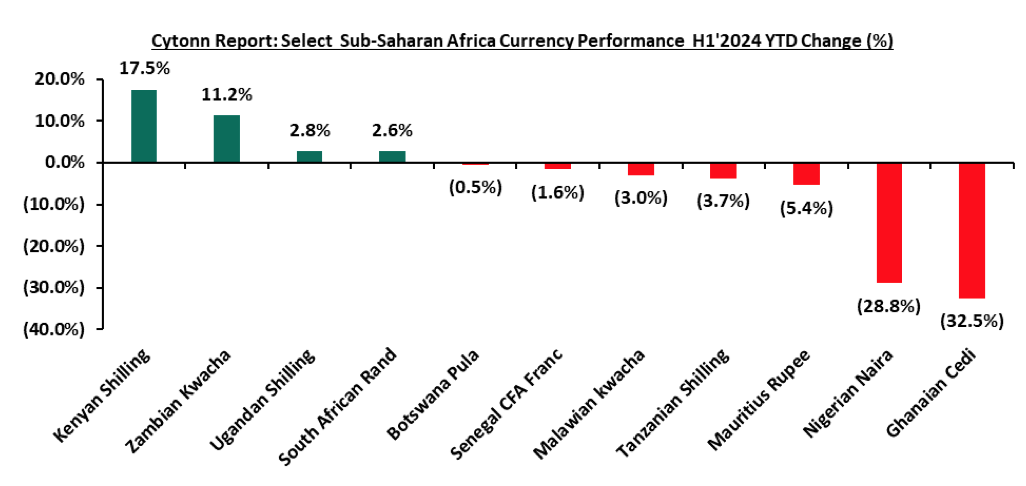

Currency Performance:

In H1’2024, most of the select Sub-Saharan currencies depreciated against the US Dollar, mainly attributable to the elevated inflationary pressures in the region, high debt servicing costs that continue to dwindle foreign exchange reserves, and monetary policy tightening by advanced economies. The high interest rates in developed countries have led to massive capital outflows as investors, both institutional and individual seek to take advantage of the higher returns offered in developed economies. Further, the elevated inflationary pressures in most economies in the region puts pressure on the value of local currencies due to expensive importation. Below is a table showing the performance of select African currencies against the US Dollar:

|

Cytonn Report: Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Jun-23 |

Jan-24 |

Jun-24 |

2024 y/y change (%) |

YTD change (%) |

|

Ghanaian Cedi |

11.3 |

11.6 |

15.3 |

(35.1%) |

(32.5%) |

|

Malawian kwacha |

1043.0 |

1683.4 |

1734.0 |

(66.2%) |

(3.0%) |

|

Kenyan Shilling |

140.5 |

157.0 |

129.5 |

7.8% |

17.5% |

|

Botswana Pula |

13.4 |

13.5 |

13.6 |

(1.0%) |

(0.5%) |

|

Zambian Kwacha |

17.7 |

27.1 |

24.0 |

(35.6%) |

11.2% |

|

Nigerian Naira |

758.8 |

1191.9 |

1535.4 |

(102.4%) |

(28.8%) |

|

Senegal CFA Franc |

625.0 |

602.8 |

612.5 |

2.0% |

(1.6%) |

|

South African Rand |

18.8 |

18.7 |

18.2 |

3.4% |

2.6% |

|

Ugandan Shilling |

3665.0 |

3815.0 |

3710.1 |

(1.2%) |

2.8% |

|

Mauritius Rupee |

45.4 |

44.8 |

47.2 |

(4.0%) |

(5.4%) |

The chart below shows the year-to-date performance of different sub-Saharan African countries in H1’2024;

Source: Yahoo Finance

Key take outs from the above table and chart include:

- The Kenyan Shilling was the largest gainer against the USD Dollar, gaining by 17.5% year to date to close at Kshs 129.5 as at the end of June from the Kshs 157.0 recorded at the beginning of the year. The shilling was supported by the government’s Eurobond buyback in February, alleviating the debt risk on the country, increased dollar inflows into the country including the recent World Bank funding amounting USD 1.2 bn under the Development Policy Operations (DPO), partly channeled towards settling the last June 2024 Eurobond maturity payment. Notably, the Kenyan economy has continued to improve during the period under review with the Purchasing Managers Index (PMI) having crossed the 50.0 points threshold to 51.8 as of May 2024,

- The Ghanaian Cedi was the worst performing currency in H1’2024, depreciating by 32.5%, mainly as a result of the lower current account surplus due to increased import demand, a sharp decline in cocoa exports and energy sector payments, in addition to speculative activity and delays in external debt restructuring,

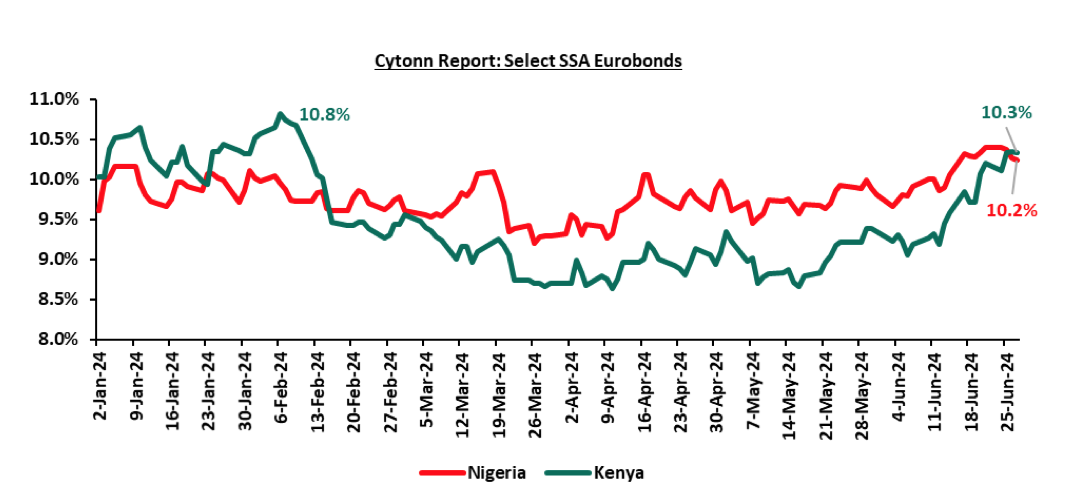

African Eurobonds:

Africa’s appetite for foreign-denominated debt has increased in recent times with the latest issuers during the first half of 2024 being Ivory Coast, Benin, and Kenya raising a total of USD 2.6 bn, USD 0.8 bn, and USD 1.4 bn respectively. Notably, all the bonds were oversubscribed with the high support being driven by the yield hungry investors and also the outlook of positive recovery in the regional economies. It is good to note that there was a general decline in the yields of the various bonds from different countries due to general improvement in investor sentiment as the economy recovers and the easing inflationary pressures in the region. The yields of the Nigeria’s 10-year Eurobond maturing in 2031 increased marginally by 0.8% points to 10.2% as at the end of June 2024 from 9.5% recorded in December 2023. Similarly, the Yields of the Kenya’s 10-year Eurobond maturing in 2028 increased by 0.5% points to 10.3% as at the end of June 2024 from 9.8% in December 2023, partly attributable to improved investor confidence following the successful buy-back of the 2024 Eurobond maturity, increased IMF Credit funding and the strengthening of the Kenyan shilling against the dollar having gained by 17.5% on a year-to-date. Below is a graph showing the Eurobond secondary market performance of select 10-year Eurobonds issued by the respective countries:

Source: Debt Management Office Nigeria, CBK

Equities Market Performance:

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in H1’2024, with Kenya’s stock market (NASI) being the best performing market gaining by 44.5% YTD driven by gains in the large-cap stocks in the financial sector following improved earnings during the period as well as the improved business conditions in the country as evidenced by the Purchasing Managers Index (PMI) which came in at 51.8 as of May 2024. Nigeria’s NGSEASI was the worst performing stock market, declining by 22.1% YTD, mainly attributable to increased capital flight with investors chasing higher returns from advanced economies following hiking of interest rates as well as deterioration in investor confidence in country on the back of macroeconomic uncertainties occasioned by the high inflation at 34.0% as of May 2024 and continued weakening of the Nigerian Naira which has depreciated by 28.8% on year-to-date basis in 2024. Below is a summary of the performance of key indices:

|

Cytonn Report: SSA Equities Market Performance H1’2024 (Dollarized*) |

||||||

|

Country |

Index |

Jun-23 |

Jan-24 |

Jun-24 |

Last 12 months |

YTD Change |

|

Kenya |

NASI |

0.8 |

0.6 |

0.8 |

10.5% |

44.5% |

|

Zambia |

LASILZ |

474.4 |

455.5 |

567.7 |

19.7% |

24.6% |

|

Uganda |

USEASI |

0.3 |

0.2 |

0.3 |

0.1% |

20.5% |

|

Tanzania |

DARSDEI |

0.7 |

0.7 |

0.8 |

2.3% |

12.2% |

|

South Africa |

JALSH |

4,038.4 |

4,137.9 |

4,383.5 |

8.5% |

5.9% |

|

Rwanda |

RSEASI |

0.1 |

0.1 |

0.1 |

(9.7%) |

(3.9%) |

|

Ghana |

GSECI |

255.7 |

263.0 |

252.3 |

(1.4%) |

(4.1%) |

|

Nigeria |

NGEASI |

80.4 |

84.9 |

66.1 |

(17.7%) |

(22.1%) |

|

*The index values are dollarized for ease of comparison |

||||||

Source: Cytonn Research, Kwayisi, Yahoo Finance

The chart below shows the YTD Performance of the sub-Saharan Equities Market;

Dollarized performance

GDP growth in Sub-Saharan Africa region is expected to slow down, in line with the rest of the global economy. Additionally, public debt continues to be a major headwind, with high debt levels experienced in the region on the back of continued weakening of local currencies, which will make debt servicing costlier, making the region less attractive to foreign capital.

