Cytonn Annual Markets Review - 2022

By Research Team, Jan 2, 2023

Executive Summary

Global Market Review:

According to the October 2022 World Economic Outlook by the International Monetary Fund (IMF), the global economy is projected to grow at a slower rate of 3.2% in 2022, from the 6.0% growth recorded in 2021. The expected slowdown in the Global economy’s growth is majorly attributable to the persistent inflationary pressures attributed to the high global fuel and energy prices experienced through most of the year, coupled with pre-existing supply chain disruptions worsened by the ongoing conflict in Ukraine which have greatly impacted commodities supply. Additionally, emerging markets and developing economies are projected to expand by 3.7% in 2022, lower than the 6.6% growth in 2021 while advanced economies are expected to record a 2.4% growth from the 5.2% expansion recorded in 2021. Additionally, it is worth noting that the 2021 high economic growth globally was on the back of COVID-19 recovery;

Sub-Saharan Africa Region Review

The Sub-Saharan Africa economy is projected to grow by 3.3% in 2022 according to the World Bank’s Pulse Issue and 3.6% according to the International Monetary Fund (IMF), down from the 4.1% and 4.7% growth in 2021 according to the World Bank and the IMF respectively. The decline in the growth in the region is attributable to the elevated inflationary pressures, adverse weather conditions that have undermined agricultural productivity, elevated risk of debt distress in the region and hiked interest rates in advanced economies such as the United States of America (USA) which have led to increased capital outflows in the region;

During the year, all select Sub-Saharan African currencies depreciated against the United States Dollar, with the Ghanaian Cedi being the largest decliner in 2022, depreciating by 42.8% against the U.S Dollar. Also, the region’s appetite for foreign-denominated Eurobonds remained muted with Nigeria and Angola being the only issuers during the year. Additionally, Sub-Saharan Africa (SSA) stock markets recorded mixed performance in 2022, with Zambia Stock Exchange (LASILZ) being the largest gainer with a 11.6% gain in 2022 due to improved macroeconomic environment supported by the IMF financial assistance maintaining investor confidence in the country;

Kenya Macro Economic Review

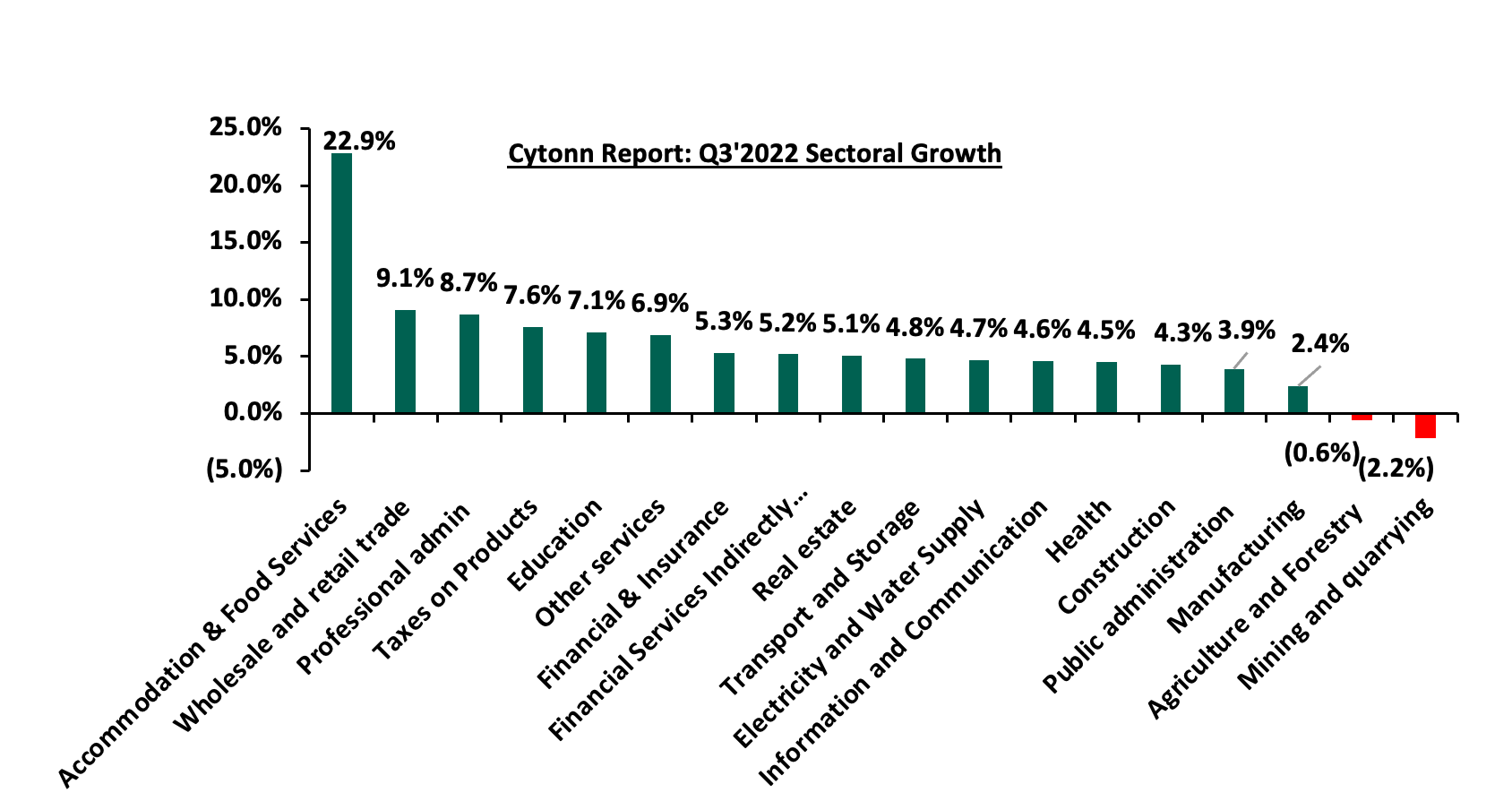

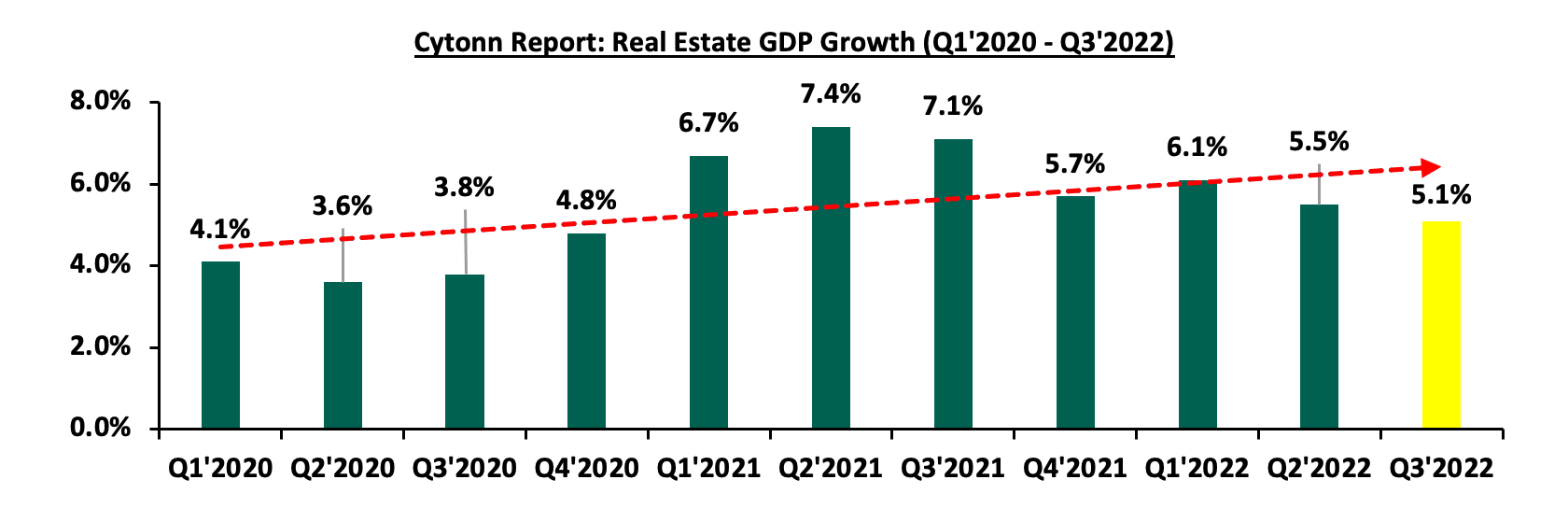

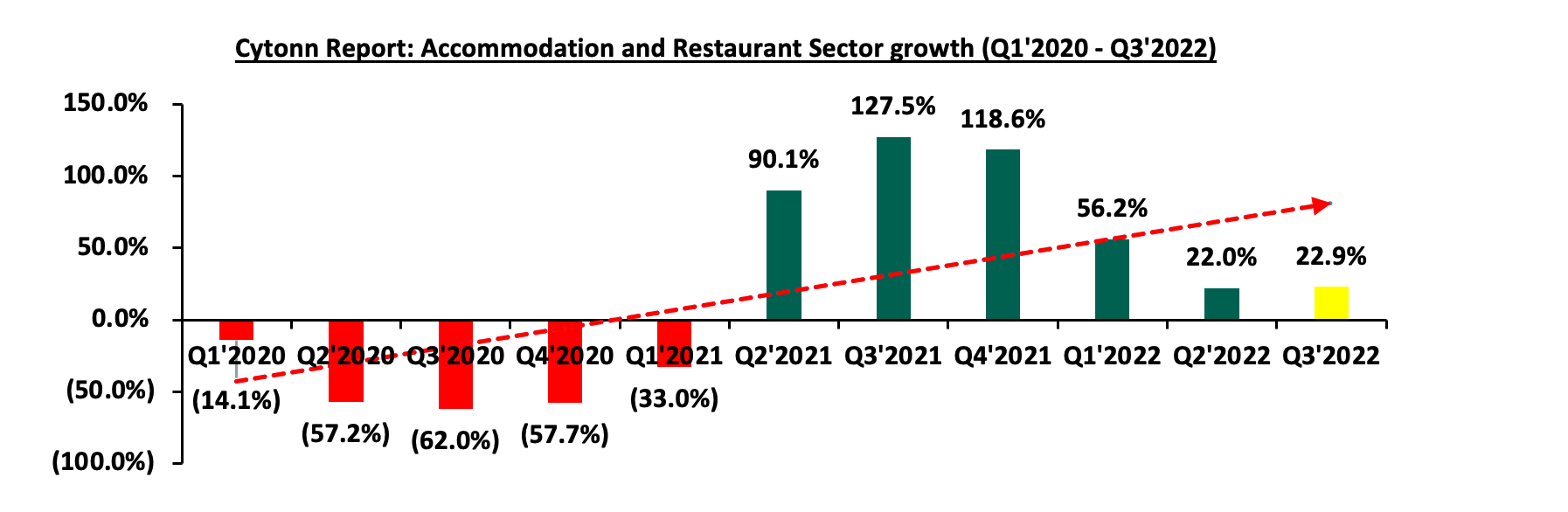

The Kenyan economy recorded an average growth of 5.6% in the period between January to September 2022, with Q3’2022 GDP coming in at 4.7%, adding to the 5.2% and 6.8% growth recorded in Q2’2022 and Q1’2022, respectively. The average GDP growth of 5.6% marked a decline from the 7.7% average growth recorded in a similar period in 2021. Growth in Q3’2022 was largely driven by the non-agricultural sectors, with accommodation and food, wholesale and retail trade, professional administrative and support, and finance and insurance sectors recording growths of 22.9%, 9.1%, 8.7%, and 5.3%, respectively, in Q3’2022, albeit slower than growth of 127.5%, 6.4%, 13.4%, and 11.8%, respectively recorded in Q3’2021. The growths in these sectors were supported by continued post COVID-19 economy recovery due to lifting of travel restrictions and ease in cross border transactions. However, the sectoral growths remained subdued due to uncertainties of the electioneering period and the adverse macroeconomic conditions in the country. Notably, the agricultural sector recorded a 0.6% contraction in Q3’2022, compared to a corresponding expansion of 0.6% growth in Q3’2021 but an improvement from preceding contractions of 2.1% and 0.7% recorded in Q2’2022 and Q1’2022, respectively. The contraction during the quarters is mainly attributable to unfavorable weather conditions witnessed during the period, as well as increased costs of agricultural inputs such as fertilizer;

In 2022, the Kenyan economy is projected to grow at an average of 5.1%, lower than the 7.5% growth recorded in 2021. The slower growth is mainly attributable to a deteriorated business environment for majority of the year brought about by the uncertainties preceding the August 2022 general elections and elevated inflationary pressures driven by the high global fuel prices and the pre-existing supply chain constraints worsened by the Russia-Ukraine conflict. Notably, the unfavorable weather conditions experienced during the period under review has subdued agricultural production, with the sector being the largest contributor to Kenya’s GDP;

Fixed Income

During the year, the yields on the government bills were on an upward trajectory with the yields on the 91-day, 182-day and 364-day T-bills increasing by 124.3 bps, 142.2 bps and 133.1 bps to 8.2%, 9.0% and 9.9% in 2021, from 7.0%, 7.6% and 8.6% at the end of 2021, respectively. Both the short term and long term government papers were undersubscribed, with the average subscription rate for T-bills and T-bonds coming in at 94.9% and 98.8%, from the 91.9% and 147.6% subscription recorded in 2021, respectively. The undersubscription was partly attributable to the tightened liquidity in the money market with the average interbank rates increasing to 4.9% in 2022, from 4.7% in 2021 and perceived risks arising from the August 2022 General Elections. Notably, the pre-election subscription rates weighed down on the overall subscriptions with the pre-election average T-bills subscriptions coming in at 88.8%, lower than 103.8% for post-election average;

During the week, T-bills were undersubscribed, for the second consecutive week, with the overall subscription rate dropping significantly to 17.9%, down from the 69.9% recorded the previous week, partly attributable to the tightened liquidity in the money market with the average interbank rate increasing to 6.4% from 6.2% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 2.2 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 54.5%, down from 347.9% recorded the previous week. The subscription rates for the 364-day and the 182-day papers also declined to 4.3% and 16.9% from 9.3% and 19.3% recorded the previous week, respectively. The yields on the government papers recorded mixed performance, with the yields on the 364-day and 91-day papers declining slightly by 0.2 bps and 0.1 bps to 10.3% and 9.4%, respectively, while the yield on 182-day paper increased marginally by 0.9 bps to 9.8%;

During the week, Nigeria’s President sent a proposal to parliament for approval to allow for a restructuring of USD 54.0 bn, short term loans owed to its Central Bank to a 40-year security at an interest of 9.0%. The debt was incurred through Ways and Means Advances to finance government deficit as a result of delayed government receipts. The Nigerian Executive also requested for a three-year moratorium on interest payments on existing debts and asked for another USD 2.2 bn (N1.0 tn) debt from Central bank on similar terms. This comes at a time when the country has been accruing more debt resulting to high debt service to revenue which was 57.1% as of Q3’2022. This comes after Ghana announced plans to restructure their domestic debt and is currently in talks with domestic bondholders, as part of the conditions to receive financial assistance worth USD 3.0 bn from the International Monetary Fund (IMF), highlighting the current debt sustainability concerns in the Sub-Saharan Africa Region;

The Kenya National Bureau of Statistics (KNBS) released the Q3’2022 Quarterly Gross Domestic Product Report , highlighting that the Kenyan economy recorded a 4.7% growth in Q3’2022, significantly lower than the 9.3% growth recorded in Q3’2021 when the most sectors of the economy were recovering from the impacts of COVID-19 pandemic. The performance during the quarter was largely supported by growth recorded in non-agricultural sectors like Accommodation and Food Services activities (22.9%), Wholesale and retail trade (9.1%), Professional, Administrative and Support services (8.7%) and Education (7.1%), among others. The expansion was however weighed down by declines recorded sectors such as Mining and quarrying, and Agriculture and Forestry which contracted by 2.2% and 0.6%, respectively. Key to note, this is the fourth consecutive quarter that the agriculture sector has recorded a contraction;

The Kenya National Bureau of Statistics released the Quarterly Balance of Payments report for Q3’2022 report highlighting that Kenya’s balance of payments position recorded a deficit of Kshs 112.7 bn, a significant increase of 283.9% from the deficit of Kshs 29.3 bn in Q3’2021. Additionally, the BoP performance was a reversal from the surplus of Kshs 10.9 bn recorded in Q2’2022. The performance was mainly attributable to widening of the current account deficit by 5.5% to Kshs 193.4 bn from Kshs 183.4 bn recorded in Q3’2021, coupled with a 13.4% expansion of the financial account to Kshs 190.8 bn from Kshs 168.3 bn recorded in Q3’2021;