According to the Kenya National Bureau of Statistics (KNBS) 2024 Economic Survey, the Kenyan economy recorded a 5.6% expansion in FY’2023, faster than the 4.9% growth recorded in FY’2022. The main contributor to Kenyan GDP remains to be the Agriculture, Fishing and Forestry sector which grew by 6.5% in FY’2023 compared to a contraction of 1.5% in FY’2022. All sectors in FY’2023, except Mining and Quarrying, recorded positive growths, with varying magnitudes across activities. Most sectors recorded improved growth compared to FY’2022, with Agriculture, Forestry and Fishing, Accommodation and Food Services, and Real Estate Sectors recording the highest growth improvements of 7.9% points, 6.8% points, and 2.8% points, respectively. Notably, the improved growth in the economy highlighted the economy’s resilience following multiple shocks such as supply chain constraints, soaring global fuel prices, elevated inflationary pressures and currency depreciation. The Kenyan Economy is projected to grow at an average of 5.3% in 2024 according to various organizations as shown below:

|

Cytonn Report: Kenya 2024 Growth Projections |

||

|

No. |

Organization |

2024 GDP Projections |

|

1 |

International Monetary Fund |

5.3% |

|

2 |

National Treasury |

5.5% |

|

3 |

World Bank |

5.2% |

|

4 |

Fitch Solutions |

5.2% |

|

5 |

Cytonn Investments Management PLC |

5.4% |

|

Average |

5.3% |

|

Source: Cytonn Research

Key to note, Kenya’s general business environment improved in the first half of 2024, with the average Purchasing Manager’s Index for the first five months of the year coming at 50.5, compared to 48.9 recorded in a similar period in 2023. The improvement was mainly on the back of the eased inflationary pressures experienced in the country, which have seen consumers increase their spending, coupled with aggressive appreciation of the Kenyan shilling which has contributed significantly to the reduced cost of inputs and production by most businesses. The chart below summarizes the evolution of PMI over the last 24 months. (A reading above 50.0 signals an improvement in business conditions, while readings below 50.0 indicate a deterioration):

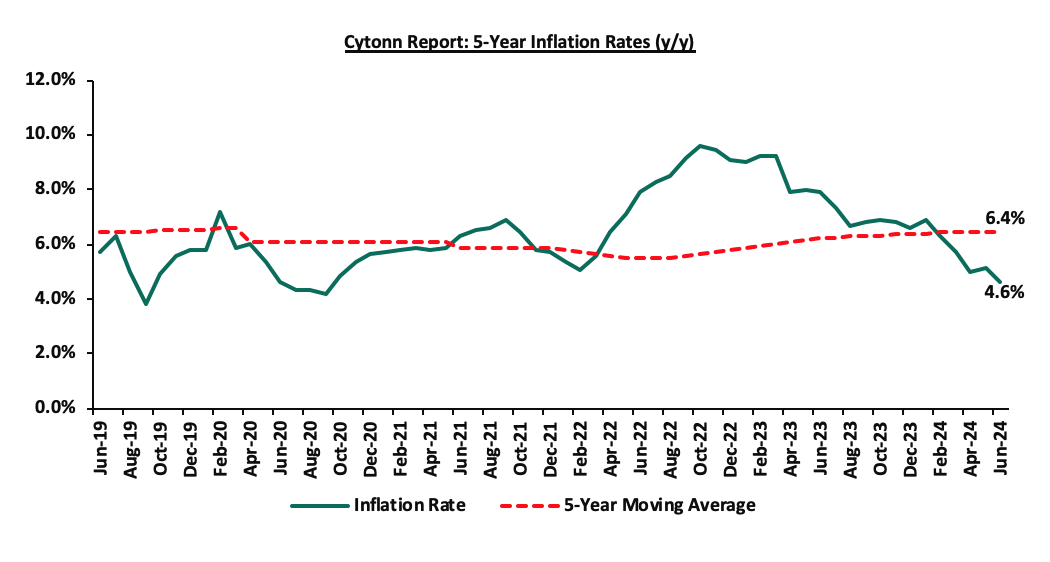

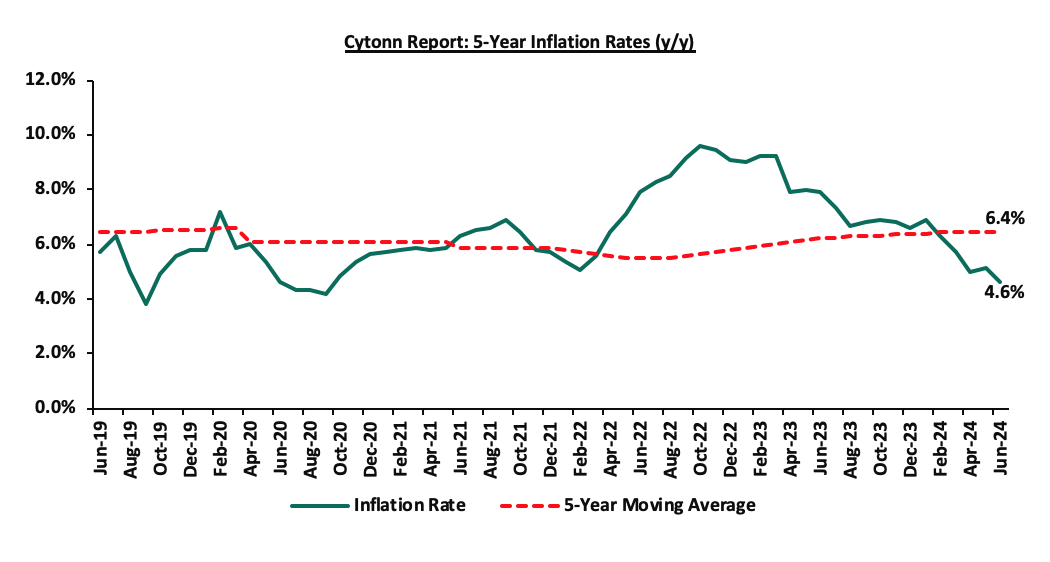

Inflation:

The average inflation rate decreased to 5.6% in H1’2024, compared to 8.5% in H1’2023, attributable to an appreciating Shilling, leading to reduced fuel prices. Notably, fuel prices decreased by 2.9%, 3.7% and 6.0% in June 2024 to Kshs 189.8, Kshs 173.1 and Kshs 163.1, from Kshs 195.5, Kshs 179.7, and Kshs 173.4 per liter in June 2023 for Super petrol, Diesel, and Kerosene, respectively. Inflation for the month of June 2024 eased to 4.6%, from 5.1% recorded in May 2024, mainly driven by a 0.2% decrease in the transport index. Below is a chart showing the inflation trend for the last five years:

For the last 12 months, Kenya’s inflation has persistently remained within the Central Bank of Kenya (CBK) target range of 2.5% - 7.5%, owing to a stronger Shilling, reduced fuel and electricity prices, and efforts by the Monetary Policy Committee (MPC) to contain the rise by raising the Central Bank Rate (CBR) by cumulative of 250 bps in June to 13.0% in June 2024 from the 10.5% CBR rate that was set in June 2023. Going forward, we expect the inflationary pressures to remain within the CBK’s preferred target, mainly on the back of stronger Shilling, reduced fuel and electricity prices. However, the high VAT on petroleum products of 16.0% is meant to hold the fuel prices elevated in the country.

June 2024 Inflation

The y/y inflation in June 2024 decreased by 0.5% points to 4.6%, from the 5.1% recorded in May 2024. This was within our expectation of a decline, but slightly below our projected range of 4.7% to 5.1%. The headline inflation in June 2024 was majorly driven by increase in prices of commodities in the following categories; transport, food and non-alcoholic beverages, and housing, water, electricity, gas and other fuels by 7.7%, 5.6% and 3.1%, respectively. The table below shows a summary of both the year on year and month on month commodity indices performance:

|

Cytonn Report: Major Inflation Changes – June 2024 |

|||

|

Broad Commodity Group |

Price change m/m (June-2024/May-2024) |

Price change y/y (June-2024/June-2023) |

Reason |

|

Transport |

(0.2%) |

7.7% |

The m/m decrease recorded in the transport Index was mainly attributable to the decline in the prices of diesel and petrol by 3.4% and 1.6% per litre respectively. |

|

Food and non-alcoholic beverages |

0.7% |

5.6% |

The m/m increase was mainly driven by the increase in prices of commodities such as cabbages, spinach and Sukuma wikiby 14.8%, 11.3%, and 10.7%, respectively. However, the increase was weighed down by decrease in prices of oranges, sugar and maize flour-sifted by 2.5%, 2.4%, and 2.0%, respectively |

|

Housing, water, electricity, gas and other fuels |

0.4% |

3.1% |

The m/m performance was mainly driven by the increase in prices of Electricity of 50kWh and 200kWh by 3.4% and 2.9% respectively. However, the price of gas/LPG and kerosene dropped by 0.2% and 3.4% respectively. |

|

Overall Inflation |

0.4% |

4.6% |

The m/m decrease was mainly attributable to the 0.2% decrease in transport. |

Notably, June’s overall headline inflation was back on the decline after increasing marginally in May 2024. This resumes the declining trend seen in the three consecutive months up to April 2024. Furthermore, it has remained within the Central Bank of Kenya (CBK) target range of 2.5% to 7.5% for the twelfth consecutive month. The decrease in headline inflation in June 2024 comes amid the decline in the prices for Super Petrol, Diesel and Kerosene which decreased by Kshs 3.0, Kshs 6.1 and Kshs 5.7 each respectively, and will retail at Kshs 189.8, Kshs. 173.1 and Kshs. 163.1 per litre respectively, for the period between 15th June 2024 to 14th July 2024. The chart below shows the inflation rates for the past 5 years:

Going forward, we expect inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a strengthened currency, tight monetary policy and reduced fuel prices. The risk, however, lies in the fuel prices which despite their decline in June 2024, still remain elevated compared to historical levels.. Key to note is that the Monetary Policy Committee maintained the Central Bank Rate at 13.0% in its June 2024 meeting, with the aim of anchoring the inflation rates further. In our view, the rate will be pegged on whether the shilling will sustain its appreciation against the dollar, resulting in a decline in the import bill and costs passed to consumers through hiked consumer prices. Additionally, favourable weather conditions may also contribute to stabilizing food prices, further supporting lower inflation rates.

The Kenyan Shilling:

The Kenyan Shilling appreciated against the US Dollar by 17.2% in H1’2024, to close at Kshs 129.5, from Kshs 156.5 as at the end of FY’2023, mainly attributable to the February buyback of the June maturity Eurobond, which alleviated the credit risk on the country, coupled with the infrastructure bond issue which attracted foreign investors as well as panic selling of dollars by investors which increased dollar supply in the market. During the week, the Kenya Shilling depreciated against the US Dollar by 0.8% to close at 129.5, from 128.6 the previous week, partly attributable to the last maturity payment of the June Eurobond.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,509.8 mn in the 12 months to May 2024, 12.8% higher than the USD 3,997.3 mn recorded over the same period in 2023, which has continued to cushion the shilling against further depreciation. In the May 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 56.0% in the period, and,

- High Forex reserves currently at USD 7.8 bn (equivalent to 4.1-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, albeit lower than EAC region’s convergence criteria of 4.5-months of import cover. Notably, the reserves were boosted by the USD 1.2 bn inflow under Development Policy Operations (DPO) from the World Bank in the previous week, with part of it being used to settle the last payment of the June maturity Eurobond, and,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 27.2% to 2.1 mn in the 12 months to March 2024, from 1.6 mn recorded during a similar period in 2023.

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 4.0% of GDP in FY’2023 from 5.1% recorded in FY’2022,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.3% of Kenya’s external debt was US Dollar denominated as of December 2023, and,

Monetary Policy:

The Monetary Policy Committee (MPC) met three times in H1’2024 and for the first time since October 2012, the Central Bank Rate was set at 13.0% in the first sitting in February 2024, owing to the sustained depreciation of the Kenyan Shilling and elevated inflationary pressures in the country on the back of high fuel and commodity prices. Additionally, the MPC has retained the CBR at 13.0% during its last two meetings despite a gaining Shilling, eased inflation, and an improved global outlook for growth, owing to continued stickiness in inflation in advanced economies, and persistent geopolitical tensions. Below are some of the Key highlights from the June meeting:

- The overall inflation tightened marginally to 5.1% in May 2024, from 5.0% in April 2023, positioning it at the mid-point of the preferred CBK range of 2.5%-7.5%, mainly driven by the high fuel prices, despite the decrease in fuel inflation. Fuel inflation decreased to 7.8% in May 2024 from 8.3% in April 2024, largely attributable to a downward adjustment in pump prices and lower electricity tariffs. The food inflation increased to 6.2% in May 2024 from 5.6% in April 2024, attributable largely to higher prices of a few vegetables i.e. onions, kales, tomatoes and Irish potatoes, following a decline in supply due to the recent heavy rains and floods in some parts of the country. The increase was however mitigated by a decrease in the prices of a few non-vegetable food items, particularly maize, sugar, and wheat flour. The non-food non-fuel inflation slightly decreased to 3.4% in May 2024 from 3.6% in April 2024. We expect the overall inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a strengthened currency, tight monetary policy, reduced fuel prices and reduced electricity prices,

- The recently released Economic Survey 2024 for FY’2023 showed continued strong performance of the Kenyan economy, with real GDP growing by 5.6%, from a growth of 4.9% in 2022. This was attributable to a strong rebound in the agriculture sector due to favorable weather conditions that boosted crop and livestock production and a resilient performance of the services sector. Leading indicators of economic activity pointed to continued strong performance in the first quarter of 2024. Despite the recent flooding in some parts of the country, the economy is expected to continue to strengthen in 2024, supported by the resilient services sector, the rebound in agriculture, and the implementation of measures to boost economic activity in priority sectors by the Government.

- Goods exports increased by 2.9% in the 12 months to April 2024, compared to a similar period in 2023, reflecting a rise in exports of agricultural commodities and re-exports. Receipts from tea and fruits and vegetables exports increased by 5.6% and 10.5% respectively, while re-exports grew by 38.1% in the period. Notably, exports increased 15.2% in the first four months of 2024 compared to the same period in 2023. Imports declined by 7.7% in the 12 months to April 2024 compared to a similar period in 2023, mainly reflecting lower imports across all categories except machinery and transport equipment. However, imports increased by 2.2% in the first four months of 2024 compared to the same period in 2023. Tourist arrivals improved by 27.2% in the 12 months to March 2024, compared to a similar period in 2023. Remittances totaled USD 4,457 mn in the 12 months to April 2024 and were 11.9% higher compared to USD 3,985 mn in a similar period in 2023. The current account deficit is estimated at 4.1% of GDP in the 12 months to April 2024, down from 4.8% of GDP in a similar period in 2023, and is projected at 4.0% of GDP in 2024, reflecting improvement in exports of agricultural products, sustained remittances, recovery in imports supported by stable exchange rate and effects of regional trade integration initiatives.

- The CBK foreign exchange reserves, which currently stand at USD 6,979 mn representing 3.6 months of import cover, continue to provide adequate cover and a buffer against any short-term shocks in the foreign exchange market,

- The banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans increased to 16.1% in April 2024 compared to 15.5% in February 2024. Increases in NPLs were noted in the agriculture, real estate, tourism, restaurant and hotels, trade, and building and construction sectors. Banks have continued to make adequate provisions for the NPLs,

- The CEOs Survey and Market Perceptions Survey conducted ahead of the MPC meeting revealed a positive outlook on business activity for the next year. Participants of the survey expressed concerns about fiscal policies, high interest rates, and the impact of geopolitical uncertainties on the economy. Despite this, they remained optimistic that economic growth would remain resilient and improve in 2024, supported by increased agricultural production, a resilient service sector and stable macroeconomic activity,

- The Survey of the Agriculture Sector revealed an expectation by respondents that the prices of key food items were expected to remain unchanged or increase in the next three months due to an expected rise in food supply due to favorable weather conditions, stable exchange rate, and lower fuel prices,

- Global growth is expected to increase by 0.1% points to 3.2% in 2024 from 3.1% in 2023, attributable to higher-than-expected growth in the United States and high growth in several large and emerging markets, particularly India. Additionally, headline inflation rates have moderated, though some persistence remains in advanced economies. Food inflation has continued to decline due to an improved supply of key food items, particularly sugar and cereals. International oil prices have moderated because of a reduced risk premium from the Middle East conflict and increased supply from non-OPEC+ oil producers.

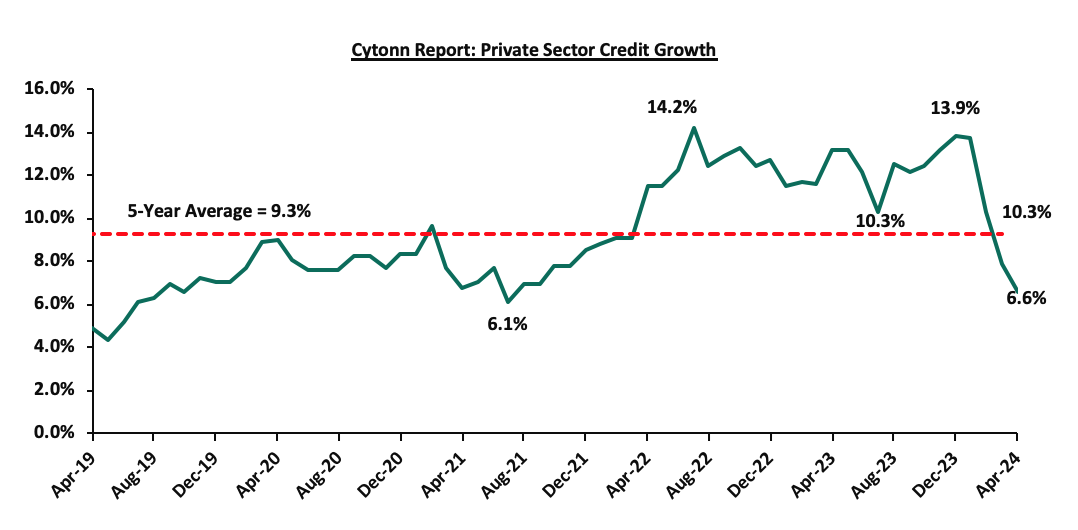

- Growth in private sector credit decreased to 6.6% in April 2024 from 7.9% in March 2024, mainly attributed to exchange rate valuation effects on foreign currency-denominated loans due to the appreciation of the Shilling. In April, local currency loans increased by 14.3%, while foreign currency loans, which make up around 26.0% of total loans, decreased by 14.2%. The chart below shows the movement of the private sector credit growth over the last five years:

- The Committee noted the ongoing implementation of the FY2023/24 Government Budget, as well as the proposed FY2024/25 Budget which are expected to continue to reinforce fiscal consolidation.

- The Committee observed that the new monetary policy implementation framework, adopted on August 9, 2023, has led to better functioning of the interbank market, reduced interest rate spreads with decreased market segmentation and improved monetary policy transmission. To further enhance the effectiveness of this framework, the MPC considered and approved a recommendation to narrow the width of the interest rate corridor around the CBR from the current 250 basis points (bps) to 150 bps. Additionally, the MPC approved a recommendation to adjust the applicable interest rate on the Discount Window from the current 400 bps above the CBR to 300 bps above the CBR.