Equities

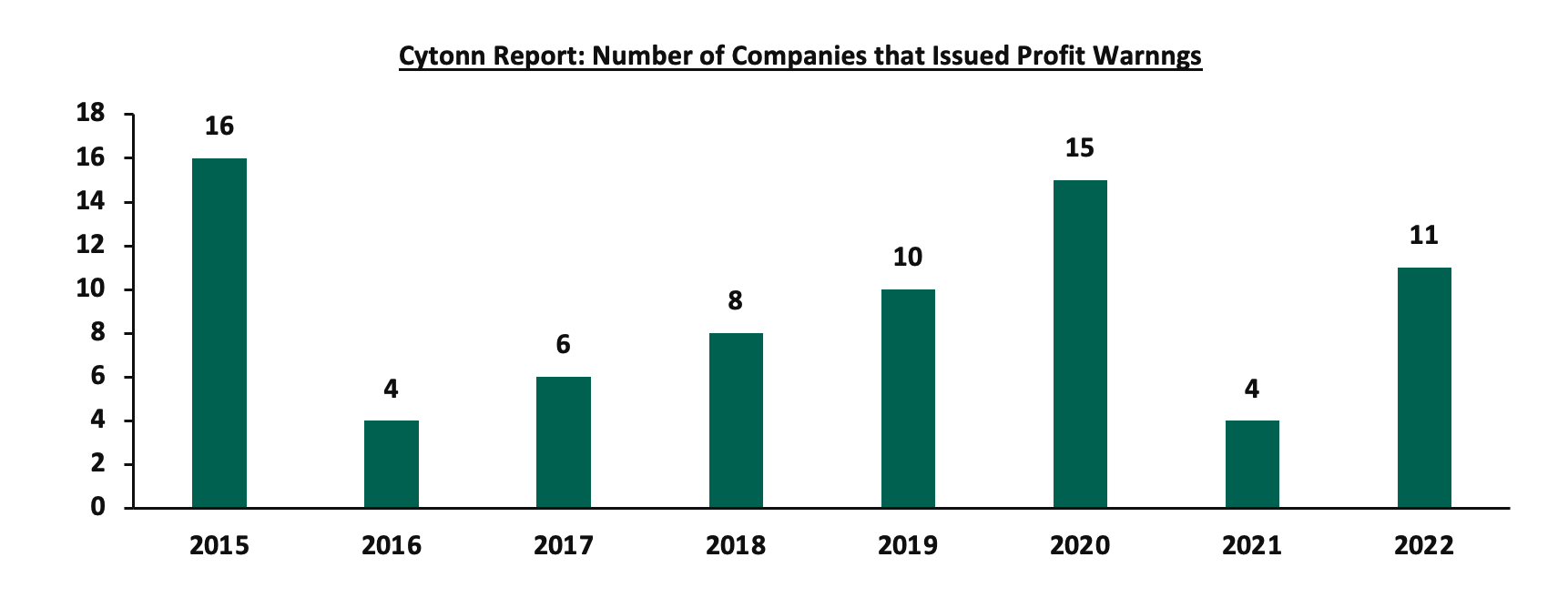

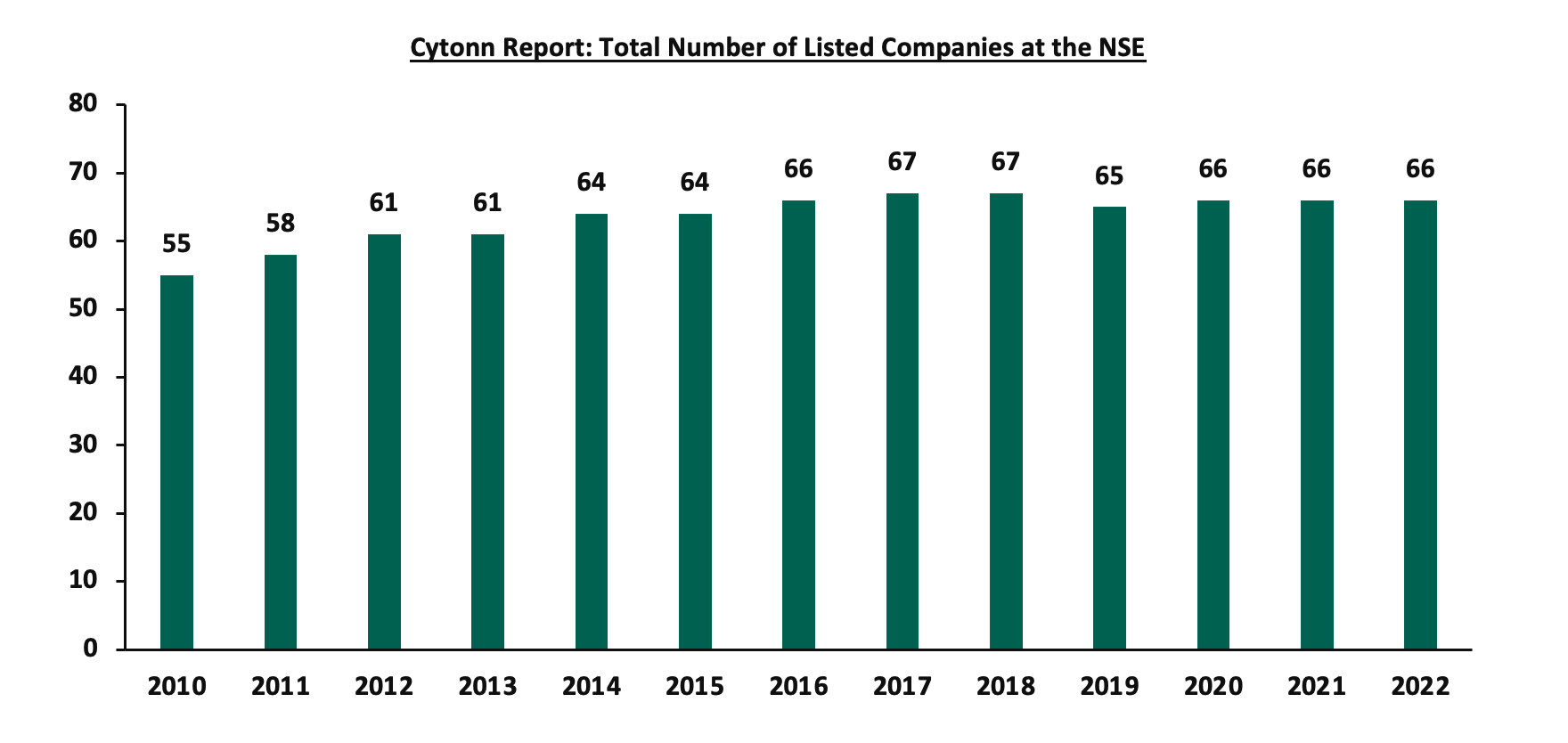

During the year, the Kenyan equities market was on a downward trajectory with all indices declining with NASI, NSE 20 and NSE 25 down by 23.7%, 12.4% and 16.6% respectively. The equities market performance was driven by losses recorded by large cap stocks such as Safaricom of 36.7%, Bamburi of 17.5%, as well as banking stocks such as KCB Group, Diamond Trust Bank Kenya, Equity Group and Co-operative Bank Kenya of 16.4%, 16.0%, 15.6%, and 5.4% respectively. The losses were however mitigated by gains recorded by other banking stocks such as NCBA Group, Standard Chartered Bank Kenya (SCBK)and ABSA Bank Kenya of 54.6%, 9.8% and 4.7%, respectively, while BAT Kenya and EABL gained by 4.5%, and 1.2%, respectively. In the banking sector, the Kenya listed banks recorded a weighted average increase in the core earnings per share of 36.7% in Q3’2022, compared to a weighted average increase of 102.0% in Q3’2021, while in the Insurance sector, the listed insurers recorded a weighted average increase in core earnings per share of share 16.0% in H1’2022, compared to a weighted average increase of 127.6% in H1’2021. During the year, 11 companies issued profit warnings, as compared to 4 companies in 2021, and 15 companies in 2020. The companies are Kakuzi Plc, The Limuru Tea Kenya Plc, Sanlam Kenya Limited, Unga Group Ltd, Liberty Kenya Holdings Ltd, Centum Investments Co Plc, Sameer Africa plc, Nairobi Securities Exchange PLC, Bamburi Cement PLC, Crown Paints Kenya Plc and Flame Tree Group Holdings Ltd. Additionally, during the year, the Capital Markets Authority approved the listing by introduction of the Local Authority Pension Trust (LAPTRUST) Imara Income Real Estate Investment Trust (I-REIT) on the Nairobi Securities Exchange (NSE) under the Restricted Sub-Segment. Four companies remained suspended at the Nairobi Securities Exchange, namely, Deacons (East Africa) PLC, ARM Cement PLC, Mumias Sugar Co. Ltd and Kenya Airways;

Real Estate

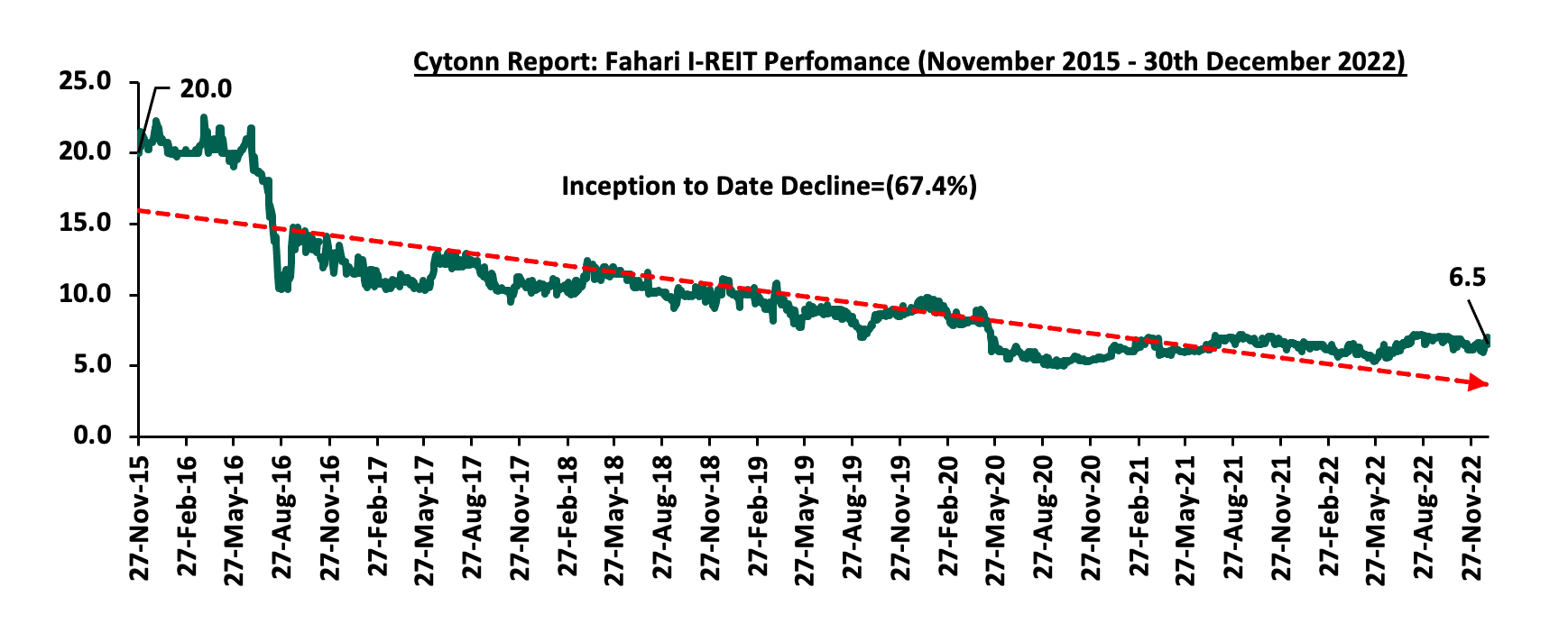

In 2022, the general Real Estate sector witnessed considerable growth in activity in terms of property transactions and development activities. Consequently, the sector’s activity contribution to GDP grew by 5.6% to Kshs 749.7 bn for the 9 months to September 2022, from Kshs 710.3 bn recorded during the same period in 2021. Additionally, selling and rental prices also continued to soar, driven by continued inflationary pressures and a weakened shilling against the United States dollar that has seen a rise in costs of construction materials. In terms of performance, the Nairobi Metropolitan Area (NMA) Residential, Commercial Office, Retail, Hospitality, and Mixed-Use Development sectors realized average rental yields of 5.1%, 7.6%, 7.9%, 6.2%, and 7.4%, respectively. This resulted to an average rental yield for the Real Estate market at 6.8%, 0.3% points higher than the 6.5% recorded in 2021. In Listed Real Estate, Fahari I-REIT closed the week trading at an average price of Kshs 6.5 per share on the Nairobi Stock Exchange, a 1.8% decline from Kshs 6.6 per share recorded the previous week. On the Unquoted Securities Platform as at 16th December 2022, Acorn D-REIT and I-REIT closed the week trading at Kshs 23.8 and Kshs 20.9 per unit, respectively, a 19.2% and 4.4% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.92%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.88% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for assignment, click here for the latest term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Economic Growth:

According to the October 2022 World Economic Outlook Report by the International Monetary Fund (IMF), the global economy is projected to grow at a slower rate of 3.2% in 2022, from the 6.0% growth recorded in 2021. Additionally, emerging markets and developing economies are projected to expand by 3.7% in 2022, 2.9% points lower than the 6.6% growth in 2021 while advanced economies are expected to record a 2.4% growth from the 5.2% expansion recorded in 2021. The expected slowdown in the Global economy’s growth is majorly attributable to;

- The persistent inflationary pressures which have seen several central banks raise their interest rates with the aim of anchoring inflation. Notably, Global inflation is forecasted to rise to 8.8% in 2022, from 4.7% in 2021,

- Unfavorable financial conditions occasioned by high cost of borrowing and worsened liquidity in emerging economies as most advanced economies continue to tighten their monetary policies, and,

- Pre-existing supply chain disruptions worsened by the ongoing conflict in Ukraine which have greatly impacted global fuel energy and food supplies, and,

- COVID-19 pandemic and its related impact remain a constraining factor for global economic growth mainly as result of emergence of new strains, and resurgence in infections in some economies such as China which have necessitated re-imposition of lockdowns.

The global economy’s future performance is majorly dependent on how soon the inflationary pressures will ease, which will see central banks will ease the monetary policy, the course of the war in Ukraine, and the possibility of further pandemic-related supply-side disruptions, for example, in China.

Global Commodities Market Performance:

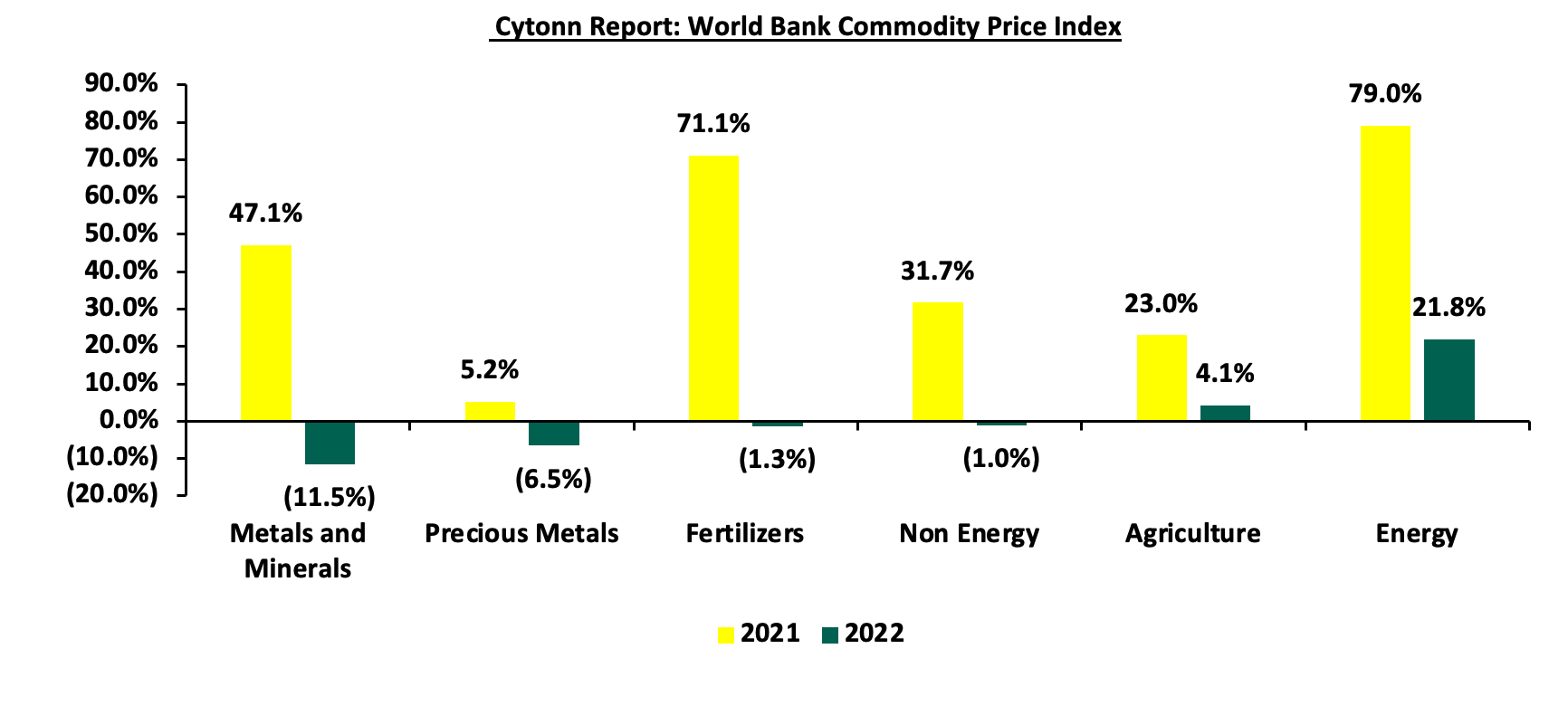

Global commodity prices registered mixed performance in 2022, with prices of metals and minerals declining the most by 11.5% largely driven by slowed global demand. Similarly, the prices of precious metals declined by 6.5% mainly attributable to reduced demand for safe haven assets, which has been accelerated by interest rate hikes in advanced economies that has seen investors opt for higher-yield-bearing assets. On the other hand, the energy prices increased the most by 21.8% year on year, mainly due increasing demand for fuel and gas amid lower supply, a situation that has been worsened by persistent supply chain bottlenecks arising from geopolitical tension between Russia and Ukraine. Below is a summary performance of various commodities;

Source: World Bank

Global Equities market performance:

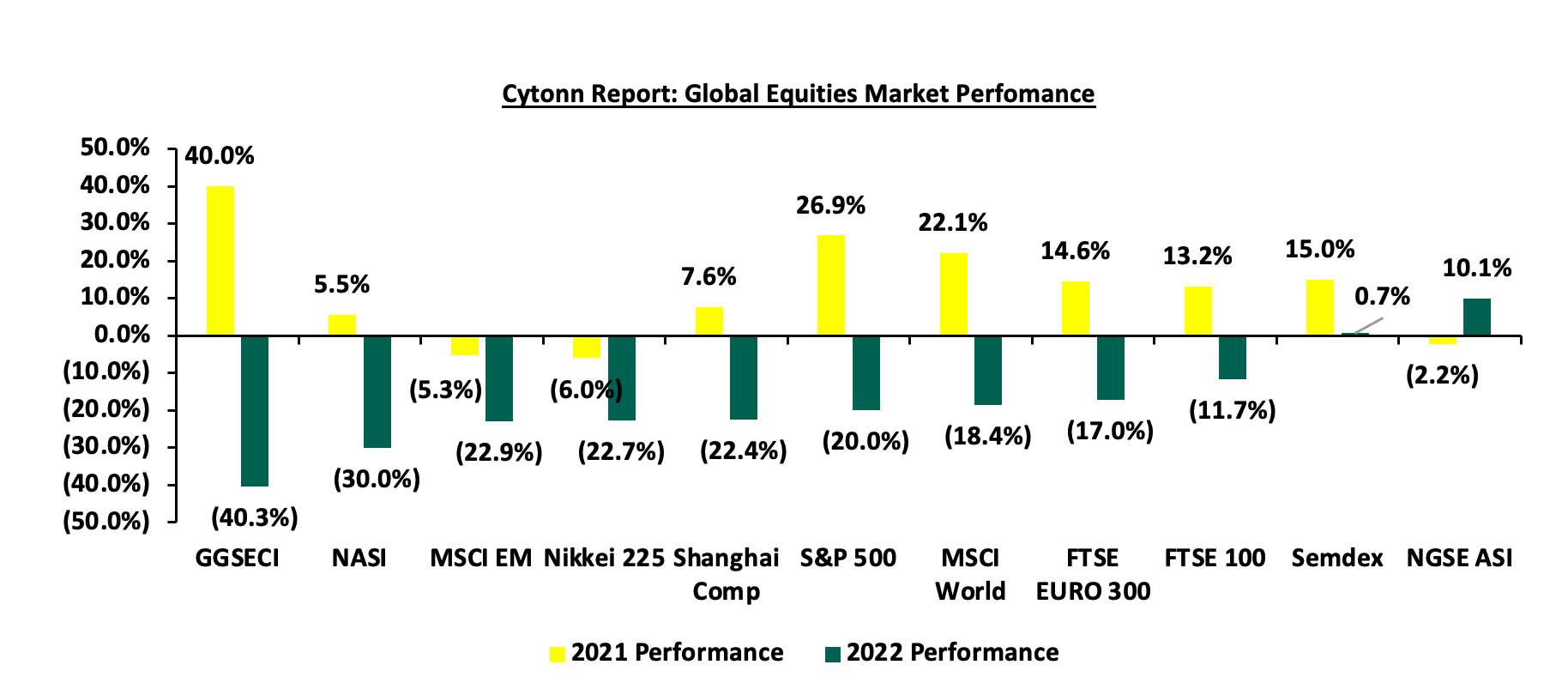

Global stock market recorded mixed performance in 2022, with most indices declining attributable to capital outflows as investors sought less risky markets such as government papers and other investments alternatives. Additionally, stock markets in developing countries witnessed high capital flights and higher declines as a result of increased uncertainties about the economies following interest rate hikes around the world particularly in advanced economies aimed at curbing the inflationary pressures. The Nigeria all share index was the largest gainer, recording a 10.1% gain, largely driven by increased investor sentiments following the rallying of crude oil prices with Nigeria being a net exporter of crude oil. Additionally, the Nigerian banking stocks recorded significant gains mainly attributable to the Central Bank of Nigeria’s decision to gradually hike the Monetary Policy Rate (MPR) to 16.5% in November 2022, from 11.5% in January 2022, which consequently led to 0.5% points increase in maximum lending rate to 28.1% in November 2022, from 27.7% in January 2022. On the other hand, Ghana stock composite index was the largest decliner recording losses of 40.3%, mainly due to continuous deterioration in the country’s business environment arising from high inflation at 50.3% as of November 2022 coupled with continued weakening of the Ghanaian Cedi which depreciated by 42.8% in 2022. Additionally, the re-imposition of capital gains tax on securities listed on the GSE has seen investors prefer fixed income securities. Below is a summary of the performance of key indices:

*Dollarized performance

Economic Growth

The Sub-Saharan Africa economy is projected to grow by 3.3% in 2022 according to the World Bank’s Pulse Issue and 3.6% according to the International Monetary Fund (IMF), down from the 4.1% and 4.7% growth in 2021 according to the World Bank and the IMF respectively. Notably, the projected region’s growth was revised downwards from the initial growth forecast of 3.6% and 3.8% in April 2022 by the World Bank and the IMF, respectively. The decline in the region’s economic growth is attributable to;

- Elevated inflationary pressures, emanating from the spill over effects of the Russian Invasion to Ukraine have led to increased fuel and food prices in the global markets given that majority of the SSA countries are net importers, coupled with adverse weather conditions that have undermined agricultural productivity in the region,

- Rising risk of debt distress in the region is expected to weigh down on the region’s growth, and notably, countries like Ghana and Zambia have initiated forms of public debt restructuring during the year, due to unsustainable debt levels,

- Pre-existing supply chain constraints have been worsened by disruptions arising from increasing lock downs to curb the spread of COVID-19 in China which is the region’s largest trading partner, and,

- Hiked interest rates in advanced economies such as the United States of America (USA) has increased capital outflows in the region further fuelling the economic decline in the SSA.

Currency Performance

In 2022, all select Sub-Saharan African currencies depreciated against the U.S Dollar, mainly on the back of elevated inflationary pressures in the region, high debt servicing costs that continue to dwindle foreign exchange reserves, coupled with monetary policy tightening by United States Federal reserve. The table below shows the performance of select African currencies against the USD;

|

Cytonn Report: Select Sub-Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Dec-20 |

Dec-21 |

Dec 22 |

2021 y/y change(%) |

2022 y/y change (%) |

|

Ghanaian Cedi |

5.8 |

6.0 |

8.6 |

(4.3%) |

(42.8%) |

|

Malawian kwacha |

770.8 |

816.4 |

1,026.4 |

(5.9%) |

(25.7%) |

|

Kenyan Shilling |

109.2 |

113.1 |

123.4 |

(3.6%) |

(9.0%) |

|

Botswana Pula |

10.8 |

11.7 |

12.8 |

(8.8%) |

(8.8%) |

|

Zambian Kwacha |

21.2 |

16.7 |

18.1 |

21.2% |

(8.4%) |

|

Nigerian Naira |

379.5 |

413.0 |

447.1 |

(8.8%) |

(8.3%) |

|

Senegal CFA Franc |

532.0 |

577.0 |

615.0 |

(8.5%) |

(6.6%) |

|

South African Rand |

14.6 |

15.9 |

16.9 |

(8.5%) |

(6.5%) |

|

Ugandan Shilling |

3,650.1 |

3,544.7 |

3,717.5 |

2.9% |

(4.9%) |

|

Mauritius Rupee |

39.4 |

43.5 |

43.9 |

(10.3%) |

(1.1%) |

|

Tanzanian Shilling |

2,298.5 |

2,297.8 |

2,308.9 |

0.0% |

(0.5%) |

Key take outs from the table include;

- The Ghanaian Cedi was the worst performer during the year, depreciating by 42.8% against the dollar, attributable to the deteriorated macroeconomic environment, evidenced by its elevated inflation, with November 2022 inflation rate coming in at a record of 50.3%, tightened monetary policy as Ghana’s interest rates were hiked to 27.0% in November 2022 and a high debt distress with its public debt to GDP coming in at 75.9% in September 2022. As a result, the government announced a cease of debt servicing on foreign bonds, commercial and bilateral loans in December 2022 and also initiated a Domestic Debt Exchange Programme (DDEP) for its domestic bonds coupled with a staff level agreement for a financing assistance package of USD 3.0 bn from the IMF. This partially increased confidence in their economy and consequently the Cedi appreciated by 34.6% to close the year at GHc 8.6 from the adverse exchange rate of GHc 13.1 against the U.S Dollar recorded on 17th November 2022,

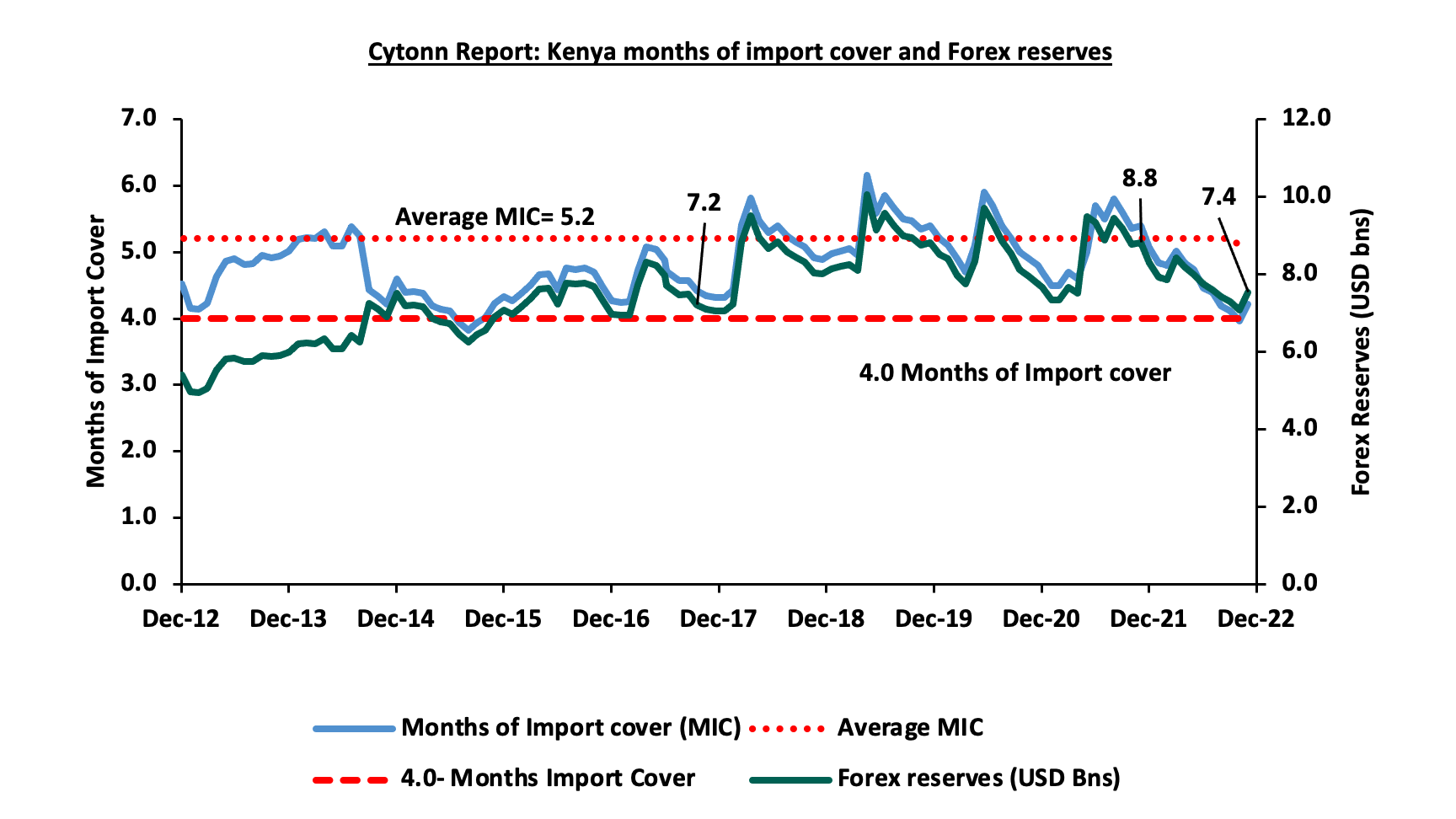

- The Kenyan Shilling depreciated by 9.0% in 2022 to close at Kshs 123.4 against the U.S Dollar, compared to the Kshs 113.1 recorded at the end of 2021, driven by increased dollar demand from importers, especially oil and energy sectors against a slower supply of hard currency. Additionally, the 15.1% YTD decline of its foreign exchange reserves which currently stand at USD 7.4 bn representing 4.2 months of import cover, from USD 8.8 bn recorded at the beginning of the year has continued to put pressure on the Kenyan shilling, and,

- The Zambian Kwacha depreciated by 8.4% during the year from an appreciation of 21.2% in 2021, attributable to public debt sustainability concerns that have continued to weigh down investor confidence, especially the external debt, which resulted to a 62.1% external debt to GDP ratio at the end of 2021, leading to the country initiating an external debt restructuring. Additionally, with copper being its main export commodity, the 17.3% decline in the global copper prices in 2022 compared with the 37.6% price increase in 2021 has continued to weigh down on the country’s current account.

African Eurobonds

The region’s appetite for foreign-denominated debt declined during the year, due to its high yields that translates to high borrowing costs, attributable to elevated inflationary pressures and tough macroeconomic conditions that have worsened pre-pandemic debt sustainability concerns. As such, Nigeria and Angola were the only Eurobonds issuers during the year, with the countries raising USD 1.3 bn and USD 1.8 bn in March and April 2022, for Nigeria and Angola, respectively, translating to a total of USD 3.1 bn raised, down from USD 11.8 bn raised in 2021 representing a 73.7% decline. Yields for the African Eurobonds significantly increased during the year, attributable to investors attaching a higher risk premium to the region, driven by the region’s elevated inflationary pressures, public debt distress and currency depreciation that have deteriorated the region’s macroeconomic environment.

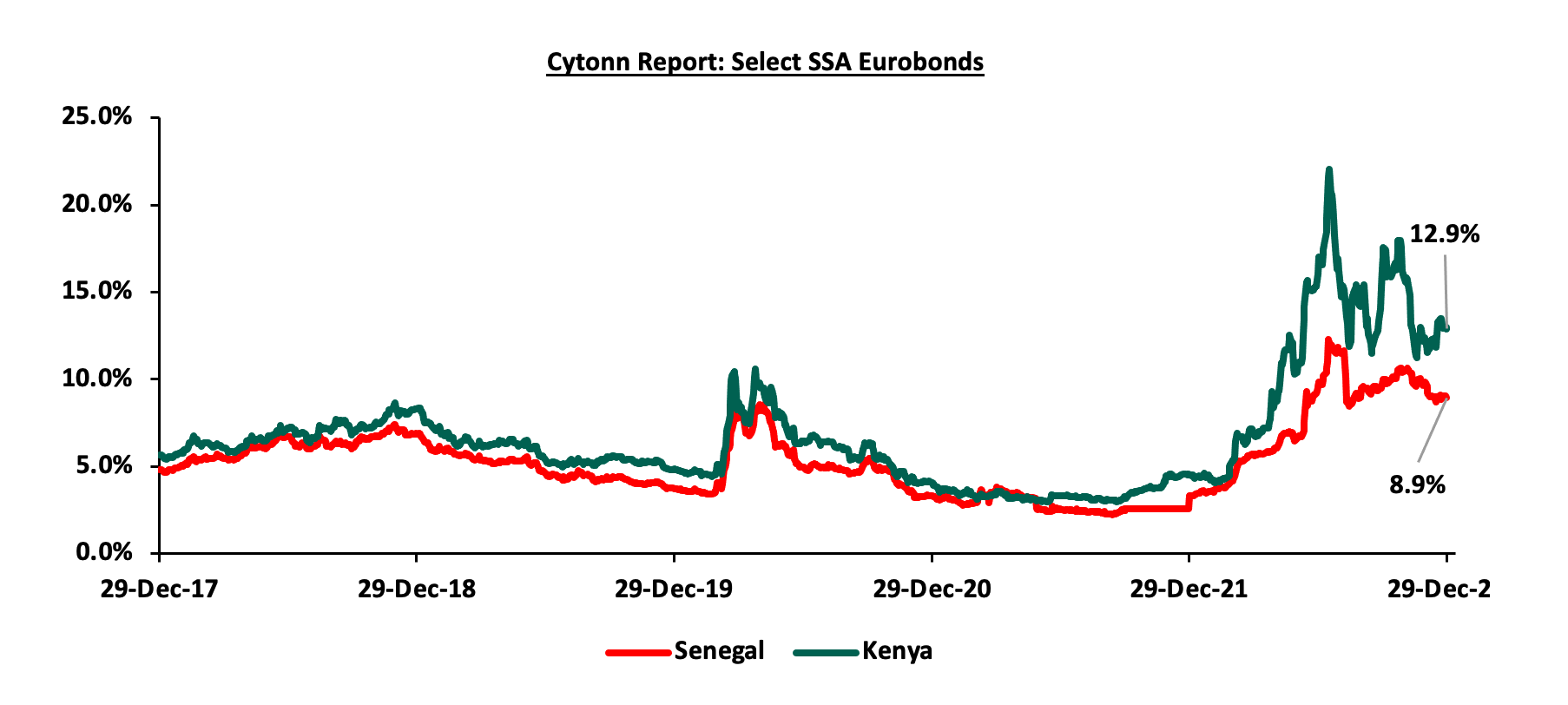

Yields for the Kenyan and Senegal Eurobonds increased by 8.4% and 5.6% during the year, to close the year at 12.9% and 8.9%, from 4.5% and 3.3% recorded at the end of December 2021. The graph below shows the 5-year Eurobond secondary market performance of select 10-year Eurobonds issued by Kenya and Senegal;

Equities Market Performance

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in 2022, with Zambia Stock Exchange (LASILZ) being the largest gainer with an 11.6% gain in 2022 due to improved macroeconomic environment supported by the IMF financial assistance maintaining investor confidence in the country. This has however declined from the 96.9% gain in 2021 partly due to the 17.3% drop in global copper prices in 2022 compared to a 37.6% increase in copper prices in 2021. On the other hand, Ghana’s GSCECI was the worst performing index in 2022, recording a loss of 41.7% due to a deteriorated macroeconomic environment and regulatory policies such the re-imposition of capital gains tax on listed equities securities, and this has adversely impacted the stock exchange by dampening investor sentiments. Below is a summary of the performance of the key SSA indices;

|

Cytonn Report: Equities Market Performance |

||||||

|

Country |

Index |

Dec-20 |

Dec-21 |

Dec-22 |

2021 y/y change (%) |

2022 y/y change (%) |

|

Zambia |

LASILZ |

185.2 |

364.7 |

406.9 |

96.9% |

11.6% |

|

Nigeria |

NGEASI |

105.8 |

103.5 |

111.4 |

(2.2%) |

10.8% |

|

Rwanda |

RSEASI |

0.2 |

0.1 |

0.1 |

(4.0%) |

(4.6%) |

|

South Africa |

JALSH |

4,044.8 |

4,618.3 |

4,292.8 |

14.2% |

(7.0%) |

|

Tanzania |

DARSDEI |

0.7 |

0.6 |

0.6 |

(2.7%) |

(8.1%) |

|

Uganda |

USEASI |

0.4 |

0.4 |

0.3 |

11.6% |

(18.6%) |

|

Kenya |

NASI |

1.4 |

1.5 |

1.0 |

5.5% |

(29.8%) |

|

Ghana |

GSECI |

332.5 |

465.6 |

271.5 |

40.0% |

(41.7%) |

|

*The index values are dollarized for ease of comparison |

||||||

The tough macroeconomic environment experienced in the region in 2022 coupled with socio-political turmoil in West and Central Africa have continued to adversely impact its economic growth. As such, subdued GDP growth rate in Sub-Saharan Africa is expected to continue in 2023, in line with the rest of the global economy, amid fears of a global recession in 2023. Elevated inflation rates, debt sustainability concerns and supply chain constraints in the region are expected to persist in 2023, and this will continue to weigh down its economic growth. Additionally, the continued weakening of local currencies will even make debt servicing costlier, and this lead to increased perceived risks in the region, resulting to reduced investor confidence in the region.