The MPC noted that its previous measures have successfully reduced overall inflation to the mid-point of the target range of 2.5% - 7.5%, stabilized the exchange rate, and anchored inflationary expectations. The Committee also observed that NFNF inflation has remained persistent in recent months and that interest rates in major economies are expected to stay higher for longer due to persistent inflation. The MPC concluded that the current monetary policy stance will maintain overall inflation around the mid-point of the target range in the short term while ensuring continued exchange rate stability. The MPC will closely monitor the impact of its policy measures, as well as developments in the global and domestic economy, and stands ready to take further action as necessary in line with its mandate. The Committee will meet again in August 2024.

Fiscal Policy:

The total Kenyan budget for the FY’2024/2025 National Budget increased by 7.2% to Kshs 4.0 tn from the Kshs 3.7 tn in FY’2023/2024 while the total revenue inclusive of grants increasing by 15.9% to Kshs 3.4 tn from the Kshs 2.9 tn in FY’2023/2024. The increase is mainly due to an 18.8% increase in ordinary revenue to Kshs 2.8 tn for FY’2024/2025, from the Kshs 2.5 tn in FY’2023/2024 with the increase largely dependent on the effectiveness of the Kenya Revenue Authority in collecting taxes as well as an increase in some of the existing taxes to meet its revenue target. However, there are still concerns about the government's ability to meet its revenue collection targets in FY’2024/2025, on the back of the withdrawal of the Finance Bill 2024 after the president declined to assent to it, which was meant to increase revenue by Kshs 302.0 bn, coupled with a tough operating environment.

For the FY’2023/2024, we do not expect the government to meet its revenue collection target having collected Kshs 1,928.8 bn, equivalent to 78.7% of the revised estimates of Kshs 2,452.1 bn for FY’2023/2024 and 85.8% of the prorated estimates of Kshs 2,247.8 bn in the first eleven months of FY’2023/2024. Notably, the total expenditure amounted to Kshs 3,255.8 bn, equivalent to 85.4% of the revised estimates of Kshs 3,813.3 bn, and 93.1% of the prorated expenditure estimates of Kshs 3,495.5 bn, an indication of modest spending by the government. The total borrowings as at the end of May 2024 amounted to Kshs 1232.2 bn, equivalent to 72.4% of the revised estimates of Kshs 1,701.7 bn and 79.0% of the prorated estimates of Kshs 1,559.9bn.

Going forward, we believe that the withdrawn Finance Bill will force the government to borrow more to finance the fiscal deficit owing to reduced revenue collection. We therefore expect the government to cut on its expenditure, mostly the development expenditure in order to finance the growing debt maturities and the ballooning recurrent expenditure.

Weekly Highlights:

- Withdrawal of the Finance Bill 2024

Following nationwide protests that peaked on Tuesday 25th June 2024, President William Ruto, on Wednesday 26th June 2024 conceded to pressure from the public and declined to sign the controversial Finance Bill 2024 into law.

The proposed raft of tax changes in the Finance Bill 2024 were geared towards expanding the tax base and increasing revenues, with an expectation of raising Kshs 302.0 bn. This revenue was intended to support the government's budget of Kshs 4.0 tn for the fiscal year 2024/2025, and to address a budget deficit of Kshs 597.0 bn. The deficit is planned to be financed through external borrowing of Kshs 333.8 bn and domestic borrowing of Kshs 263.2 bn. Kenya’s total public debt to GDP ratio currently stands at 69.7%, which is higher than the 55.0% preferred by the World Bank and the International Monetary Fund (IMF). Below we highlight some of the key tax proposals contained in the Finance Bill 2024, changes made and the implications of the withdrawal of the Bill:

- Under the Income Tax Act:

- Motor vehicle tax: The Bill proposed a new 2.5% tax on the value of motor vehicles, payable when issuing insurance cover

- Withholding Tax on Goods Supplied to Public Entities: The Bill suggested a withholding tax on goods supplied to public entities by residents and non-residents without a permanent establishment. The rate is 3.0% for resident suppliers and 5.0% for non-residents.

- Taxation of Digital Marketplaces and Content Monetization: The Bill proposed taxing income from digital marketplaces or platforms and digital content monetization at 20.0% for non-residents and 5% for residents.

- Repeal of Digital Service Tax and Introduction of Significant Economic Presence Tax: The Bill sought to repeal the digital service tax (DST) and introduce a significant economic presence tax at 30.0% of deemed taxable profit for non-residents earning income from services provided through digital marketplaces in Kenya.

- Tax Deductibility of Contributions to Medical Funds and Housing Levy: The Bill proposed making contributions to the Social Health Insurance Fund, post-retirement medical fund, and affordable housing levy deductible expenses when calculating taxable income.

- Investment Deduction on Spectrum Licence Purchases: The Bill introduced an investment deduction for capital expenditure on spectrum licenses by telecommunications operators at 10% in equal installments. For licenses purchased before 01 July 2024, the deduction is limited to the unamortized portion over the remaining useful life.

- Tax on Interest Income from Infrastructure Bonds: The Bill proposed taxing interest income from infrastructure bonds for resident persons, while non-residents' interest income remains exempt. Interest from previously listed infrastructure bonds will continue to be exempt.

b. Under the Excise Duty Act:

- Introduction of Excise Duty on Digital Services by Non-Residents: The Bill proposed a 20.0% excise duty on services provided by non-residents through digital platforms in Kenya. This applies to: Telephone and internet data services, fees for money transfer services by banks, money transfer agencies, and other financial service providers, betting, lottery, gaming, and prize competitions, and fees on digital lending.

- Increase of Excise Duty on Money Transfer Services: The Bill suggested raising excise duty from 15.0% to 20.0% on fees for money transfer services provided by banks, money transfer agencies, and other financial service providers, and cellular phone service providers or payment service providers licensed under the National Payment Systems Act, 2011

- Extension of Timeline for Excise Duty Payment by Alcoholic Beverage Manufacturer: The Bill proposed extending the payment timeline for excise duty by licensed alcoholic beverage manufacturers to five working days after removing goods from the stockroom. The previous requirement was to pay within 24 hours.

- Repeal of Automatic Adjustment for Inflation: The Bill proposed removing provisions for the automatic adjustment of excise duty rates on excisable goods for inflation.

c. Under the Value Added Tax (VAT) Act

- VAT on Financial Services: The Bill proposed removing VAT exemptions for several financial services, making them subject to the standard VAT rate of 16.0%. These services include: Issuing credit and debit cards, telegraphic money transfers, foreign exchange transactions, cheque handling and processing, issuing securities for money, debt assignment for consideration, financial services provided on a commission basis

- Increase of VAT Registration Threshold: The Bill proposed raising the threshold for mandatory VAT registration from Kshs 5.0 mn to Kshs 8.0 mn.

- Exemption for Transfer of Business: The Bill proposed exempting the transfer of a business as a going concern from VAT, which is currently taxed at 16.0%.

- VAT on Insurance Premiums: The Bill proposed limiting VAT exemptions to insurance and reinsurance premiums only, subjecting other related services to the standard VAT rate of 16.0%.

- VAT on Betting, Gaming, and Lotteries: The Bill proposed removing the VAT exemption for betting, gaming, and lotteries, making them subject to the standard VAT rate of 16.0%.

- Removal of VAT Exemptions in Tourism: The Bill proposed deleting the following VAT exemptions in the tourism sector: Goods for the construction of tourism facilities and recreational parks of 50 acres or more, locally assembled vehicles for transporting tourists, purchased by tour operators, services for the construction of tourism facilities and recreational parks of 50 acres or more

- Removal of VAT Exemptions in Manufacturing and Construction: The Bill proposed deleting the following VAT exemptions for the manufacturing and construction sectors: Capital goods promoting investment in manufacturing with a value of at least Kshs 2.0 bn, plant, machinery, and equipment for constructing plastics recycling plants, and goods and services for constructing and equipping specialized hospitals with a minimum bed capacity of 50, approved by the Cabinet Secretary for Health

Changes effected to the Finance Bill 2024 included:

- Removal of VAT on Bread: The Finance Committee scrapped the proposed 16.0% VAT on bread following public backlash.

- Excise Duty on Vegetable Oil: The President approved the removal of a proposed 25.0% excise duty on vegetable oil.

- VAT on Sugar Cane Transportation: The State House eliminated the proposed 16.0% VAT on transporting sugar cane to factories, which could have led to higher sugar prices.

- VAT on Financial Services: The Committee removed VAT on financial services and foreign exchange transactions, preventing a potential increase from 15.0% to 40.0% that could have affected forex transactions.

- Mobile Money Transfer Charges: The proposed increase of excise duty on mobile money transfer charges from 15.0% to 20.0% was reversed.

- Motor Vehicle Tax: The proposed annual motor vehicle tax of 2.5% of car value, with a minimum of Kshs 5,000 and a maximum of Kshs 100,000, was removed due to public outcry.

- Housing Fund and Social Health Insurance Levies: These proposed levies were converted to tax-deductible expenses, exempting them from income tax and benefiting employees.

- Eco Levy Adjustments: The Eco Levy will now apply only to imported finished products, not locally manufactured goods, addressing concerns about stifling local manufacturing growth.

- Exemptions on Locally Manufactured Products: The Eco Levy will not apply to locally made products, including sanitary towels, diapers, phones, computers, tyres, and motorcycles.

- VAT Registration Threshold: Small businesses with a turnover of less than Kshs 8.0 mn are exempt from VAT registration, up from the previous threshold of Kshs 5.0 mn.

- eTIMS Exemption: Farmers and small businesses with a turnover below Kshs 1.0 mn are exempt from registering for the electronic Tax Invoice Management System (eTIMS).

- Excise Duty on Imported Agricultural Products: The Committee imposed excise duty on imported table eggs, onions, and potatoes to protect local farmers, scrapping the proposed 16.0% VAT.

- Excise Duty on Alcoholic Beverages: Excise duty will be based on alcohol content rather than volume, encouraging the production of safer and more affordable alcohol.

- Pension Contributions: The exemption threshold for pension contributions was increased from Kshs 20,000 to Kshs 30,000.

- Funding for Junior Secondary School Interns: The budget for recruiting Junior Secondary School interns was increased from Kshs 13.4 bn to Kshs 18.0 bn.

- Teacher Intern Recruitment: Funds have been allocated to hire 20,000 teacher interns, with a policy shift to transition these teachers to permanent and pensionable terms.

The withdrawal of the Finance Bill 2024 in Kenya has significant implications for the country's economy and investment landscape. The withdrawal of the Bill will create a revenue shortfall for the FY2024/2025 budget, and will likely result in Kenya missing the 3.3% fiscal deficit target this year and lead to a possible cut in development expenditure, increased borrowing, higher interest rates, and a potential rise in public debt. Furthermore, after reaching staff-level agreement with the IMF, the proposed tax measures reversal will possibly impede the disbursement of future IMF funds. Uncertainty about the budgetary trajectory and the IMF program would further complicate the government's efforts to increase external funding.

The Finance Bill's withdrawal may affect investor confidence, especially if the market perceives it as a sign of political or economic instability, and could impact both domestic and foreign investment inflows. Investors may adopt a wait-and-see approach, leading to decreased market activity.

Money Markets, T-Bills Primary Auction:

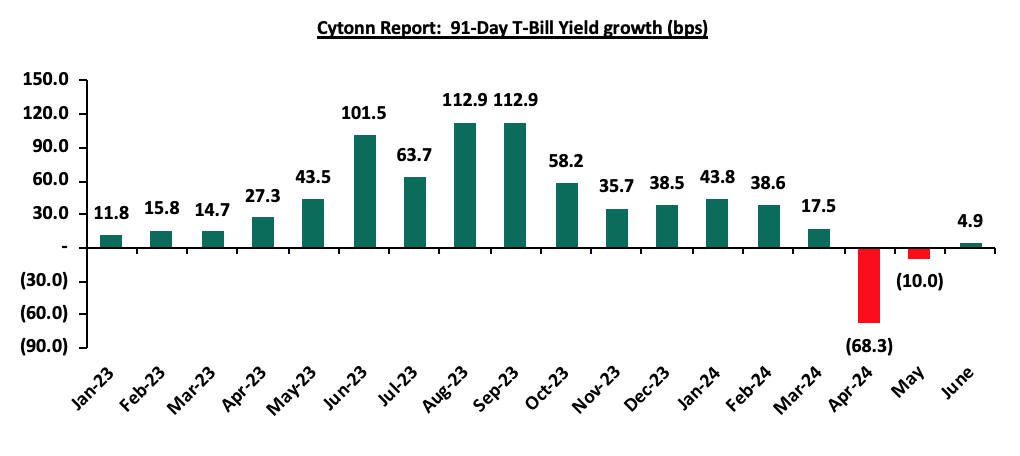

During H1’2024, T-bills were oversubscribed, with the overall subscription rate coming in at 132.6%, up from 121.7% in H1’2023. Investors’ preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 420.6 bn against the offered Kshs 104.0 bn, translating to an oversubscription rate of 404.4%, albeit lower than the oversubscription rate of 481.8% recorded in H1’2023. Overall subscription rates for the 364-day and 182-day papers came in at 80.7% and 75.7%, higher than the 37.9% and 61.3%, respectively, recorded in H1’2023. The average yields on the 364-day, 182-day, and 91-day papers increased by 5.7% points, 6.1% points, and 6.1% points to 16.7%, 16.6%, and 16.2% in H1’2024, respectively, from 11.0%, 10.5%, and 10.2%, respectively, in H1’2023. The upward trajectory in yields is mainly on the back of investors attaching higher risks amid increased credit risk in the country, hence the need to demand higher returns to cushion against the possible loss, and, the government’s desperate need to keep borrowing in the domestic market. The acceptance rate during the period came in at 92.3%, higher than the 91.6% recorded in H1’2023, with the government accepting a total of Kshs 763.5 bn out of the Kshs 827.3 bn worth of bids received. The chart below shows the yield growth rate for the 91-day paper during the year:

During the week, T-bills remained undersubscribed for the third consecutive week, with the overall undersubscription rate coming in at 32.0%, lower than the undersubscription rate of 60.0% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 4.4 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 109.0%, albeit lower than the oversubscription rate of 148.0% recorded the previous week. The subscription rates for the 182-day and 364-day papers decreased to 14.9% and 18.3% respectively from the 39.3% and 45.5% respectively recorded the previous week. The government accepted a total of Kshs 6.1 bn worth of bids out of Kshs 7.7 bn bids received, translating to an acceptance rate of 78.7%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day, and 91-day papers increasing by 3.7 bps, 2.6 bps, and 0.6 bps to 16.79%, 16.76%, and 15.98% respectively from 16.75%, 16.74% and 15.97% respectively recorded the previous week.

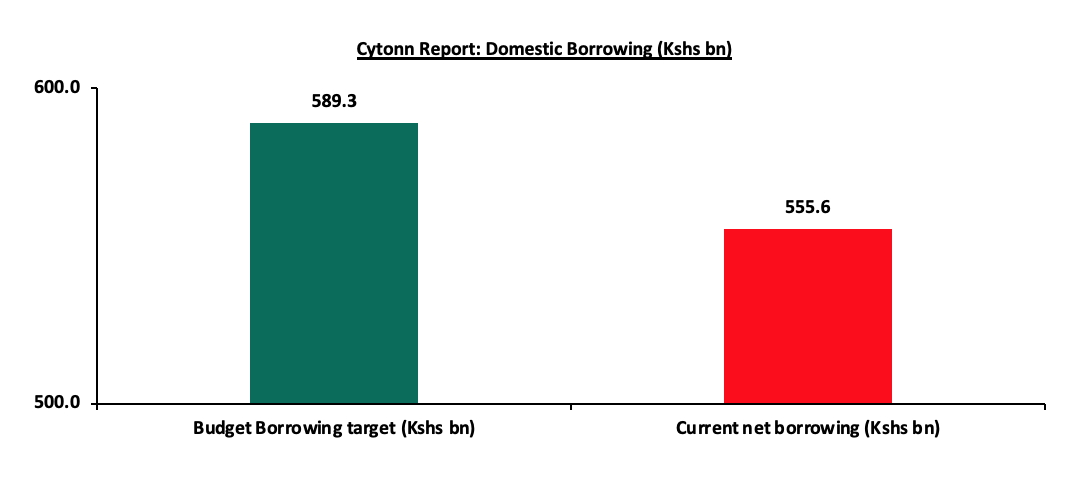

The government closed FY’2023/24, having advertised government securities totalling Kshs 1,914.0 bn. The government accepted bids worth Kshs 2,261.1 bn, of which Kshs 1,472.1 bn and Kshs 789.0 bn were treasury bills and bonds, respectively. Total redemptions in FY’2023/24 amounted to Kshs 1,705.5 bn, with treasury bills accounting for Kshs 1,587.4 bn and bonds accounting for Kshs 124.0 bn. As a result, the government had a domestic borrowing surplus of Kshs 555.6 bn in FY’2023/24, with the government closing the year 5.7% behind its net domestic borrowing target of Kshs 589.3 bn. The chart below shows the government’s domestic borrowing as at the end of FY’2023/24:

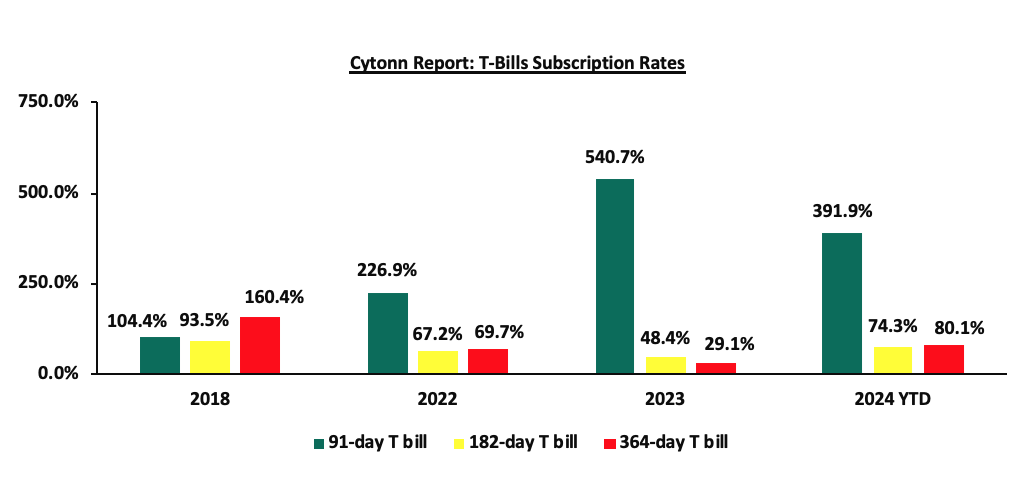

The chart below compares the overall average T-bills subscription rates obtained in 2018, 2022, 2023, and 2024 Year to Date (YTD):

Primary T-Bond Auctions in H1’2024

During H1’2024, the Government issued two new treasury bonds, and one infrastructure bond, reopened five, and issued nine bonds on tap-sale, seeking to raise Kshs 385.0 bn. The bonds were generally oversubscribed, receiving total bids worth Kshs 657.5 bn translating to an overall subscription rate of 170.8%. The government rejected expensive bids and only accepted bids worth Kshs 518.2 bn, out of the Kshs 657.5 bn of bids received, translating to an acceptance rate of 78.8%. The table below provides more details on the bonds issued during the period:

|

Cytonn Report: H1’2024 Kenya Bond Issuances |

|||||||||

|

Issue Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount offered (Kshs bn) |