Economic Growth

The Kenyan economy recorded an average growth of 5.6% in the period between January to September 2022, with Q3’2022 GDP coming in at 4.7%, adding to the 5.2% and 6.8% growth recorded in Q2’2022 and Q1’2022, respectively. The average GDP growth of 5.6% marked a decline from the 7.7% average growth recorded in a similar period in 2021. The growth in Q3’2022 was largely driven by the non-agricultural sectors, with accommodation and food, wholesale and retail trade, professional administrative and support, and finance and insurance sectors recording growths of 22.9%, 9.1%, 8.7%, and 5.3%, respectively, in Q3’2022, albeit slower than growth of 127.5%, 6.4%, 13.4%, and 11.8%, respectively recorded in Q3’2021. The growths in these sectors were supported by continued post COVID-19 economy recovery due to lifting of travel restrictions and ease in cross border transactions. However, the sectoral growths remained subdued due to uncertainties of the electioneering period and the adverse macroeconomic conditions in the country. Notably, the agricultural sector recorded a 0.6% contraction in Q3’2022, compared to a corresponding expansion of 0.6% growth in Q3’2021 but an improvement from preceding contractions of 2.1% and 0.7% recorded in Q2’2022 and Q1’2022, respectively. The contraction during the quarters is mainly attributable to unfavorable weather conditions witnessed during the period, as well as increased costs of agricultural inputs such as fertilizer;

In 2022, the Kenyan economy is projected to grow at an average of 5.1%, lower than the 7.5% growth recorded in 2021. The slower growth is mainly attributable to a deteriorated business environment for majority of the year brought about by the uncertainties preceding the August 2022 general elections and elevated inflationary pressures driven by the high global fuel prices and the pre-existing supply chain constraints worsened by the Russia-Ukraine conflict. Notably, the unfavorable weather conditions experienced during the period under review has subdued agricultural production, with the sector being the largest contributor to Kenya’s GDP. The table below shows the projections of Kenya’s 2022 GDP by various organizations:

|

Cytonn Report: 2022 GDP Projections |

||

|

No. |

Organization |

2022 Projections |

|

1 |

International Monetary Fund |

5.3% |

|

2 |

National Treasury |

6.0% |

|

3 |

Cytonn Investments Management PLC |

4.5% |

|

4 |

World Bank |

5.5% |

|

5 |

S&P Global |

4.4% |

|

Average |

5.1% |

|

|

Median of Growth Estimates |

5.3% |

|

Source: Cytonn Research, 2022

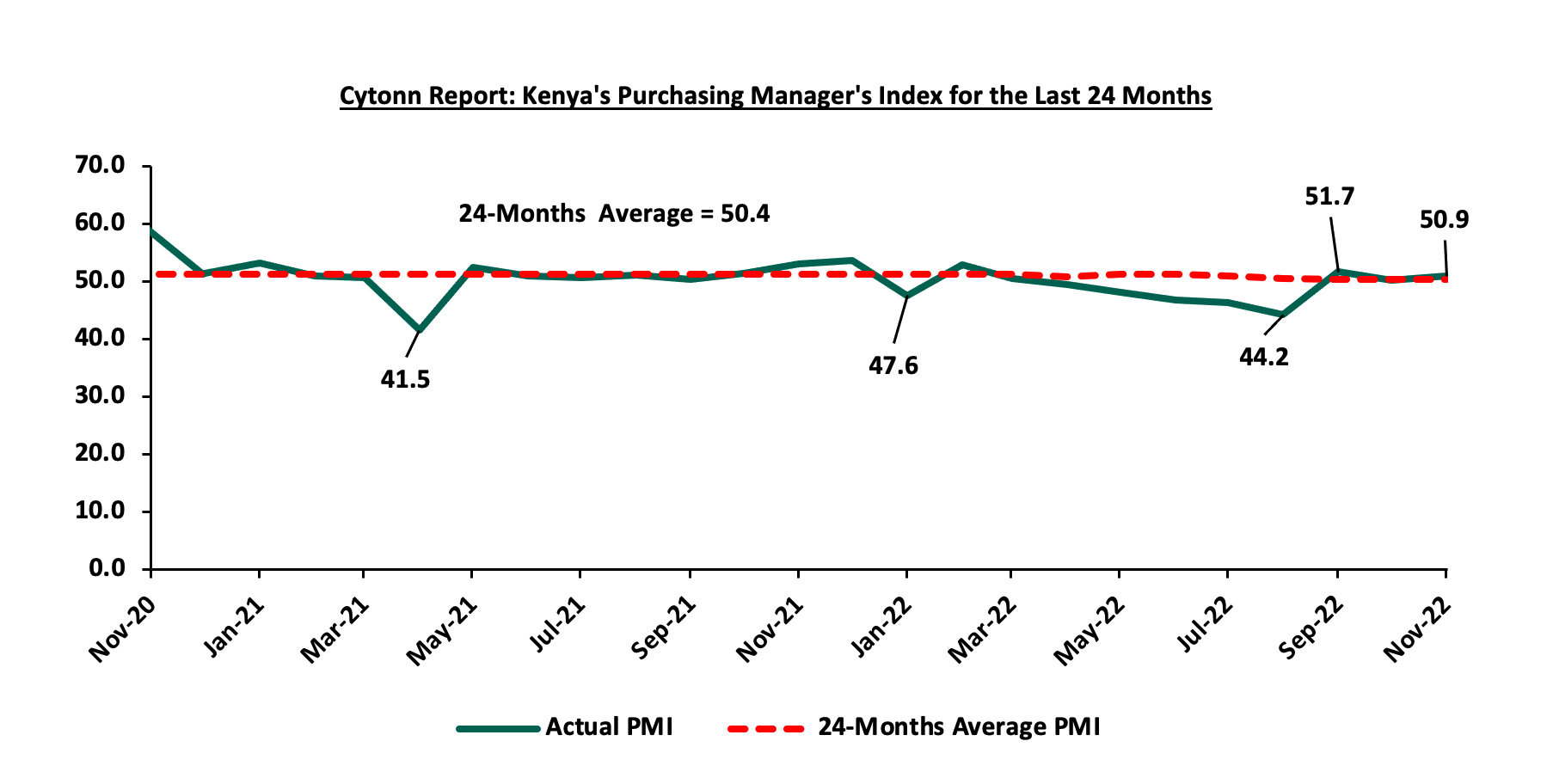

Business conditions in the Kenyan private sector remained subdued during the year, with the average Stanbic Bank Monthly Purchasing Managers’ Index (PMI) for the first eleven months averaging at 49.0, 1.6 points lower than the average of 50.6 recorded during a similar period in 2021 indicating a deterioration of the country’s business environment in 2022 compared to 2021. However, for the month of November 2022, the index improved to 50.9 from 50.2 recorded in October 2022. The chart below shows the trend of Kenya’s Purchasing Managers index for the last 24 months;

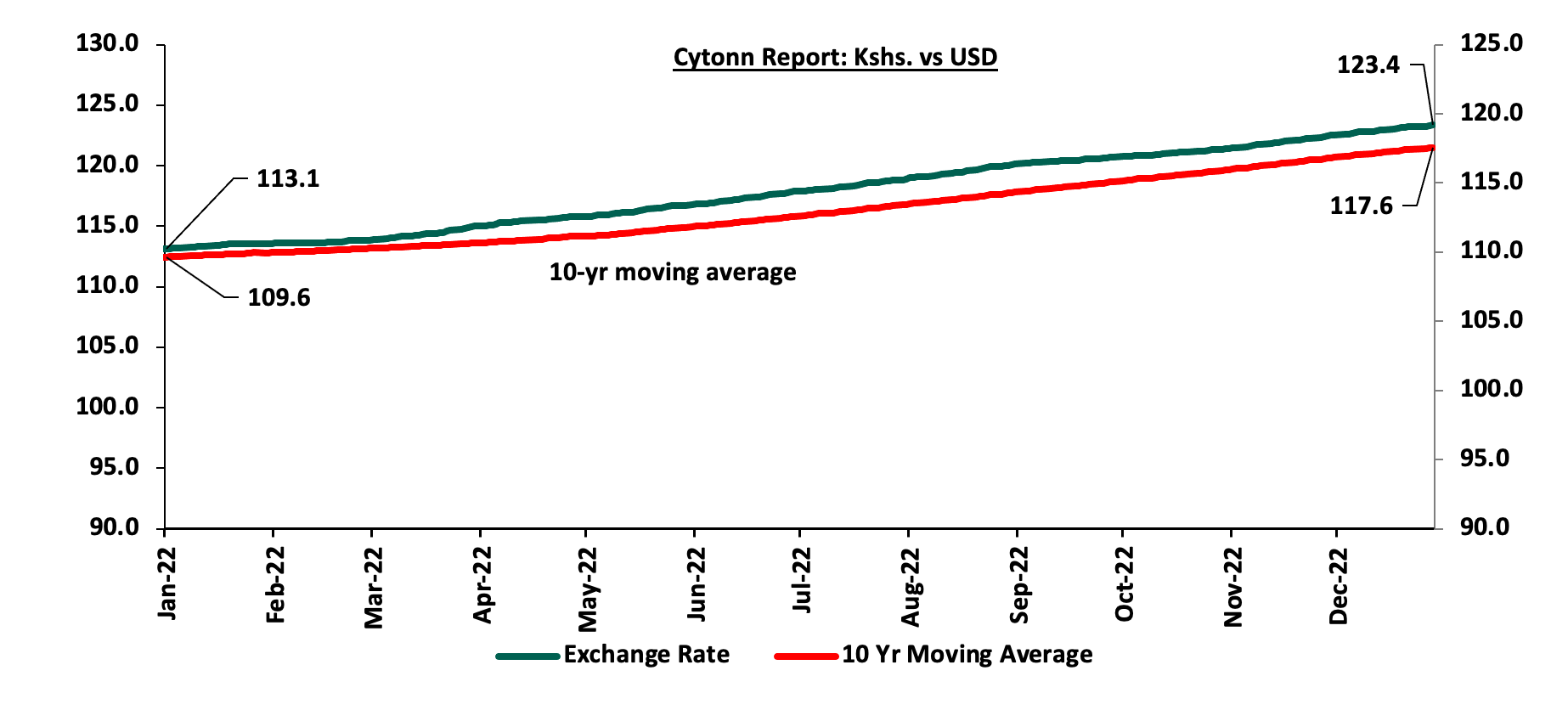

Kenyan Shilling

The Kenya Shilling depreciated by 9.0% against the US Dollar to close at Kshs 123.4 in 2022, compared to Kshs 113.1 at the end of 2021, equivalent to a 3.6% depreciation. The chart below highlights the performance of the Kenyan Shilling against the US Dollar in 2022;

The depreciation of the Kenyan shilling in 2022 was driven by;

- High global crude oil prices attributable to the persistent supply chain constraints and high demand with fuel being an integral input in most sectors,

- Increased dollar demand by importers especially in the oil and energy sector, as well as, manufacturers against a low supply of dollar currency leading to shortage of USD in the Kenyan market,

- Existence of an ever-present current account deficit estimated at 5.5% of GDP in the 12 months to October 2022, same to what was recorded in a similar period in 2021. Key to note, the current account deficit was driven by a 15.8% deterioration in trade imbalance to Kshs 373.1 bn, from Kshs 322.0 bn in Q3’2021. This is despite merchandise exports increasing by a faster 29.7% to Kshs 228.2 bn in Q3’2022 from 175.9 bn recorded in Q3’2021 relative to a 20.8% increase in merchandise imports to Kshs 601.2 bn in Q3’2022 from Kshs 498.0 bn recorded in a similar period in 2021,

- The need for Government debt servicing which continues to put pressure on forex reserves given that 69.3% of Kenya’s External debt was US Dollar denominated as of October 2022, and,

- A continued hike in the USA Fed interest rates in 2022 to a range of 4.25%-4.50% in December 2022 to curb inflation has strengthened the dollar against other currencies resulting in capital outflows from emerging and developing markets such as Kenya.

The shilling received some support driven by:

- Sufficient Forex reserves closing the year at USD 7.4 bn (equivalent to 4.2 months of import cover), which is slightly above the statutory requirement of maintaining at least 4.0-months of import cover. However, despite the Forex reserves being adequate, they have dropped by 15.1% YTD from USD 8.8 bn recorded in January 2022. The following is a graph showing Kenya months of import cover and forex reserves for the last 10 years;

- Improved diaspora remittances standing at a cumulative USD 4.0 bn as at November 2022, representing a 9.7% y/y increase from USD 3.7 bn recorded over the same period in 2021,

- The government received USD 750.0 mn World Bank loan facility in March 2022, as well, USD 235.6 mn and USD 447.4 mn funding from the International Monetary Fund (IMF) disbursed under the fourth and fifth tranches of the 38-month Extended Fund Facility (EFF) and Extended Credit Facility (ECF) in July and December 2022. Additionally, through the Special Drawing Rights, IMF disbursed an additional USD 14.6 mn (Kshs 26.6 bn) as buffer from the drought effects, which supported the reserves despite the continued depreciation of the Kenyan currency. The latter loan disbursement is expected to further support the Kenyan Shilling in 2023 evidenced by forex reserves increasing to USD 7.5 bn in December 2022, from USD 7.0 bn recorded in November 2022, and,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars.

Against our expectations, the Kenyan shilling closed the year at Kshs 123.4. We expected the Kenyan shilling to remain within a range of Kshs 115.1 and Kshs 119.1 against the USD in the medium term based on the Purchasing Power Parity (PPP) and Interest Rate Parity (IRP) approach respectively, with a bias of a 4.7% depreciation. Read on our outlook on Performance of Kenya Currency.

Inflation

The inflation rate for the year 2022 averaged at 7.6%, 1.5% points higher than average inflation rate of 6.1% recorded in 2021. Notably on a m/m basis, Kenya’s inflation rate declined by 0.4% points to 9.1% in December 2022, from 9.5% recorded in November 2022, but remained above the government’s target range of 2.5% - 7.5%. The relatively high inflation can be attributed to increase in prices of major commodity indices with food and non-alcoholic index and transport index, registering the highest year-on-year (y/y) increases of 13.8% and 13.0%, respectively. This is mainly attributable to the high fuel prices experienced in 2022 as a result of persistent supply chain constraints, as well as, the erratic weather conditions experienced in the first half of the year and increased costs of agricultural inputs which affected agricultural production.

Going forward, we expect the inflation rate to remain elevated in the short-term and above the government’s set range of 2.5% - 7.5% driven by the high global fuel prices coupled with the expected complete removal of the fuel subsidy program at the end of the year which could have spillover effects on production given that fuel is an integral input in production of core commodities. Food prices will also remain elevated in the short run due to erratic weather patterns experienced during the year that adversely affected agricultural production. However, with the several parts of the country have experienced rains in December, coupled with the fertilizer subsidy program introduced by the current administration to reduce agricultural input costs, we expect that food inflation will ease in the medium term on the back of improved productivity.

Monetary Policy:

During the year the Monetary Policy Committee (MPC) met 6 times where they maintained the Central Bank Rate (CBR) at 7.00% and the Cash Reserve Ratio of 4.25% in the first two of the meetings of January and March 2022. However, the MPC raised the CBR rate by 50.0 and 75.0 basis points (bps) to 7.50% and 8.25% in May 2022 and September 2022, respectively. Further, the MPC hiked the CBR by an additional 50.0 bps to 8.75% in latest meeting in November 2022 in a bid to anchor inflation which is currently above the government’s target range of 2.5% - 7.5%. We expect the MPC to continue raising the CBR rates in a bid to stabilize inflation within the government’s target range and also anchor the Kenyan shilling that has suffered a 9.0% YTD depreciation against the US Dollar.

2022 Key Highlights:

- FY’2022/2023 Budget Policy Statement;

On 7thApril 2022, the National Treasury presented Kenya’s FY’2022/2023 National Budget to the National Assembly highlighting that the total budget estimate for the 2022/2023 fiscal year was Kshs 3.3 tn, a 10.3% increase from the Kshs 3.0 tn final FY’2020/21 budget. The government projects that total revenue will increase by 20.3% to Kshs 2.4 tn, from the Kshs 2.0 tn in FY’2022/2023, the increase largely being projected to come from ordinary revenue, which is to grow by 25.4% to Kshs 2.1 tn in FY’2022/23 from Kshs 1.8 tn in the FY’2021/22 budget. The projected revenues are mainly pegged on Kenya’s economic recovery from COVID-19 effects, broadening the tax base and tax reforms, as well as reduction of the fiscal deficit to 6.2% of the GDP. The expenditure is expected to increase by 10.3% to Kshs 3.3 tn in FY’2022/23, from Kshs 3.0 tn in the FY’2021/22 budget. For more information, see our Kenya’s FY’2022/2023 Budget Review.

- Credit Facilities extended to Kenya;

- In 2022, Kenya received a total of USD 750 mn (Kshs 80.9 bn) under the Development Policy Operation (DPO) from the World Bank and a total of USD 683.0 (Kshs 83.8 bn) from the IMF under the Extended Credit Facility arrangement (EFF/ECF) for budgetary support by providing low-cost budget financing to support key policies and institutional reforms. Additionally, the funding from the World Bank would also boost Kenya’s post-COVID-19 recovery. For more information, see our Cytonn Weekly #11/2022, and,

- On 18th July and 20th December 2022, the Kenyan authorities and the IMF reached a staff level agreement on the fourth and fifth tranches of the 38-month Extended Fund Facility (EFF) and Extended Credit Facility (ECF) - funded program. Per the agreements, Kenya would access USD 236.5 (Kshs 28.7 bn) and USD 447.4 mn (Kshs 55.1 bn) as the fourth and fifth tranches respectively to support the country’s economic growth and achieve the medium term debt strategy objectives. For more information, see our Cytonn Monthly April 2022, Cytonn Weekly #29/2022, Cytonn Weekly #45/2022 and Cytonn Weekly #51/2022.

- FY’2021/2022 KRA Revenue Performance;

On 7th July 2022, The Kenya Revenue Authority (KRA) released the annual revenue performance for the FY’2021/2022, highlighting that the total revenue collected amounted to Kshs 2.03 tn against the revised target of Kshs 1.98 tn, translating to a 2.8% over performance. Notably revenue collection grew by 21.7% to Kshs 2.0 tn in FY’2021/22, from Kshs 1.7 tn in FY’2020/21 due to the enhanced tax compliance efforts and the implementation of new tax measures. For more information, see our Cytonn Weekly #27/2022.