Actual Amount Raised (Kshs bn) |

Total bids received |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

15/01/2024 |

FXD1/2023/005 (re-opened) |

4.5 |

16.8% |

35.0 |

25.0 |

37.2 |

18.8% |

106.1% |

67.3% |

|

FXD1/2024/003 |

2.9 |

18.4% |

18.4% |

||||||

|

22/01/2024 |

FXD1/2023/005 – Tapsale |

4.5 |

16.8% |

15.0 |

11.8 |

11.9 |

18.8% |

79.1% |

99.1% |

|

FXD1/2024/003 – Tapsale |

2.9 |

18.4% |

18.4% |

||||||

|

19/02/2024 |

IFB/2024/8.5 |

8.5 |

18.5% |

70.0 |

241.0 |

288.7 |

18.5% |

412.4% |

83.5% |

|

11/03/2024 |

FXD1/2024/03 (re-opened) |

2.9 |

18.4% |

40.0 |

34.3 |

43.1 |

18.4% |

107.7% |

79.6% |

|

25/03/2024 |

FXD1/2024/005 (re-opened) |

4.5 |

16.8% |

40.0 |

22.6 |

59.7 |

18.4% |

149.3 |

37.8 |

|

FXD1/2024/010 |

10.0 |

16.0% |

16.5% |

||||||

|

4/4/2024 |

FXD1/2023/005 – Tapsale |

4.5 |

16.8% |

25.0 |

45.8 |

47.8 |

18.4% |

191.2% |

95.9% |

|

FXD1/2024/010 – Tapsale |

10.0 |

16.0% |

16.5% |

||||||

|

22/4/2024 |

FXD1/2023/002-Reopened |

1.4 |

17.0% |

40.0 |

34.8 |

47.2 |

17.0% |

118.0% |

73.7% |

|

06/05/2024 |

FXD1/2024/010-Re-opened |

9.9 |

16.0% |

25.0 |

11.0 |

15.0 |

16.2% |

59.9% |

73.4% |

|

13/05/2024 |

FXD1/2024/010-Tapsale |

9.9 |

16.0% |

15.0 |

7.0 |

7.1 |

16.2% |

47.4% |

98.8% |

|

10/06/2024

|

FXD1/2023/002 - Re-opened |

1.2 |

17.0% |

30.0 |

7.1 |

8.4 |

17.1% |

28.2% |

83.8% |

|

FXD1/2024/003 – Re-opened |

2.6 |

18.4% |

23.8 |

24.8 |

17.6% |

82.7% |

96.0% |

||

|

17/06/2024

|

FXD1/2023/010 – Re-opened |

8.7 |

14.2% |

30.0 |

7.6 |

9.6 |

16.4% |

32.1% |

78.9% |

|

FXD1/2023/005 – Re-opened |

4.1 |

16.8% |

22.6 |

31.9 |

18.2% |

106.5% |

70.7% |

||

|

24/06/2024

|

FXD1/2023/010 – Tapsale |

8.7 |

14.2% |

20.0 |

7.9 |

8.8 |

16.4% |

44.2% |

89.8% |

|

FXD1/2023/005 – Tapsale |

4.1 |

16.8% |

10.8 |

11.2 |

18.2% |

56.1% |

96.3% |

||

|

FXD1/2024/003 – Tapsale |

2.6 |

18.4% |

3.3 |

3.3 |

17.6% |

16.3% |

101.6% |

||

|

FXD1/2023/002 – Tapsale |

1.2 |

17.0% |

1.8 |

1.8 |

17.1% |

9.0% |

99.8% |

||

|

H1'2024 Total |

|

|

385.0 |

518.2 |

657.5 |

|

|

|

|

|

H1’2023 Total |

|

|

375.0 |

442.0 |

477.7 |

|

|

|

|

|

H1'2024 Average |

6.2 |

17.1% |

|

|

|

17.6% |

170.8% |

78.8% |

|

|

H1'2023 Average |

8.1 |

13.8% |

|

|

|

14.2% |

127.4% |

92.5% |

|

In the primary bond market, the government is seeking to raise a total of Kshs 50.0 bn for budgetary support in the month of July by re-opening two bonds and issuing a tap sale. The two fixed coupon treasury bonds issued concurrently include the re-opened FXD1/2024/10 and FXD1/2008/20, with a tenor to maturity of 9.7 years and 3.9 years, respectively and have their coupon rates set at 16.0% and 13.8% respectively. The bonds’ value dates will be 22nd July 2024, with maturity dates of 13th March 2034 and 5th June 2028 for FXD1/2024/10 and FXD1/2008/20 respectively; Given the bonds are trading at 15.0% and 17.7% for the FXD1/2024/10 and FXD1/2008/20 respectively in the secondary bond market, we expect the bidding range to come in at 15.25% - 16.55% and 17.55% - 17.75% respectively. Further, the government is seeking to raise Kshs 20.0 bn through the tap sale of the FXD1/2023/002 bond, with a tenor to maturity of 1.2 years, a coupon rate of 17.0% and a period of sale of Wednesday 26th June 2024 to Thursday 4th July 2024. The bids shall be priced at the average rate of accepted yield for the initial values which stood at 17.1%.

Secondary Bond Market Activity:

- Bond Turnover:

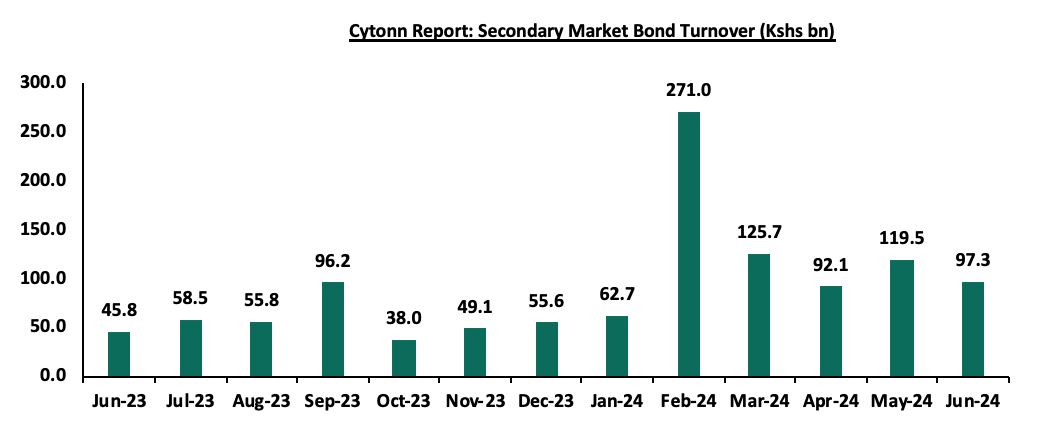

The secondary bond market recorded increased activity, with the turnover increasing significantly by 144.9% to Kshs 768.2 bn from Kshs 313.7 bn in H1’2023, pointing towards increased activities by commercial banks in the secondary bond market. Notably, February recorded outstanding activity in the secondary bond market owing to the infrastructure bond issue which gained traction among investors. Similarly, on a year-on-year basis, the bond turnover increased significantly by 112.0% to Kshs 97.3 in June 2024, from Kshs 45.8 bn worth of treasury bonds transacted over a similar period last year. The chart below shows the bond turnover over the past 12 months;

- Yield Curve:

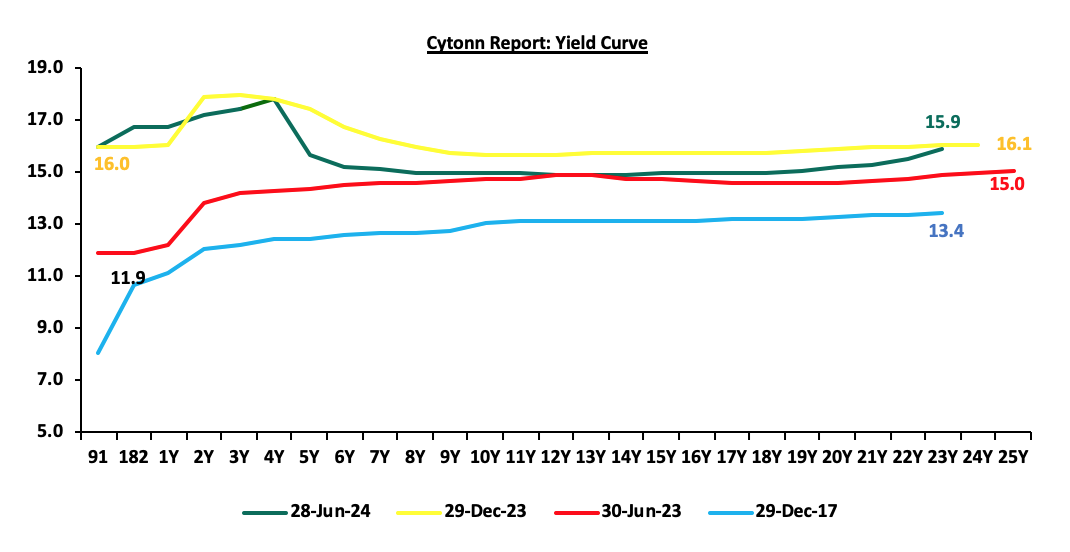

During H1’2024, yields on the government securities were on an upward trajectory compared to the same period in 2023. We observe a humped yield curve for the medium-term bonds in the 3 to 10-year maturity range, an indication of the prevailing uncertainty in the market regarding both medium-term interest rates and inflation. Investors, apprehensive about the economic outlook in the near to medium term, are demanding higher yields for bonds in the 3 to 10-year maturity range to compensate for the perceived risks as they anticipate potential fluctuations in economic conditions in the Kenyan market on the back of the government’s debt sustainability concerns. The chart below shows the yield curve movement during the period:

Money Market Performance

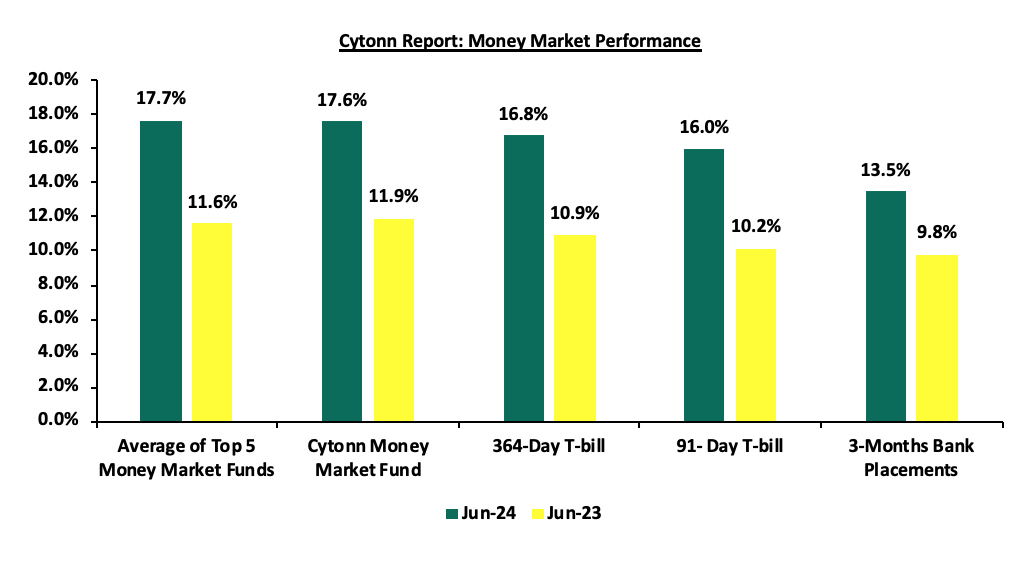

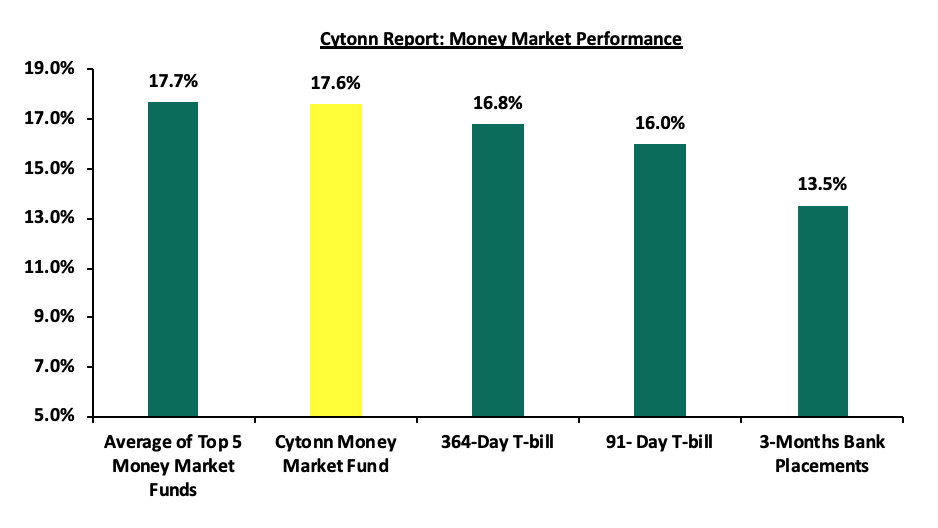

The 3-month bank placements recorded 13.5% at the end of H1’2024, 3.7% points higher than the 9.8% recorded at the end of H1’2023 (based on what we have been offered by various banks). The 91-day T-bill rate increased by 5.8% points to 16.0% at the end of H1’2024 from 10.2% at the end of H1’2023, and the average Top 5 Money Market Funds increased by 6.1% points to 17.7%, from 11.6% at the end of H1’2023. The yield on the Cytonn Money Market (CMMF) increased by 5.7% points to 17.6% at the end of H1’2024, from 11.9% recorded at the end of H1’2023.

During the week, in the money markets, 3-month bank placements ended the week at 13.5% (based on what we have been offered by various banks), and the yields on the government papers were on an upward trajectory, with the yields on the 364-day and 91-day papers increasing by 3.7 bps and 0.6 bps to 16.79% and 15.98% respectively from 16.75% and 15.97% respectively recorded the previous week. The yields on the Cytonn Money Market Fund remained unchanged at the 17.6% recorded the previous week, while the average yields on the Top 5 Money Market Funds increased by 15.4 bps to 17.7% from the 17.5% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 28th June 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 28th June 2024 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Etica Money Market Fund |

18.3% |

|

2 |

Lofty-Corban Money Market Fund |

18.3% |

|

3 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn App) |

17.6% |

|

4 |

Arvocap Money Market Fund |

17.1% |

|

5 |

Kuza Money Market fund |

17.1% |

|

6 |

GenAfrica Money Market Fund |

16.7% |

|

7 |

Nabo Africa Money Market Fund |

16.6% |

|

8 |

GenCap Hela Imara Money Market Fund |

15.9% |

|

9 |

Enwealth Money Market Fund |

15.7% |

|

10 |

Co-op Money Market Fund |

15.7% |

|

11 |

Jubilee Money Market Fund |

15.6% |

|

12 |

Apollo Money Market Fund |

15.6% |

|

13 |

KCB Money Market Fund |

15.6% |

|

14 |

Madison Money Market Fund |

15.4% |

|

15 |

Mayfair Money Market Fund |

15.3% |

|

16 |

Mali Money Market Fund |

15.2% |

|

17 |

AA Kenya Shillings Fund |

15.2% |

|

18 |

Sanlam Money Market Fund |

15.1% |

|

19 |

Absa Shilling Money Market Fund |

15.0% |

|

20 |

Orient Kasha Money Market Fund |

14.5% |

|

21 |

Dry Associates Money Market Fund |

14.0% |

|

22 |

Old Mutual Money Market Fund |

13.6% |

|

23 |

CIC Money Market Fund |

13.2% |

|

24 |

ICEA Lion Money Market Fund |

12.3% |

|

25 |

Equity Money Market Fund |

12.0% |

|

26 |

British-American Money Market Fund |

9.7% |

Source: Business Daily

Liquidity:

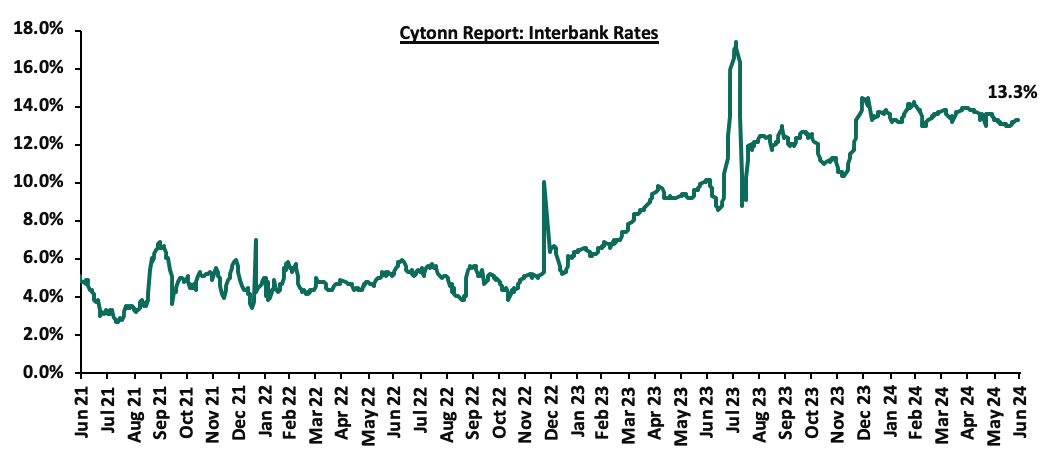

In H1’2024, liquidity in the money markets tightened, as evidenced by the increase in the interbank rate to 13.5%, from 7.8% H1’2023, partly attributable to tax remittances that offset government payments. Additionally, the average volumes traded in the interbank market increased by 8.9% to Kshs 23.0 bn, from Kshs 21.1 bn recorded in H1’2023.

Similarly, during the week, liquidity in the money markets tightened, with the average interbank rate increasing by 19.3 bps to 13.3% from 13.1% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded decreased by 23.6% to Kshs 20.4 bn from Kshs 26.7 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During H1’2024, the yields on Eurobonds recorded mixed performance, with the yield on the 7-Year Eurobond issued in 2019 declining by 0.2% points to 9.9% from 10.1% recorded at the beginning of the year, while the yields on the 13-year Eurobond issued in 2021 gained the most by 1.2% points to 10.8% from 9.5% recorded at the beginning of the year. Similarly, on a year-on-year basis, the yields on all Eurobonds were on a downward trend, save for the 13-year Eurobond issued in 2021 whose yield gained by 0.5% points to 10.8% from 10.3% recorded at the end of H1’2023, while the 7-year Eurobond issued in 2019 declined the most by 1.3% points to 9.9% from 11.3% recorded at the end of H1’2023.

During the week, the yields on Eurobonds were on an upward trajectory, with the yield on the 7-Year Eurobond issued in 2019 increasing the most by 33.5 bps to 9.9% from 9.6% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 27 June 2024;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2018 |

2019 |

2021 |

2024 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

|

Years to Maturity |

3.7 |

23.7 |

2.9 |

7.9 |

10.0 |

6.6 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

|

30-Jun-23 |

11.0% |

11.1% |

11.3% |

11.1% |

10.3% |

|

|

01-Jan-24 |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

|

|

03-Jun-24 |

9.2% |

10.1% |

9.0% |

9.7% |

9.8% |

9.7% |

|

20-Jun-24 |

10.1% |

10.8% |

9.6% |

10.5% |

10.5% |

10.5% |

|

21-Jun-24 |

10.2% |

10.9% |

9.7% |

10.7% |

10.6% |

10.7% |

|

24-Jun-24 |

10.1% |

10.8% |

9.5% |

10.7% |

10.6% |

10.7% |

|

25-Jun-24 |

10.3% |

10.9% |

9.8% |

10.8% |

10.7% |

10.8% |

|

26-Jun-24 |

10.3% |

10.9% |

9.8% |

10.8% |

10.8% |

10.8% |

|

27-Jun-24 |

10.3% |

10.9% |

9.9% |

10.8% |

10.8% |

10.7% |

|

Weekly Change |

0.3% |

0.1% |

0.3% |

0.2% |

0.2% |

0.2% |

|

Y/Y Change |

(0.7%) |

(0.1%) |

(1.3%) |

(0.3%) |

0.5% |

- |

|

YTD Change |

0.5% |

0.7% |

(0.2%) |

0.9% |

1.2% |

- |

Source: Central Bank of Kenya (CBK)

H1’2024 Highlights:

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th January 2024 to 14th February 2024. Notably, the maximum allowed price for Super Petrol, Diesel and Kerosene decreased by Kshs 5.0, Kshs 5.0, and Kshs 4.8 respectively and retailed at Kshs 207.4, Kshs 196.5, and Kshs 194.2 per litre respectively from the December 2023 prices of Kshs 212.4, Kshs 201.5 and Kshs 199.1 respectively. Please see our Cytonn Weekly 02/2024,

- The Executive Board of the International Monetary Fund (IMF) concluded the 2023 Article IV consultation with Kenya together with the sixth reviews and augmentations of access of USD 941.2 mn (Kshs 151.3 bn) under the Extended Fund Facility (EFF) and the Extended Credit Facility (ECF) arrangements, and the first review under the 20-month Resilience and Sustainability Facility (RSF) arrangement, approved in July 2023. Please see our Cytonn Weekly 03/2024,

- The National Treasury gazetted the revenue and net expenditures for the sixth month of FY’2023/2024, ending 29th December 202 Total revenue collected as at the end of December 2023 amounted to Kshs 1,092.1 bn, equivalent to 42.4% of the revised estimates of Kshs 2,576.8 bn for FY’2023/2024 and is 84.8% of the prorated estimates of Kshs 1,288.4 bn. December’s 84.8% attainment of the revenue target was a 2.6%-points improvement from the performance in November where the government achieved 82.2% of the revenue targets. Please see our Cytonn Weekly 03/2024,

- Ivory Coast (Côte d’Ivoire) became the first Sub-Saharan Africa (SSA) country to tap into the international capital markets, issuing two bonds with respective maturities of 8.5 years and 12.5 years, maturing on 30th January 2033 and 30th January 2037 respectively. This was the first issue in the SSA region since 2022, when rising global interest rates and geopolitical tensions made foreign currency debt prohibitively expensive for most African borrowers. Notably, the sovereign raised a total of USD 2.6 bn from the two tranches, with the two issues recording an oversubscription of over USD 8.0 bn. The coupon rates for the 8.5-year (maturity 2033) and the 12.5-year (maturity 2037) were fixed at 7.625% and 8.250% respectively, with the coupons being payable semi-annually in arrears. Please see our Cytonn Weekly #04/2024,

- The Monetary Policy Committee met on February 6, 2024, to review the outcome of its previous policy decisions against a backdrop of continued global uncertainties, moderating global oil prices, an improved global growth outlook as well as heightened geopolitical tensions. The MPC decided to raise the CBR rate by 0.5% points to 13.0% from 12.5% on account of inflation remaining sticky in the economy as well as continued pressures on the exchange rate, albeit reduced. Please see our Cytonn Weekly 06/2024,

- Kenya announced it was going through with the earlier announced plan of buying back the 10-year tenor USD 2.0 bn Eurobond issued in 2014. In the announcement, Kenya stated that the buyback plan would be financed by the issuance of a new Eurobond. This followed successful issues by Ivory Coast and Benin which raised USD 2.6 bn and USD 750.0 mn respectively, marking the return of the Sub-Saharan region to the international Eurobonds market after nearly two years of absence. Please see our Cytonn Weekly 06/2024,

- Benin became the second country in the Sub-Saharan Africa (SSA) region to tap into the international capital markets in 2024, issuing their debut dollar bond with a tenor of 14 years and a coupon rate of 8.375%. Notably, the bond was oversubscribed with the overall subscription rate coming in at 666.7% having received bids worth USD 5.0 bn against the offered USD 750.0 mn; Please see our Cytonn Weekly 06/2024,

- The Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of January 2024 improved slightly, coming in at 49.8, up from 48.8 in December 2023, signalling a modest and softer downturn in operating conditions across Kenya’s business environment; Please see our Cytonn Weekly 06/2024,

- The Energy and Petroleum Regulatory Authority (EPRA) released its monthly statement on the maximum retail fuel prices in Kenya, effective from 15th February 2024 to 14th March 2024. Notably, the maximum allowed price for Super Petrol, Diesel and Kerosene decreased by Kshs 1.0 each, and retailed at Kshs 206.4, Kshs 195.5, and Kshs 193.2 per litre respectively from the January 2024 prices of Kshs 207.4, Kshs 196.5 and Kshs 194.2 respectively; Please see our Cytonn Weekly 07/2024,

- The Government, through the Ministry of National Treasury & Planning announced the successful pricing of a new USD 1.5 bn Eurobond. The new issuance (KENINT 2031) attracted a yield of 10.375% and a coupon rate of 9.75%, in line with our expectations which were informed by the prevailing market conditions, Kenya’s credit ratings, and the unique nature of the buyback and issue plan. Interest payments for the bond are to be paid semi-annually on February 16th and August 16th starting August 2024; Please see our Cytonn Weekly 07/2024,

- The Government, on 15th February 2024, announced the results of the Tender offer of its USD 2.0 bn 10-year tenor Eurobond issued in 2014. The buyback offer received tenders worth 1.5 bn against the offered 1.4 bn, translating to an oversubscription rate of 106.1%, with Kenya accepting bids worth USD 1.4 bn, slightly below the offered USD 1.5 bn. This translated to an acceptance rate of 97.0%; Please see our Cytonn Weekly 07/2024,

- The global ratings agency, S&P Global affirmed Kenya's long-term sovereign credit rating at 'B' with a negative outlook and assigned a 'B' long-term issue rating to the proposed U.S. dollar-denominated Eurobonds. This came in following the buyback of the 10-year tenor USD 2.0 bn Eurobond tenders issued in 2014 and the new issuance of the KENINT 2031 Eurobond priced at USD 1.5 bn. In addition, the global ratings agency, Moody’s announced its revision of the Kenyan banks’ outlook to negative from stable on the back of the high volume of non-performing loans (NPLs), which have thrown a pall over the sector's strong profitability and liquidity. Please see our Cytonn Weekly 07/2024,

- The National Treasury gazetted the revenue and net expenditures for the seventh month of FY’2023/2024, ending 31st January 2024 highlighting that total revenue collected as at the end of January 2024 amounted to Kshs 1,261.0 bn, equivalent to 48.9% of the revised estimates of Kshs 2,576.8 bn for FY’2023/2024 and is 83.9% of the prorated estimates of Kshs 1,503.1 bn; Please see our Cytonn Weekly 07/2024,

- Yields on the Government securities had been on an upward trajectory with the 91-day paper yielding 16.6% from 9.4% in January 2023. Going forward, we anticipate a very modest increase in yields on the government papers before they stabilize in the remaining months of FY’2023/24. The increase will be muted going forward due to the positive investor sentiment brought about by the successful offering of the Eurobond, which helped alleviate the fears of possible default by the government. Please see our Cytonn Weekly 08/2024,

- Stanbic Bank released its monthly Purchasing Manager's Index (PMI)-Kenya highlighting that the index for the month of February 2024 improved, coming in at 51.3, up from 49.8 in January 2024. The index was also at its highest level in over a year, with positive directional influences seen in all five of its sub-components. The upturn of the general business environment was mainly attributable to eased inflationary pressures, appreciating Shilling, and reduced fuel prices. Please see our Cytonn Weekly 10/2024,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th March 2024 to 14th April 202 Notably, the maximum allowed price for Super Petrol, Diesel and Kerosene decreased by Kshs 7.2, Kshs 5.1, and Kshs 4.5 each respectively, and will retail at Kshs 199.2, Kshs 190.4 and Kshs 188.7 per litre respectively, from the February 2024 prices of Kshs 206.4, Kshs 195.5 and Kshs 193.2 respectively. Please see our Cytonn Weekly 11/2024,

- The National Treasury gazetted the revenue and net expenditures for the eighth month of FY’2023/2024, ending 29th February 2024. Total revenue collected as at the end of February 2024 amounted to Kshs 1,424.9 bn, equivalent to 55.3% of the revised estimates of Kshs 2,576.8 bn for FY’2023/2024, and was 82.9% of the prorated estimates of Kshs 1,717.8 bn. Please see our Cytonn Weekly 11/2024, and,

- Ghanaian authorities and international bondholders were poised to engage in crucial talks that week to navigate the complexities of restructuring approximately USD 13.0 bn of defaulted global debt. This effort marked the start of formal talks to restructure Ghana’s debt to private international bondholders. Please see our Cytonn Weekly 11/2024.