- Balance of Payments

The Kenya National Bureau of Statistics released the Q3’2022 Balance of Payments Report highlighting that Kenya’s balance of payments deteriorated by 283.9% in Q3’2022, coming in at a deficit of Kshs 112.7 bn, from a deficit of Kshs 29.3 bn in Q3’2021. The deterioration was brought by a 5.5% widening of the Current Account deficit to Kshs 193.4 bn, from Kshs 183.4 bn in Q3’2021, driven by a 15.8% deterioration in trade imbalance to Kshs 373.1 bn, from Kshs 322.0 bn in Q3’2021. This is despite merchandise exports increasing by a faster 29.7% to Kshs 228.2 bn in Q3’2022 from 175.9 bn recorded in Q3’2021 relative to a 20.8% increase in merchandise imports to Kshs 601.2 bn in Q3’2022 from Kshs 498.0 bn recorded in a similar period in 2021,

- Credit Ratings;

In 2022, Fitch Ratings, a global rating agency, revised Kenya's Long-Term Foreign-Currency Issuer Default Rating (IDR) downwards to ‘B’ from ‘B+’, but with a stable outlook. The rating is similar to Standard & Poor’s affirmation of the country’s long and short-term foreign and local currency sovereign credit ratings at 'B' with a Stable Outlook in August 2022. Fitch Rating pointed out that the downgrade was attributable to the widened current account deficit coming in at 5.5% of the GDP in October 2022 against low currency reserves at USD 7.4 bn having registered a 19.3% YTD decline from the USD 8.8 bn recorded in January 2022, coupled with a high debt to GDP ratio at 385.0% of the GDP surpassing the recommended 282.0% ratio mark. On the other hand, the Stable Outlook on the ratings reflected the gradual fiscal consolidation and the steady economic growth. For more information, see our Cytonn Weekly #50/2022. Below is a summary of the credit rating on Kenya by various rating agencies;

|

Cytonn Report: Kenya Credit Rating Agencies Ratings |

||||

|

Rating Agency |

Previous Rating |

Current Rating |

Current Outlook |

Date Released |

|

Fitch Ratings |

B+ |

B |

Stable |

14th December 2022 |

|

S&P Global |

B |

B |

Stable |

30th August 2022 |

Source: Fitch Ratings, S&P Global

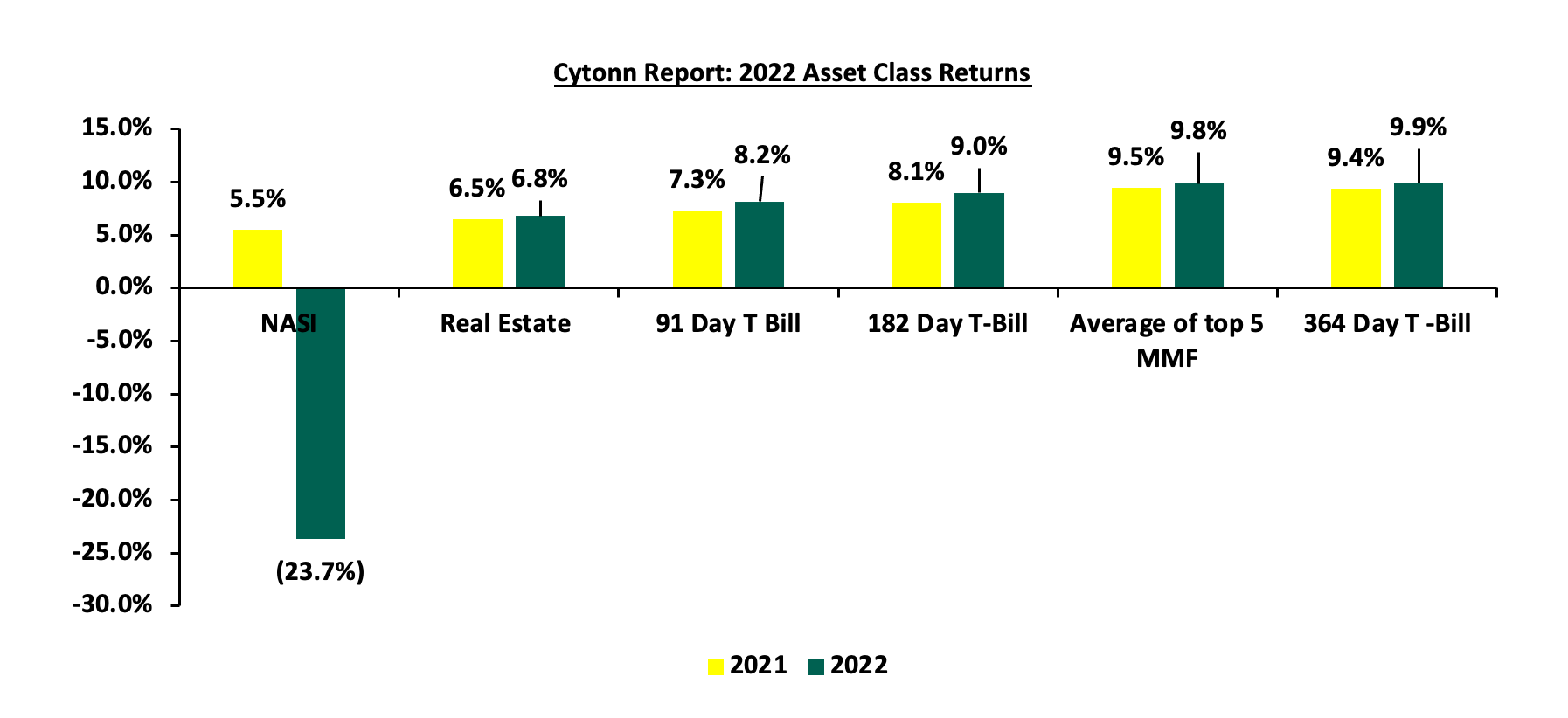

2022 returns by various Asset Classes

The returns by the various asset classes improved in 2022, with the average of the top five money market funds (MMFs), Real Estate yield and government papers being on upward trajectories. The average of top 5 MMF recorded a yield of 9.8%, 0.3% points increase from 9.5% recorded in 2021 as the average Real Estate yield also increased by 0.3% points to 6.8% in 2022, from 6.5% recorded in 2021. Similarly, the 364-day, 182-day and 91-day Government papers recorded average yields of 9.9%, 9.0% and 8.2%, respectively. However, for the equities class, NASI registered a 23.7% loss in 2022 from a 5.5% gain recorded in 2021. The graph below shows the summary of returns by various asset classes (Average top 5 MMF, Fixed Income, Real Estate and Equities).

The table below shows the macro-economic indicators that we track, indicating our expectations for each variable at the beginning of 2022 versus the experience;

|

Cytonn Report: Macro-Economic & Business Environment Outlook |

||||

|

Macro-Economic Indicators |

2022 Outlook |

Effect |

2022 Experience |

Effect |

|

Government Borrowing |

|

Negative |

|

Negative |

|

Exchange Rate |

|

Neutral |

|

Negative |

|

Interest Rates |

|

Neutral |

|

Negative |

|

Inflation |

|

Neutral |

|

Negative |

|

GDP |

|

Neutral |

|

Neutral |

|

Investor Sentiment |

|

Negative |

|

Negative |

|

Security |

|

Neutral |

|

Positive |

Since the beginning of the year, the notable changes we have seen out of the seven metrics that we track, fall under four metrics, namely; Interest rates, Inflation, Exchange rates, and Security. Key to note, Security changed from neutral to positive while Interest rates, Inflation, and Exchange rate changed from neutral to negative. In conclusion, macroeconomic fundamentals showed mixed performance during the year with most metrics on downward trajectories. We expect a slight recovery in 2023 supported by the improving business conditions in the country evidenced by the November PMI coming in at 50.9, an improvement from 50.2 in October. However, improvement of the business conditions in the country, are largely pegged on how fast global fuel prices stabilize, decline in inflation rates and stabilization of the Kenyan currency. This is because, Kenya, as a net fuel importer suffers from imported inflation levels.

T-Bills & T-Bonds Primary Auction:

During the year, T-bills auction recorded an undersubscription, with the average subscription rate coming in at 94.9% compared to an average of 91.9% in 2021, partially attributable to tightened liquidity in the market with the average interbank rate increasing to 4.9% in 2022 from 4.7% in 2021 and perceived risks arising from the August 2022 General Elections. Notably, the pre-election subscription rates weighed down on the overall subscriptions with the pre-election T-bills average subscription coming in at 88.8%, lower than the Post-election average of 103.8%. The yields on the 91-day, 182-day and 364-day T-bills increased by 124.3 bps, 142.2 bps and 133.1 bps to 8.2%, 9.0% and 9.9% in 2021, from 7.0%, 7.6% and 8.6% at the end of 2021, respectively. Yields on government securities were on an upward trajectory, mainly attributable to investors attaching higher premiums to compensate for perceived risks arising from inflationary pressures and local currency depreciation.

During the week, T-bills were undersubscribed, for the second consecutive week, with the overall subscription rate dropping significantly to 17.9%, down from the 69.9% recorded the previous week, partly attributable to the tightened liquidity in the money market with the average interbank rate increasing to 6.4% from 6.2% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 2.2 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 54.5%, down from 347.9% recorded the previous week. The subscription rates for the 364-day and the 182-day papers also declined to 4.3% and 16.9% from 9.3% and 19.3% recorded the previous week, respectively. The yields on the government papers recorded mixed performance, with the yields on the 364-day and 91-day papers declining slightly by 0.2 bps and 0.1 bps to 10.3% and 9.4%, respectively, while the yield on 182-day paper increased marginally by 0.9 bps to 9.8%. The Government continued to reject expensive bids, accepting a total of Kshs 4.2 bn worth of bids out of the Kshs 4.3 bn worth of bids received, translating to an acceptance rate of 98.6%.

Primary T-bond auctions in 2022 were undersubscribed, with the subscription rate averaging 98.8%, which was lower than the 147.6% average subscription rate recorded in 2021, partly attributable to the tightened liquidity in the money market with the average interbank rate increasing to 4.9% in 2022, from 4.7% in 2021 and perceived risks arising from the August 2022 General Elections Notably, the pre-election subscription rates weighed down on the overall subscriptions with the pre-election average T-bills subscriptions coming in at 88.8% lower than 103.8% for post-elections. The average acceptance rate came in at 87.2% in 2022, a 7.3% points increase from the 79.9% recorded in 2021 as the market adjusted to the increasing interest rate in the country.

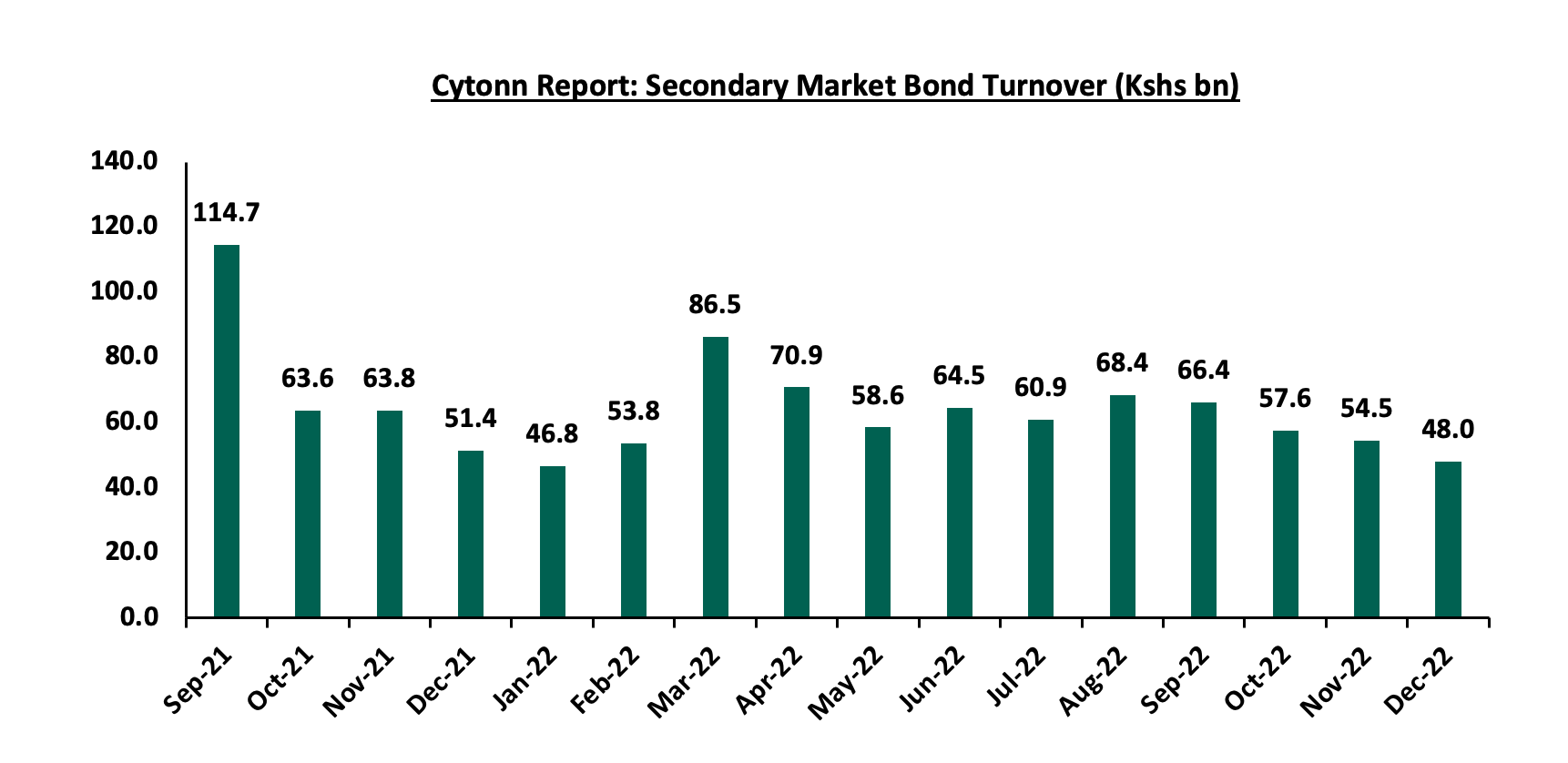

Secondary Bond Market Activity:

The secondary bond market recorded reduced activity with the turnover having declined by 19.8% to Kshs 736.9 bn, from Kshs 919.1 bn in 2021. This is attributable to local institutional investors decreasing their allocation to treasury bonds as most of them increased lending to the private sector, higher interest rates in developed countries leading to capital flight by foreign investors and tightened liquidity in the market.

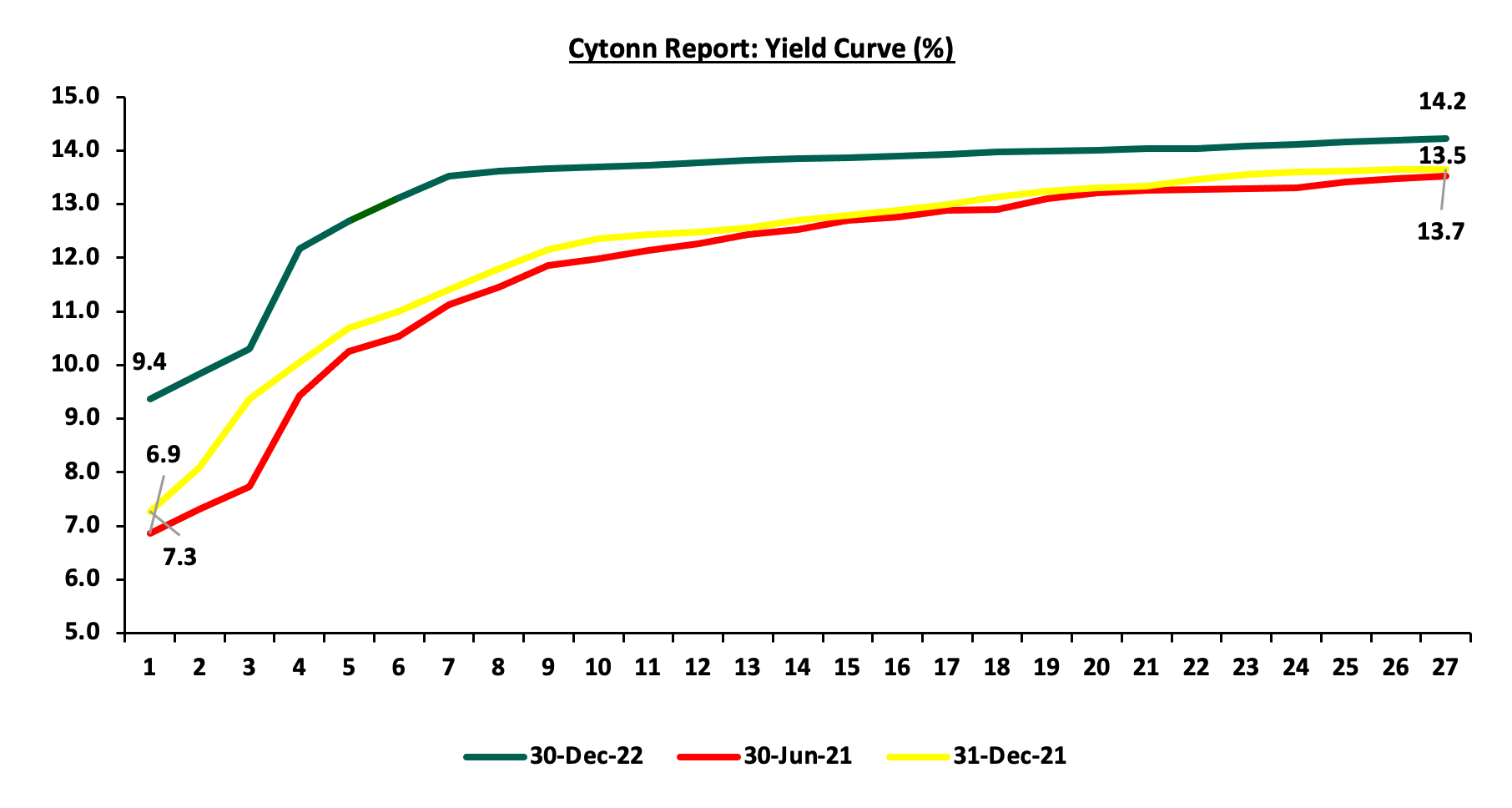

In 2022, the yield curve experienced an upward adjustment, partly attributable to the increased government borrowing, currency depreciation and the increasing inflation seen in 2022 which is expected to persist in the short-term. As such, investors will continue to demand higher yields to compensate for inflation and currency depreciation risk leading to rise across the yield curve. The chart below is the yield curve movement during the period;

Money Market Performance:

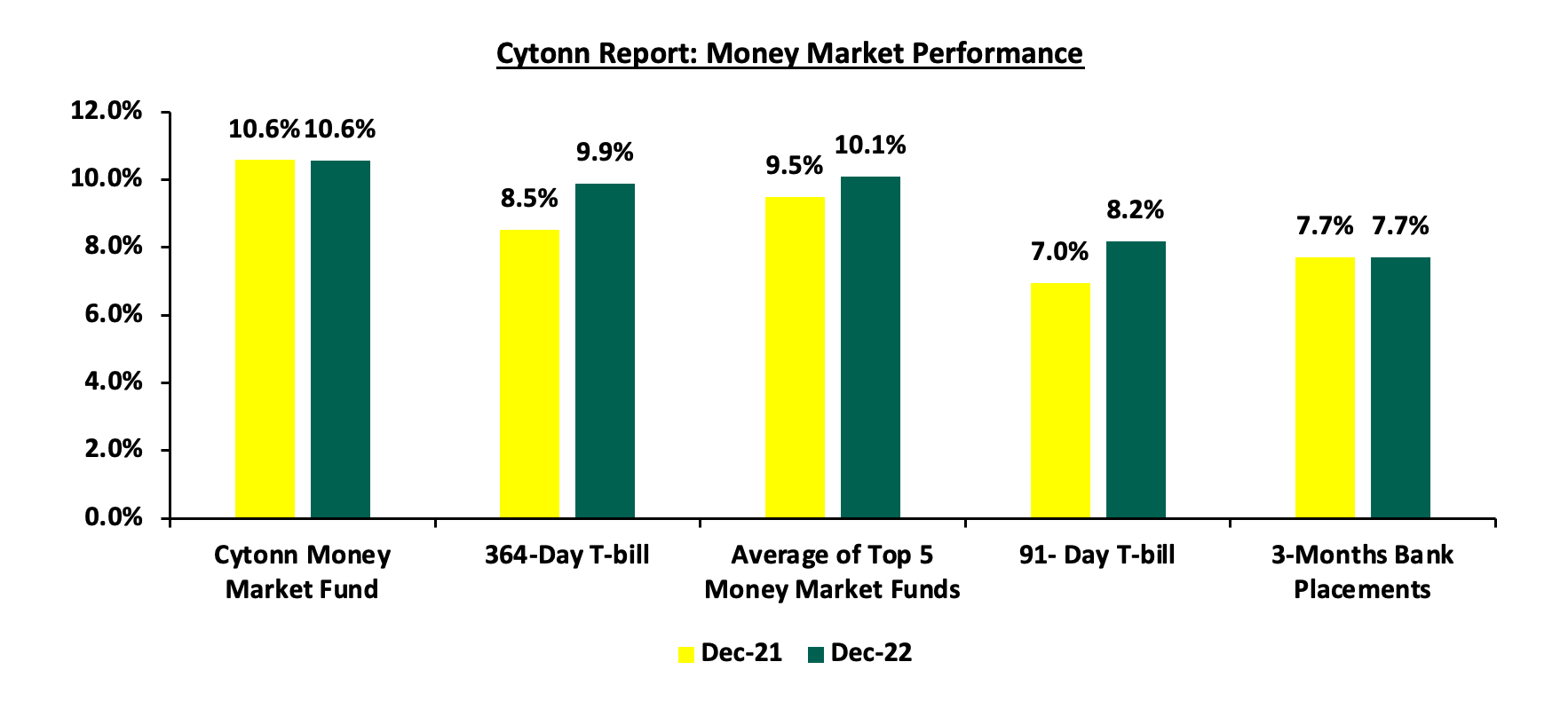

The 3-month bank placements recorded 7.7% as at the end of FY’2022, similar to what was recorded at the end of FY’2021 (based on what we have been offered by various banks). The average yield on the 91-day T-bill and the average Top 5 Money Market Funds increased by 1.2% points and 0.6% points to 8.2% and 10.1% in FY’2022 from 7.0% and 9.5% in FY’2021, respectively. The average yield on the Cytonn Money Market (CMMF) remained relatively unchanged at 10.6% in FY’2022 same as to what was recorded in FY’2021.

During the week, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 364-day T-bill and 91-day T-bill declined slightly by 0.2 bps and 0.1 bps to 10.3% and 9.4%, respectively. The average yield of the Top 5 Money Market Funds and Cytonn Money Market Fund remained relatively unchanged at 10.1% and 10.9%, respectively, as recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 30th December 2022:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 30th December 2022 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund(dial *809# or download Cytonn App) |

10.9% |

|

2 |

Zimele Money Market Fund |

9.9% |

|

3 |

NCBA Money Market Fund |

9.9% |

|

4 |

Kuza Money Market fund |

9.9% |

|

5 |

GenCap Hela Imara Money Market Fund |

9.9% |

|

6 |

Apollo Money Market Fund |

9.8% |

|

7 |

Sanlam Money Market Fund |

9.6% |

|

8 |

Nabo Africa Money Market Fund |

9.5% |

|

9 |

Madison Money Market Fund |

9.5% |

|

10 |

Old Mutual Money Market Fund |

9.5% |

|

11 |

Co-op Money Market Fund |

9.2% |

|

12 |

Dry Associates Money Market Fund |

9.2% |

|

13 |

CIC Money Market Fund |

9.1% |

|

14 |

British-American Money Market Fund |

9.0% |

|

15 |

AA Kenya Shillings Fund |

8.7% |

|

16 |

ICEA Lion Money Market Fund |

8.7% |

|

17 |

Orient Kasha Money Market Fund |

8.6% |

|

18 |

Absa Shilling Money Market Fund |

7.9% |

Source: Business Daily

Liquidity:

During the year, liquidity levels tightened as evidenced by the increase in the average interbank rate to 4.9%, from 4.7% in 2021. The tightened liquidity is partly due to tax remittances which offset government payments. The average volumes traded in the interbank market increased significantly by 74.7% to Kshs 18.6 bn in 2022 from Kshs 10.7 bn recorded in 2021.

During the week, liquidity in the money markets slightly tightened, with the average interbank rate rising to 6.4% from 6.2% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded declined by 0.6% to Kshs 21.3 bn from Kshs 21.2 bn recorded the previous week.

Kenya Eurobonds:

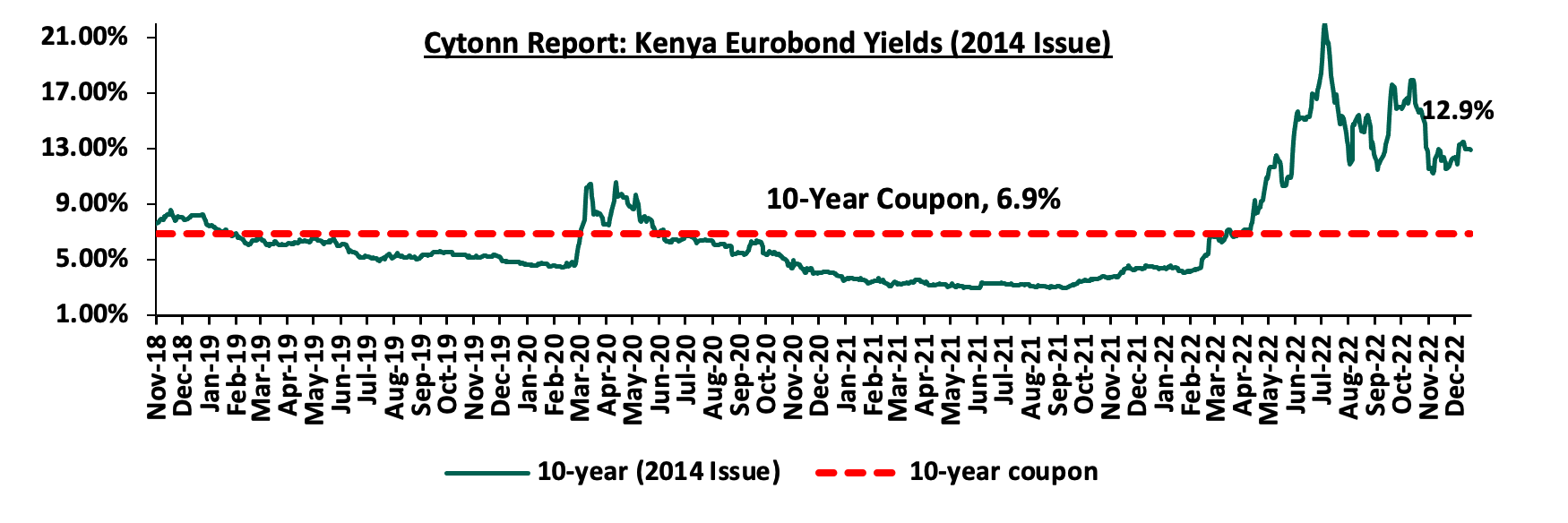

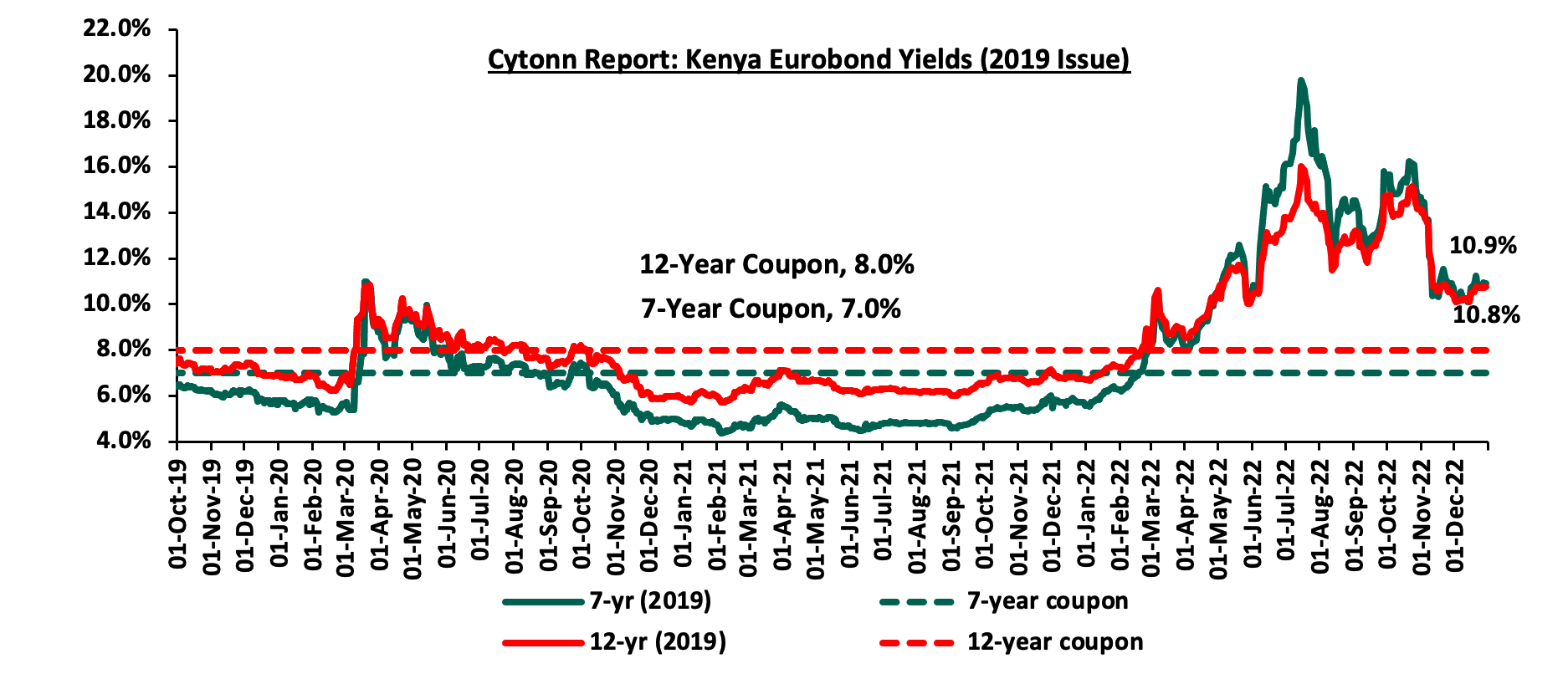

Yields on all Kenyan Eurobonds generally increased in 2022, pointing towards increased concerns on the elevated inflationary pressures and currency depreciation. As a result, investors attached higher premiums to the country’s Eurobonds. According to the CBK, the yields on the 10-Year Eurobond issued in 2014, set to mature in 2024, increased the most by 8.5% points to 12.9%, from 4.4% recorded at the end of 2021.

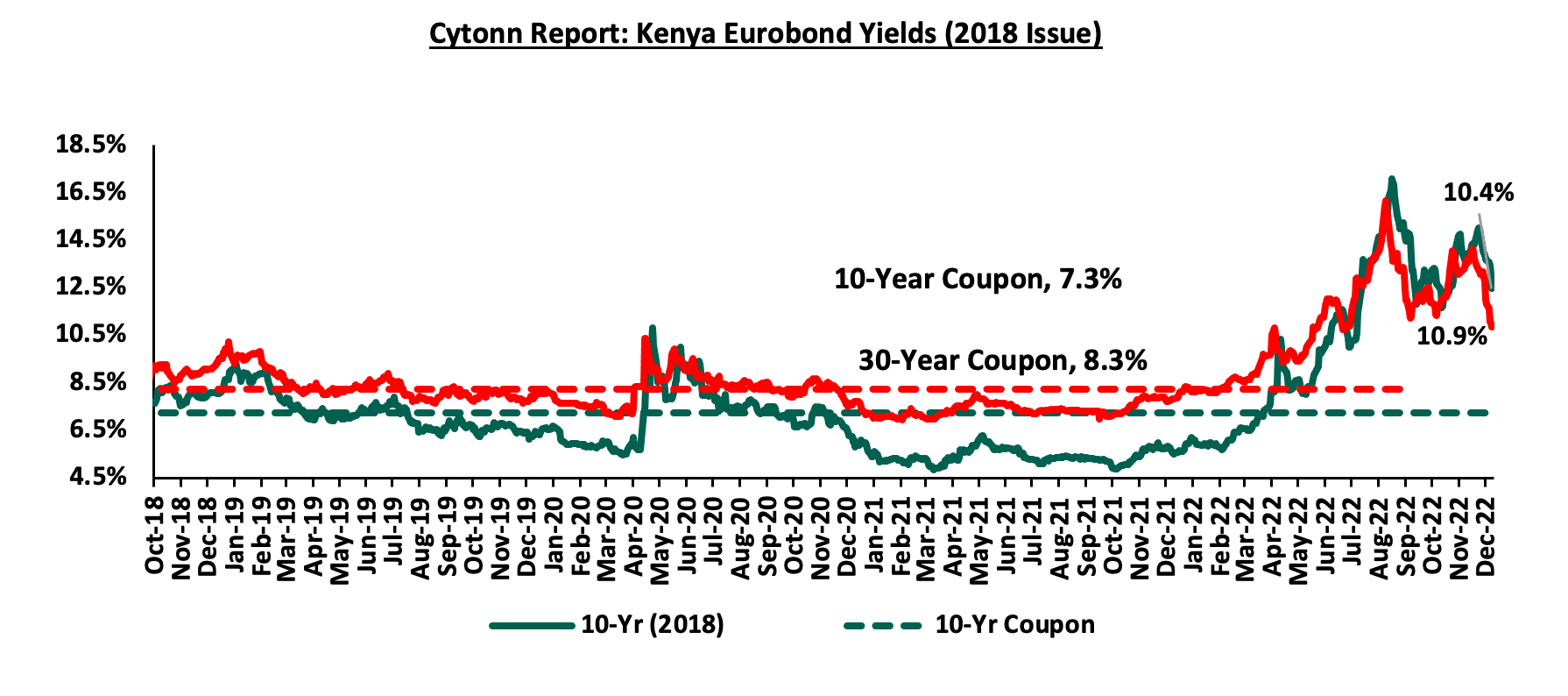

For the 2018 Eurobond issue, the yields on the 10-year Eurobond and the 30-year Eurobond both increased by 4.6% points and 2.8% points to close the year at 10.4% and 10.9%, from yields of 5.8% and 8.1% at the close of 2021 respectively.

For the 2019 Dual-tranche Eurobond issue, the yields on the 7-year Eurobond and the 12-year Eurobond increased by 5.3% points and 4.1% points to close the year at 10.9% and 10.8%, from 5.6% and 6.7% at the close of 2021, respectively.

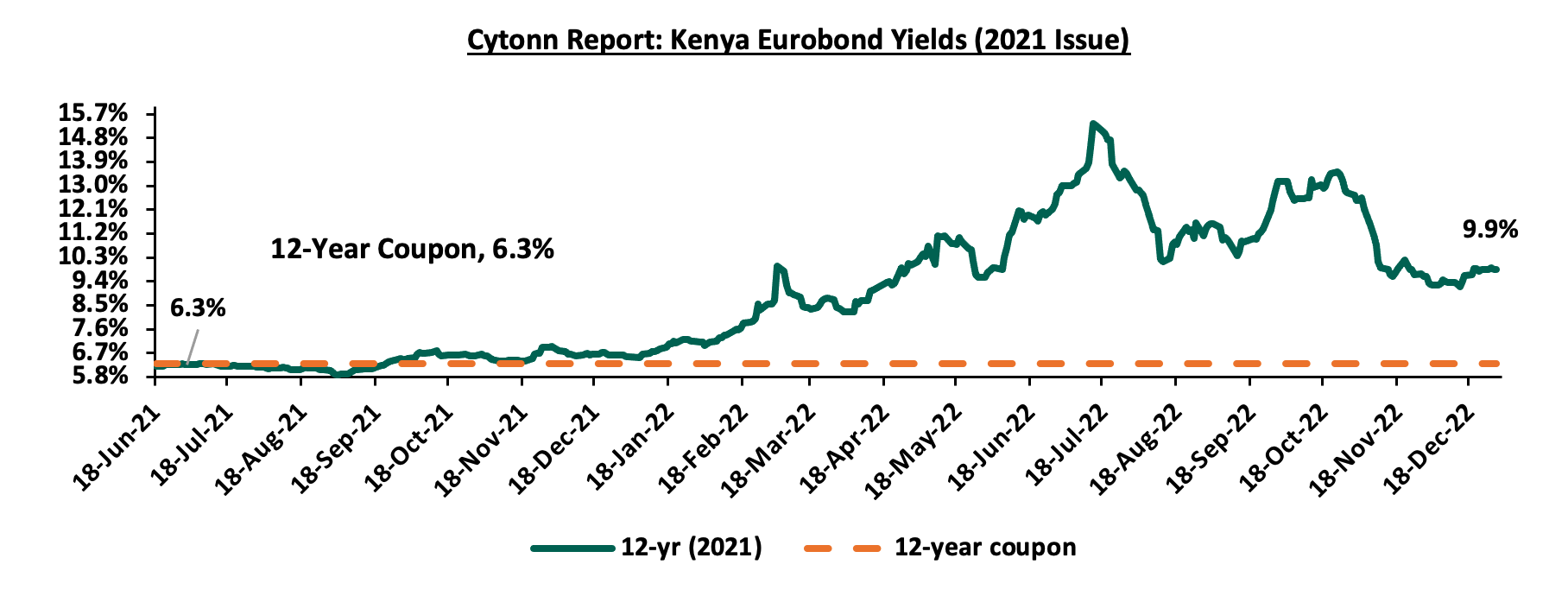

The yields on the 12-Year Eurobond issued in 2021, set to mature in 2033, increased by 3.3% points to 9.9%, from 6.6% recorded at the end of 2022

However, during the week, the yields on Eurobonds recorded mixed performance with the 7-year Eurobond issued in 2019, 12-year Eurobond issued in 2019 and 12-year Eurobond issued in 2021 increasing by 0.1% points each to 10.9%, 10.8% and 9.9% from 10.8%, 10.7% and 9.8%, respectively while the 10-year Eurobond issued in 2014 declined the most by 0.2% points to 12.9% from 13.1%. The table below shows the summary of the performance of the Kenyan Eurobonds as of 30th December 2022;

|

Cytonn Report: Kenya Eurobond Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

3-Jan-22 |

4.4% |

8.1% |

8.1% |

5.6% |

6.7% |

6.6% |

|

30-Nov-22 |

12.0% |

10.1% |

10.8% |

10.7% |

10.4% |

9.6% |

|

22-Dec-22 |

13.1% |

10.4% |

10.9% |

10.8% |

10.7% |

9.8% |

|

23-Dec-22 |

13.0% |

10.4% |

10.9% |

10.8% |

10.7% |

9.9% |

|

26-Dec-22 |

13.0% |

10.4% |

10.9% |

10.8% |

10.7% |

9.9% |

|

27-Dec-22 |

13.0% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

28-Dec-22 |

13.0% |

10.4% |

10.9% |

10.9% |

10.7% |

9.9% |

|

29-Dec-22 |

12.9% |

10.4% |

10.9% |

10.9% |

10.8% |

9.9% |

|

Weekly Change |

(0.2%) |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

|

MTM Change |

0.9% |

0.4% |

0.1% |

0.2% |

0.3% |

0.3% |

|

YTD Change |

8.5% |

2.4% |

2.8% |

5.3% |

4.1% |

3.3% |

Source: Central Bank of Kenya (CBK)

Weekly Highlights:

- Nigeria Government seeks to restructure short term loans owed to the Central Bank of Nigeria

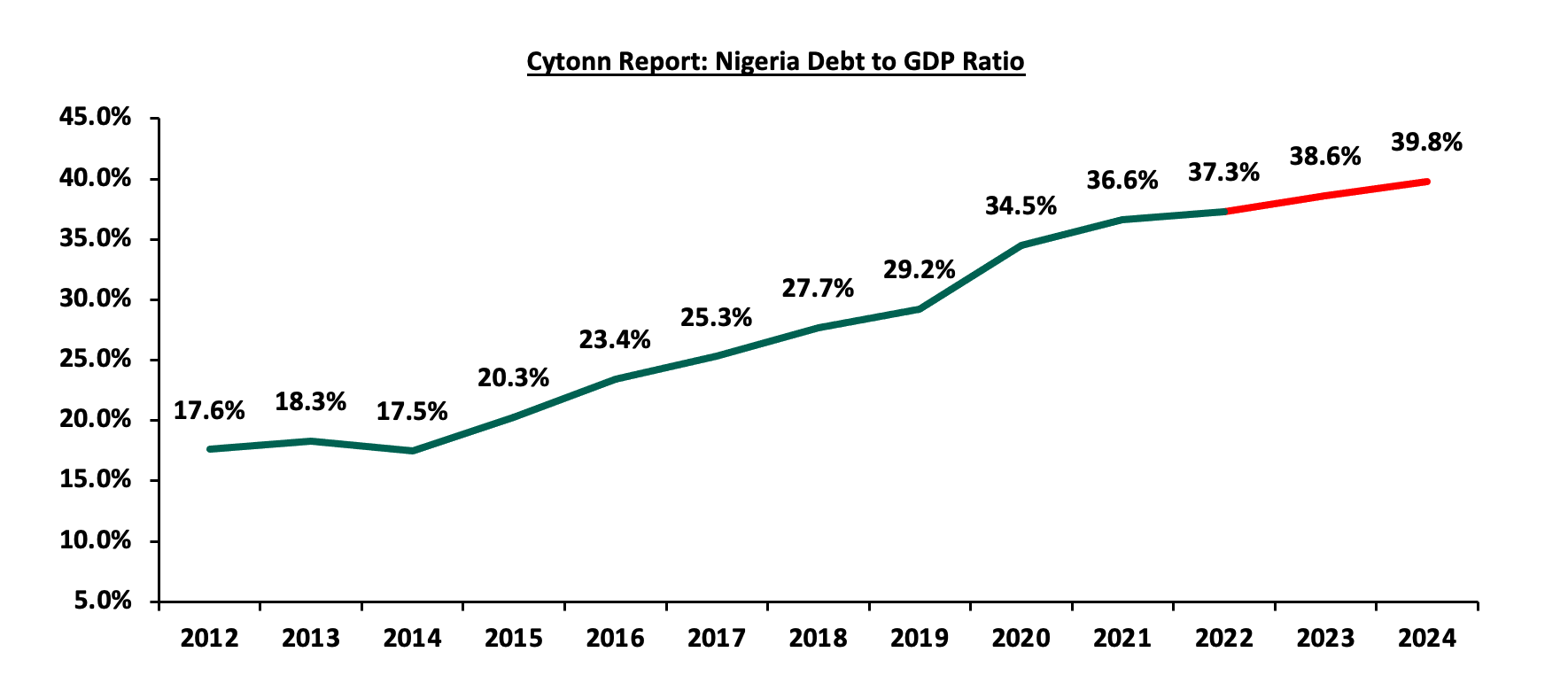

During the week, Nigeria’s President sent a proposal to parliament for approval to allow for a restructuring of USD 54.0 bn, short term loans owed to its Central Bank to a 40-year security at an interest of 9.0%. The debt was incurred through Ways and Means Advances to finance government deficit as a result of delayed government receipts. The Nigerian Executive also requested for a three-year moratorium on interest payments on existing debts and asked for another USD 2.2 bn (N1.0 tn) debt from Central bank on similar terms. This comes at a time when the country has been accruing more debt resulting to high debt service to revenue, it was at 57.1% in 2021. High debt service has resulted to deterioration on debt payment leading to Fitch downgrading Nigeria’s rating to ‘B-‘ with stable outlook. According to the Nigeria’s Central Bank Report, the total public debt at the end of September 2022 stood at USD 98.2 bn (N44.1 tn), representing 37.3% of GDP. This represents an increase of 32.0% to USD 98.2 bn (N44.1 tn) in September 2022 from USD 75.3 bn (N33.8 tn) as at the end of September 2021. The increase is mainly attributable to new borrowings by the federal government to finance the estimated budget deficit of 6.2% of GDP in 2022 mainly attributable to fuel subsidy costs. The total domestic debt stood at USD 60.0 (N26.9 tn), representing 61.1% of total debt while the external debt was at USD 38.2 (N17.2 tn).

According to International Monetary Fund (IMF), the government’s debt to GDP is projected at 37.3% for 2022 which is 12.7% points below the IMF’s threshold of 50.0% for developing countries. However, this is not of significant concern since debt to GDP ratio is still sustainable. Additionally, the USD 54.0 bn debt is owed to the central bank and not the investors in the government securities. Significant to note, the World Bank stated that Nigeria has not approached them for debt restructuring, but for suitable options to reduce the high debt service. This indicates that Nigeria’s debt is sustainable in the medium-term, however, such debt is susceptible to macro-economic shock which can quickly push debt levels straining revenue through high interest payments making the fiscal position highly vulnerable to real interest rate shocks. Additionally, the increasing debt situation will also reduce expenditure on vital social issues such as health and education which are already in poor state. Below is a chart showing Nigeria’s debt to GDP levels;

Source: IMF

Despite Nigeria’s ability to manage her debt in the medium-term, many counties in Sub-Saharan Africa (SSA) are on the verge of debt distress. One such case study is Ghana, which we covered in our Cytonn Weekly highlighting that Ghana’s Public Debt stood at USD 54.5 bn, equivalent to 77.5% of GDP as of May 2022 with external debt to GDP at 39.9% while that of the domestic debt at 37.5%. The debt service to revenue ratio as of 2021 stood at 47.8% and is projected at 90.7% for 2022 which is 40.7% points above the IMF’s threshold of 50.0% for developing countries. Below is a table comparing various debt metrics between Nigeria, Ghana and Kenya;

|

|

Nigeria |

Ghana |

Kenya |

|

Public Debt (USD bn) |

98.2 |

54.4 |

70.9 |

|

Public Debt to GDP |

37.3% |

90.7% |

69.4% |

|

Debt Service to Revenue ratio |

57.1% |

47.8% |

50.0% |

Source: Nigeria Ministry of Finance, Kenya National Treasury, IMF and Ministry of Finance Ghana

Key to note, public debt has been increasing steadily in Sub-Saharan Africa escalated by the increasing spending and reduced revenue collection during the COVID-19 pandemic. According to the IMF Regional Economic Outlook for Sub-Saharan Region, at least one-third of the region’s economies have debt levels above 70.0% of the GDP resulting to 19 of the region’s 35 low-income nations to be in debt distress or at a high risk of such. As such, Nigeria is better placed to manage its debt situation compared to the many nations in SSA on the verge of debt distress.

- Kenya Q3’2022 GDP growth

The Kenya National Bureau of Statistics (KNBS) released the Q3’2022 Quarterly Gross Domestic Product Report highlighting that the Kenyan economy recorded a 4.7% growth in Q3’2022, significantly lower than the 9.3% growth recorded in Q3’2021 when the most sectors of the economy were recovering from the impacts of COVID-19 pandemic. The performance during the quarter was largely supported by growth recorded in sectors like Accommodation and Food Services activities (22.9%), Wholesale and retail trade (9.1%), Professional, Administrative and Support services (8.7%) and Education (7.1%), among others. The expansion was however weighed down by declines recorded sectors such as Mining and quarrying, and Agriculture and Forestry which contracted by 2.2% and 0.6%, respectively. The key take-outs from the report include;

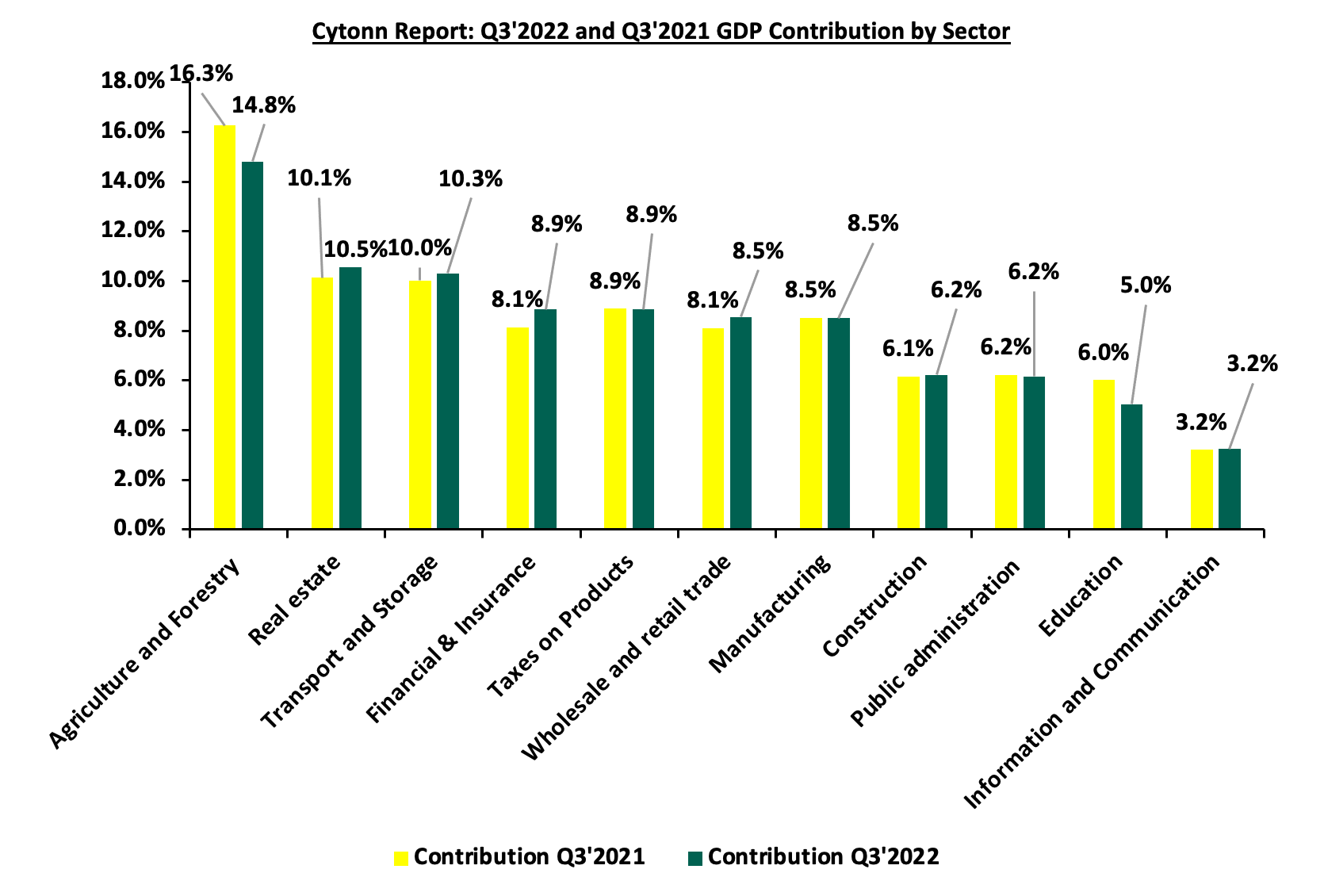

- Sectoral Contribution to Growth - The biggest gainer in terms of sectoral contribution to GDP was Financial and Insurance sector, increasing by 0.8% points to 8.9% from 8.1% in Q3’2021, while Agriculture and Forestry was the biggest loser, declining by 1.5% points to 14.8% in Q3’2022, from 16.3% in Q3’2021. Real Estate remained the 2nd largest contributor to GDP at 10.5%, a 0.4% increase from 10.1% in Q3’2021. Accommodation and Food Services sector recorded the highest growth rate in Q3’2022 growing by 22.9% compared to the 127.5% growth recorded in Q3’2021. The chart below shows the top contributors to GDP by sector in Q3’2022:

Source: KNBS Q3’2022 and Q3’2021 GDP Report

- Continued subdued Growth in the Agricultural Sector – Agriculture, Forestry and Fishing activities recorded a decline of 0.6% in Q3’2022 compared to a growth of 0.6% in Q3’2021. The contraction recorded during the quarter was mainly attributable to unfavorable weather conditions experienced in the first three quarters of 2022 which resulted to lower agricultural production. The sector's poor performance was reflected by declines recorded in vegetable exports and milk production. However, increased production of fruits, coffee, and cane cushioned the sector from a deeper slump,

- Slower growth in the manufacturing sector - The manufacturing sector reported a growth of 2.4% in Q3’2022 compared to a 10.2% growth in a similar period of review in 2021. However, the sectoral contribution remained relatively unchanged at 8.5%, as was recorded in the similar period in 2021, and,

- Sustained rebound in the Accommodation and Food services sector- The sector recorded 22.9% growth in Q3’2022 though lower than the 127.5% growth recorded in Q3’2021. This comes after sector recorded significantly subdued performance in 2020 and part of 2021 as a consequence of the COVID-19 pandemic. As such, the activity in the sector remained resilient during the quarter, with the number of visitor’s arrival through Jomo Kenyatta international Airport and Moi international Airport increasing by 44.6% to 315,112 up from 217, 873 recorded in Q3’2021. Additionally, the sectoral contribution increased by 0.5% points to 1.0% in Q3’2022 from 0.5% recorded in Q3’2021. The chart below shows the different sectoral GDP growth rates for Q3’2022:

Source: KNBS Q3’2022 GDP Report

Going forward, we expect the economy to grow at a slower pace given the subdued general business environment in the country mainly as a result of elevated inflationary pressures occasioned by high fuel and food prices. Additionally, the MPC decision to raise the Central Bank Rate (CBR) by 50.0 bps to 8.75% from 82.5% by the CBK Monetary Policy Committee in a bid to curb inflation and maintain price stability is expected to curtail economic growth. Further, we expect the Agricultural sector to remain subdued largely due to erratic weather conditions. However, the sector is expected to be supported by the recent fiscal policies such as subsidizing costs of crucial farm inputs such as fertilizers that will enhance growth in the sector, which remains as Kenya’s largest contributor to GDP as well as food prices being a major contributor to headline inflation.

- Kenya’s Q3’2022 Balance of Payments

The Kenya National Bureau of Statistics released the Quarterly Balance of Payments report for Q3’2022 report highlighting that Kenya’s balance of payments position recorded a deficit of Kshs 112.7 bn, a significant declines of 283.9% from a deficit of Kshs 29.3 bn in Q3’2021. Additionally, the BoP performance was a reversal from the surplus of Kshs 10.9 bn recorded in Q2’2022. The performance was mainly attributable to widening of the current account deficit by 5.5% to Kshs 193.4 bn from Kshs 183.4 bn recorded in Q3’2021, coupled with a 13.4% expansion of the financial account to Kshs 190.8 bn from Kshs 168.3 bn recorded in Q3’2021. The table below shows the breakdown of the various balance of payments components, comparing Q3’2022 and Q3’2021;

Cytonn Report: Quarterly Balance of Payments

Item

Q2’2021

Q2’2022

Q3’2021

Q3’2022

y/y % Change

Current Account Balance

(158.9)

(174.4)

(183.4)

(193.4)

(5.5%)

Capital Account Balance

7.4

4.9

3.9

0.6

(84.0%)

Financial Account Balance

(282.5)

(253.0)

(168.3)

(190.8)

13.4%

Net Errors and Omissions

48.7

(72.6)

(18.1)

(110.7)

(511.7%)

Balance of Payments

179.8

10.9

(29.3)

(112.7)

(283.9%)

All values in Kshs bns

Key take-outs from the table include;

- The current account deficit (value of goods and services imported exceeds the value of those exported) expanded 5.5% to Kshs 193.4 bn from Kshs 183.4 bn in Q3’2021, mainly attributable to the 15.8% increase in the merchandise trade balance deficit to Kshs 373.1 bn, from Kshs 322.0 bn recorded in Q3’2021,

- The capital account (shows capital transfers receivable and payable between residents and non-residents, including the acquisition and disposal of non-produced non-financial items) which includes foreign direct investments (FDIs), contracted by 84.0% to Kshs 0.6 bn from Kshs 3.9 bn in Q3’2021, highlighting the increased perceived risks by investors due to the deteriorated macroeconomic and business environment,

- The financial account balance deficit (the difference between the foreign assets purchased by domestic buyers and the domestic assets purchased by foreign buyers) expanded by 13.4% to Kshs 190.8 bn from a deficit of Kshs 168.3 bn recorded in Q3’2021. Also, the stock of gross official reserves declined by 11.7% to Kshs 940.2 bn, from Kshs 1,064.2 in Q3’2021 and,

- Consequently, the Balance of Payments (BoP) position declined to a deficit of Kshs 112.7 bn from a deficit of Kshs 29.3 bn mainly due to the 5.5% widening of the current account and the 84.0% decline in capital account balance.

Current Account Balance

The Kenya’s current account deficit increased by 5.5% to Kshs 193.4 bn in Q3’2022 from Kshs 183.4 bn in Q3’2021 and a 10.9% increase from a deficit of Kshs 174.4 bn in Q2’2022, driven by;

- The widening of the merchandise trade (a scenario where imports are greater than exports of goods resulting to a negative net foreign investment) by 15.8% to Kshs 373.1 bn, from Kshs 322.0 bn recorded in Q3’2021,

- A 162.7% increase in the services trade balance (the difference between imports and exports of services) to Kshs 59.2 bn from Kshs 22.5 bn in Q3’2021, and,

- An 8.7% increase in the secondary income balance (the transactions recorded in the secondary income account pertain to those current transfers between residents and non-residents that directly affect the level of gross national disponsable income and thus influence the economy’s ability to consume goods and services), to Kshs 183.8 bn from Kshs 169.1 bn in Q3’2021.

The table below shows the breakdown of the various current account components, comparing Q3’2022 and Q3’2021;

Cytonn Report: Quarterly Current Account Balance

Item

Q2’2021

Q2’2022

Q3’2021

Q3’2022

% Change

Merchandise Trade balance

(271.6)

(365.6)

(322.0)

(373.1)

15.8%

Service Trade Balance

12.7

59.3

22.5

59.2

162.7%

Primary Income Balance

(62.5)

(51.6)

(53.0)

(63.3)

19.5%

Secondary Income (Transfers) Balance

162.5

183.5

169.1

183.8

8.7%

Current Account Balance

(158.9)

(174.4)

(183.4)

(193.4)

5.5%

All values in Kshs bns

During Q3’2022, the Kenyan Shilling depreciated by 9.2% y/y to Kshs 120.7 from Kshs 110.5 in Q3’2021, which, however, was supported by sufficient forex reserves which came in at USD 7.4 bn in Q3’2022. The performance of Kenya’s Balance of Payments reflects the tough macroeconomic performance in the country evidenced by the slowdown in the country’s economic growth to 4.7% in Q3’2022 from the 9.3% recorded in Q3’2021. As such, we expect the country’s reliance on imports coupled with high global commodity prices to continue weighing down on the country’s Balance of payments. However, the current administration’s initiatives to increase exports especially agricultural products through multilateral partnerships such as the US- Kenya Strategic Trade and Investment Partnership and the Africa Continental Free Trade Area (AfCFTA) are also expected to ensure relative stability in the Kenya’s Balance of Payments.

Rates in the Fixed Income market have remained relatively stable due to the relatively ample liquidity in the money market. The government is 6.3% ahead of its prorated borrowing target of Kshs 290.9 bn having borrowed Kshs 309.1 bn of the Kshs 581.7 bn borrowing target for the FY’2022/2023. We expect sustained gradual economic recovery as evidenced by the revenue collections of Kshs 789.3 bn in the FY’2022/2023 as at the end of November, equivalent to a 36.9% of its target of Kshs 2.1 tn. Despite the performance, we believe that the projected budget deficit of 6.2% is relatively ambitious given the downside risks and deteriorating business environment occasioned by high inflationary pressures. We however expect the support from the IMF and World Bank to ease the need for elevated borrowing and thus help maintain a stable interest rate environment since the government is not desperate for cash. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance

In 2022, the Kenyan equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 23.7%, 12.4% and 16.6%, respectively. Below is a summary of the 2022 annual performance of some of the large cap stocks in the Kenyan stock market:

|

Cytonn Report: Kenya Equities Performance - Large Cap Gainers and Losers 2022 |

||

|

No |

Company |

Share Price Performance 2022 |

|

1 |

NCBA Bank Kenya |

54.6% |

|

2 |

Standard Chartered Bank Kenya |

9.8% |

|

3 |

ABSA Bank Kenya |

4.7% |

|

4 |

BAT Kenya |

4.5% |

|

5 |

East African Breweries Limited (EABL) |

1.2% |

|

6 |

Co-operative Bank Kenya |

(5.4%) |

|

7 |

Equity Group |

(15.6%) |

|

8 |

Diamond Trust Bank Kenya |

(16.0%) |

|

9 |

KCB Group |

(16.4%) |

|

10 |

Bamburi Cement |

(17.5%) |

|

11 |

Safaricom |

(36.7%) |

During the week, the equities market recorded mixed performance with NASI declining by 0.5%, while NSE 20 and NSE 25 gained by 0.8% and 0.2%, respectively. The equities market performance was mainly driven by losses recorded by large cap stocks such as Safaricom and Equity Group of 1.8% and 1.7%, respectively. The losses were however mitigated by gains recorded by banking stocks such as NCBA Group, Diamond Trust Bank Kenya, ABSA Bank and Co-operative Bank of 5.5%, 2.0%, 1.7% and 1.2% respectively.

During the year, equities turnover declined by 36.5% to USD 0.8 bn, from USD 1.3 bn in ’2021. Foreign investors remained net sellers, with a net outflow of USD 204.3 mn, compared to net outflows of USD 91.9 mn recorded in 2021. The foreign-investor outflows during the year can be largely attributed to investors fleeing emerging markets such as Kenya, to advanced economies such as United States and United Kingdom following interest rate hikes as well as increased concerns on macroeconomic deterioration.

During the week, equities turnover declined by 31.8% to USD 6.9 mn from USD 10.1 mn recorded the previous week, taking the YTD turnover to USD 794.7 mn. Additionally, foreign investors remained net sellers, with a net selling position of USD 2.9 mn, from a net selling position of USD 4.0 mn recorded the previous week, taking the YTD net selling position to USD 204.3 mn.

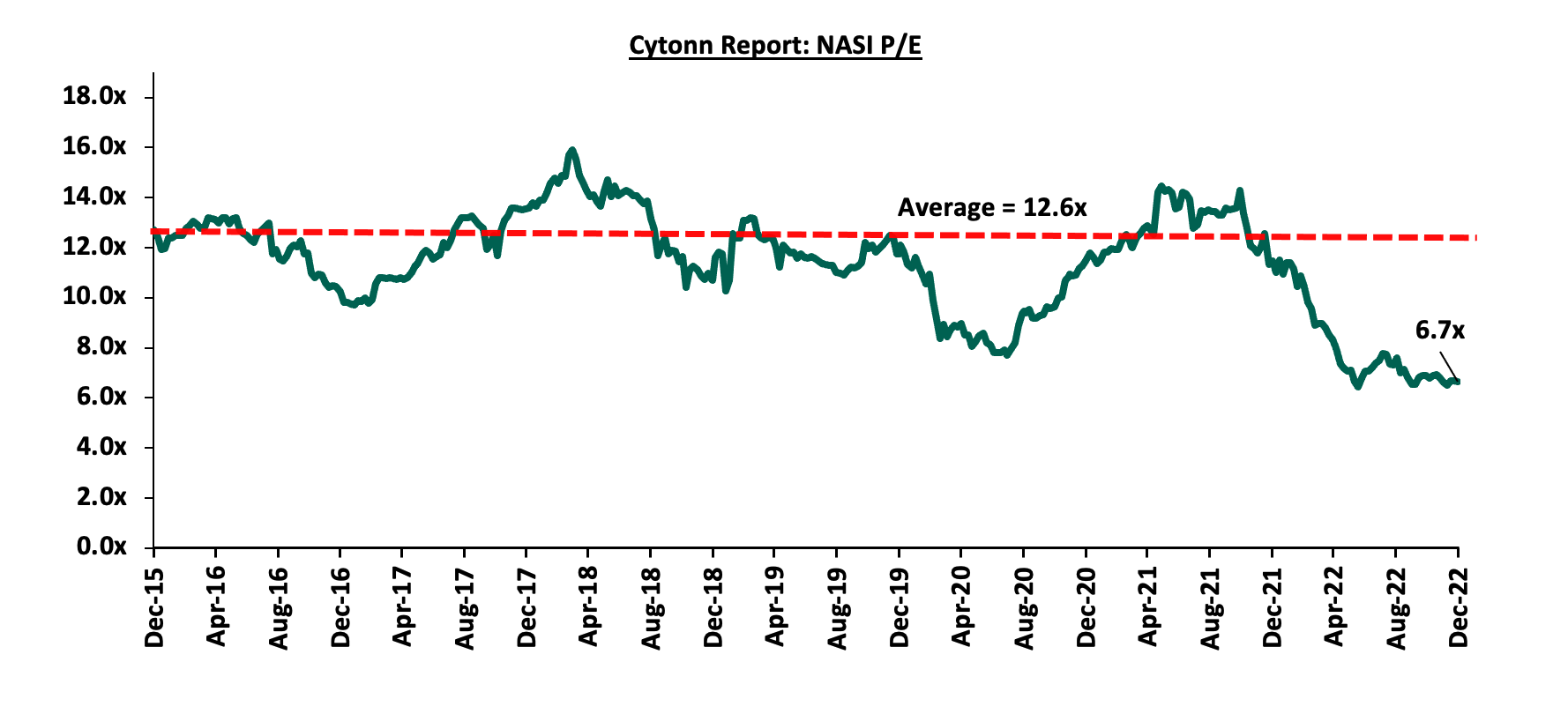

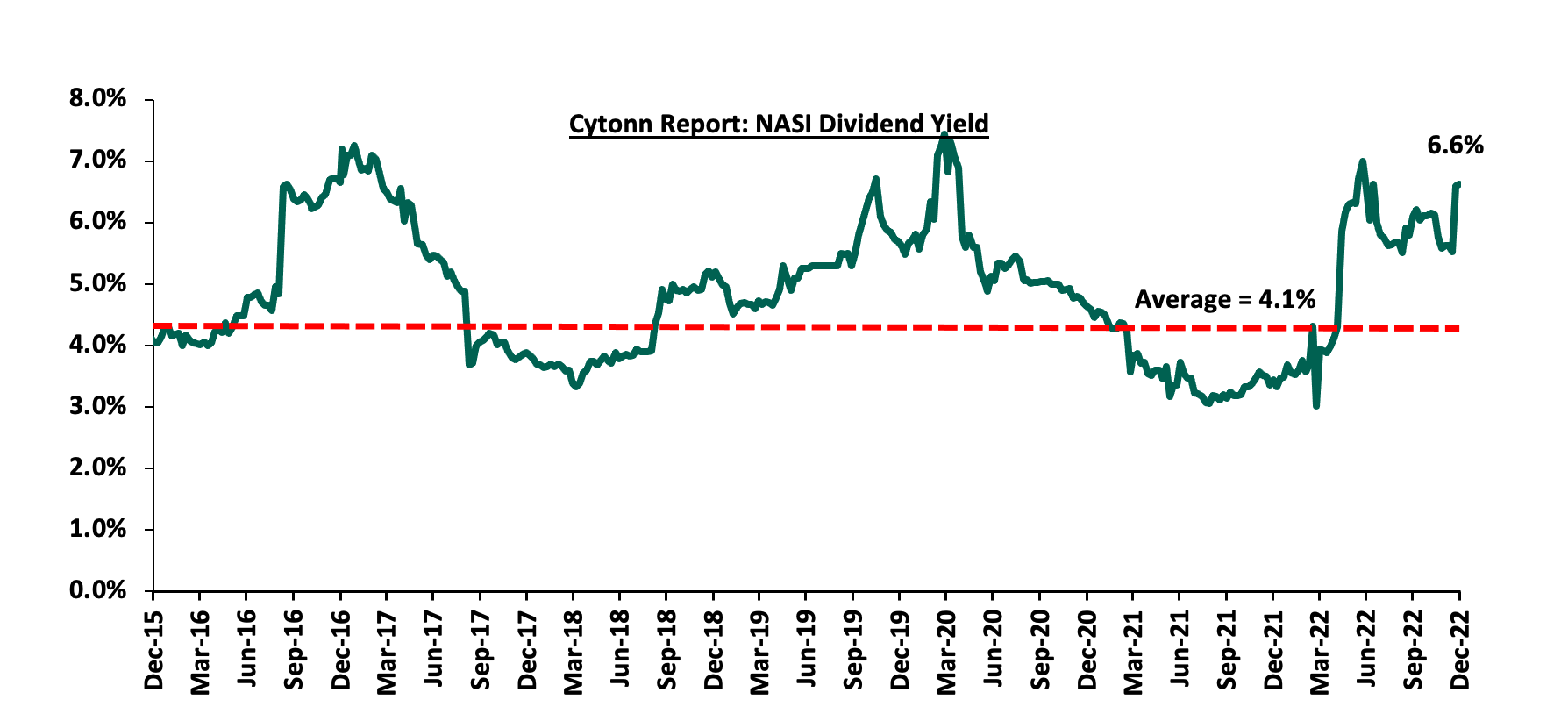

The market is currently trading at a price to earnings ratio (P/E) of 6.7x lower than 11.5x recorded at the end of 2021, and is 47.0% below the 12-year historical average of 12.6x. NASI’s P/E ratio remained suppressed for majority of the year, mainly attributable to drop in prices of large cap stocks such as Safaricom whose price declined by 36.7% during the year. Safaricom continues to be a key part of Kenyan equities portfolios, accounting for 49.6% of Nairobi Stock Exchange (NSE’s) market capitalization, and has dominated both the market turnover and determines the direction of the market given its weight and liquidity in the Nairobi Securities Exchange. On the other hand, the dividend yield is currently at 6.6%, 2.5% points above the historical average of 4.1%.

Key to note, NASI’s PEG ratio currently stands at 0.9x an indication that the market is undervalued relative to its future earnings growth. The charts below indicate the market’s historical P/E and dividend yield:

2022 Key Highlights

- Banking Sector Earnings

As per the Q3’2022 results, the listed banks recorded a weighted average increase in the core earnings per share of 36.7%, compared to a weighted average increase of 102.0% in Q3’2021. The table below highlights the performance of the banking sector, showing the performance using several metrics, and the key take-outs of the performance.

|

Cytonn Report: Listed Banks Q3’2022 Earnings and Growth Metrics |

|||||||||||||

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

HF |

110.8% |

6.8% |

0.7% |

13.9% |

4.7% |

66.1% |

32.4% |

(3.6%) |

3.5% |

51.2% |

90.7% |

1.7% |

0.5% |

|

NCBA |

96.2% |

13.3% |

10.8% |

15.1% |

6.0% |

40.1% |

49.2% |

5.2% |

3.2% |

9.1% |

57.6% |

11.7% |

21.2% |

|

Co-op |

47.0% |

10.5% |

7.2% |

11.7% |

8.5% |

28.3% |

38.6% |

31.7% |

2.8% |

(5.7%) |

77.6% |

9.4% |

22.5% |

|

SCBK |

37.1% |

4.1% |

(12.6%) |

7.3% |

6.3% |

16.1% |

35.7% |

(13.4%) |

10.7% |

13.2% |

47.6% |

3.3% |

21.0% |

|

Stanbic |

36.8% |

3.1% |

19.2% |

26.8% |

6.2% |

37.5% |

44.6% |

8.1% |

25.6% |

38.3% |

88.6% |

34.1% |

25.1% |

|

ABSA |

30.1% |

24.7% |

22.4% |

25.3% |

7.6% |

16.4% |

30.4% |

(1.2%) |

4.6% |

10.5% |

103.0% |

26.4% |

23.2% |

|

Equity |

27.9% |

25.6% |

31.3% |

23.6% |

7.3% |

32.0% |

41.4% |

28.6% |

15.1% |

(0.1%) |

66.9% |

20.6% |

31.3% |

|

I&M |

25.1% |

17.3% |

20.0% |

15.6% |

6.6% |

43.0% |

35.4% |

26.0% |

6.7% |

(2.6%) |

75.1% |

11.4% |

13.9% |

|

KCB |

21.4% |

13.6% |

28.4% |

9.1% |

8.1% |

30.2% |

33.2% |

17.3% |

7.4% |

6.9% |

80.1% |

16.4% |

22.6% |

|

DTB-K |

21.1% |

15.4% |

17.2% |

43.5% |

5.7% |

43.5% |

29.0% |

24.5% |

11.1% |

17.4% |

67.7% |

18.5% |

8.0% |

|

Q3'22 Mkt Weighted Average* |

36.7% |

16.4% |

19.6% |

17.6% |

7.3% |

30.1% |

38.1% |

16.2% |

9.7% |

6.5% |

73.7% |

17.1% |

24.2% |

|

Q3'21 Mkt Weighted Average** |

102.0% |

15.9% |

14.9% |

16.9% |

7.3% |

14.3% |

35.2% |

11.4% |

14.3% |

11.7% |

69.7% |

12.4% |

18.7% |

|

*Market cap weighted as at 08/12/2022 |

|||||||||||||

|

**Market cap weighted as at 10/12/2021 |

|||||||||||||

Key takeaways from the table include:

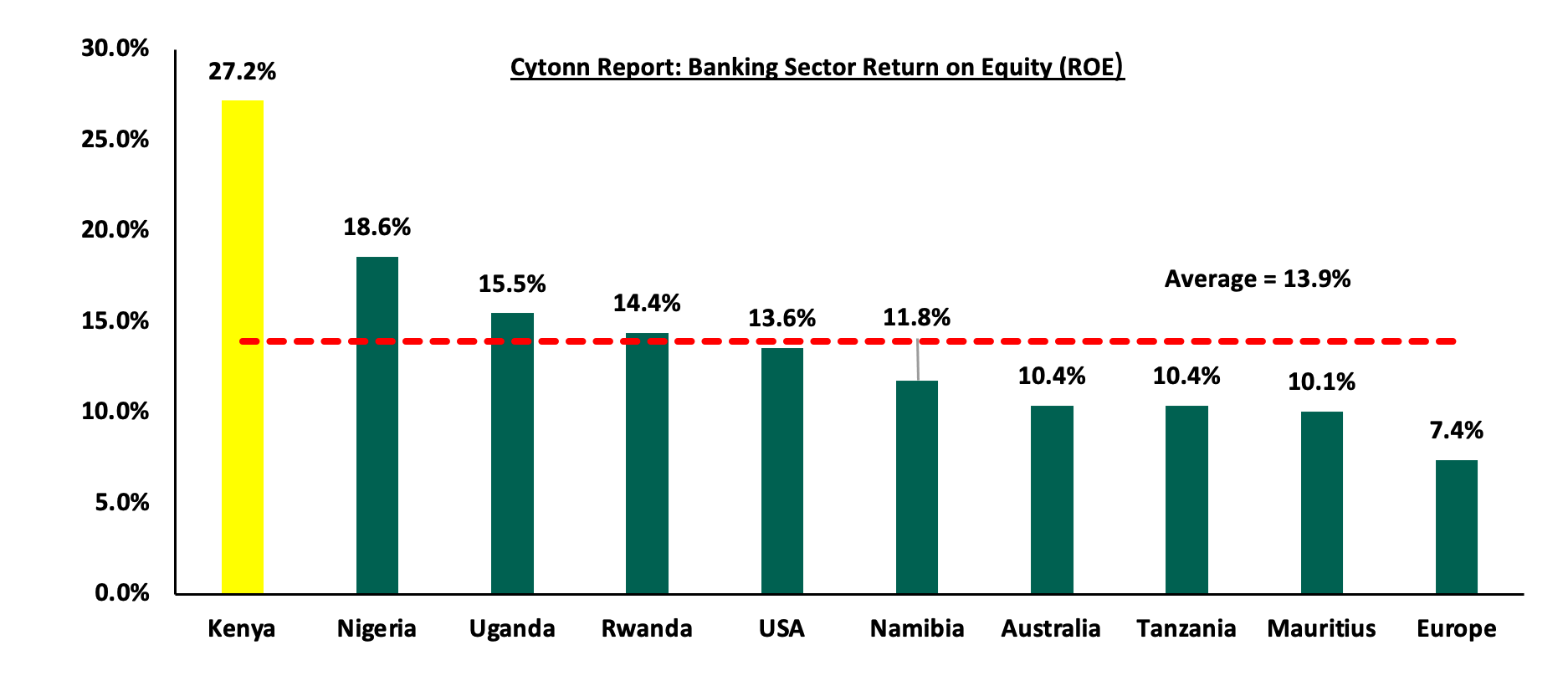

- The listed banks recorded a 36.7% weighted average growth in core Earnings per Share (EPS), compared to a weighted growth of 102.0% recorded in Q3’2021 when the sector was recovering from a lower base. The performance during the period was mainly attributed to a 30.1% growth in non-funded income coupled with a 17.6% growth in net interest income,

- The listed banks continued to implement their revenue diversification strategies as evidenced by non-funded income growth of 30.1% in Q3’2022 compared to 14.3% growth recoded in Q3’2021. The performance was mainly driven by 16.2% growth in total fees and commissions, which was an increase from 11.4% growth recorded during the same period last year,

- The Banks recorded a weighted average deposit growth of 9.7%, slower than the 14.3% growth recorded in Q3’2021, an indication of reduced investment risk in the business environment,

- Interest income grew by 16.4% in Q3’2022, compared to a growth of 15.9% recorded in Q3’2021 while the weighted average Yield on Interest Earning Assets (YIEA) remained relatively unchanged at 9.9%, similar to what was recorded in in Q3’2021 for the listed banking sector. Additionally, the Net Interest Margin (NIM) also remained unchanged at 7.3%, as was recorded in Q3’2021 for the whole listed banking sector, and,